مقدمة عن الشركة

| RBCCM ملخص المراجعة | |

| تأسست | 2001 |

| البلد/المنطقة المسجلة | كندا |

| التنظيم | لا يوجد تنظيم |

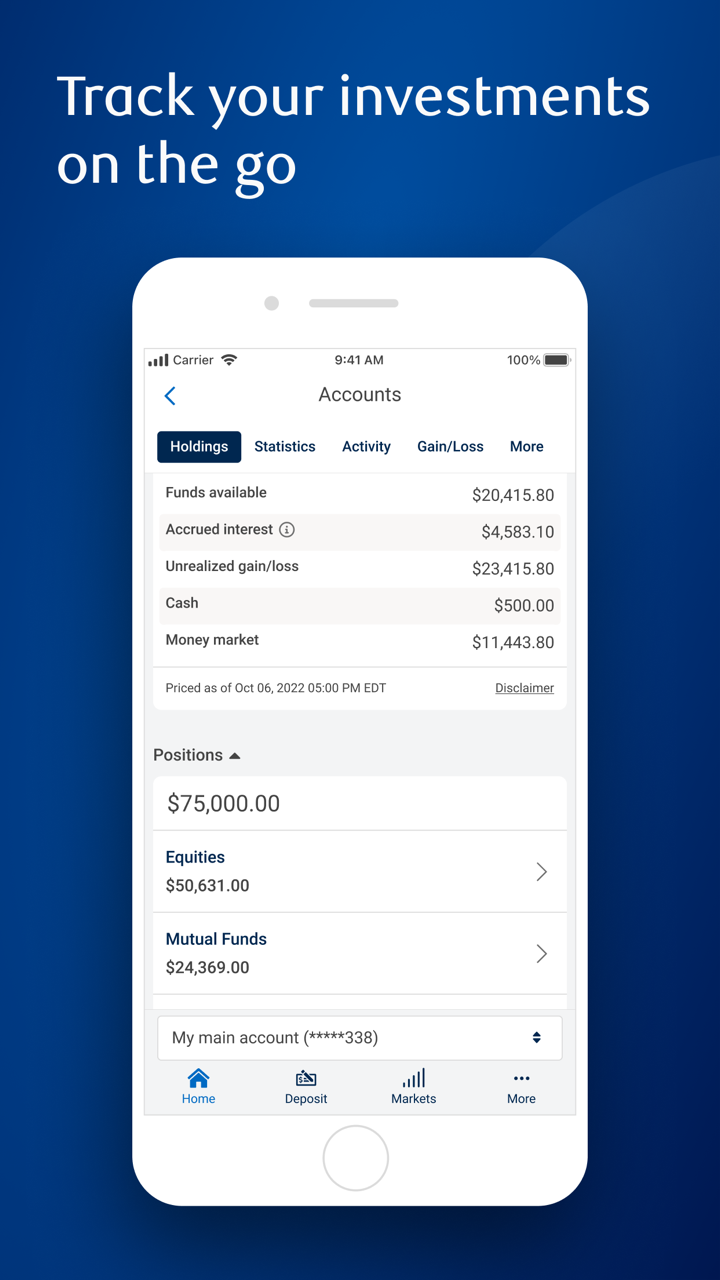

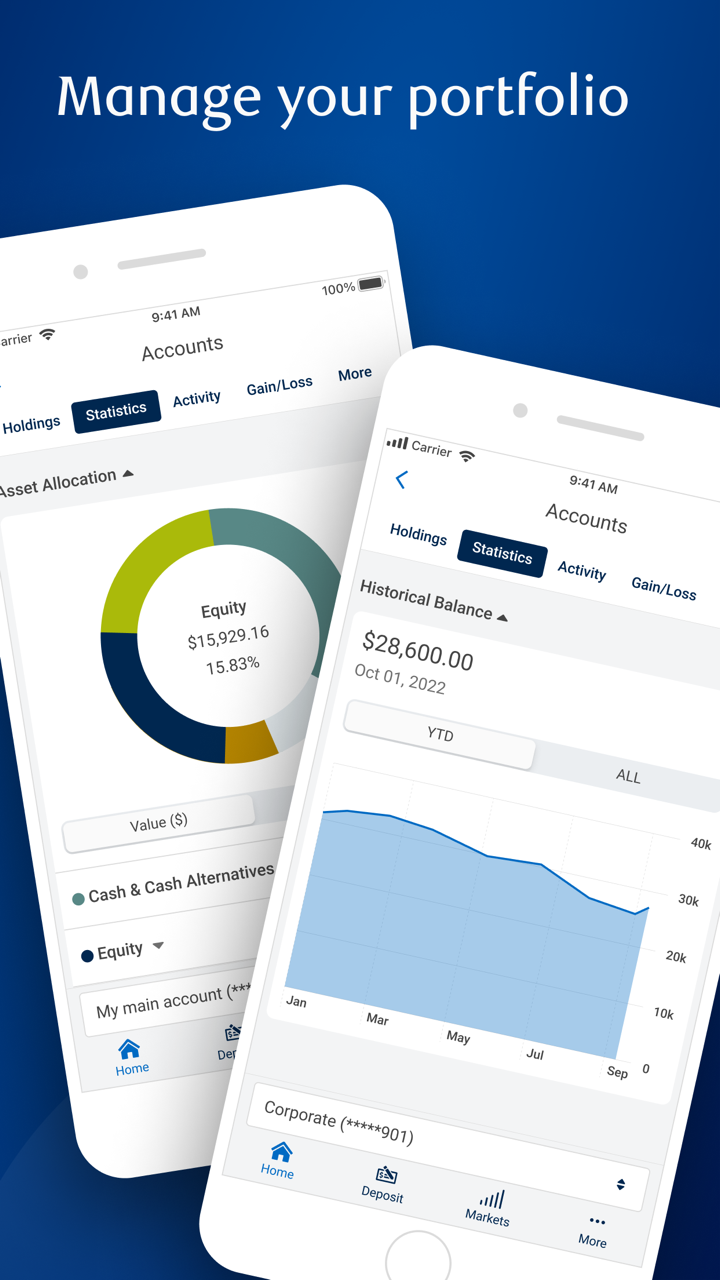

| أدوات السوق | السلع، الأسهم، صناديق الاستثمار المتداولة، العملات الأجنبية، الدخل الثابت |

| حساب تجريبي | / |

| الرافعة المالية | / |

| الانتشار | / |

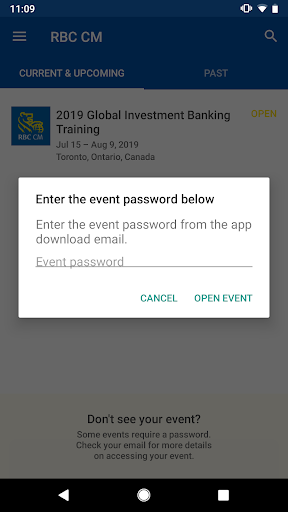

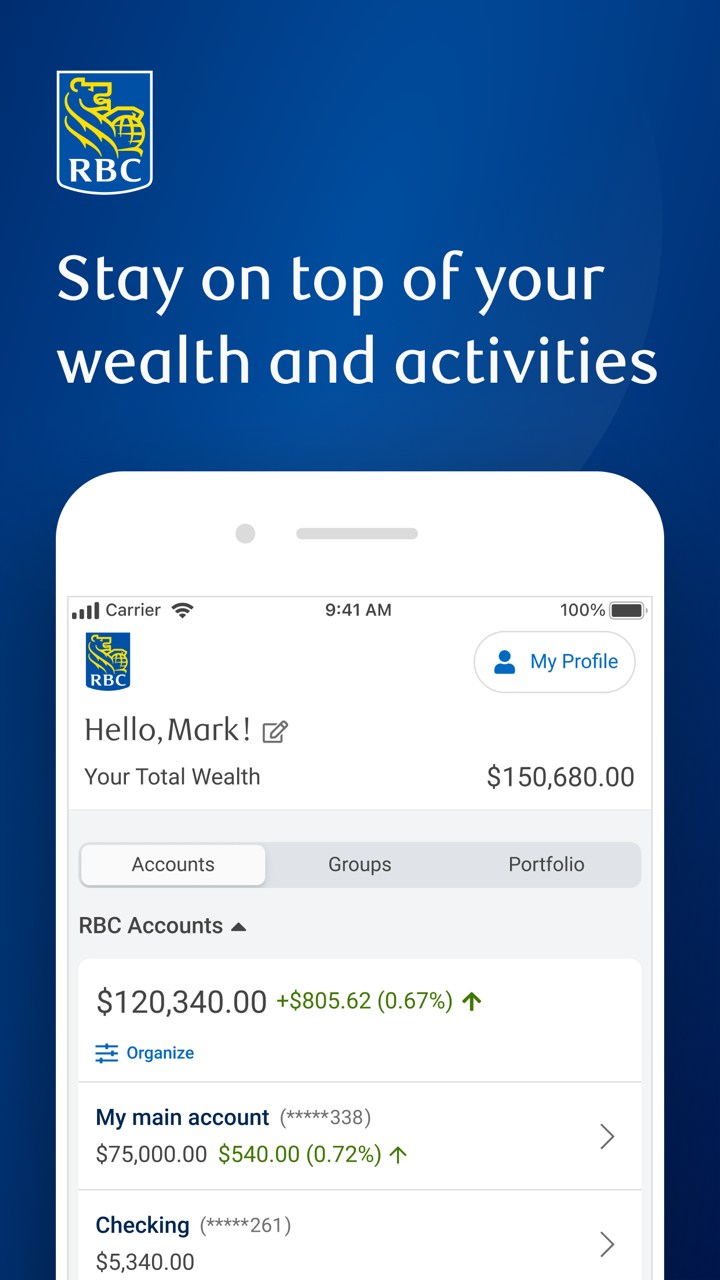

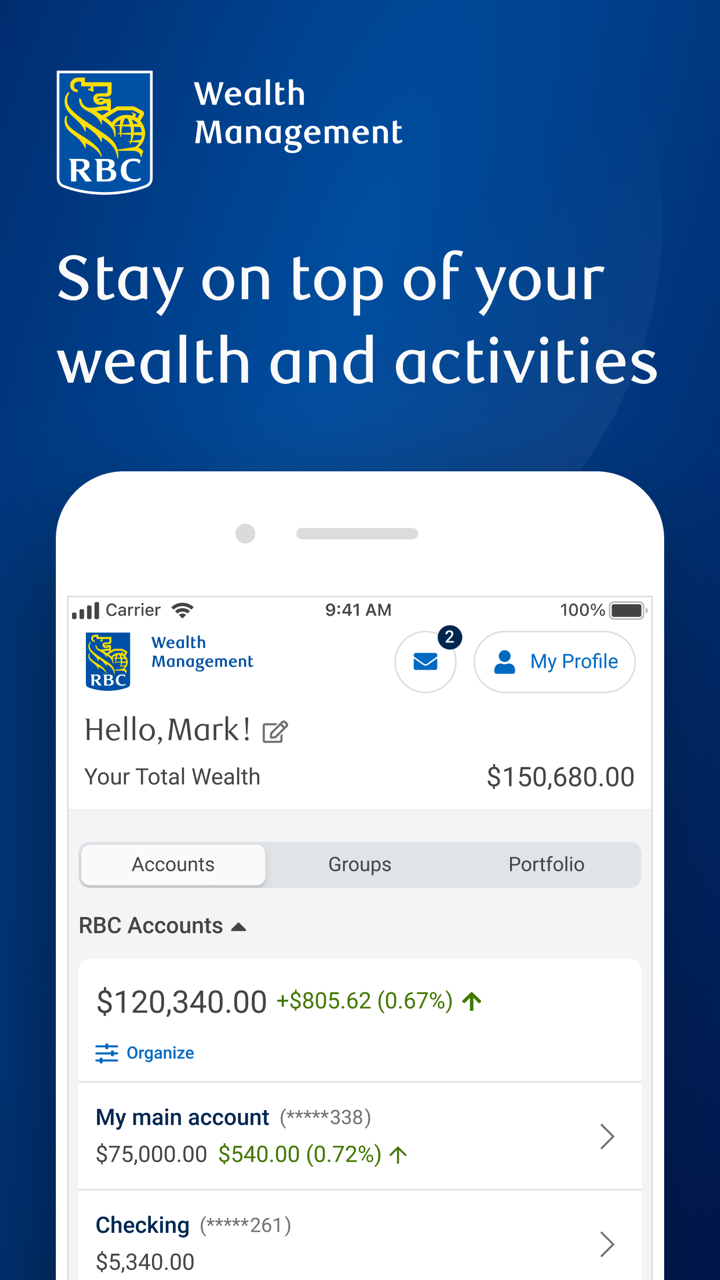

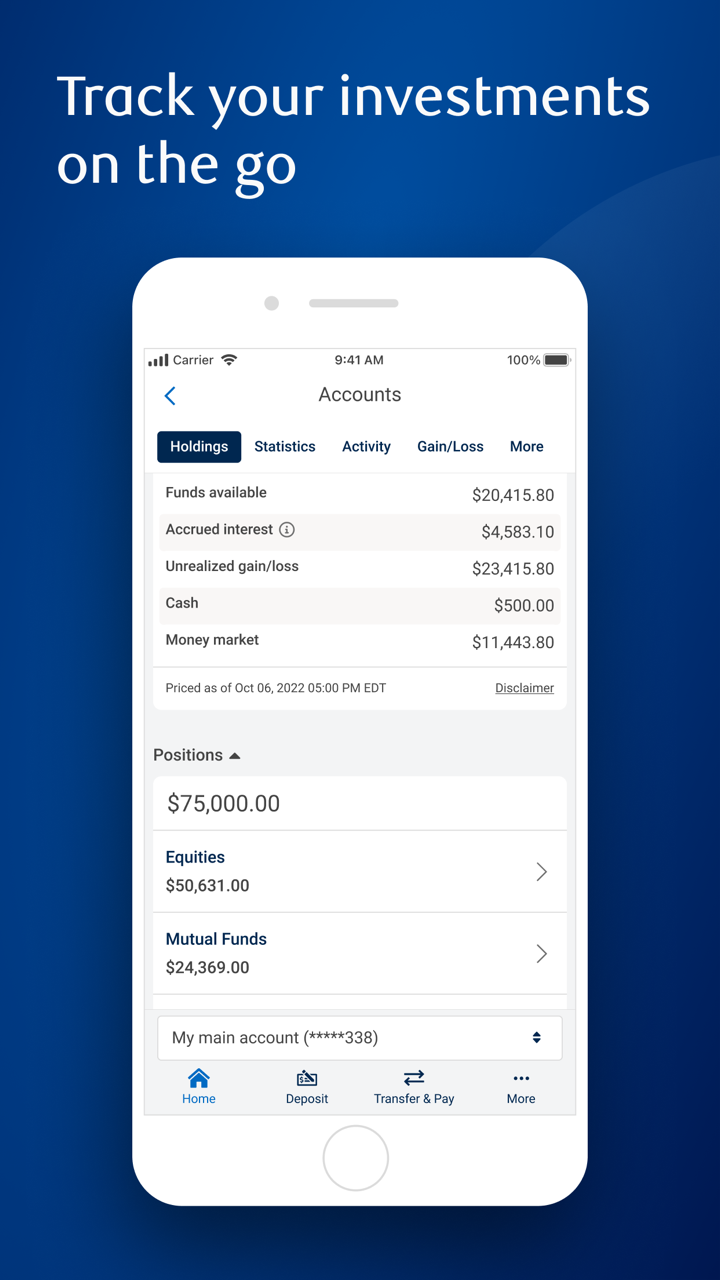

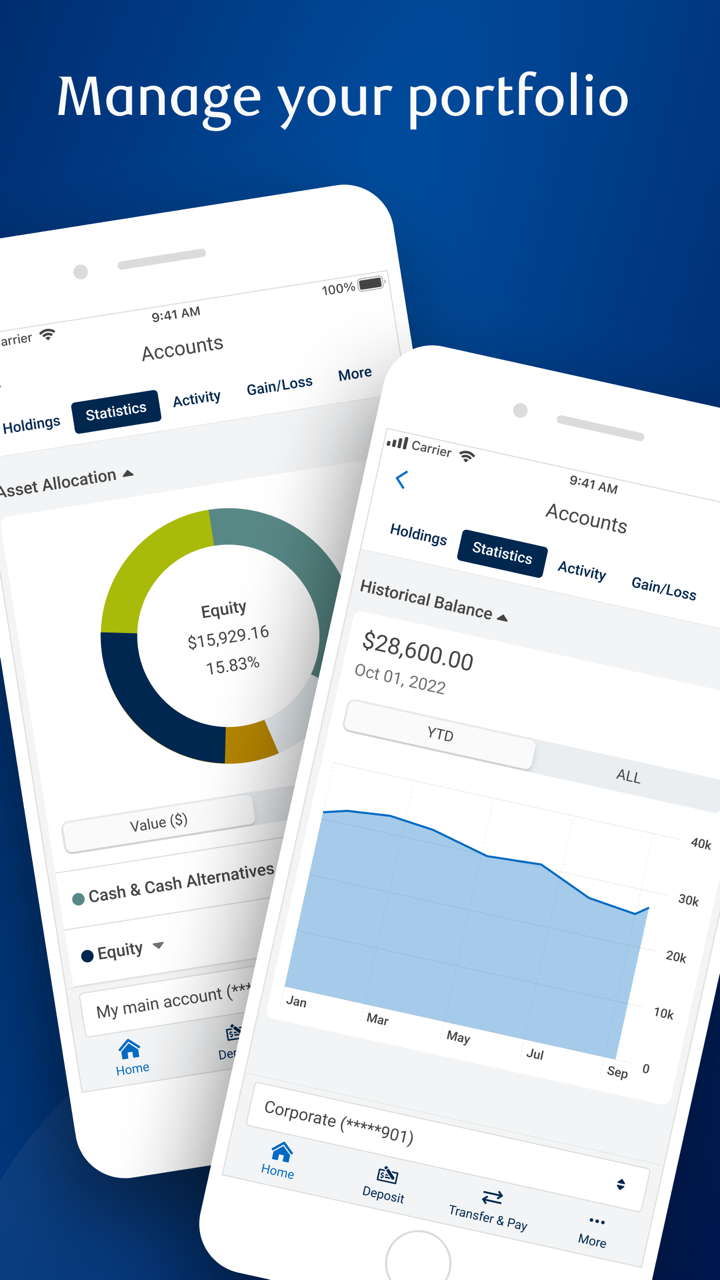

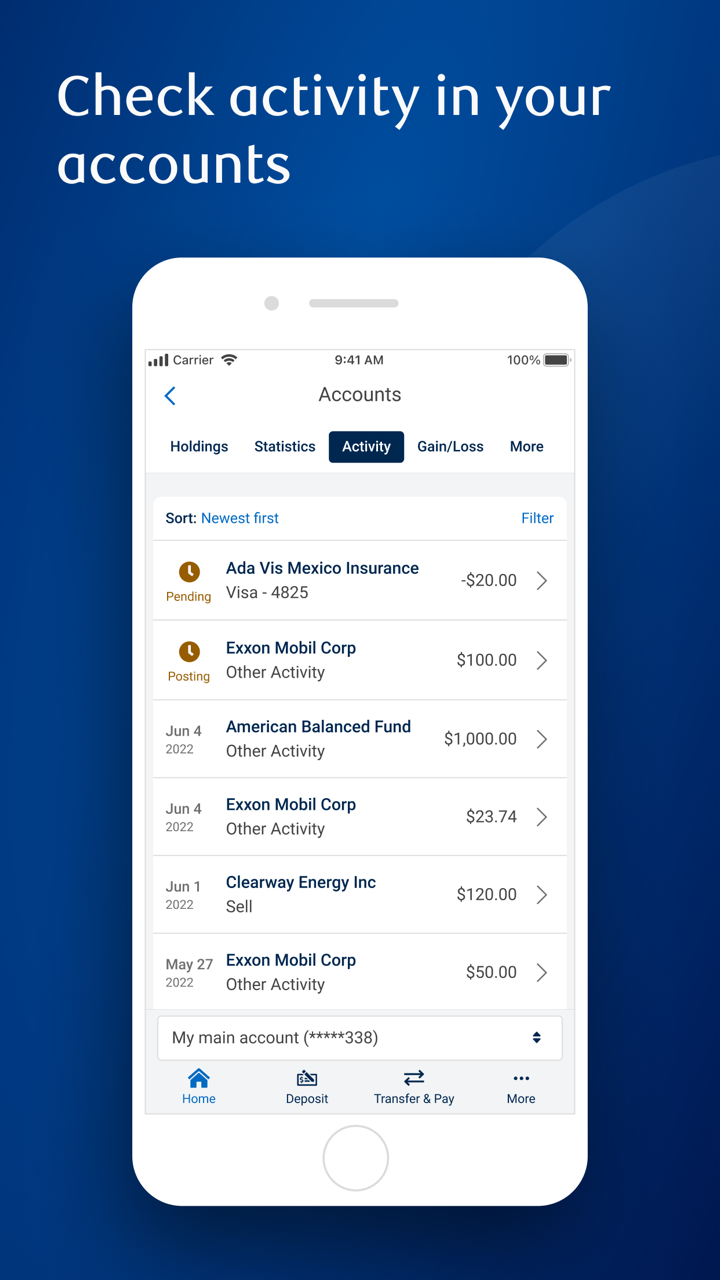

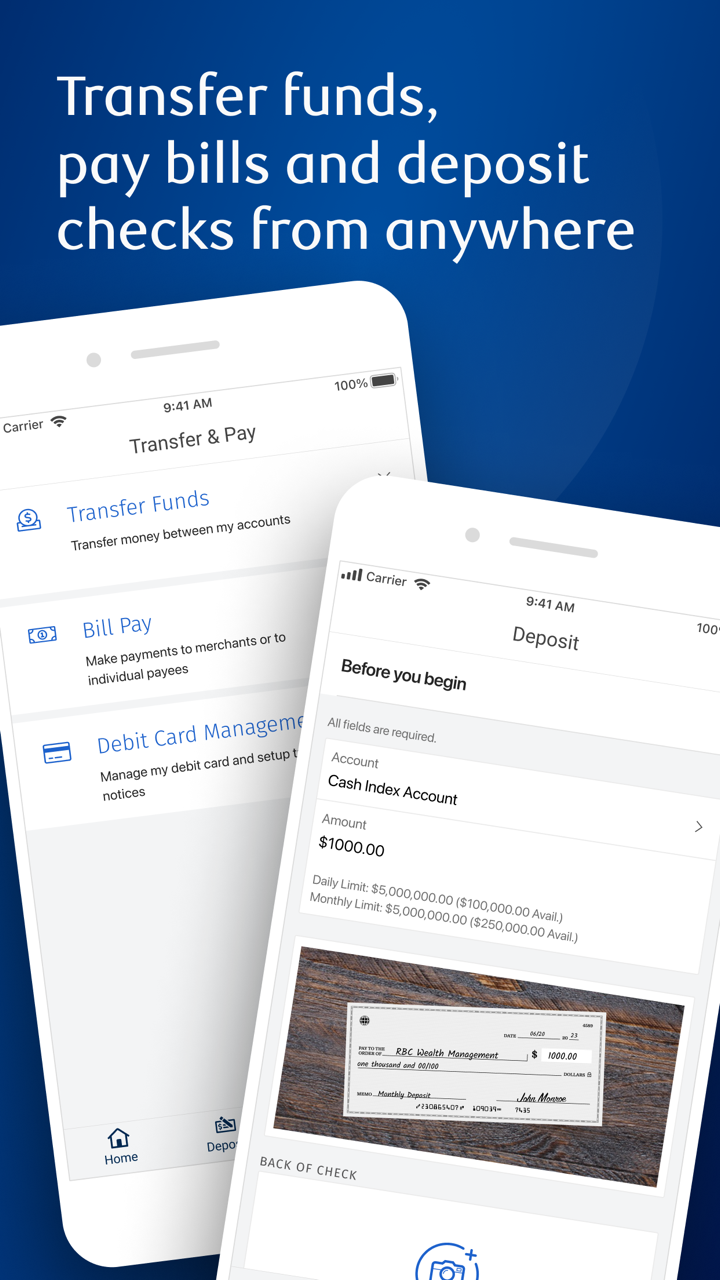

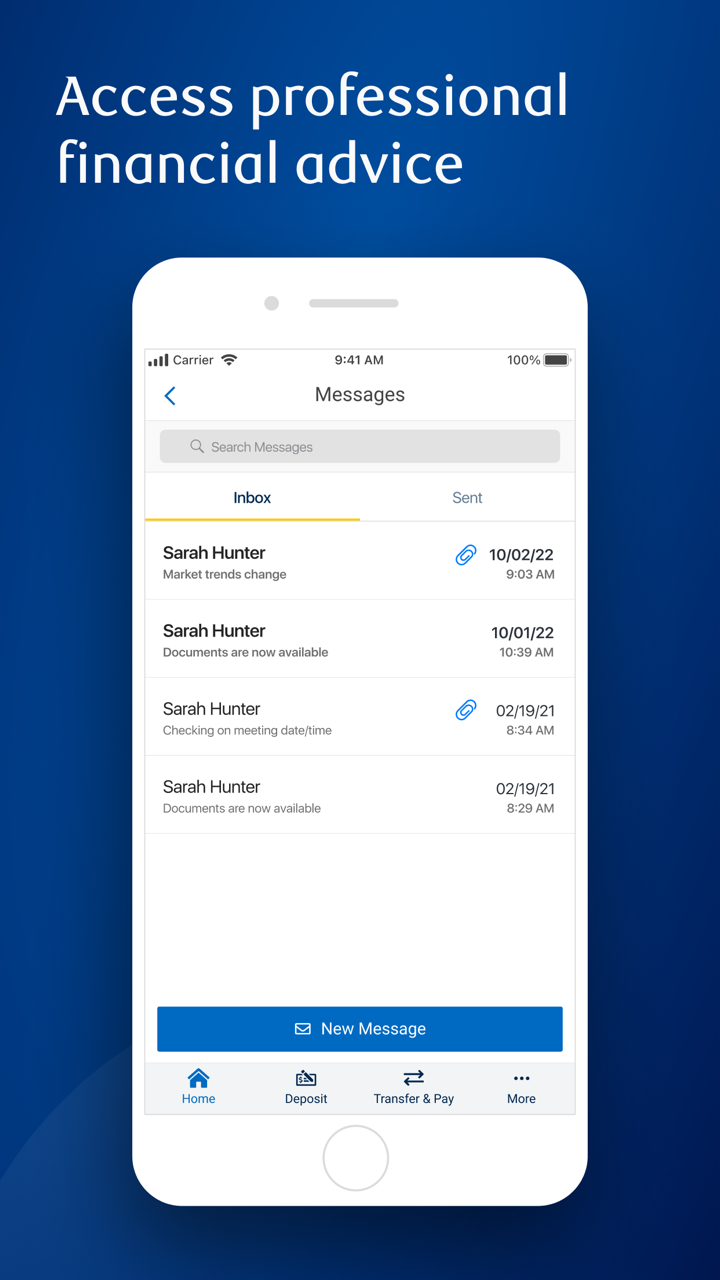

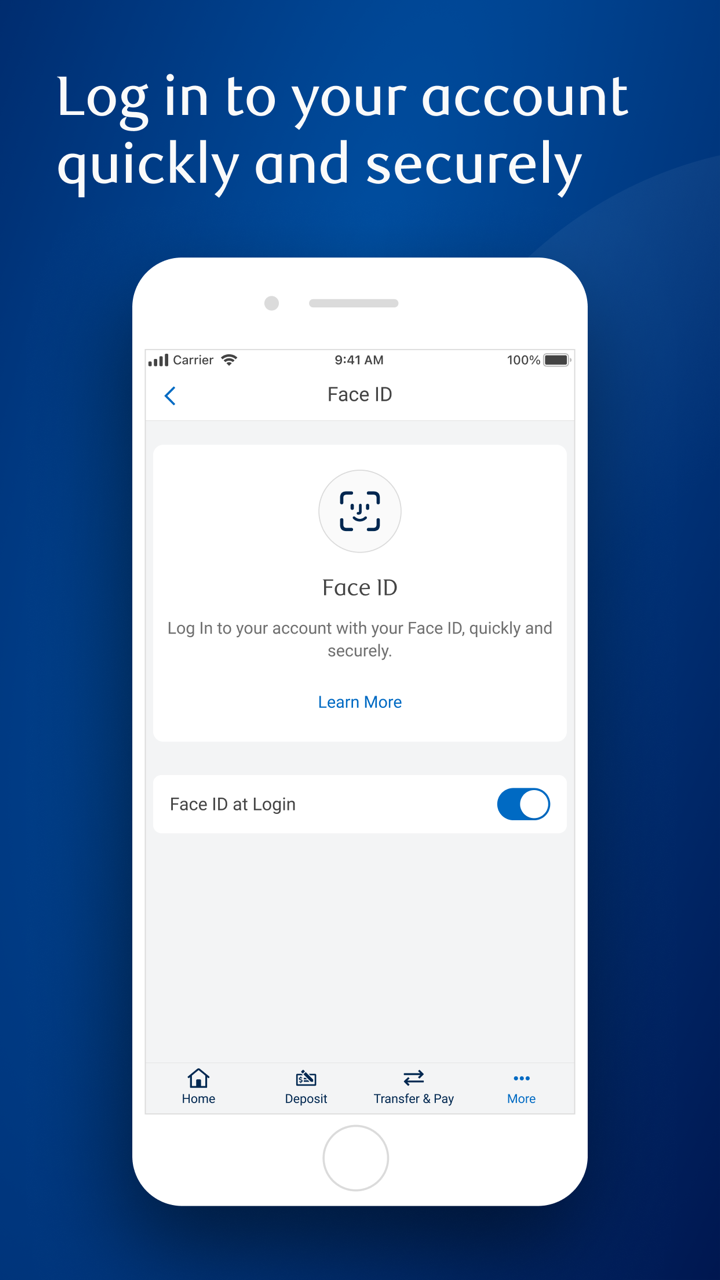

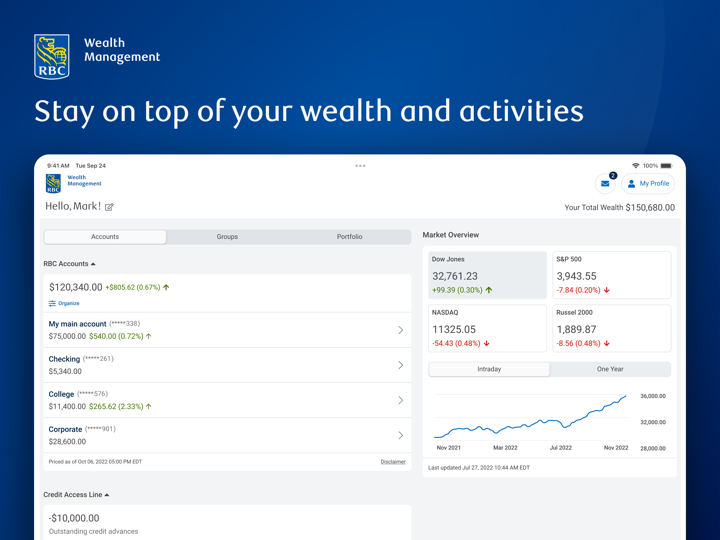

| منصة التداول | تطبيق الجوال |

| الحد الأدنى للإيداع | / |

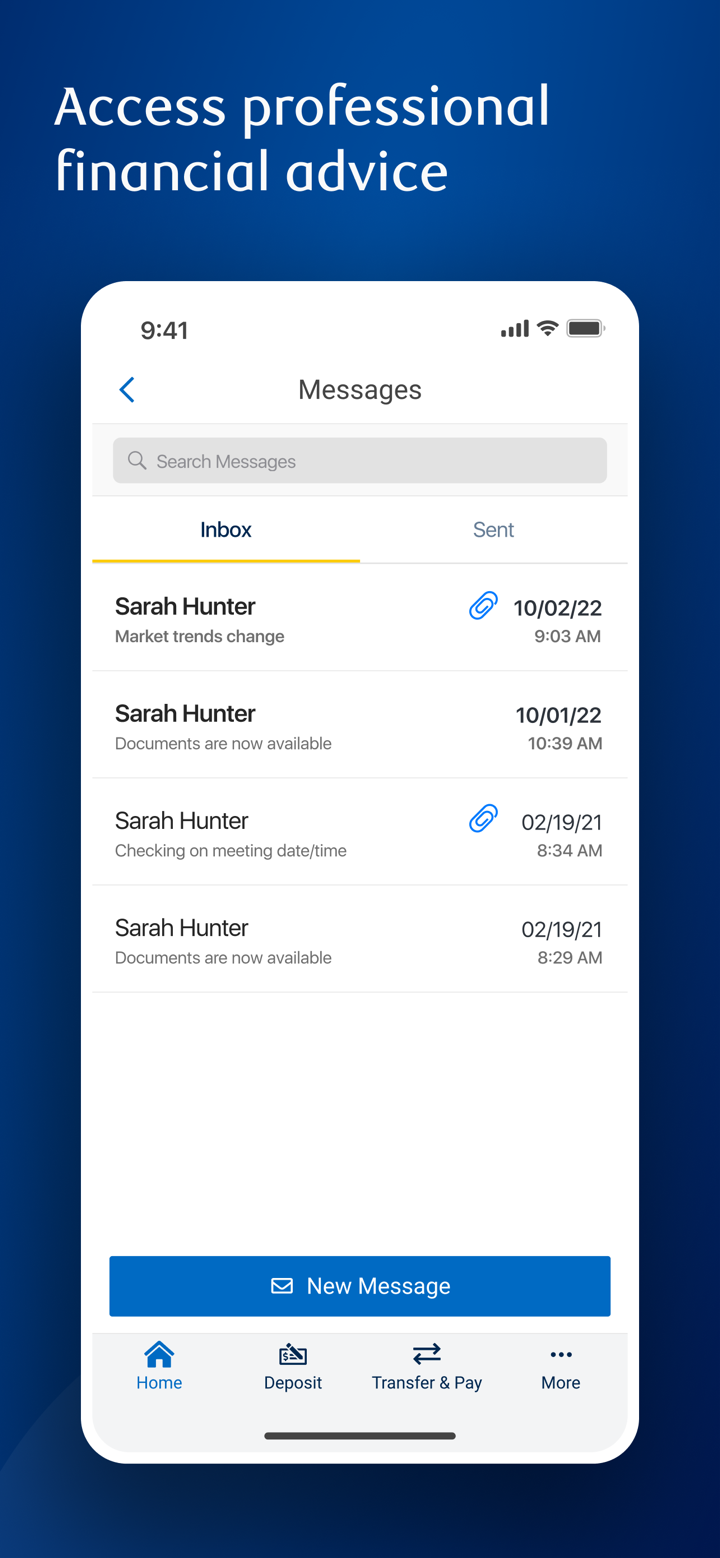

| دعم العملاء | نموذج الاتصال |

| هاتف: +14168422000 | |

| وسائل التواصل الاجتماعي: LinkedIn، YouTube، X | |

| العنوان: RBC Centre 155 Wellington St W Toronto، أونتاريو M5V 3K7 | |

معلومات RBCCM

RBCCM هو وسيط مقره في كندا تأسس في عام 2001، وهو غير منظم. يقدم مجموعة متنوعة من أدوات السوق، بما في ذلك السلع، الأسهم، صناديق الاستثمار المتداولة، العملات الأجنبية، والدخل الثابت.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| مجموعة متنوعة من الأصول التجارية | وضع غير منظم |

| معلومات محدودة حول شروط التداول | |

| لا يوجد MT4/MT5 | |

| لا توجد معلومات حول الإيداع والسحب |

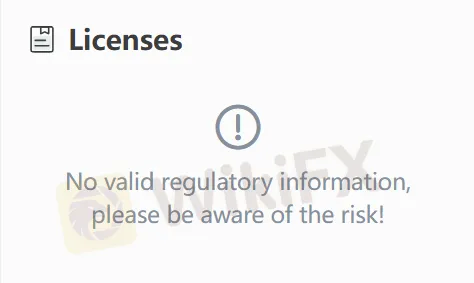

هل RBCCM شرعي؟

RBCCM غير مرخص حاليًا. يرجى أخذ الحيطة والحذر من المخاطر!

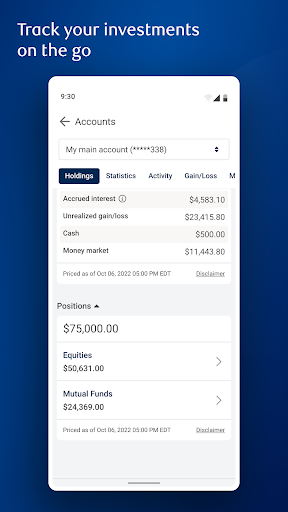

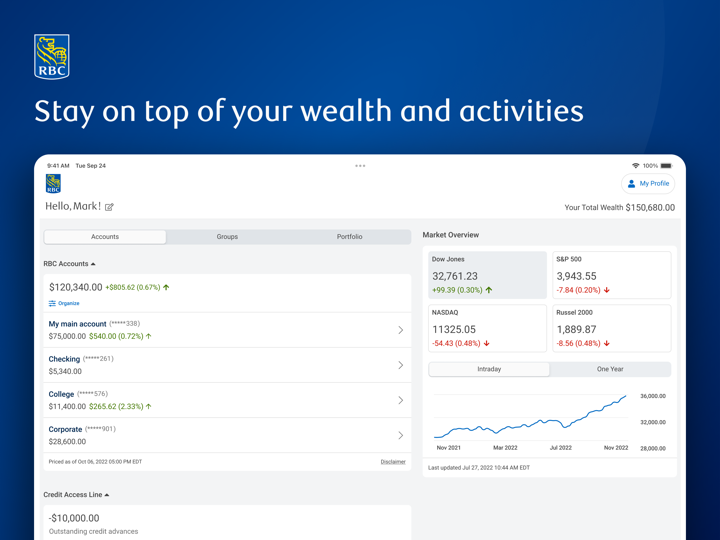

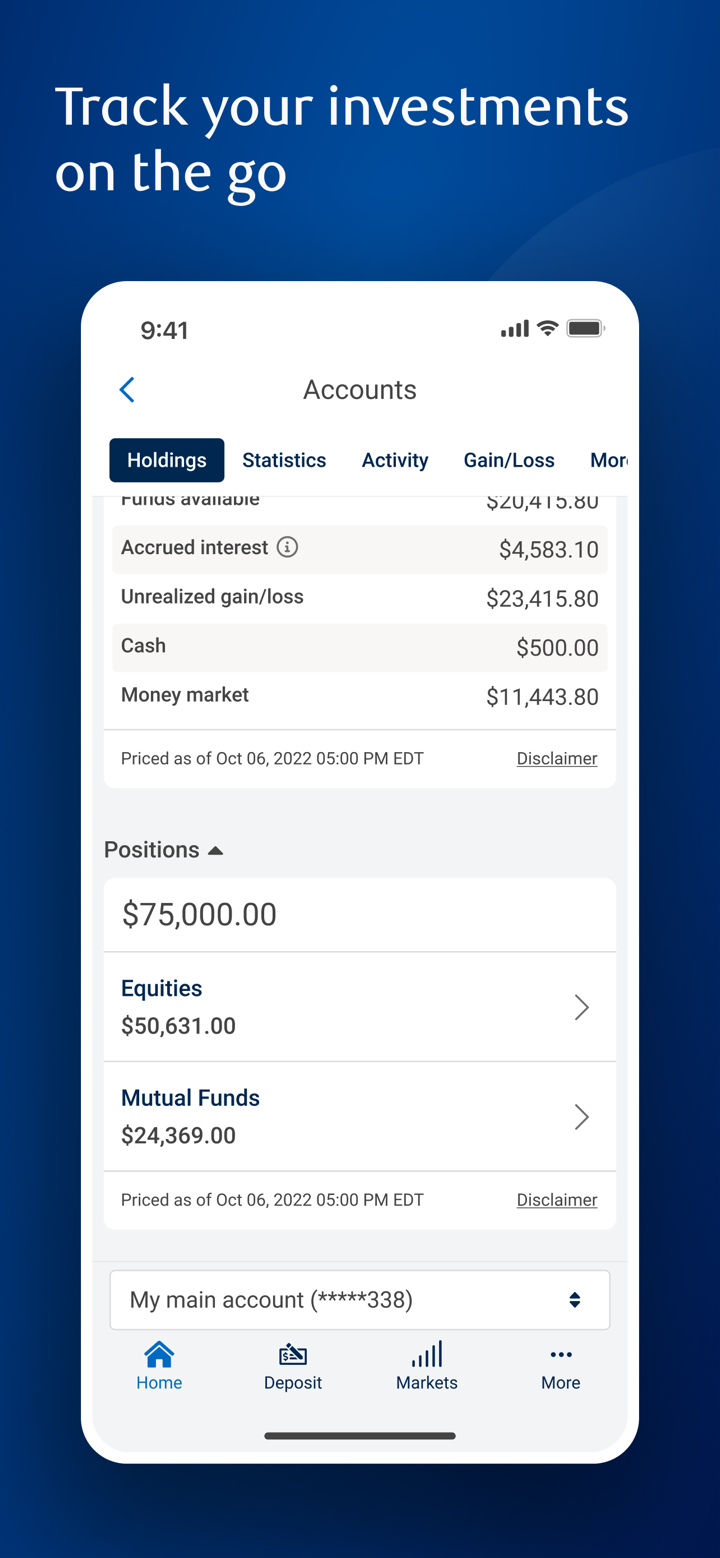

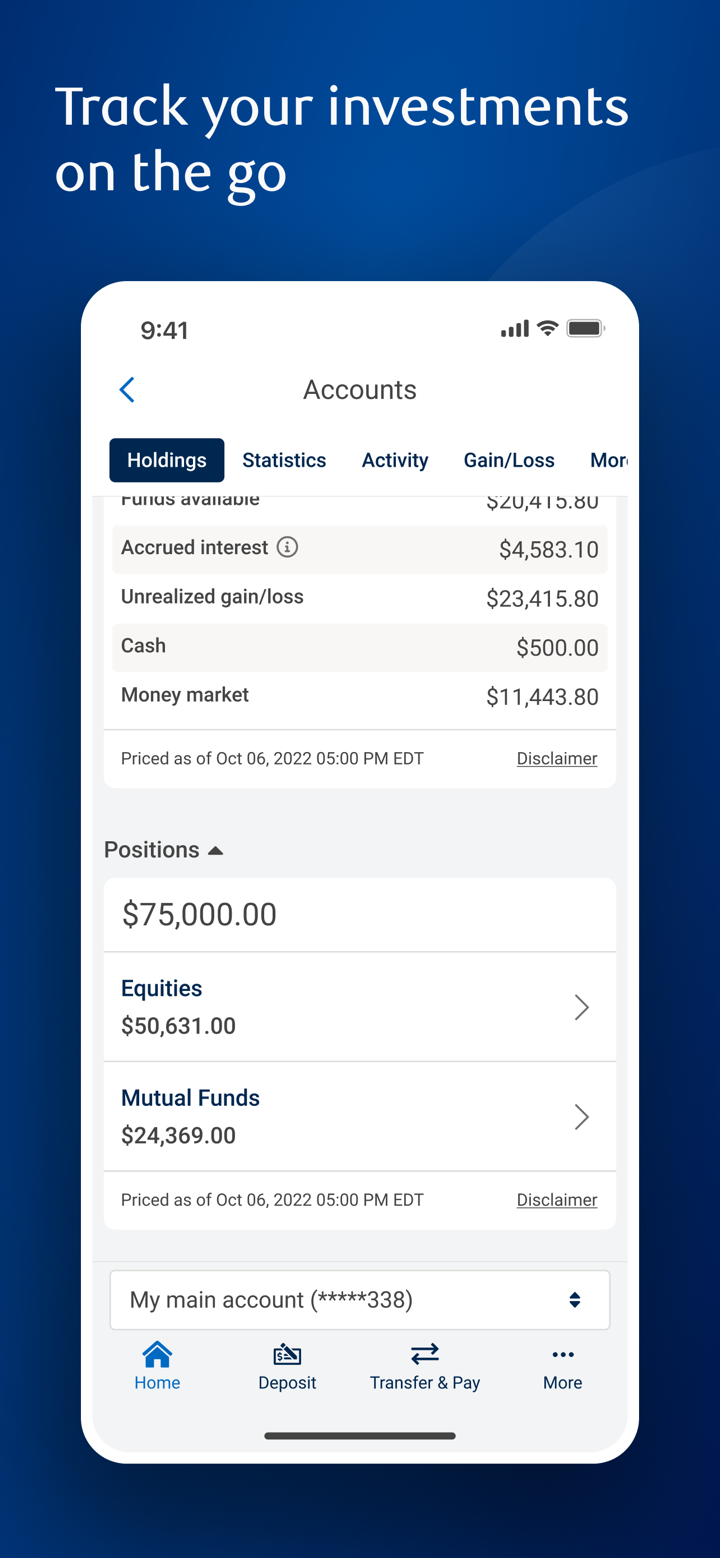

ما الذي يمكنني التداول به على RBCCM؟

| الأدوات التجارية | مدعوم |

| السلع | ✔ |

| الأسهم | ✔ |

| صناديق الاستثمار المتداولة (ETF) | ✔ |

| العملات الأجنبية (الفوركس) | ✔ |

| الدخل الثابت | ✔ |

| المؤشرات | ❌ |

| الأسهم | ❌ |

| العملات الرقمية (الكريبتو) | ❌ |

| السندات | ❌ |

| الخيارات | ❌ |

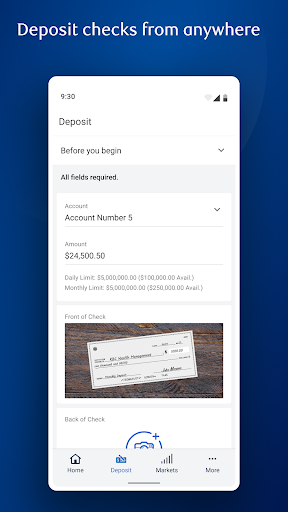

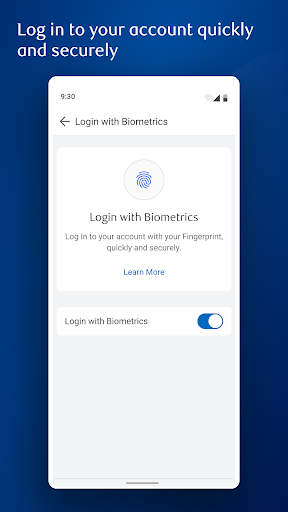

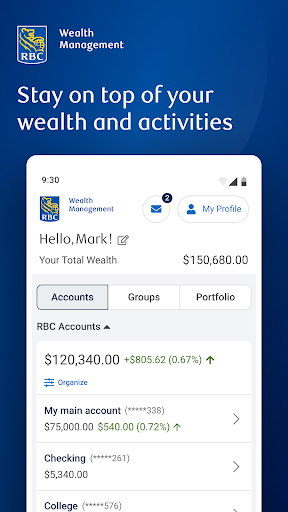

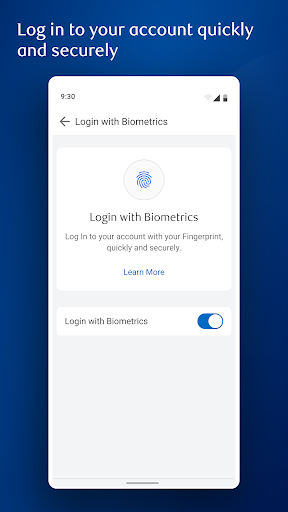

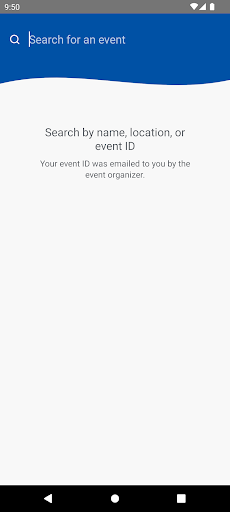

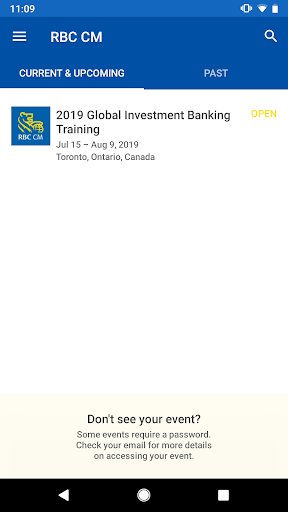

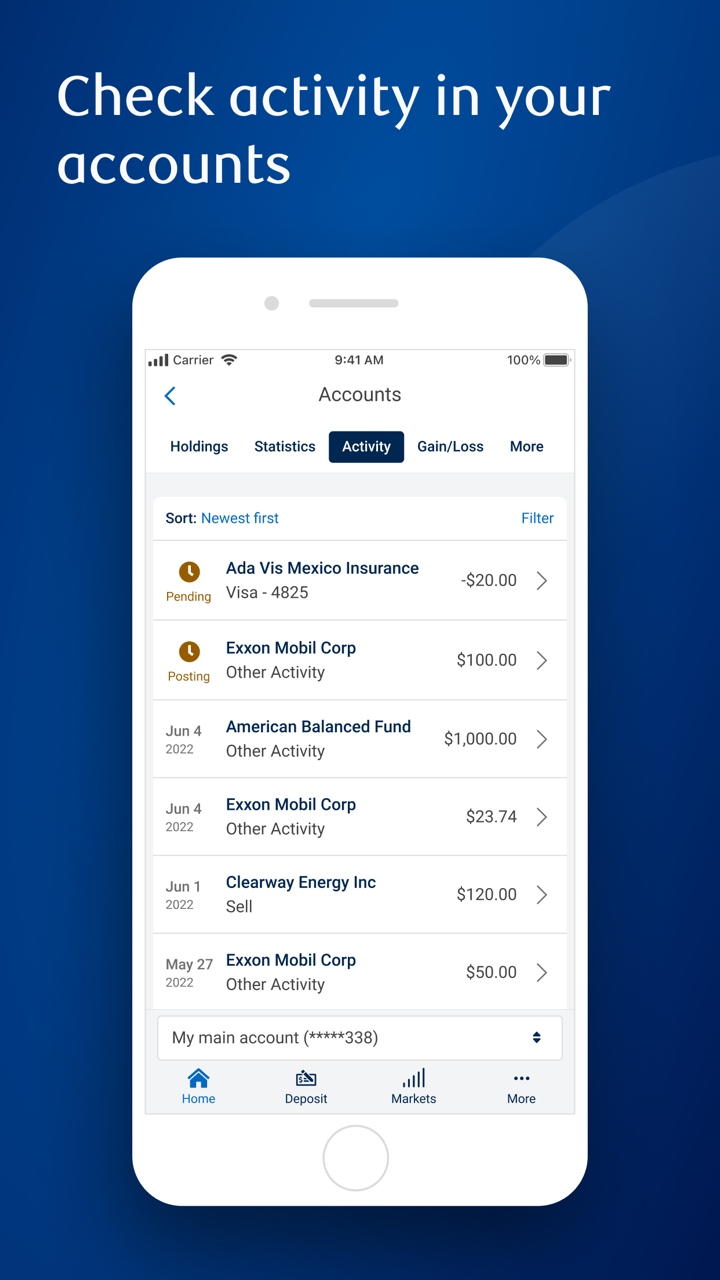

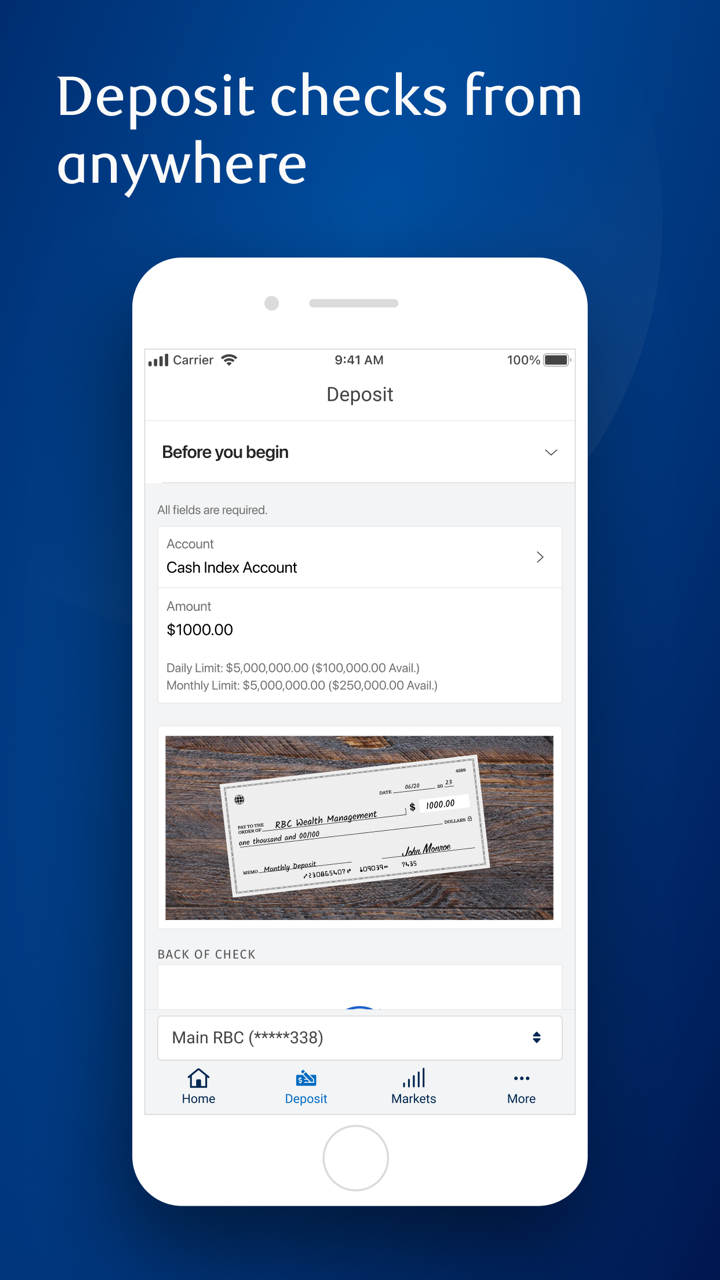

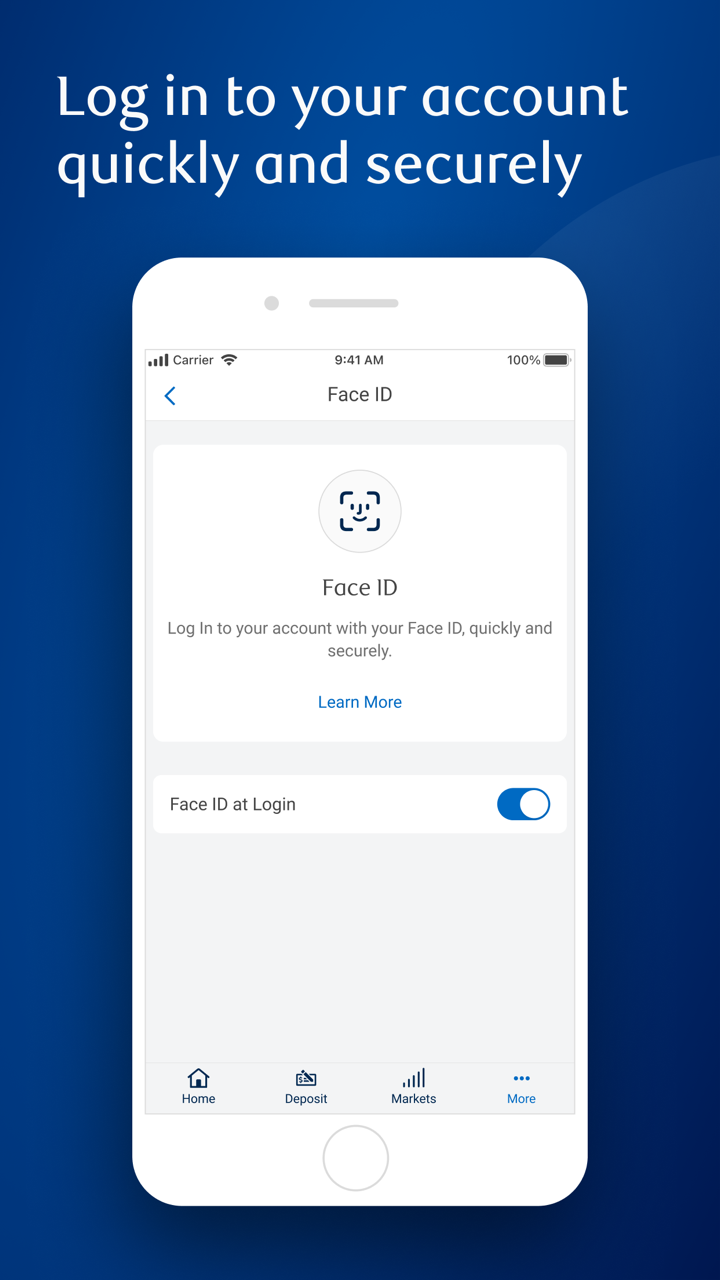

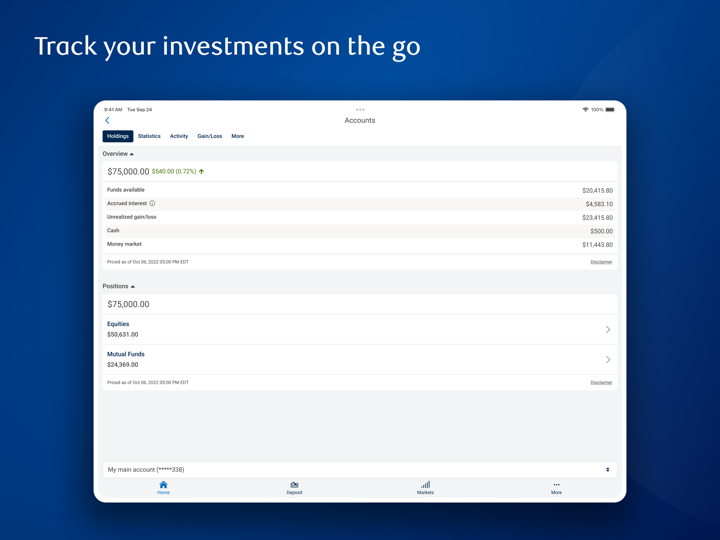

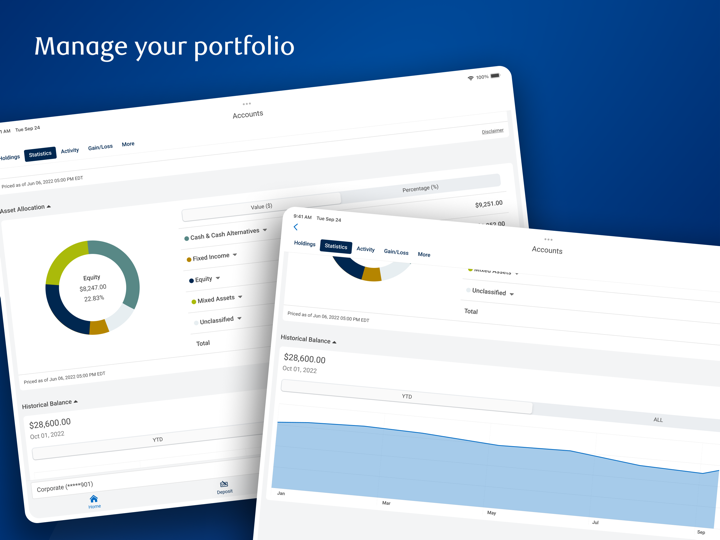

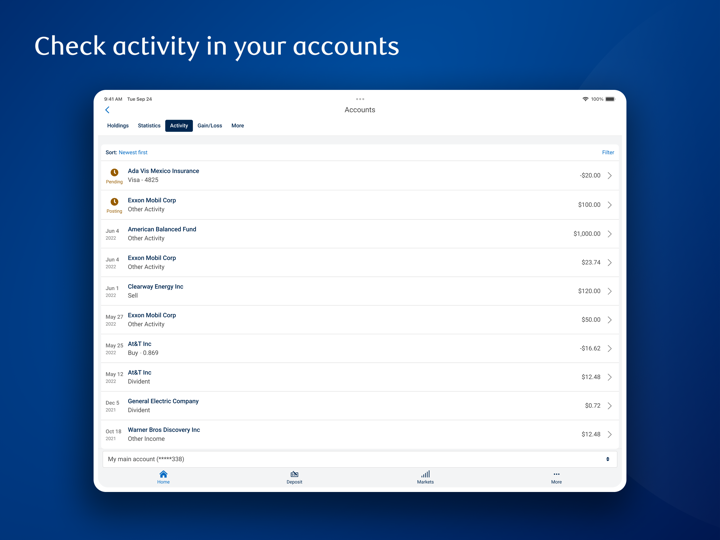

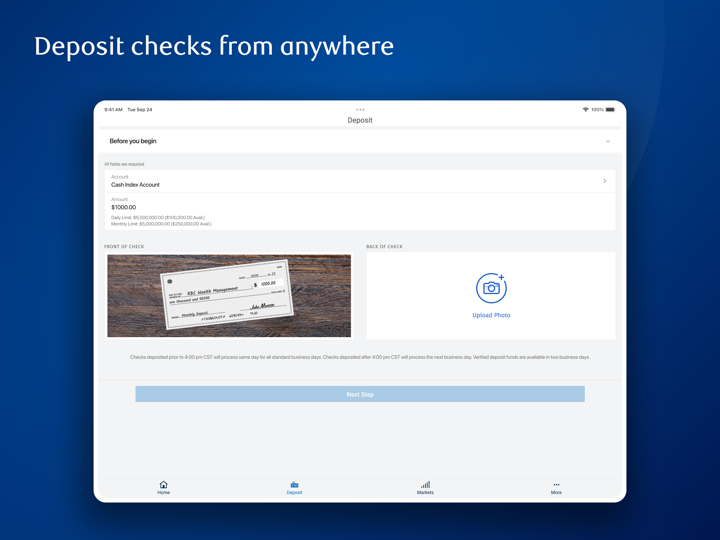

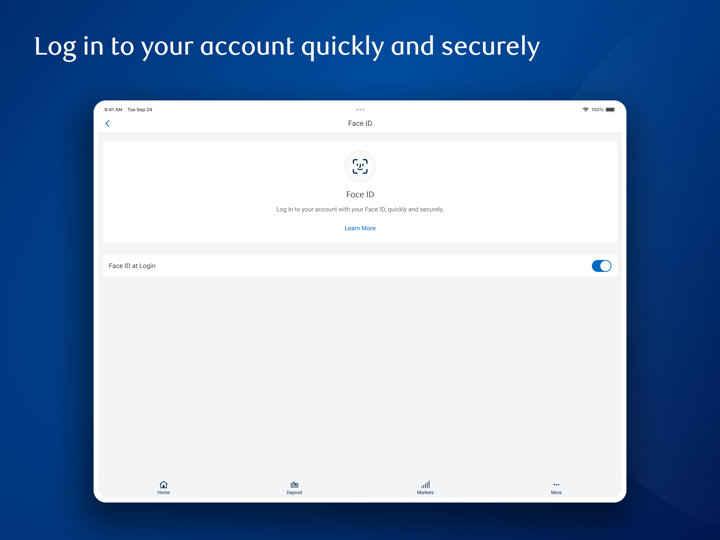

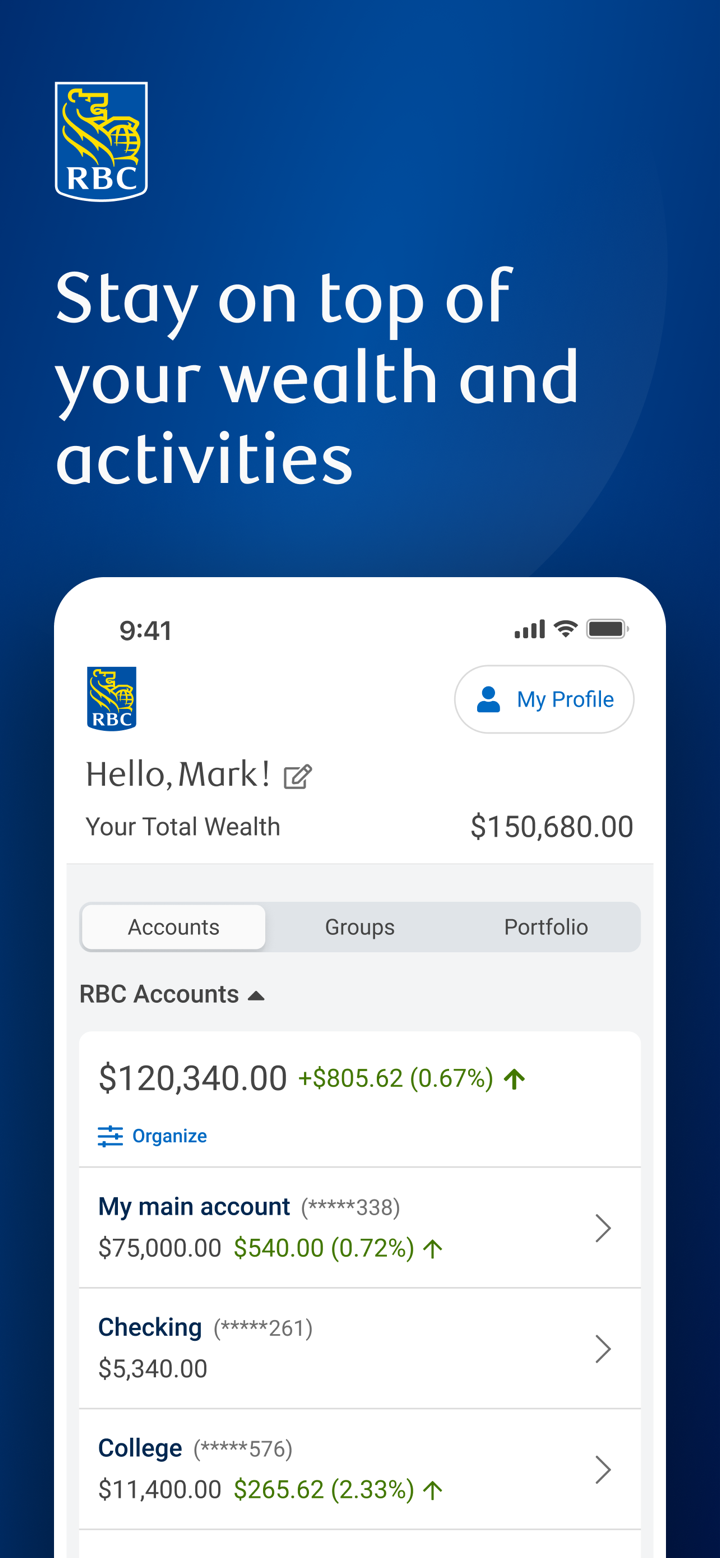

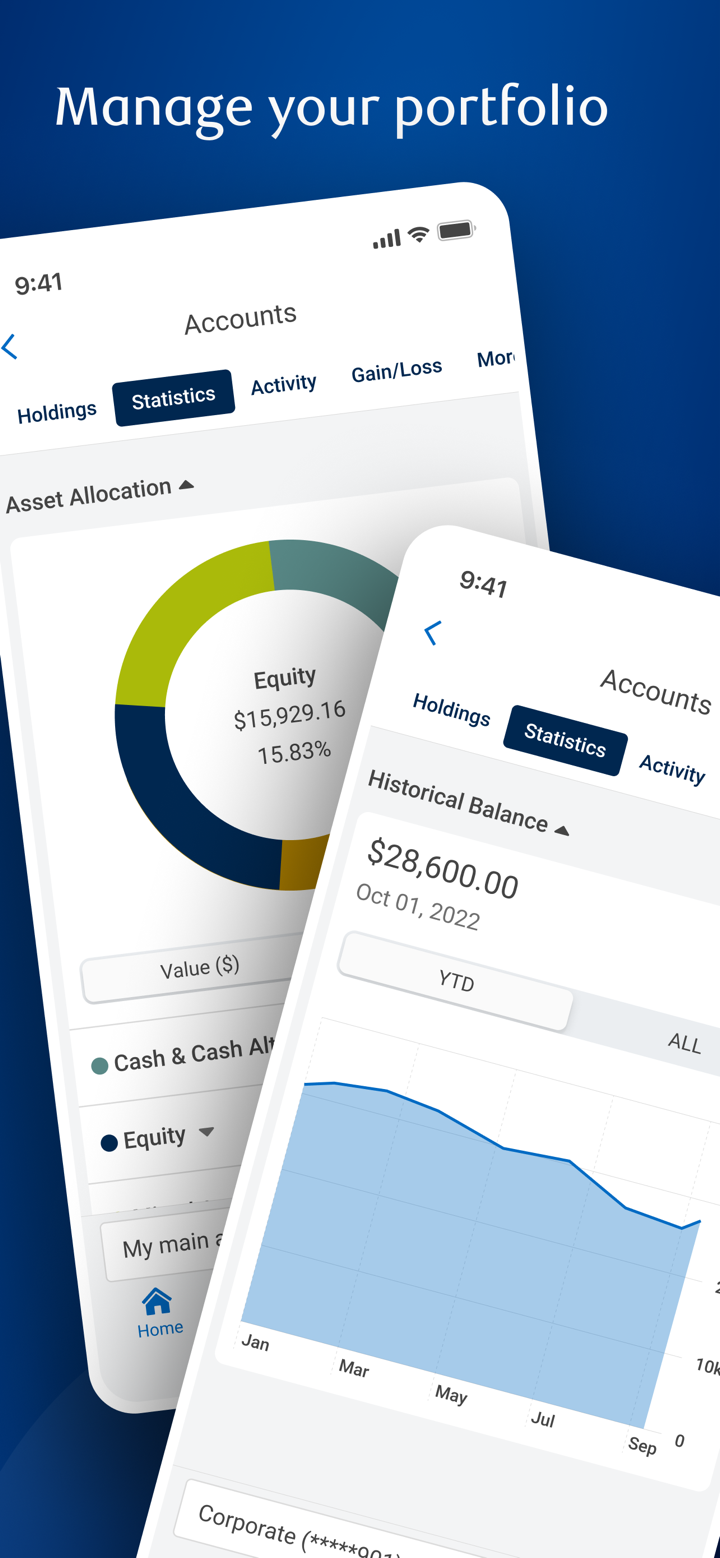

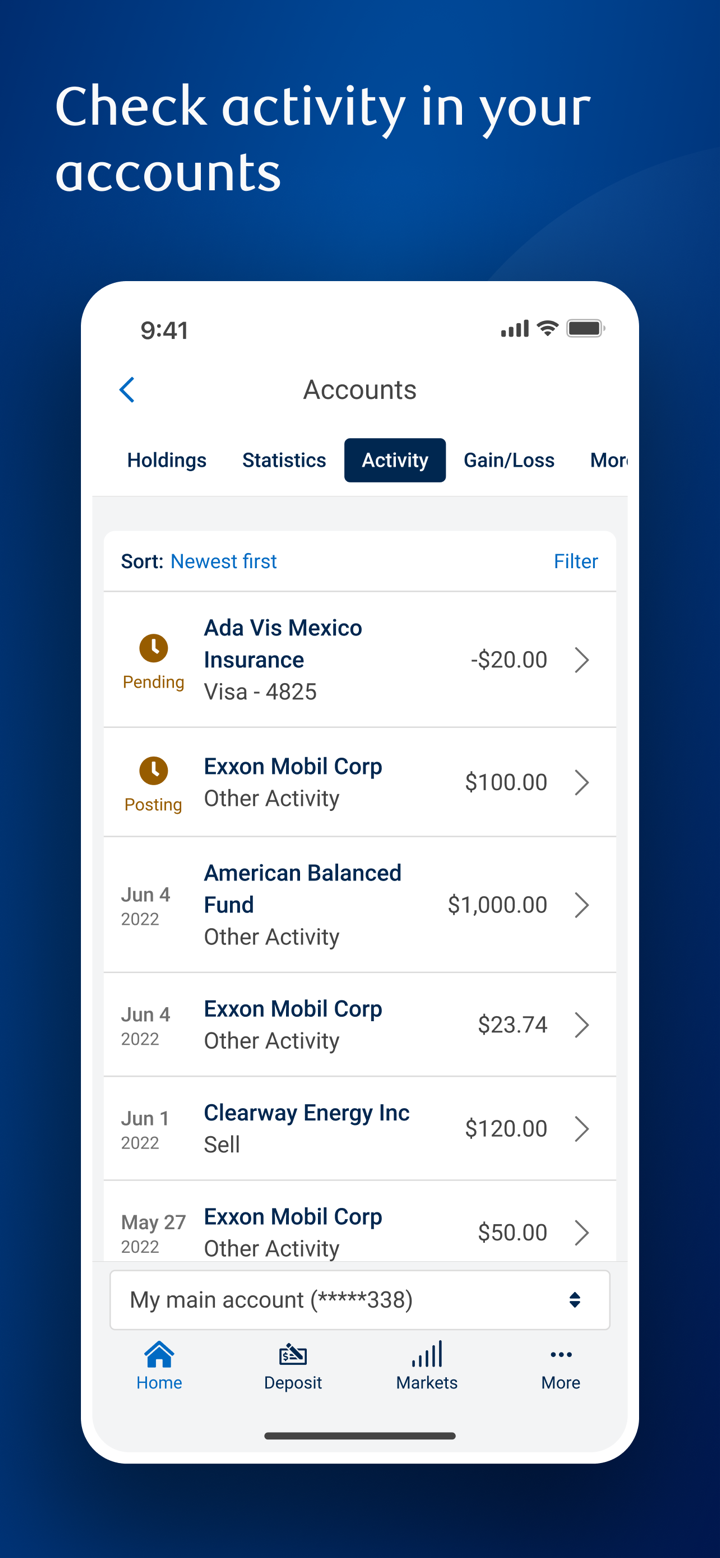

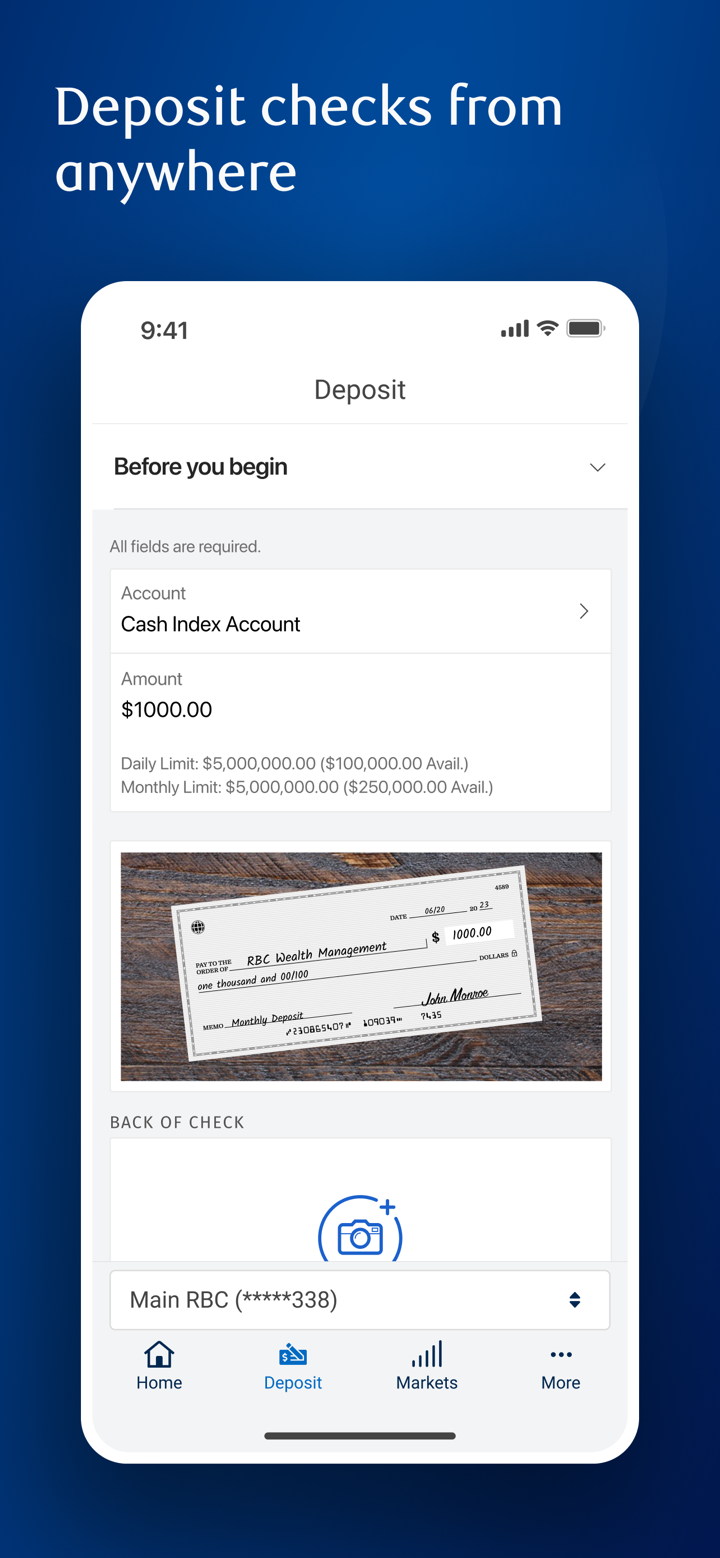

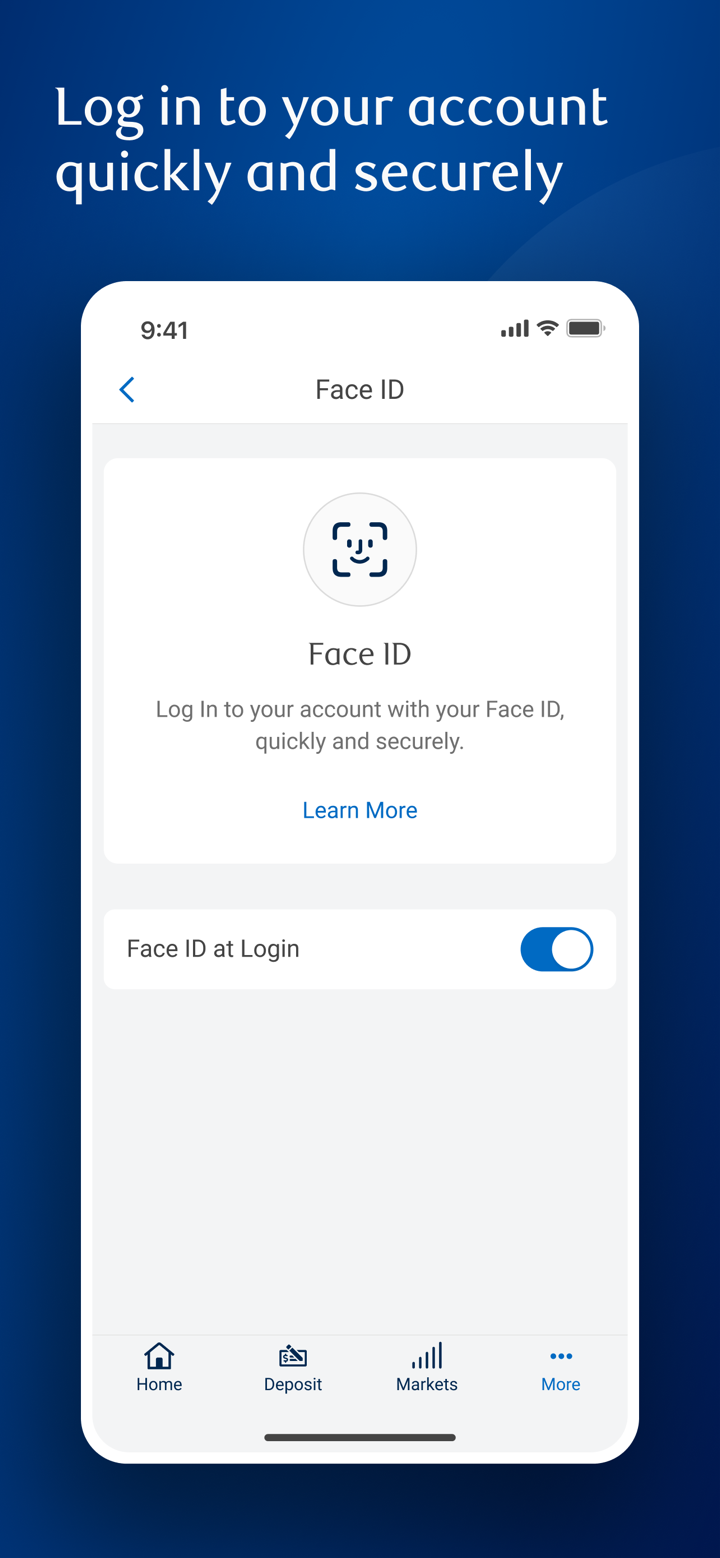

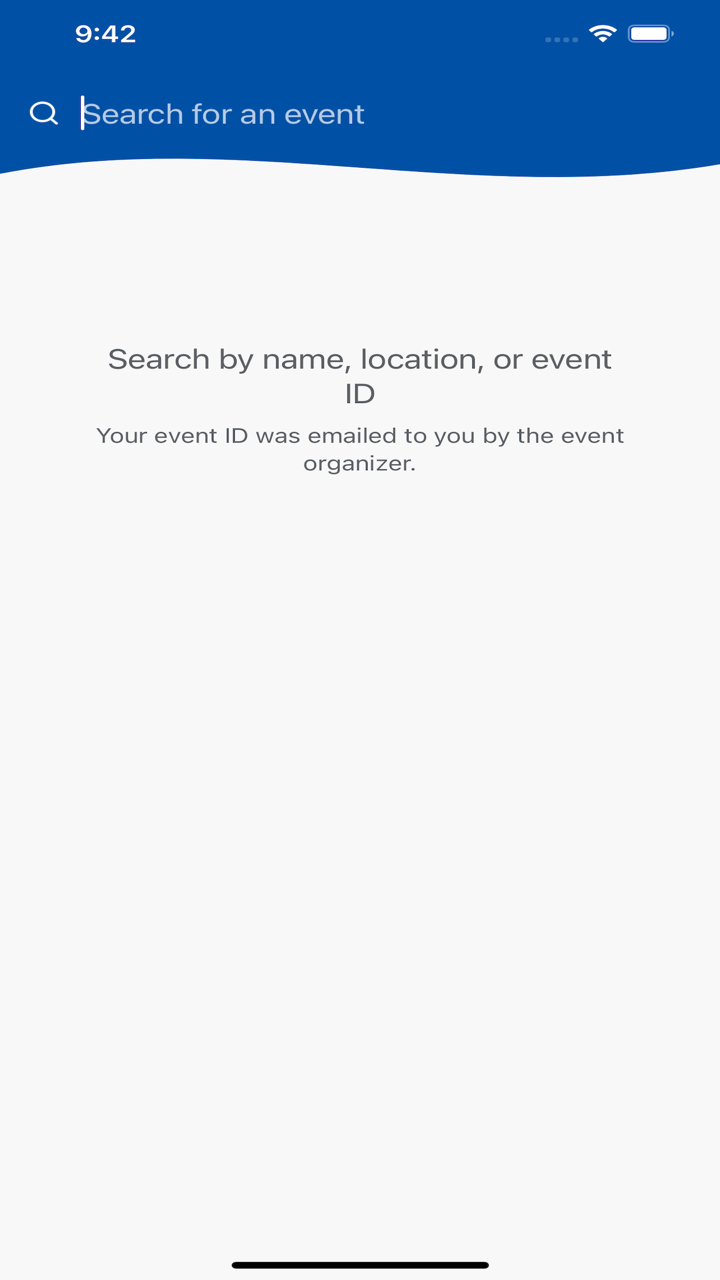

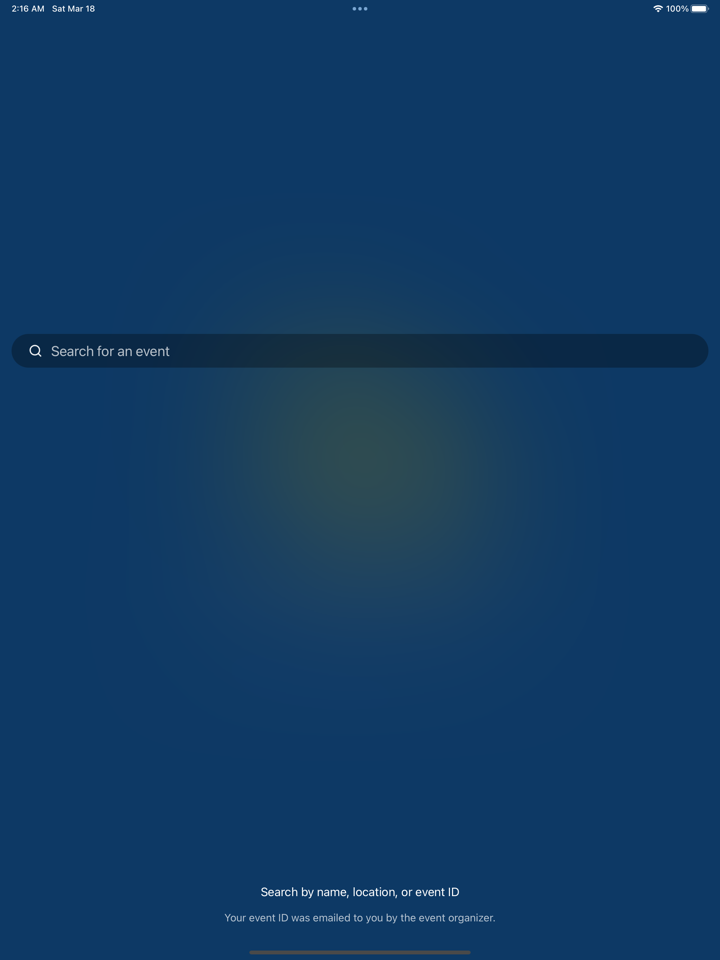

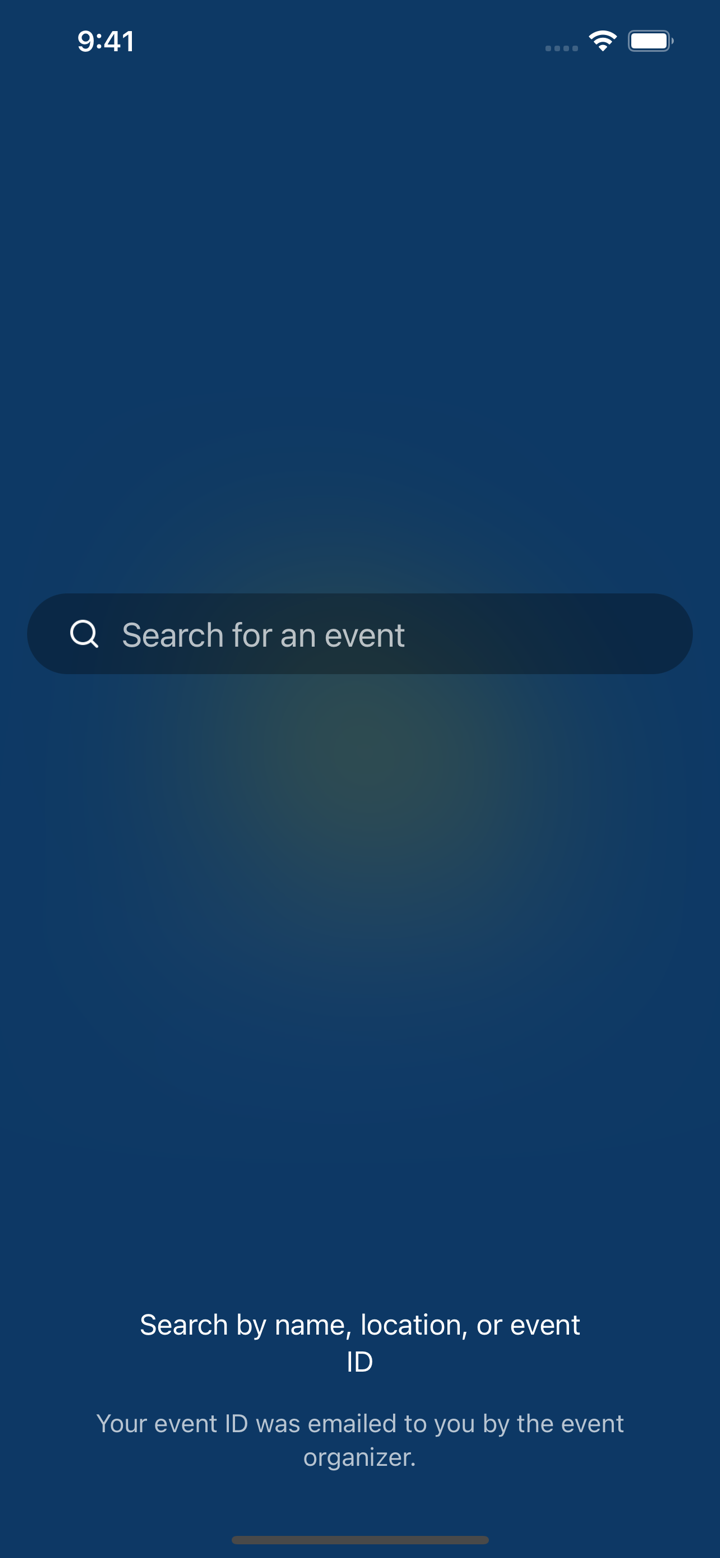

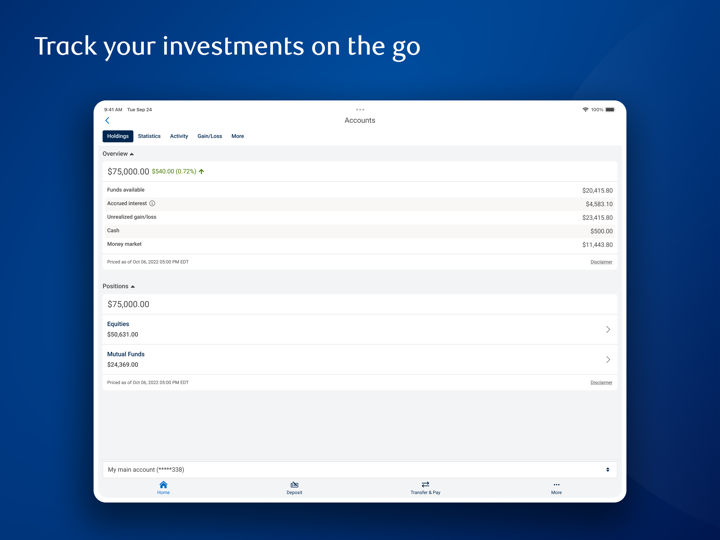

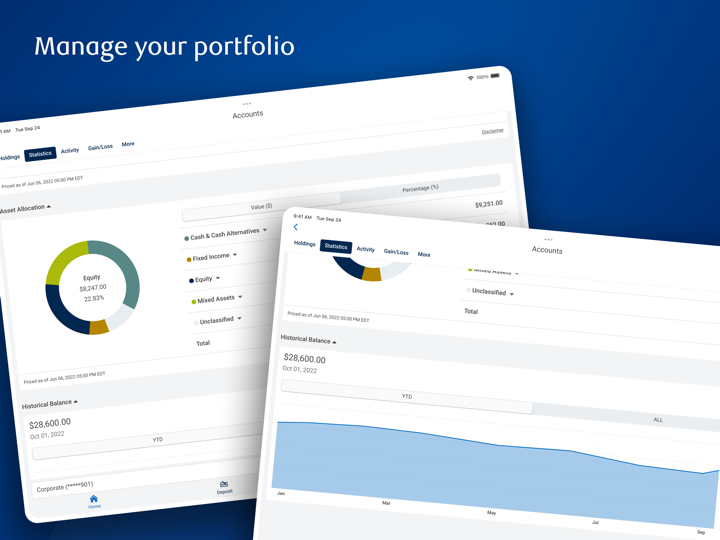

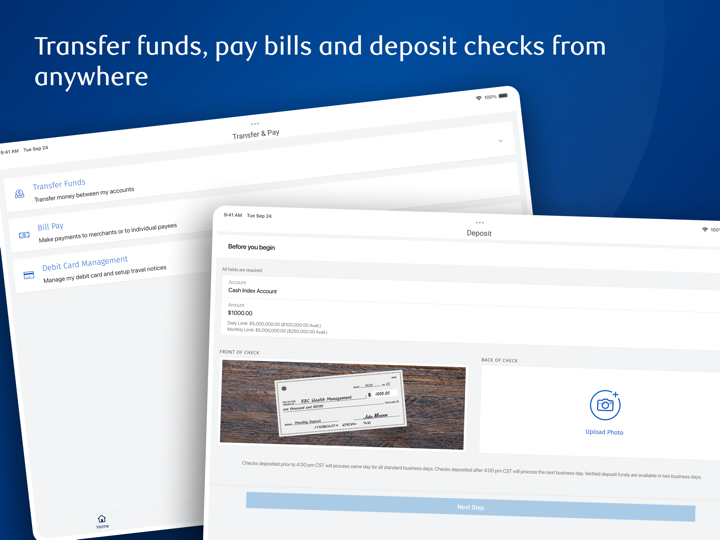

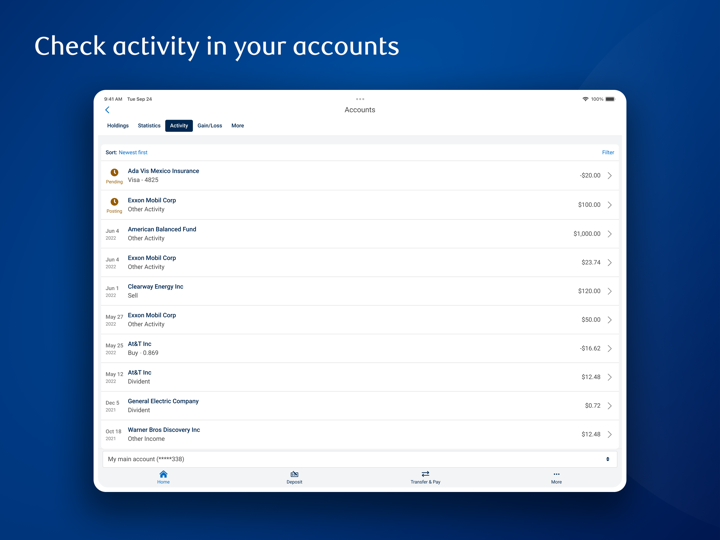

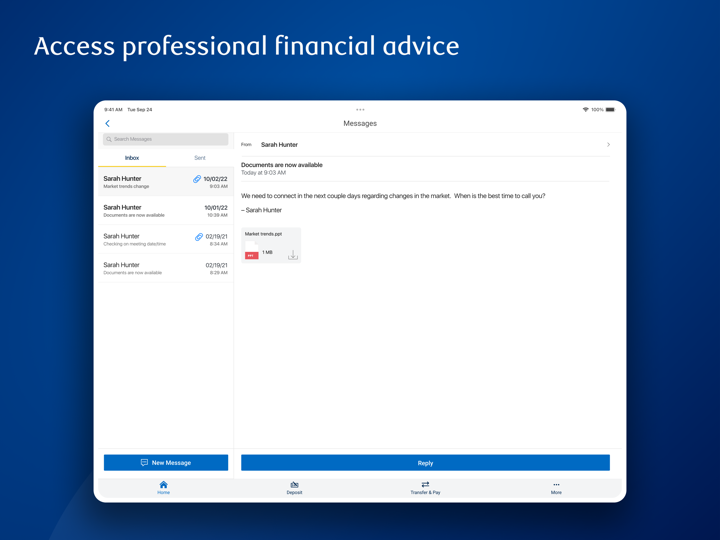

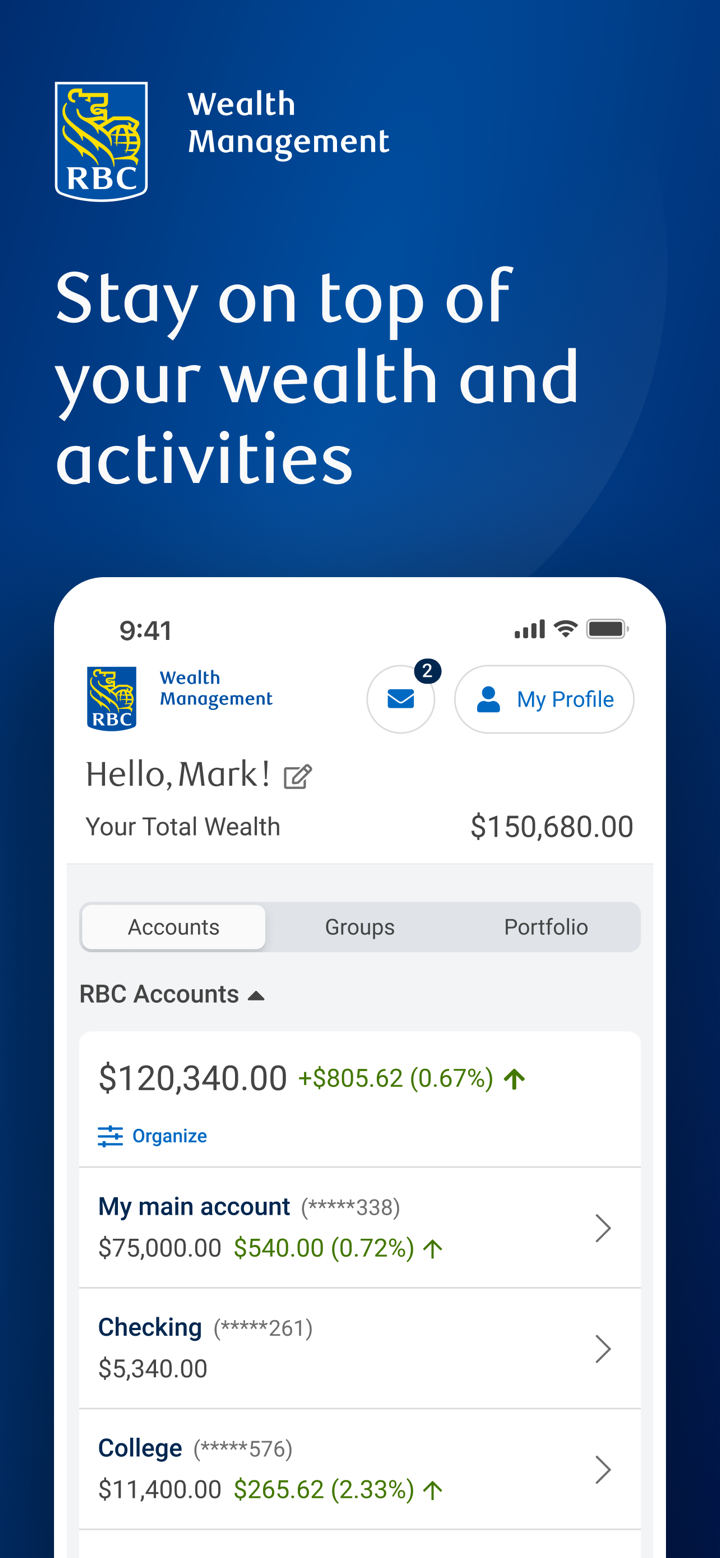

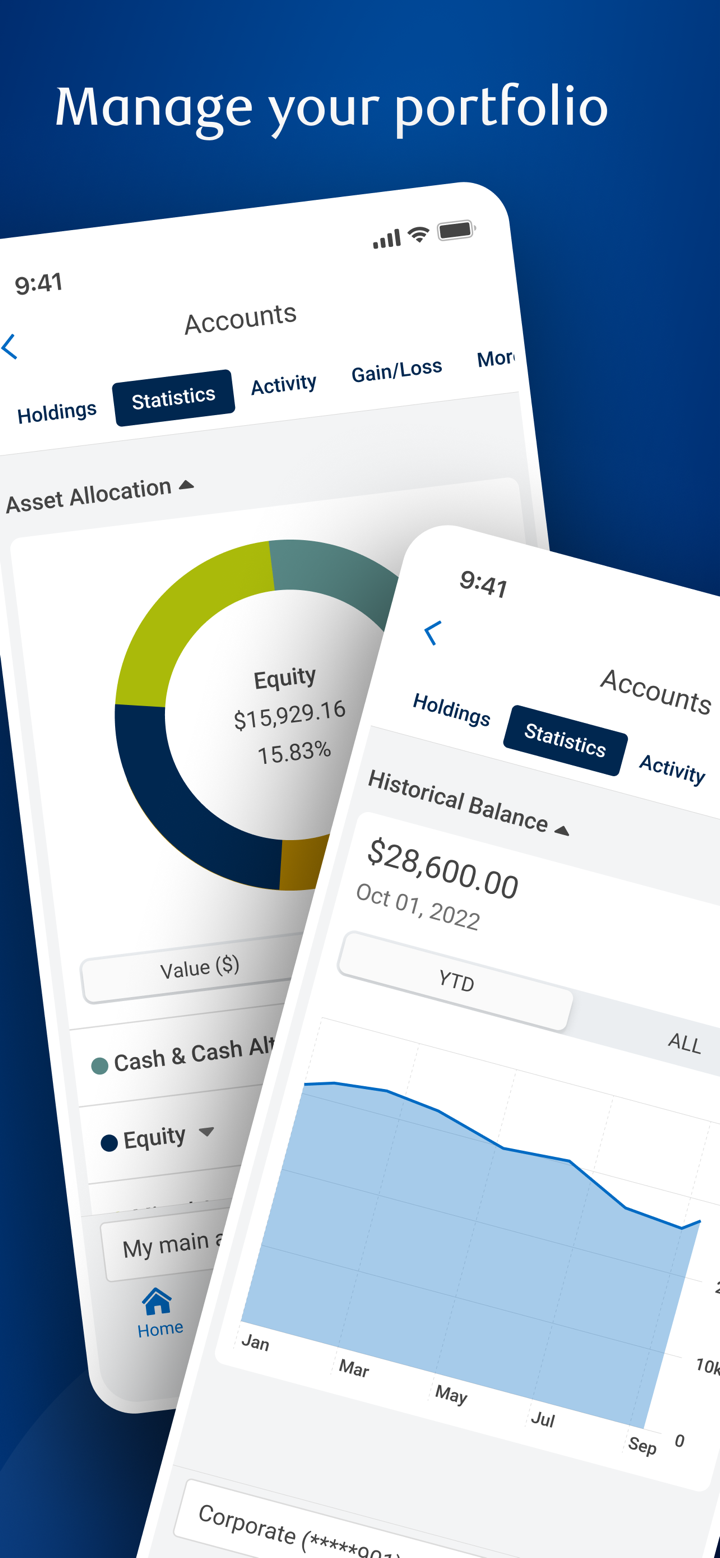

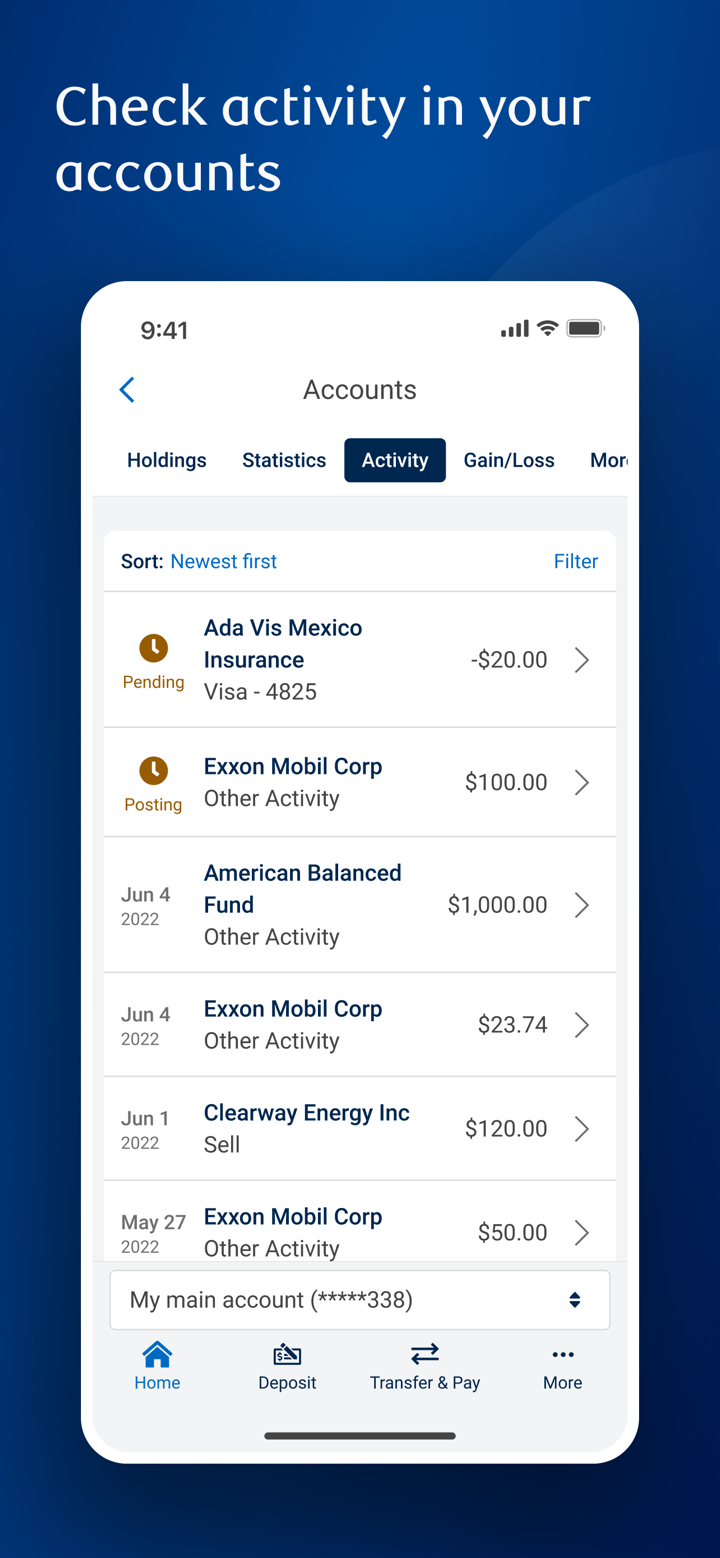

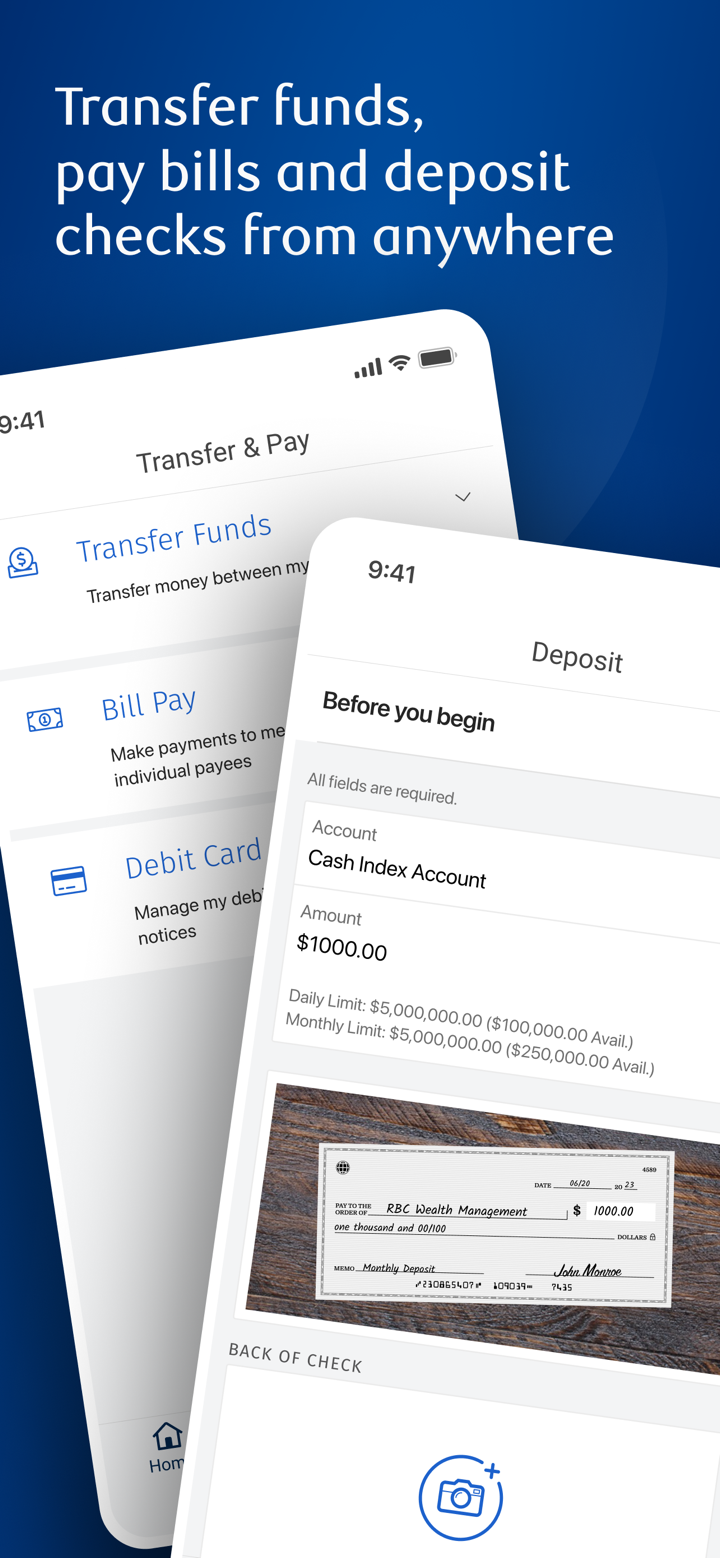

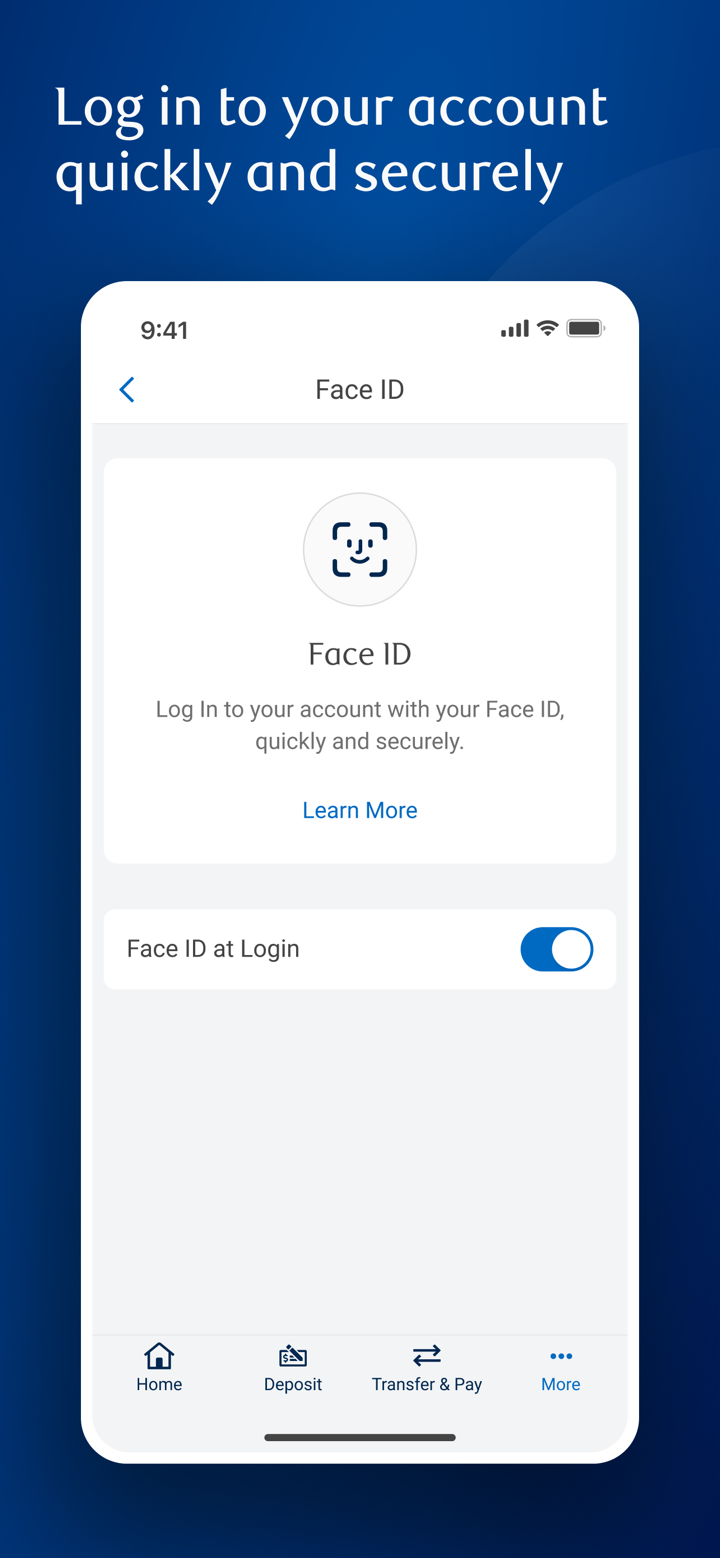

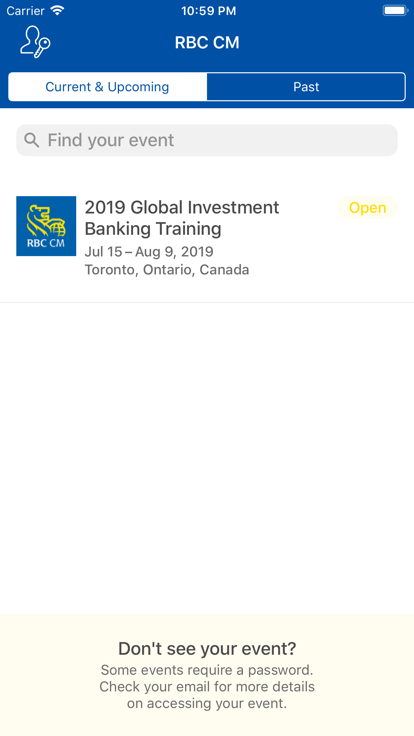

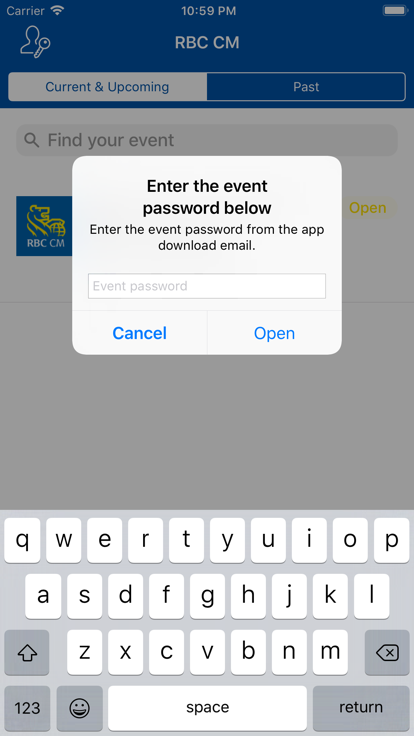

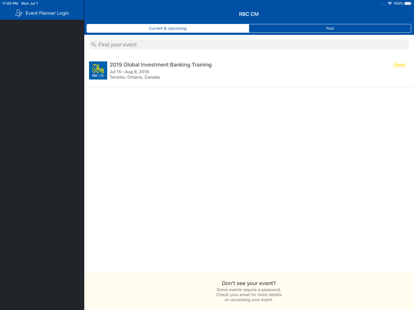

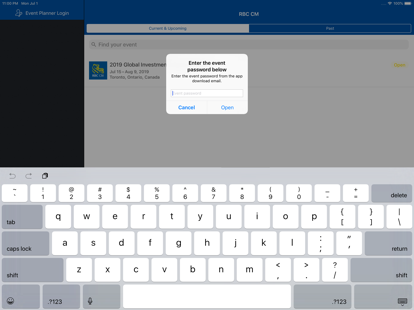

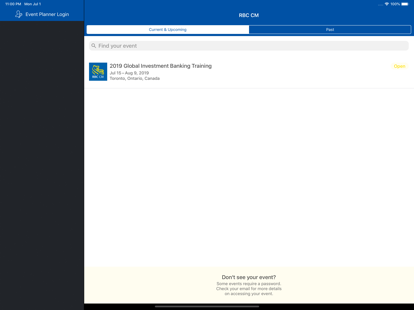

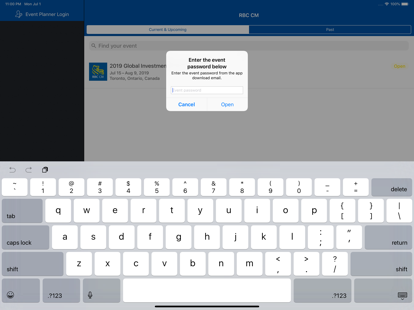

منصة التداول

| منصة التداول | مدعوم | الأجهزة المتاحة | مناسبة لـ |

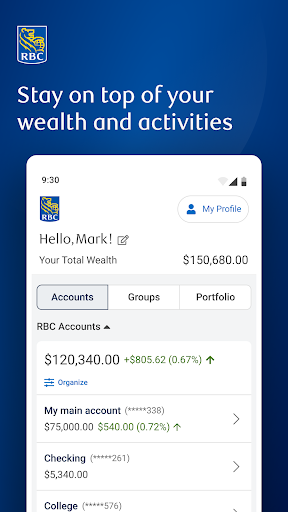

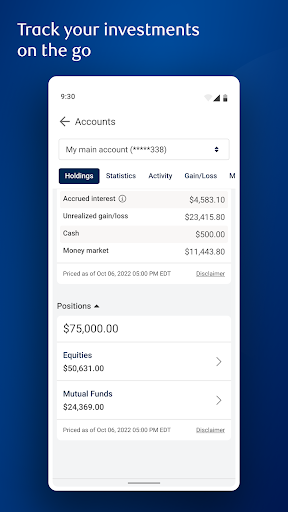

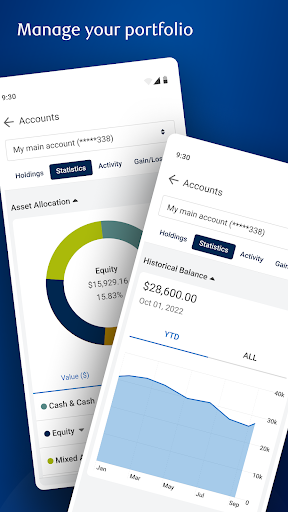

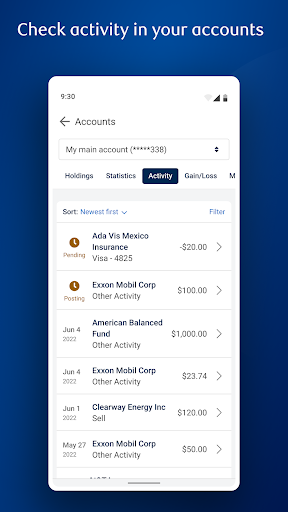

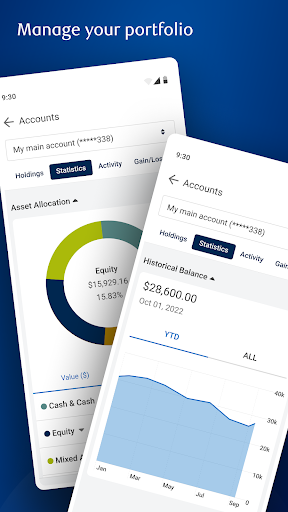

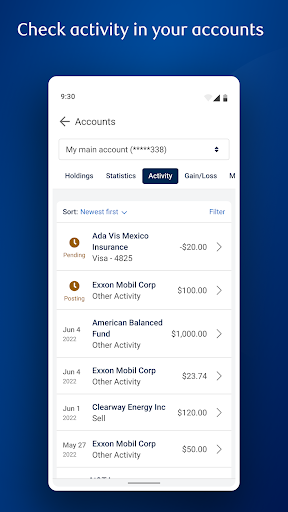

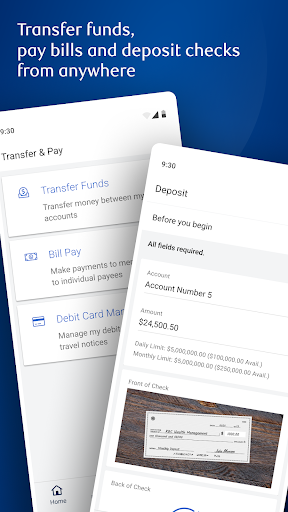

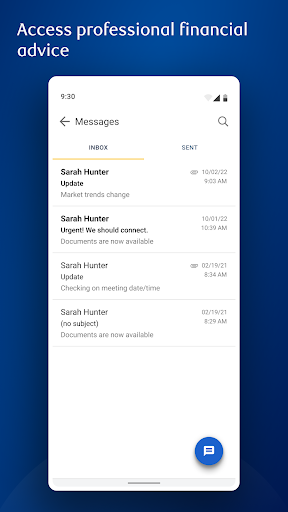

| تطبيق الجوال | ✔ | الجوال | / |

| MT4 | ❌ | / | المبتدئين |

| MT5 | ❌ | / | المتداولين المحترفين |