회사 소개

| SK 리뷰 요약 | |

| 설립 연도 | 1955 |

| 등록 국가/지역 | 대한민국 |

| 규제 | 규제 없음 |

| 제품 및 서비스 | 주식 거래, 기업 금융, 구조화 금융, 자산 관리, 디지털 투자 플랫폼, 로보 어드바이저 |

| 데모 계정 | / |

| 레버리지 | / |

| 스프레드 | / |

| 거래 플랫폼 | / |

| 최소 입금액 | / |

| 고객 지원 | 전화: 82-2-3773-8245 |

| 주소: 대한민국 서울 영등포구 국제금융로8길 31 | |

SK 정보

대한민국에는 1955년에 설립된 SK Securities가 있습니다. 금융위원회와 금융감독원은 이를 감독하지 않지만 일반 투자 사업처럼 작동하여 중개, 구조화 금융, 기업 금융 및 로보 어드바이저를 포함한 서비스를 제공합니다.

장단점

| 장점 | 단점 |

| 장기간 운영 (1955년 이후) | 규제되지 않음 |

| 다양한 금융 서비스 제공 | 거래 조건에 대한 정보 제한 |

| AI 기반 로보 어드바이저 제공 |

SK 합법적인가요?

SK은 규제되지 않은 브로커입니다. 한국에 기반을 두고 있으며 금융위원회(FSC)와 금융감독원(FSS)이 감독하거나 라이선스를 부여하지 않는다고 합니다.

제품 및 서비스

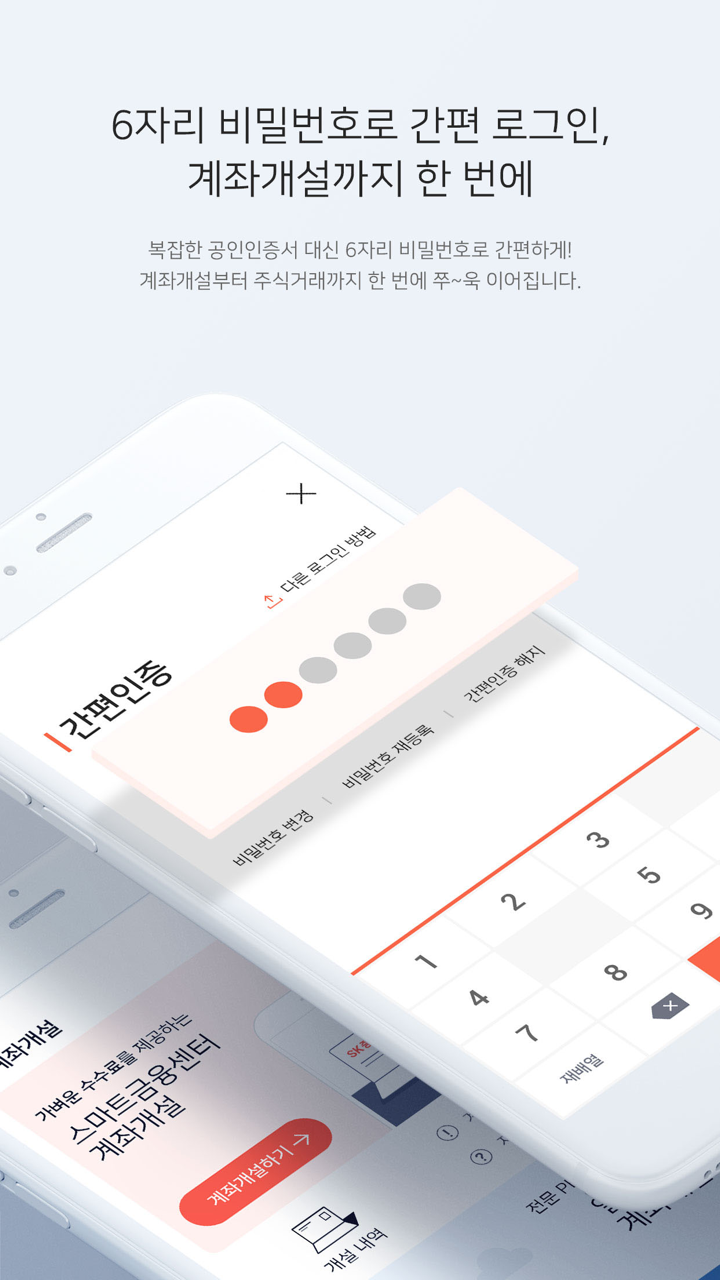

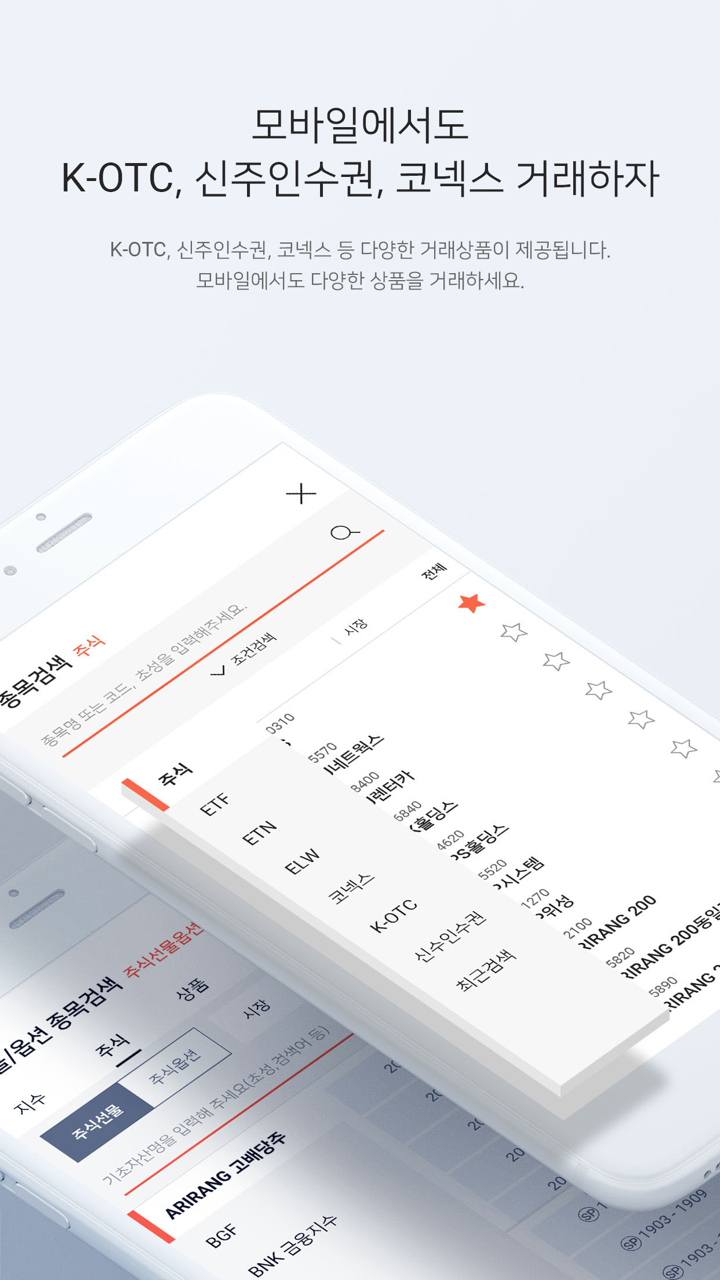

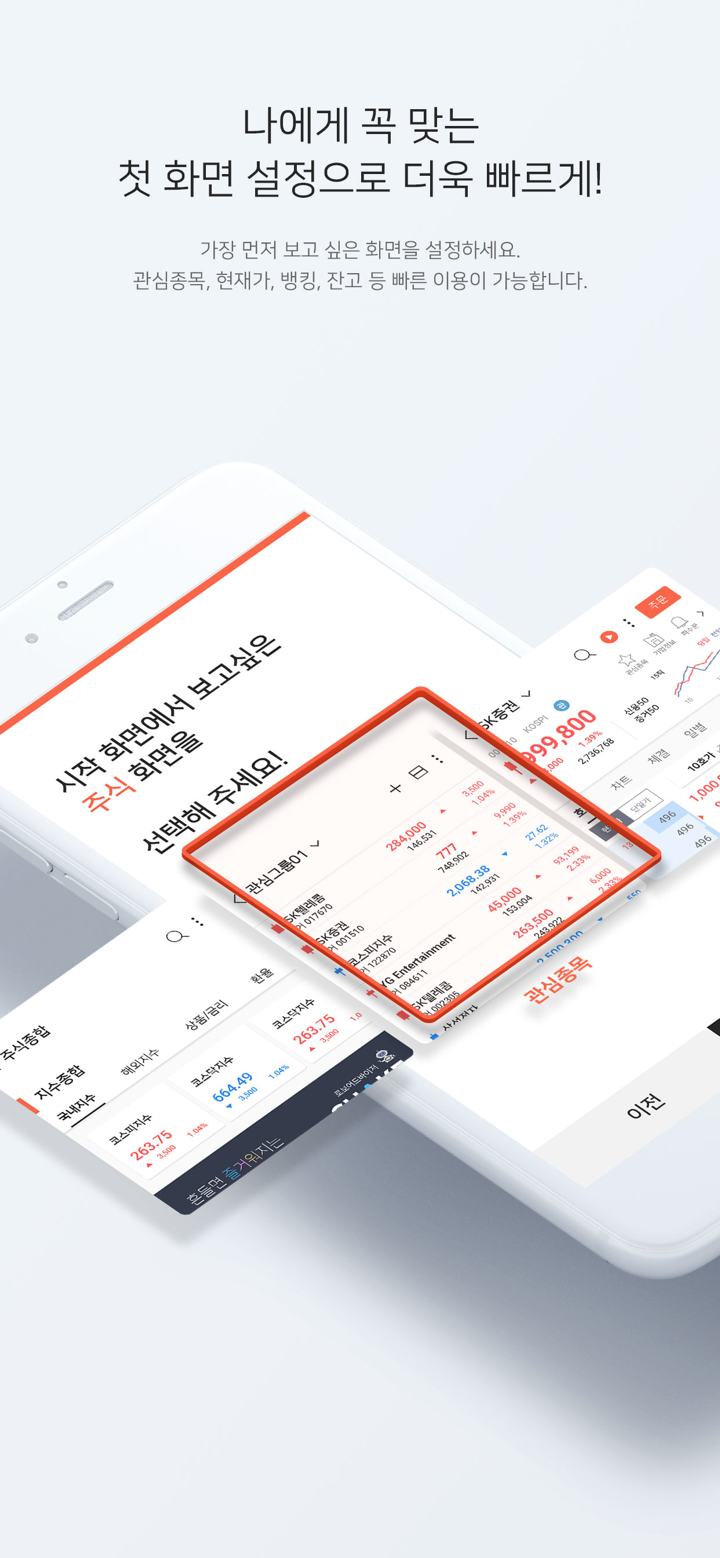

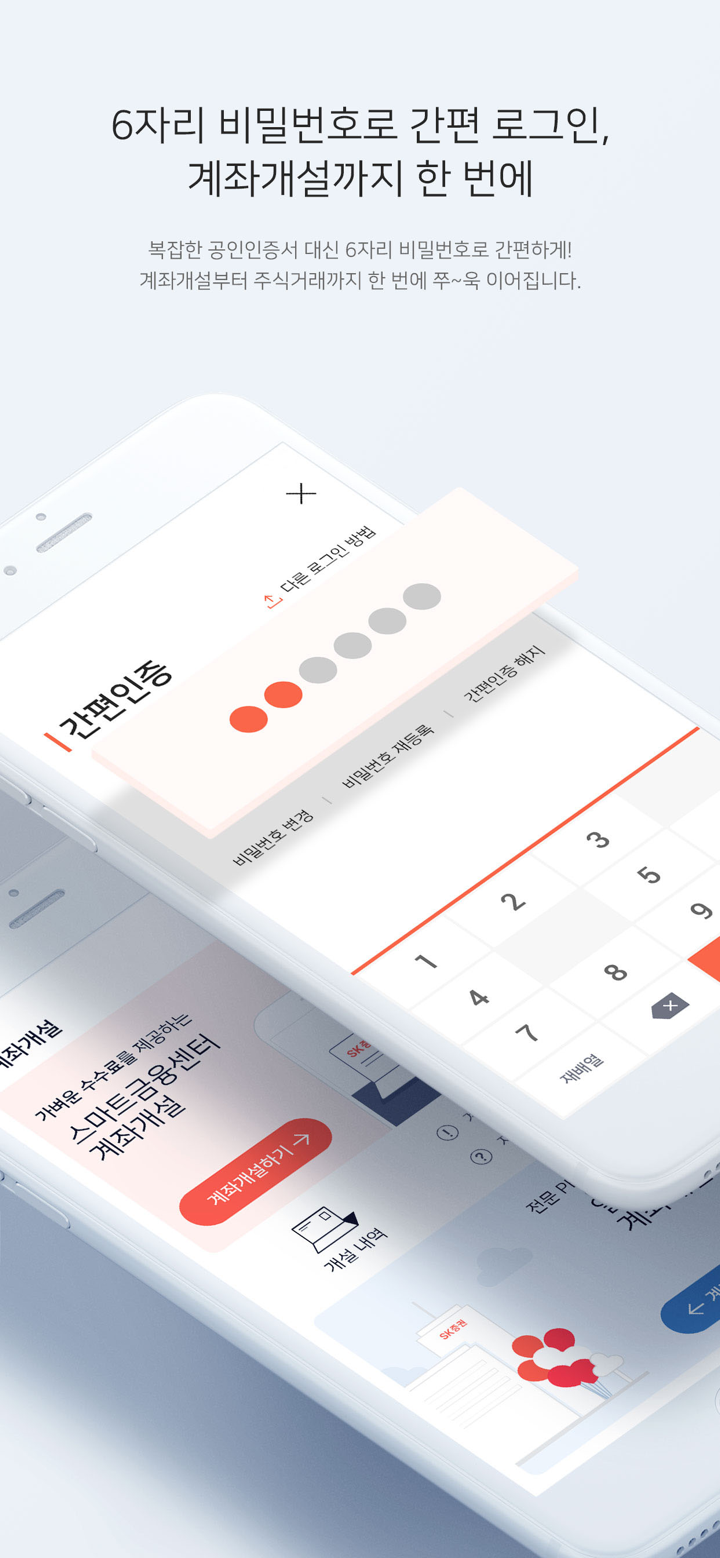

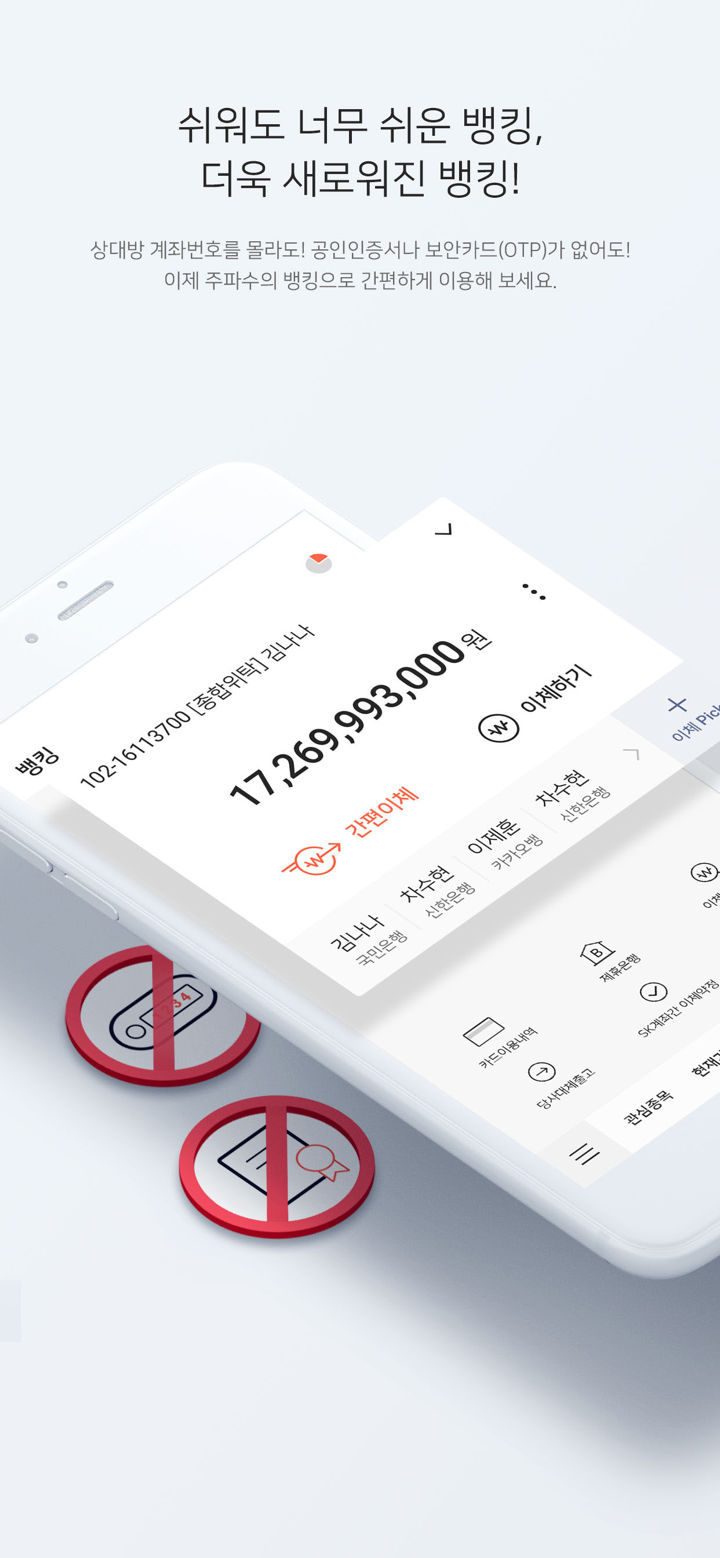

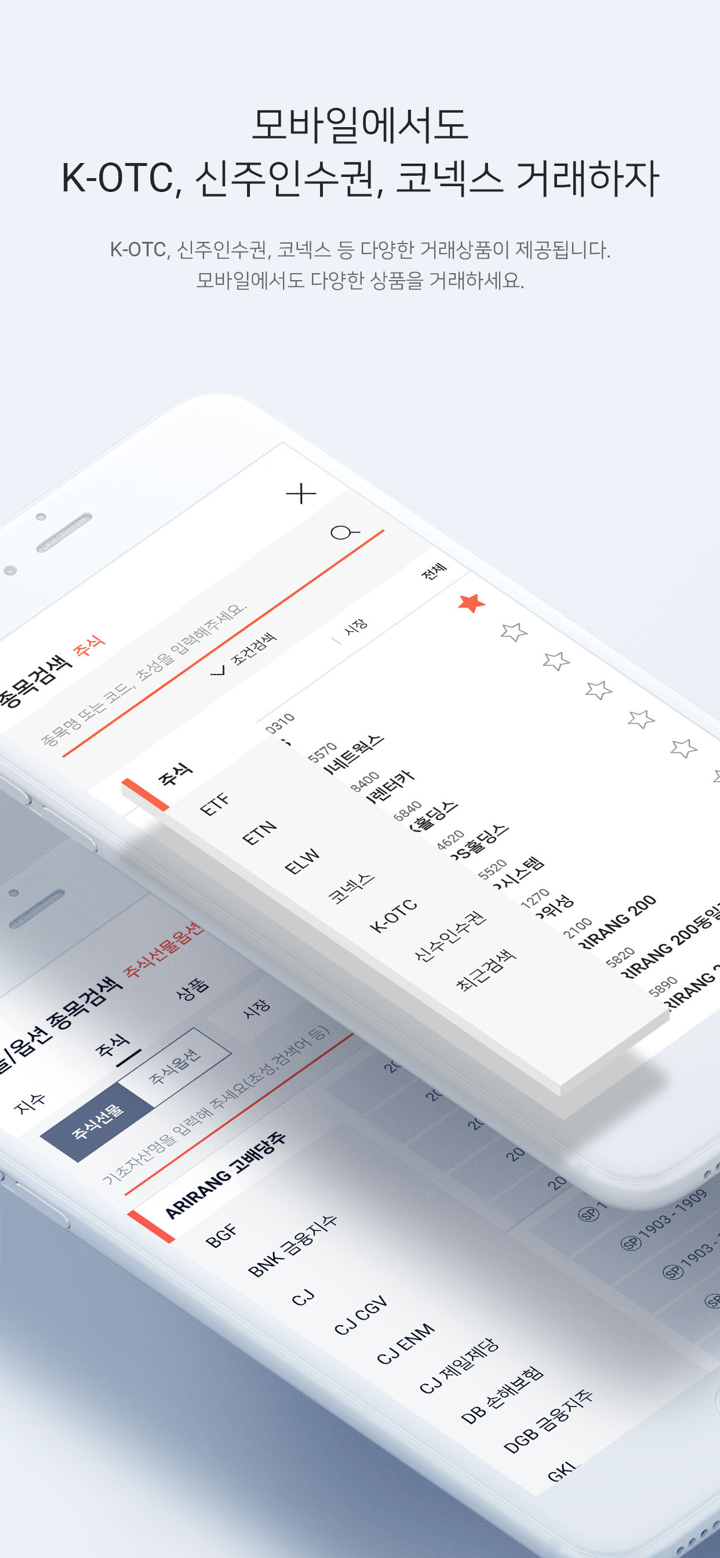

SK Securities는 전통적인 금융과 디지털 금융 모두에서 다양한 서비스를 제공합니다. 중개, 자산 관리, 기업 금융, 디지털 투자 플랫폼 및 로보 어드바이저와 같은 서비스를 제공합니다.

| 제품 / 서비스 | 지원 |

| 주식 거래 (한국) | ✔ |

| 기업 금융 / IPO | ✔ |

| 구조화 금융 | ✔ |

| 자산 관리 | ✔ |

| 로보 어드바이저 (AI 기반) | ✔ |

| 디지털 투자 플랫폼 | ✔ |