Perfil de la compañía

| PNB Resumen de la reseña | |

| Establecido | 1916 |

| País/Región Registrada | Filipinas |

| Regulación | Sin regulación |

| Productos y Servicios | Banca Minorista y Corporativa, Préstamos e Hipotecas, Remesas, Seguros, Inversiones, Corretaje de Acciones, Banca Móvil y en Línea |

| Cuenta Demo | / |

| Apalancamiento | / |

| Spread | / |

| Plataforma de Trading | PNB Aplicación Digital |

| Depósito Mínimo | PHP 3,000 (para cuenta de ahorros básica) |

| Soporte al Cliente | Línea Principal: (+632) 8526 3131 |

| Línea Directa del Banco: (+632) 8573-8888 | |

| Correo Electrónico: customercare@pnb.com.ph | |

| Redes Sociales: Facebook, X, Instagram, YouTube, LinkedIn | |

Información de PNB

Philippine National Bank (PNB) es uno de los bancos comerciales privados más antiguos y grandes de Filipinas, que abrió en 1916. Actualmente no está regulado por ninguna autoridad financiera, ni en EE. UU. ni en el extranjero, pero ofrece una amplia gama de servicios financieros tradicionales y digitales a clientes en EE. UU. y en el extranjero a través de su extensa red de sucursales y cajeros automáticos.

Pros y Contras

| Pros | Contras |

| Historia bancaria de larga data desde 1916 | No regulado |

| Amplia red de sucursales locales e internacionales | Estructura de tarifas compleja |

| Ofrece una amplia gama de servicios bancarios | |

| Varios canales de contacto |

¿Es PNB Legítimo?

PNB no está regulado por ninguna institución financiera filipina, incluyendo la Comisión de Valores y Bolsa (SEC) y el Banco Central de Filipinas (BSP). Además, no está supervisado por ningún regulador financiero reconocido internacionalmente, como la FCA (Reino Unido), ASIC (Australia) o CySEC (Chipre).

Productos y Servicios

PNB ofrece una amplia gama de servicios financieros tradicionales e innovadores, que incluyen banca minorista, banca corporativa, remesas, gestión de activos, préstamos, seguros y opciones de inversión. Tiene una de las redes de sucursales nacionales y extranjeras más grandes de cualquier banco filipino, atendiendo tanto a clientes filipinos locales como en todo el mundo.

| Productos / Servicios | Soportado |

| Banca Minorista y Corporativa | ✔ |

| Préstamos e Hipotecas (por ejemplo, OPHL) | ✔ |

| Servicios de Remesas | ✔ |

| Seguros (Vida y No Vida) | ✔ |

| Servicios de Inversión y Fideicomiso | ✔ |

| Corretaje de Acciones | ✔ |

| Banca Móvil y en Línea | ✔ |

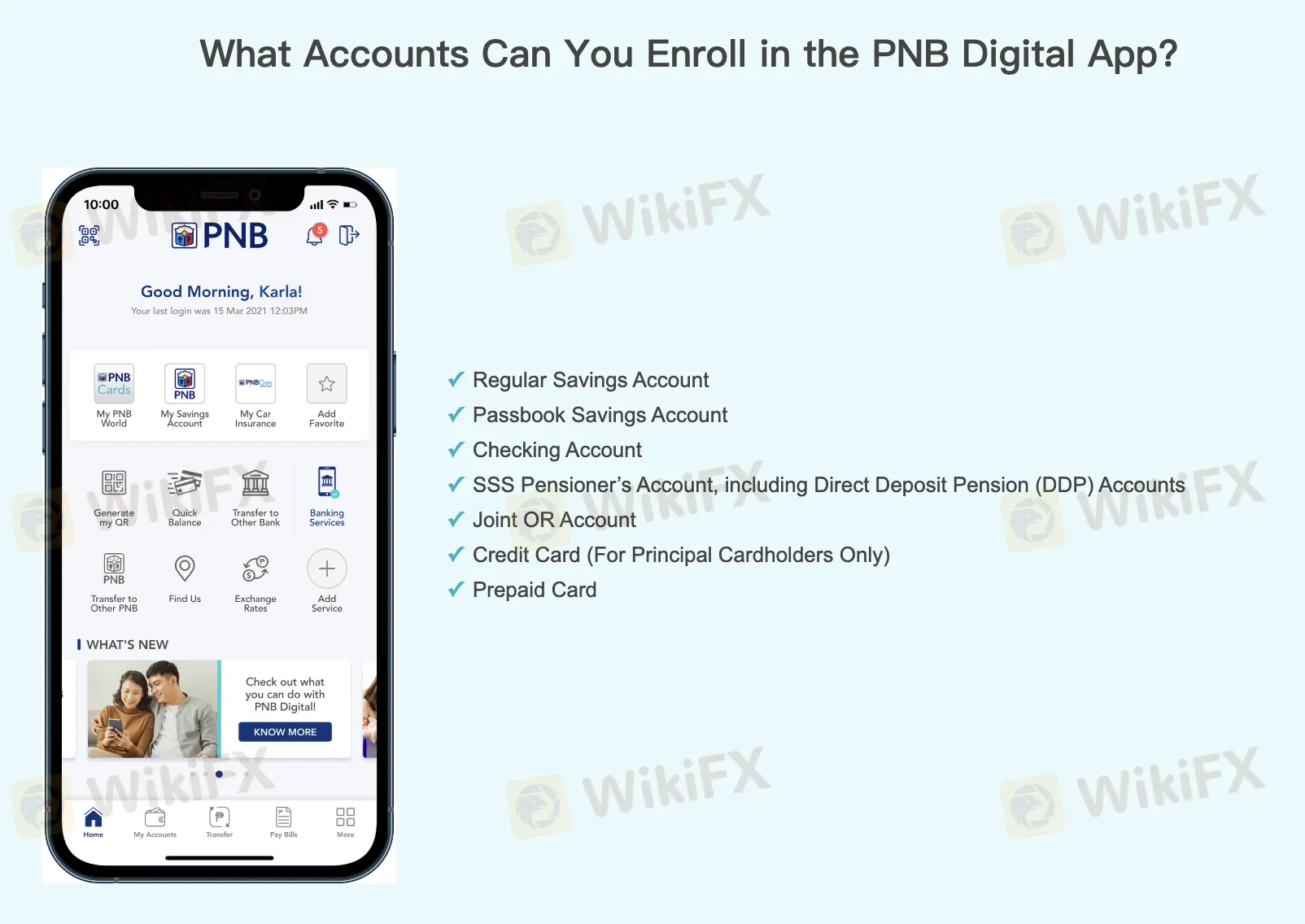

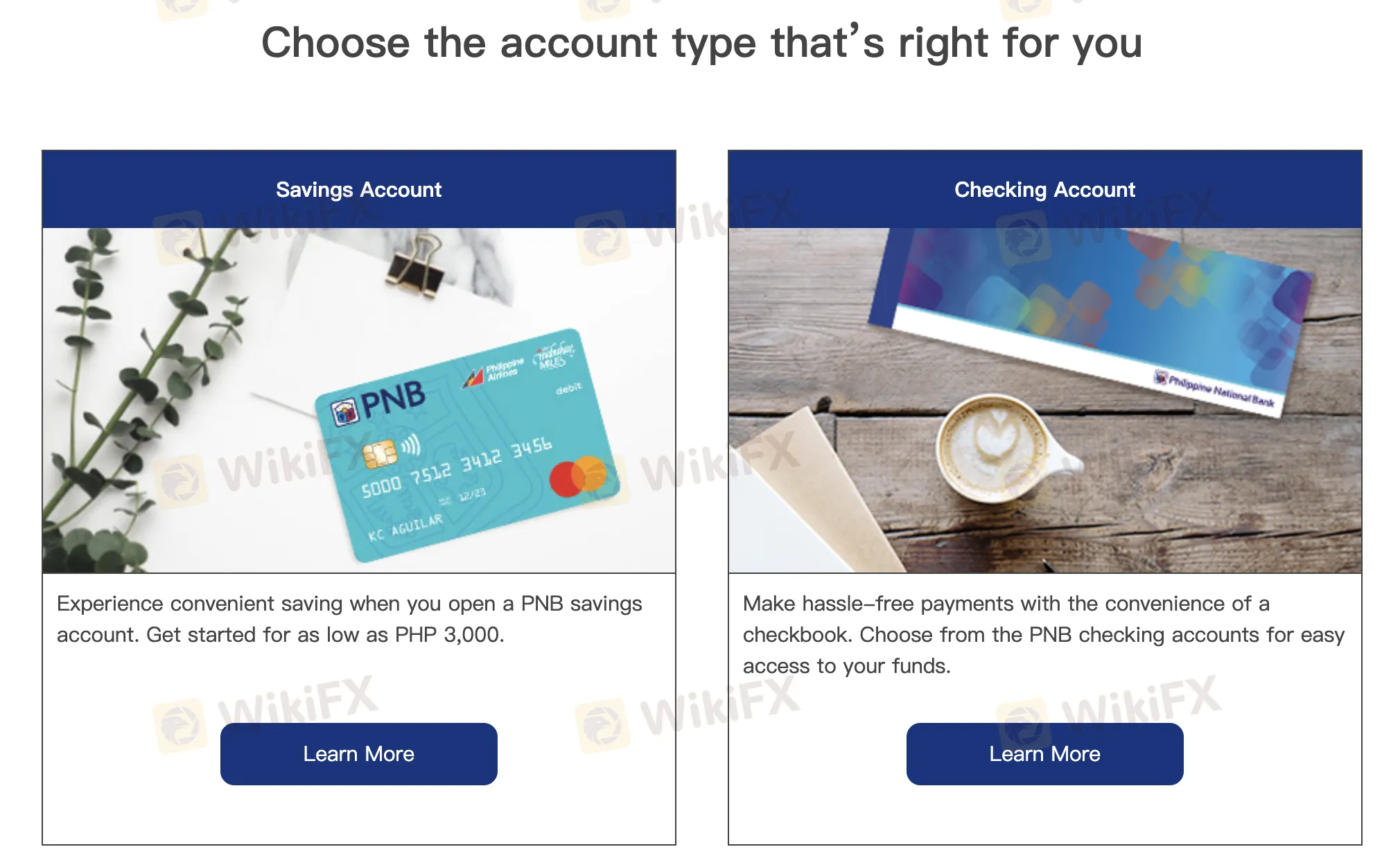

Tipos de Cuentas

| Tipo de Cuenta | Propósito / Características | Adecuado Para |

| Cuenta de Ahorros | Cuenta de depósito básica; el depósito inicial comienza desde PHP 3,000 | Ahorradores diarios |

| Cuenta Corriente | Viene con talonario de cheques; para pagos fáciles y acceso a fondos | Individuos/empresas que necesitan flexibilidad de pago |

| Depósito a Plazo | Ahorros a plazo fijo con interés | Personas que buscan un crecimiento seguro de ahorros |

| Moneda Extranjera | Para mantener monedas extranjeras de forma segura | Personas con necesidades de divisas o transacciones en el extranjero |

Tarifas de PNB

En comparación con otros bancos, PNB cobra tarifas moderadas a altas, especialmente para transacciones entre sucursales y con personas de otros países. Dentro de su red, algunos servicios, como consultar su saldo y usar un cajero automático, son gratuitos. Sin embargo, muchos otros, especialmente aquellos que involucran sucursales en diferentes regiones, en otras islas o con diferentes monedas, tienen tarifas diferentes.

| Categoría de Tarifa | Descripción | Tarifa |

| Depósito en Efectivo entre Sucursales | Misma región: GratisOtra región: ₱50/₱100K o más | ₱50 mínimo, ₱50 por ₱100K |

| Depósito de Cheques entre Sucursales | Regular ↔ Sucursal en Isla | ₱100 |

| Depósito de Efectivo/Cheques en USD | Todas las sucursales | ₱100 |

| Retiro entre Sucursales (PHP) | Regular ↔ Sucursal en Isla | ₱200 |

| Retiro/Canje en USD | Todas las sucursales | ₱200 |

| ATM (Local) | ATM de PNB: GratisOtros bancos: ₱15 retiro, ₱2 consulta de saldo | ₱2–₱15 |

| ATM (Internacional) | Retiro: ₱150–₱250Consulta de Saldo: ₱75 | ₱75–₱250 |

| Transferencias Digitales (Minoristas) | InstaPay / PESONet | ₱20 por transacción |

| Transferencia Digital de PNB a PNB | Primeras 3 gratis por semana; siguientes ₱10 cada una | ₱0–₱10 |

| Servicios en Ventanilla | Formulario de Retiro: ₱50Reorden de Chequera: ₱250–₂500Certificado Bancario: ₱200 | Varía |

| Remesa Entrante en USD | Tarifa de servicio + DST | $5–$8 |

| Tarifa de Inactividad | Después de 5 años inactiva | ₱30 / $0.50 (cuentas seleccionadas) |

| Cierre Anticipado (≤30 días) | Cuentas en PHP: ₱500Cuentas en USD: $10 | ₱500 / $10+ |

| Penalización por Saldo Mínimo | Peso: ₱350–₱500USD: $10–$20Otras monedas varían | ₱350+ / $10+ |

| Otras Tarifas | Solicitudes de SOA, remesas, giros bancarios, alquiler de cajas de seguridad, etc. | Varía según el servicio |

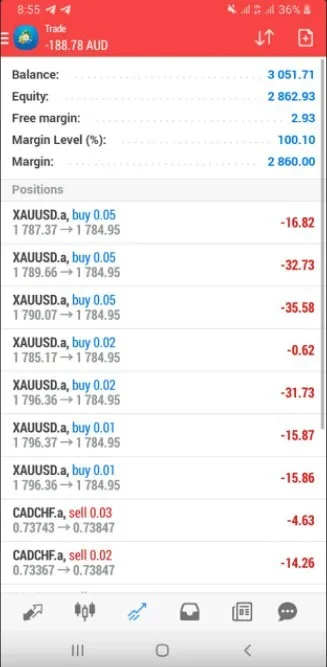

Plataforma de Trading

| Plataforma de Trading | Compatible | Dispositivos Disponibles | Adecuado para |

| Aplicación Digital de PNB | ✔ | Android, iOS | / |