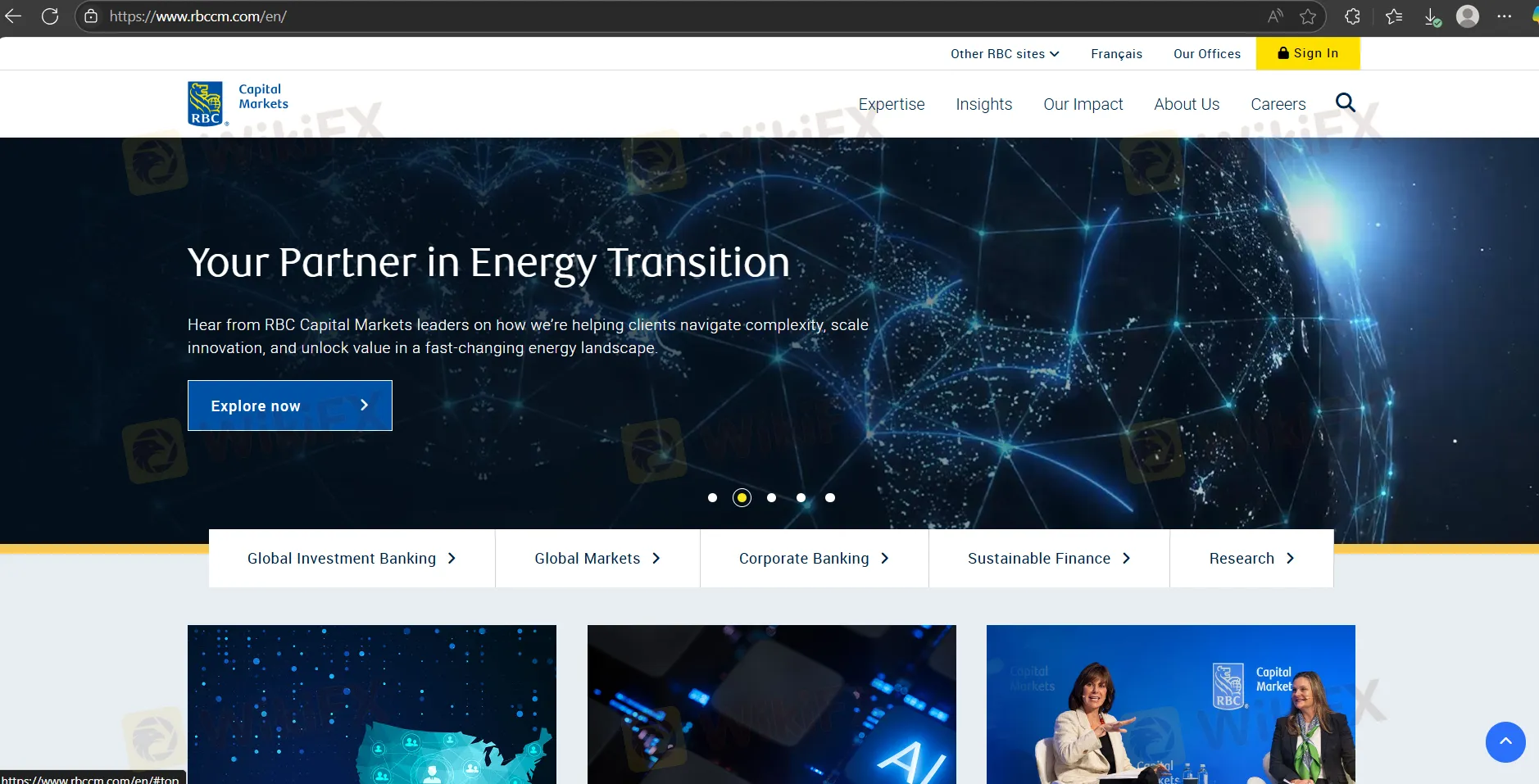

회사 소개

| RBCCM 리뷰 요약 | |

| 설립 연도 | 2001 |

| 등록 국가/지역 | 캐나다 |

| 규제 | 규제 없음 |

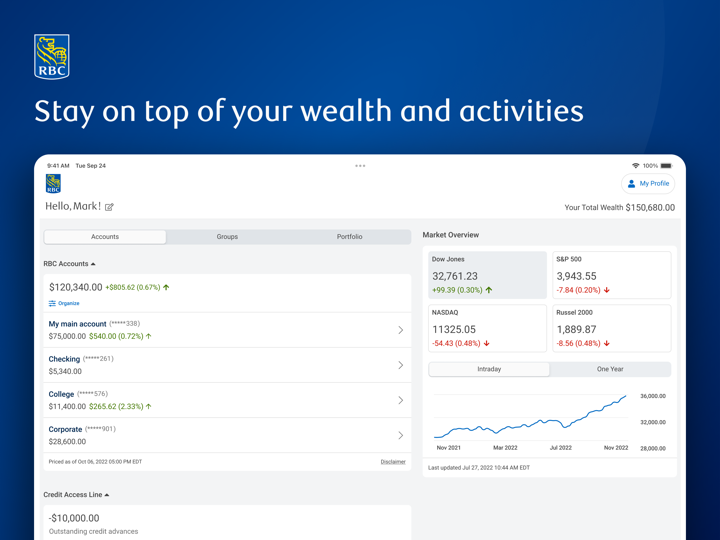

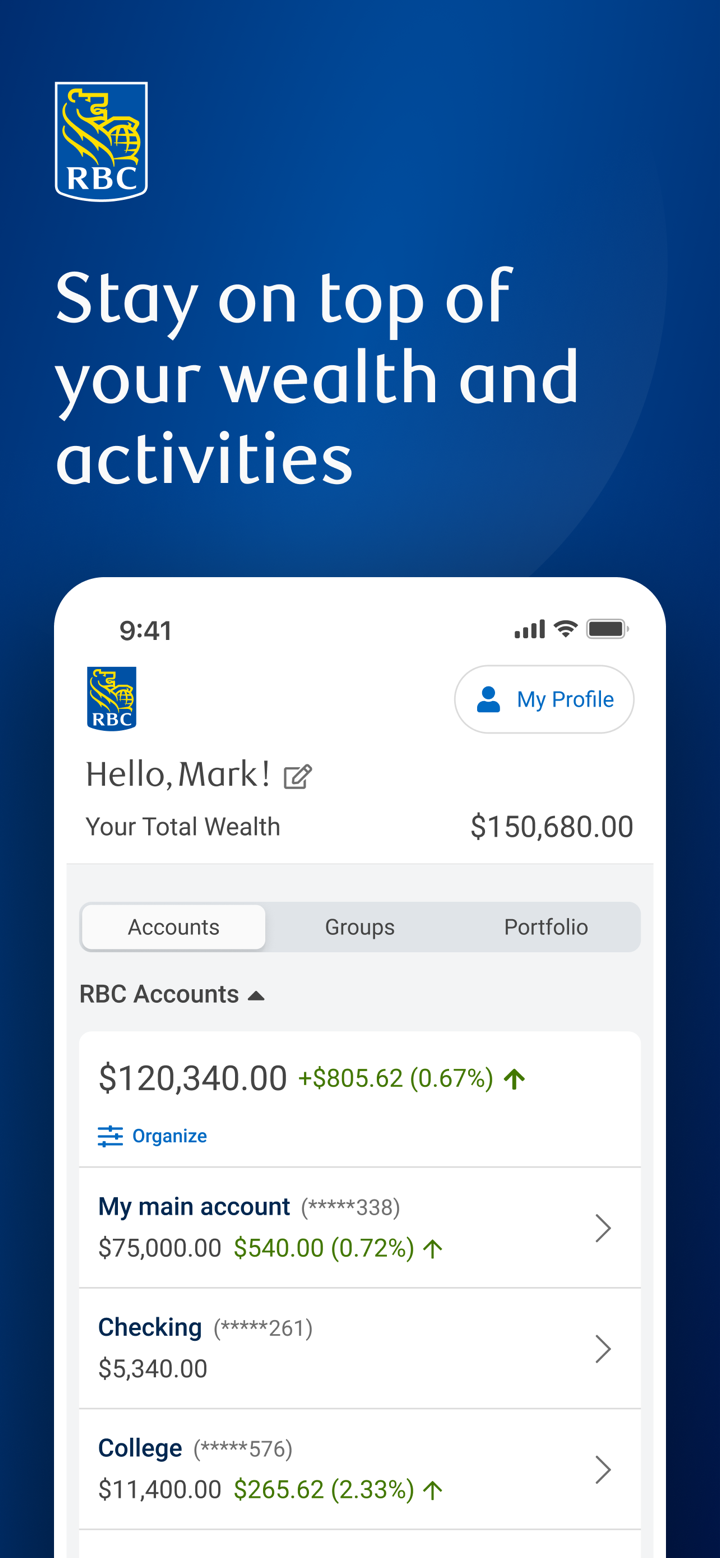

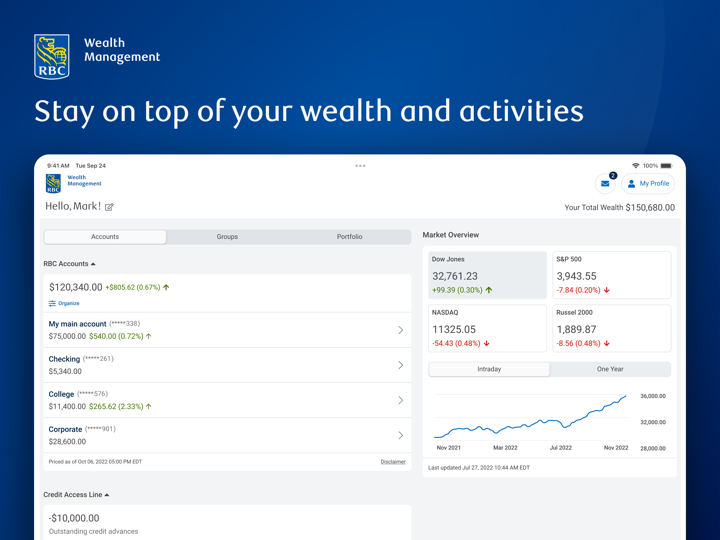

| 시장 상품 | 상품, 주식, ETF, 외환, 고정 소득 |

| 데모 계정 | / |

| 레버리지 | / |

| 스프레드 | / |

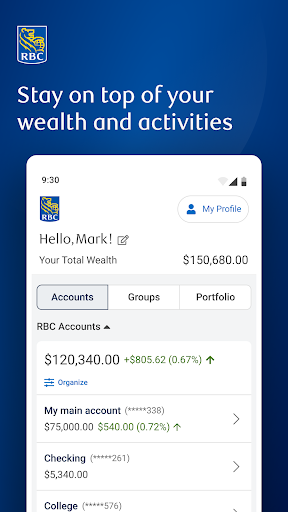

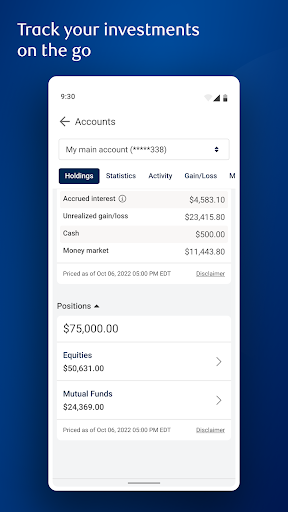

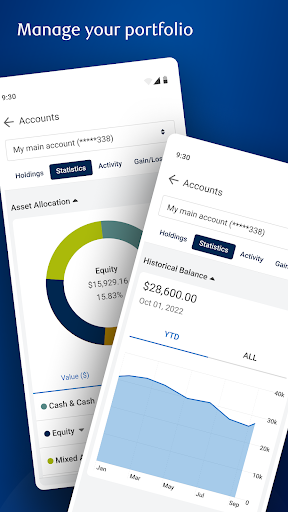

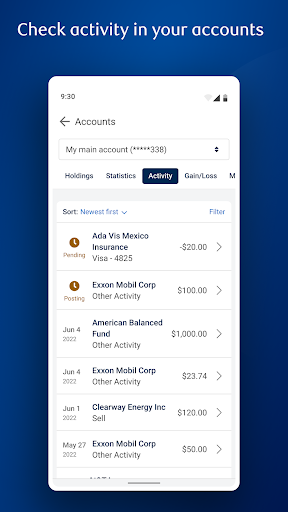

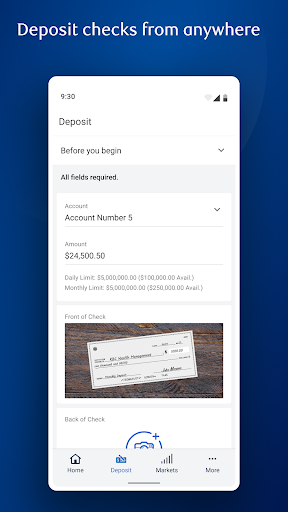

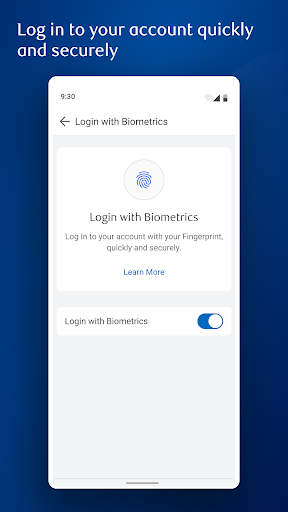

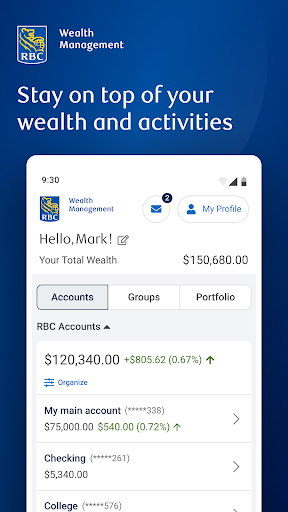

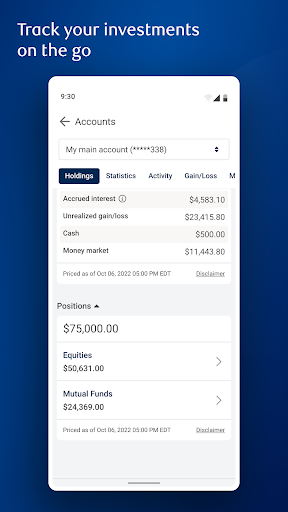

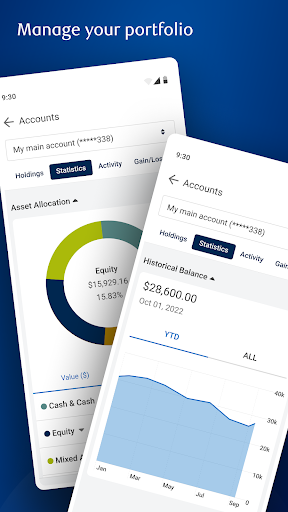

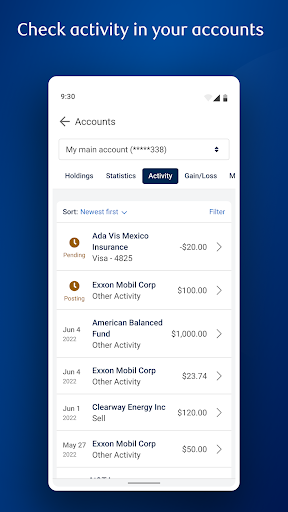

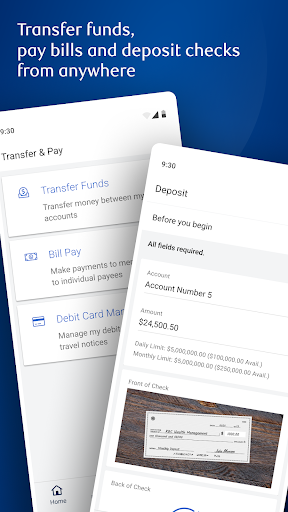

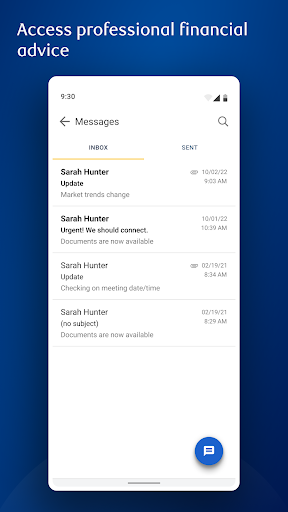

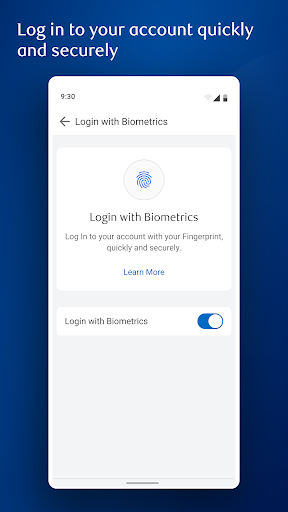

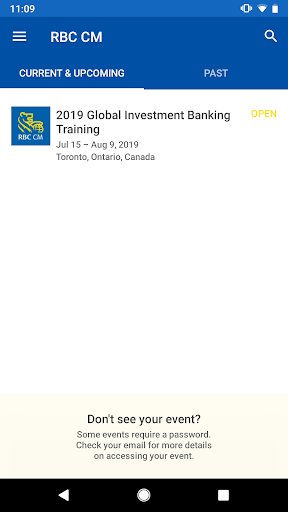

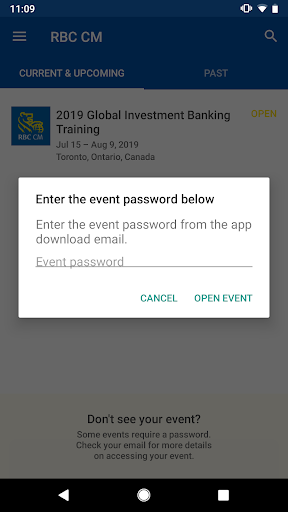

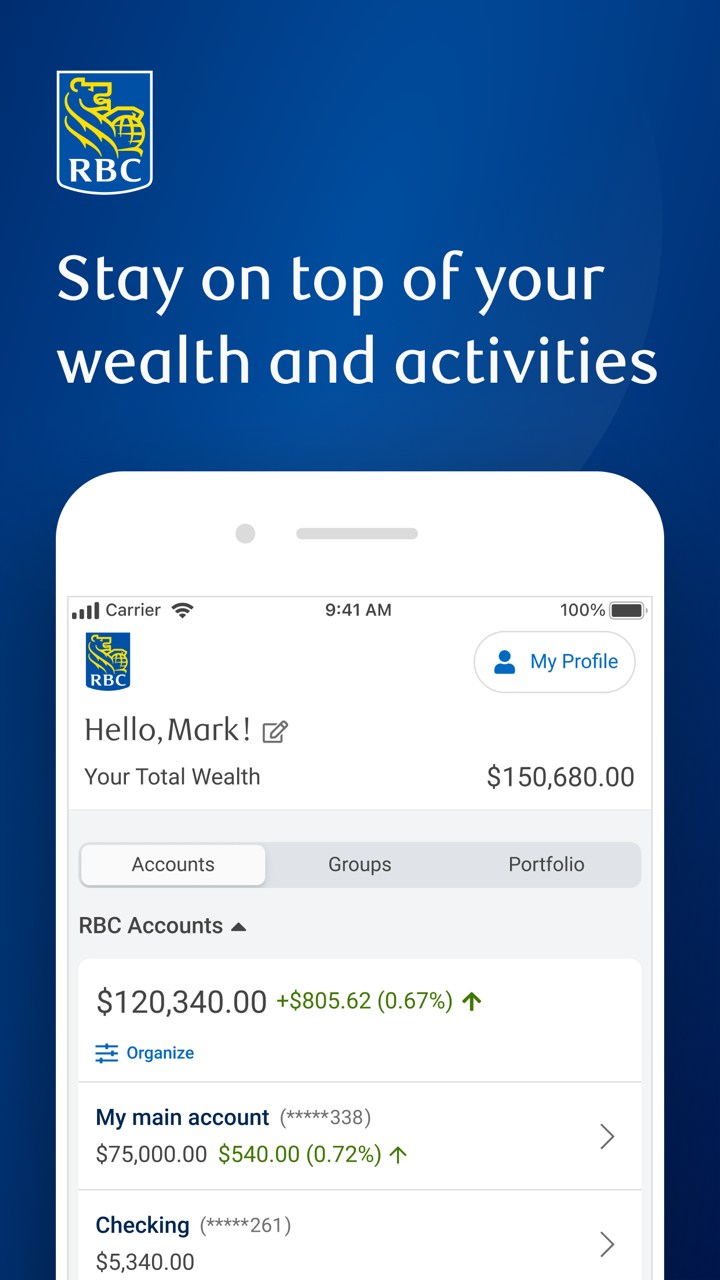

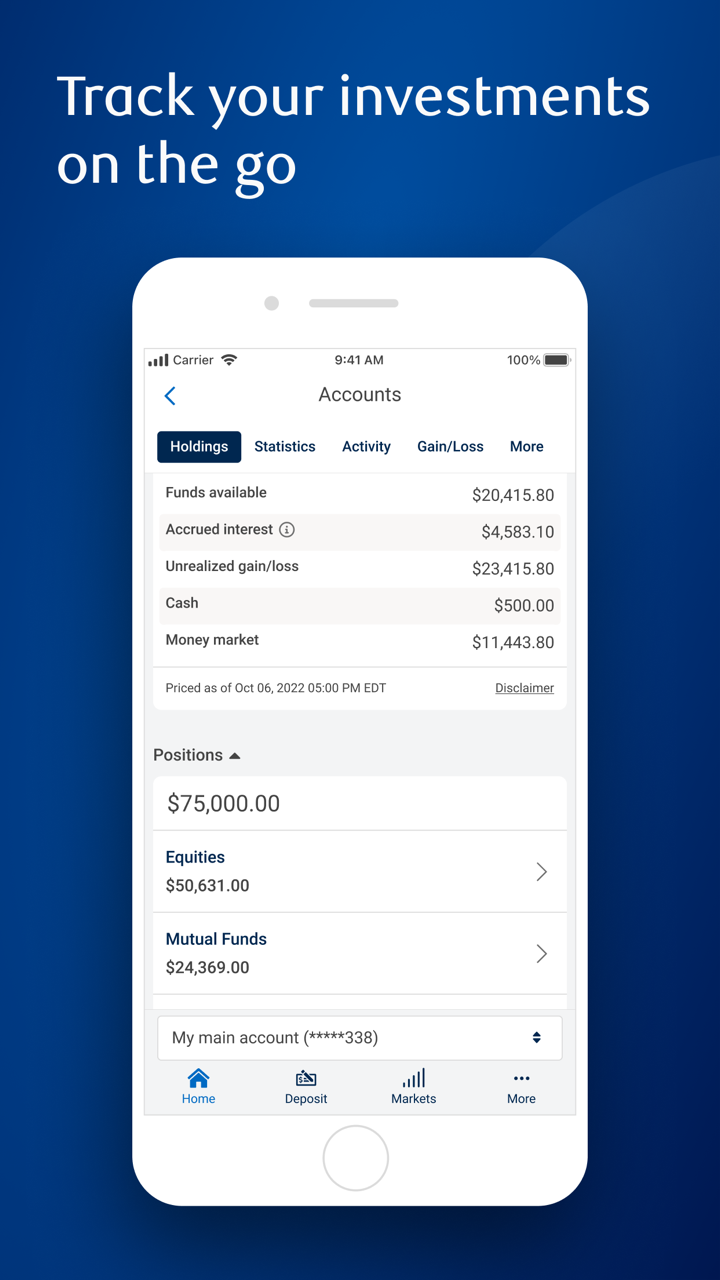

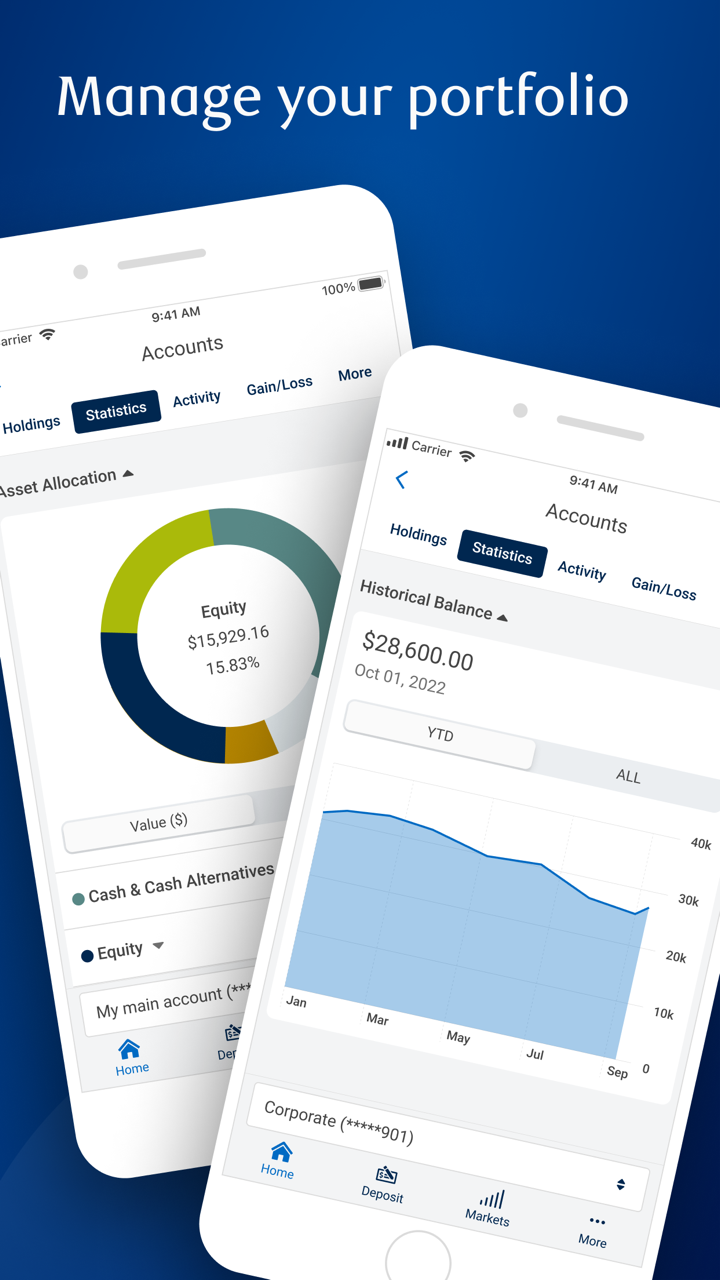

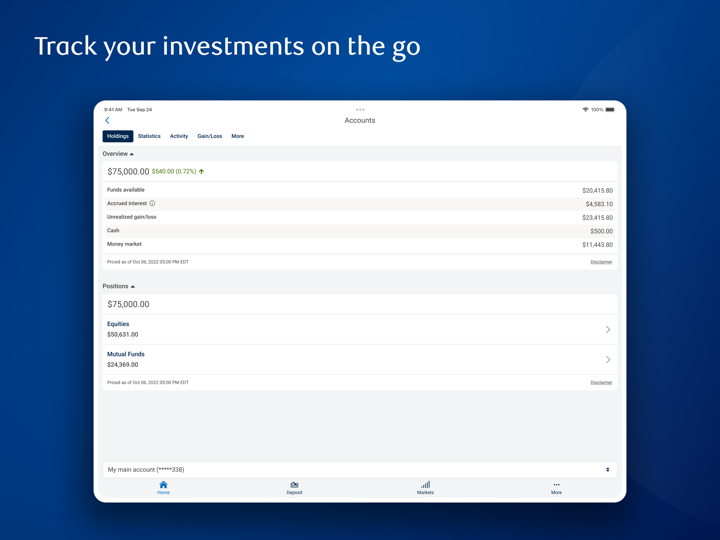

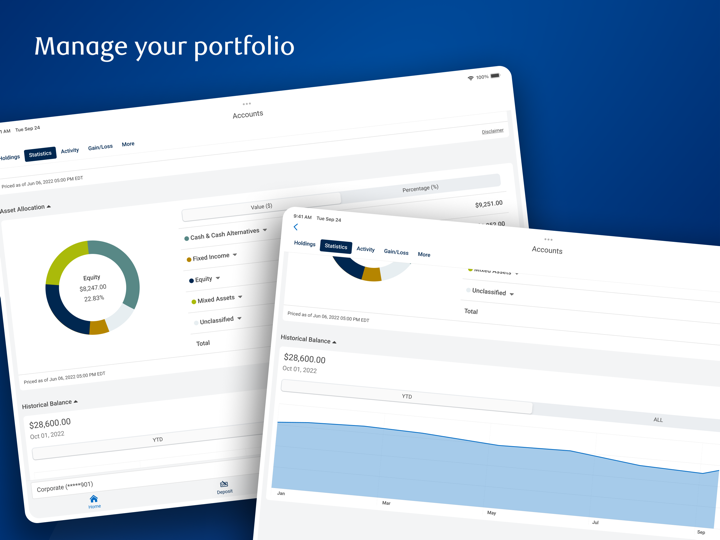

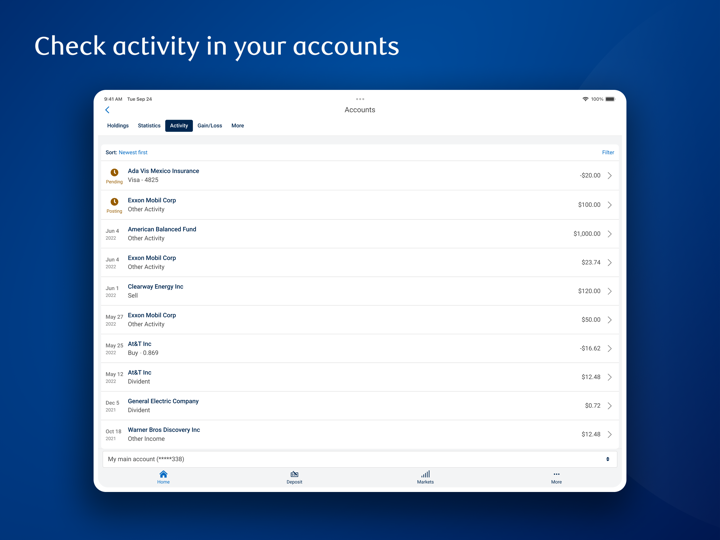

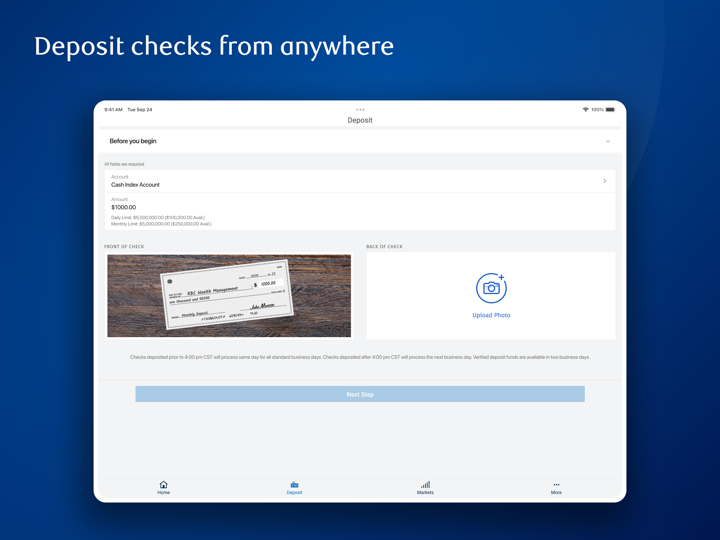

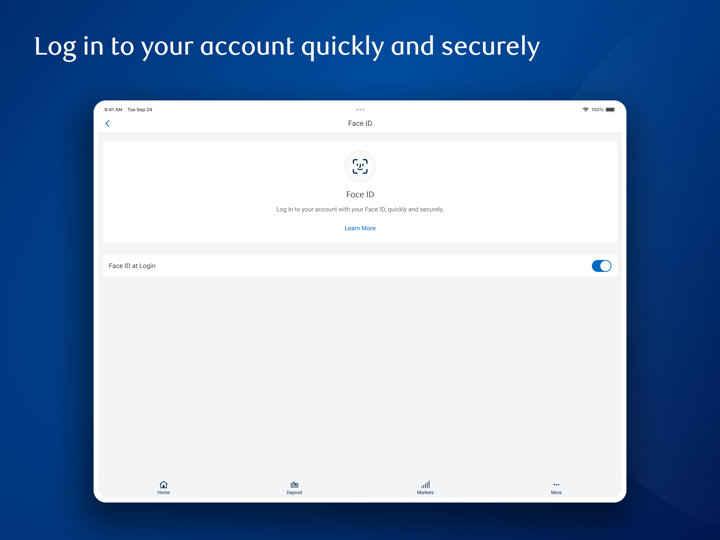

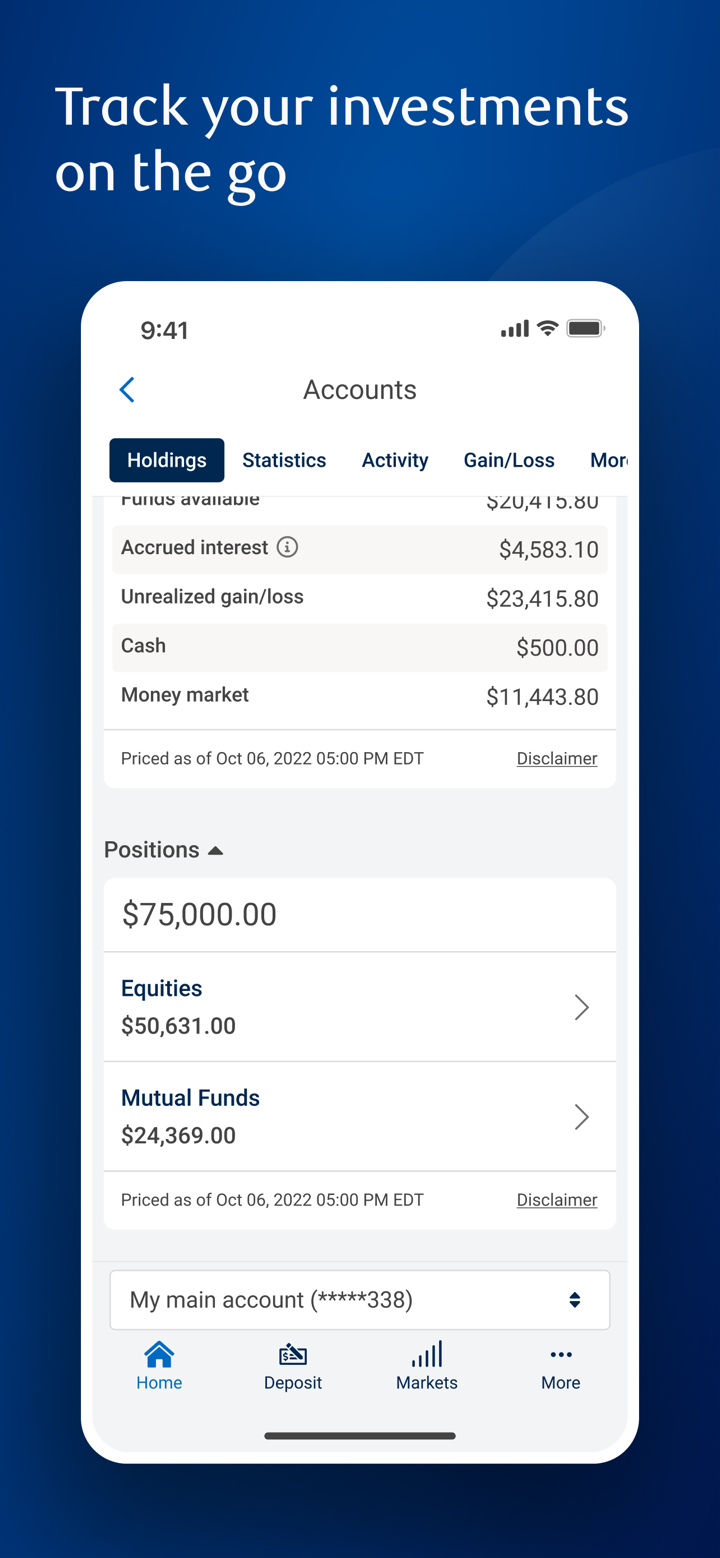

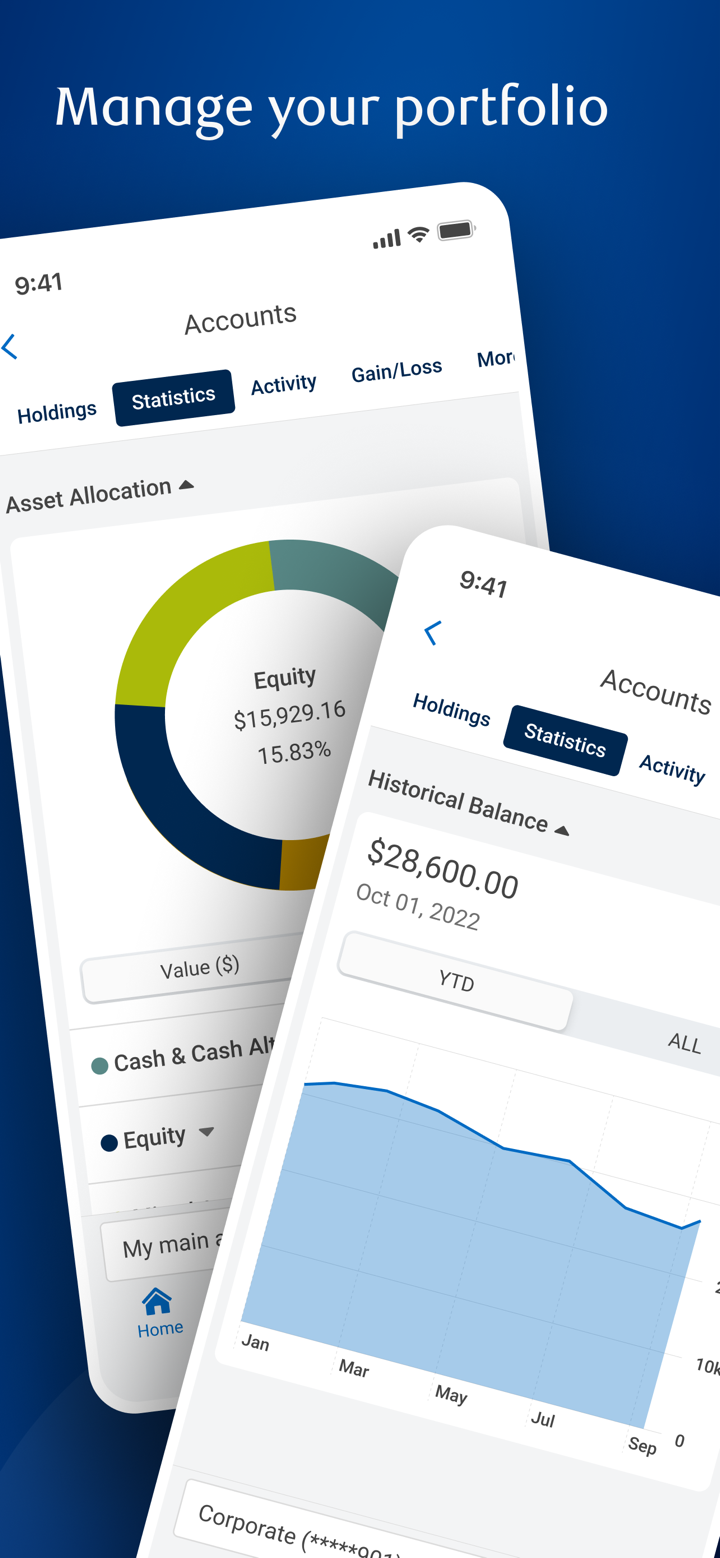

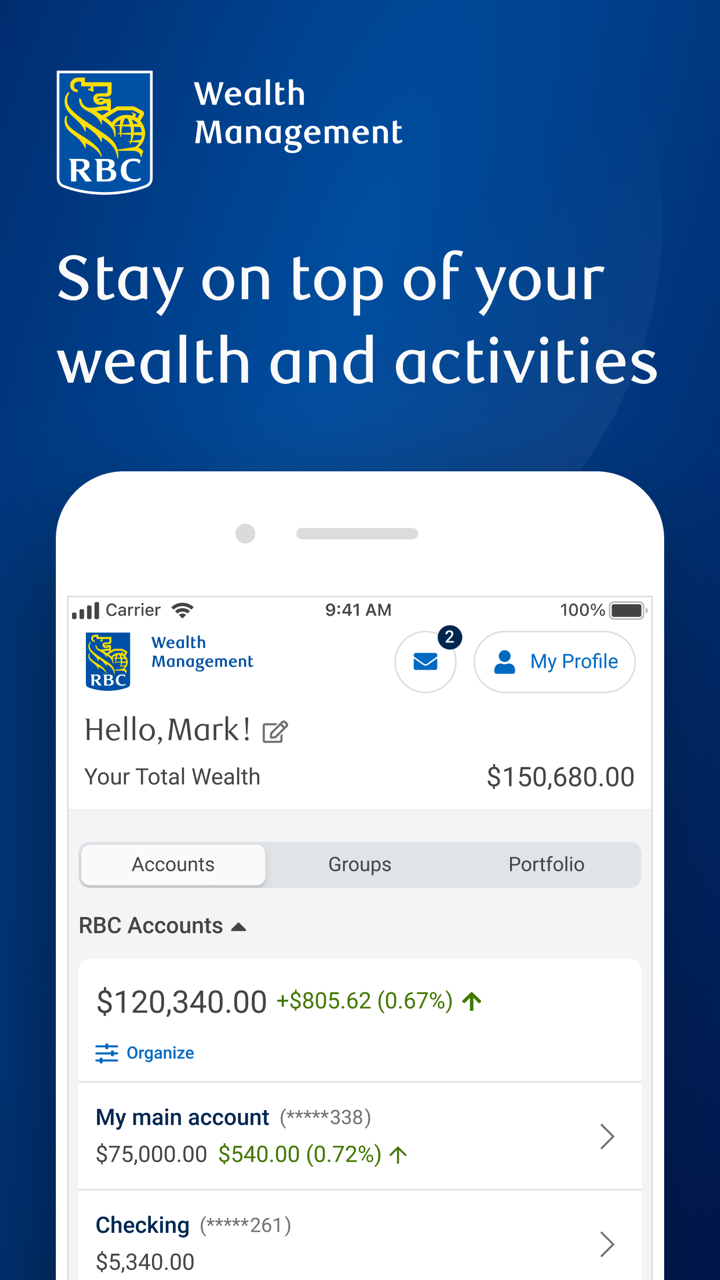

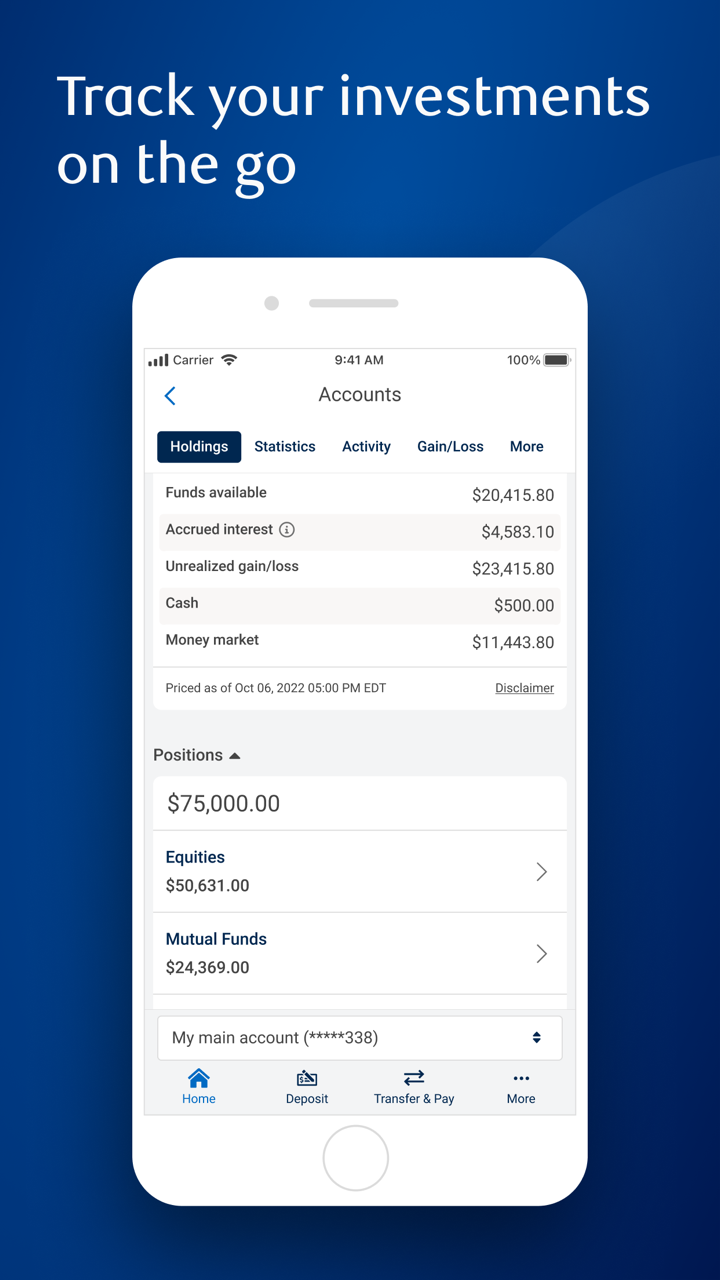

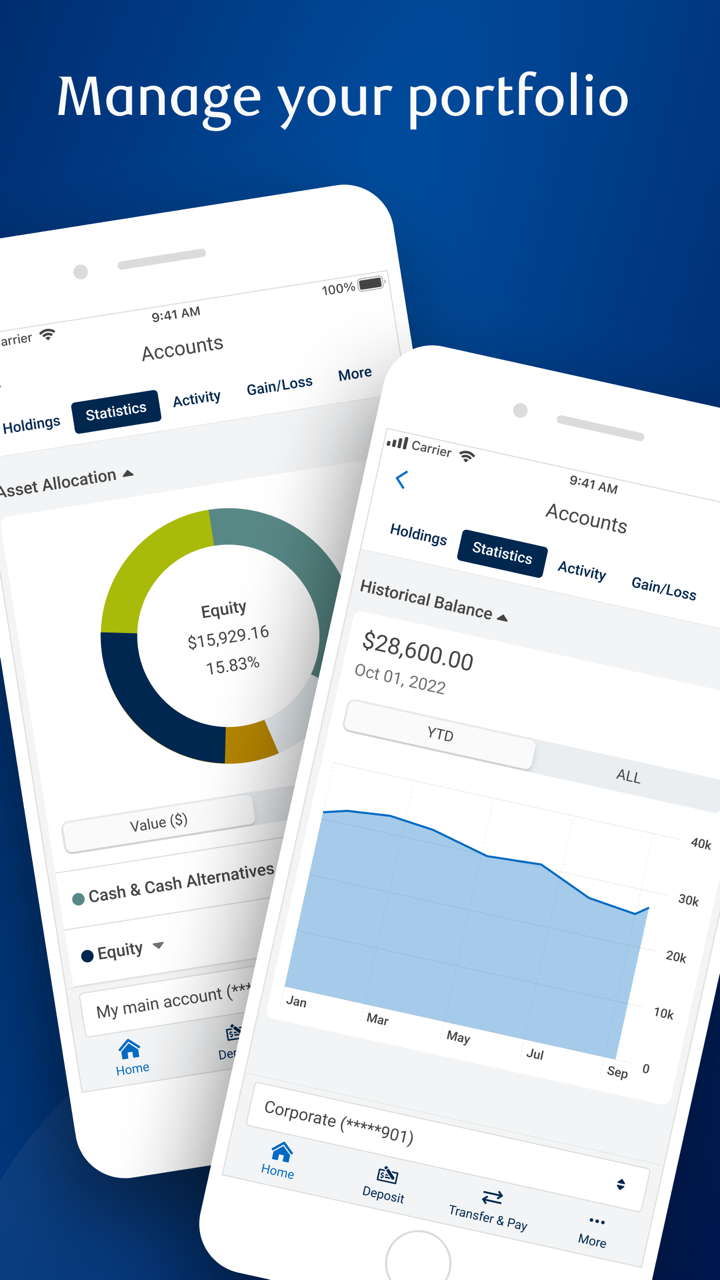

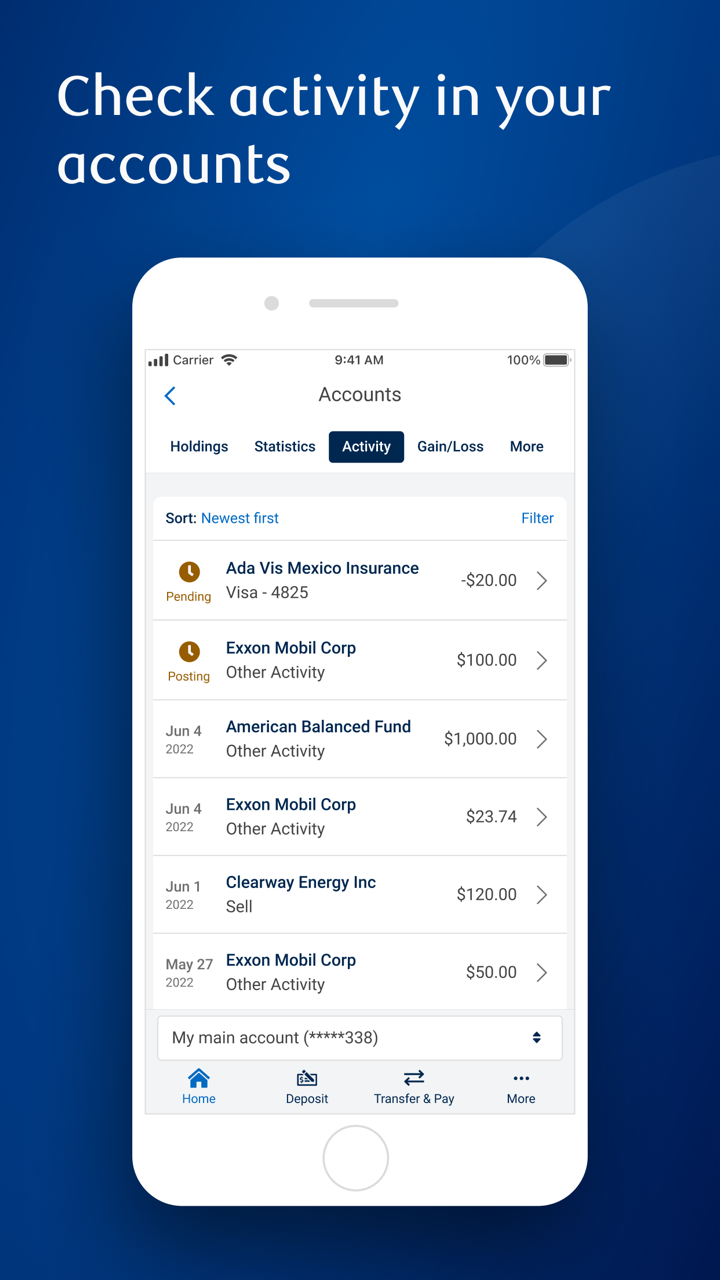

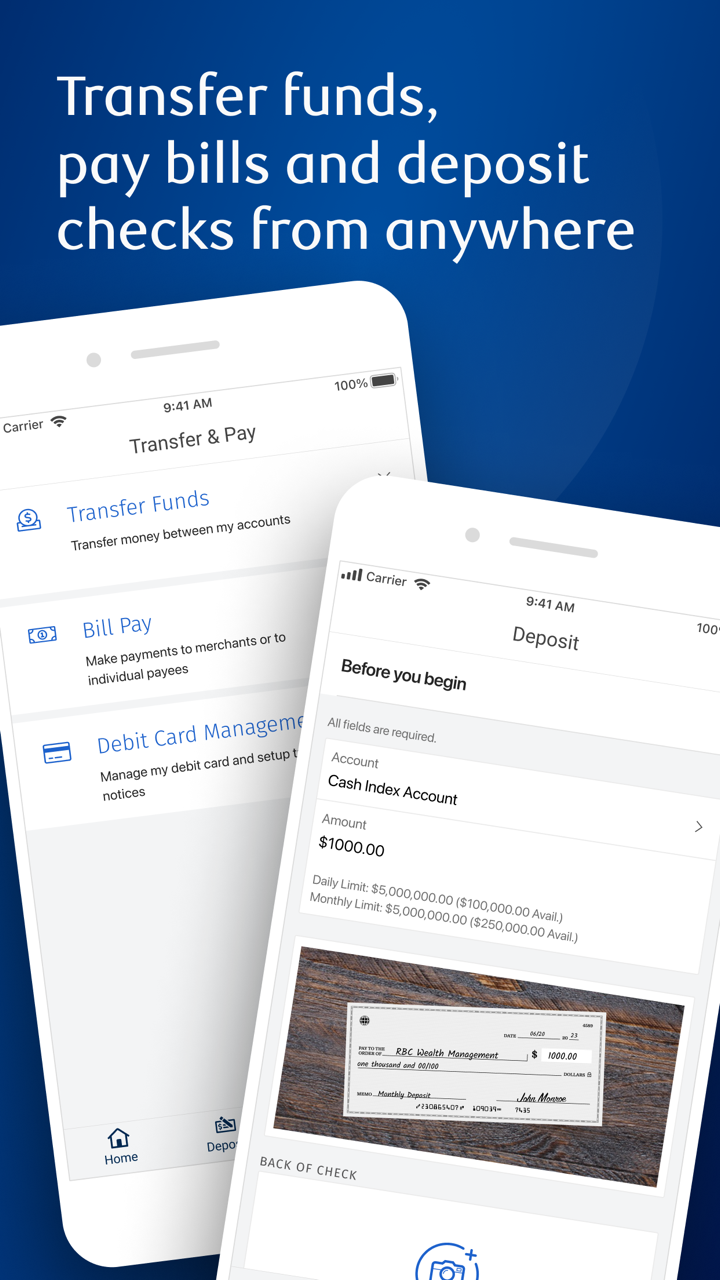

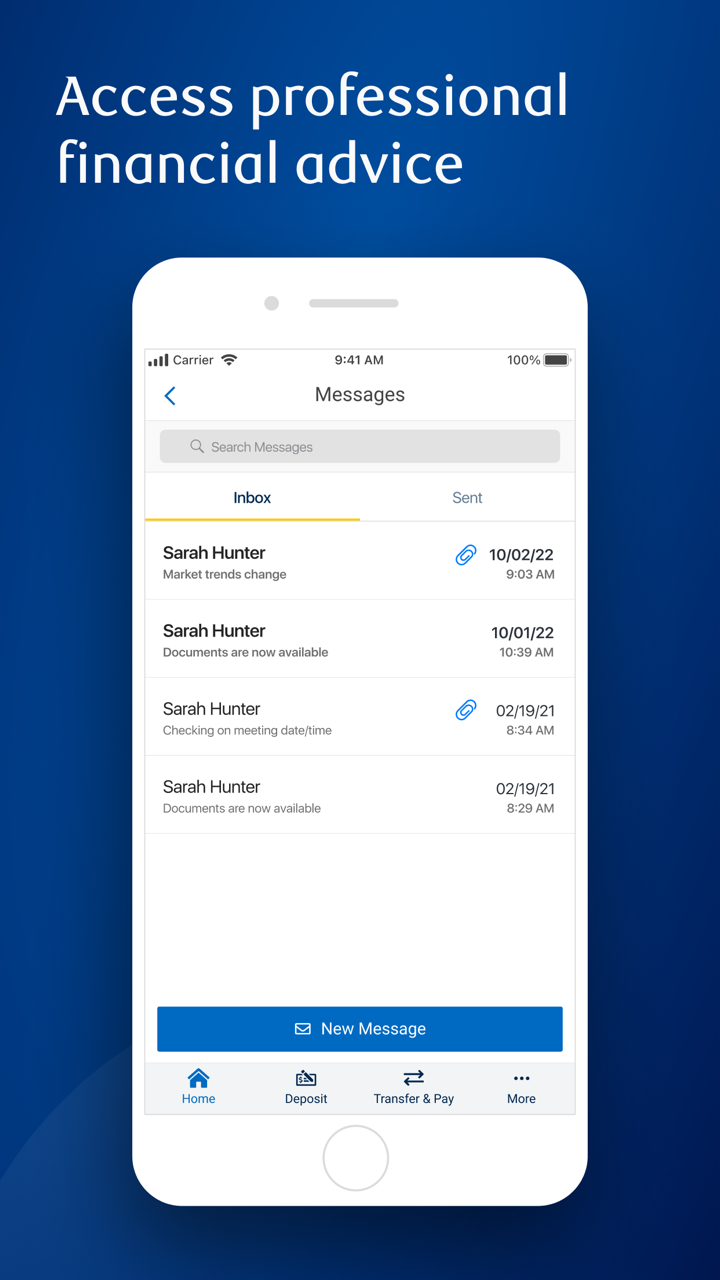

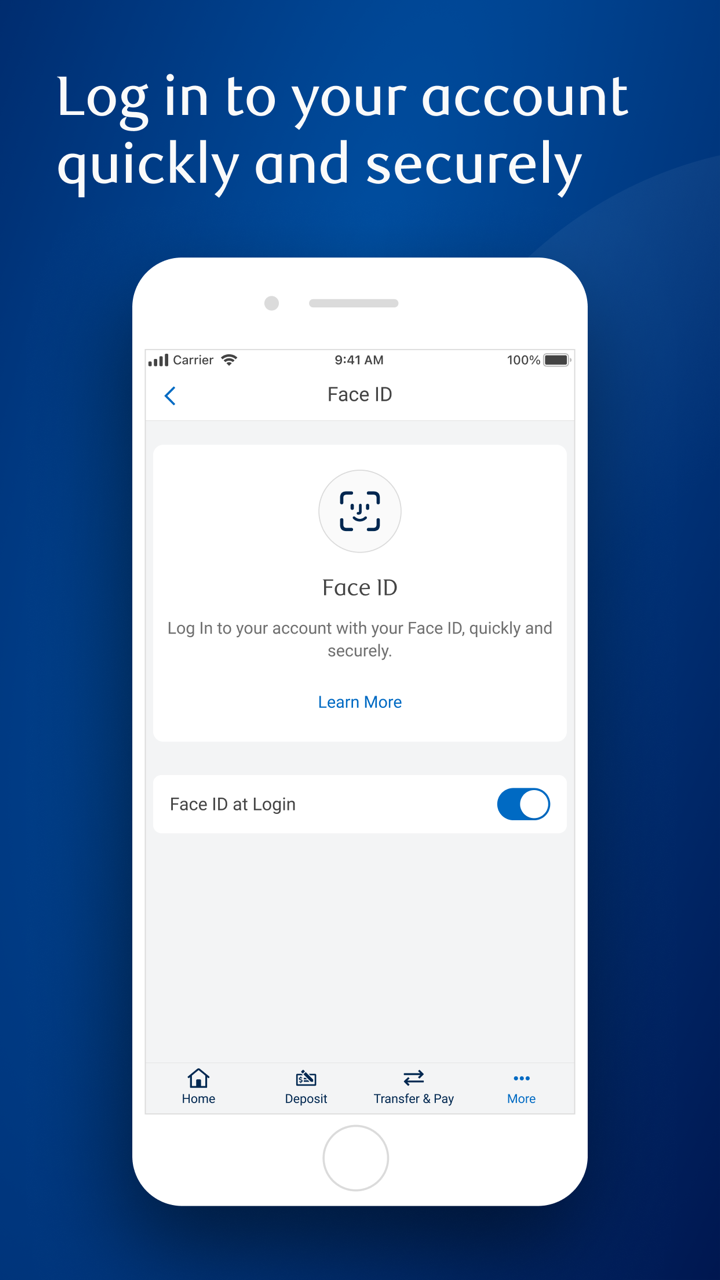

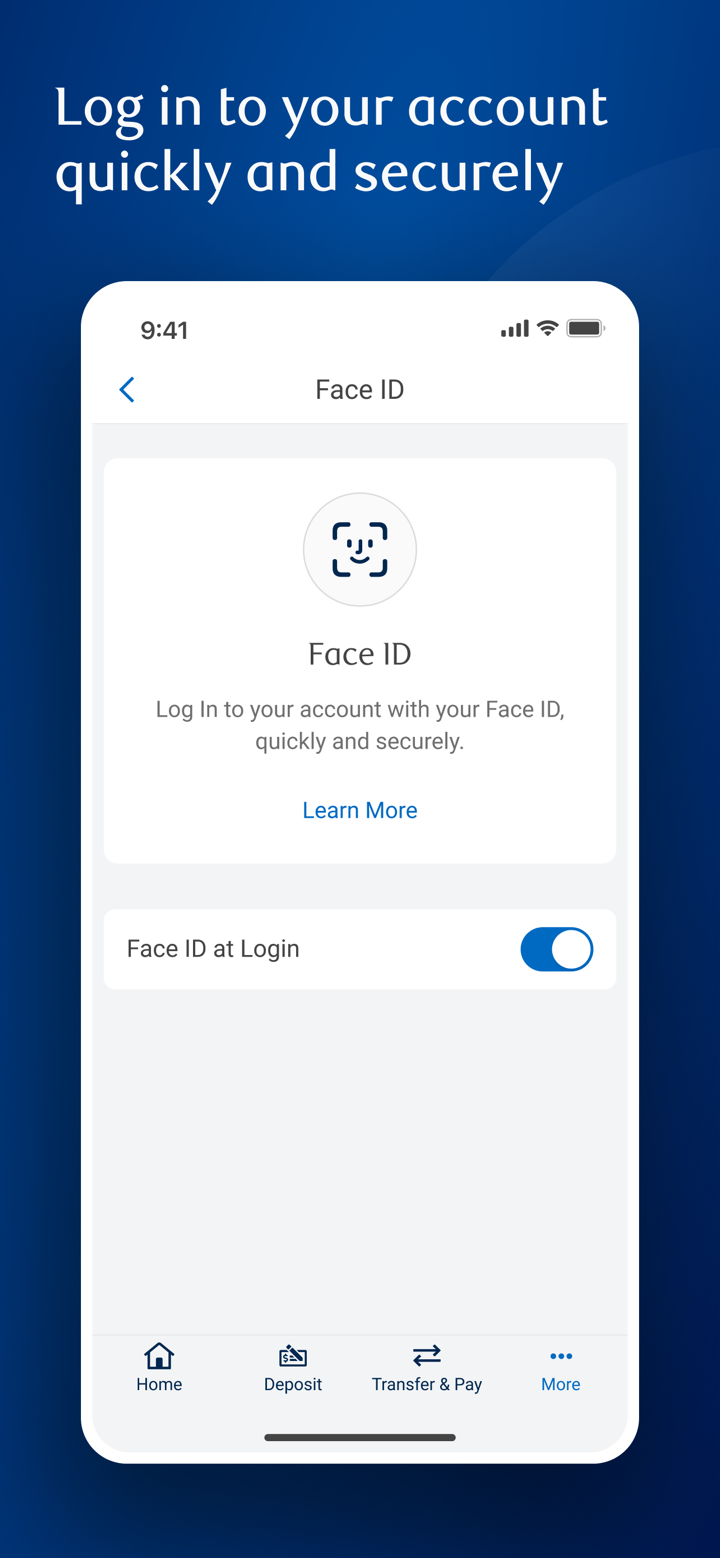

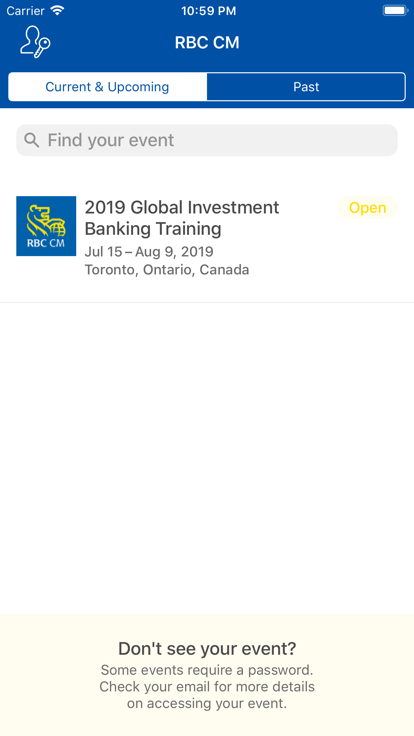

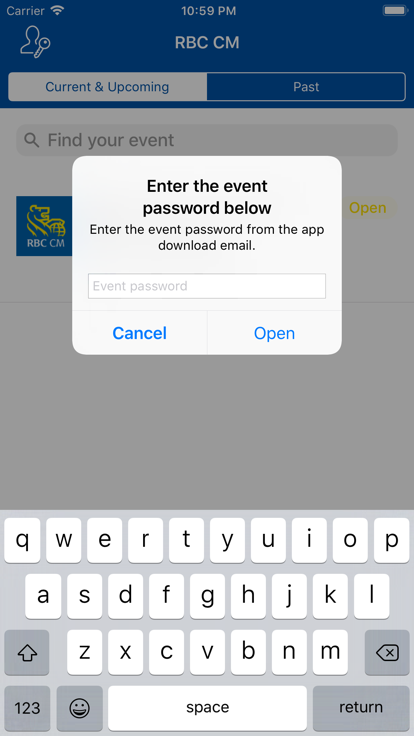

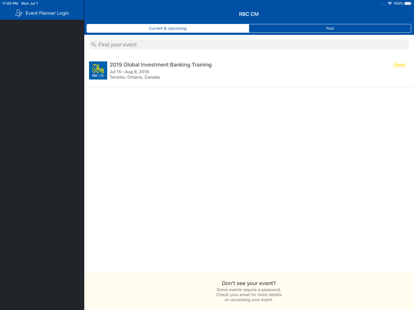

| 거래 플랫폼 | 모바일 앱 |

| 최소 입금액 | / |

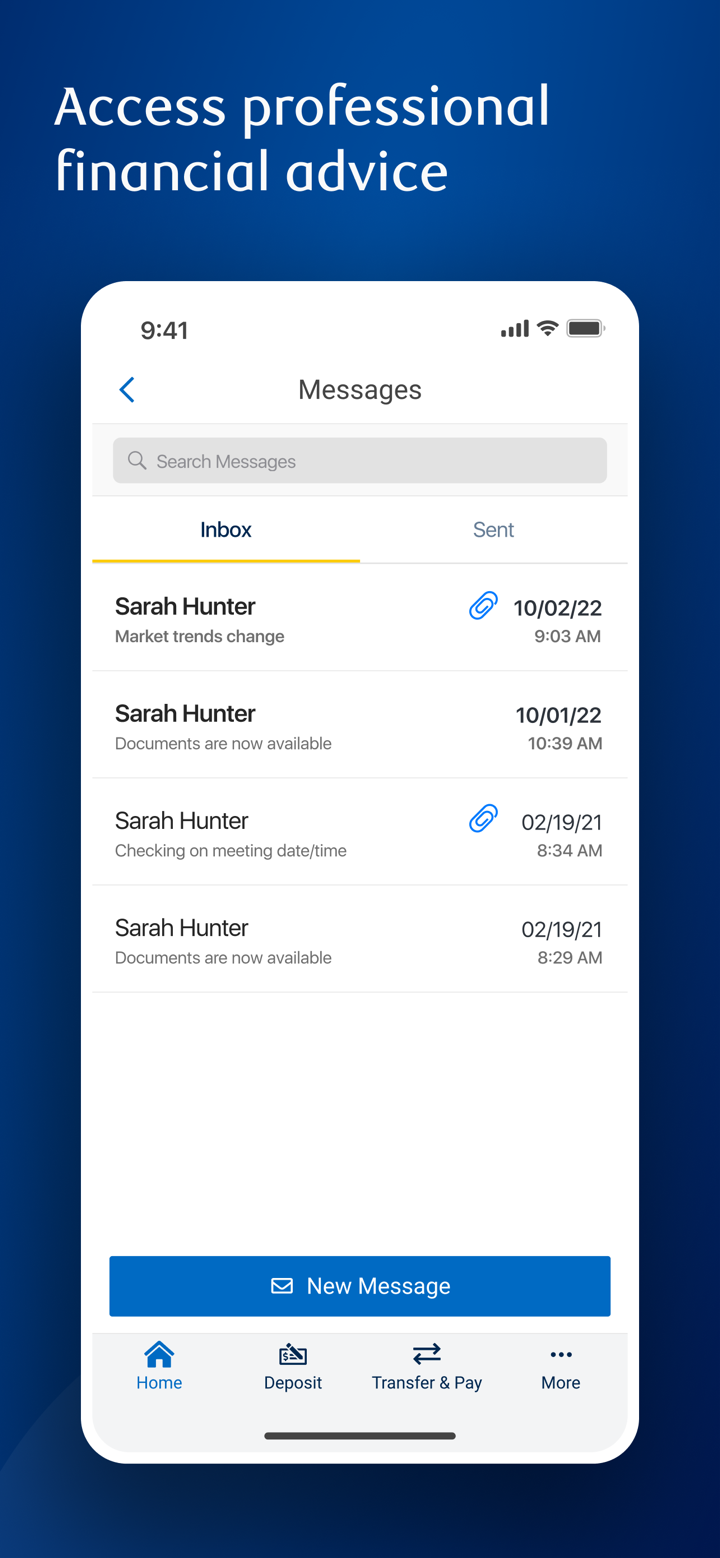

| 고객 지원 | 문의 양식 |

| 전화: +14168422000 | |

| 소셜 미디어: LinkedIn, YouTube, X | |

| 주소: RBC Centre 155 Wellington St W Toronto, Ontario M5V 3K7 | |

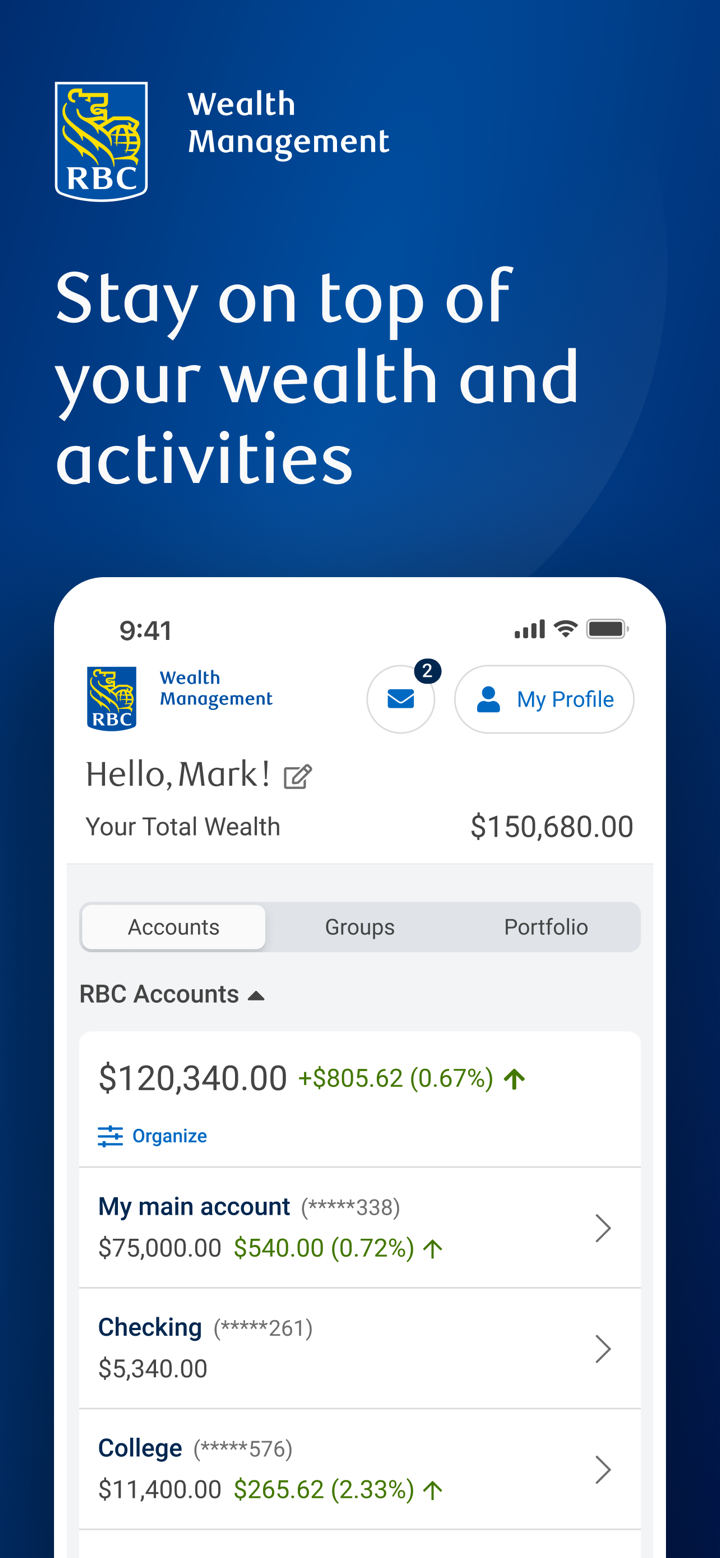

RBCCM 정보

RBCCM은 2001년에 설립된 캐나다 기반의 브로커로, 규제가 없습니다. 상품, 주식, ETF, 외환 및 고정 소득을 포함한 다양한 시장 상품을 제공합니다.

장단점

| 장점 | 단점 |

| 다양한 거래 자산 | 규제가 없는 상태 |

| 거래 조건에 대한 제한된 정보 | |

| MT4/MT5 미지원 | |

| 입출금 정보 없음 |

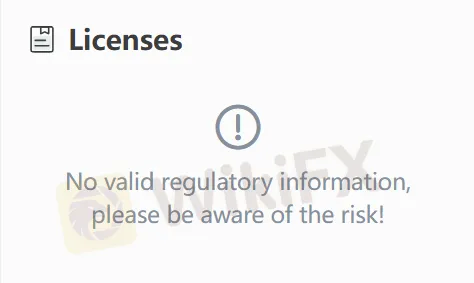

RBCCM 합법적인가요?

RBCCM은 현재 비규제 상태입니다. 리스크를 주의하십시오!

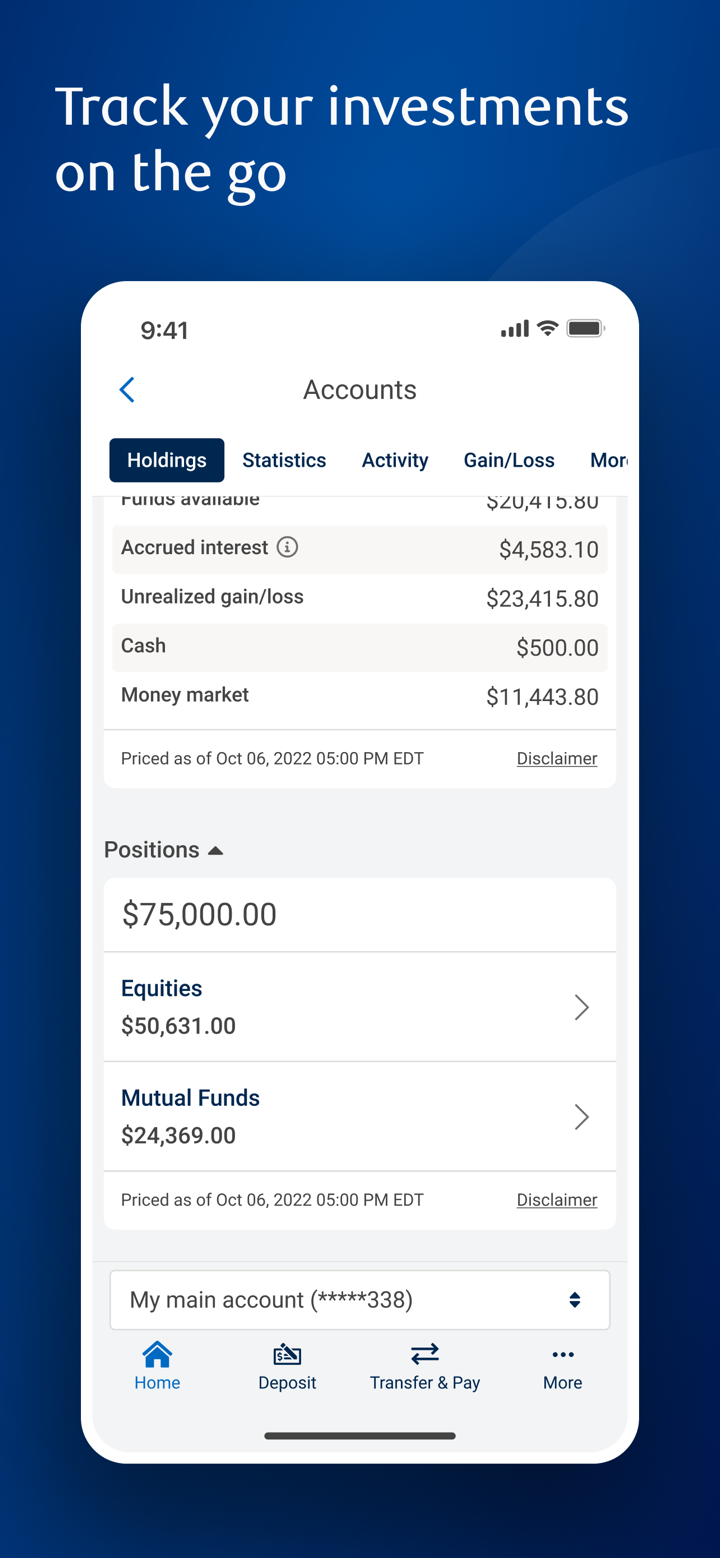

RBCCM에서 무엇을 거래할 수 있나요?

| 거래 가능한 상품 | 지원 |

| 상품 | ✔ |

| 주식 | ✔ |

| ETF | ✔ |

| 외환 | ✔ |

| 고정 수익 | ✔ |

| 지수 | ❌ |

| 주식 | ❌ |

| 암호화폐 | ❌ |

| 채권 | ❌ |

| 옵션 | ❌ |

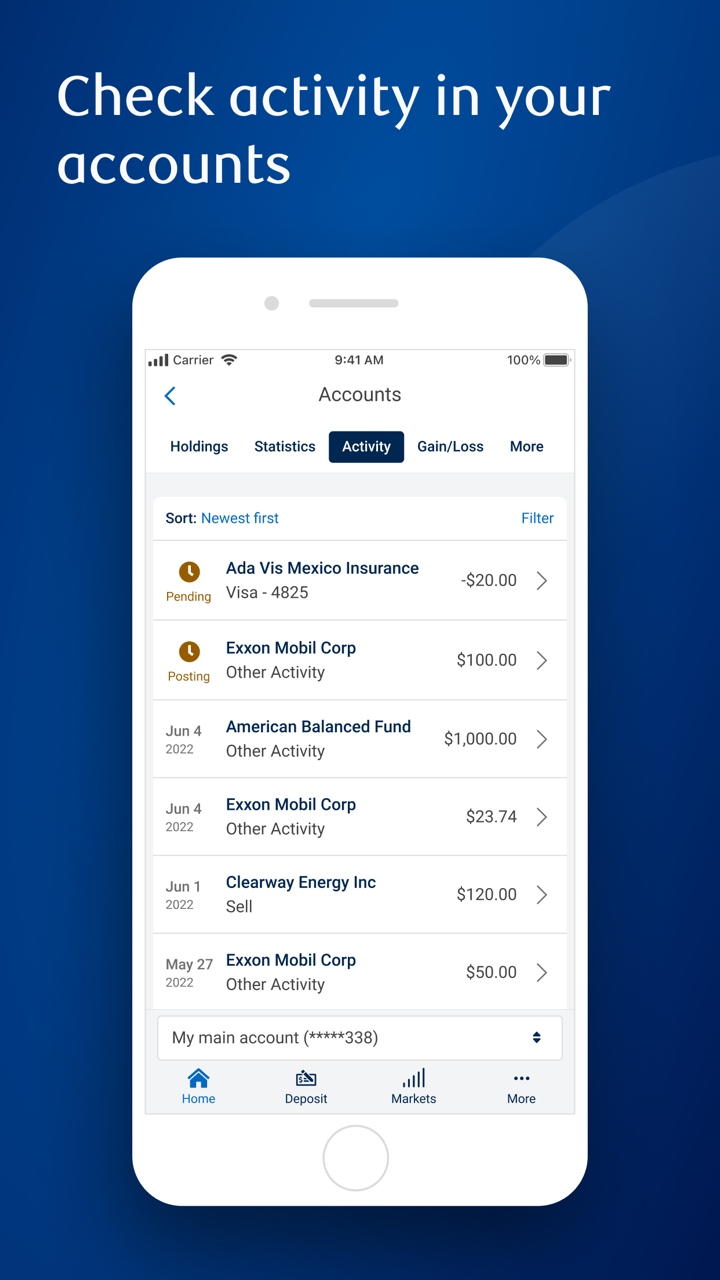

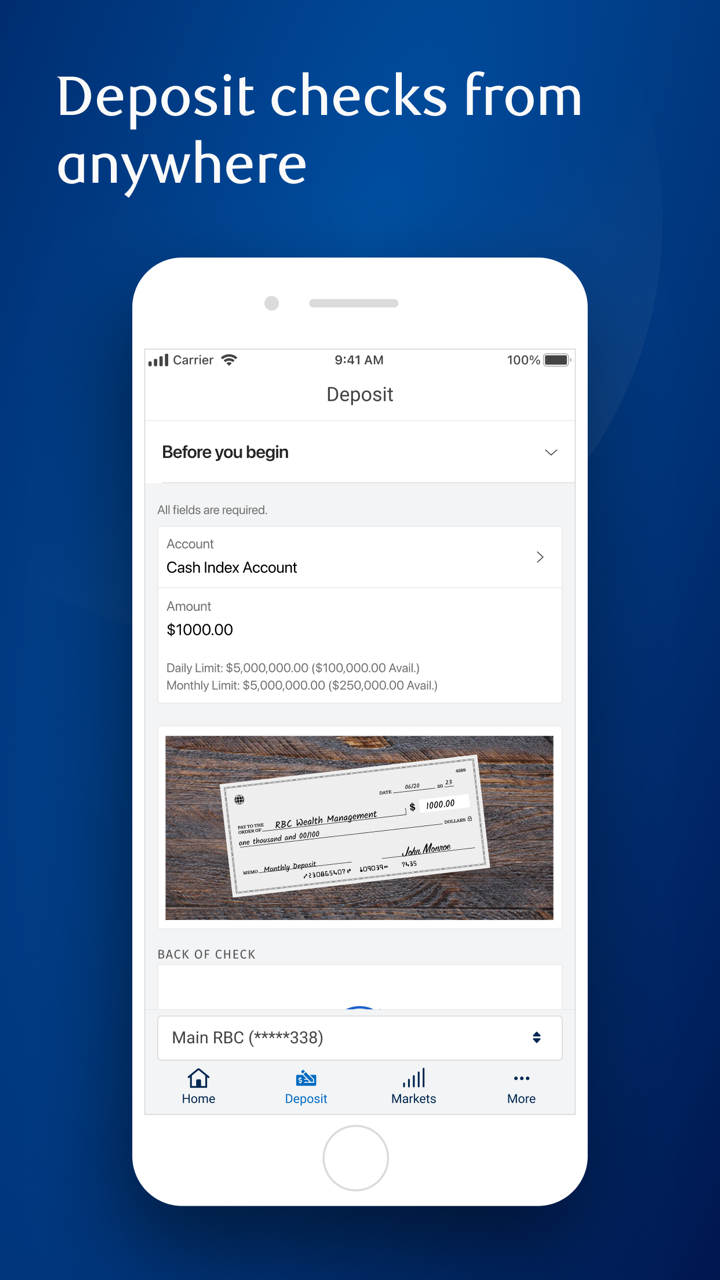

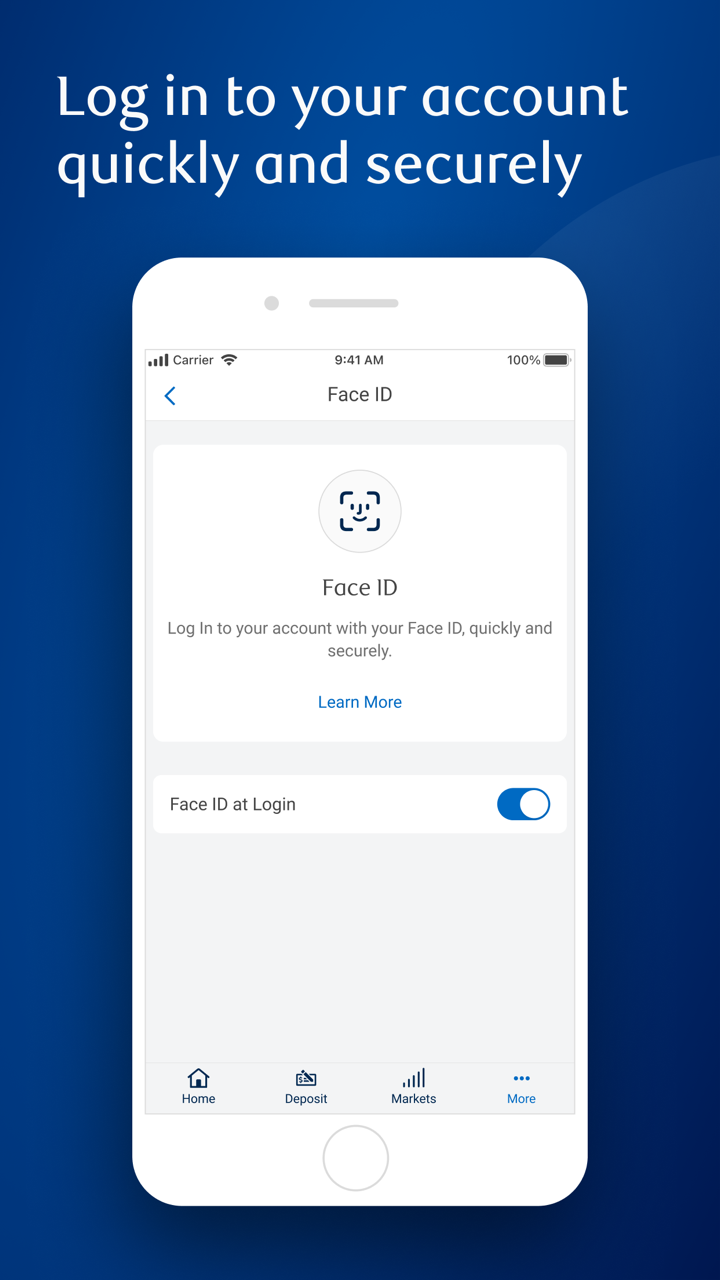

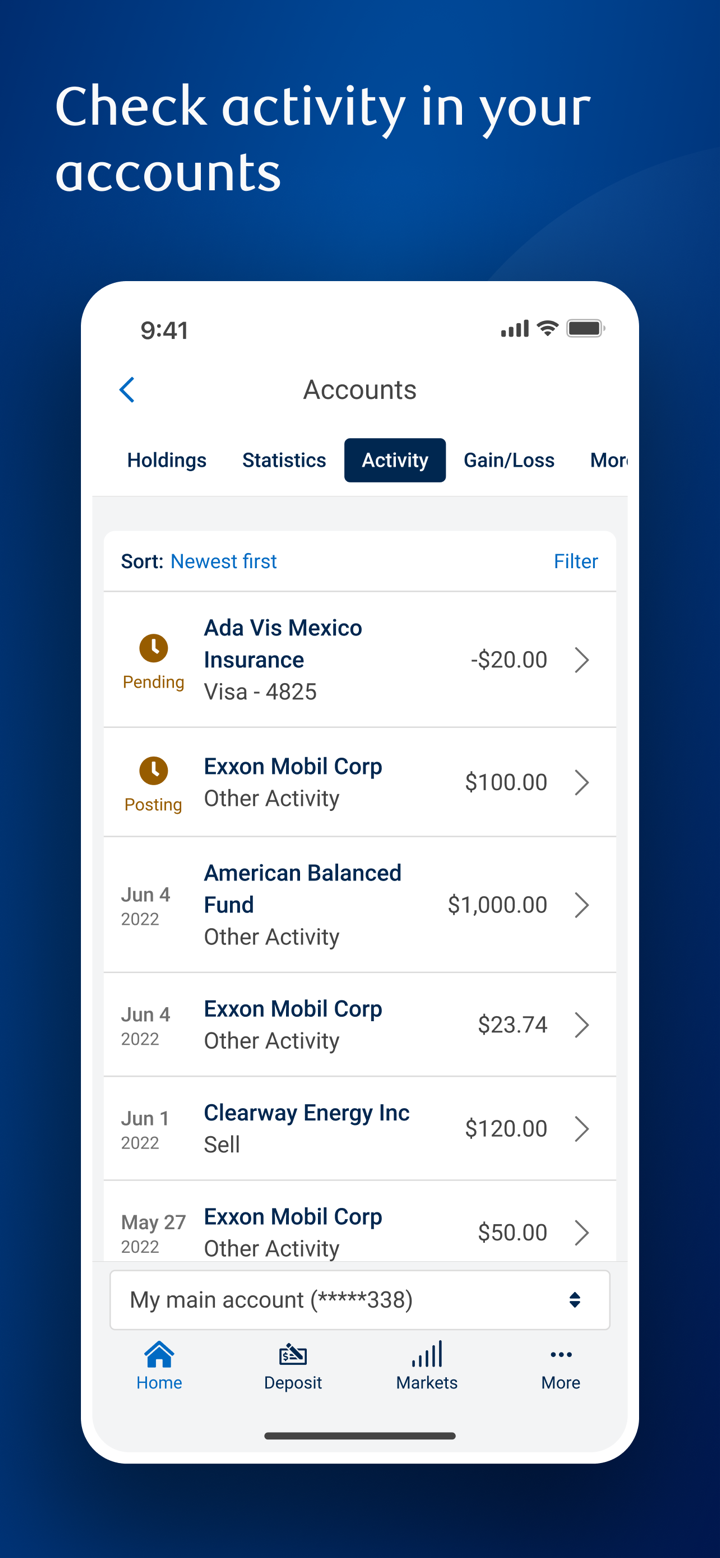

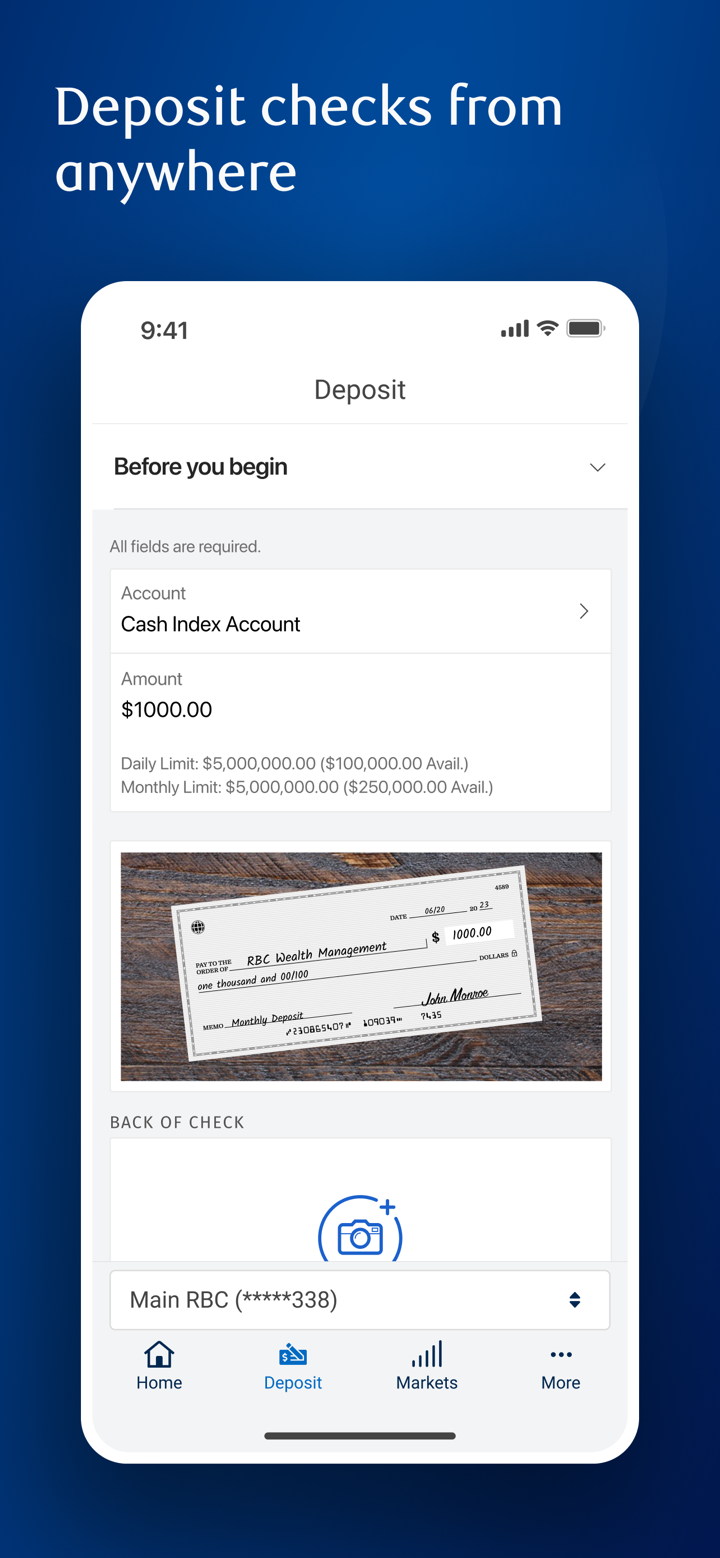

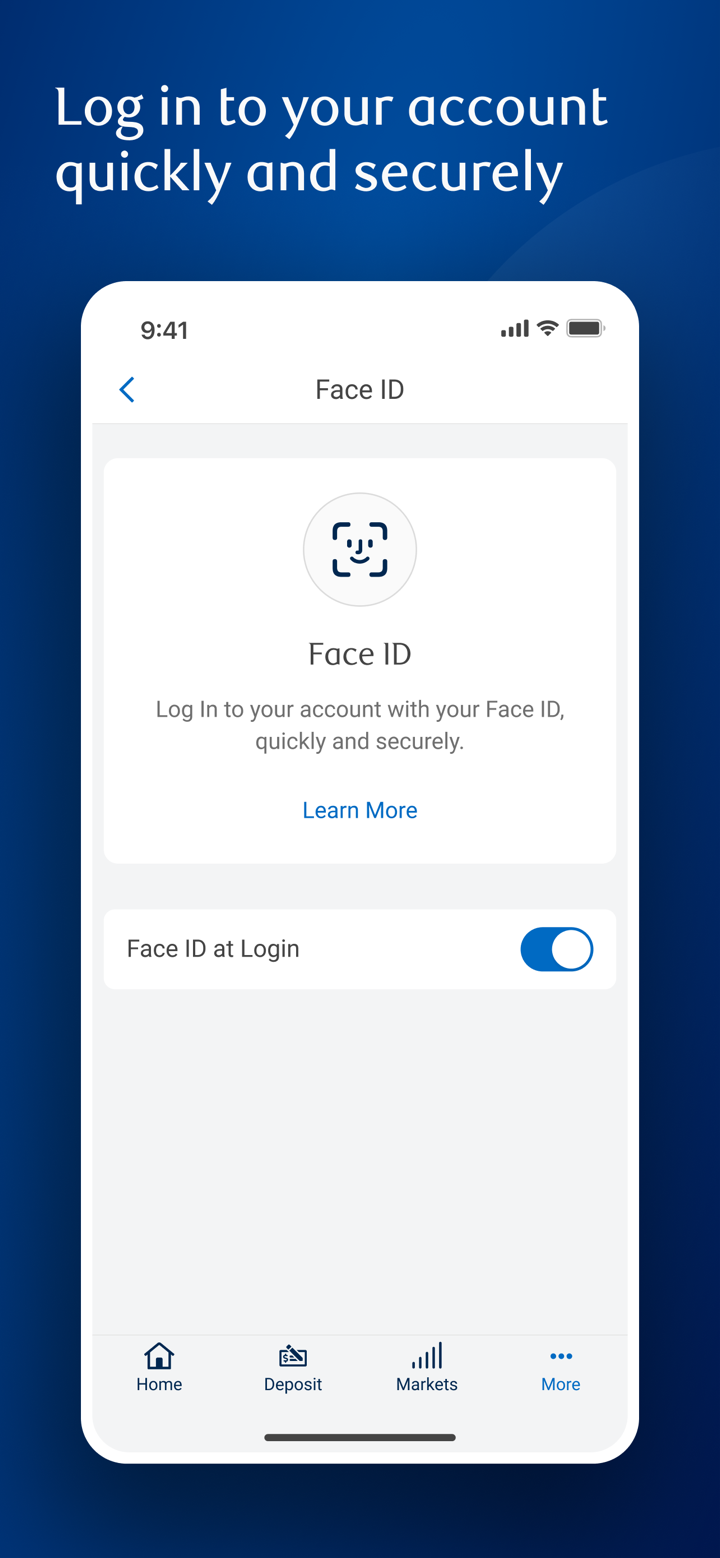

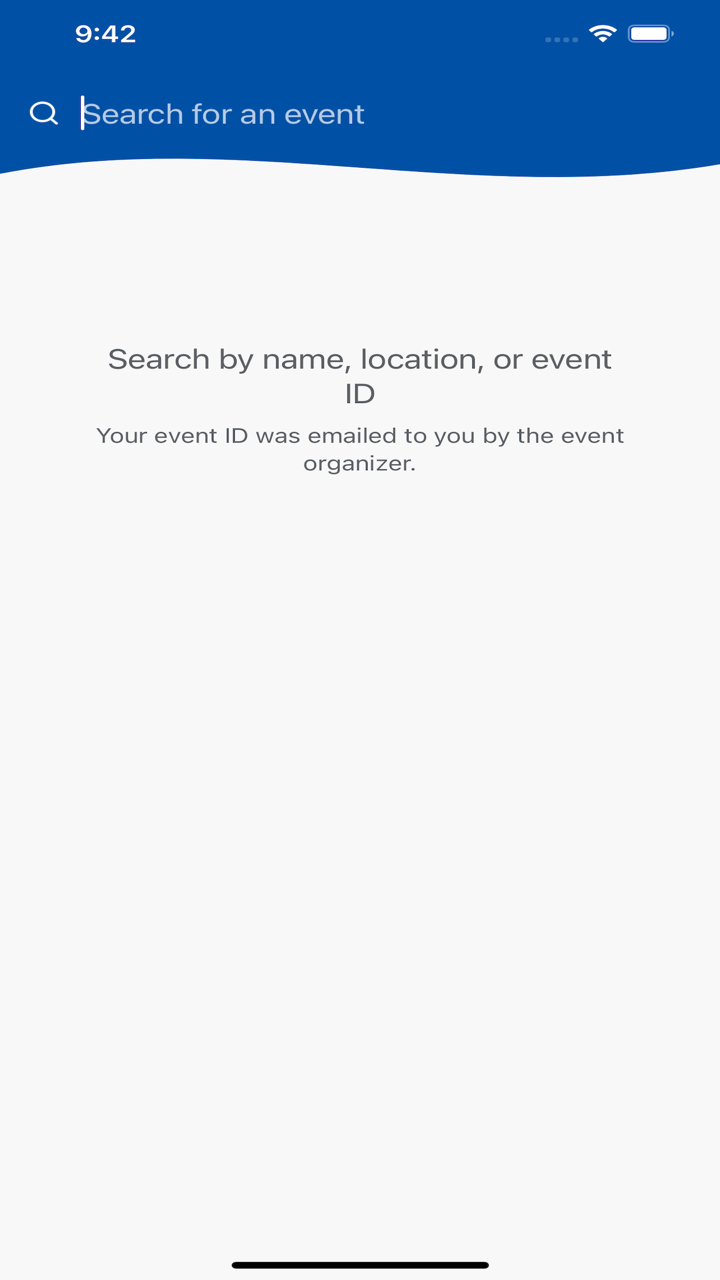

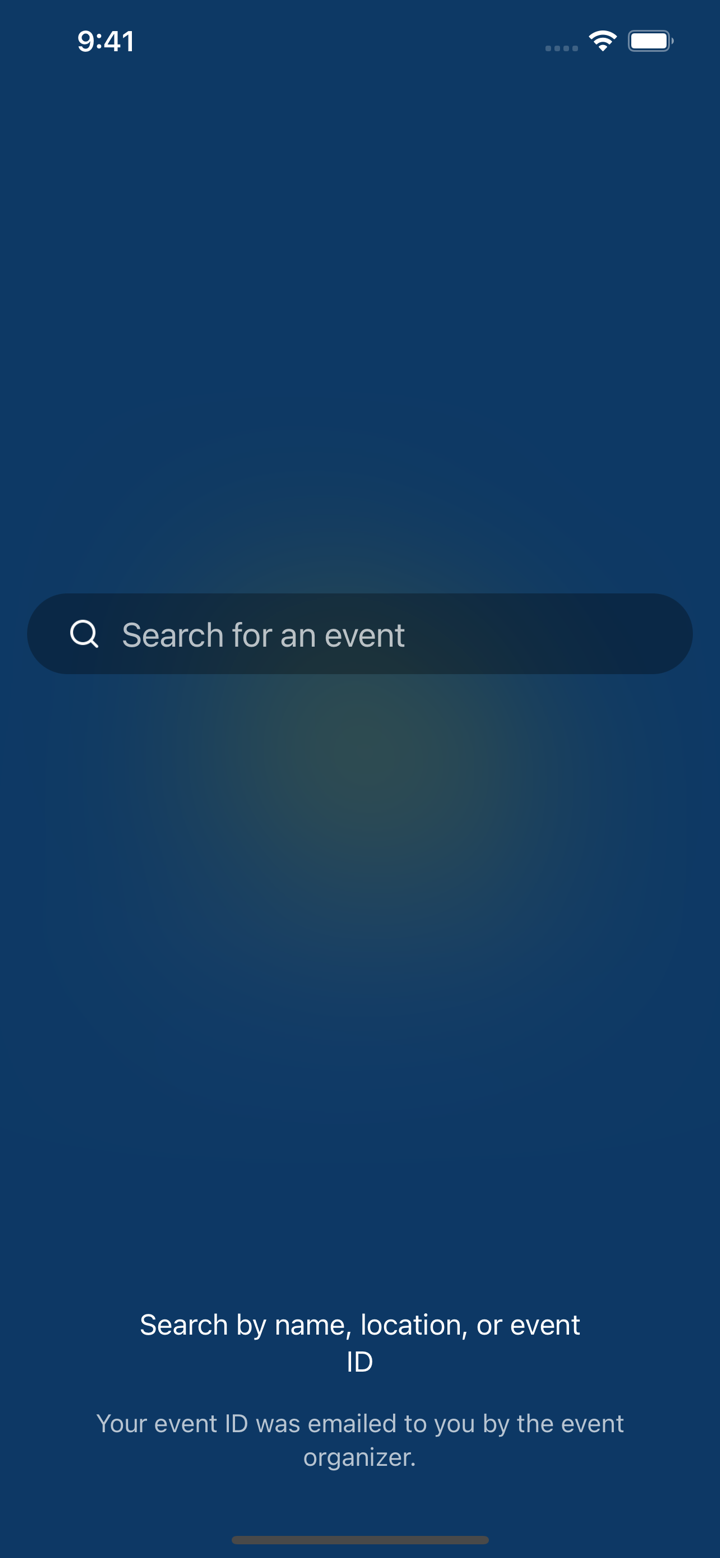

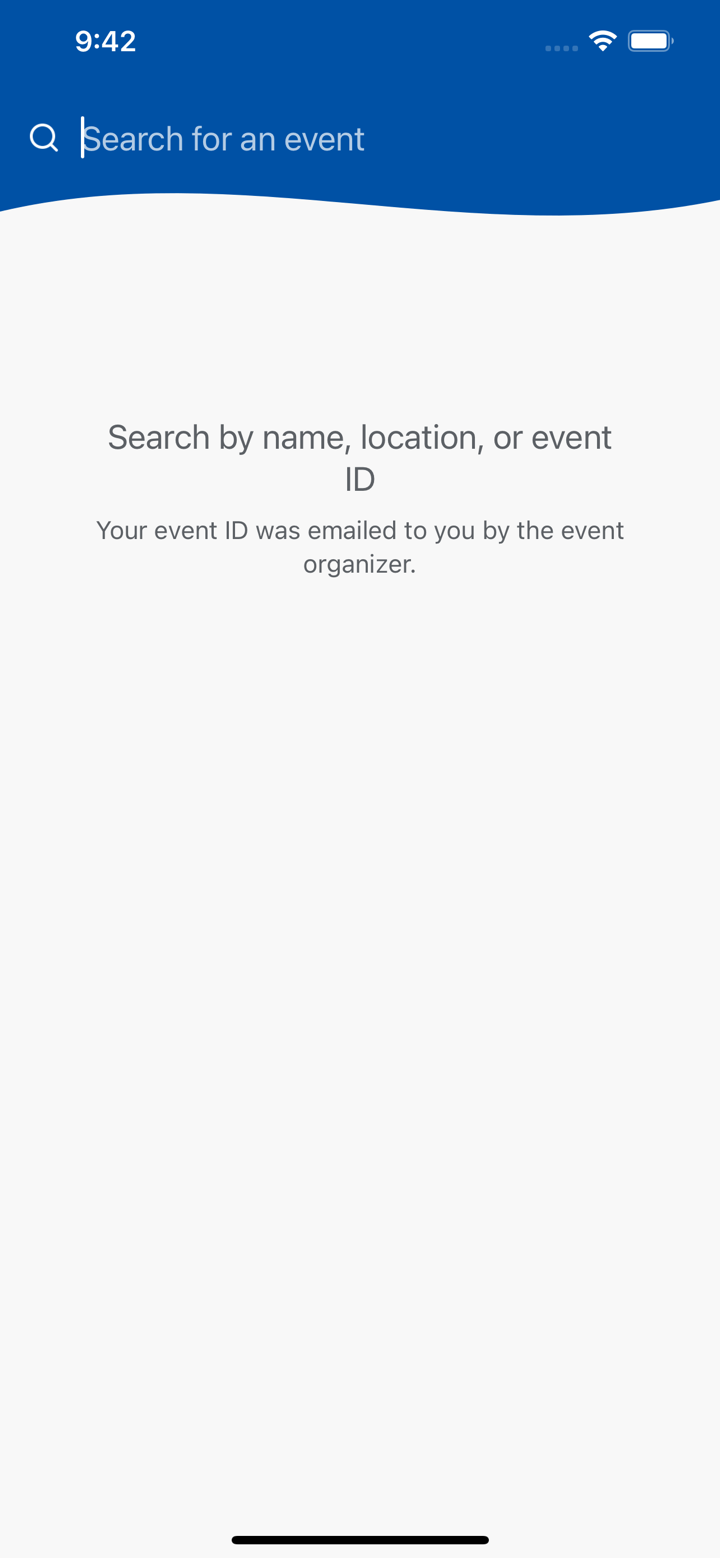

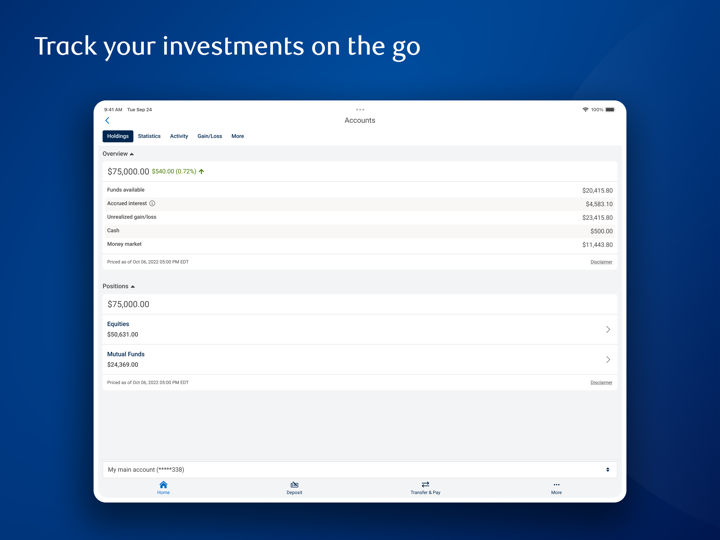

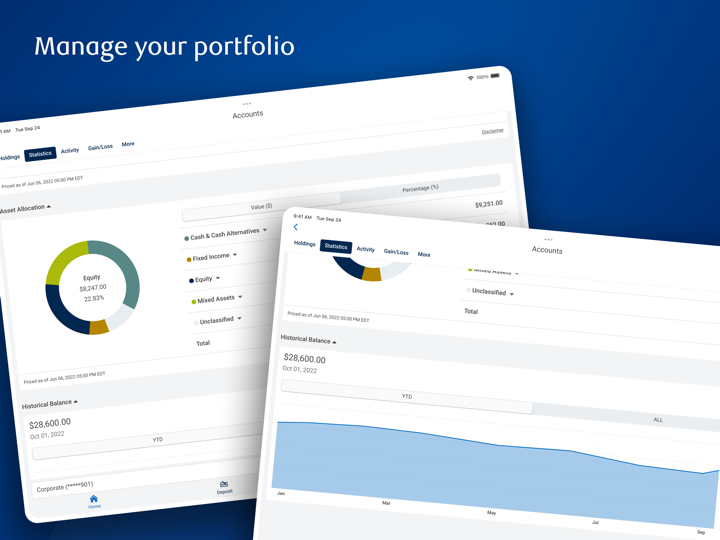

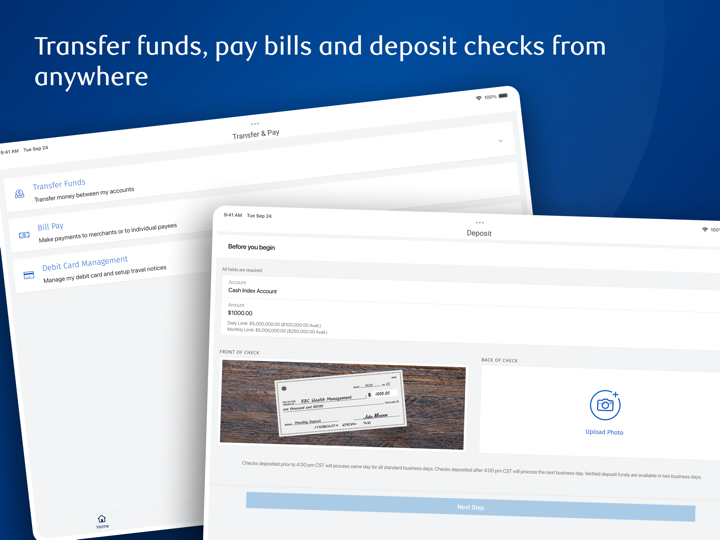

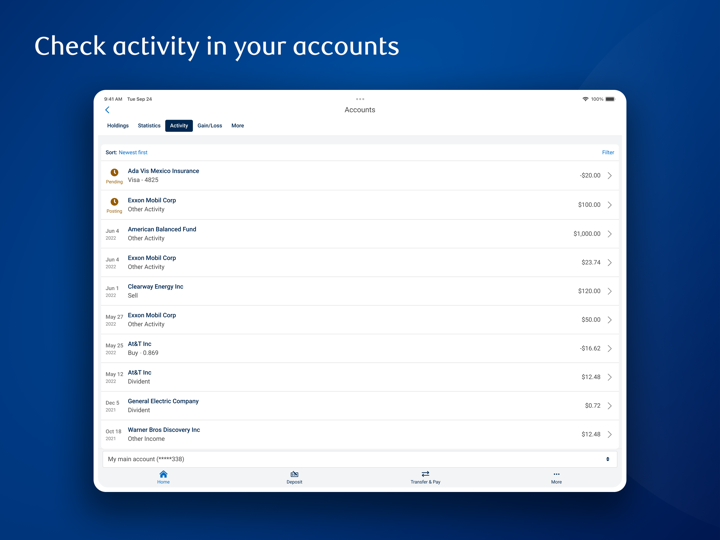

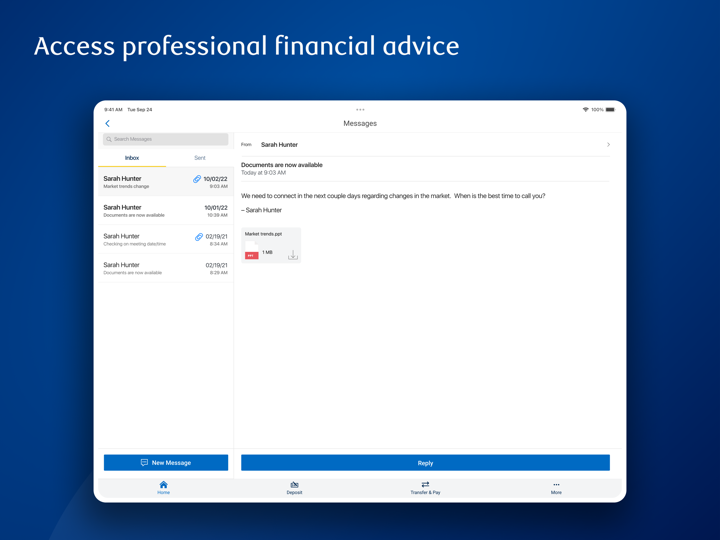

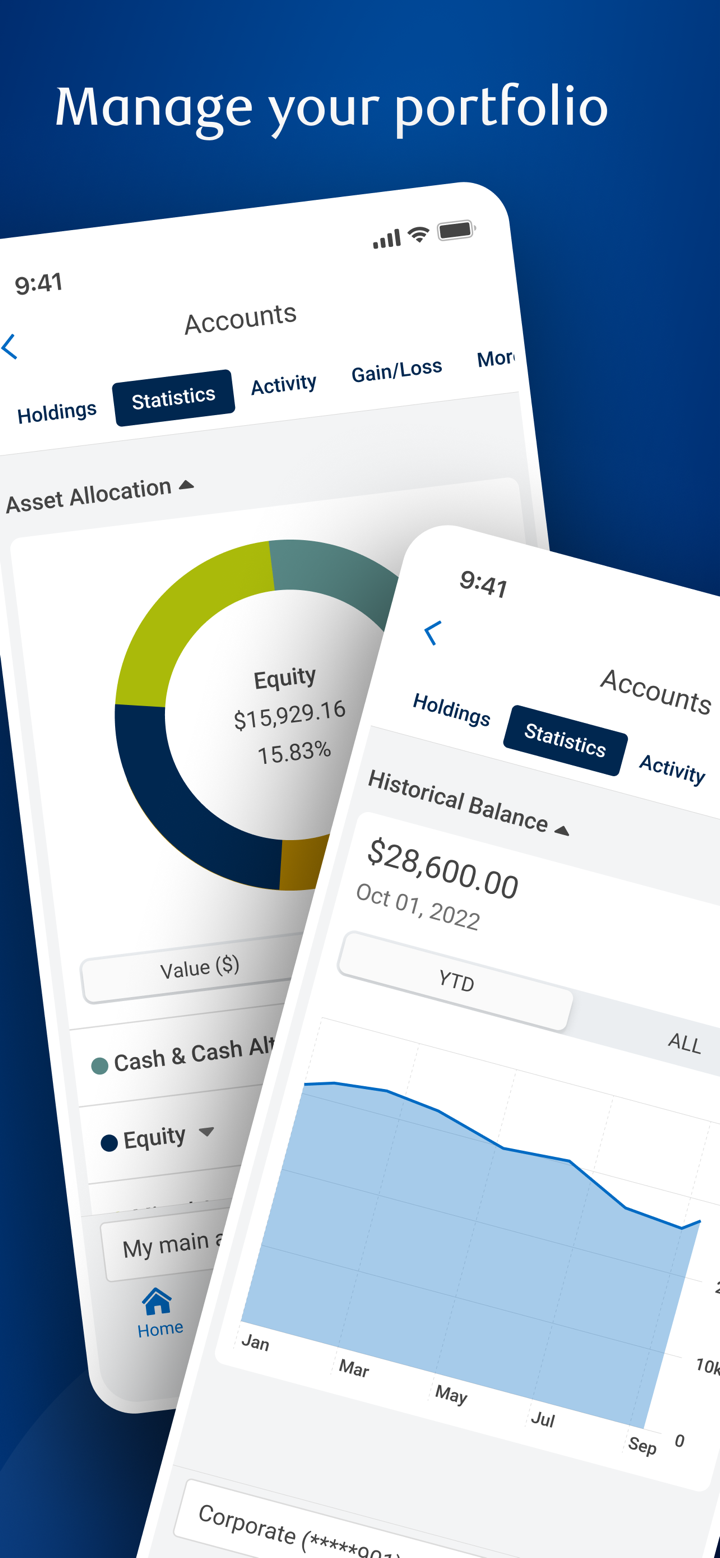

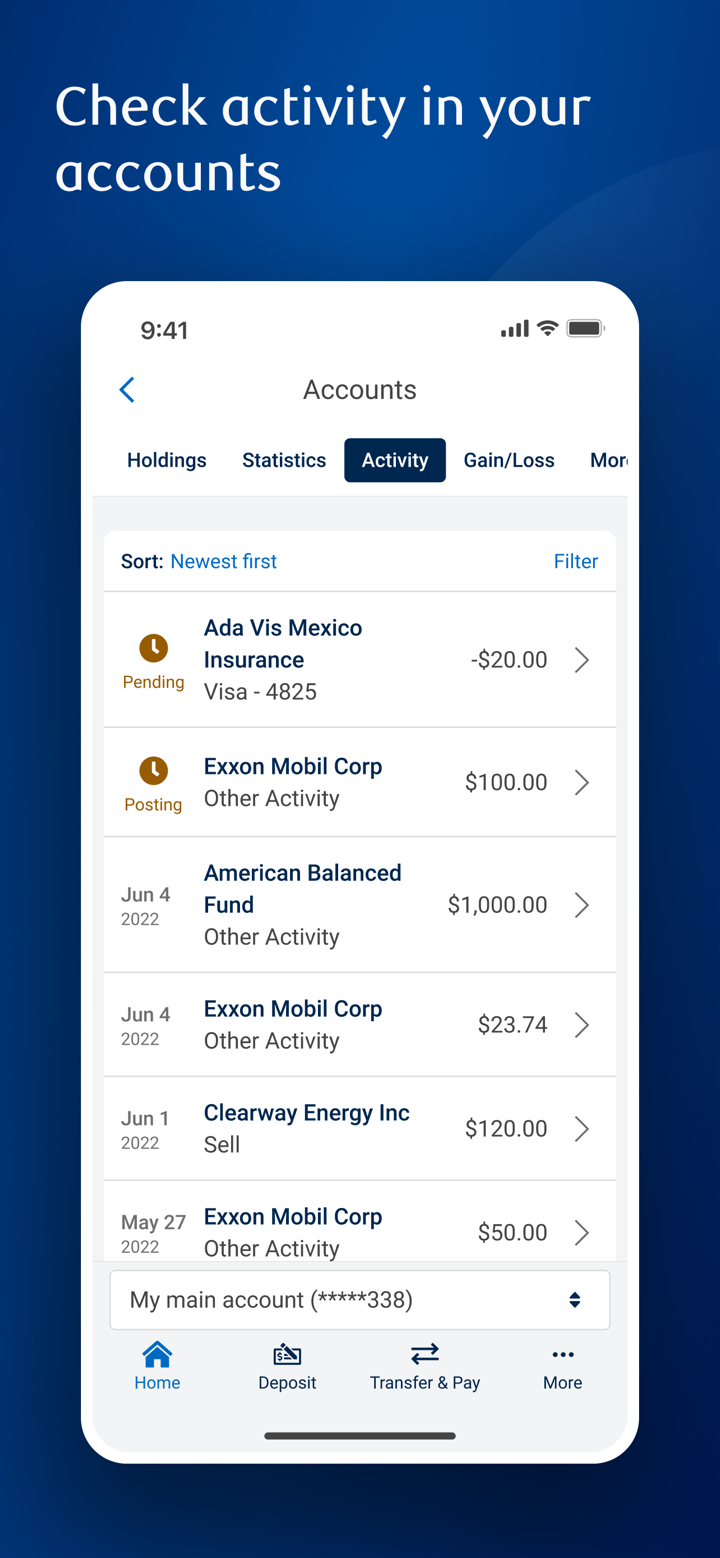

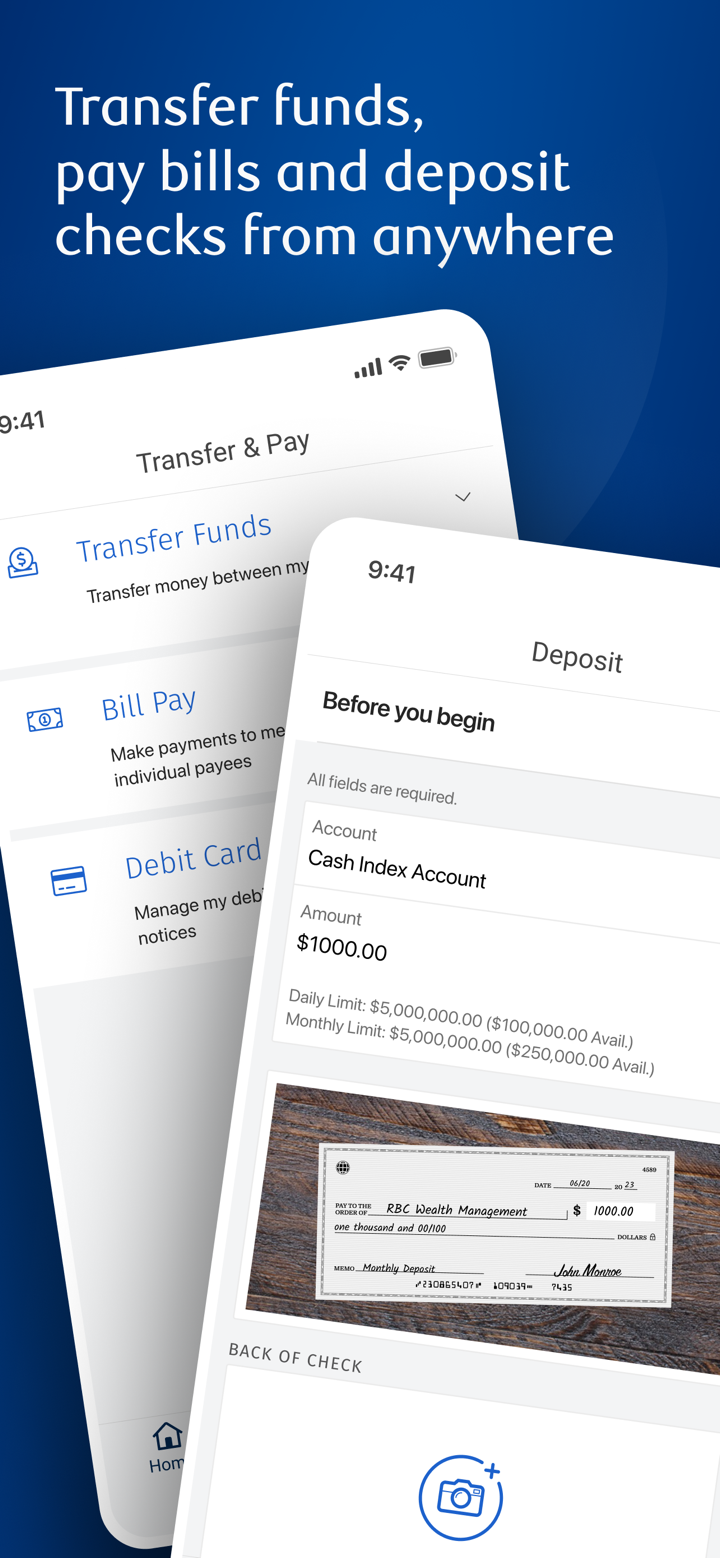

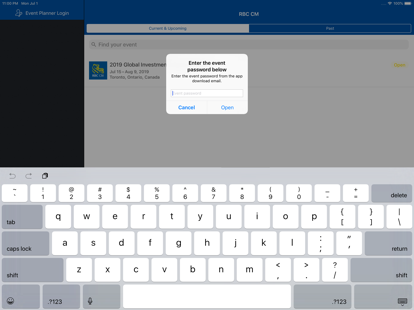

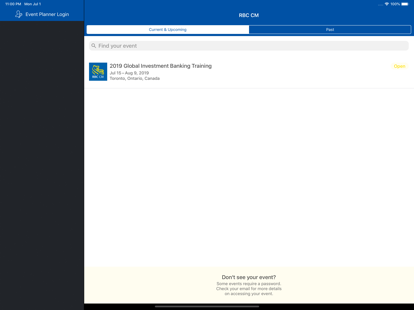

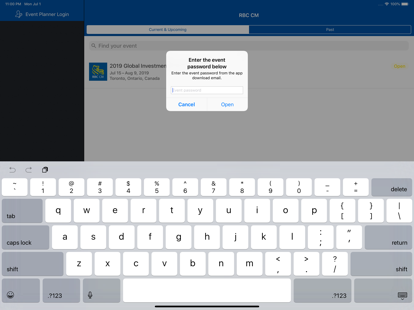

거래 플랫폼

| 거래 플랫폼 | 지원 | 사용 가능한 장치 | 적합 대상 |

| 모바일 앱 | ✔ | 모바일 | / |

| MT4 | ❌ | / | 초보자 |

| MT5 | ❌ | / | 경험 있는 트레이더 |