Riepilogo dell'azienda

Informazioni generali e regolamento

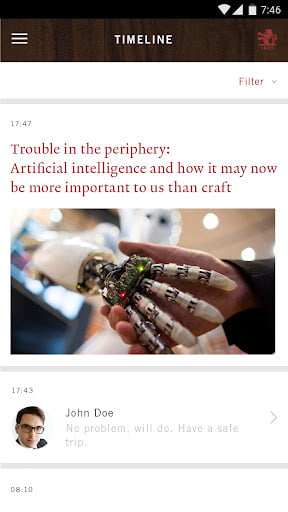

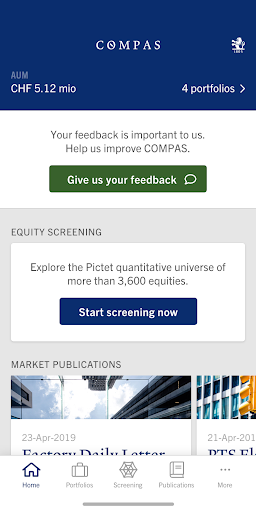

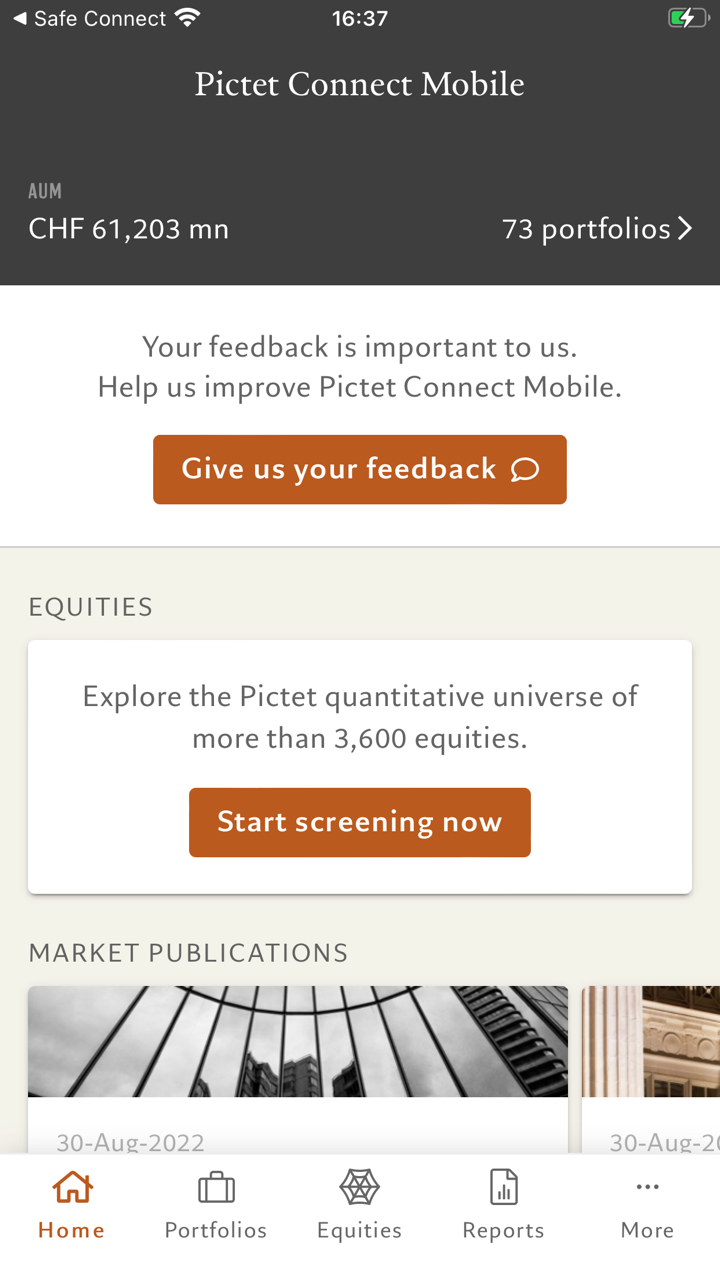

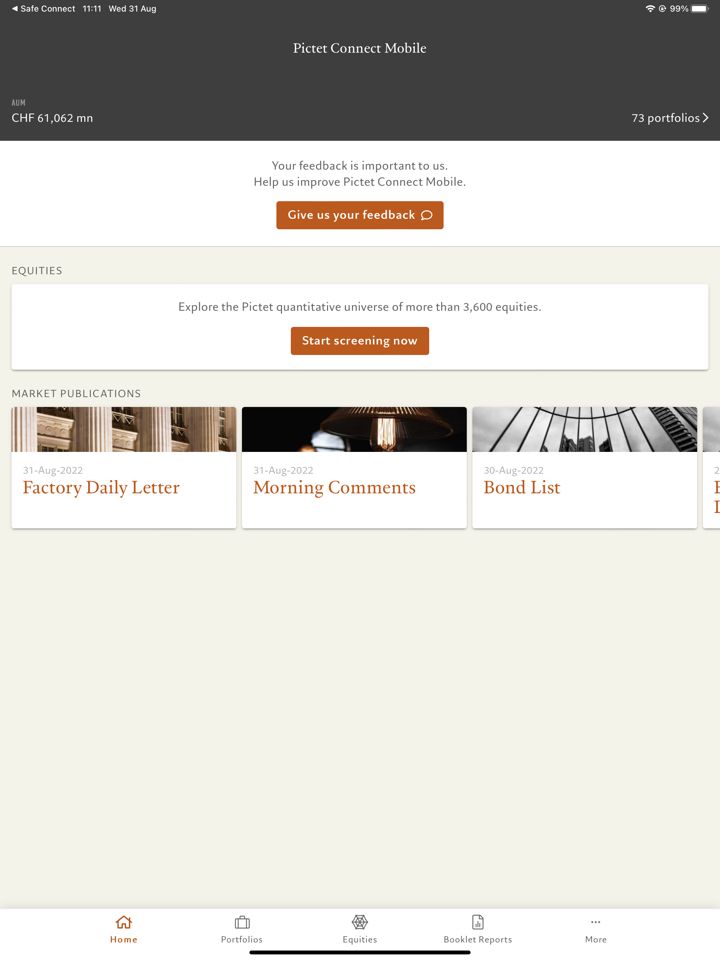

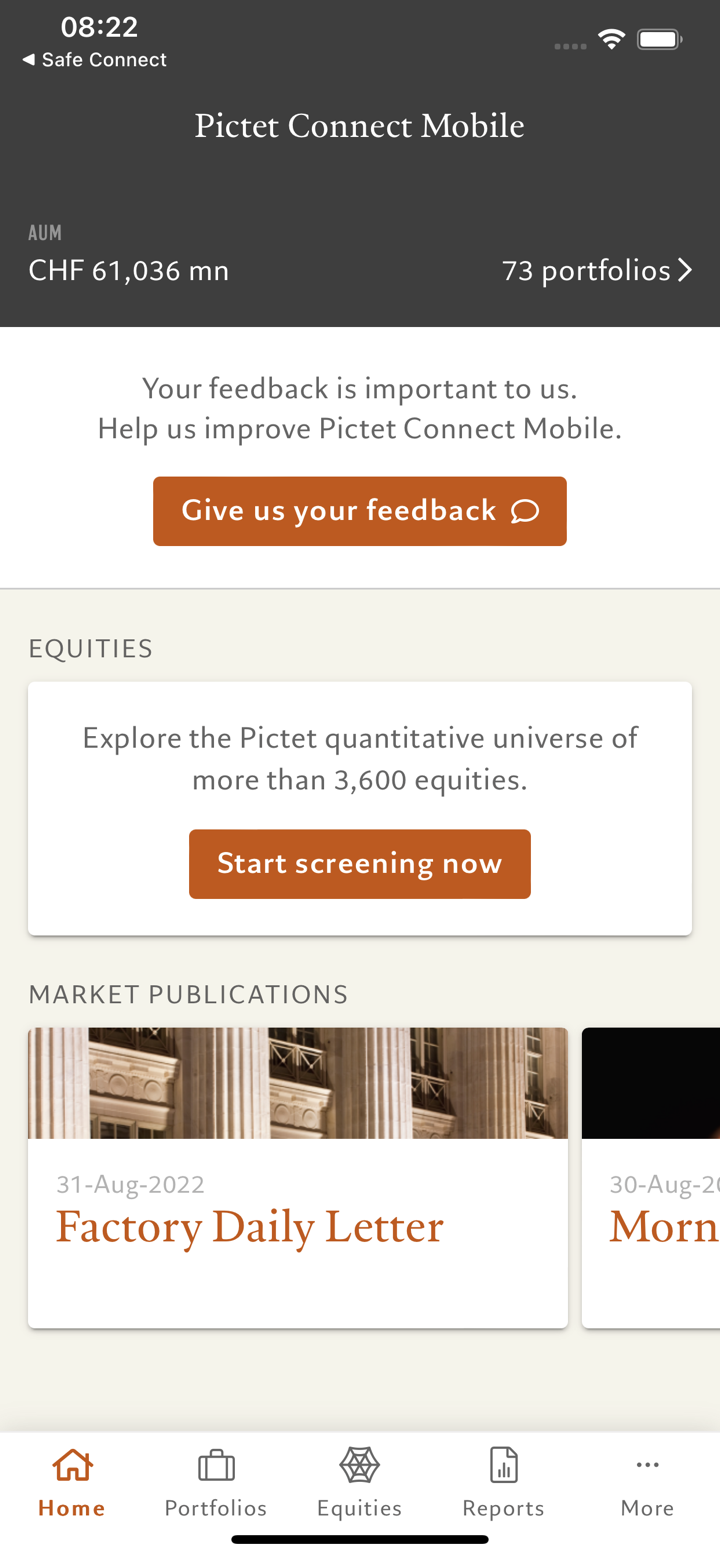

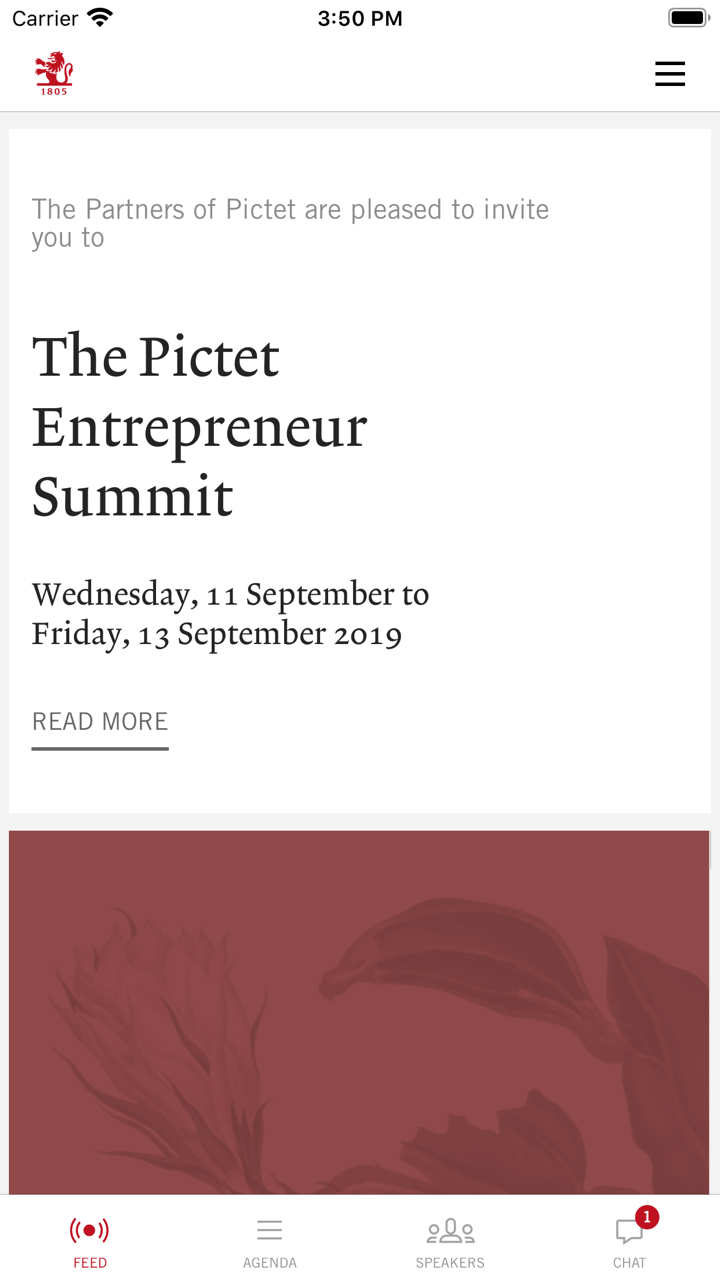

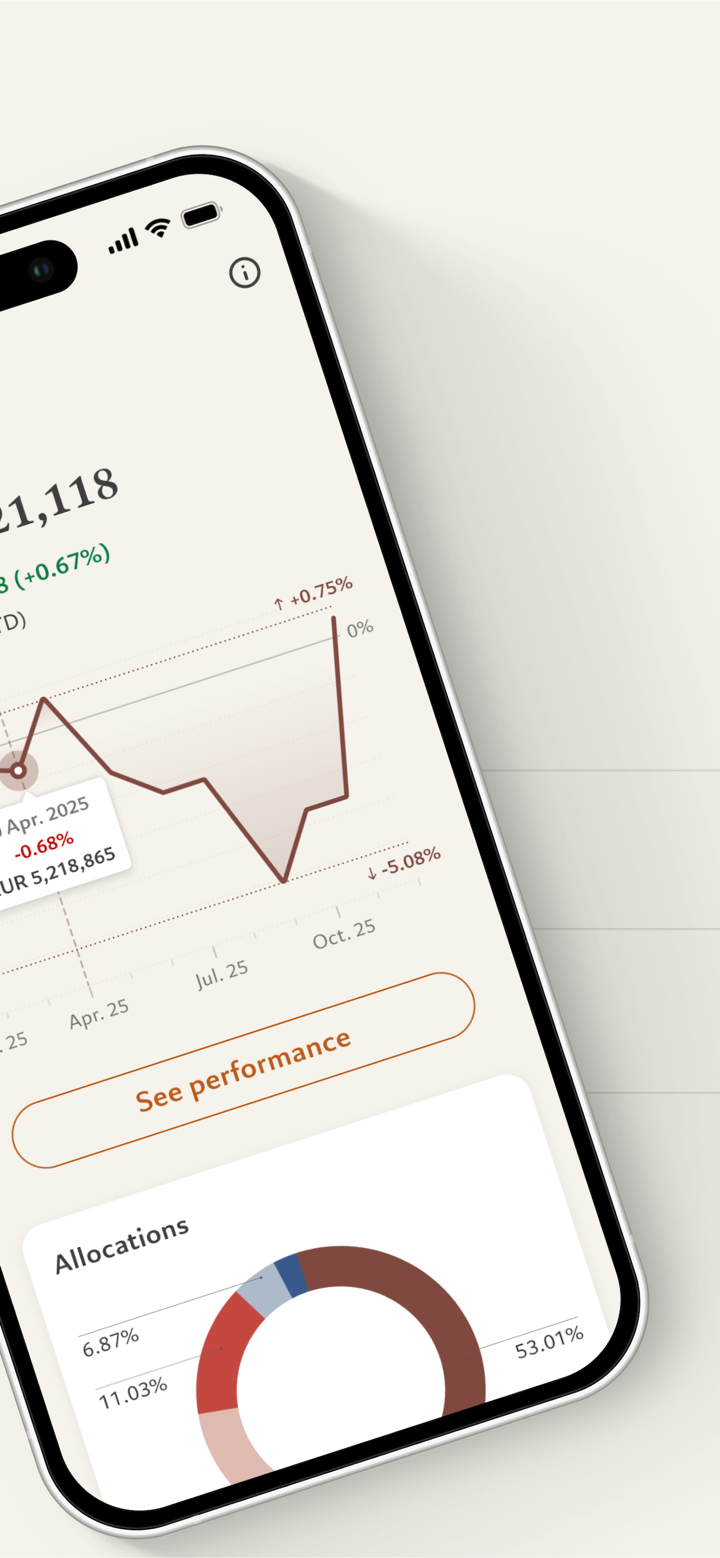

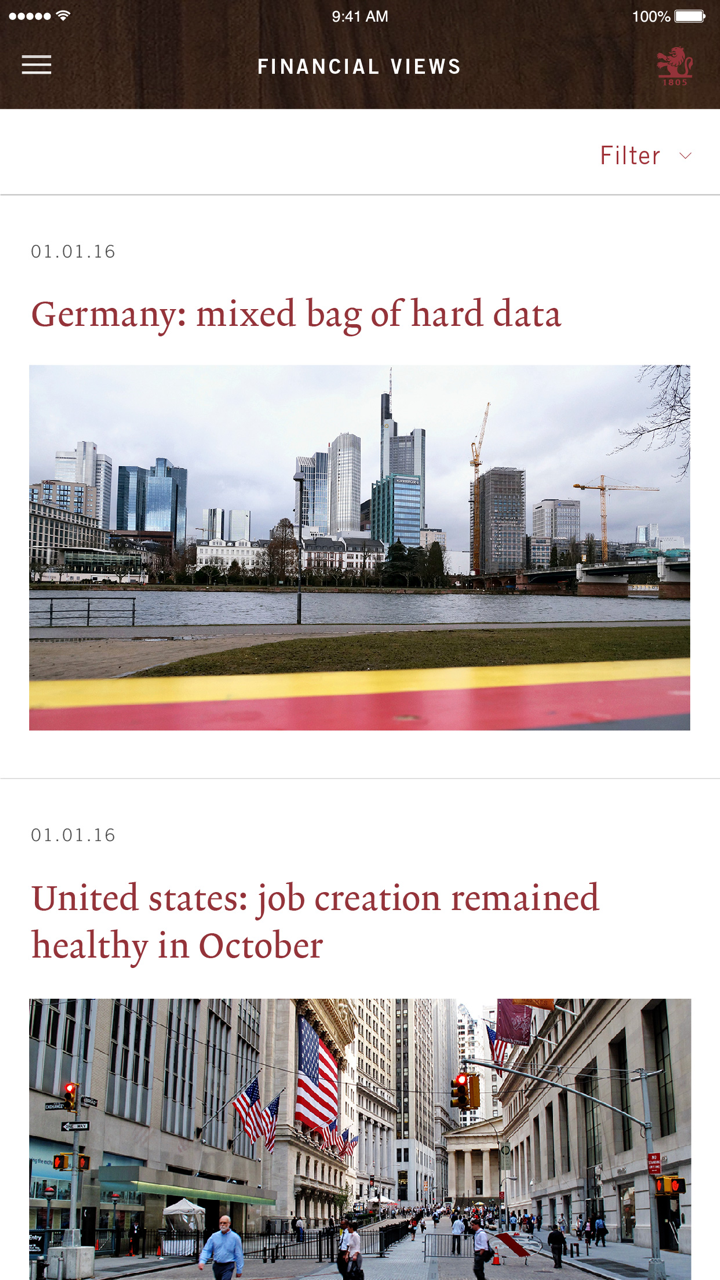

IL Pictet Group è una società di servizi orientata agli investimenti, che offre gestione patrimoniale, gestione patrimoniale e servizi correlati. non si occupa di investment banking, né concede prestiti commerciali. Pictet asset management (hong kong) limited (aag715) è un gestore patrimoniale indipendente autorizzato dalla commissione per i titoli e i futures di hong kong (sfc).

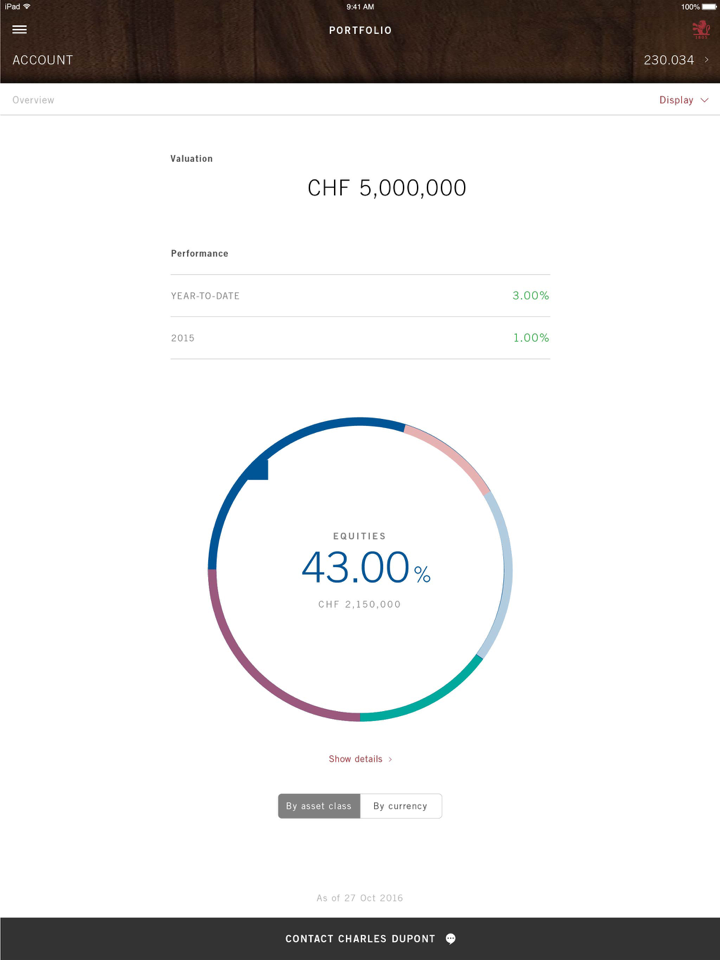

Servizi

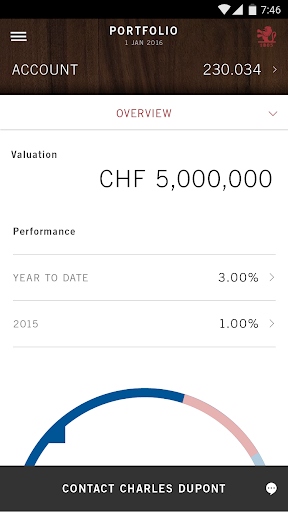

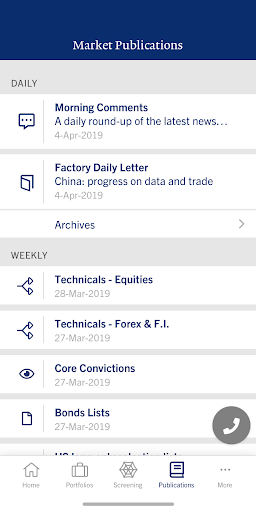

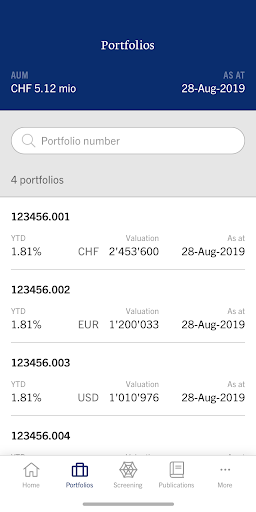

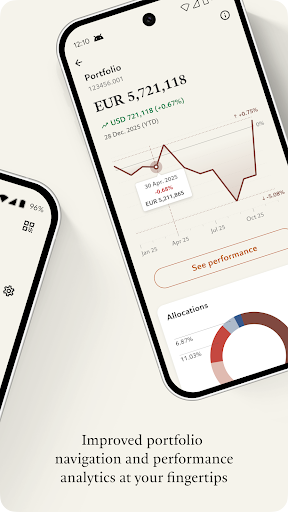

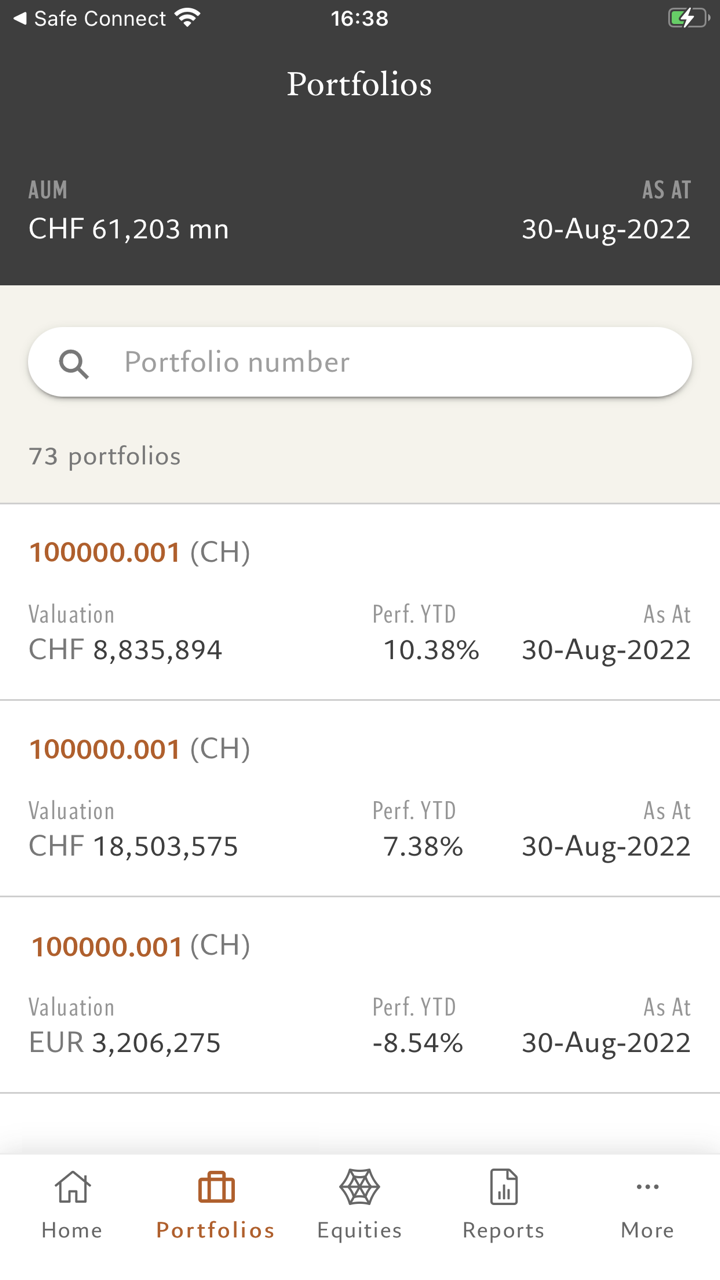

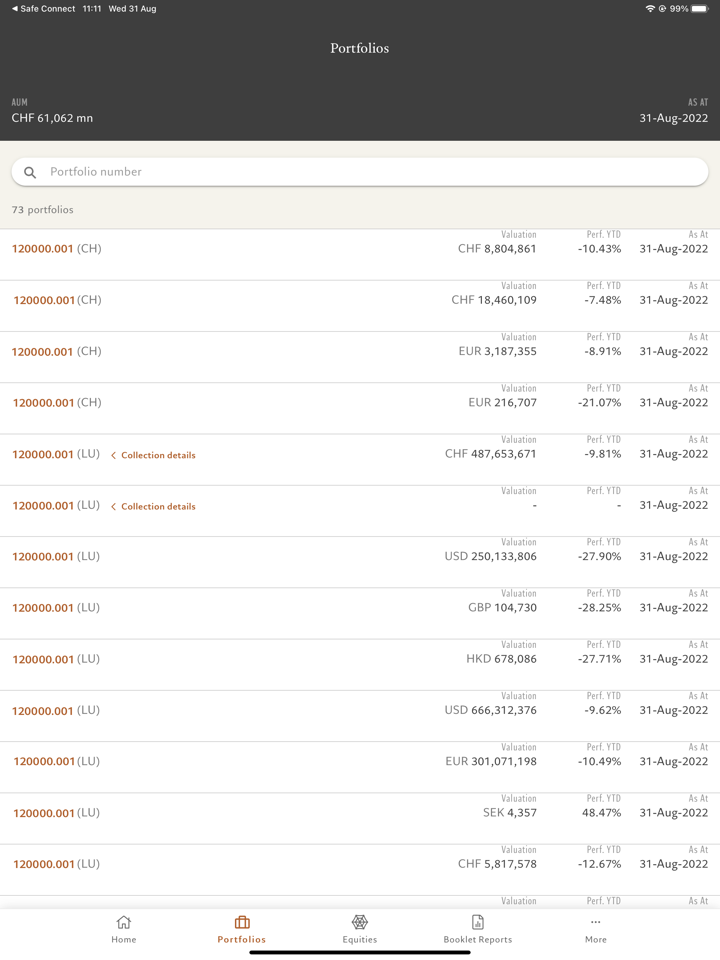

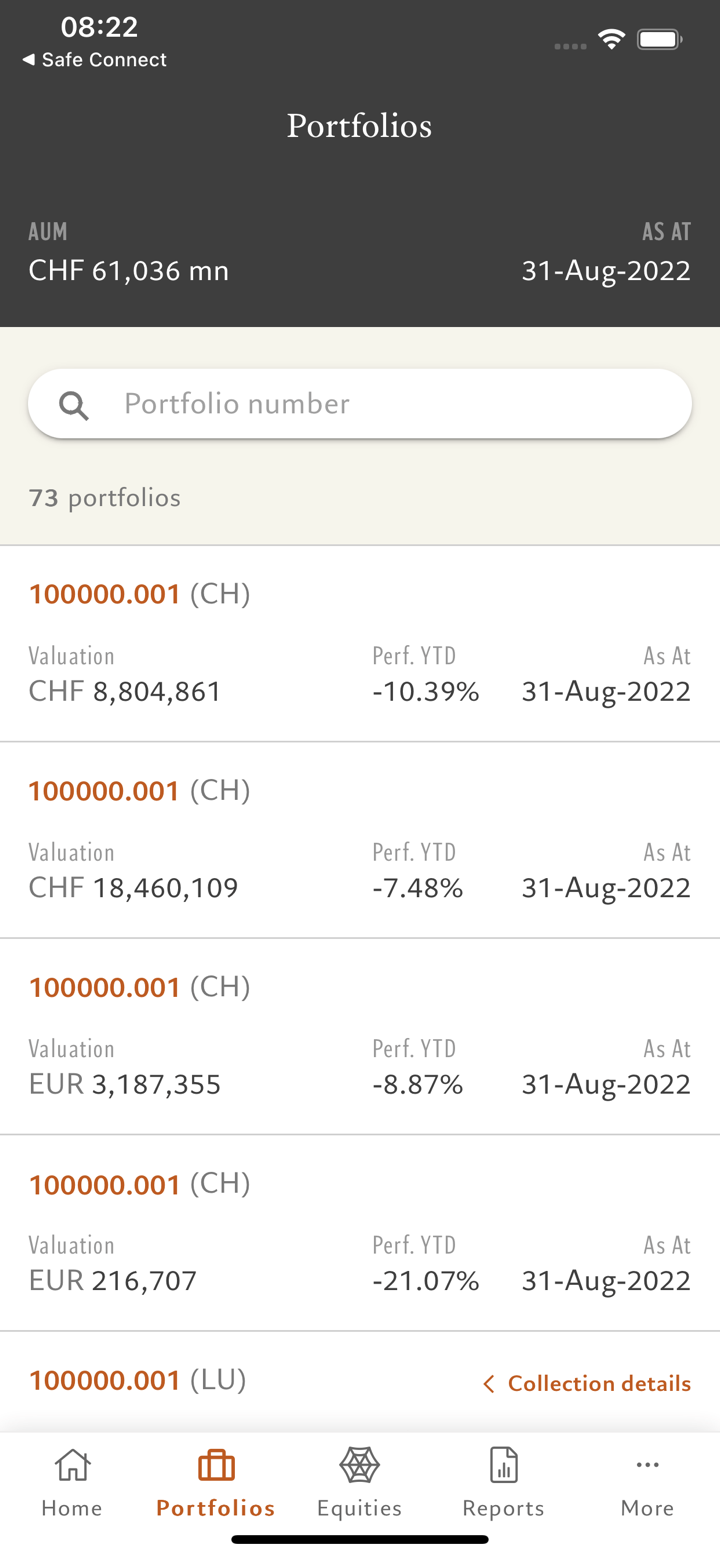

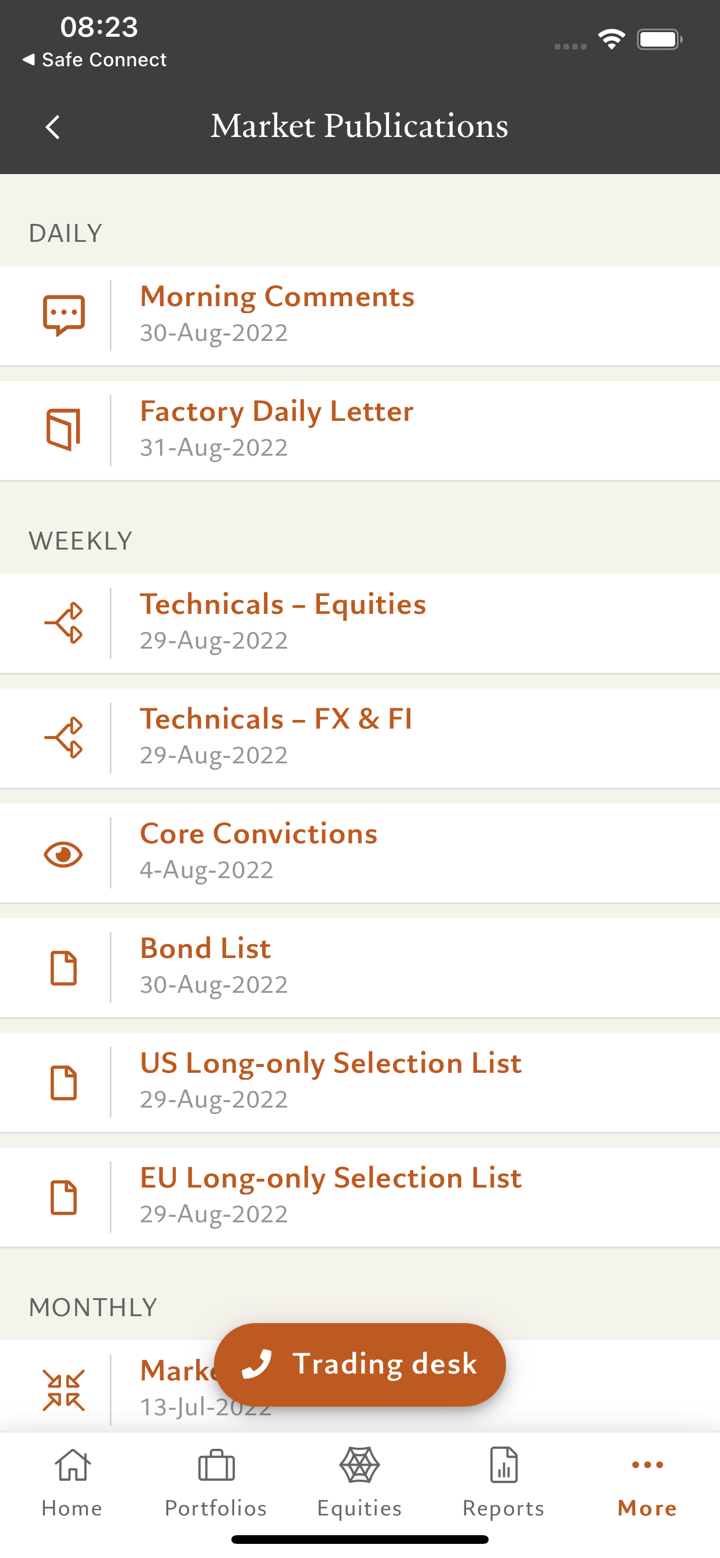

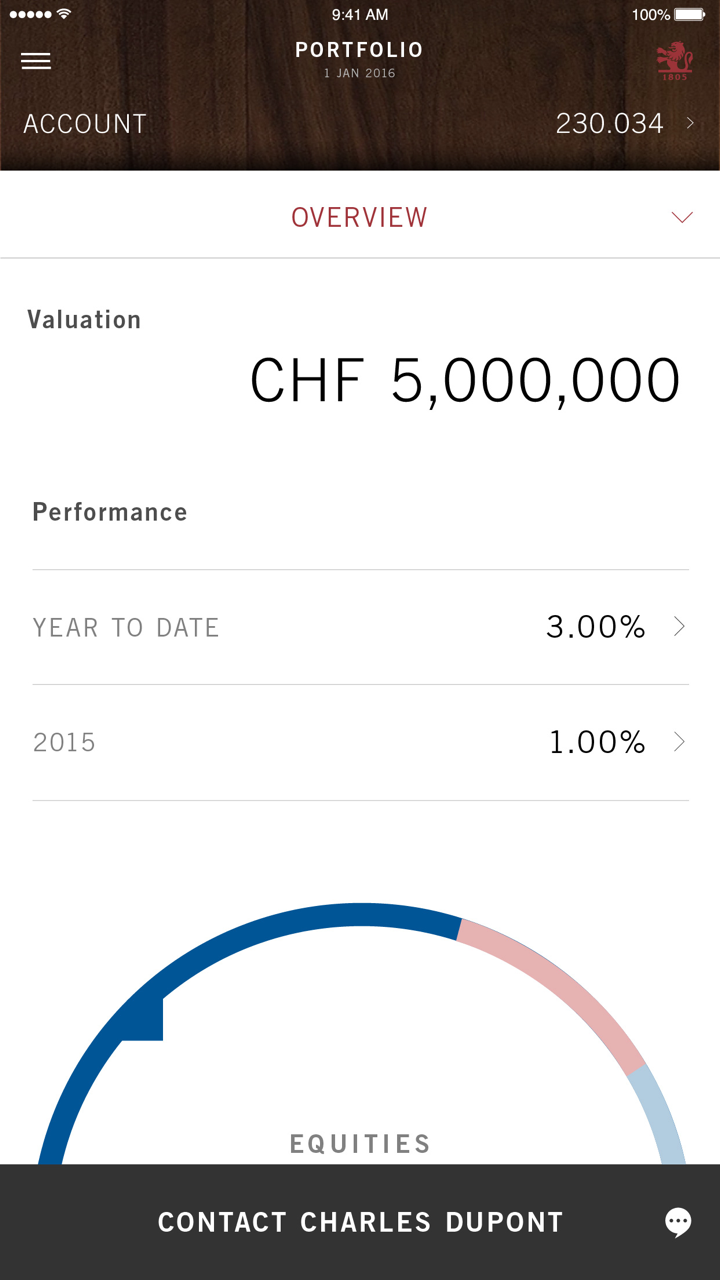

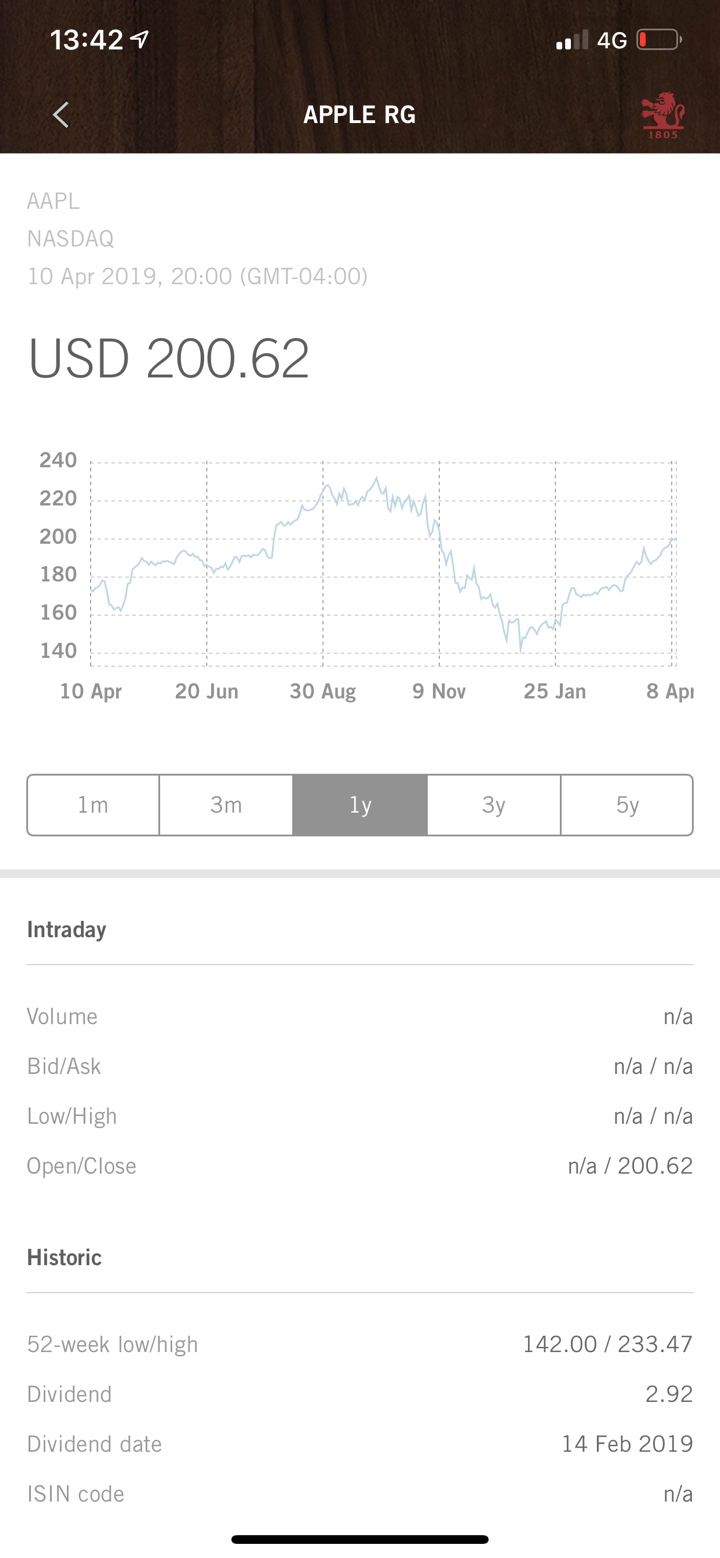

Wealth Management (per persone facoltose, imprenditori e famiglie): soluzioni patrimoniali, soluzioni di investimento e soluzioni bancarie;

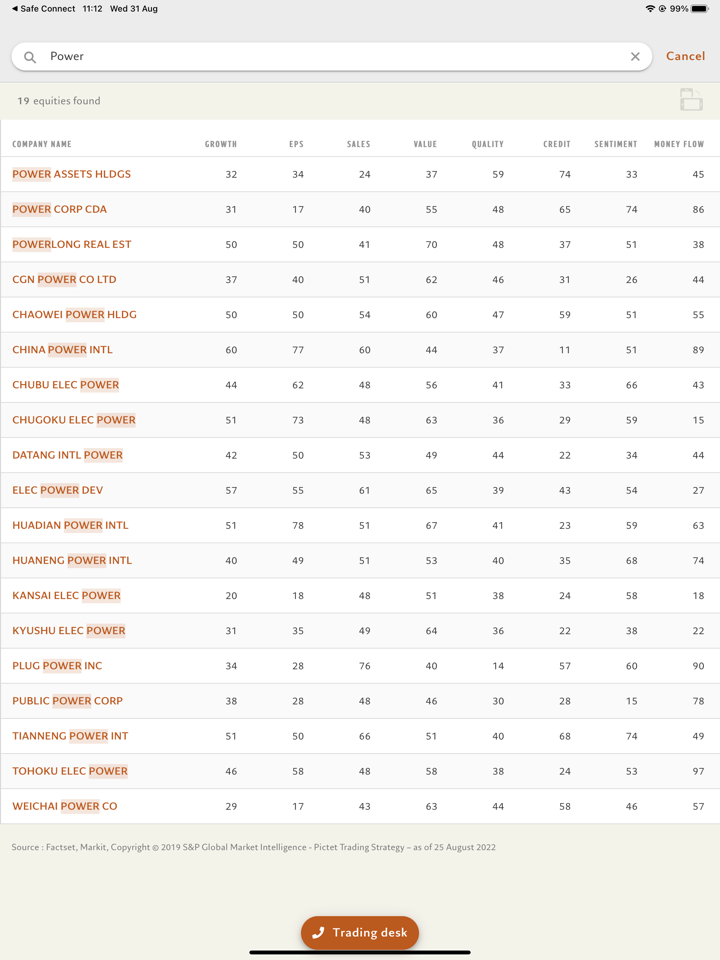

Asset Management (per investitori professionali e i loro clienti): supervisione di oltre 255 miliardi di franchi svizzeri per i clienti attraverso una gamma di strategie azionarie, obbligazionarie, multi-asset e alternative;

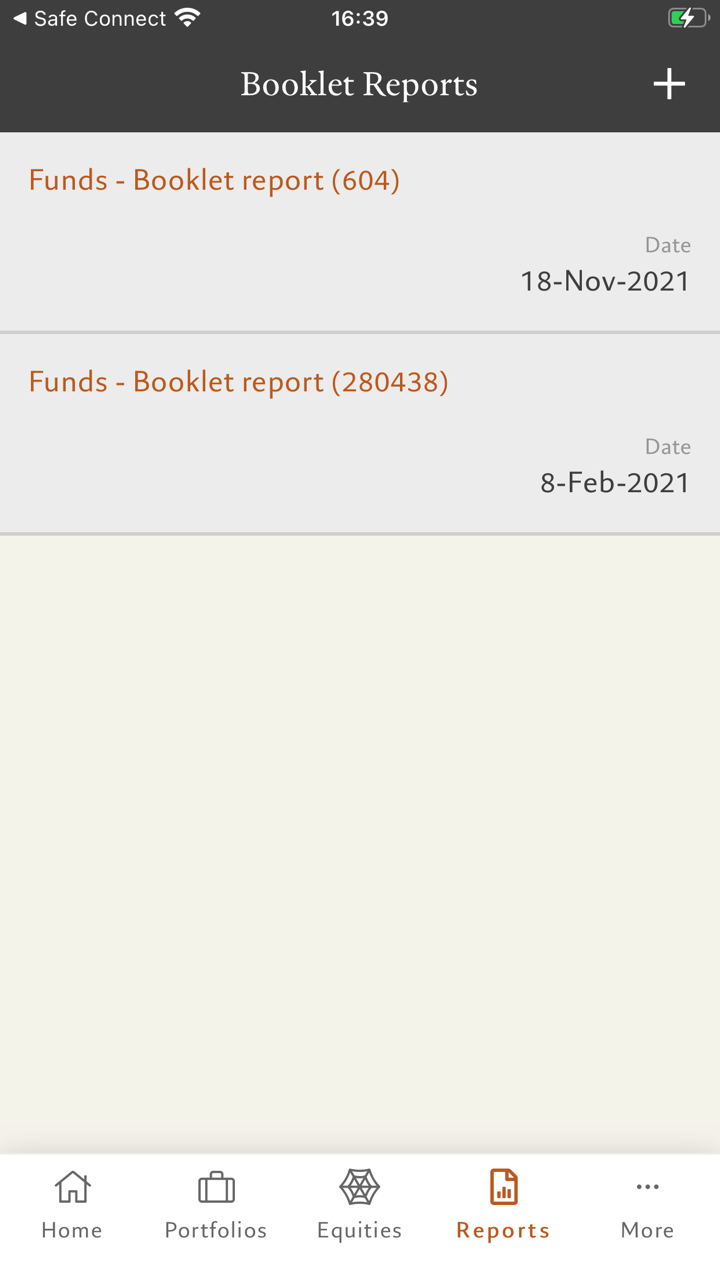

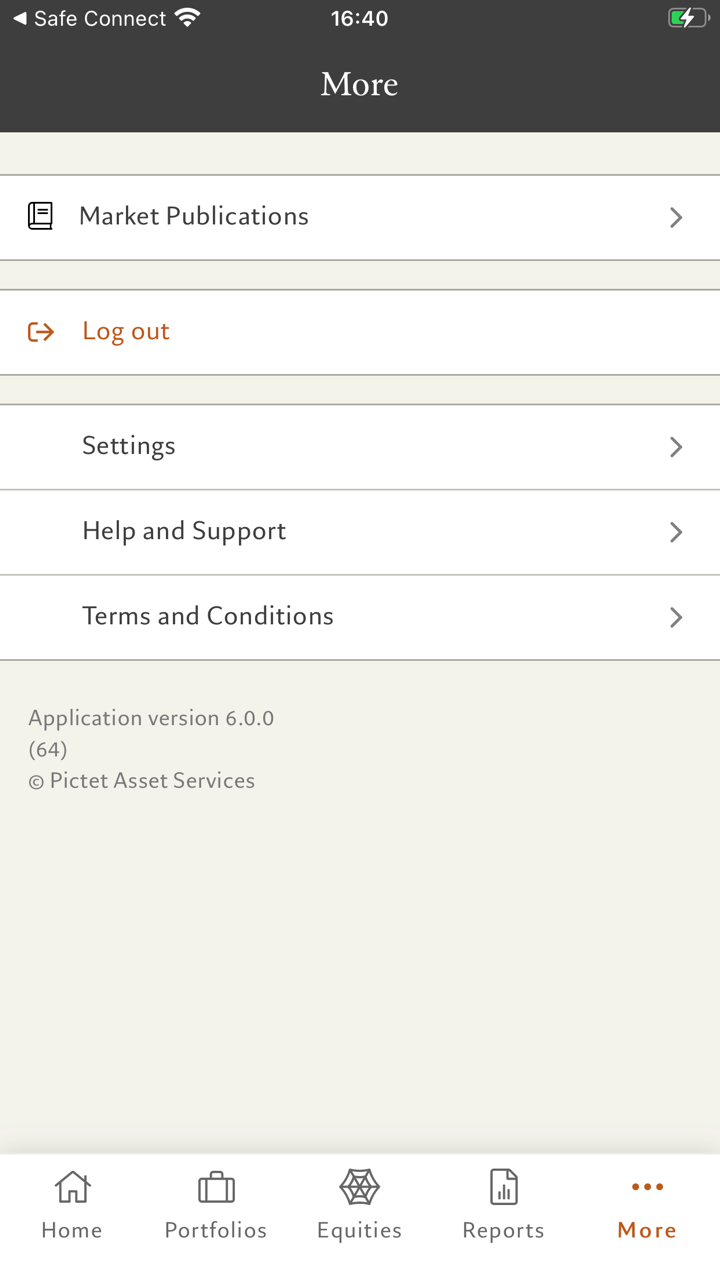

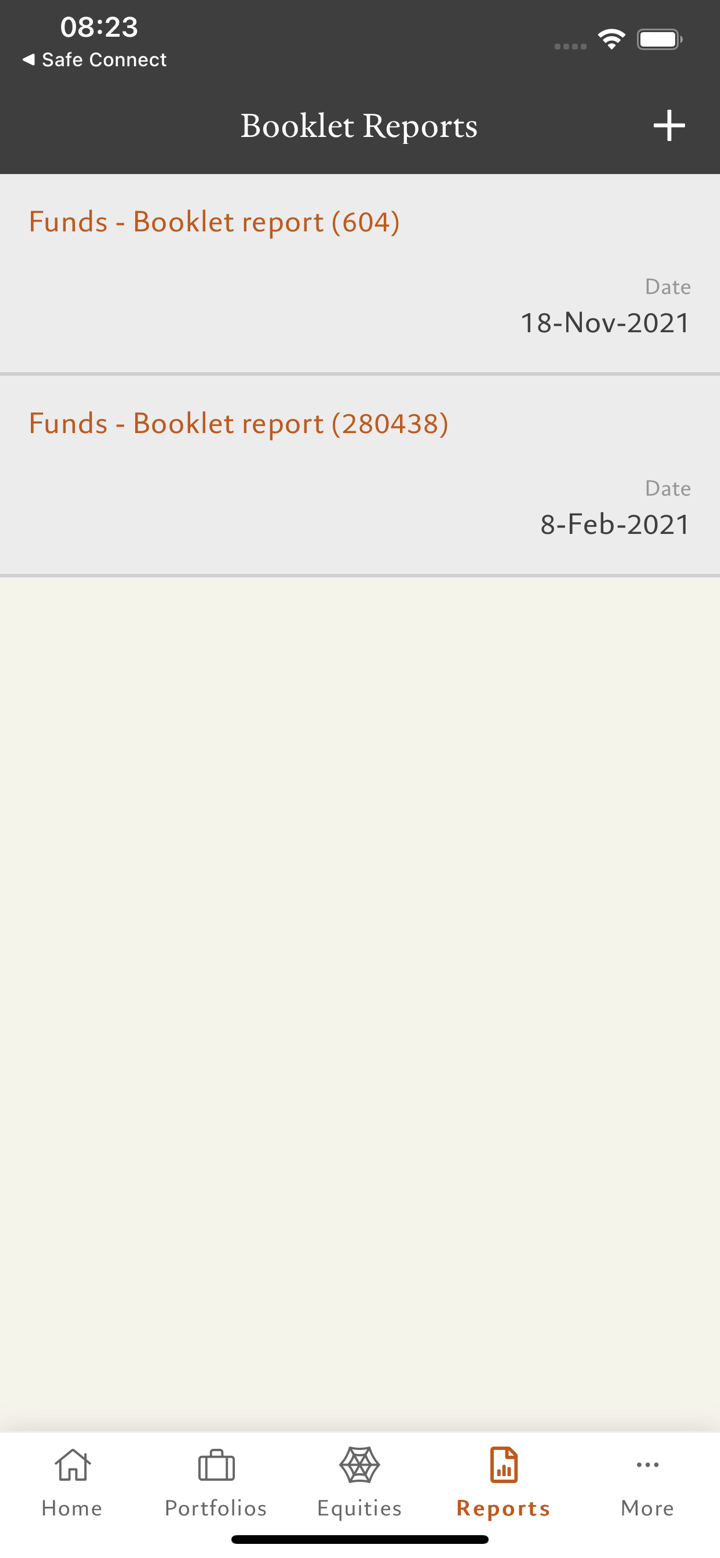

Asset Services (per gestori di fondi, gestori patrimoniali esterni e istituzioni): servizi di custodia, amministrazione di fondi, governance di fondi;

Investimenti alternativi (per investitori istituzionali e privati): hedge fund, private equity, real estate;

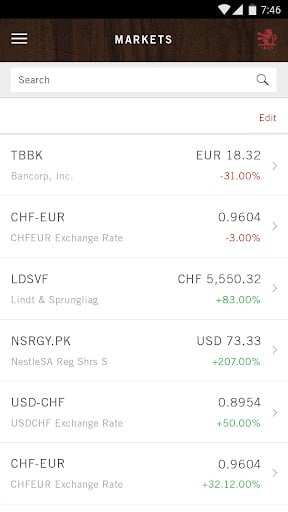

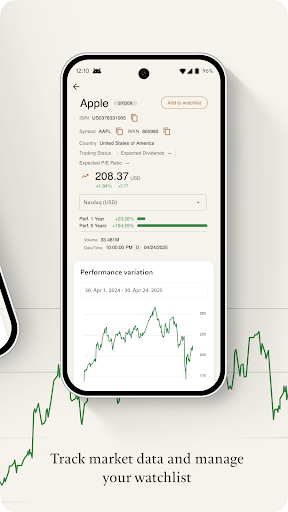

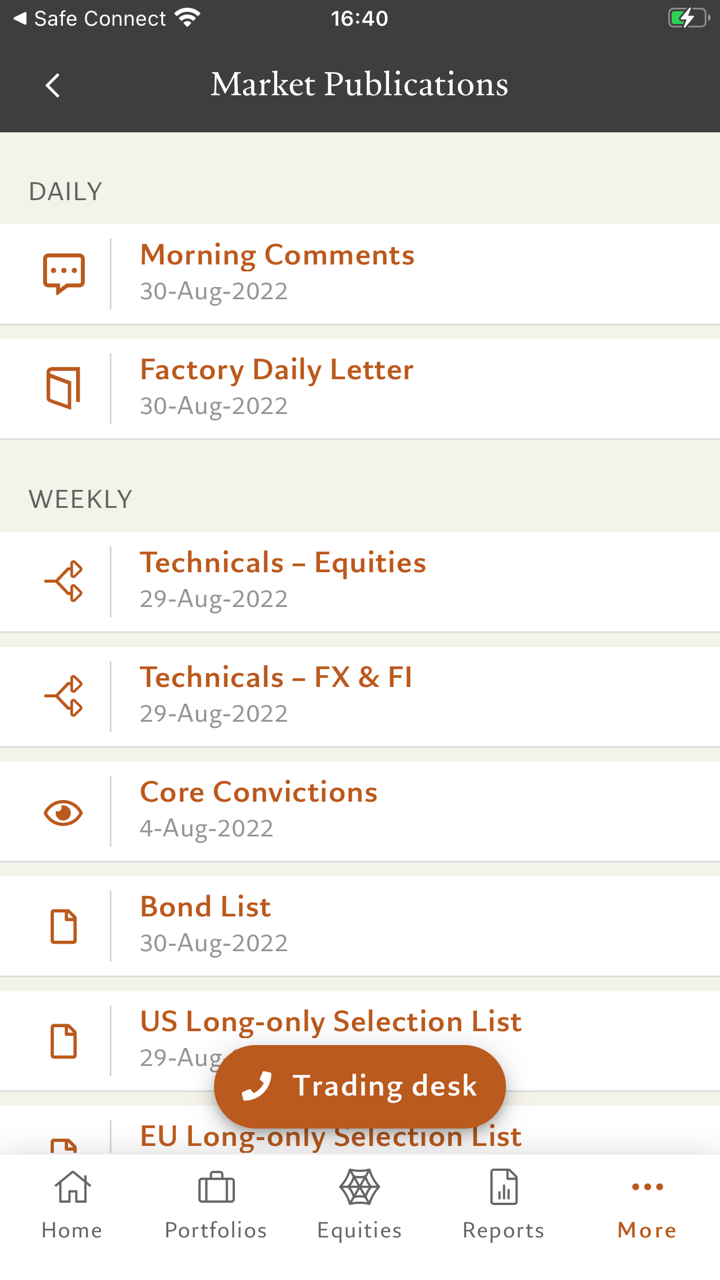

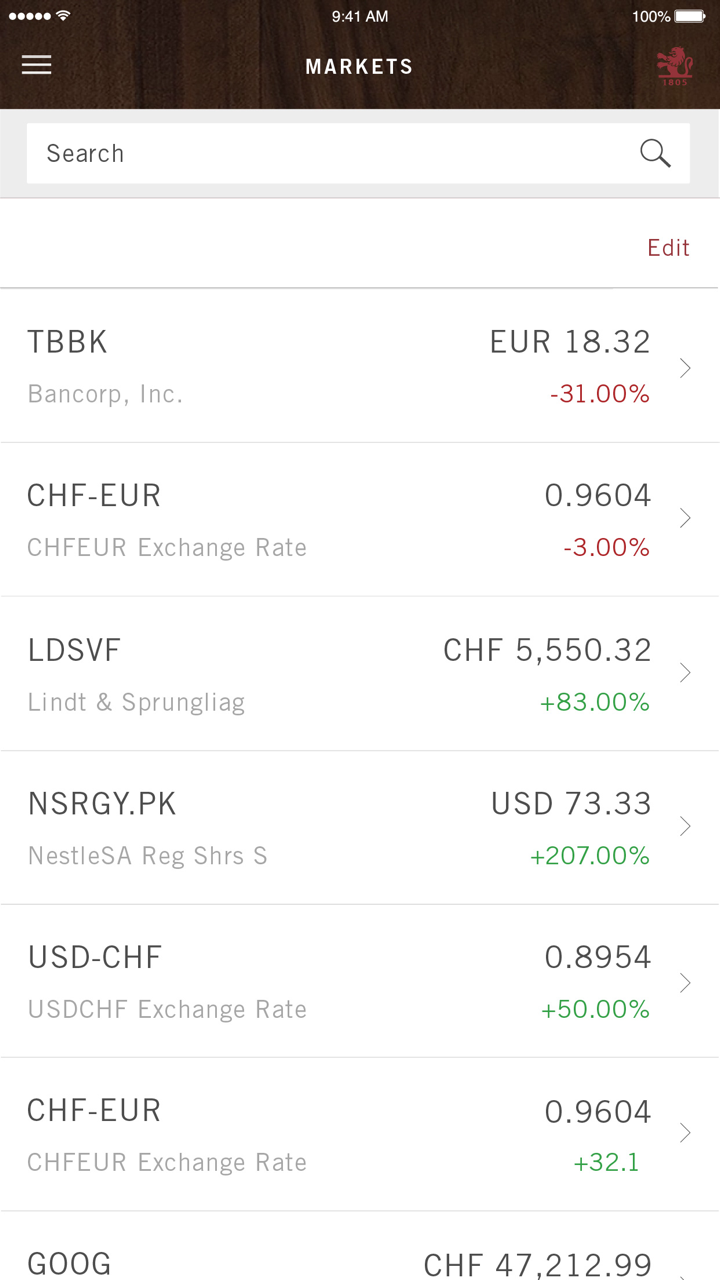

Trading & Sales: azioni, reddito fisso, cambi e metalli preziosi, fondi di investimento, prodotti strutturati e derivati (OTC e quotati).

Uffici in tutto il mondo

Pictetha una portata internazionale ed è presente in 30 centri finanziari in tutto il mondo:

Svizzera: Basilea, Ginevra, Losanna, Zurigo;

Europa: Amsterdam, Barcellona, Bruxelles, Francoforte, Londra, Londra Mayfair, Lussemburgo, Madrid, Milano, Monaco, Monaco, Parigi, Roma, Stoccarda, Torino, Verona;

Asia: Hong Kong, Osaka, Shanghai, Singapore, Taipei, Tokyo;

Medio Oriente: Dubai, Tel Aviv;

Americhe: Montreal, Nassau, New York.

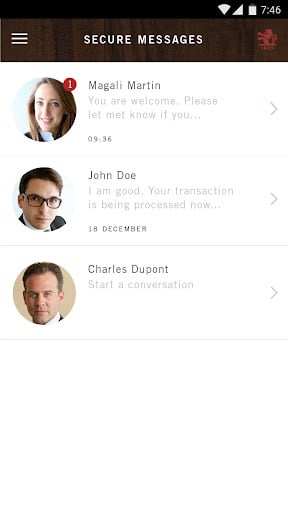

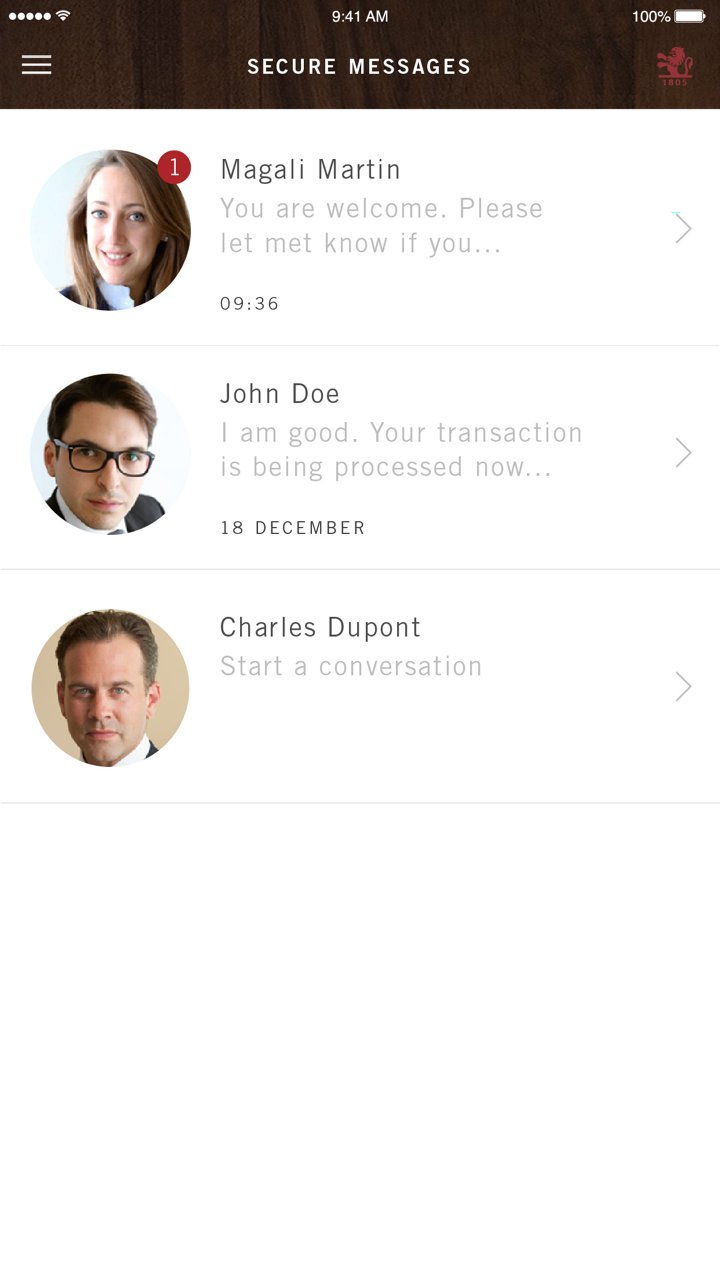

Servizio Clienti

i clienti che hanno domande o dubbi possono visitare Pictet s sito ufficiale https://www.group. Pictet / e scegli il reparto che desideri contattare nella sezione “contatti”.