회사 소개

| OSL 리뷰 요약 | |

| 설립 연도 | 2013 |

| 등록 국가/지역 | 파키스탄 |

| 규제 | 규제 없음 |

| 시장 상품 | 주식 |

| 데모 계정 | ❌ |

| 거래 플랫폼 | OSL |

| 고객 지원 | 문의 양식 |

| WhatsApp: +92 300 8204 910 | |

| 전화: 922132446744 & 922132446747 | |

| 이메일: info@osl.com.pk | |

| 주소: Regd. Office # 731–732, 7th floor, Stock Exchange Building, Stock Exchange Road, Off I. I. Chundrigar Road, Karachi. | |

OSL 정보

OSL은 2013년에 파키스탄에서 설립된 규제되지 않은 회사입니다. 주식 중개, 온라인 거래, 백오피스, SMS 서비스 및 이메일 서비스를 제공합니다. 또한 자체 거래 플랫폼을 사용하며 MT4 또는 MT5를 지원하지 않습니다.

장단점

| 장점 | 단점 |

| 다양한 제품 및 서비스 | 규제 없음 |

| 다양한 연락 채널 | 데모 계정 없음 |

| 한정된 결제 옵션 유형 |

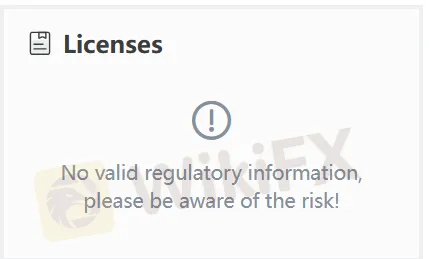

OSL 합법적인가요?

No. OSL은 현재 규제가 없습니다. 리스크를 주의하십시오!

OSL에서 무엇을 거래할 수 있나요?

| 거래 가능한 상품 | 지원 |

| 주식 | ✔ |

| 외환 | ❌ |

| 상품 | ❌ |

| 지수 | ❌ |

| 주식 | ❌ |

| 암호화폐 | ❌ |

| 채권 | ❌ |

| 옵션 | ❌ |

| ETF | ❌ |

거래 플랫폼

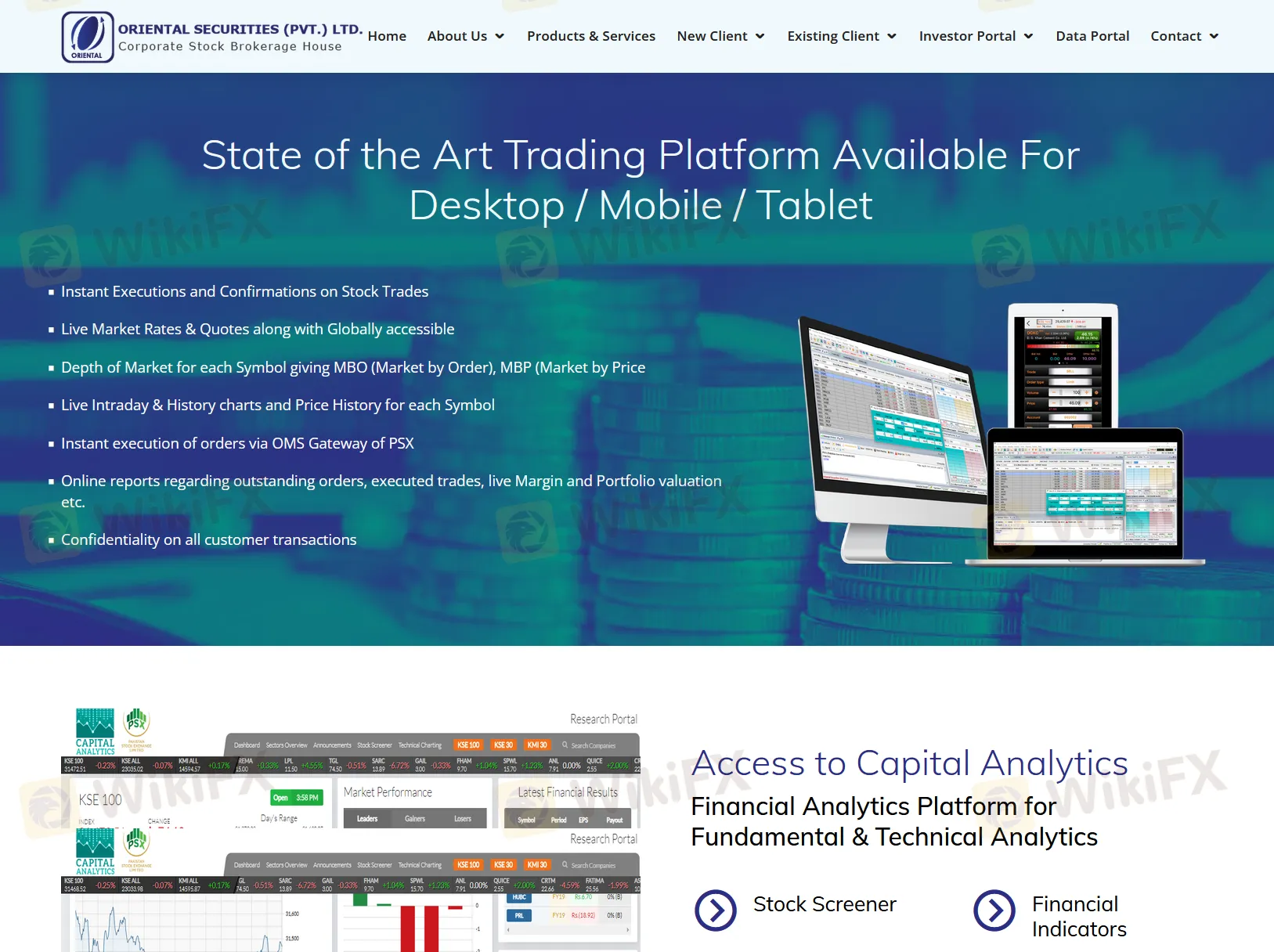

OSL은 데스크톱, 모바일 및 태블릿 기기에서 사용할 수 있는 거래 플랫폼을 제공합니다.

| 거래 플랫폼 | 지원 | 사용 가능한 기기 | 적합한 대상 |

| OSL | ✔ | 데스크톱, 모바일, 태블릿 | / |

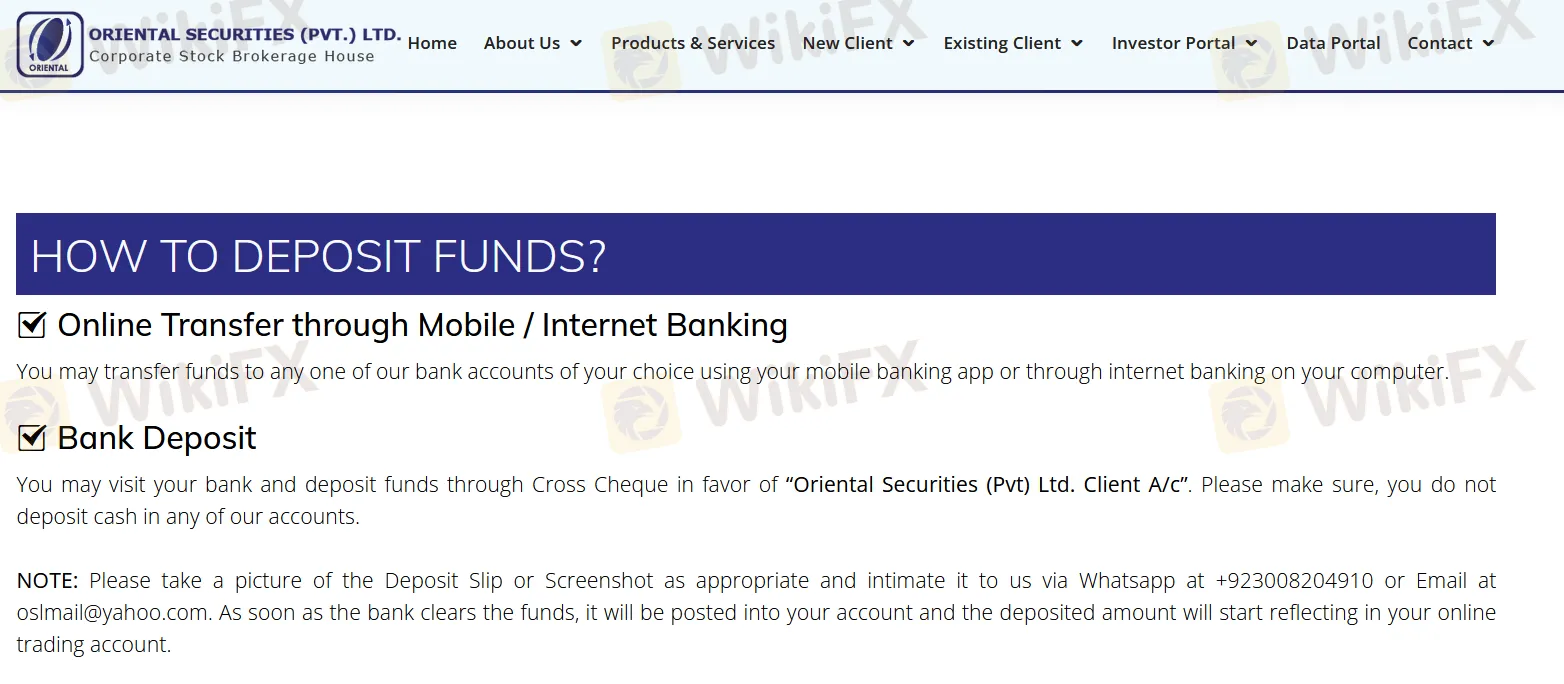

입금 및 출금

OSL은 자금을 조달하기 위해 두 가지 옵션을 제공합니다:

옵션 1: 모바일 / 인터넷 뱅킹을 통한 온라인 이체

- 모바일 또는 인터넷 뱅킹을 사용하여 OSL 은행 계좌로 이체합니다.

옵션 2: 은행 입금

- 크로스 체크를 통해 입금하십시오:

- “Oriental Securities (Pvt.) Ltd. 클라이언트 계정”

- OSL 계정으로 현금을 입금하지 마십시오.