회사 소개

| Olive Tree Capital Markets Review Summary | |

| 설립 | 2000 |

| 등록 국가/지역 | 키프로스 |

| 규제 | CySEC |

| 시장 기구 | 고정 소득, 주식, 파생 상품, 구조화 상품 대체 투자 및 외환 |

| 데모 계정 | ❌ |

| 레버리지 | / |

| 거래 플랫폼 | / |

| 최소 입금액 | / |

| 고객 지원 | 전화: +357 22 222 332; +357 22222305 |

| 이메일: info@otcm.eu | |

| 주소: Methonis Tower, 73 Makarios Avenue, 7th Floor, Office 701, Nicosia, Cyprus, 1070 | |

Olive Tree Capital Markets은 2000년에 키프로스에서 설립된 투자 회사로, 공식적으로 키프로스증권거래위원회에 의해 규제되며 런던 증권거래소의 회원이기도 합니다. 이 회사는 고정 소득, 주식, 파생 상품, 구조화 상품 대체 투자 및 외환을 포함한 다양한 투자 상품을 제공합니다.

장단점

| 장점 | 단점 |

| 긴 운영 역사 | 데모 계정 없음 |

| 키프로스증권거래위원회 규제 | 거래 조건에 대한 제한된 정보 |

| 다양한 투자 상품 |

Olive Tree Capital Markets이 신뢰할 만한가요?

네, Olive Tree Capital Markets은 법적인 브로커입니다. 이 회사는 키프로스증권거래위원회(CySEC)에 의해 키프로스 투자 회사로 등록되었으며, 라이선스 번호는 104/09입니다.

또한, Olive Tree Capital Markets은 런던 증권거래소(LSE)의 거래 회원으로 활동하고 있습니다.

| 규제 국가 | 규제 기관 | 현재 상태 | 규제 업체 | 라이선스 유형 | 라이선스 번호 |

| 키프로스증권거래위원회(CySEC) | 규제됨 | Olive Tree Capital Markets 리미티드 (이전 Atonline Ltd) | 마켓 메이킹 (MM) | 104/09 |

제품 및 서비스

Olive Tree Capital Markets은 거래 및 실행 서비스, 보관(보호 및 현금/담보물 관리와 관련된 서비스), 투자 연구 및 금융 분석, 리포 및 마진 금융 및 투자 펀드를 포함한 다양한 투자 서비스를 제공합니다.

또한, 이 회사는 고정 소득, 주식, 파생 상품, 구조화 상품 대체 투자 및 외환과 같은 다양한 제품을 제공합니다(금융 상품 거래에 관련된 규정에 연결됨).

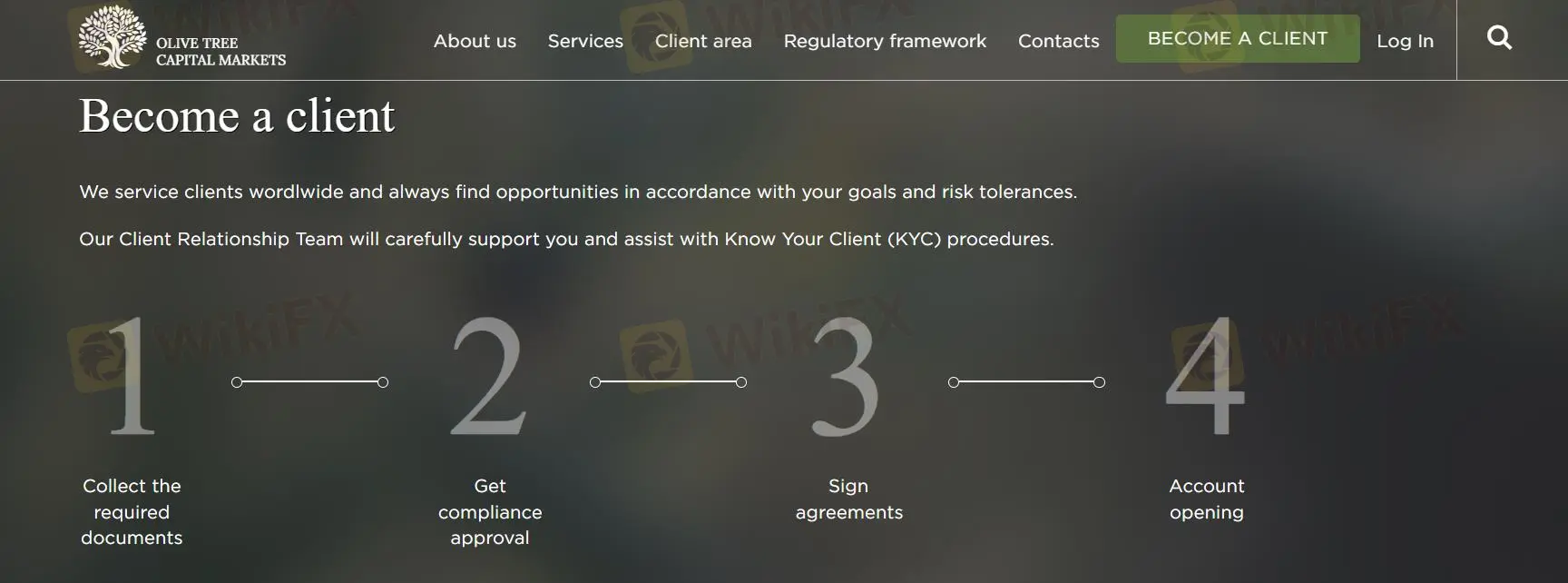

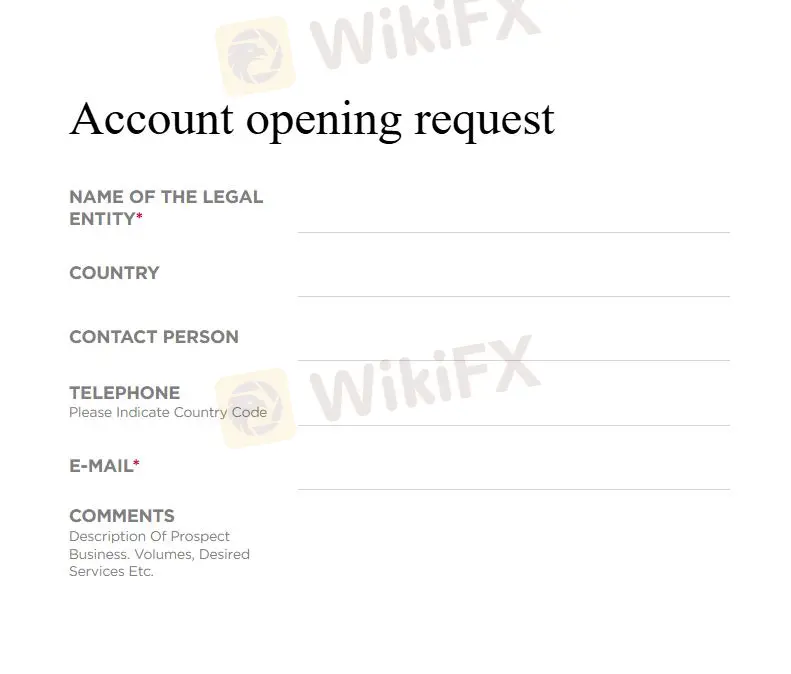

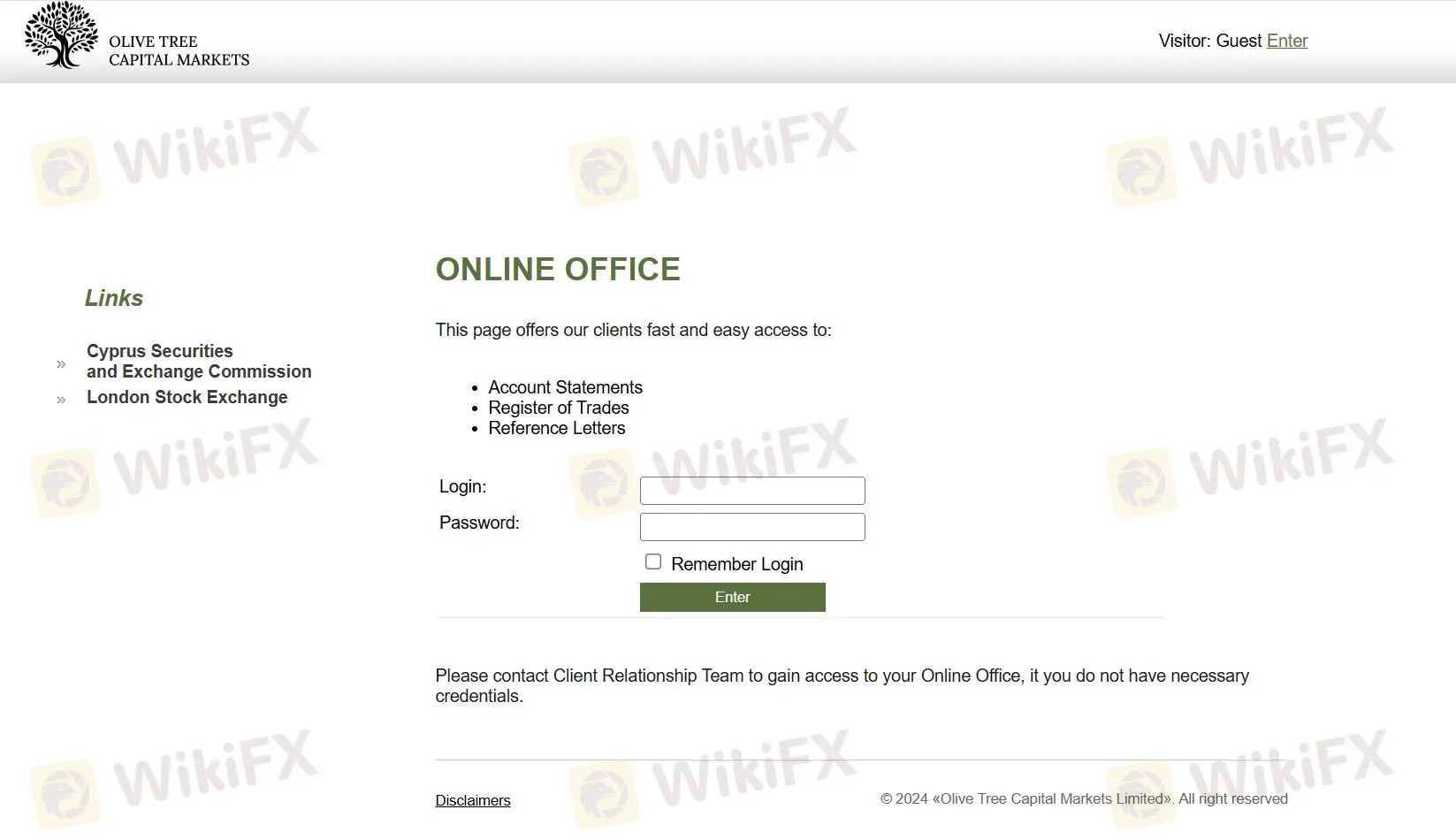

Olive Tree Capital Markets에서 계정을 개설하는 방법은 무엇인가요?

Olive Tree Capital Markets에서 계좌를 개설하는 것은 꽤 복잡합니다. 먼저 "계좌 개설 신청" 양식을 작성하여 승인을 받아야 합니다. 또한 계좌 개설과 관련된 필요한 문서를 수집하고 계약에 서명해야 합니다. 이러한 단계를 완료한 후에야 계좌 번호와 비밀번호를 입력하여 계좌를 개설할 수 있습니다.