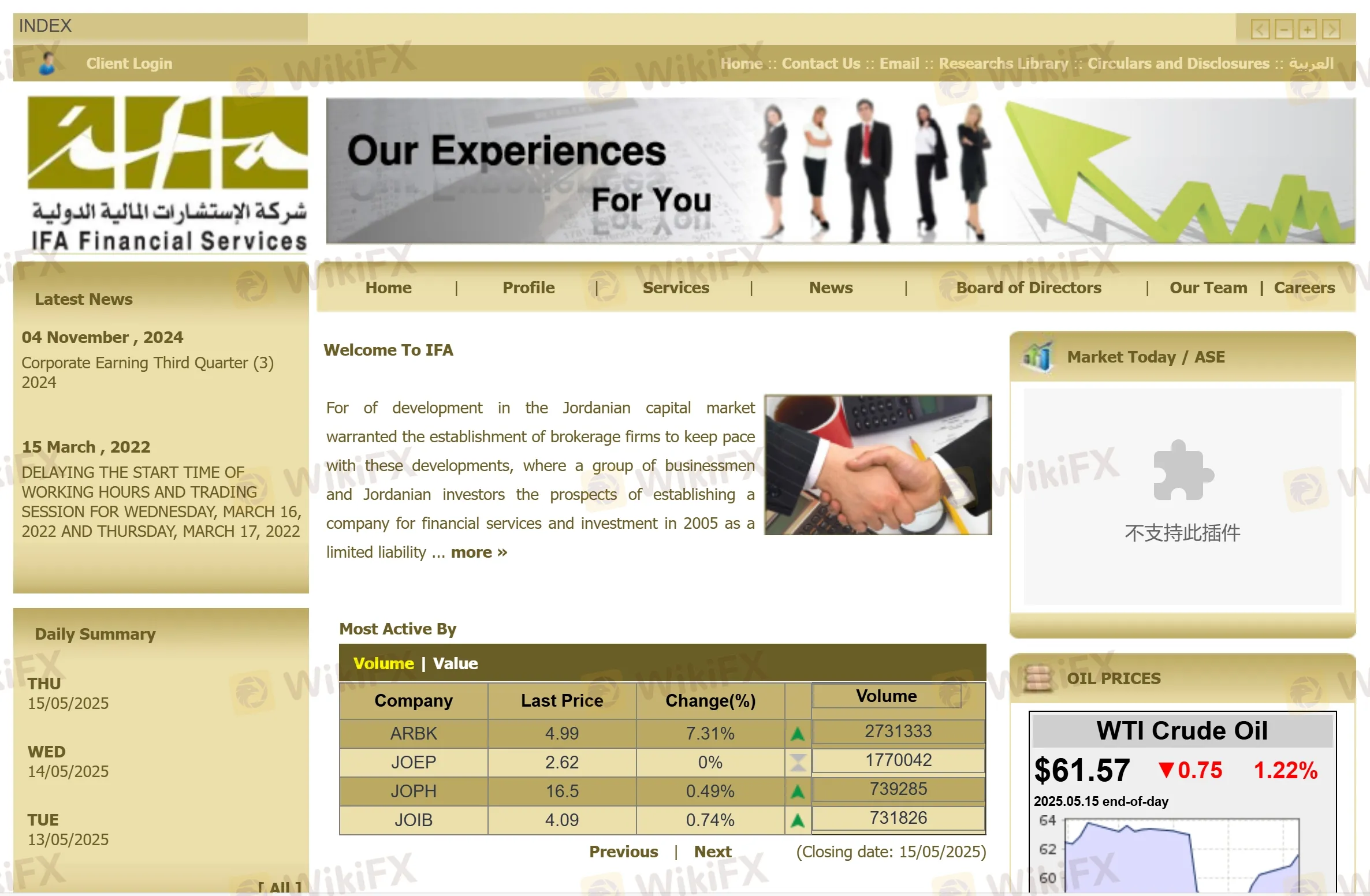

Profil perusahaan

| IFA Ringkasan Ulasan | |

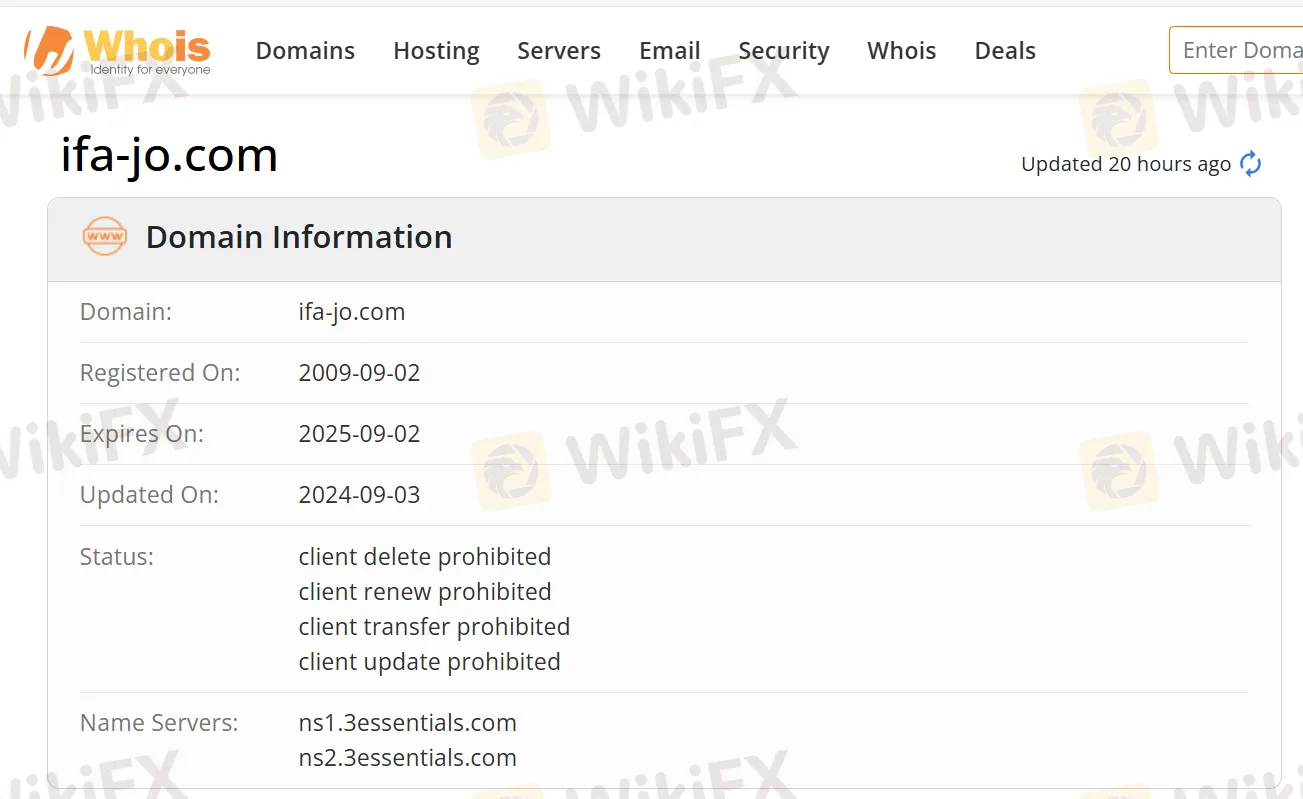

| Didirikan | 2009 |

| Negara/Daerah Terdaftar | Yordania |

| Regulasi | Tidak diatur |

| Produk & Layanan | Intermediasi keuangan di Bursa Saham Amman, layanan konsultasi keuangan, pendanaan margin |

| Akun Demo | / |

| Platform Perdagangan | / |

| Dana Minimum | / |

| Dukungan Pelanggan | Fax: 5626665 |

| Tel: 5690922-5690933-5690977 | |

| Email: Info@ifa-jo.com | |

Informasi IFA

IFA (Penasihat Keuangan Internasional) adalah broker tanpa regulasi yang didirikan di Yordania, menawarkan berbagai layanan keuangan seperti intermediasi keuangan di Bursa Saham Amman, layanan konsultasi keuangan, dan pendanaan margin.

Pro dan Kontra

| Pro | Kontra |

| Layanan keuangan komprehensif | Tidak diatur |

| Waktu operasi panjang | |

| Berbagai saluran kontak |

Apakah IFA Legal?

Tidak. Saat ini, IFA tidak memiliki regulasi yang valid. Harap waspada terhadap risiko!

Produk & Layanan

Broker ini menyediakan layanan seperti intermediasi keuangan di Bursa Saham Amman serta layanan konsultasi keuangan dan pendanaan margin.

| Produk & Layanan | Didukung |

| Intermediasi keuangan di Bursa Saham Amman | ✔ |

| layanan konsultasi keuangan | ✔ |

| pendanaan margin | ✔ |