회사 소개

| Qian Kun Futures 리뷰 요약 | |

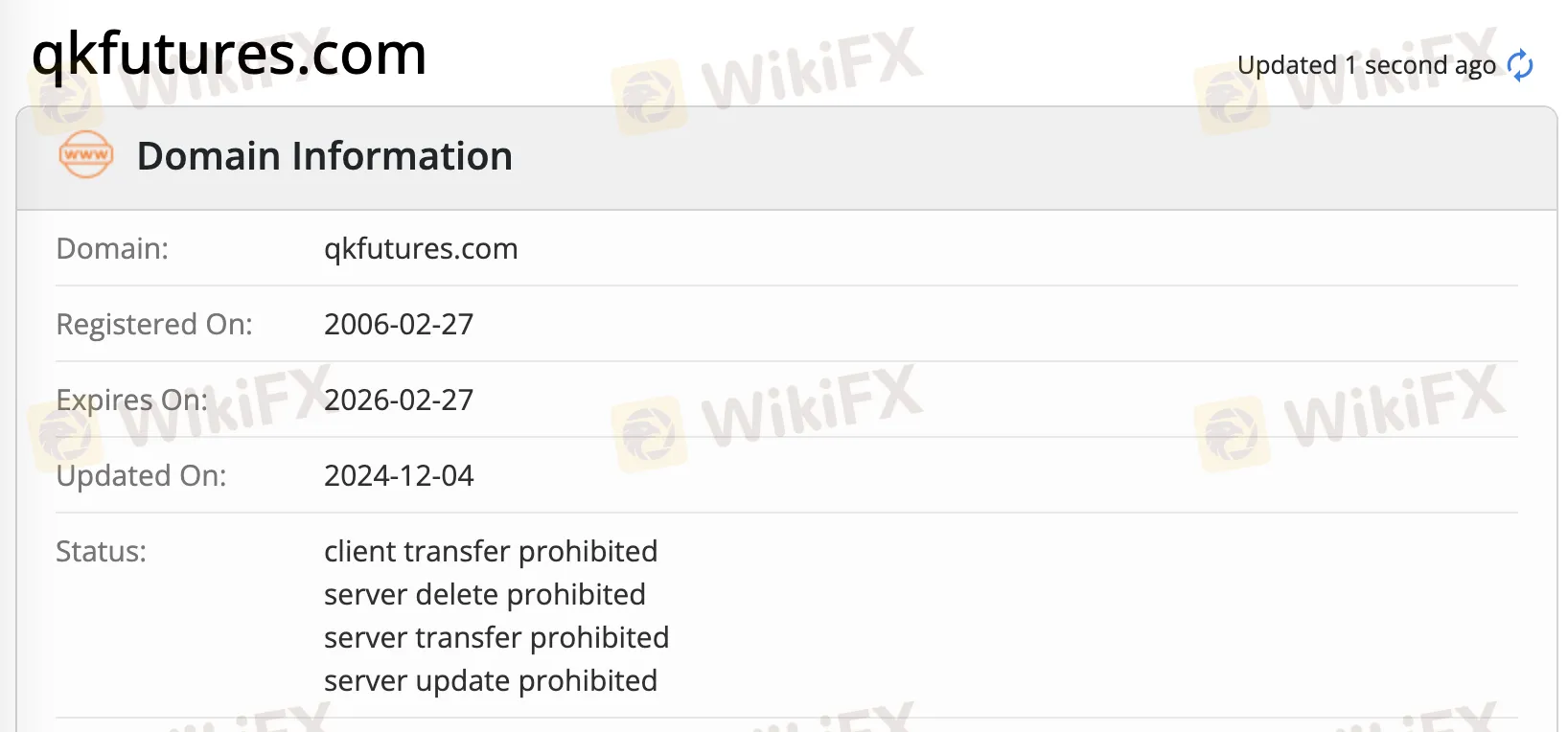

| 설립 연도 | 2006 |

| 등록 국가/지역 | 중국 |

| 규제 | CFFE (규제됨) |

| 시장 상품 | 선물 |

| 데모 계정 | ❌ |

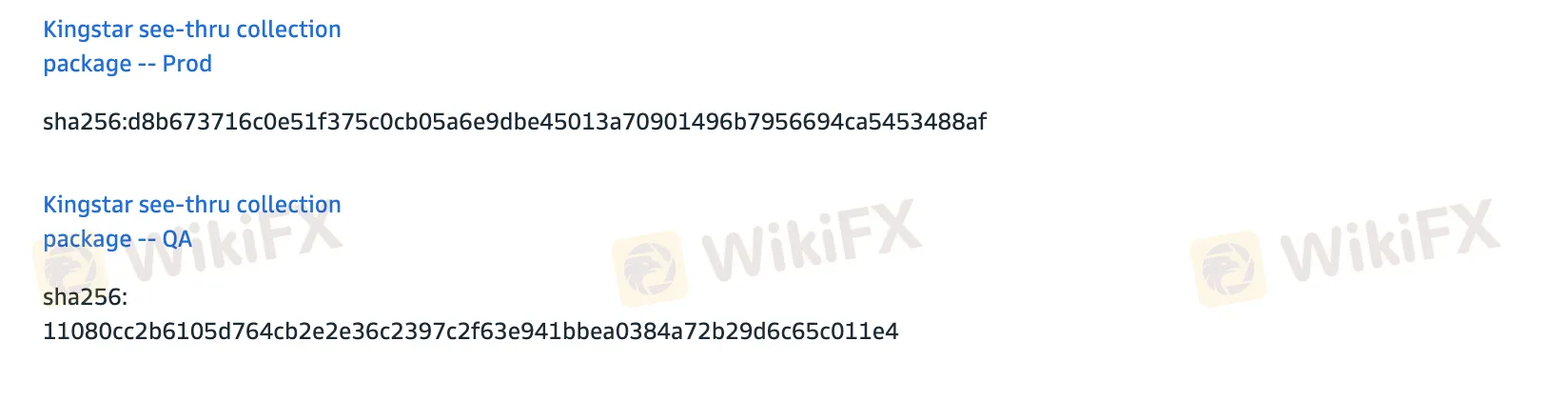

| 거래 플랫폼 | Qiankun Market II (Tongdaxin), Wind Information Financial Terminal, Kingstar see-thru collection package -- Prod, Kingstar see-thru collection package -- QA |

| 고객 지원 | 팩스: 86-755 8291 2965 |

| 우편번호: 518048 | |

| 전화: 86-755 2222 1100; 86-755 2222 1155 | |

| 이메일: services@qkfutures.com | |

Qian Kun Futures 정보

Qian Kun Futures는 다양한 거래 플랫폼에서 선물 거래를 제공하는 규제된 브로커입니다. 브로커는 데모 계정을 제공하지 않으며 거래 조건에 대한 정보가 부족합니다. 제공된 정보가 적기 때문에 웹 사이트의 투명성이 부족합니다.

장단점

| 장점 | 단점 |

| 잘 규제됨 | 한정된 거래 상품 유형 |

| 다양한 거래 플랫폼 | 데모 계정 없음 |

| 운영 시간이 길다 | 투명성 부족 |

| 고객 지원을 위한 다양한 채널 | 한정된 입출금 옵션 |

| 이체 수수료 없음 |

Qian Kun Futures 합법적인가요?

네. Qian Kun Futures는 CFFEX에 의해 라이선스를 받아 서비스를 제공합니다.

| 규제 국가 | 규제 기관 | 현재 상태 | 규제 업체 | 라이선스 유형 | 라이선스 번호 |

| 중국 금융 선물 거래소 | 규제됨 | Qian Kun Futures有限公司 | 선물 라이선스 | 0308 |

Qian Kun Futures에서 무엇을 거래할 수 있나요?

Qian Kun Futures은 선물 거래를 제공합니다.

| 거래 가능한 상품 | 지원 |

| 선물 | ✔ |

| 외환 | ❌ |

| 상품 | ❌ |

| 지수 | ❌ |

| 주식 | ❌ |

| 암호화폐 | ❌ |

| 채권 | ❌ |

| 옵션 | ❌ |

| ETFs | ❌ |

Qian Kun Futures 수수료

은행 송금을 통한 입금/출금은 수수료를 지불할 필요가 없습니다.

거래 플랫폼

| 거래 플랫폼 | 지원 | 사용 가능한 장치 |

| Qiankun Market II (Tongdaxin) | ✔ | Web |

| Wind Information Financial Terminal | ✔ | App |

| Kingstar see-thru collection package -- Prod | ✔ | Web |

| Kingstar see-thru collection package -- QA | ✔ | Web |

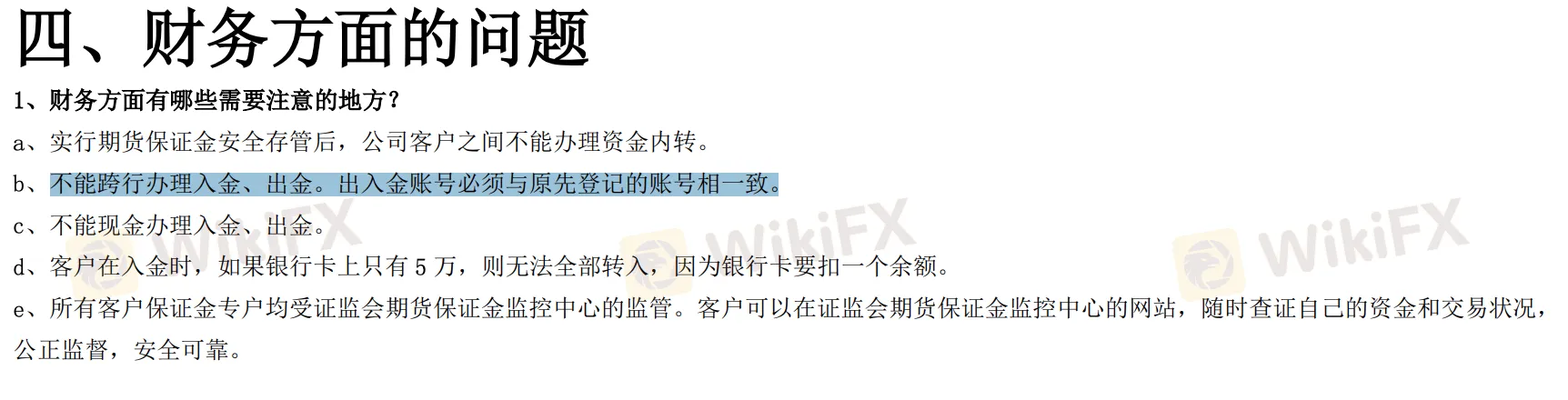

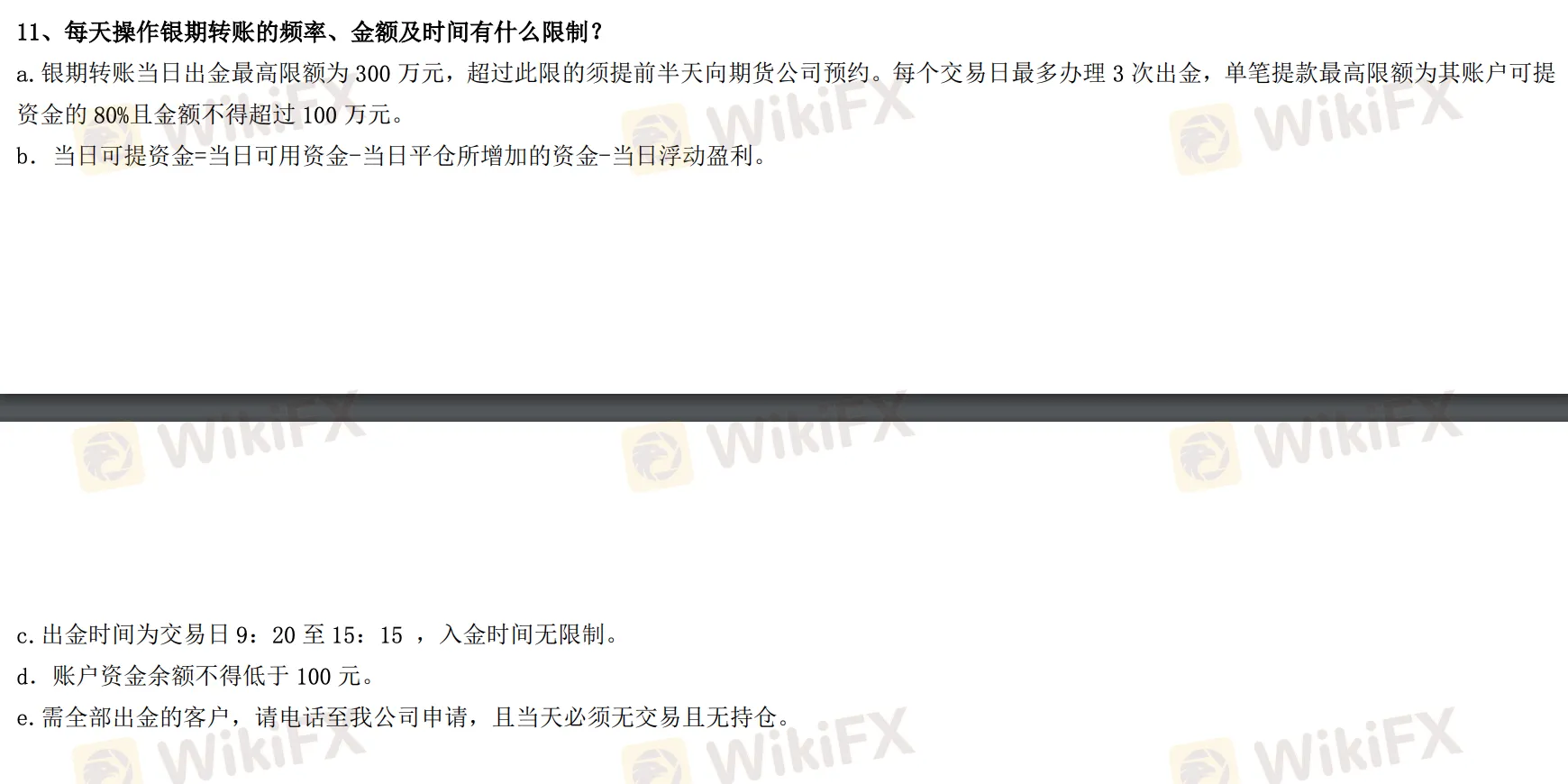

입출금

브로커는 은행 송금을 통한 결제를 수락합니다. 입출금 계좌는 동일해야 합니다. 계좌 잔액은 100위안 이상이어야 합니다. 최소 입금 또는 출금 금액이 정의되어 있지 않으며 수수료나 요금이 명시되어 있지 않습니다.