회사 소개

| GUOSEN FUTURES 리뷰 요약 | |

| 설립 | 2008 |

| 등록 국가/지역 | 중국 |

| 규제 | CFFEX (규제) |

| 시장 상품 | 금, 강철, 농산물, 기초 금속, 에너지 상품 |

| 데모 계정 | ❌ |

| 거래 플랫폼 | Guosen Futures CTP—Boyi Cloud Trading Edition, EasyStar 9.5 macOS, Guoxin Futures CTP- Quick Futures V3 Client, Wenhua Winshun WH6 등 |

| 최소 입금액 | / |

| 고객 지원 | 전화: 400-86-95536 / 0755-22941888 |

Guosen Futures Limited는 Guoxin Securities Company Limited의 완전 소유 자회사입니다. 본사는 상하이에 위치하고 있으며 다양한 거래 플랫폼에서 거래 가능한 자산을 제공합니다. Guosen Futures는 Guoxin Securities의 100개 이상의 사업부에 의해 지원되는 주요 도시를 포함한 광범위한 네트워크를 보유하고 있어 업계에서 상위 10위 안에 위치하고 있습니다. CFFEX에 의해 잘 규제되고 있습니다.

장단점

| 장점 | 단점 |

| CFFEX 규제 | 시간이 많이 소요되는 계좌 개설 절차 |

| 다양한 기기에서 사용 가능한 다양한 거래 플랫폼 | 제한된 연락 채널 |

| 데모 계정 없음 |

GUOSEN FUTURES이 신뢰할 수 있나요?

GUOSEN FUTURES은 중국 금융선물거래소(China Financial Futures Exchange Co. Ltd., CFFEX)에 의해 규제를 받고 있습니다. 라이선스 번호 0113을 소지하고 있습니다.

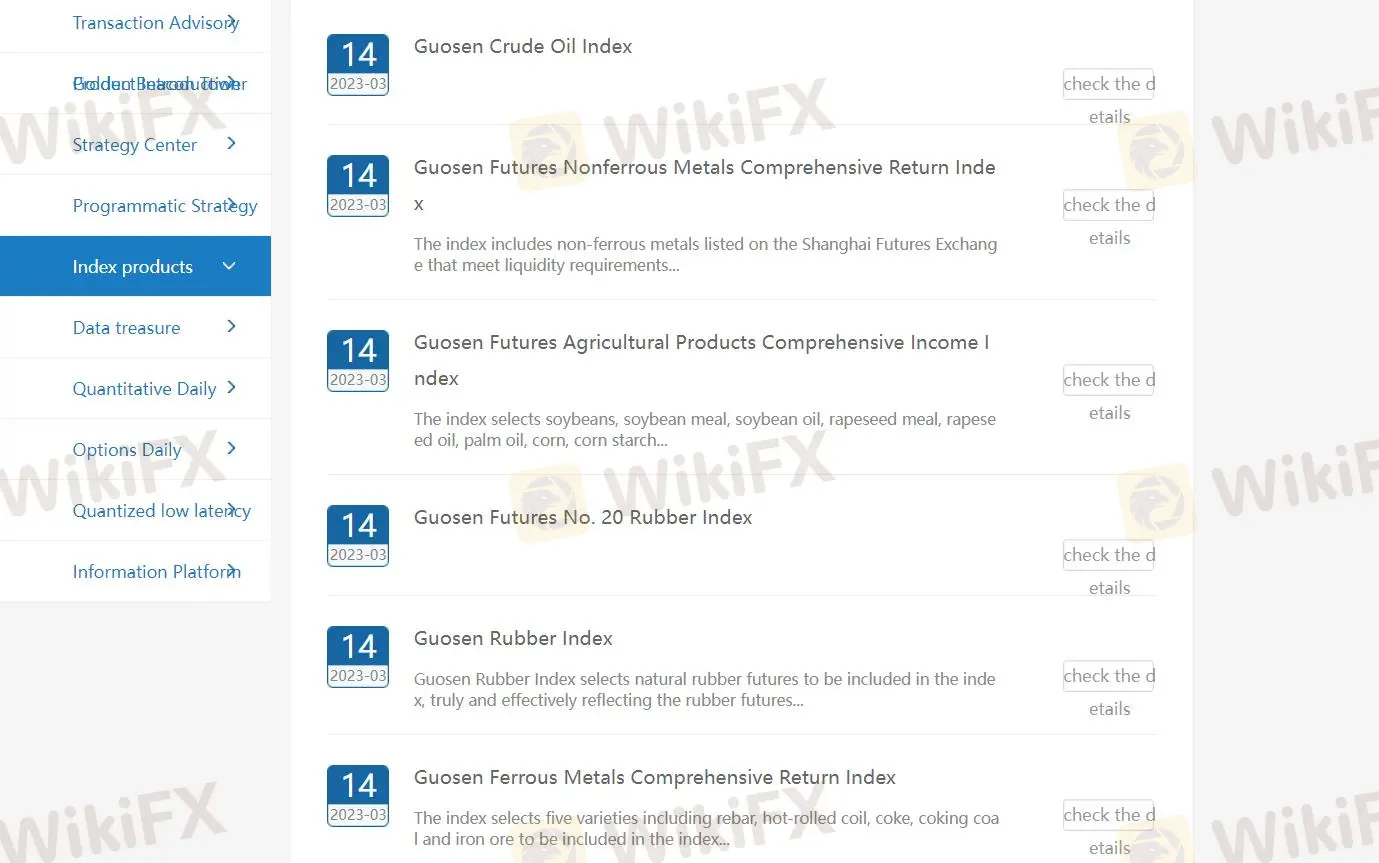

GUOSEN FUTURES에서 무엇을 거래할 수 있나요?

GUOSEN FUTURES은 선물, 금, 강철, 농산물, 기초 금속 및 에너지 상품을 제공합니다.

계정 유형

GUOSEN FUTURES의 계정을 개설하려면 휴대폰이나 컴퓨터를 통해 선물 인터넷 계정 개설 클라우드 시스템에 등록하고 로그인한 후 개인 정보를 입력하고 개설하려는 계정 유형을 선택해야 합니다. 또한 평가를 수행하고 해당 거래소에 신청하고 관련 문서에 서명해야 합니다. 따라서 절차는 복잡하고 시간이 많이 소요됩니다.

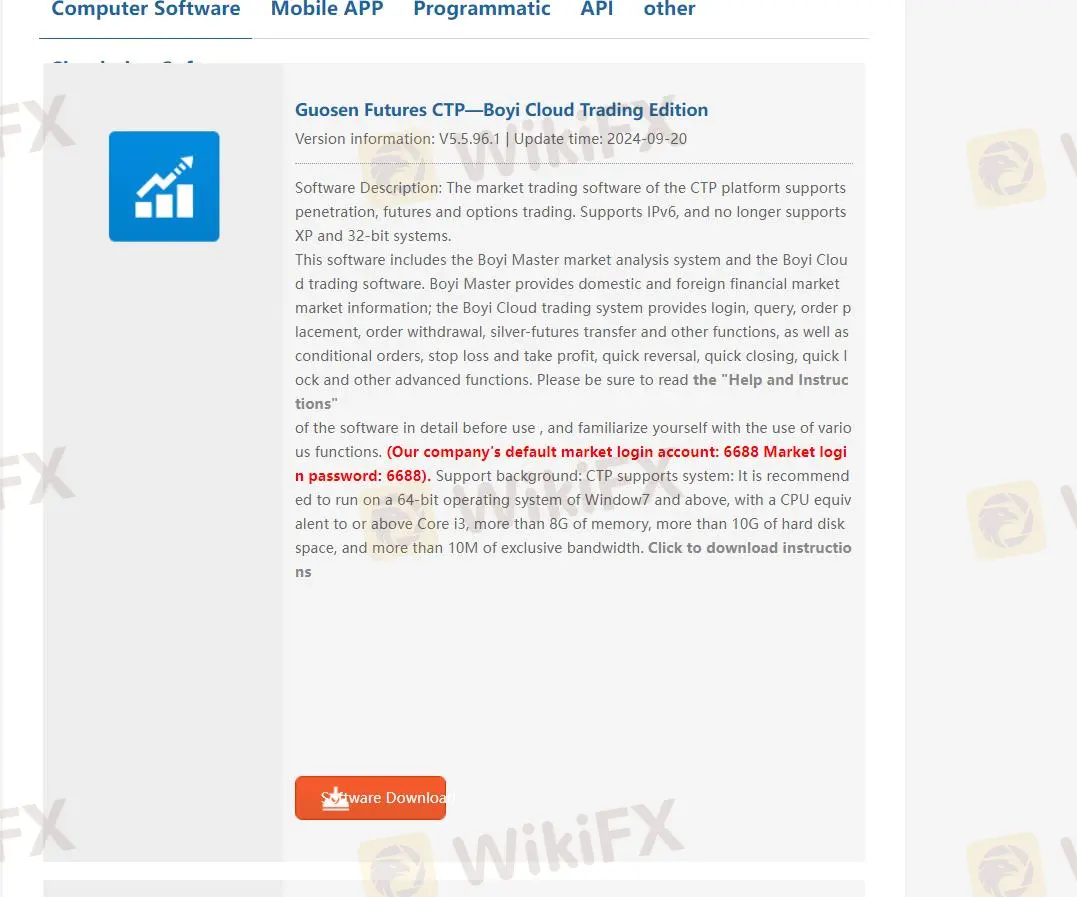

거래 플랫폼

GUOSEN FUTURES은 데스크톱 소프트웨어, 모바일 앱, 프로그래밍, API 등 다양한 거래 플랫폼을 제공합니다. 컴퓨터 소프트웨어에는 Guosen Futures CTP—Boyi Cloud Trading Edition, EasyStar 9.5 macOS, Guoxin Futures CTP- Quick Futures V3 Client, Wenhua Winshun WH6 등이 포함됩니다.

또한, 그들의 앱은 Guosen Futures와 Guosen Futures Premium Edition입니다. 거래 조건에 따라 다른 플랫폼을 선택할 수 있습니다. 거래 플랫폼에 대한 자세한 내용은 다음을 통해 알아볼 수 있습니다: https://www.guosenqh.com.cn/main/kfzx/xjzq/dnrj/index.shtml

입출금

GUOSEN FUTURES은 은행-선물 이체, 인터넷 뱅킹 이체 및 당선 이체를 지원합니다. 은행-선물 이체는 ICBC, ABC, BOC, CCB, BOC, SPDB, Minsheng, CMB, CITIC, Everbright, Ping An, Industrial Bank 및 Postal Savings Bank에 개설되어 있습니다.

하루에 인출할 수 있는 최대 금액은 1천만 위안이며, 단일 이체의 최대 한도도 1천만 위안입니다. 100 위안의 보증 기금은 인출할 수 없습니다 (거래나 포지션 없는 경우, 전화로 보증 기금 인출을 신청할 수 있습니다).