Buod ng kumpanya

| PNB Buod ng Pagsusuri | ||

| Itinatag | 1916 | |

| Nakarehistrong Bansa/Rehiyon | Pilipinas | |

| Regulasyon | Walang regulasyon | |

| Mga Produkto at Serbisyo | Retail & Corporate Banking, Loans & Mortgages, Remittance, Insurance, Investments, Stock Brokerage, Mobile & Online Banking | |

| Demo Account | / | |

| Leverage | / | |

| Spread | / | |

| Platform ng Paggagalaw | Minimum na Deposit | PHP 3,000 (para sa basic savings account) |

| Suporta sa Customer | Trunkline: (+632) 8526 3131 | |

| Bank Hotline: (+632) 8573-8888 | ||

| Email: customercare@pnb.com.ph | ||

| Social Media: Facebook, X, Instagram, YouTube, LinkedIn | ||

Impormasyon Tungkol sa PNB

Philippine National Bank (PNB) ay isa sa pinakamatandang at pinakamalaking pribadong komersyal na bangko sa Pilipinas, na binuksan noong 1916. Sa kasalukuyan, ito ay hindi nireregula ng anumang mga awtoridad sa pinansya, maging sa US o sa ibang bansa, ngunit nag-aalok ito ng buong hanay ng tradisyunal at digital na mga serbisyo sa pinansya sa mga customer sa US at sa ibang bansa sa pamamagitan ng malawak nitong network ng mga sangay at mga ATM.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Matagal nang kasaysayan sa bangko mula pa noong 1916 | Hindi nireregula |

| Malawak na lokal at internasyonal na network ng sangay | Komplikadong istraktura ng bayad |

| Nag-aalok ng malawak na hanay ng mga serbisyong bangko | |

| Iba't ibang mga paraan ng pakikipag-ugnayan |

Tunay ba ang PNB?

Ang PNB ay hindi nireregula ng anumang institusyon sa Pilipinas, kabilang ang Securities and Exchange Commission (SEC) at ang Bangko Sentral ng Pilipinas (BSP). Bukod dito, ito ay hindi binabantayan ng anumang kilalang pandaigdigang mga tagapamahala ng pinansya, tulad ng FCA (UK), ASIC (Australia), o CySEC (Cyprus).

Mga Produkto at Serbisyo

PNB nagbibigay ng malawak na hanay ng tradisyunal at makabagong mga serbisyong pinansyal, kabilang ang retail banking, corporate banking, remittance, asset management, lending, insurance, at mga pagpipilian sa investment. Isa ito sa may pinakamalaking domestic at foreign branch networks kumpara sa anumang bangko sa Pilipinas, na naglilingkod sa lokal at sa buong mundo sa mga kliyenteng Pilipino.

| Mga Produkto / Serbisyo | Sinusugan |

| Retail & Corporate Banking | ✔ |

| Loans & Mortgages (e.g. OPHL) | ✔ |

| Remittance Services | ✔ |

| Insurance (Life & Non-life) | ✔ |

| Investment & Trust Services | ✔ |

| Stock Brokerage | ✔ |

| Mobile & Online Banking | ✔ |

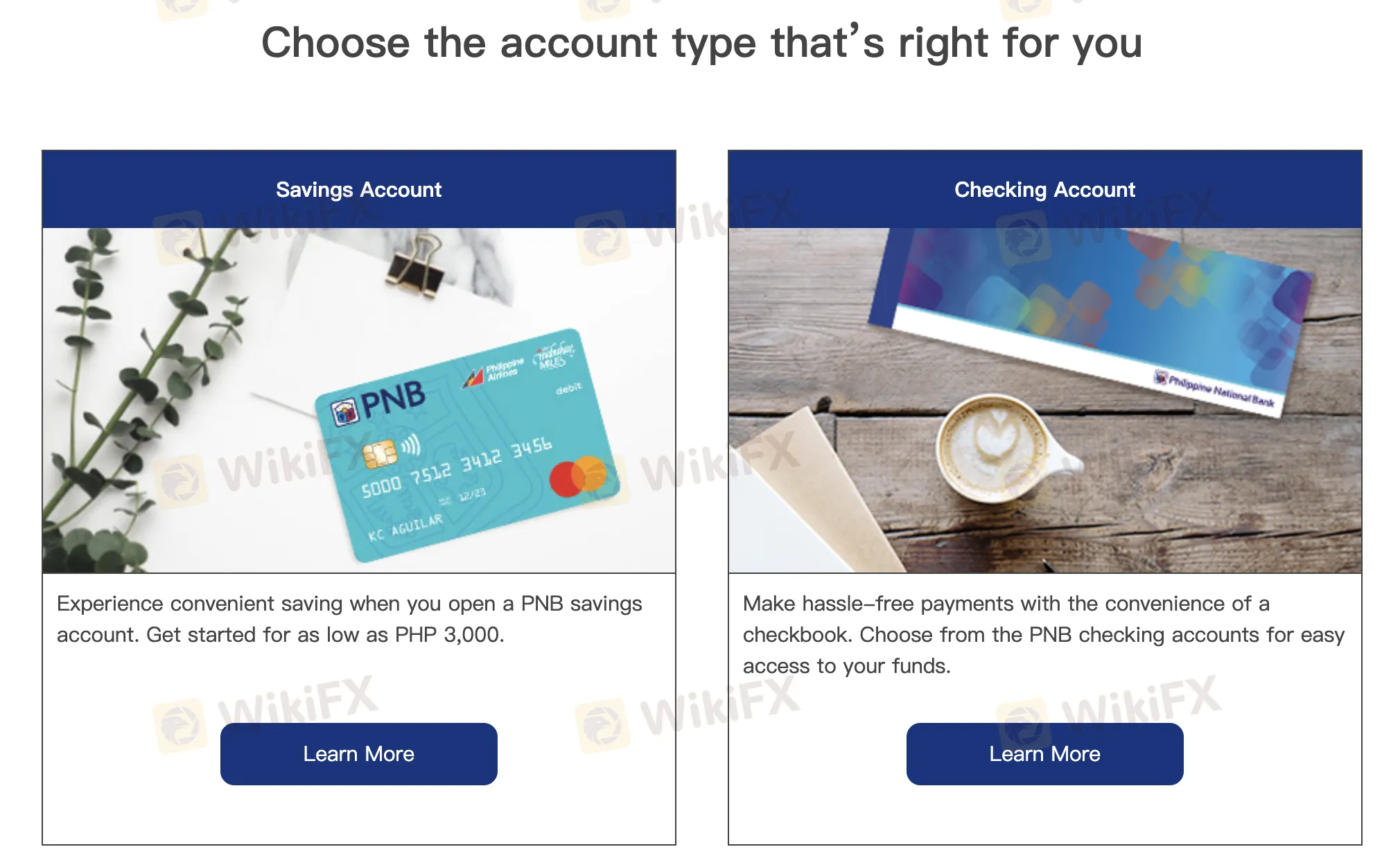

Uri ng Account

| Uri ng Account | Layunin / Mga Tampok | Angkop Para Sa |

| Savings Account | Basic deposit account; ang initial deposit ay nagsisimula mula sa PHP 3,000 | Mga taong nag-iipon araw-araw |

| Checking Account | May kasamang checkbook; para sa madaling pagbabayad at access sa pondo | Mga indibidwal/negosyo na nangangailangan ng flexibility sa pagbabayad |

| Time Deposit | Fixed-term savings na may interes | Mga naghahanap ng ligtas na paglago ng ipon |

| Foreign Currency | Para sa ligtas na paghawak ng mga dayuhang pera | Mga indibidwal na may pangangailangan sa forex o overseas transactions |

Mga Bayad sa PNB

Kumpara sa iba pang mga bangko, PNB ay nagpapataw ng katamtaman hanggang mataas na bayad, lalo na para sa mga transaksyon sa pagitan ng mga sangay at sa mga tao mula sa ibang bansa. Sa loob ng kanilang network, ang ilang serbisyo, tulad ng pag-check ng iyong balanse at paggamit ng ATM, ay libre. Gayunpaman, marami pang iba, lalo na ang mga may kinalaman sa mga sangay sa iba't ibang rehiyon, sa iba't ibang mga isla, o may iba't ibang mga currency, ay may iba't ibang bayad.

| Kategorya ng Bayad | Paglalarawan | Bayad |

| Interbranch Cash Deposit | Parehong rehiyon: LibreIba't ibang rehiyon: ₱50/₱100K o higit pa | ₱50 minimum, ₱50 bawat ₱100K |

| Interbranch Check Deposit | Regular ↔ Island Branch | ₱100 |

| USD Cash/Check Deposit | Lahat ng sangay | ₱100 |

| Interbranch Withdrawal (PHP) | Regular ↔ Island Branch | ₱200 |

| USD Withdrawal/Encashment | Lahat ng sangay | ₱200 |

| ATM (Local) | PNB ATM: LibreIba pang bangko: ₱15 withdrawal, ₱2 balance inquiry | ₱2–₂15 |

| ATM (International) | Withdrawal: ₱150–₱250Balance Inquiry: ₱75 | ₱75–₂250 |

| Digital Transfers (Retail) | InstaPay / PESONet | ₱20 bawat transaksyon |

| Digital PNB to PNB Transfer | Unang 3 kada linggo libre; susunod na ₱10 bawat isa | ₱0–₂10 |

| Over-the-Counter Services | Withdrawal slip: ₱50Checkbook reorder: ₱250–₂500Bank cert: ₱200 | Nag-iiba |

| Inward USD Remittance | Service fee + DST | $5–$8 |

| Dormancy Fee | Matapos ang 5 taon na walang aktibidad | ₱30 / $0.50 (piling accounts) |

| Early Closure (≤30 days) | Mga account sa PHP: ₱500Mga account sa USD: $10 | ₱500 / $10+ |

| Maintaining Balance Penalty | Peso: ₱350–₂500USD: $10–$20Iba't ibang currencies | ₱350+ / $10+ |

| Iba't ibang Bayad | Mga kahilingan ng SOA, remittances, demand drafts, safety box rental, atbp. | Nag-iiba depende sa serbisyo |

Plataforma ng Pagtitingi

| Plataforma ng Pagtitingi | Supported | Available Devices | Suitable for |

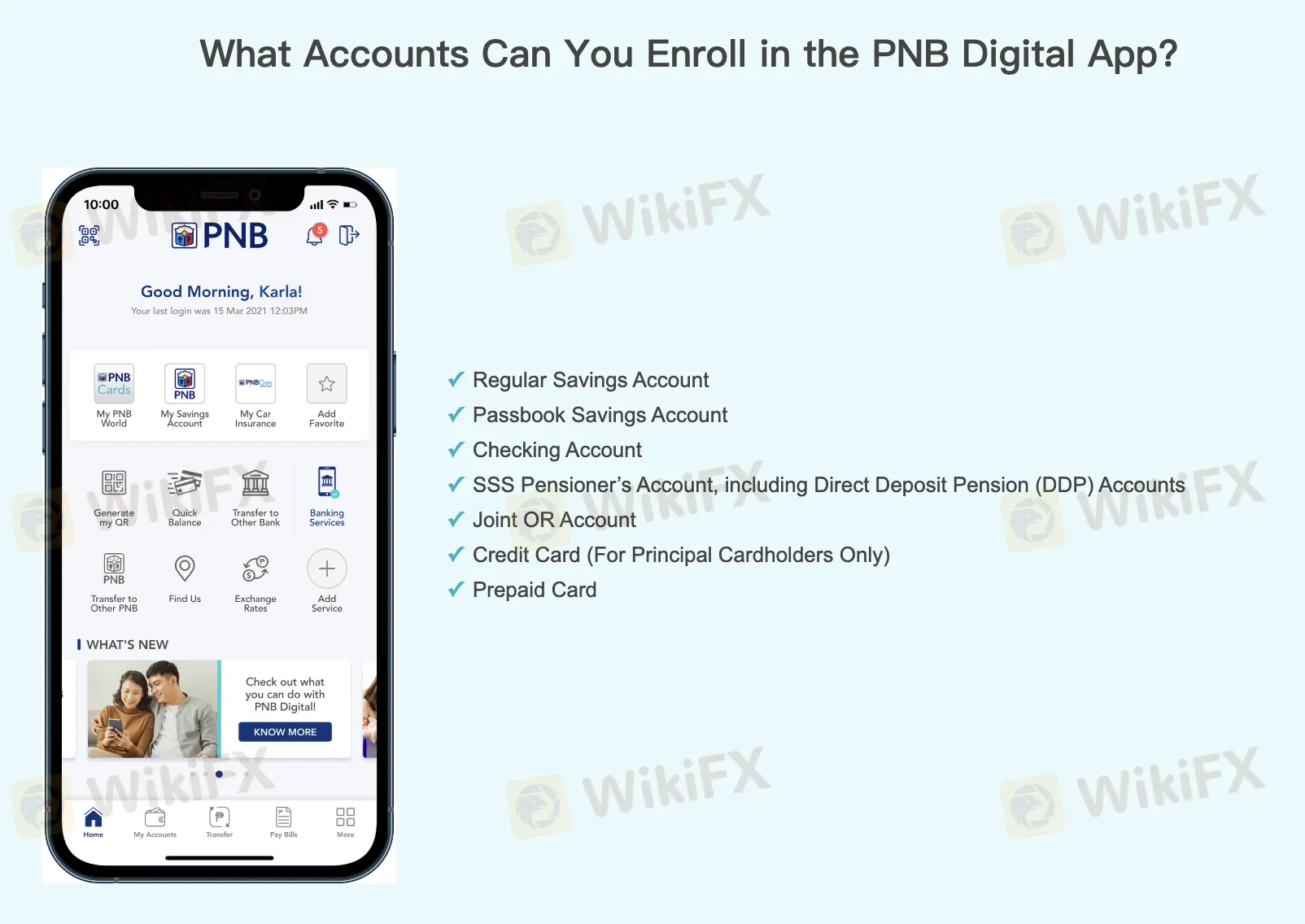

| PNB Digital App | ✔ | Android, iOS | / |