Profil perusahaan

| PNB Ringkasan Ulasan | |

| Didirikan | 1916 |

| Negara/Daerah Terdaftar | Filipina |

| Regulasi | Tidak diatur |

| Produk dan Layanan | Perbankan Ritel & Korporat, Pinjaman & Hipotek, Pengiriman Uang, Asuransi, Investasi, Perantara Saham, Perbankan Mobile & Online |

| Akun Demo | / |

| Daya Ungkit | / |

| Spread | / |

| Platform Perdagangan | PNB Aplikasi Digital |

| Deposit Minimum | PHP 3.000 (untuk rekening tabungan dasar) |

| Dukungan Pelanggan | Trunkline: (+632) 8526 3131 |

| Hotline Bank: (+632) 8573-8888 | |

| Email: customercare@pnb.com.ph | |

| Media Sosial: Facebook, X, Instagram, YouTube, LinkedIn | |

Informasi PNB

Philippine National Bank (PNB) adalah salah satu bank komersial swasta tertua dan terbesar di Filipina, yang dibuka pada tahun 1916. Saat ini tidak diatur oleh otoritas keuangan manapun, baik di AS maupun di luar negeri, namun menyediakan berbagai layanan keuangan tradisional dan digital kepada pelanggan di AS dan luar negeri melalui jaringan cabang dan ATM yang luas.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Sejarah perbankan yang berdiri sejak 1916 | Tidak diatur |

| Jaringan cabang lokal dan internasional yang luas | Struktur biaya yang kompleks |

| Menawarkan berbagai layanan perbankan | |

| Berbagai saluran kontak |

Apakah PNB Legal?

PNB tidak diatur oleh lembaga keuangan Filipina manapun, termasuk Komisi Sekuritas dan Bursa (SEC) dan Bangko Sentral ng Pilipinas (BSP). Selain itu, tidak diawasi oleh regulator keuangan yang diakui secara internasional, seperti FCA (Inggris), ASIC (Australia), atau CySEC (Siprus).

Produk dan Layanan

PNB menyediakan berbagai layanan keuangan tradisional dan inovatif, termasuk perbankan ritel, perbankan korporat, pengiriman uang, manajemen aset, pinjaman, asuransi, dan opsi investasi. Bank ini memiliki salah satu jaringan cabang domestik dan luar negeri terbesar di antara bank-bank Filipina lainnya, melayani klien lokal dan global dari Filipina.

| Produk / Layanan | Didukung |

| Perbankan Ritel & Korporat | ✔ |

| Pinjaman & Hipotek (misalnya OPHL) | ✔ |

| Layanan Pengiriman Uang | ✔ |

| Asuransi (Jiwa & Non-jiwa) | ✔ |

| Layanan Investasi & Kepercayaan | ✔ |

| Broker Saham | ✔ |

| Perbankan Mobile & Online | ✔ |

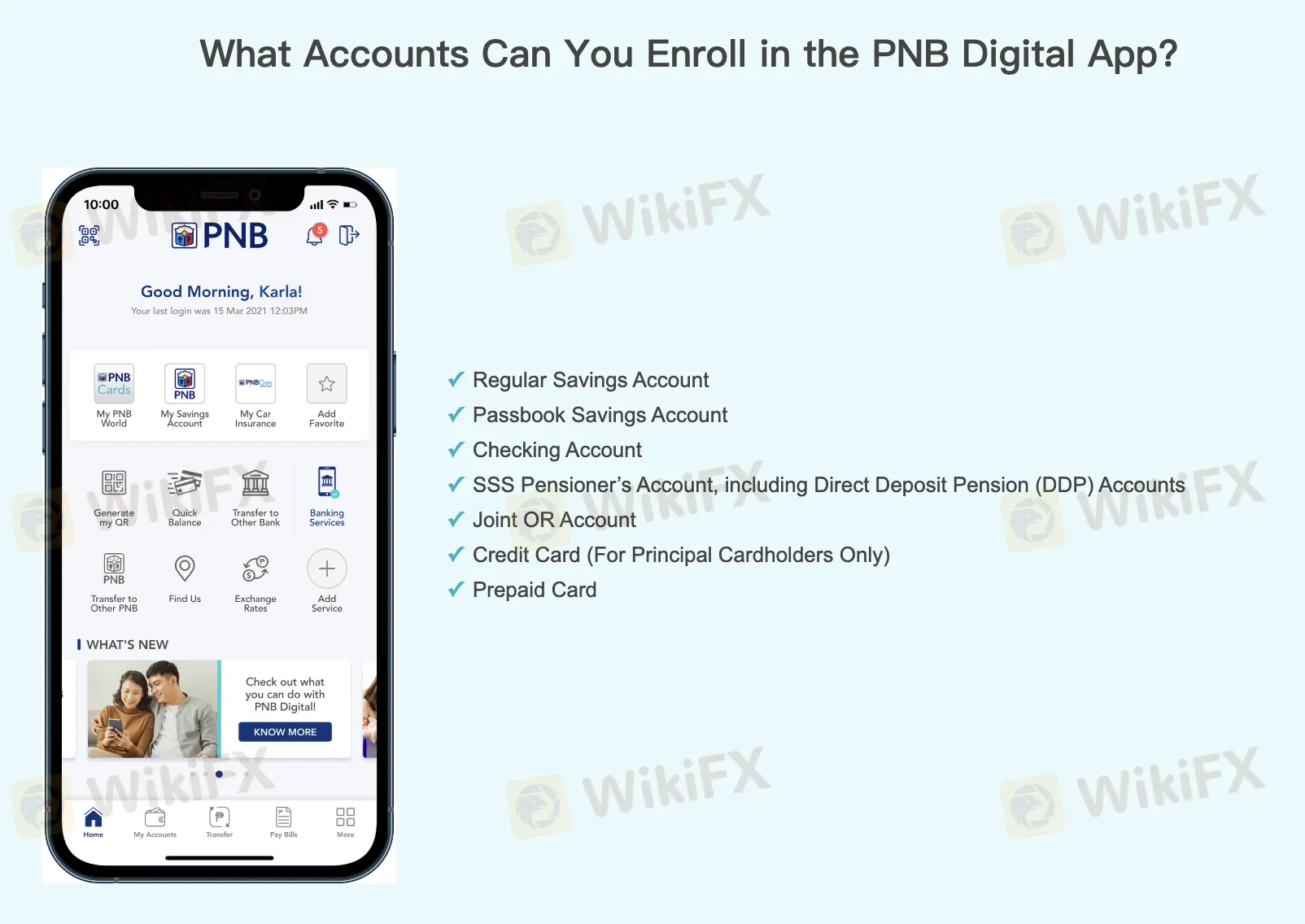

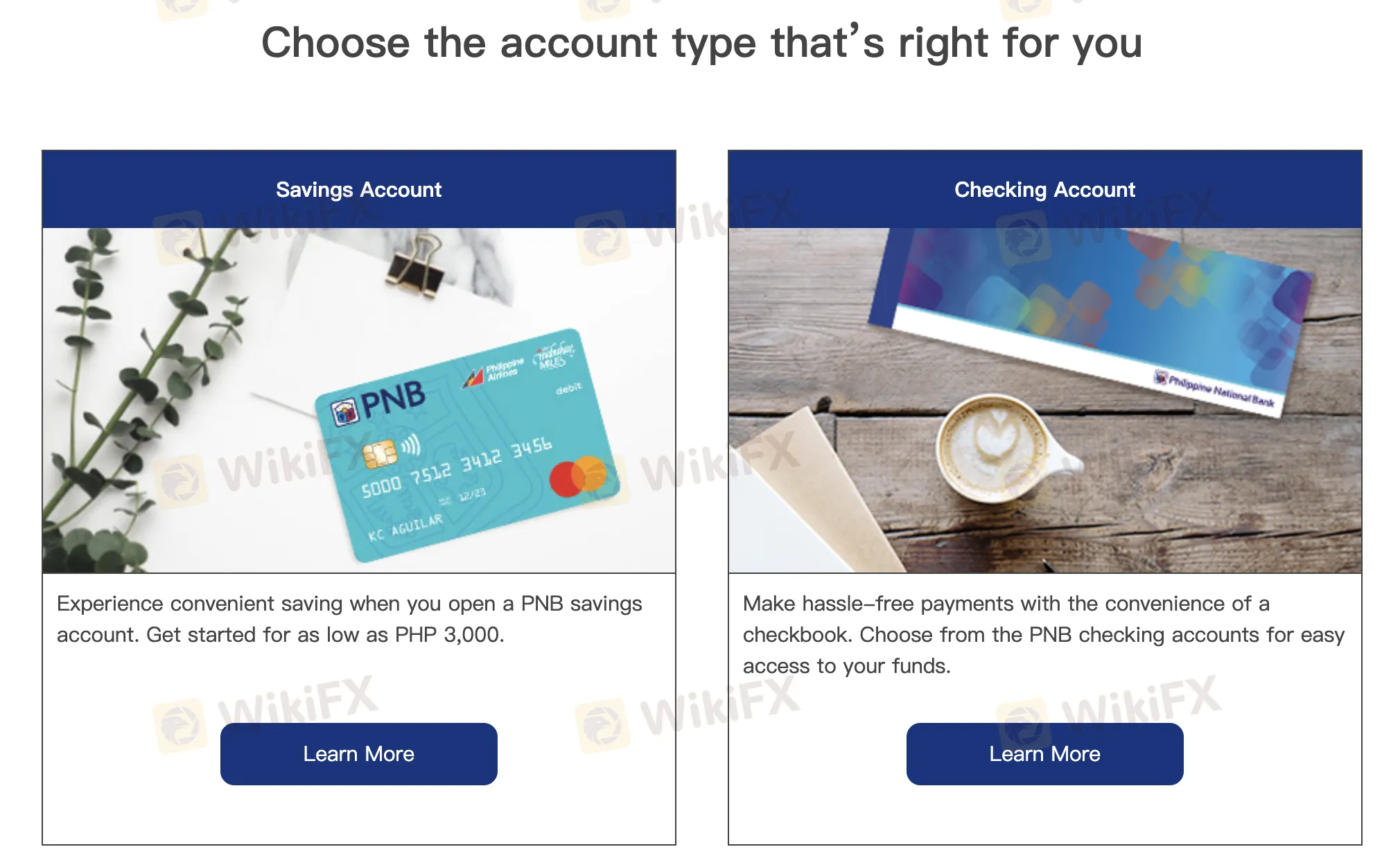

Jenis Akun

| Jenis Akun | Tujuan / Fitur | Cocok Untuk |

| Tabungan | Akun deposit dasar; deposit awal mulai dari PHP 3.000 | Penghemat sehari-hari |

| Akun Giro | Dilengkapi dengan cek; untuk pembayaran mudah dan akses dana | Individu/usaha yang membutuhkan fleksibilitas pembayaran |

| Deposito Berjangka | Tabungan dengan jangka waktu tetap dan bunga | Mereka yang mencari pertumbuhan tabungan yang aman |

| Mata Uang Asing | Untuk menyimpan mata uang asing dengan aman | Individu dengan kebutuhan forex atau transaksi luar negeri |

Biaya PNB

Dibandingkan dengan bank lain, PNB mengenakan biaya moderat hingga tinggi, terutama untuk transaksi antar cabang dan dengan orang dari negara lain. Dalam jaringannya, beberapa layanan, seperti cek saldo dan penggunaan ATM, gratis. Namun, banyak layanan lain, terutama yang melibatkan cabang di wilayah yang berbeda, di pulau lain, atau dengan mata uang yang berbeda, memiliki biaya yang berbeda.

| Kategori Biaya | Deskripsi | Biaya |

| Setoran Tunai Antar Cabang | Wilayah yang sama: GratisWilayah yang berbeda: ₱50/₱100K atau lebih | Minimum ₱50, ₱50 per ₱100K |

| Setoran Cek Antar Cabang | Reguler ↔ Cabang Pulau | ₱100 |

| Setoran Tunai/Cek USD | Semua cabang | ₱100 |

| Penarikan Antar Cabang (PHP) | Reguler ↔ Cabang Pulau | ₱200 |

| Penarikan/Encashment USD | Semua cabang | ₱200 |

| ATM (Lokal) | ATM PNB: GratisBank lain: Penarikan ₱15, cek saldo ₱2 | ₱2–₂15 |

| ATM (Internasional) | Penarikan: ₱150–₱250Cek Saldo: ₱75 | ₱75–₂250 |

| Transfer Digital (Ritel) | InstaPay / PESONet | ₱20 per transaksi |

| Transfer Digital PNB ke PNB | 3 pertama per minggu gratis; berikutnya ₱10 setiap transaksi | ₱0–₂10 |

| Layanan Teller | Slip penarikan: ₱50Pemesanan cek: ₱250–₱500Sertifikat bank: ₱200 | Bervariasi |

| Remitansi USD Masuk | Biaya layanan + DST | $5–$8 |

| Biaya Dormansi | Setelah 5 tahun tidak aktif | ₱30 / $0.50 (akun tertentu) |

| Penutupan Awal (≤30 hari) | Akun PHP: ₱500Akun USD: $10 | ₱500 / $10+ |

| Denda Pemeliharaan Saldo | Peso: ₱350–₱500USD: $10–$20Mata uang lain bervariasi | ₱350+ / $10+ |

| Biaya Lainnya | Permintaan SOA, remitansi, wesel, penyewaan kotak keamanan, dll. | Bervariasi berdasarkan layanan |

Platform Perdagangan

| Platform Perdagangan | Dukungan | Perangkat Tersedia | Cocok untuk |

| Aplikasi Digital PNB | ✔ | Android, iOS | / |