Profil perusahaan

| Forex Sport Ringkasan Ulasan | |

| Didirikan | 2011 |

| Negara/Daerah Terdaftar | Australia |

| Regulasi | ASIC |

| Layanan | Pembelian/Penjualan Aset, Manajemen Risiko FX, Pembayaran Pemasok Internasional, Pembayaran Karyawan Secara Global, Menerima Pembayaran Internasional, Pajak |

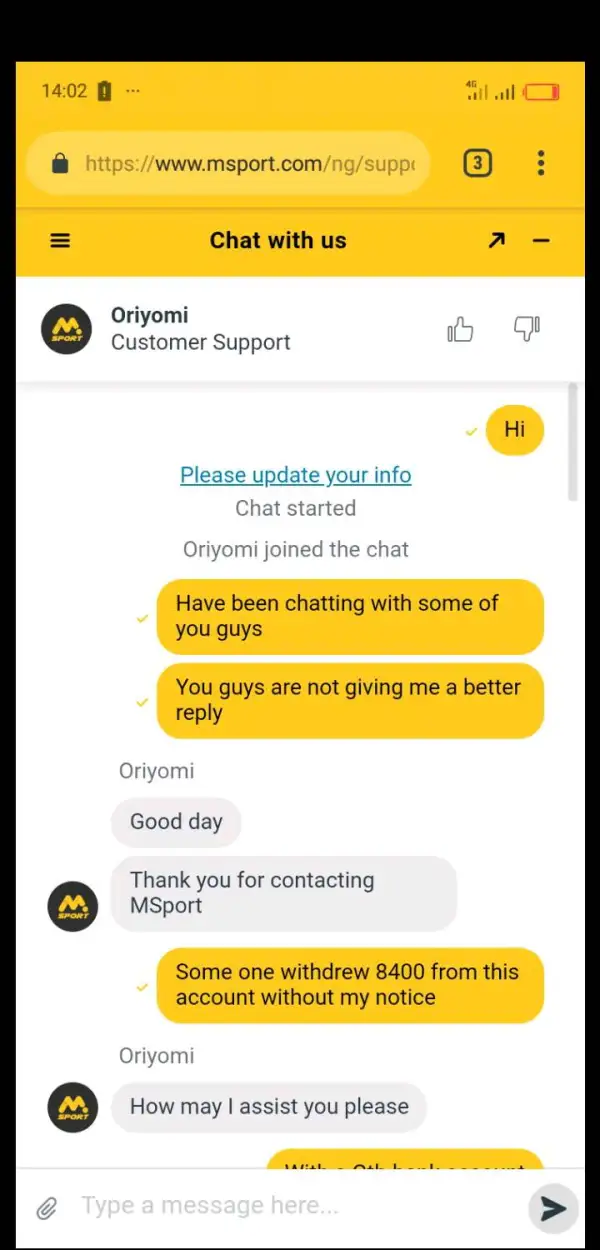

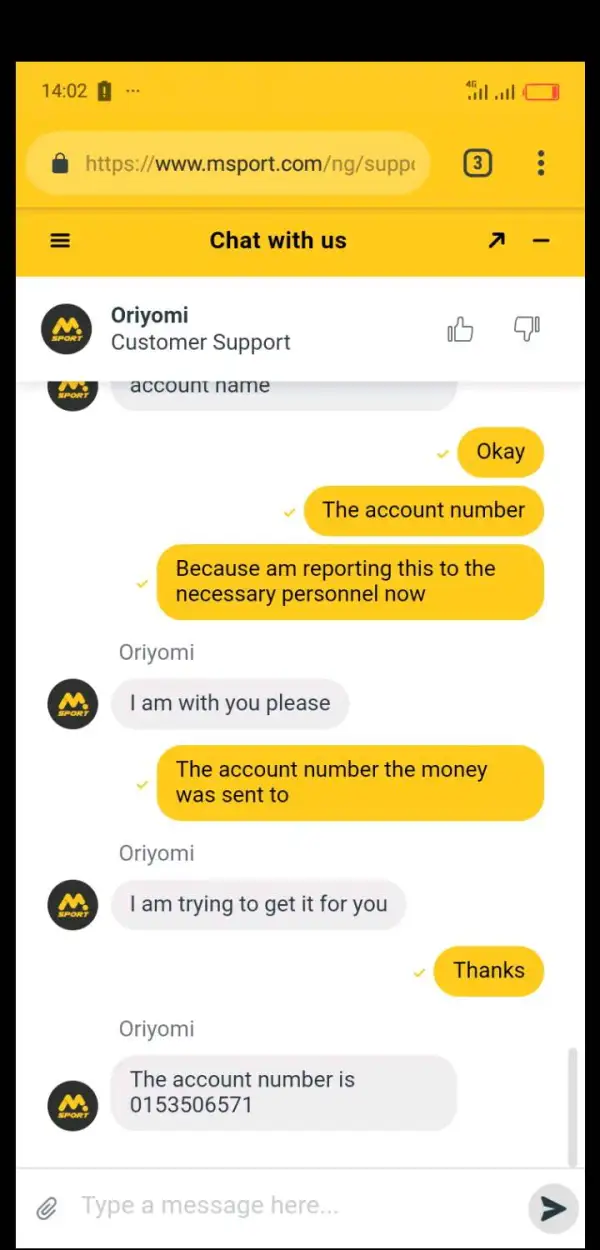

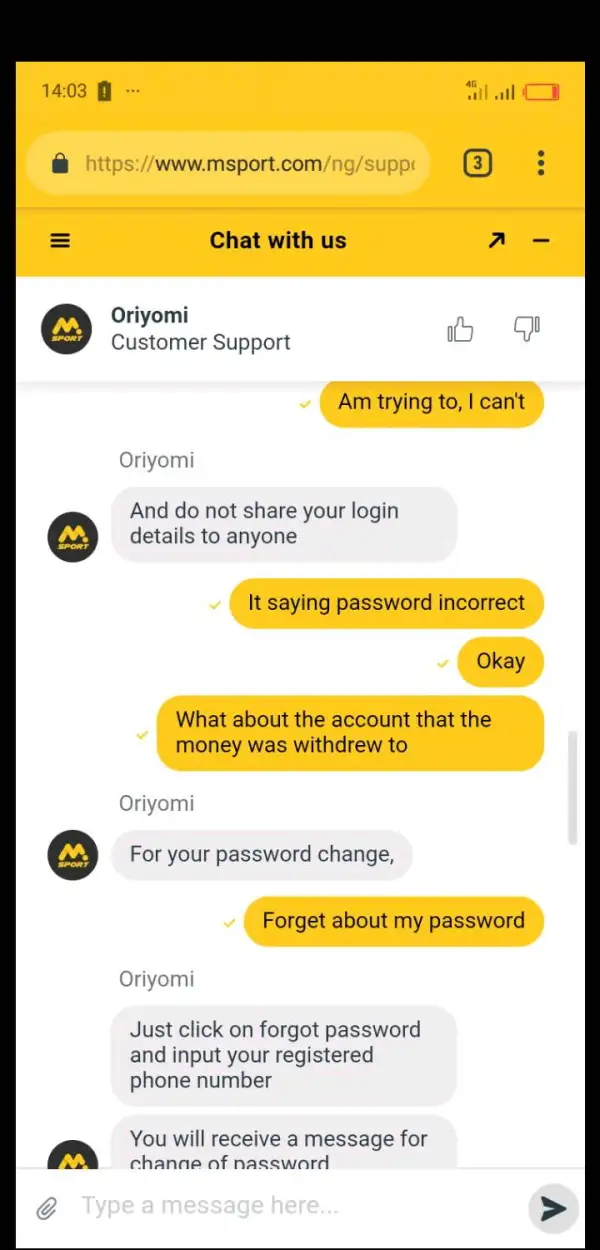

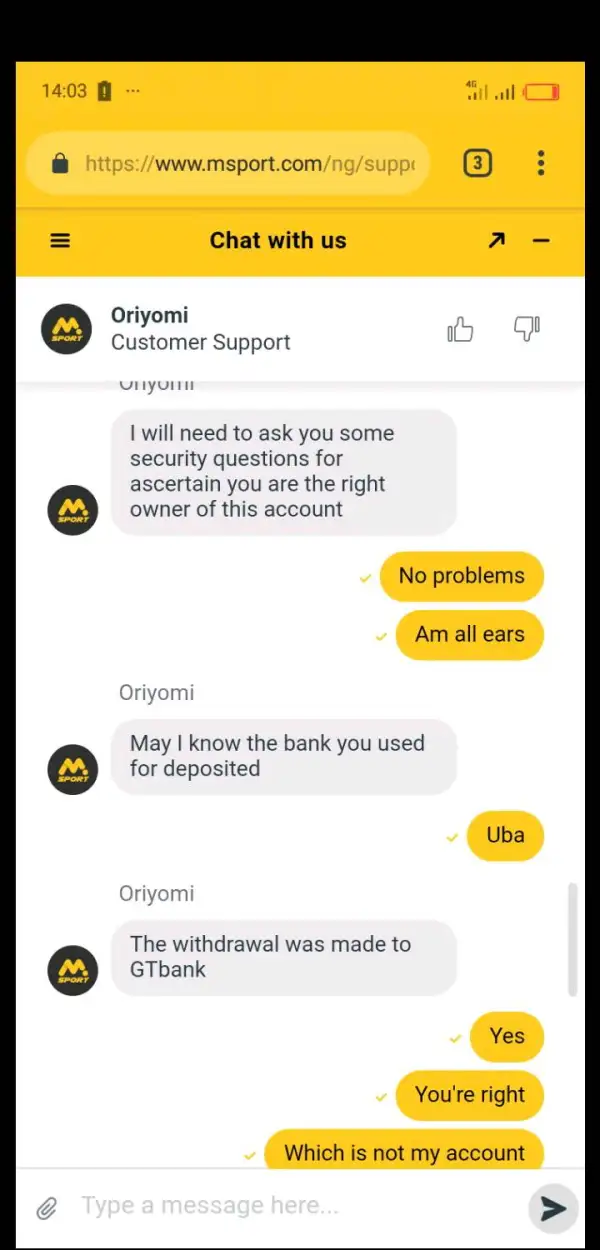

| Dukungan Pelanggan | Obrolan langsung, formulir kontak |

| Tel: +61 03 9008 1880 | |

| Email: admin@forexsport.com | |

| Alamat: Level 4 100 Collins Street Melbourne Victoria 3000 | |

| LinkedIn, YouTube, Facebook | |

Forex Sport terdaftar di Australia pada tahun 2011 dan diatur oleh ASIC. Mereka mengklaim menawarkan cara yang lebih murah dan lebih baik untuk mengirim uang Anda ke seluruh dunia.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Diatur oleh ASIC | Tidak ada |

| Berbagai layanan keuangan | |

| Tidak ada biaya untuk transaksi di atas $1000 | |

| Dukungan obrolan langsung |

Apakah Forex Sport Terpercaya?

Ya. Forex Sport diatur oleh Australia Securities & Investment Commission (ASIC).

| Negara yang Diatur | Otoritas yang Diatur | Status Saat Ini | Entitas yang Diatur | Jenis Lisensi | Nomor Lisensi |

|---|---|---|---|---|---|

| Australia Securities & Investment Commission (ASIC) | Diatur | FOREX SPORT PTY. LTD. | Market Making (MM) | 401379 |

Layanan

| Layanan | Didukung |

| Pembelian/Penjualan Aset | ✔ |

| Manajemen Risiko FX | ✔ |

| Pembayaran Pemasok Internasional | ✔ |

| Pembayaran Karyawan Secara Global | ✔ |

| Menerima Pembayaran Internasional | ✔ |

| Pajak | ✔ |

Biaya Forex Sport

Tidak ada biaya tersembunyi saat memproses Forex Sport, dan tidak ada biaya yang dikenakan untuk transaksi di atas 1000 USD.