Buod ng kumpanya

| SK Buod ng Pagsusuri | |

| Itinatag | 1955 |

| Nakarehistrong Bansa/Rehiyon | Timog Korea |

| Regulasyon | Walang regulasyon |

| Mga Produkto at Serbisyo | Stock trading, Corporate Finance, Structured Finance, Asset Management, Digital Investment Platform, Robo-Advisory |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Plataforma ng Trading | / |

| Minimum na Deposito | / |

| Suporta sa Customer | Telepono: 82-2-3773-8245 |

| Address: 31, Gukjegeumyung-ro 8-gil, Yeongdeungpo-gu, Seoul, Republic of Korea | |

Impormasyon Tungkol sa SK

Ang Timog Korea ang tahanan ng SK Securities, na itinatag noong 1955. Hindi ito binabantayan ng FSC at FSS, ngunit gumagana ito tulad ng isang regular na negosyo sa pamumuhunan, na nag-aalok ng mga serbisyo tulad ng brokerage, structured finance, corporate finance, at robo-advisory.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Matagal nang itinatag (mula 1955) | Hindi nairegulate |

| Nag-aalok ng malawak na hanay ng mga serbisyong pinansiyal | Limitadong impormasyon sa mga kondisyon ng kalakalan |

| Nagbibigay ng AI-based robo-advisory |

Tunay ba ang SK?

Ang SK ay hindi isang nairegulate na broker. Sinasabi nito na ito ay nakabase sa Timog Korea, bagaman ang Financial Services Commission (FSC) at ang Financial Supervisory Service (FSS) ay hindi nagbabantay o nagbibigay ng lisensya dito.

Mga Produkto at Serbisyo

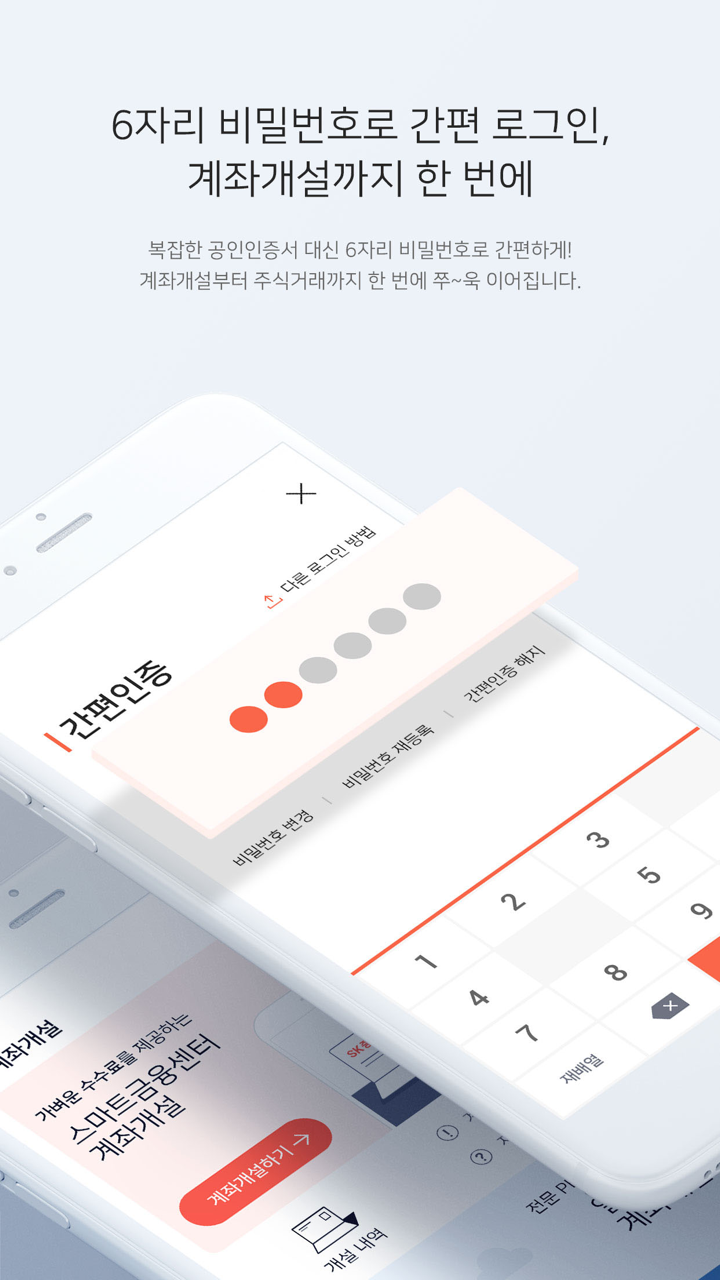

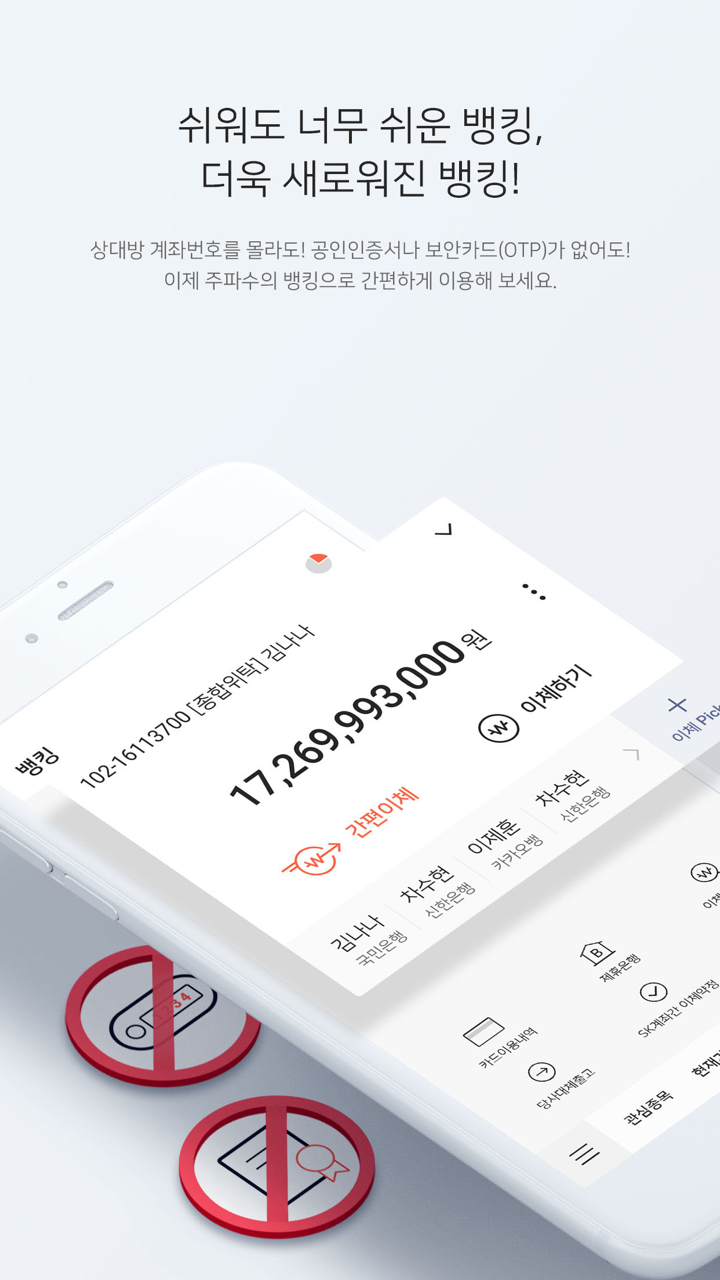

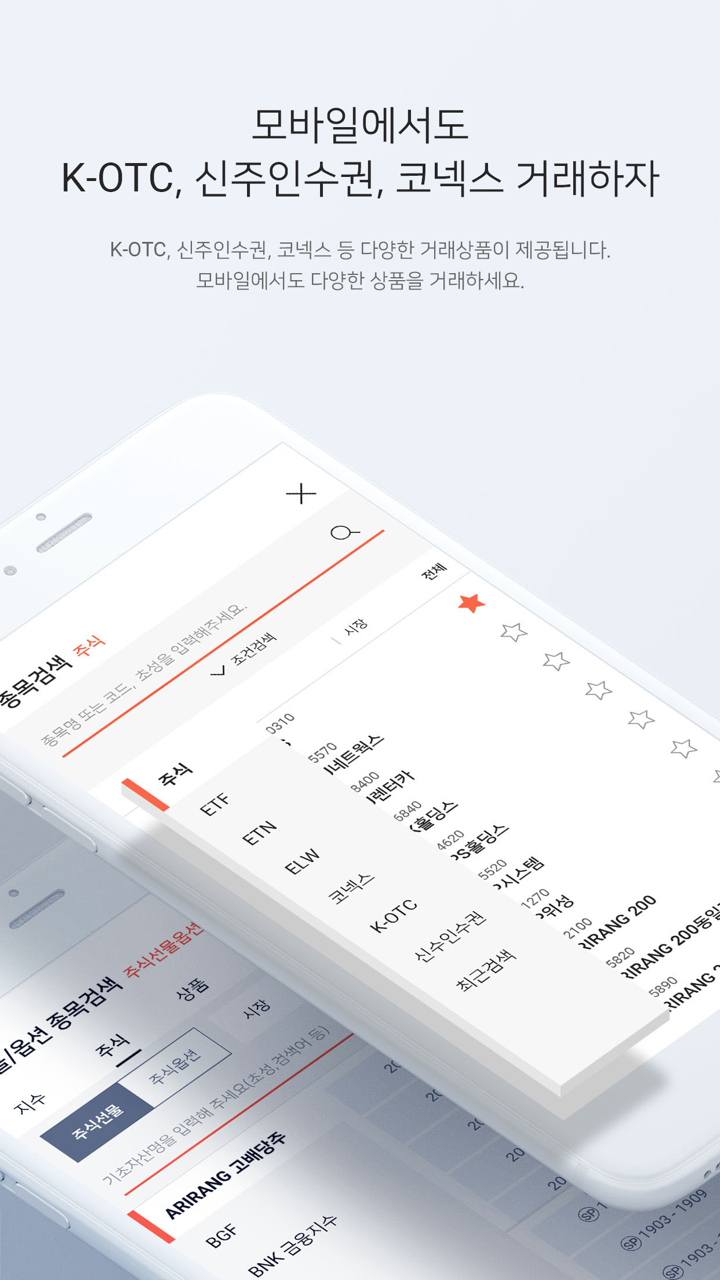

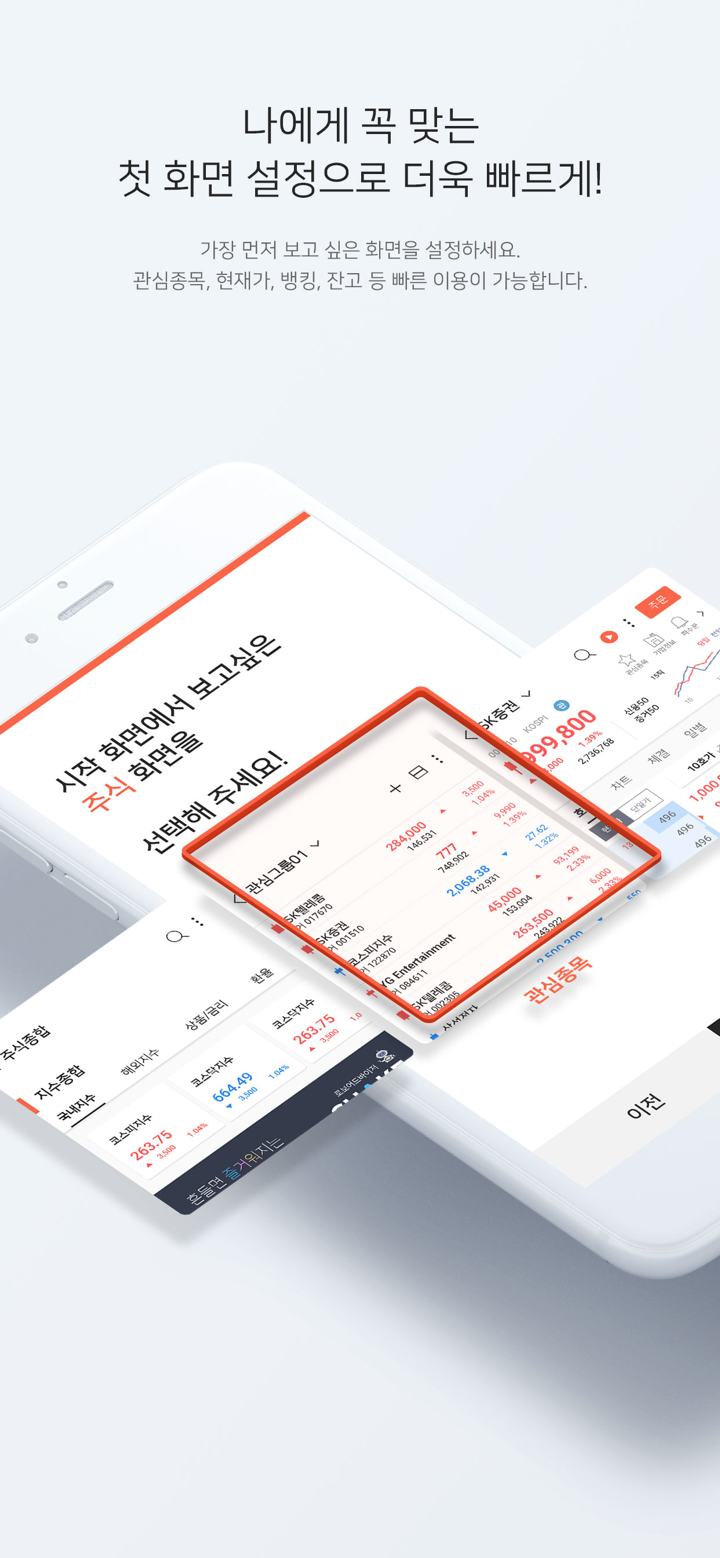

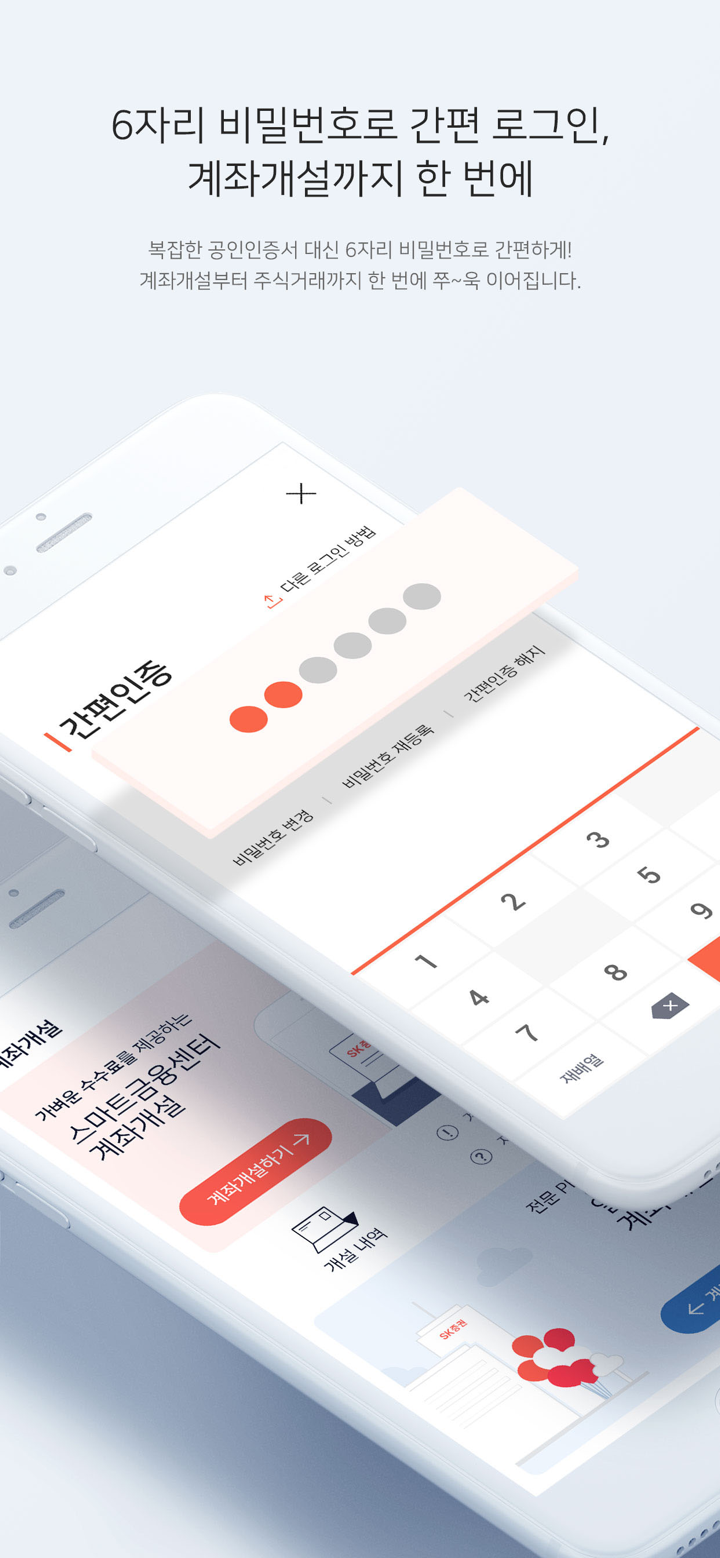

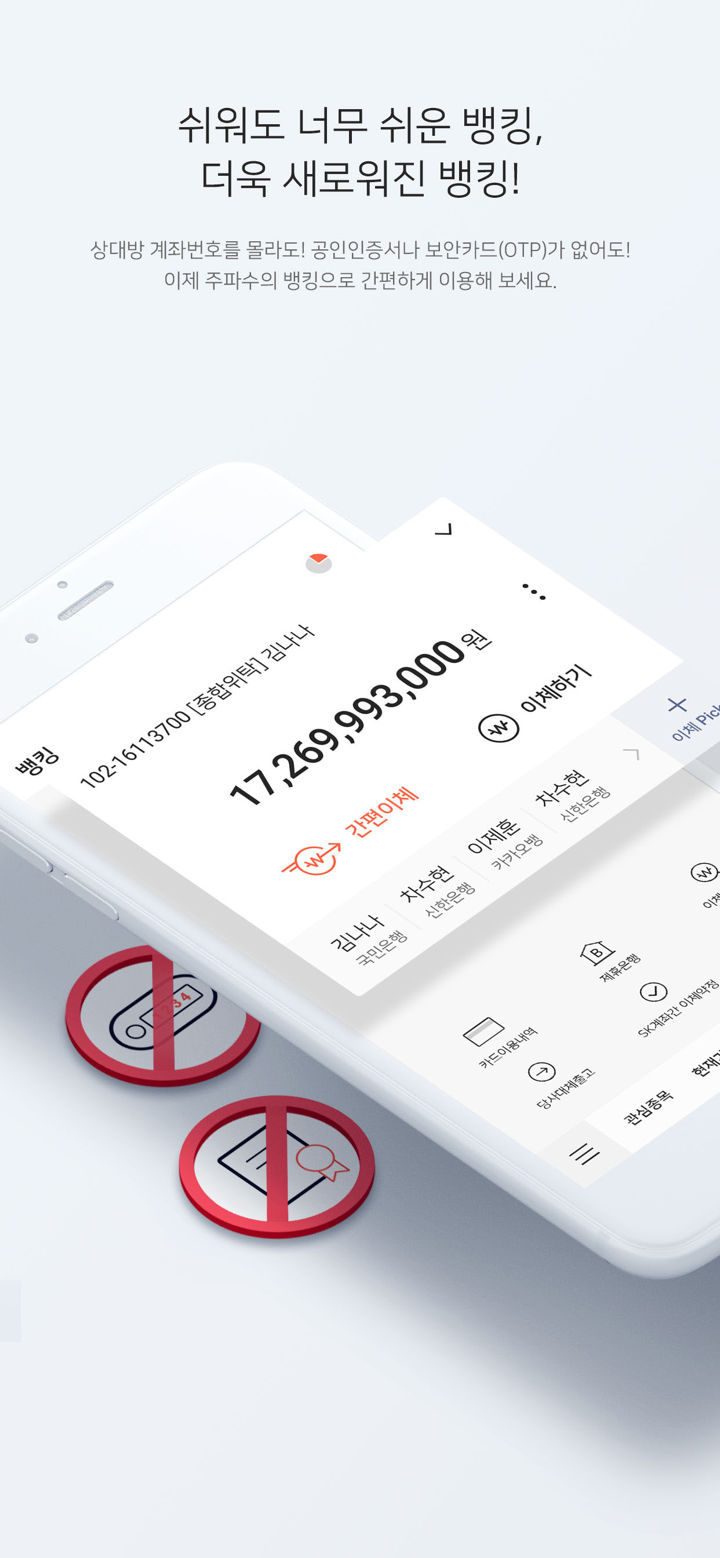

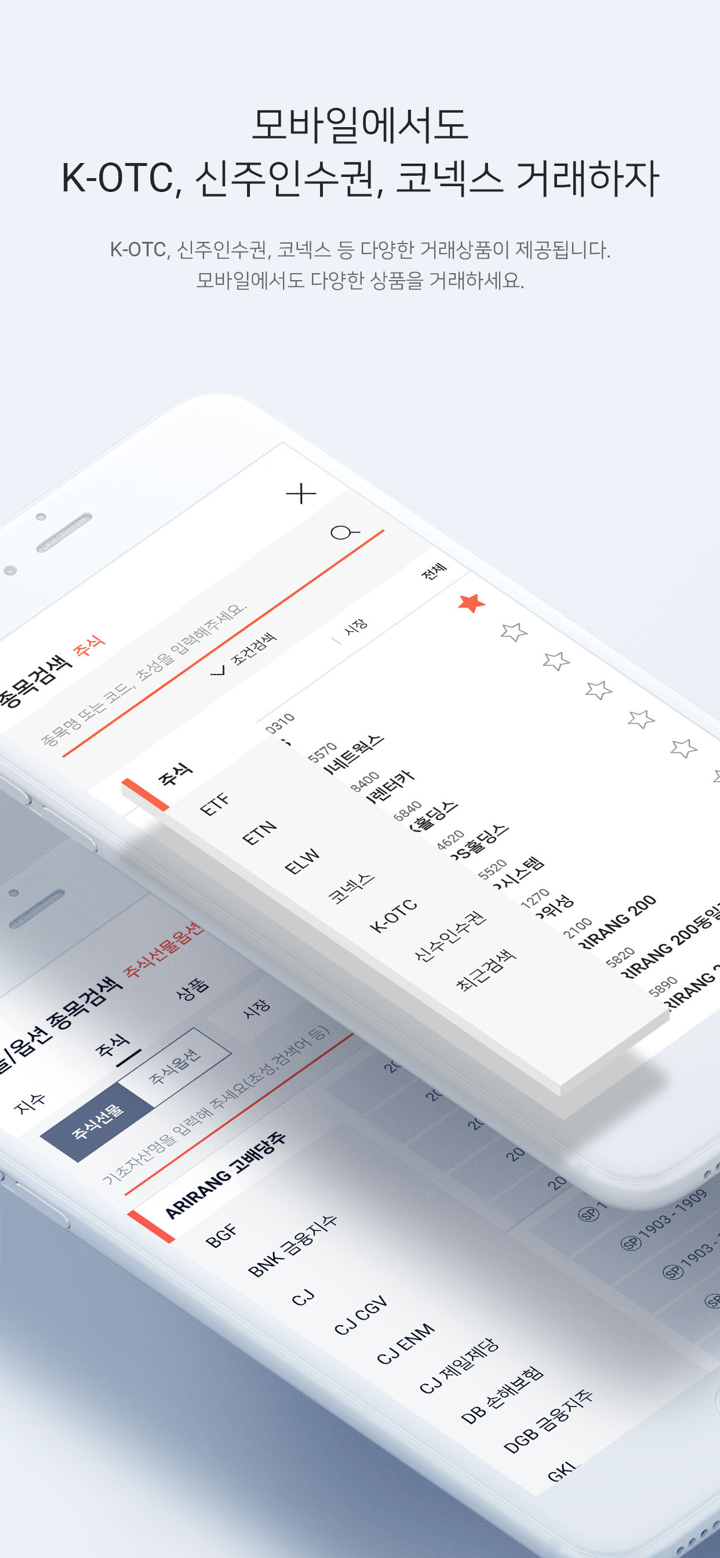

Nag-aalok ang SK Securities ng malawak na hanay ng mga serbisyo sa tradisyonal at digital na pananalapi. Nag-aalok ito ng mga serbisyong tulad ng brokerage, asset management, corporate finance, digital investment platforms, at robo-advisory.

| Mga Produkto / Serbisyo | Supported |

| Stock Trading (Korea) | ✔ |

| Corporate Finance / IPO | ✔ |

| Structured Finance | ✔ |

| Asset Management | ✔ |

| Robo-Advisor (AI-based) | ✔ |

| Digital Investment Platform | ✔ |