Resumo da empresa

| SK Resumo da Revisão | |

| Fundação | 1955 |

| País/Região Registrada | Coreia do Sul |

| Regulação | Sem regulação |

| Produtos e Serviços | Negociação de ações, Finanças Corporativas, Finanças Estruturadas, Gestão de Ativos, Plataforma de Investimento Digital, Robo-Consultoria |

| Conta Demonstrativa | / |

| Alavancagem | / |

| Spread | / |

| Plataforma de Negociação | / |

| Depósito Mínimo | / |

| Suporte ao Cliente | Telefone: 82-2-3773-8245 |

| Endereço: 31, Gukjegeumyung-ro 8-gil, Yeongdeungpo-gu, Seul, República da Coreia | |

Informações sobre SK

A Coreia do Sul é o lar da SK Securities, fundada em 1955. A FSC e a FSS não a supervisionam, mas ela opera como uma empresa de investimentos regular, oferecendo serviços que incluem corretagem, finanças estruturadas, finanças corporativas e robo-consultoria.

Prós e Contras

| Prós | Contras |

| Estabelecimento de longa data (desde 1955) | Não regulamentado |

| Oferece uma ampla gama de serviços financeiros | Informações limitadas sobre condições de negociação |

| Fornece robo-consultoria baseada em IA |

SK é Legítimo?

SK não é um corretor regulamentado. Diz estar sediado na Coreia do Sul, embora a Comissão de Serviços Financeiros (FSC) e o Serviço de Supervisão Financeira (FSS) não o supervisionem ou licenciem.

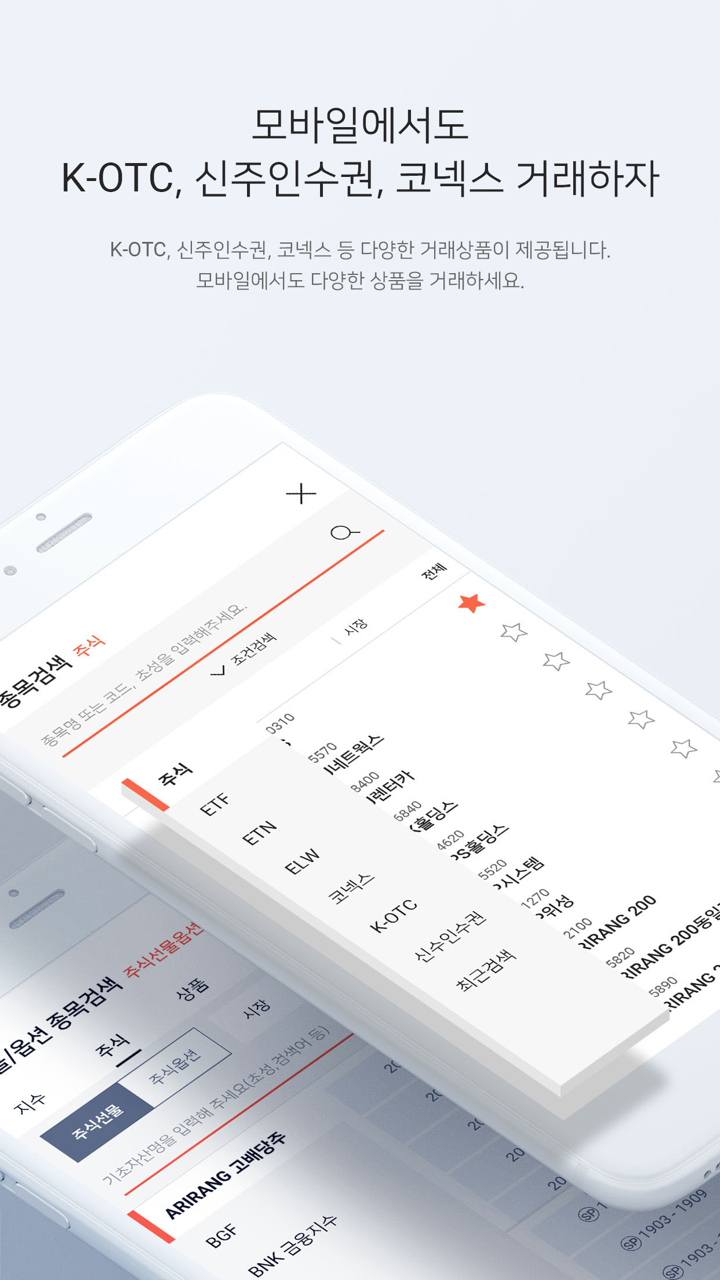

Produtos e Serviços

SK Securities oferece uma ampla gama de serviços tanto na área financeira tradicional quanto digital. Oferece serviços como corretagem, gestão de ativos, finanças corporativas, plataformas de investimento digital e robo-consultoria.

| Produtos / Serviços | Suportado |

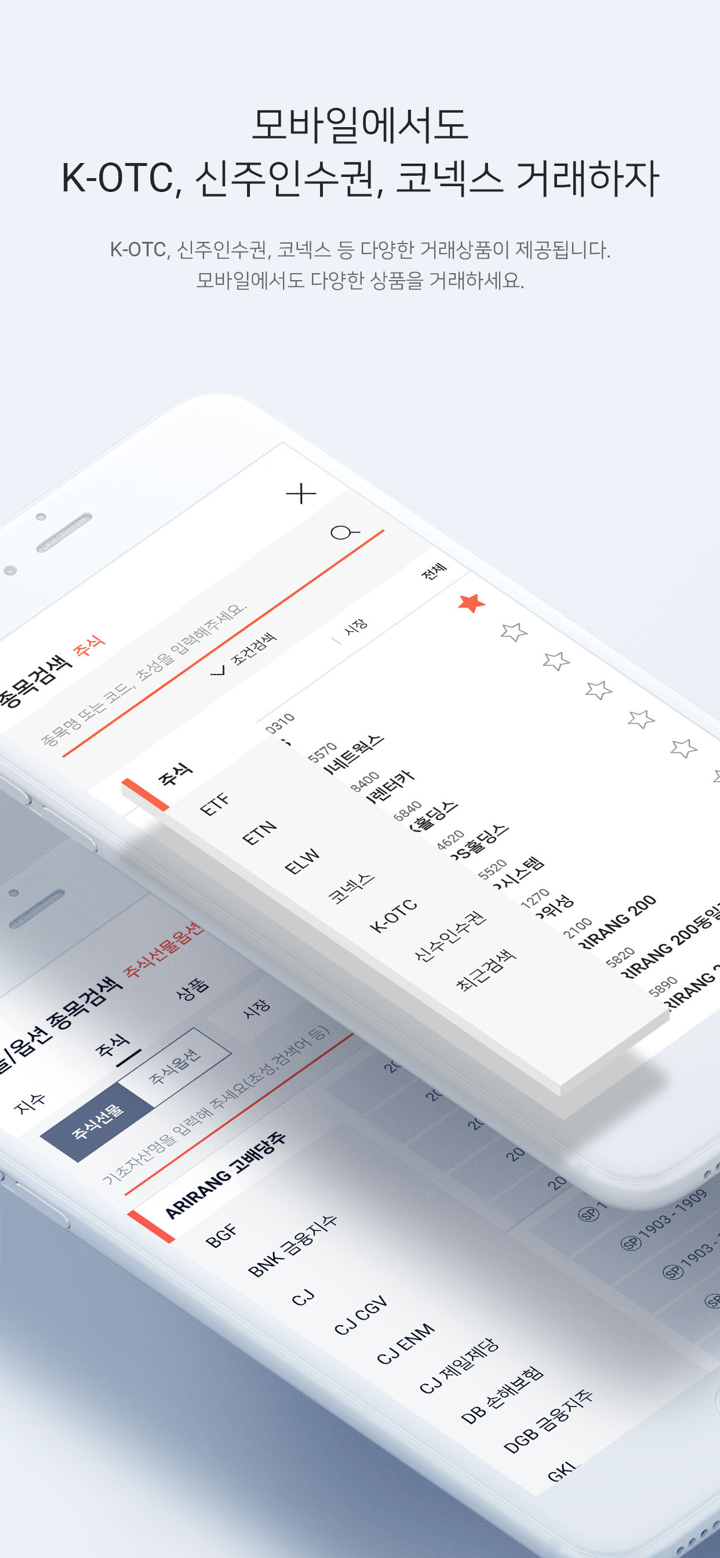

| Negociação de Ações (Coreia) | ✔ |

| Finanças Corporativas / IPO | ✔ |

| Finanças Estruturadas | ✔ |

| Gestão de Ativos | ✔ |

| Robo-Consultoria (baseada em IA) | ✔ |

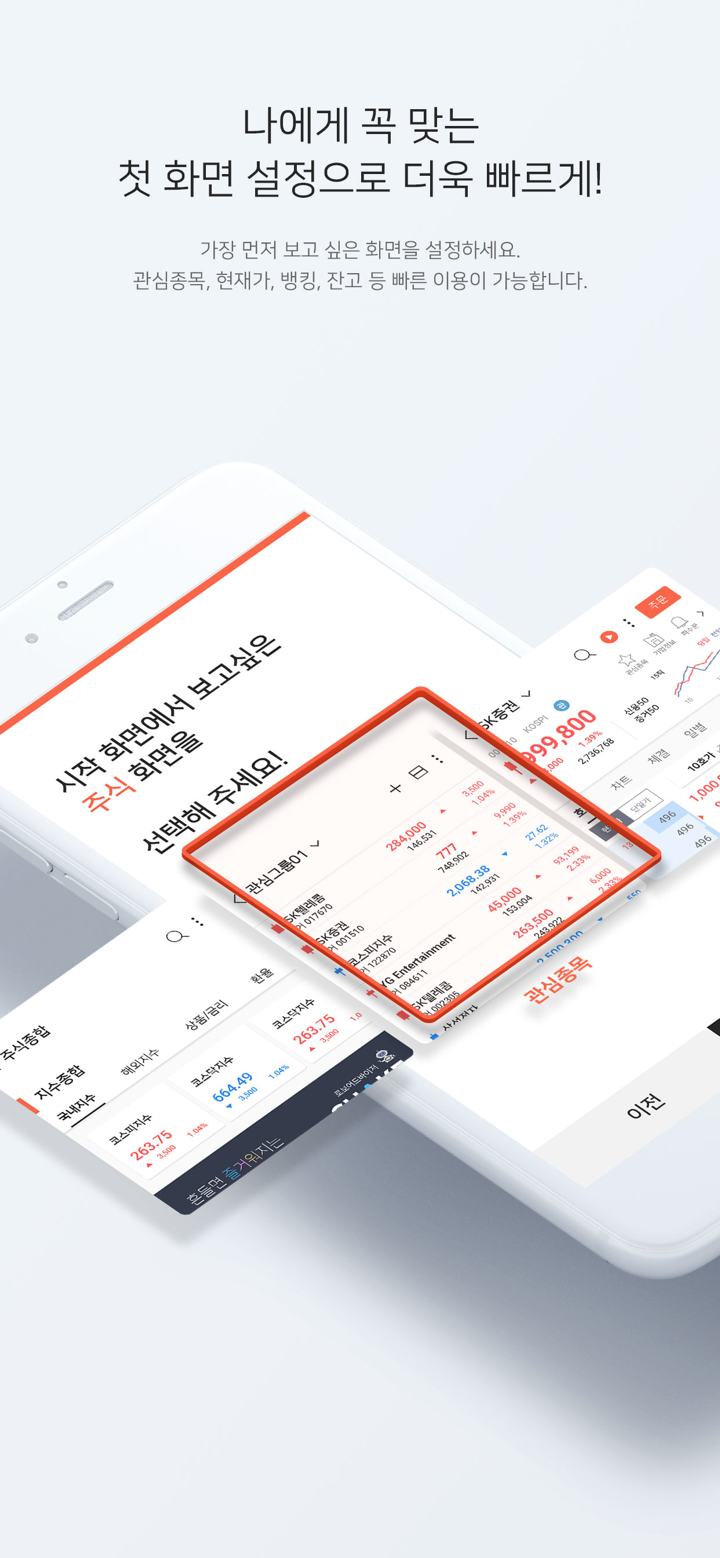

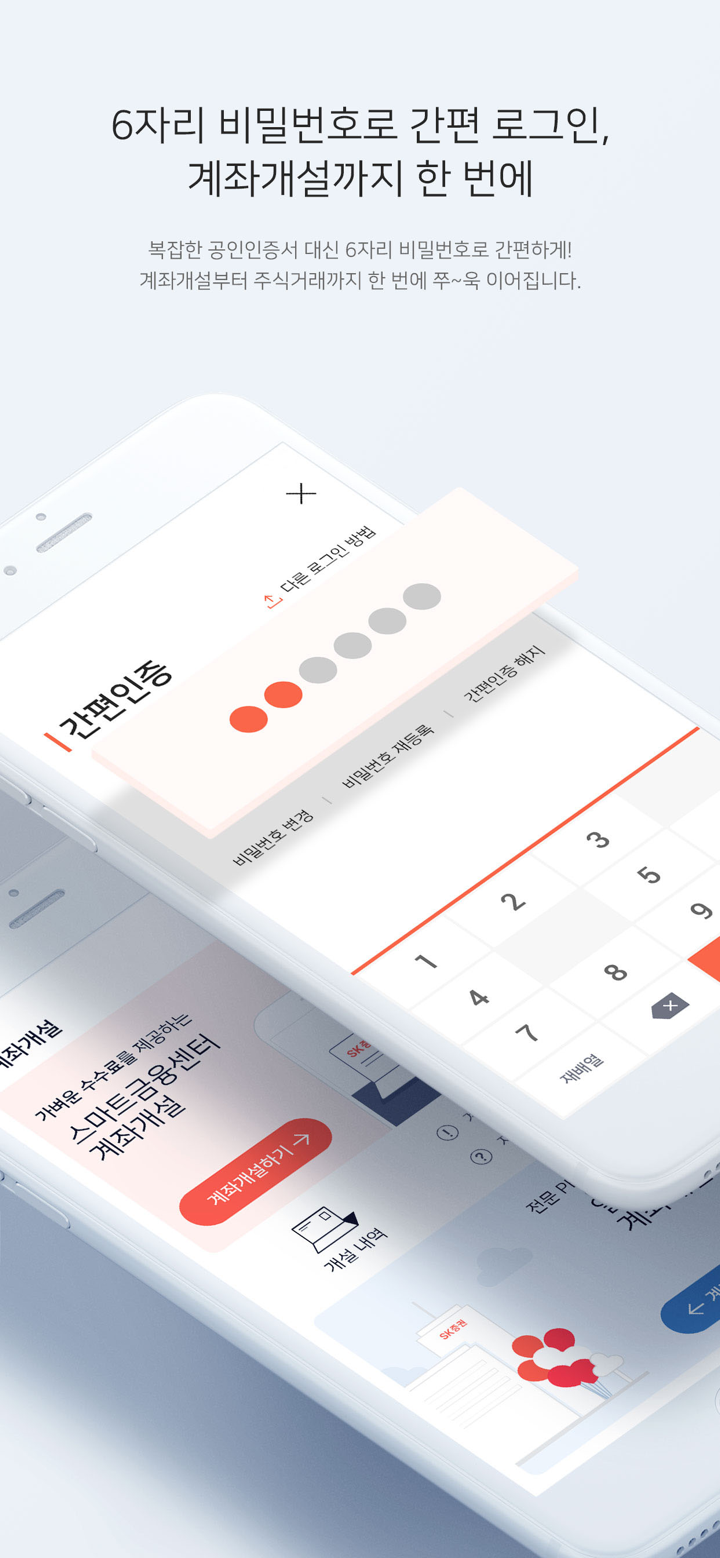

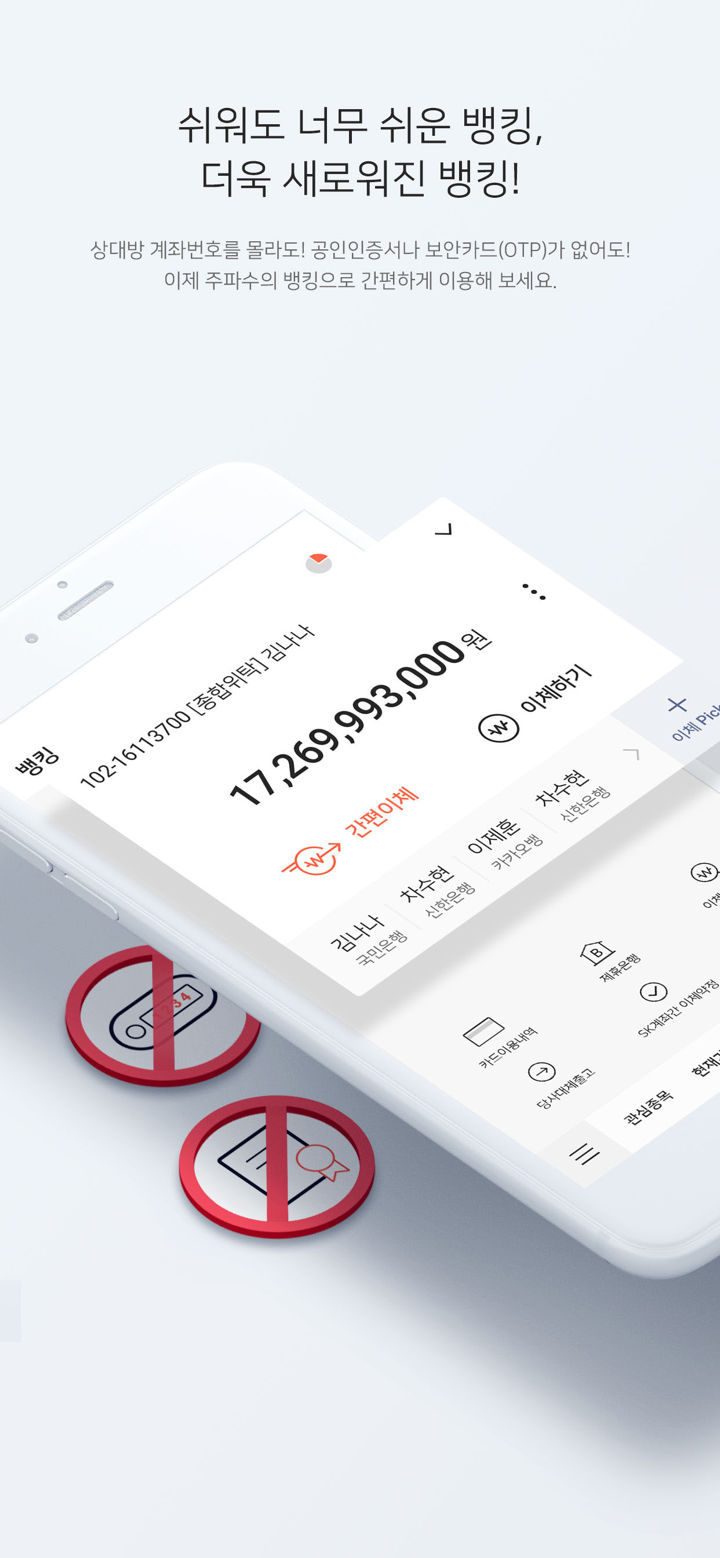

| Plataforma de Investimento Digital | ✔ |