مقدمة عن الشركة

| ملخص مراجعة ATG | |

| تأسست | 2009 |

| البلد/المنطقة المسجلة | هونغ كونغ |

| التنظيم | لا يوجد تنظيم |

| أدوات السوق | العقود الآجلة، الأسهم |

| دعم العملاء | هاتف: +(31) 205 782 180 |

| البريد الإلكتروني: emailus@algorithmictradinggroup.com | |

| مكتب أمستردام: Beursplein 5، 1012 JW أمستردام، هولندا | |

| مكتب هونغ كونغ: الوحدة 2، الطابق 13، مركز جافا رود التجاري 108 جافا رود، هونغ كونغ | |

معلومات ATG

شركة Algorithmic Trading Group (ATG) Limited هي شركة تداول مملوكة إلكترونيًا تمتلك مكاتب في أمستردام وهونغ كونغ. تأسست في عام 2009 في هونغ كونغ، تشارك الشركة في تداول العقود الآجلة الرئيسية وأسواق الأسهم عبر أوروبا وآسيا وأمريكا، وتعمل تقريبًا 24 ساعة في اليوم، خمسة أيام في الأسبوع.

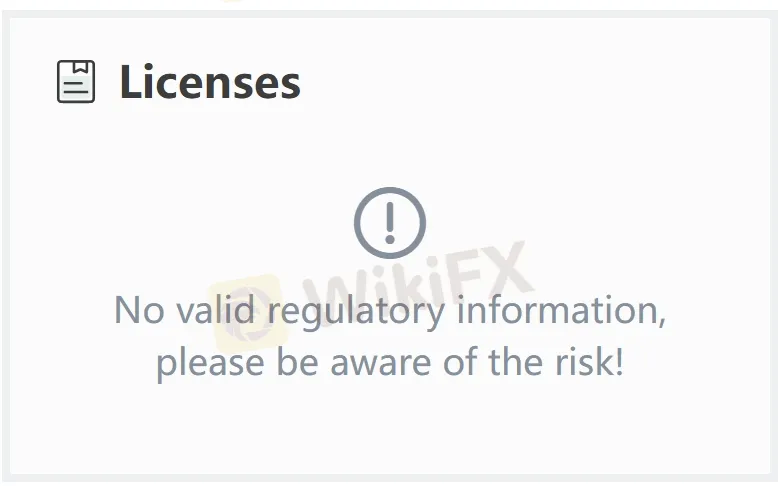

ومع ذلك، موقع ATG بسيط إلى حد ما مع شفافية محدودة حول خلفيتها ونطاق عملها. الأسوأ من ذلك، الشركة لم يتم تنظيمها من قبل أي سلطات رسمية حتى الآن، مما يجب أن يثير انتباهك بسبب نقص الجدارة والموثوقية.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| لا شيء | لا يوجد تنظيم |

| شفافية محدودة حول خلفيتها ونطاق عملها |

هل ATG شرعية؟

أهم عامل في قياس سلامة منصة الوساطة هو ما إذا كانت منظمة رسميًا. ATG هي وسيط غير منظم ، مما يعني أن سلامة أموال المستخدمين وأنشطتهم التجارية ليست محمية بشكل فعال. يجب على المستثمرين اختيار ATG بحذر.

ما الذي يمكنني التداول به على ATG؟

يمكننا أن نتعلم فقط من بضع كلمات من موقعها غير الإيضاحي أن الشركة تشارك في الأسواق الرئيسية لل العقود الآجلة والأسهم عبر أوروبا وآسيا وأمريكا، وتعمل تقريبًا 24 ساعة في اليوم، خمسة أيام في الأسبوع.