مقدمة عن الشركة

| Olive Tree Capital Markets ملخص المراجعة | |

| تأسست | 2000 |

| البلد/المنطقة المسجلة | قبرص |

| التنظيم | CySEC |

| أدوات السوق | الدخل الثابت، الأسهم، المشتقات، منتجات مهيكلة، الاستثمارات البديلة والفوركس |

| حساب تجريبي | ❌ |

| الرافعة المالية | / |

| منصة التداول | / |

| الحد الأدنى للإيداع | / |

| دعم العملاء | هاتف: +357 22 222 332؛ +357 22222305 |

| البريد الإلكتروني: info@otcm.eu | |

| العنوان الفعلي: برج ميثونيس، شارع مكاريوس 73، الطابق 7، مكتب 701، نيقوسيا، قبرص، 1070 | |

Olive Tree Capital Markets، شركة استثمار تأسست في قبرص عام 2000، مرخصة رسميًا من قبل هيئة الأوراق المالية والبورصة في قبرص وهي أيضًا عضو في بورصة لندن. تقدم الشركة مجموعة من المنتجات الاستثمارية، بما في ذلك الدخل الثابت، الأسهم، المشتقات، منتجات مهيكلة، الاستثمارات البديلة والفوركس.

المزايا والعيوب

| المزايا | العيوب |

| تاريخ عمل طويل | لا توجد حسابات تجريبية |

| تنظيم من قبل CySEC (قبرص) | معلومات محدودة حول شروط التداول |

| منتجات استثمارية متنوعة |

هل Olive Tree Capital Markets شرعي؟

نعم، Olive Tree Capital Markets هو وسيط قانوني. تم ترخيصها كشركة استثمار قبرصية من قبل هيئة الأوراق المالية والبورصة في قبرص (CySEC) برقم الترخيص 104/09.

بالإضافة إلى ذلك، Olive Tree Capital Markets هي عضو تداول في بورصة لندن (LSE).

| البلد المنظم | السلطة المنظمة | الحالة الحالية | الكيان المنظم | نوع الترخيص | رقم الترخيص |

| هيئة الأوراق المالية والبورصة في قبرص (CySEC) | منظمة | Olive Tree Capital Markets المحدودة (سابقًا Atonline Ltd) | صانع سوق (MM) | 104/09 |

المنتجات والخدمات

Olive Tree Capital Markets يقدم مجموعة واسعة من خدمات الاستثمار المناسبة، بما في ذلك خدمات التداول والتنفيذ، الحفظ (خدمات الودائع والخدمات ذات الصلة مثل إدارة النقد/الضمانات)، البحث الاستثماري والتحليل المالي، إعادة الشراء والتمويل بالهامش وصناديق الاستثمار.

كما يوفر مجموعة متنوعة من المنتجات، بما في ذلك الدخل الثابت، الأسهم، المشتقات، منتجات مهيكلة، الاستثمارات البديلة وسوق الصرف الأجنبي (يرتبط بتوصية توفير الصلة المتعلقة بالمعاملات في الأدوات المالية.).

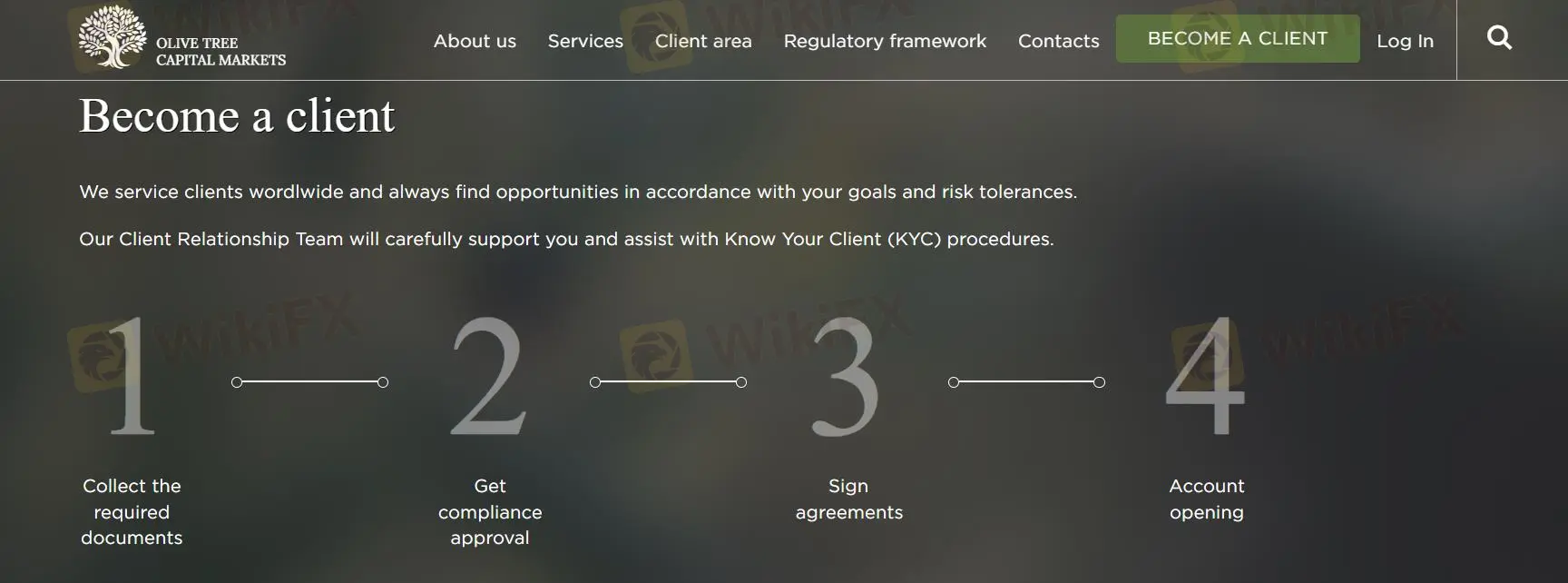

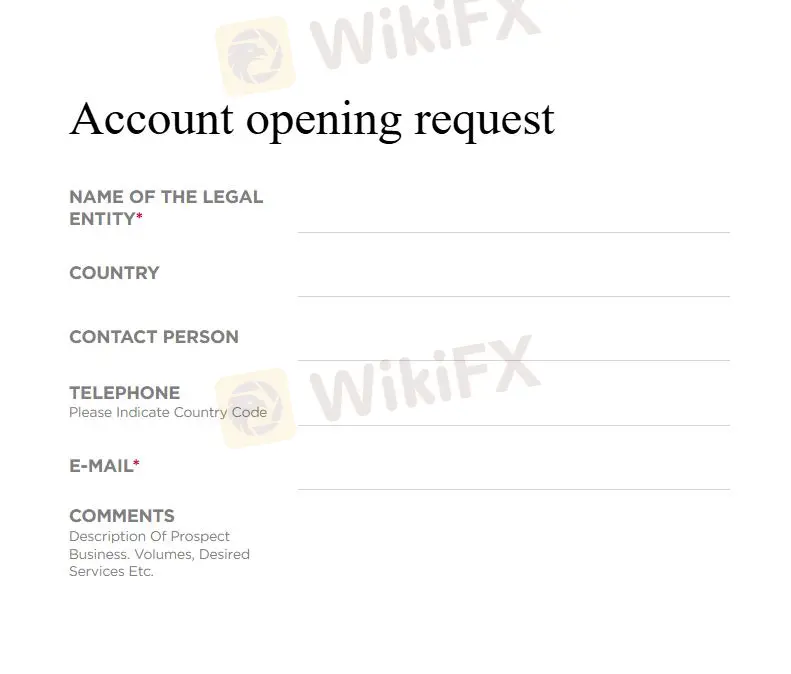

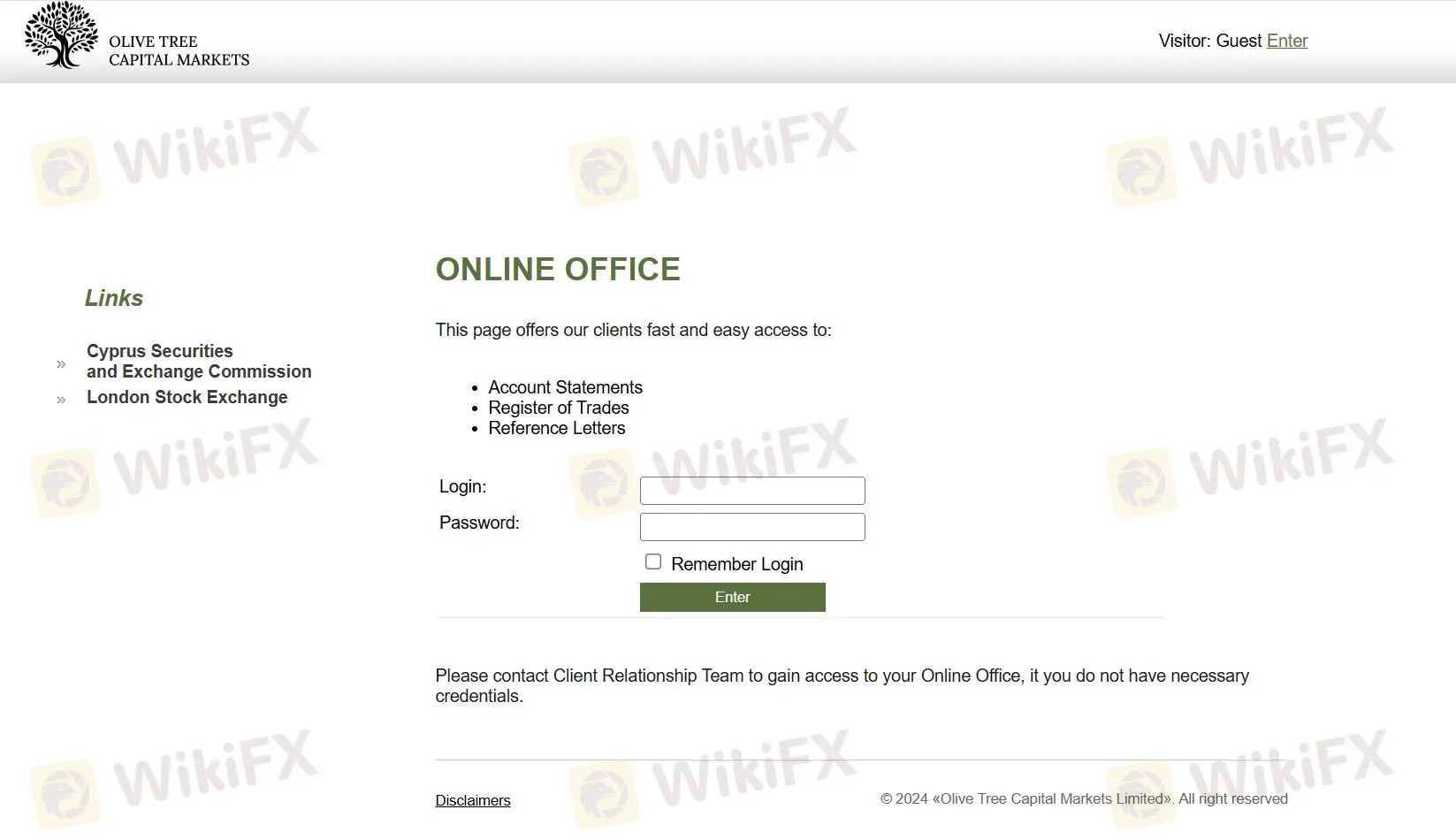

كيفية فتح حساب على Olive Tree Capital Markets؟

فتح حساب على Olive Tree Capital Markets أمر معقد إلى حد ما. للبدء ، يجب عليك ملء نموذج "طلب فتح حساب" للحصول على الموافقة. بالإضافة إلى ذلك ، يجب عليك جمع الوثائق اللازمة وتوقيع الاتفاقيات المتعلقة بفتح الحساب. بمجرد الانتهاء من هذه الخطوات ، يمكنك أخيرًا فتح حسابك عن طريق إدخال رقم الحساب وكلمة المرور.