Resumo da empresa

| Olive Tree Capital Markets Resumo da Revisão | |

| Fundado | 2000 |

| País/Região Registrado | Chipre |

| Regulação | CySEC |

| Instrumentos de Mercado | Renda fixa, ações, derivativos, produtos estruturados, investimentos alternativos e forex |

| Conta Demonstração | ❌ |

| Alavancagem | / |

| Plataforma de Negociação | / |

| Depósito Mínimo | / |

| Suporte ao Cliente | Tel: +357 22 222 332; +357 22222305 |

| Email: info@otcm.eu | |

| Endereço físico: Methonis Tower, 73 Makarios Avenue, 7th Floor, Office 701, Nicosia, Chipre, 1070 | |

Olive Tree Capital Markets, uma empresa de investimentos estabelecida em Chipre em 2000, é oficialmente regulamentada pela Comissão de Valores Mobiliários e Câmbio de Chipre e também é membro da Bolsa de Valores de Londres. A empresa oferece uma variedade de produtos de investimento, incluindo renda fixa, ações, derivativos, produtos estruturados, investimentos alternativos e forex.

Prós e Contras

| Prós | Contras |

| Longa história de operação | Sem contas de demonstração |

| Regulamentado pela CySEC (Chipre) | Informações limitadas sobre condições de negociação |

| Vários produtos de investimento |

É Olive Tree Capital Markets Legítimo?

Sim, Olive Tree Capital Markets é uma corretora legal. Ela é licenciada como uma Empresa de Investimento de Chipre pela Comissão de Valores Mobiliários e Câmbio de Chipre (CySEC) sob o número de licença 104/09.

Além disso, Olive Tree Capital Markets é membro negociante da Bolsa de Valores de Londres (LSE).

| País Regulamentado | Autoridade Reguladora | Status Atual | Entidade Regulamentada | Tipo de Licença | Número de Licença |

| Comissão de Valores Mobiliários e Câmbio de Chipre (CySEC) | Regulamentado | Olive Tree Capital Markets Limited (ex Atonline Ltd) | Market Making (MM) | 104/09 |

Produtos e Serviços

Olive Tree Capital Markets oferece uma ampla gama de serviços de investimento adequados, incluindo serviços de negociação e execução, custódia (guarda e serviços relacionados, como gerenciamento de caixa/garantias), pesquisa de investimento e análise financeira, repo e financiamento de margem e fundo de investimento.

Também oferece uma ampla variedade de produtos, incluindo renda fixa, ações, derivativos, produtos estruturados, investimentos alternativos e câmbio estrangeiro (esteja conectado à recomendação de provisão relacionada a transações em instrumentos financeiros.).

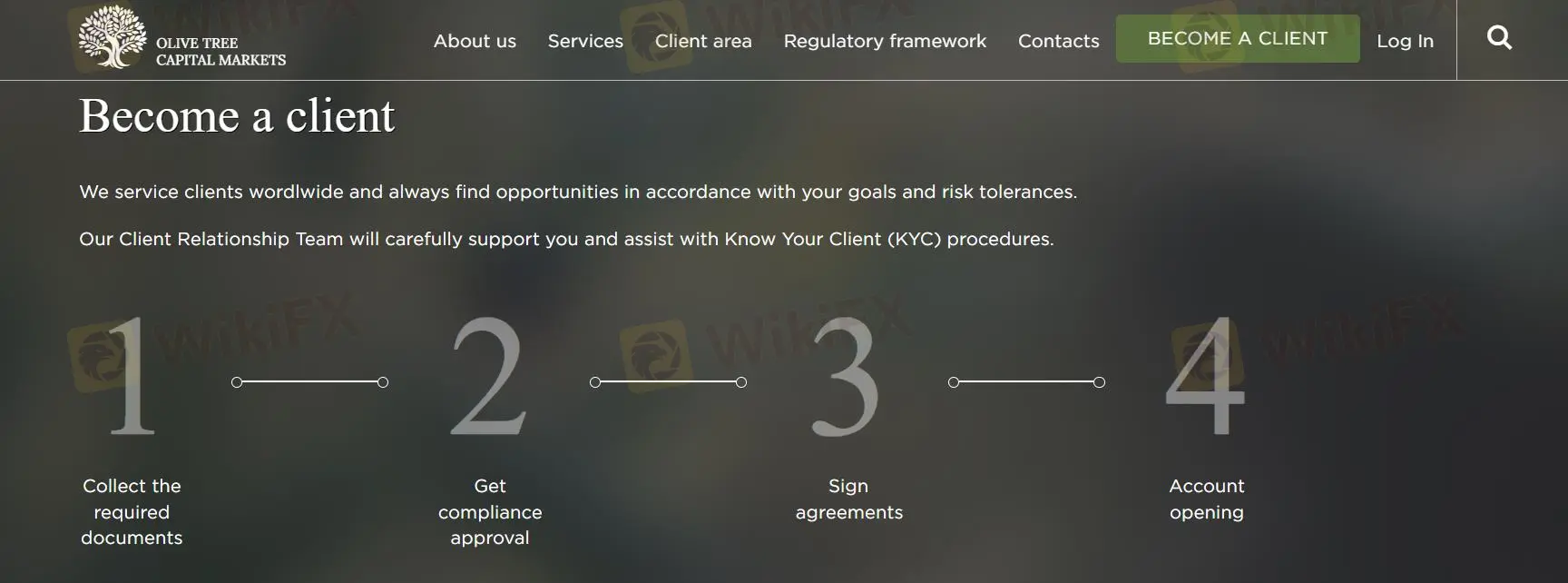

Como Abrir uma Conta no Olive Tree Capital Markets?

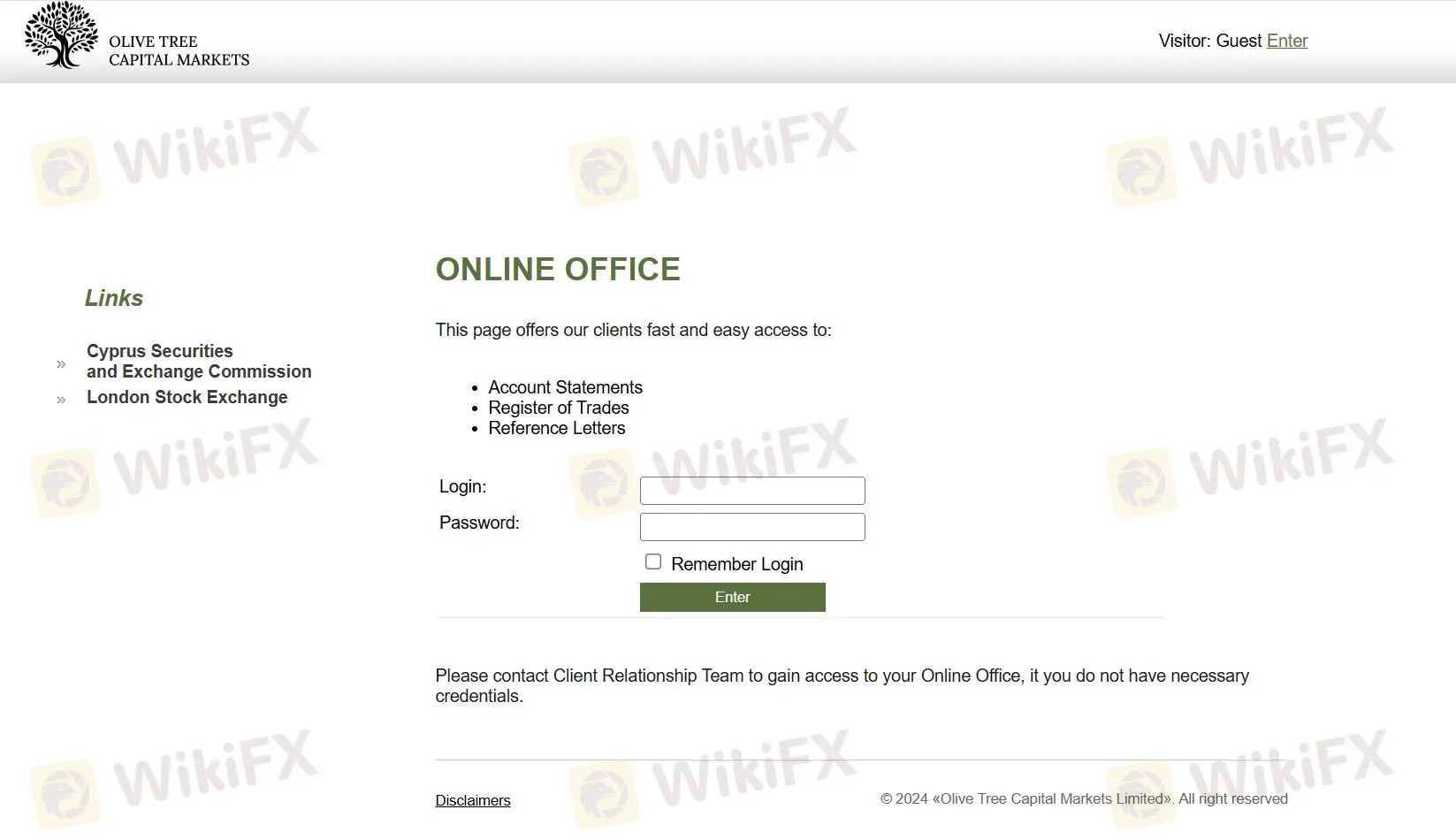

Abrir uma conta em Olive Tree Capital Markets é bastante complexo. Para começar, você deve preencher um formulário de "Solicitação de Abertura de Conta" para obter aprovação. Além disso, você precisa reunir os documentos necessários e assinar os acordos relacionados à abertura da conta. Uma vez concluídas essas etapas, você pode finalmente abrir sua conta inserindo um número de conta e senha.