Riepilogo dell'azienda

Informazioni generali e regolamento

Fortune Wealth Management, nome commerciale di Fortune Wealth Management Company India (P) Limited , è presumibilmente una società di intermediazione azionaria non regolamentata costituita nel 2003 e registrata in India, che pubblicizza per fornire ai propri clienti un'ampia selezione di mercati, prodotti e servizi sulle piattaforme di trading di applicazioni mobili e basate sul Web.

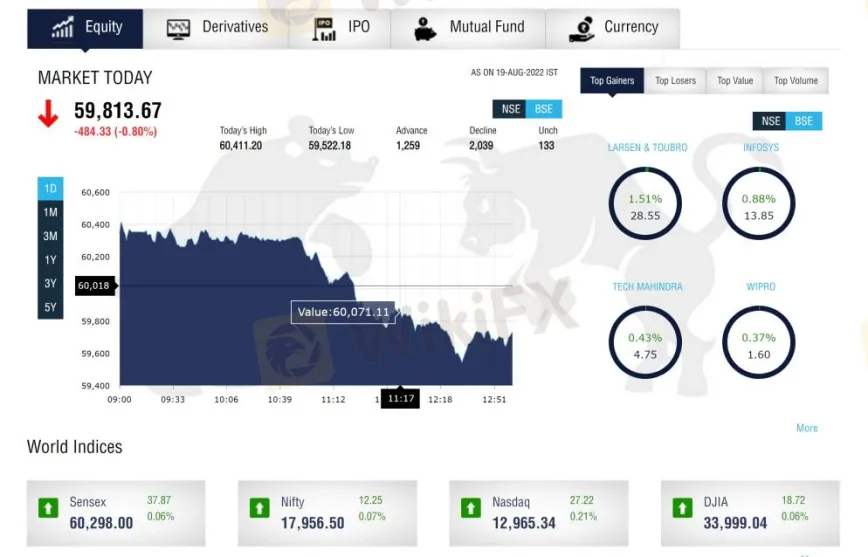

MercatoS

Fortune Wealth Managementpubblicizza di essere specializzato nel mercato azionario, inclusi titoli azionari, derivati, ipo, fondi comuni di investimento e valute.

Prodotti

Fortune Wealth Managementafferma inoltre di fornire una gamma diversificata di prodotti, tra cui lo schema di investimento del portafoglio, i servizi di gestione del portafoglio, gli investimenti sugli indici, i fondi comuni di investimento e la gestione dei fondi in eccedenza giornaliera.

Servizi

servizi disponibili a Fortune Wealth Management consistono in intermediazione di azioni, derivati e materie prime, finanziamento a margine, servizi di deposito, pagamenti a pronti, trading online, derivati su valute e formazione degli investitori.

Conti

COME Fortune Wealth Management Come mostra il sito, il broker offre ai trader una scelta di demat e conto di trading, tuttavia, non dice nulla sul requisito minimo di capitale iniziale.

Piattaforma di trading disponibile

Fortune Wealth Managementdice di offrire il trading online attraverso ora (piattaforma di trading web nses), l'app mobile di nse e i terminali odin. in questo modo, i trader possono fare trading comodamente da casa o in viaggio.

Servizio Clienti

Fortune Wealth ManagementL'assistenza clienti è raggiungibile telefonicamente: 0422-4334333, fax: 0422-4334331, e-mail: info@fortunewmc.com. puoi anche seguire questo broker su piattaforme di social media come facebook e linkedin. sede centrale: 1056, avanashi road, opp the nilgiris, coimbatore 641018, tamilnadu, india.