Riepilogo dell'azienda

Informazioni generali e regolamento

ADCB, nome commerciale di ADCB Securities , sarebbe una società finanziaria registrata negli emirati arabi uniti e regolamentata dalla sca (securities and commodities authority), dall'adx (abu dhabi securities exchange) e dal dfm (dubai financial market). il broker afferma di fornire ai clienti sia individuali che istituzionali un'ampia selezione di prodotti e servizi su piattaforme di trading basate sul web e su dispositivi mobili.

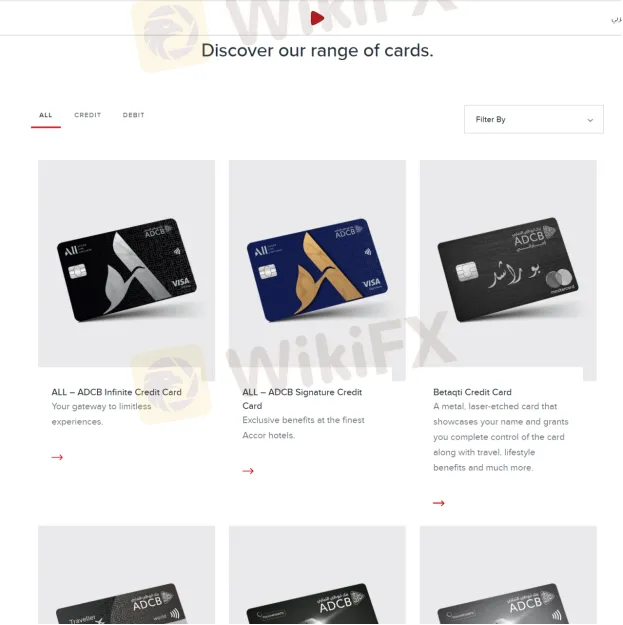

Prodotti

ADCBpubblicizza l'offerta di un'ampia varietà di prodotti, tra cui carte di credito/debito, prestiti e gestione patrimoniale come investimenti, assicurazioni, gestione patrimoniale, servizi di intermediazione e mercati dei capitali.

Tipi di conto

in generale, ci sono principalmente due diversi conti di intermediazione offerti da ADCB , vale a dire conto di intermediazione individuale e conto di intermediazione istituzionale. in particolare sono disponibili conto corrente & risparmio, conto etihad guest, conto deposito fisso e altro ancora.

Piattaforma di trading disponibile

piattaforme disponibili per il trading a ADCB sono la piattaforma di trading basata sul web e ADCB Securities app. il broker afferma che l'app mobile può consentire ai trader di fare trading in movimento e controllare gli ultimi prezzi delle azioni, nonché gestire i propri portafogli. può essere scaricato nell'App Store di Apple o nel Play Store di Google.

Bonus

ADCBafferma sulla sua home page che quando i trader si registrano per una carta di credito Visa touchpoint, possono guadagnare fino a 250.000 touchpoint. tuttavia, non può essere sicuro che questi bonus possano essere ritirati senza alcuna condizione.

Servizio Clienti

ADCBL'assistenza clienti di s può essere contattata dal lunedì al venerdì, dalle 08:00 alle 15:00 per telefono: negli Emirati Arabi Uniti 600 50 3325, fuori dagli Emirati Arabi Uniti +97126211608 o inviare messaggi online per mettersi in contatto. indirizzo dell'azienda: sheikh zayed bin sultan street, accanto alla società di distribuzione adnoc - abu dhabi.