Présentation de l'entreprise

| J.P. Morgan Résumé de l'examen | |

| Fondé | 1921 |

| Pays/Région enregistré | Chine Hong Kong |

| Régulation | SFC, Labuan FSA |

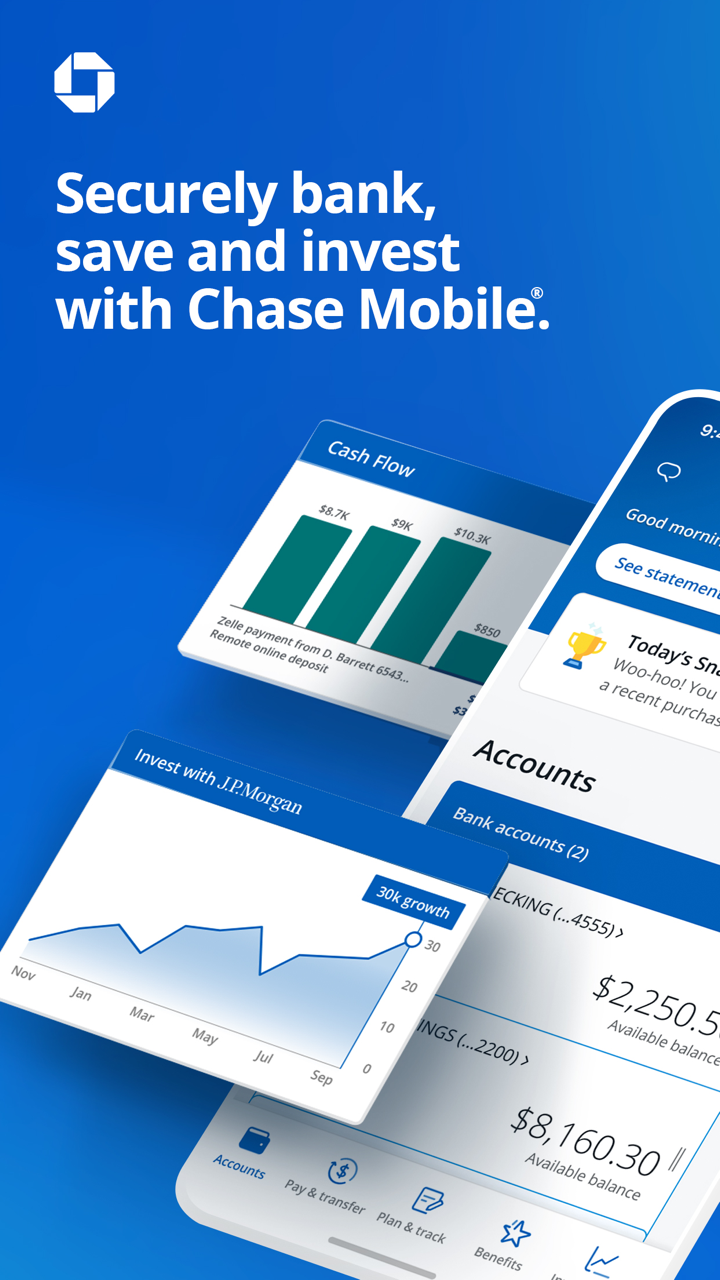

| Produits et services | Banque commerciale, Crédit et Financement, Investissement institutionnel, Banque d'investissement, Paiements |

| Support client | +86 10 5931 8888, +86 21 5200 2368 |

Informations sur J.P. Morgan

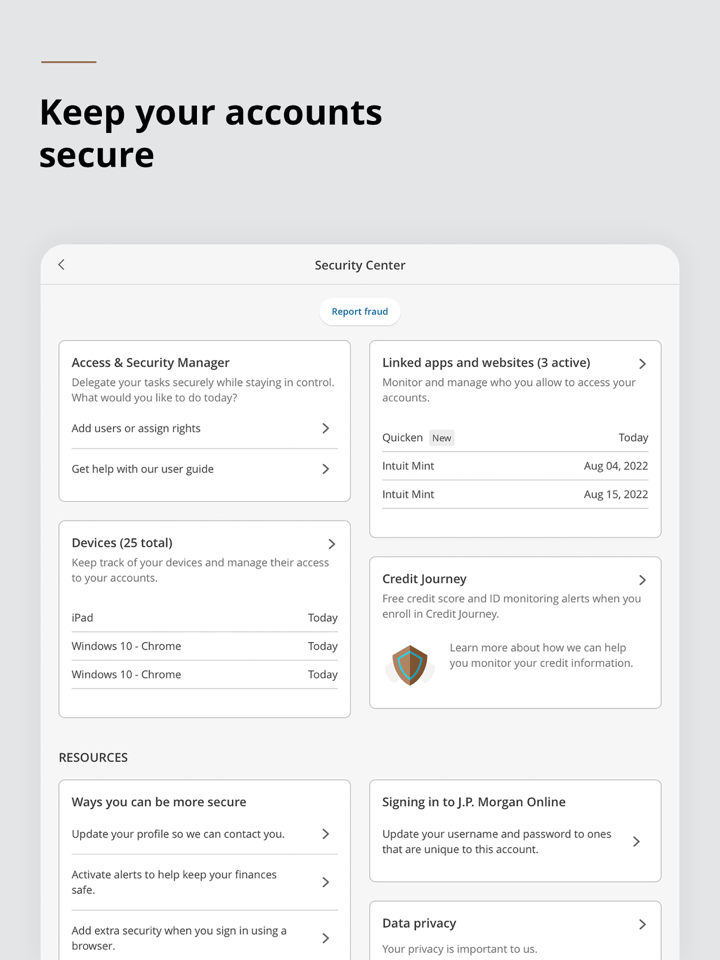

J.P. Morgan, réglementé par la SFC en Chine, à Hong Kong, et par la Labuan FSA en Malaisie, est un leader financier mondial offrant des services diversifiés, notamment la banque commerciale, la banque d'investissement, le crédit et le financement, l'investissement institutionnel et les paiements. La plateforme sert diverses industries, offrant des solutions financières sur mesure aux entreprises, aux institutions et aux investisseurs.

Avantages et Inconvénients

| Avantages | Inconvénients |

|

|

|

Est-ce que J.P. Morgan est légitime ?

J.P. Morgan est réglementé en Chine, à Hong Kong par la Securities and Futures Commission (SFC) pour le négoce de contrats à terme sous les numéros de licence AAB027 et AAA121, et également réglementé en Malaisie par l'Autorité des services financiers de Labuan (Labuan FSA) en tant que Market Maker.

| Statut réglementaire | Réglementé | Réglementé | Réglementé |

| Réglementé par | Chine Hong Kong | Chine Hong Kong | Malaisie |

| Institution agréée | La Securities and Futures Commission (SFC) | La Securities and Futures Commission (SFC) | Autorité des services financiers de Labuan (Labuan FSA) |

| Type de licence | Négociation de contrats à terme | Négociation de contrats à terme | Market Maker (MM) |

| Numéro de licence | AAB027 | AAA121 | Non publié |

Produits et services

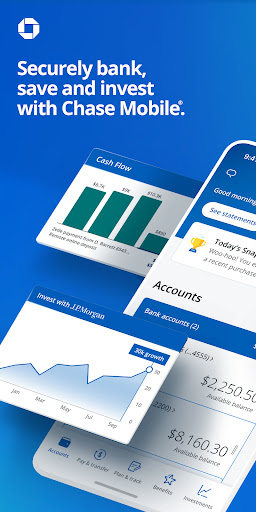

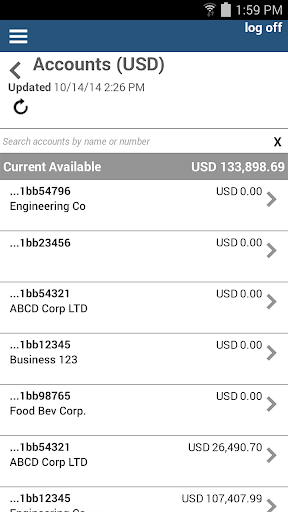

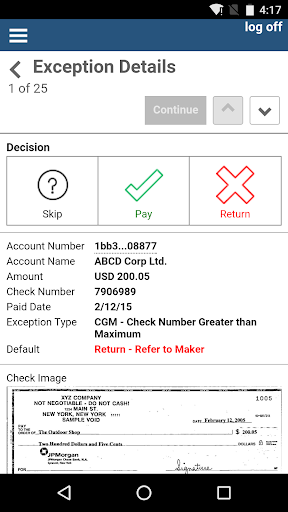

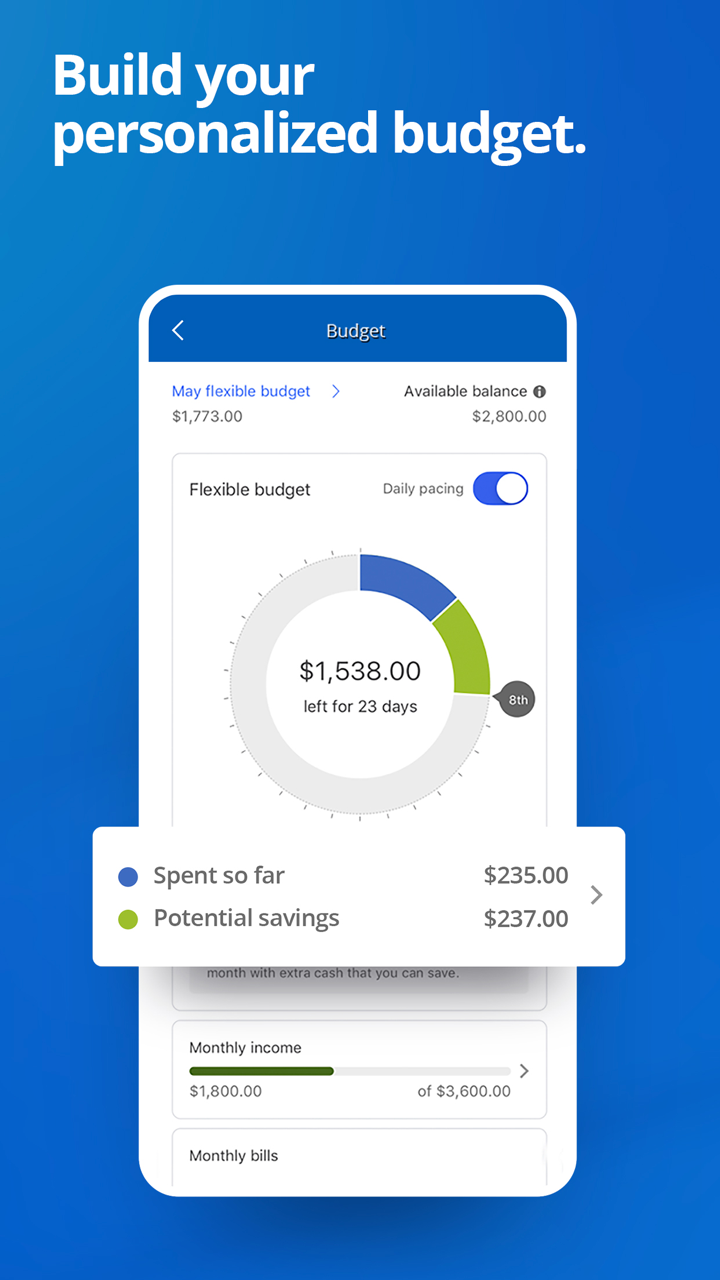

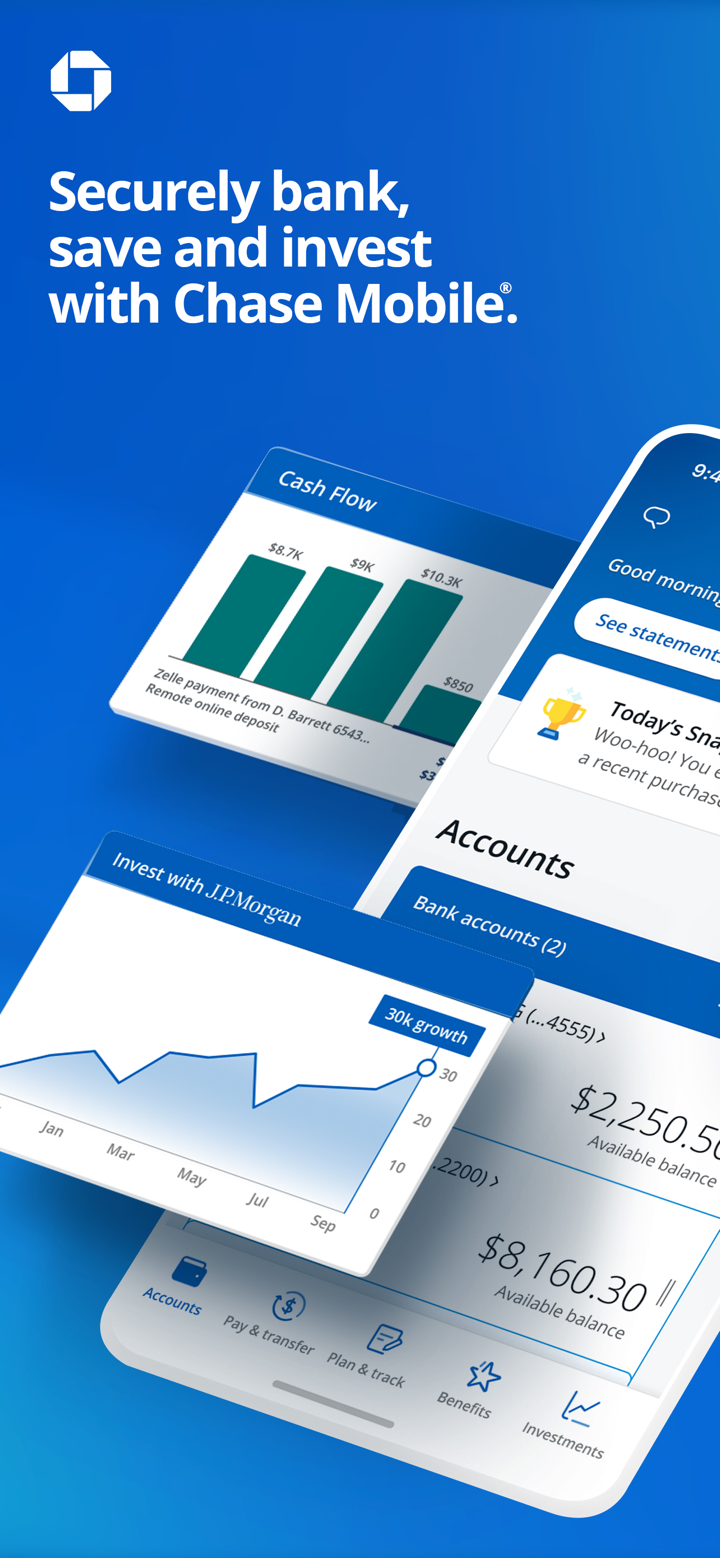

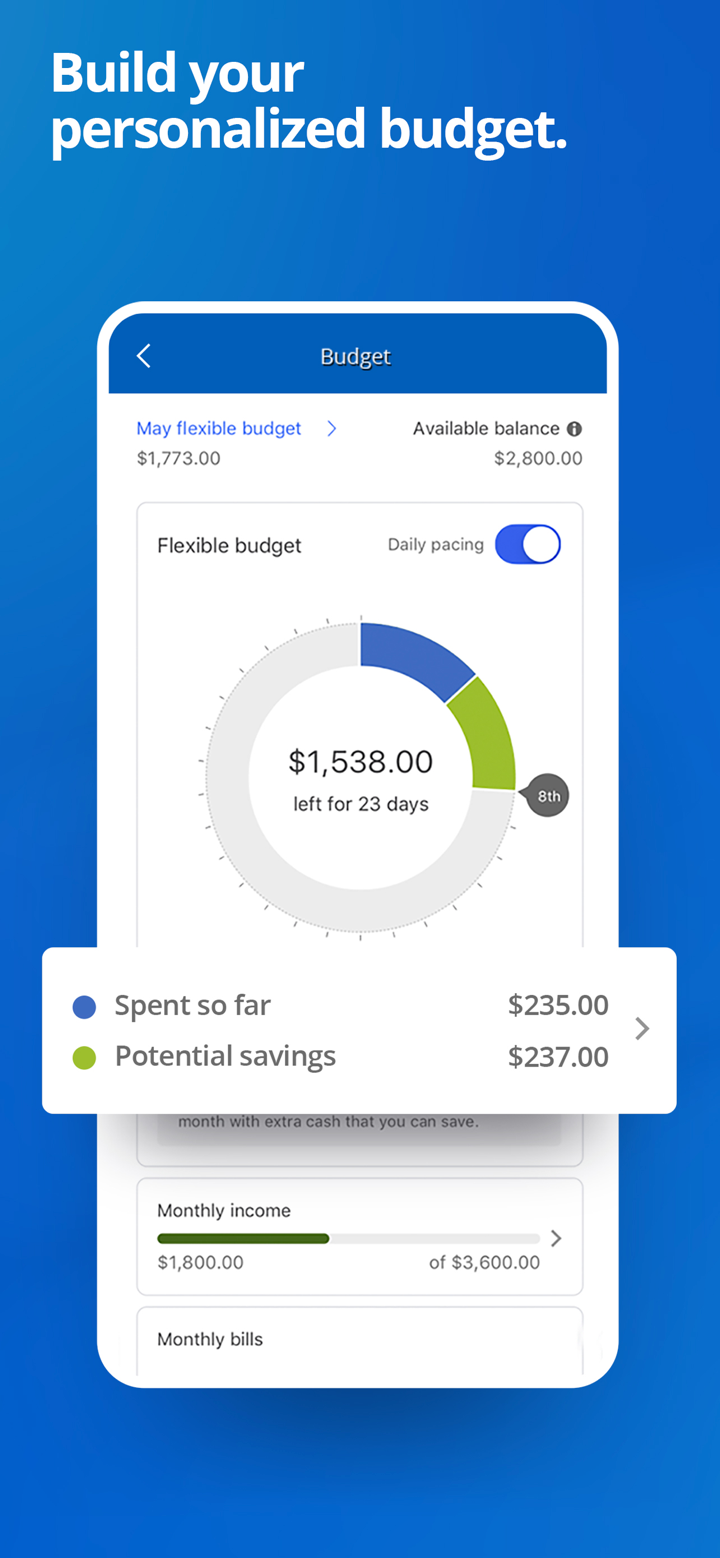

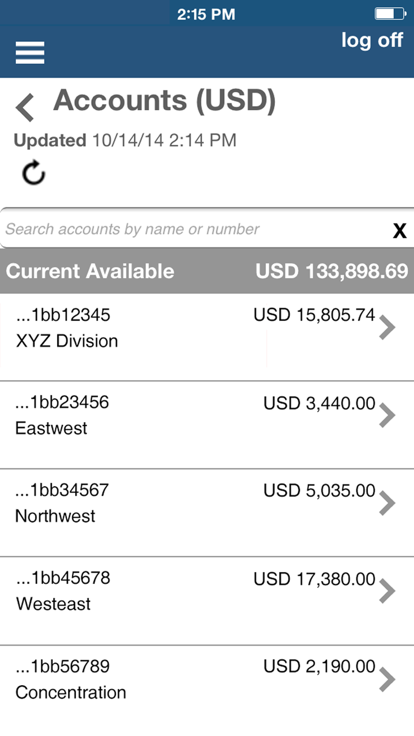

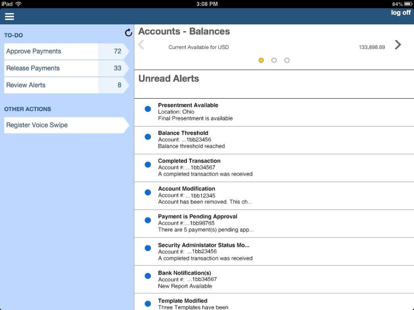

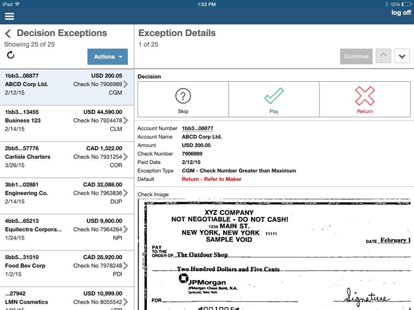

- Services bancaires commerciaux: J.P. Morgan propose des services bancaires commerciaux, offrant des solutions de crédit, de financement, de trésorerie et de paiement, ainsi que des services immobiliers commerciaux pour les investisseurs et les promoteurs.

- Services bancaires d'investissement: J.P. Morgan fournit des services bancaires d'investissement aux entreprises, aux gouvernements et aux institutions. Ces services comprennent des conseils en fusions et acquisitions (M&A), des levées de fonds en dette et en actions, des restructurations, des conseils stratégiques et des solutions de financement d'entreprise.

- Crédit et financement: J.P. Morgan propose des options de crédit et de financement de classe mondiale, y compris le prêt sur actifs pour améliorer la liquidité, le financement d'équipement pour un capital flexible, les plans de participation des employés pour les affaires et l'avenir des employés, et le financement syndiqué pour des solutions de prêt personnalisées.

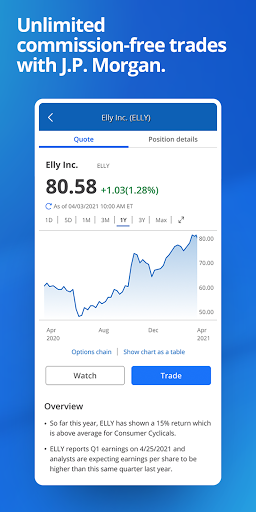

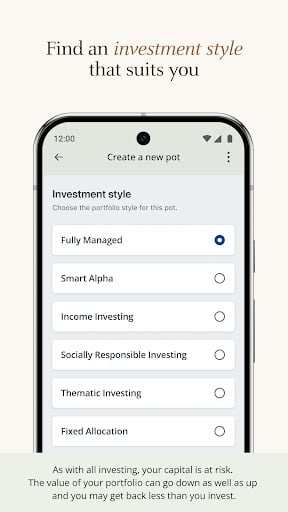

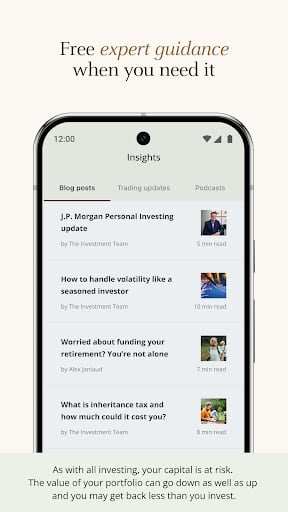

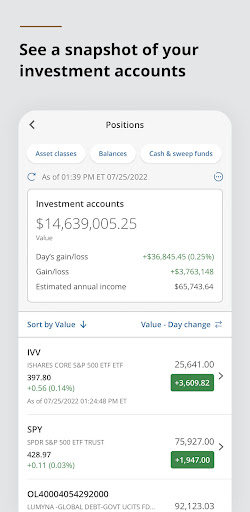

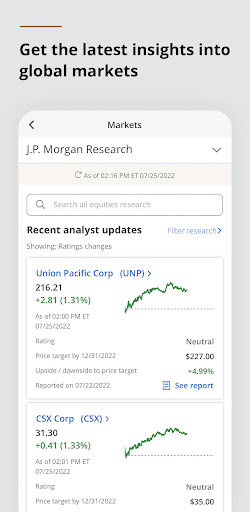

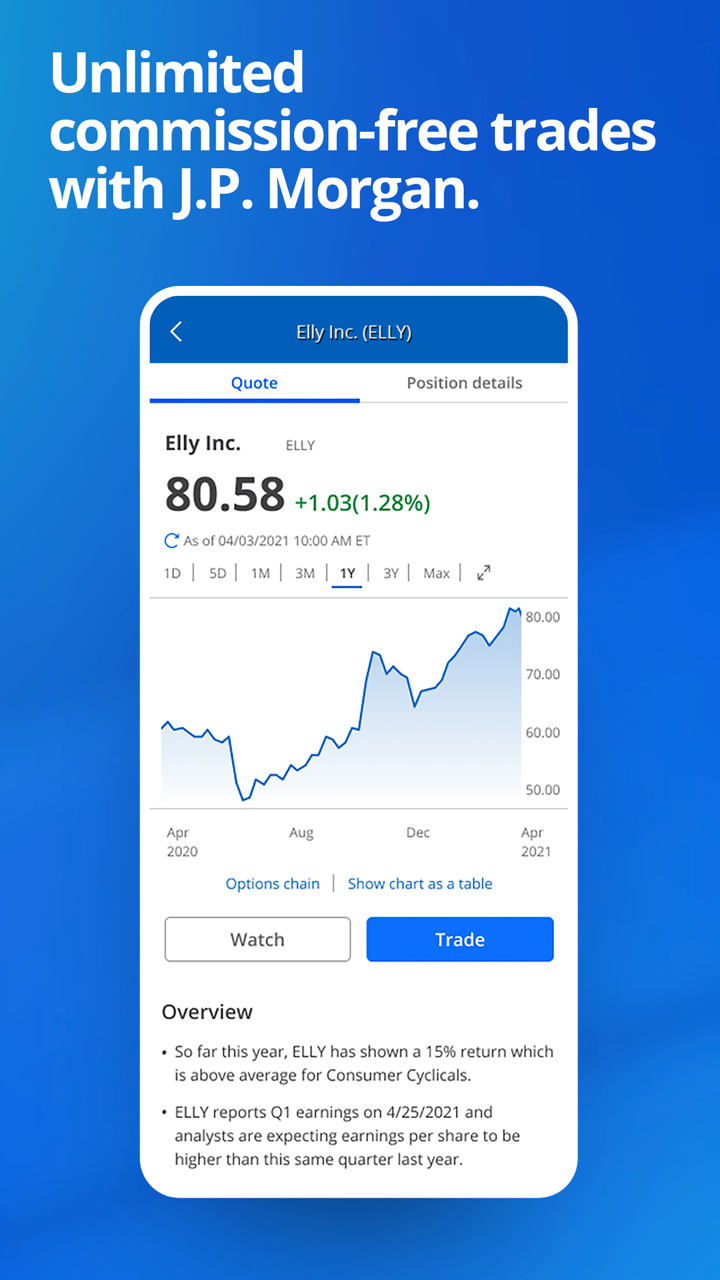

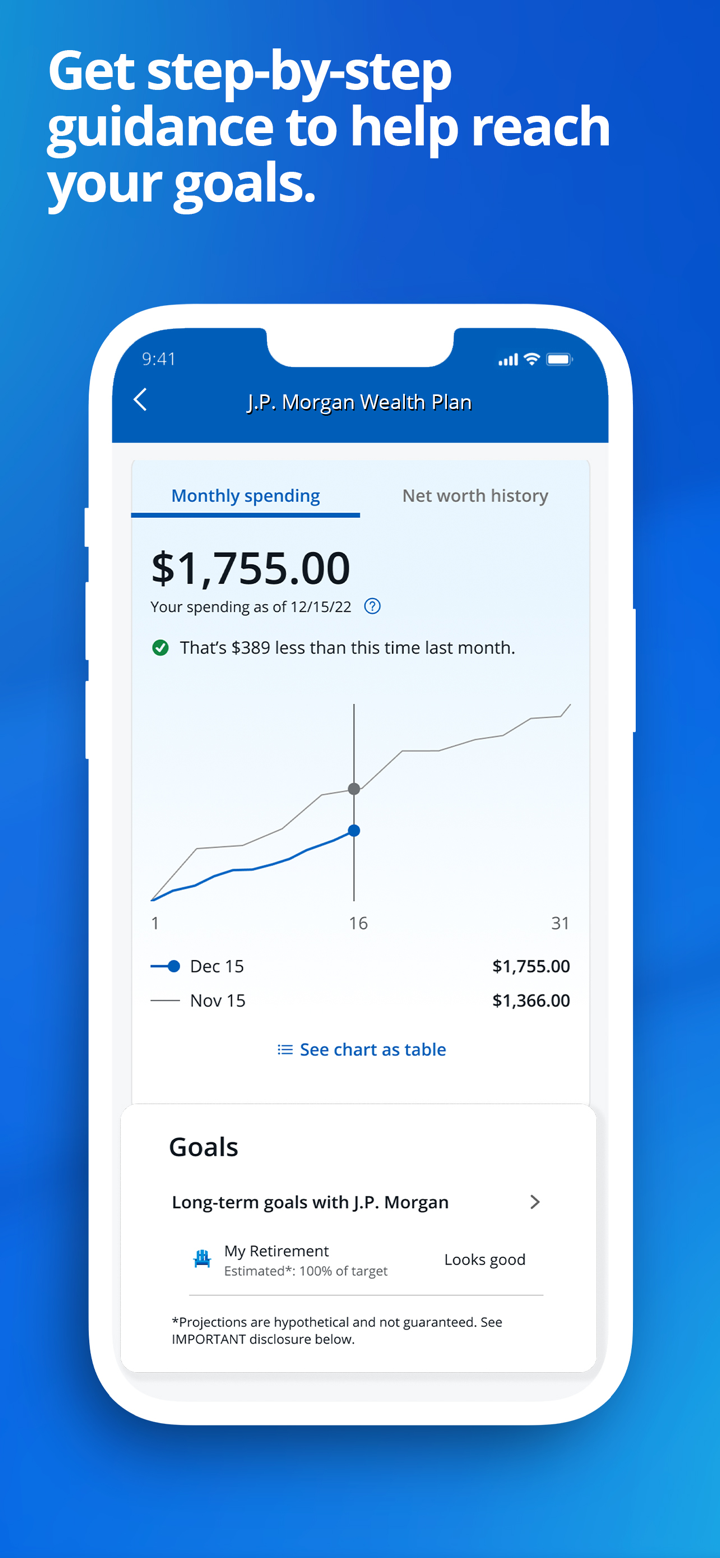

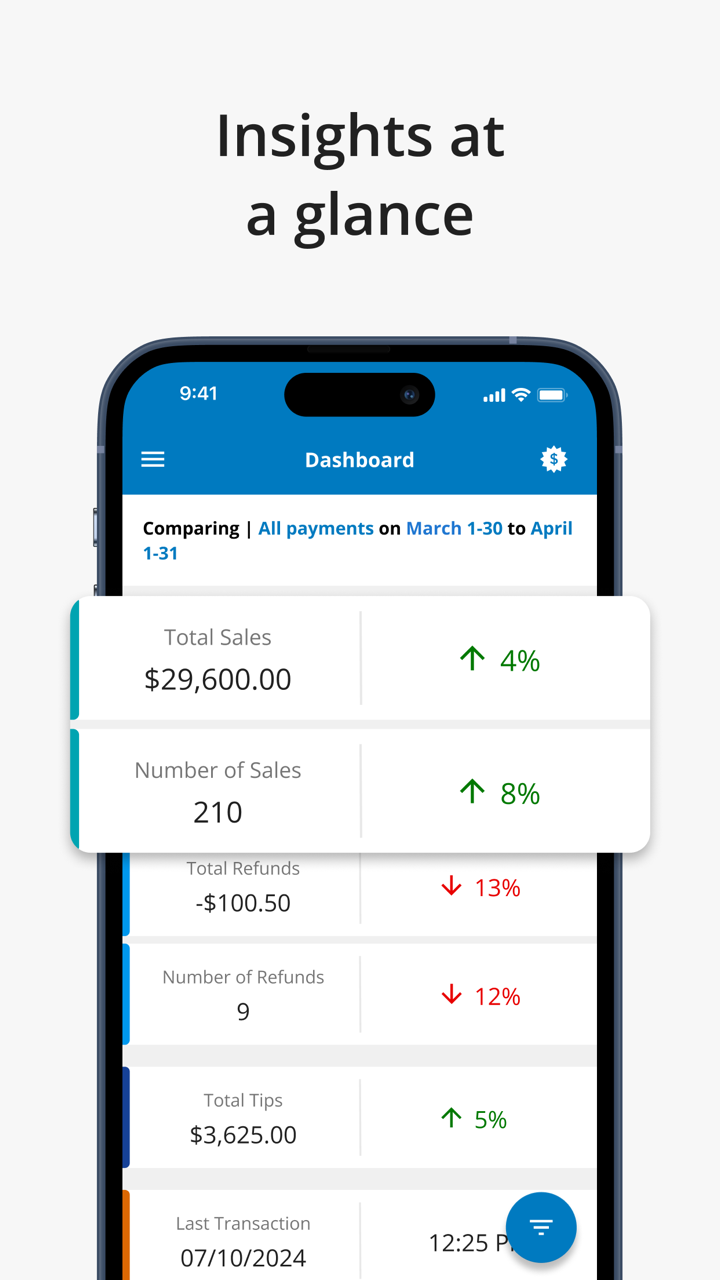

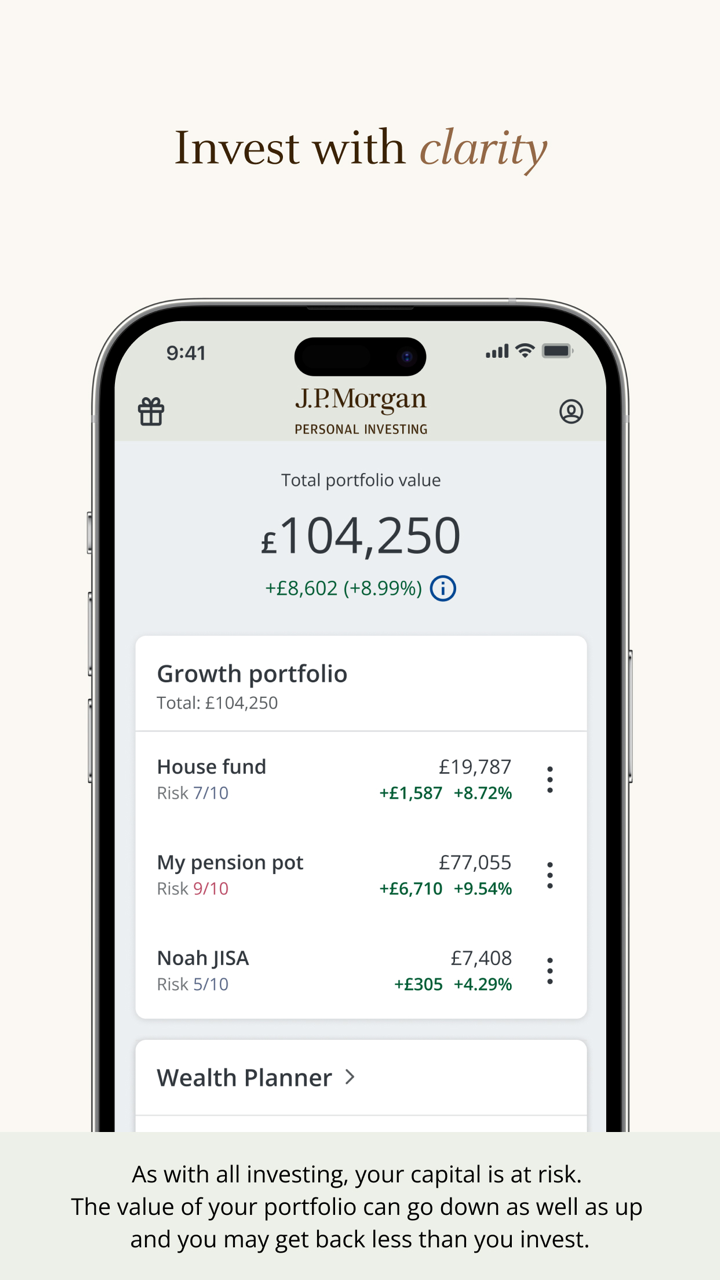

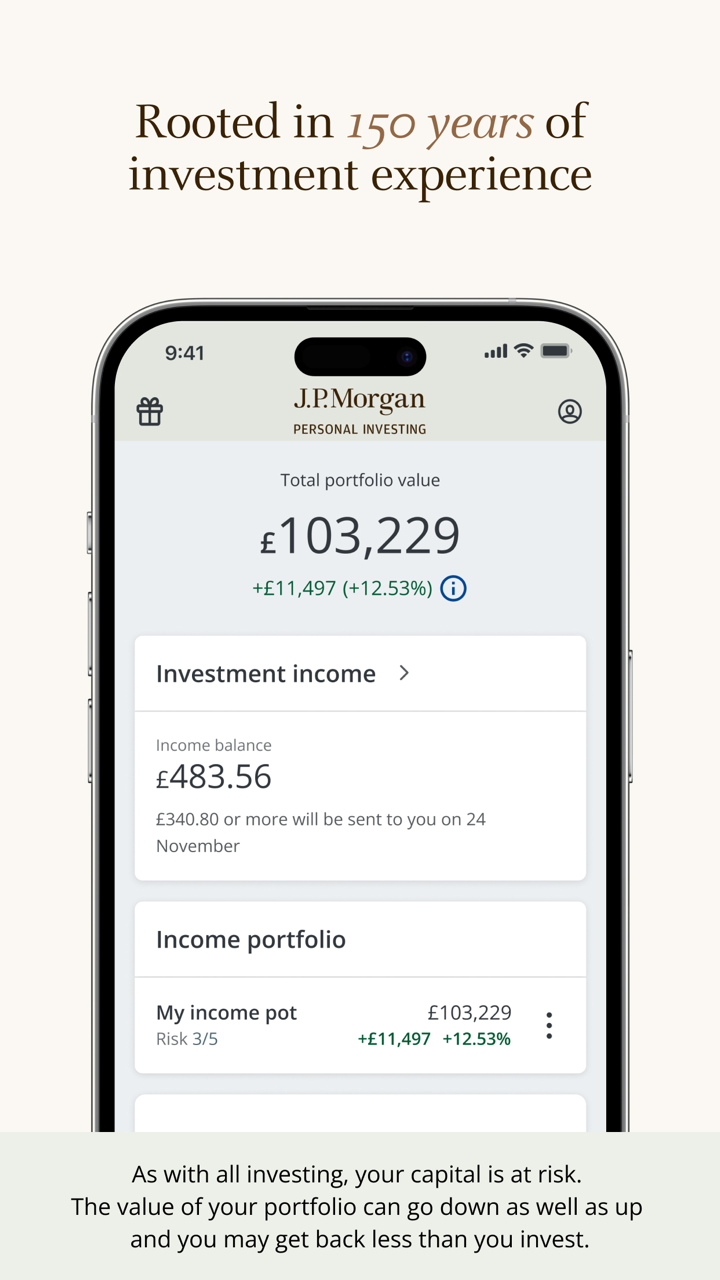

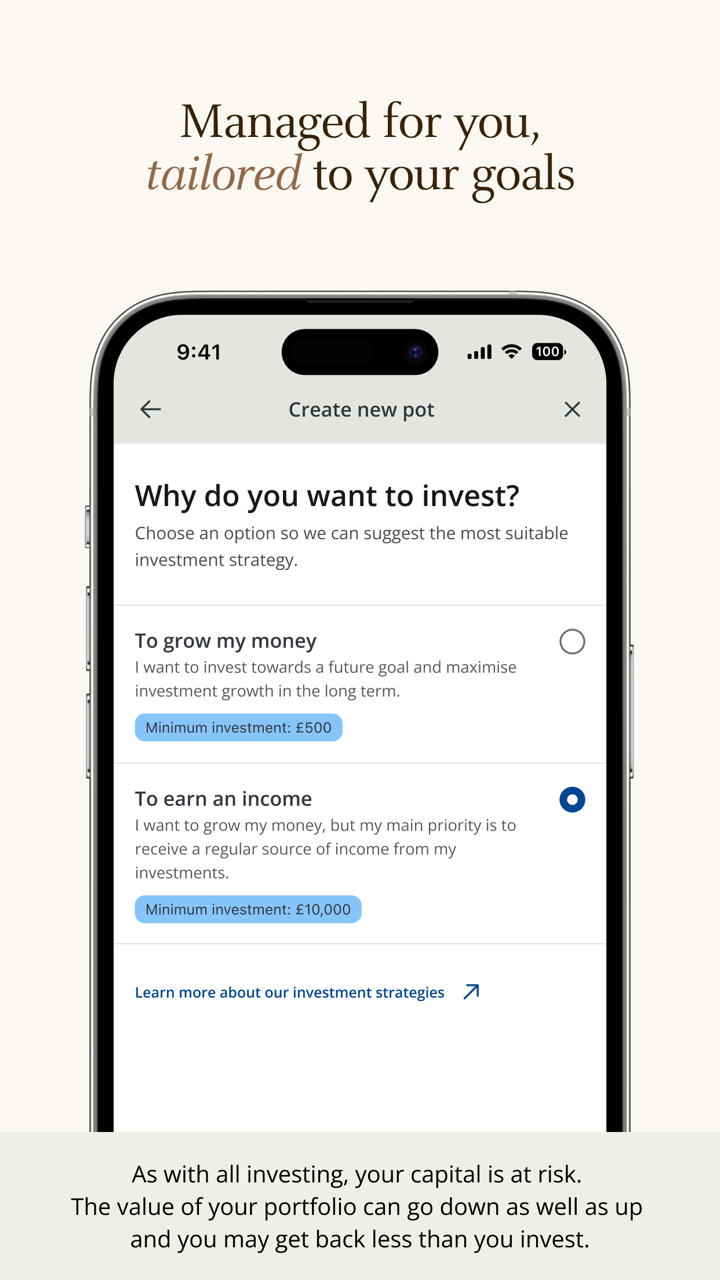

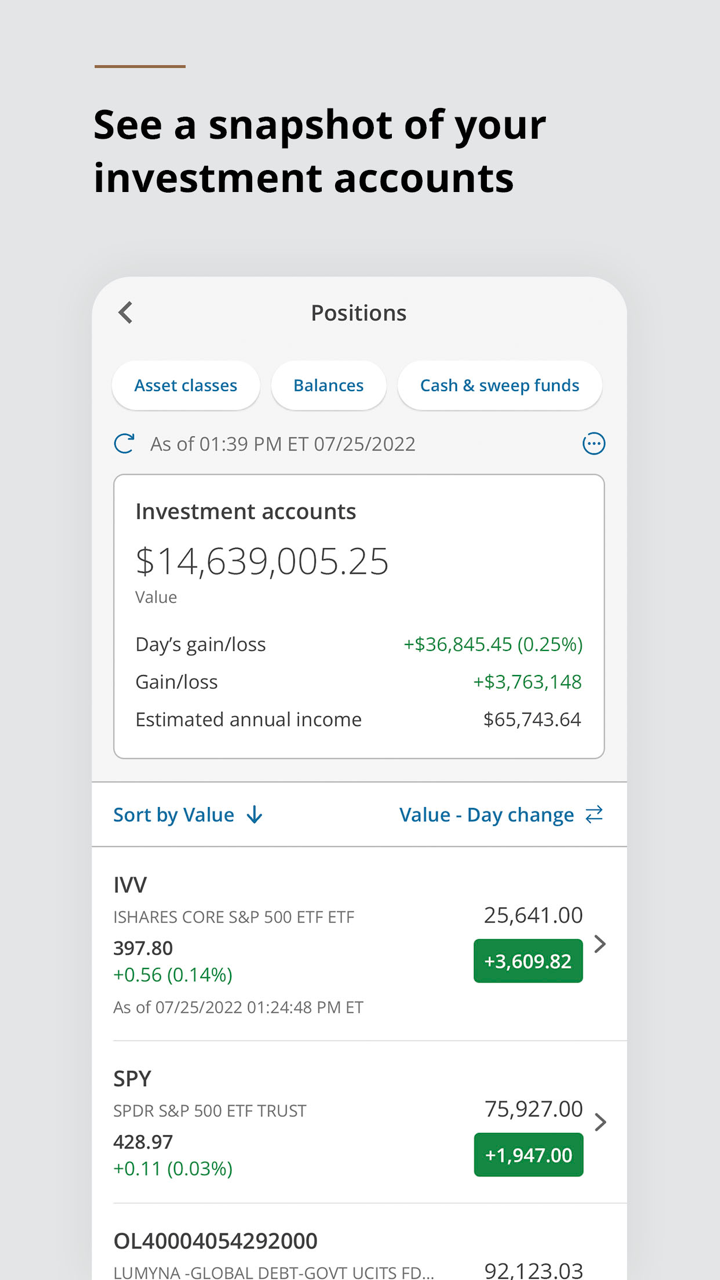

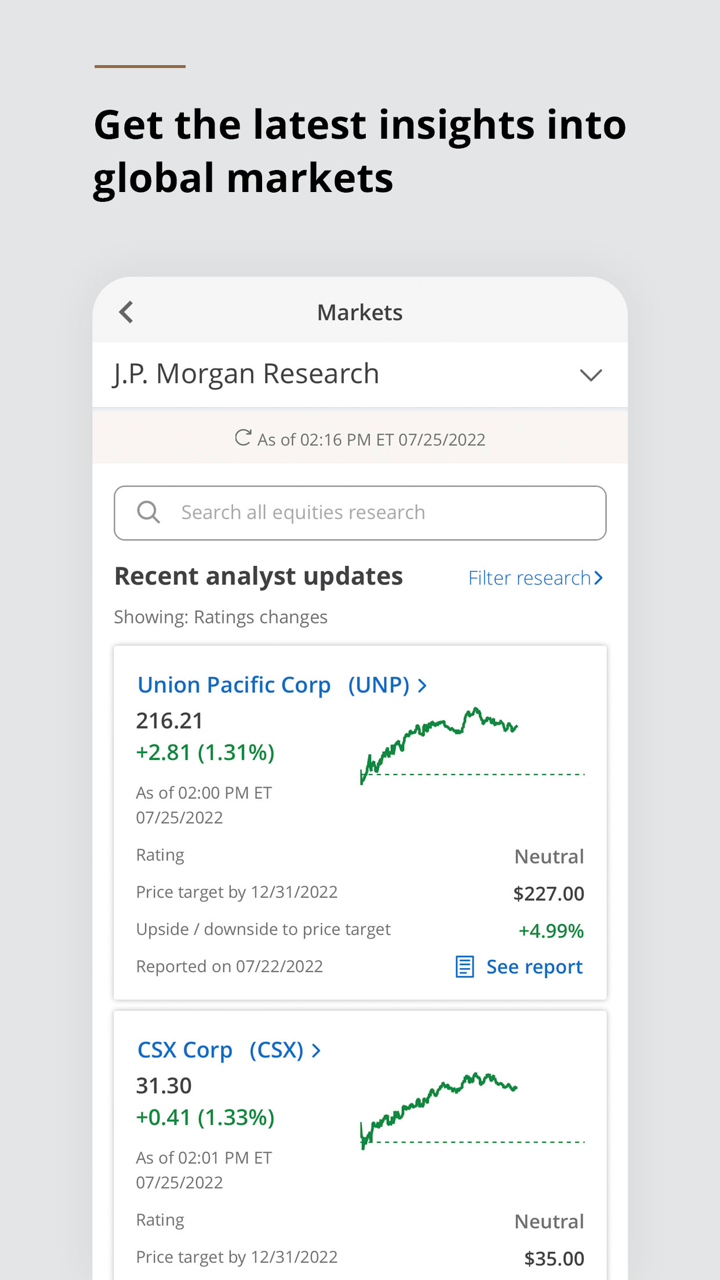

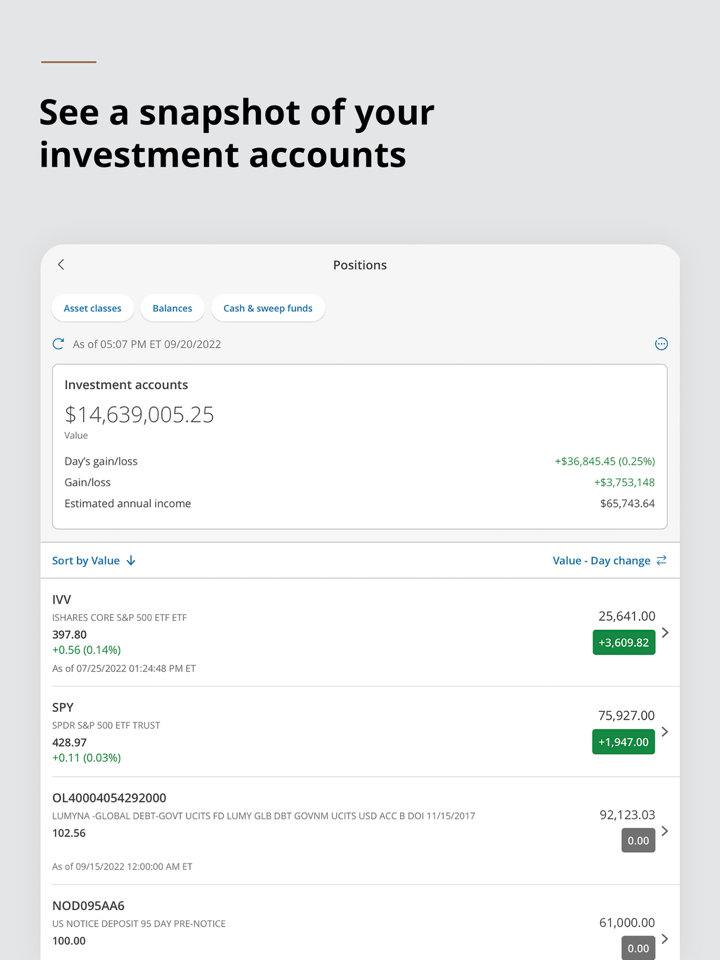

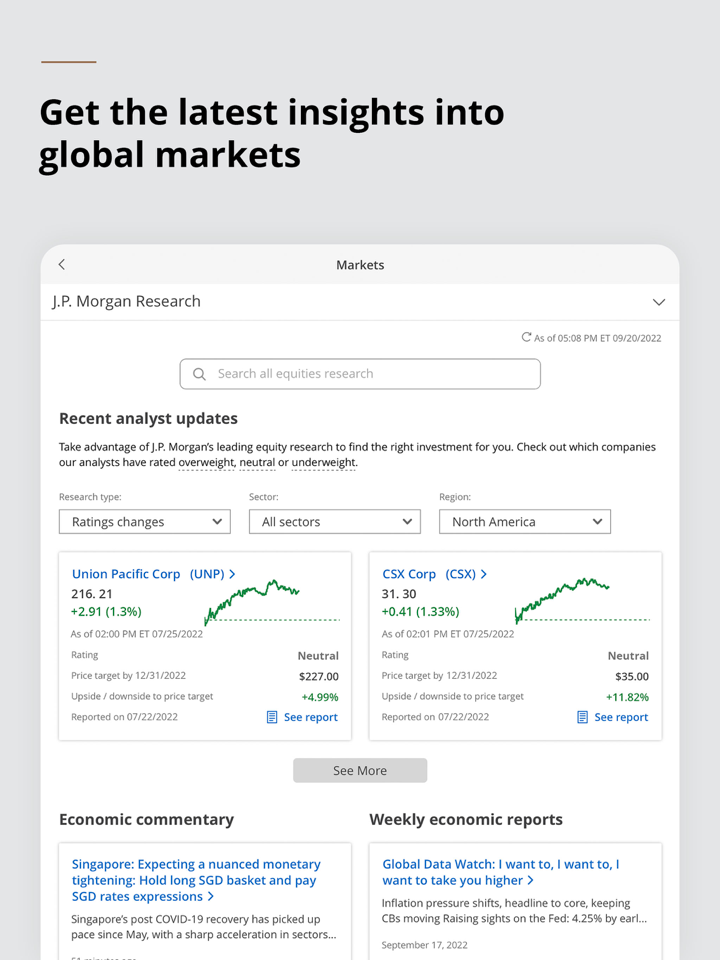

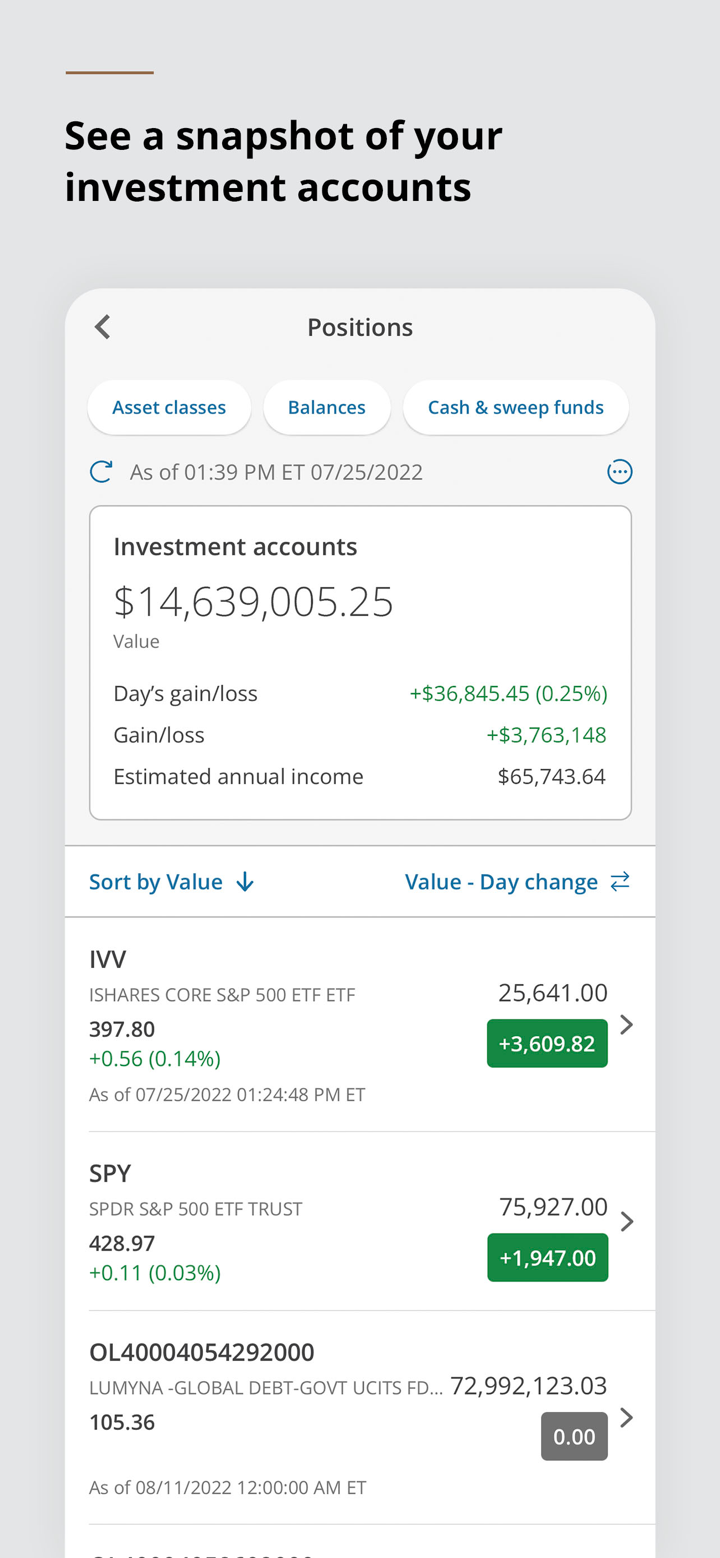

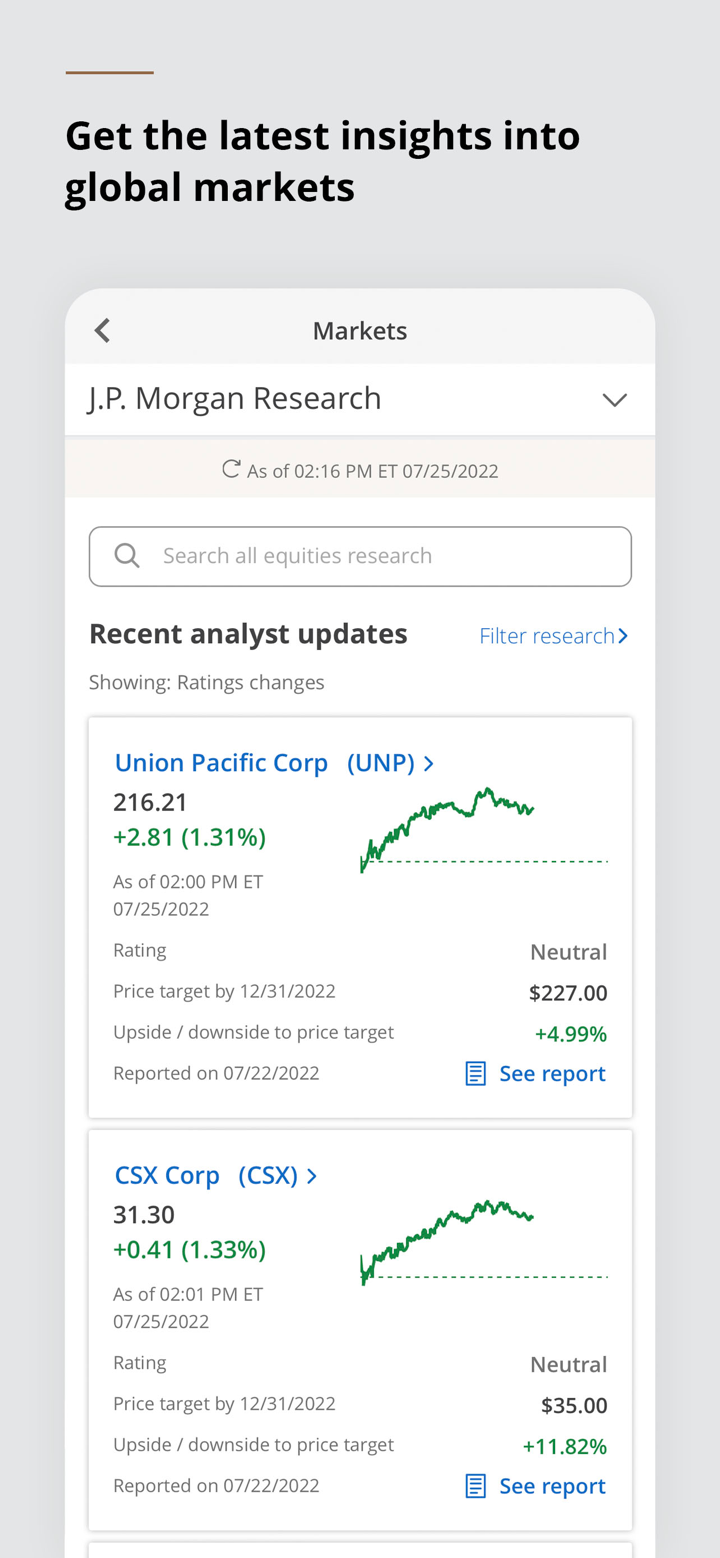

- Investissement institutionnel: L'investissement institutionnel de J.P. Morgan sert les plus grandes entreprises mondiales et les investisseurs institutionnels en soutenant l'ensemble du cycle d'investissement avec une recherche de pointe, des analyses, des exécutions et des services aux investisseurs.

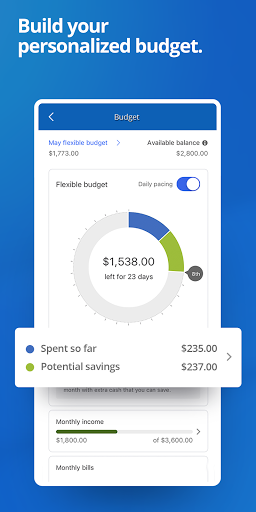

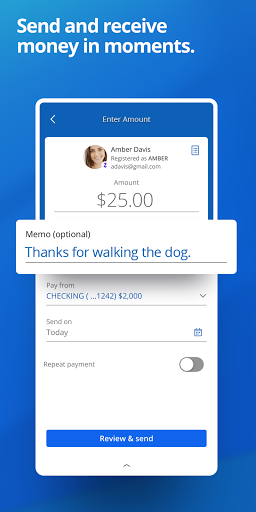

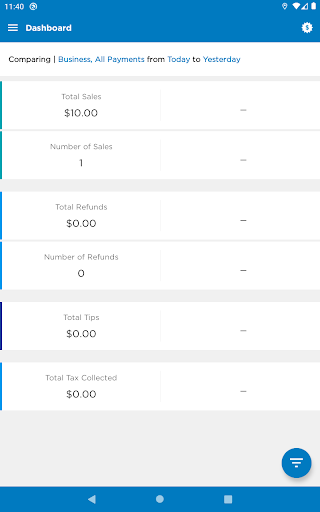

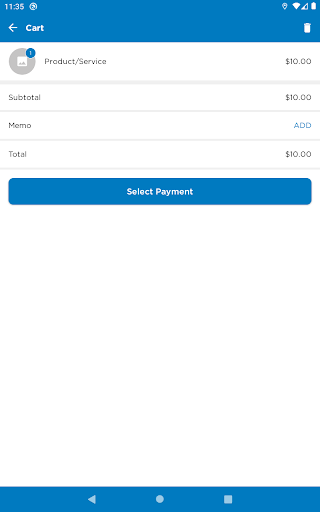

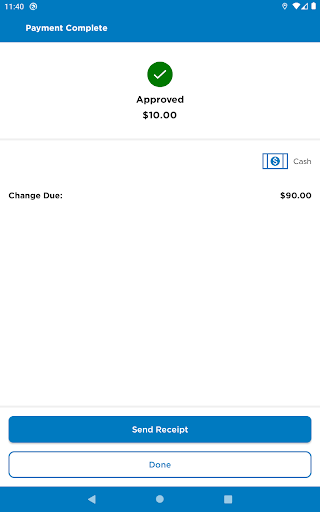

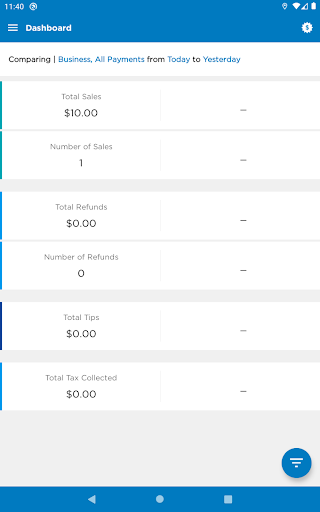

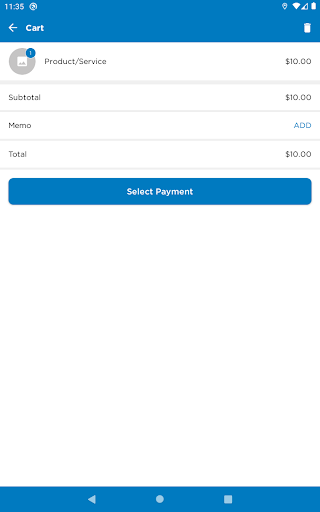

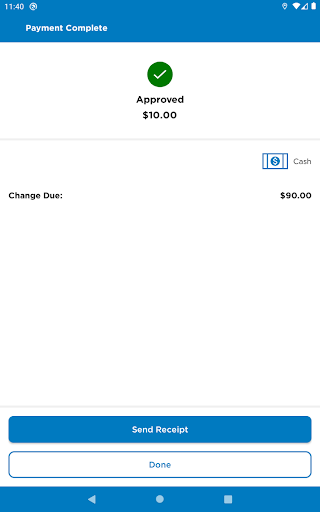

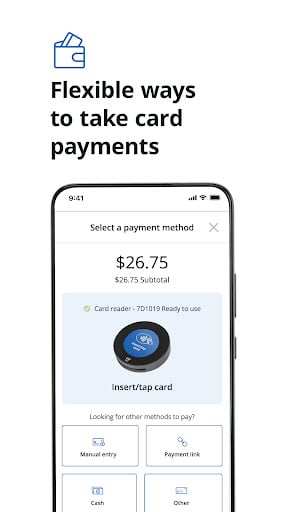

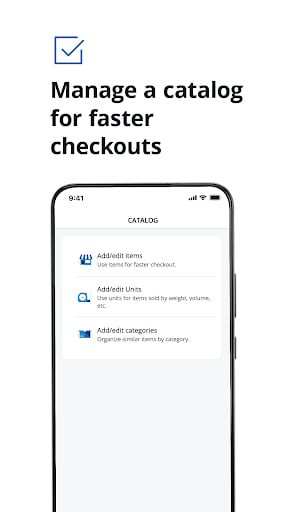

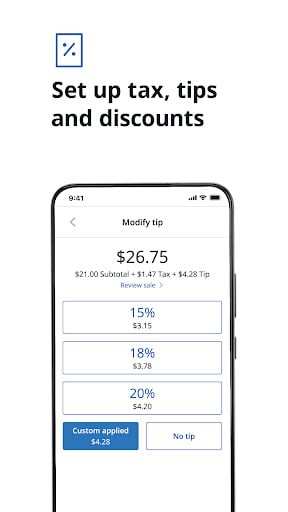

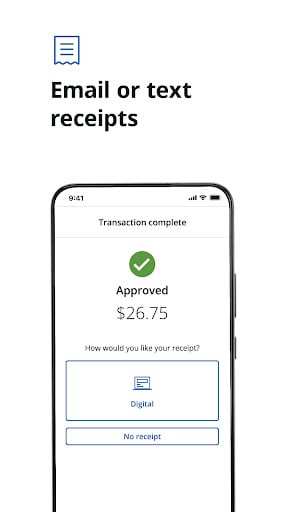

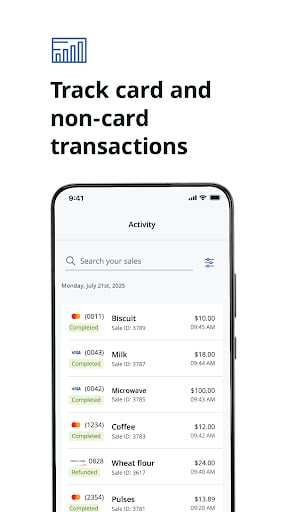

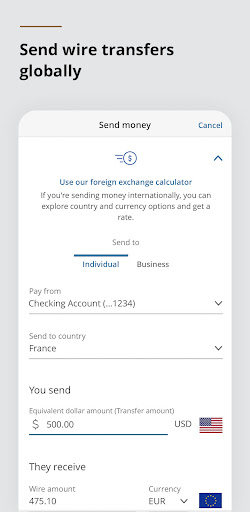

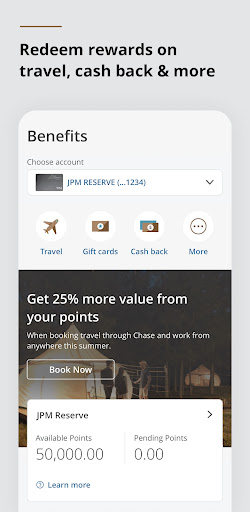

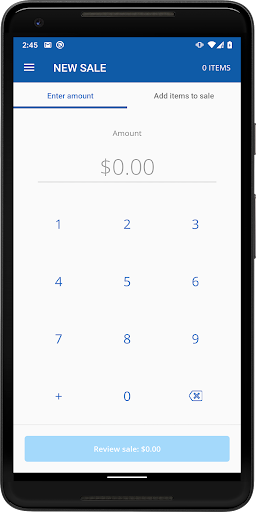

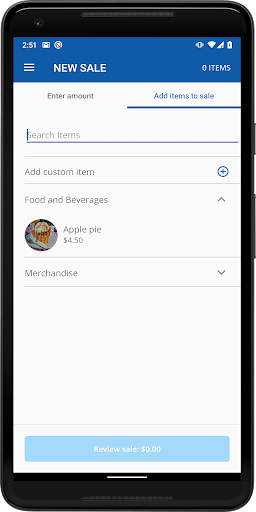

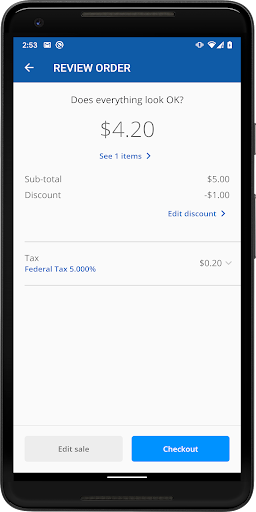

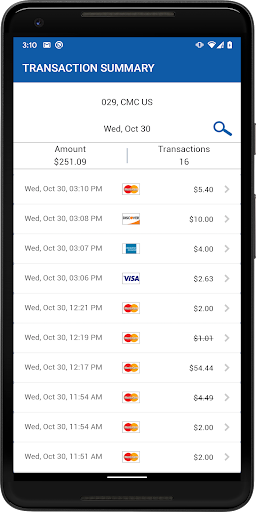

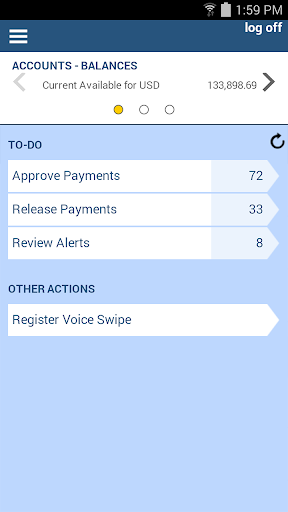

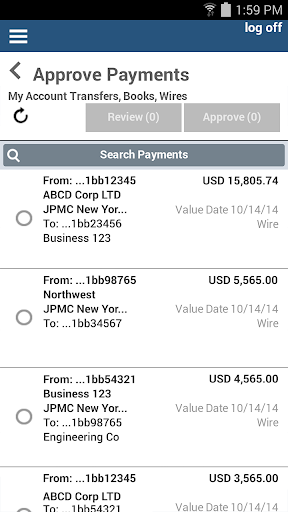

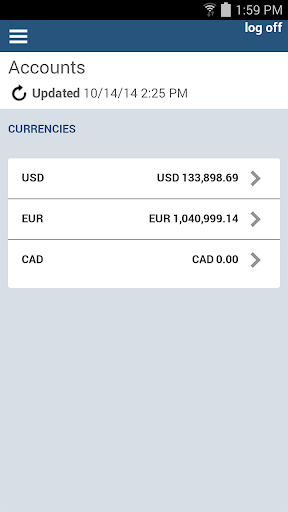

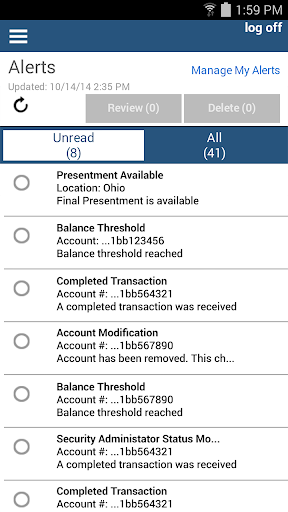

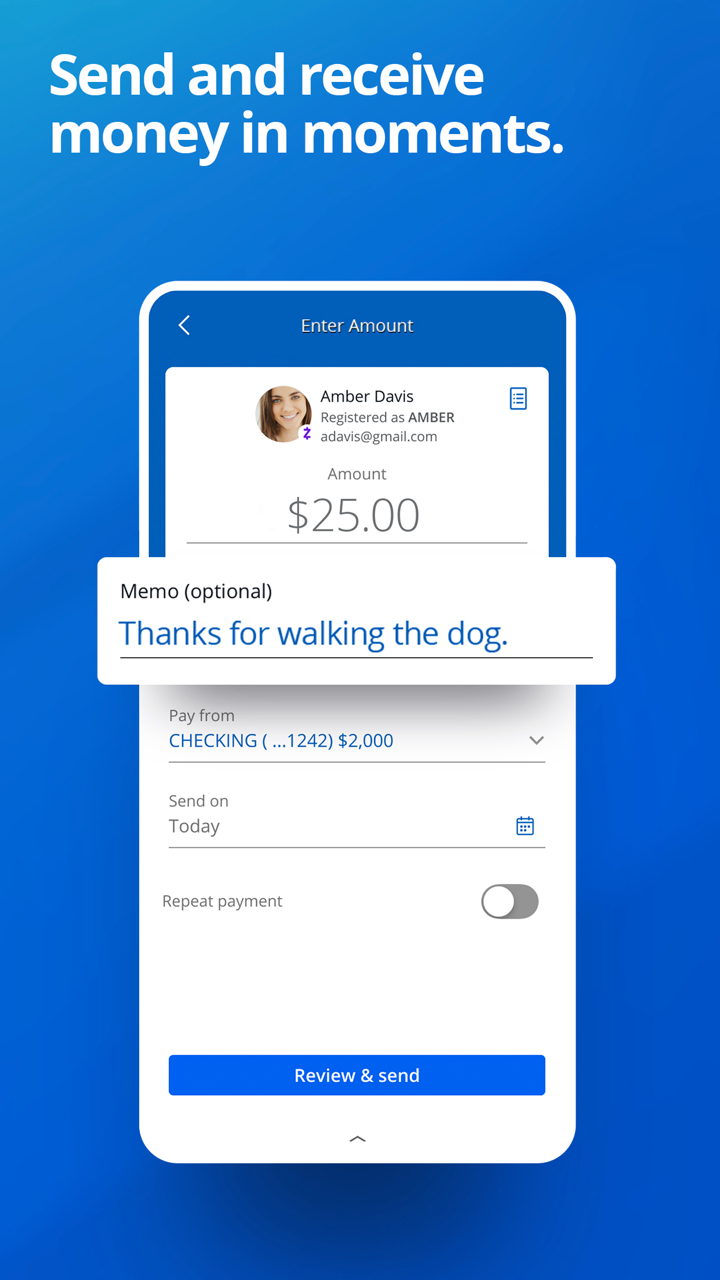

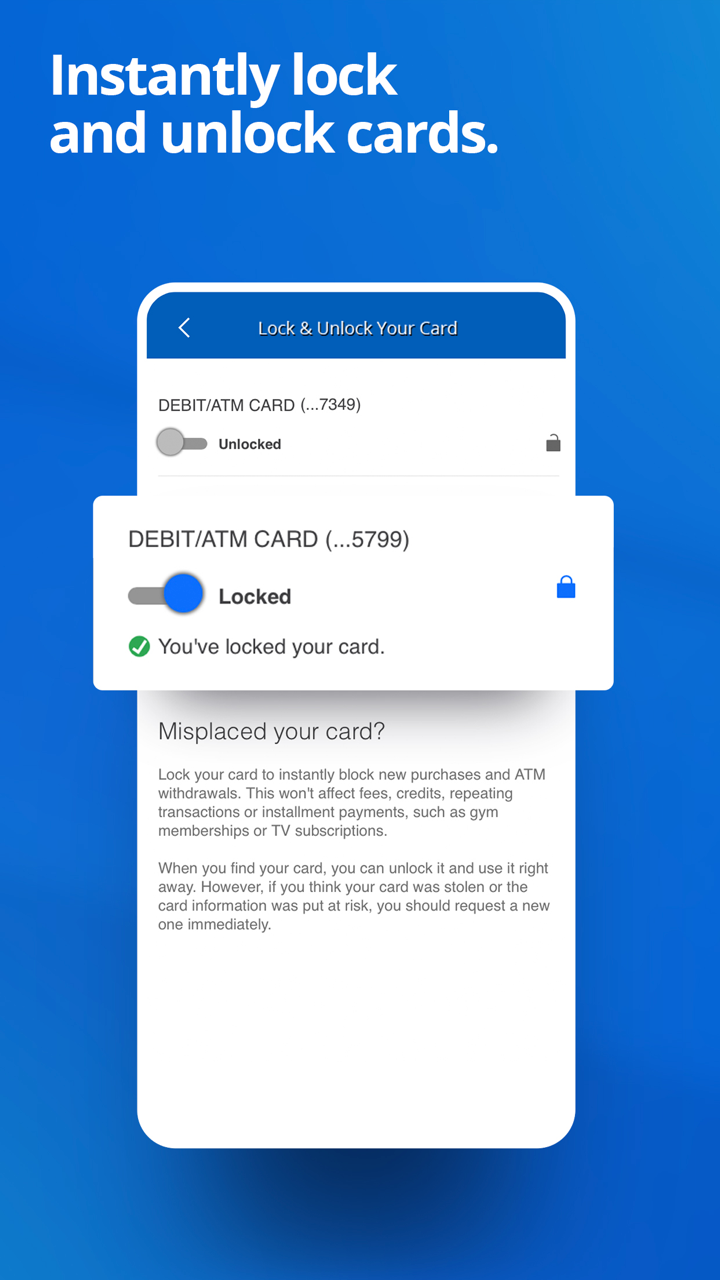

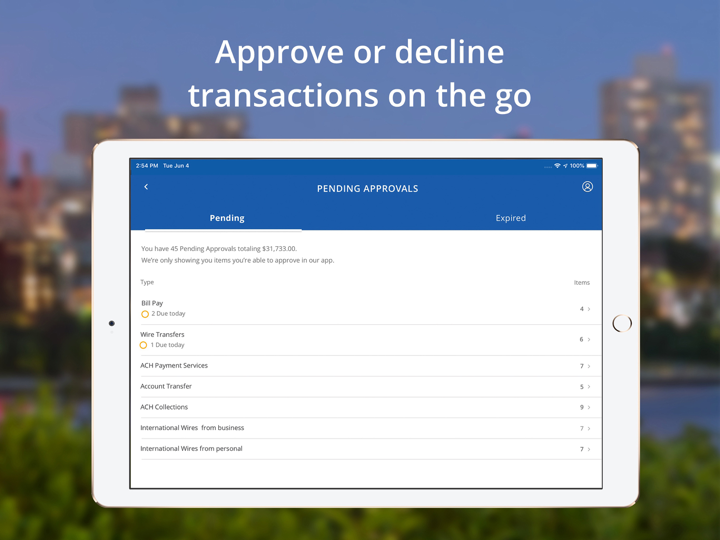

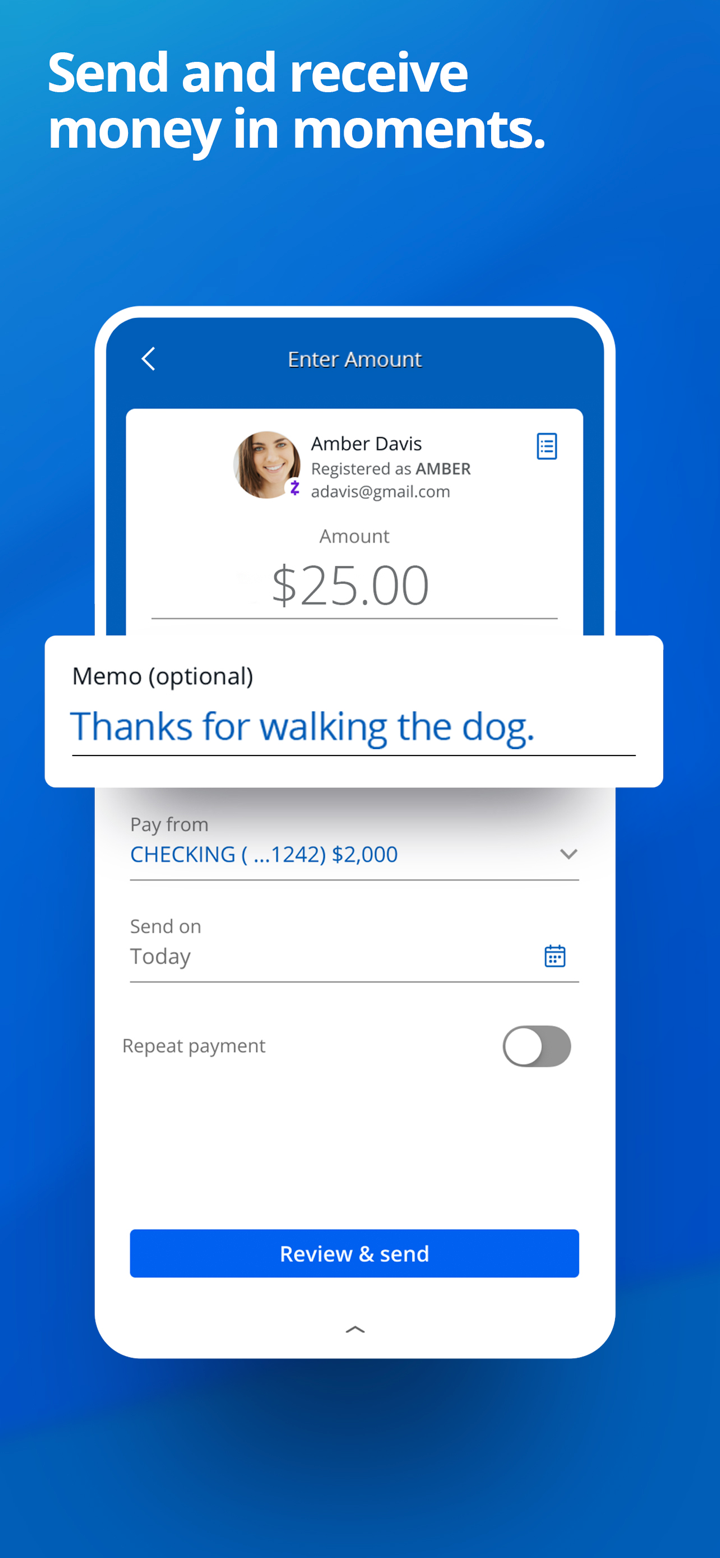

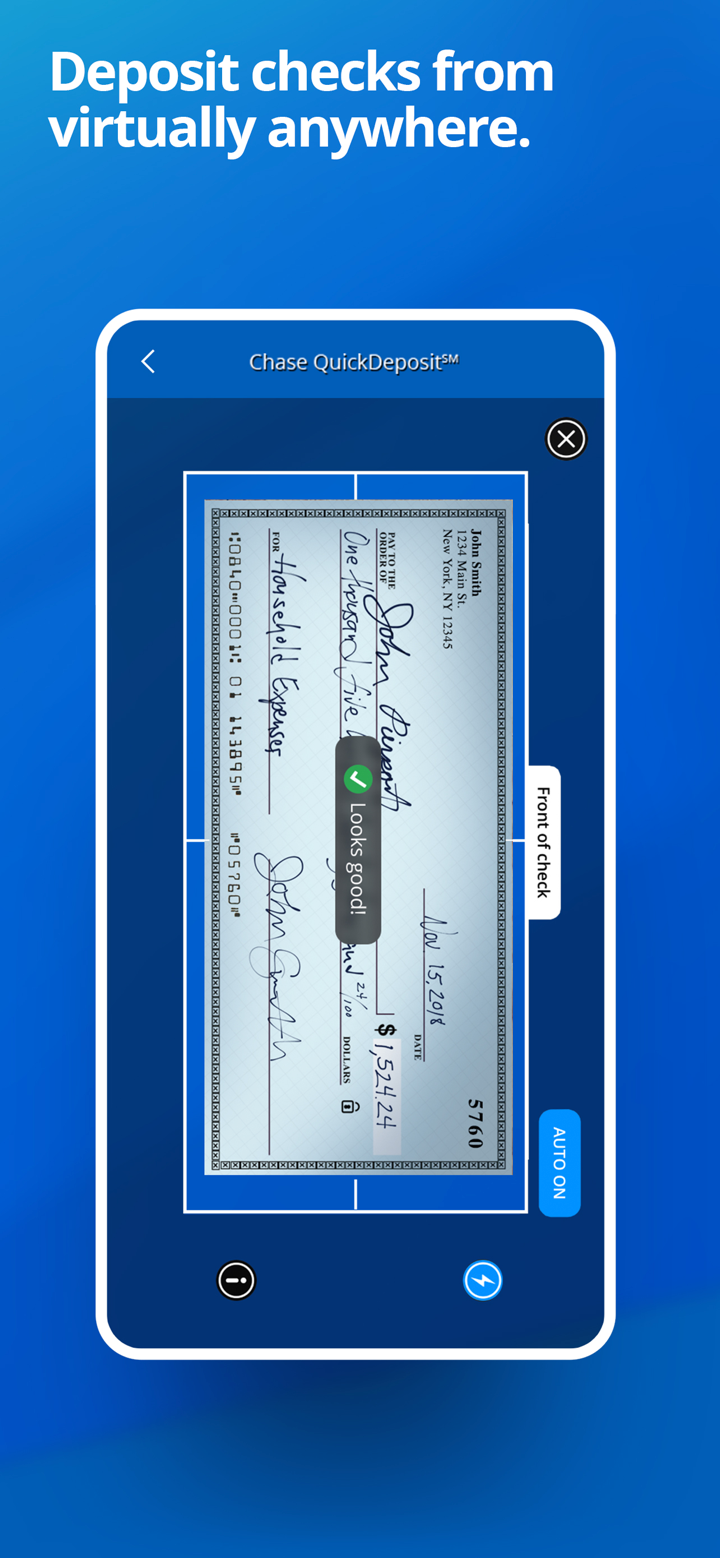

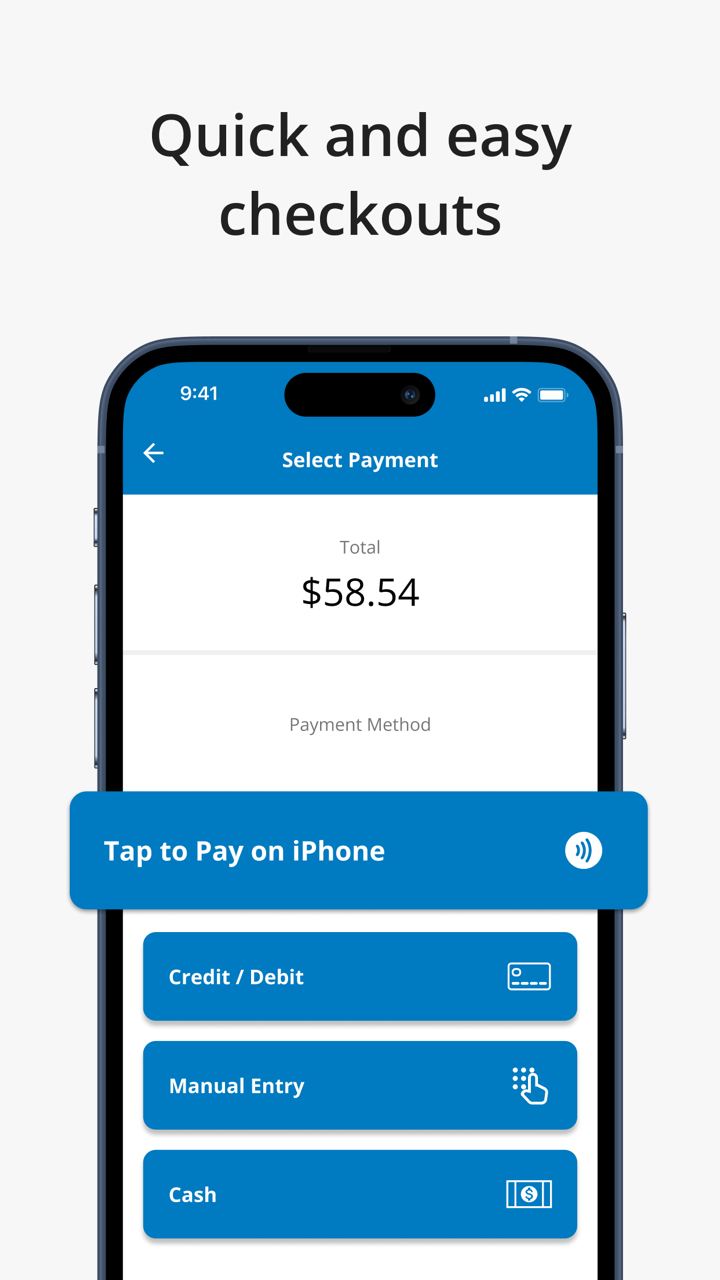

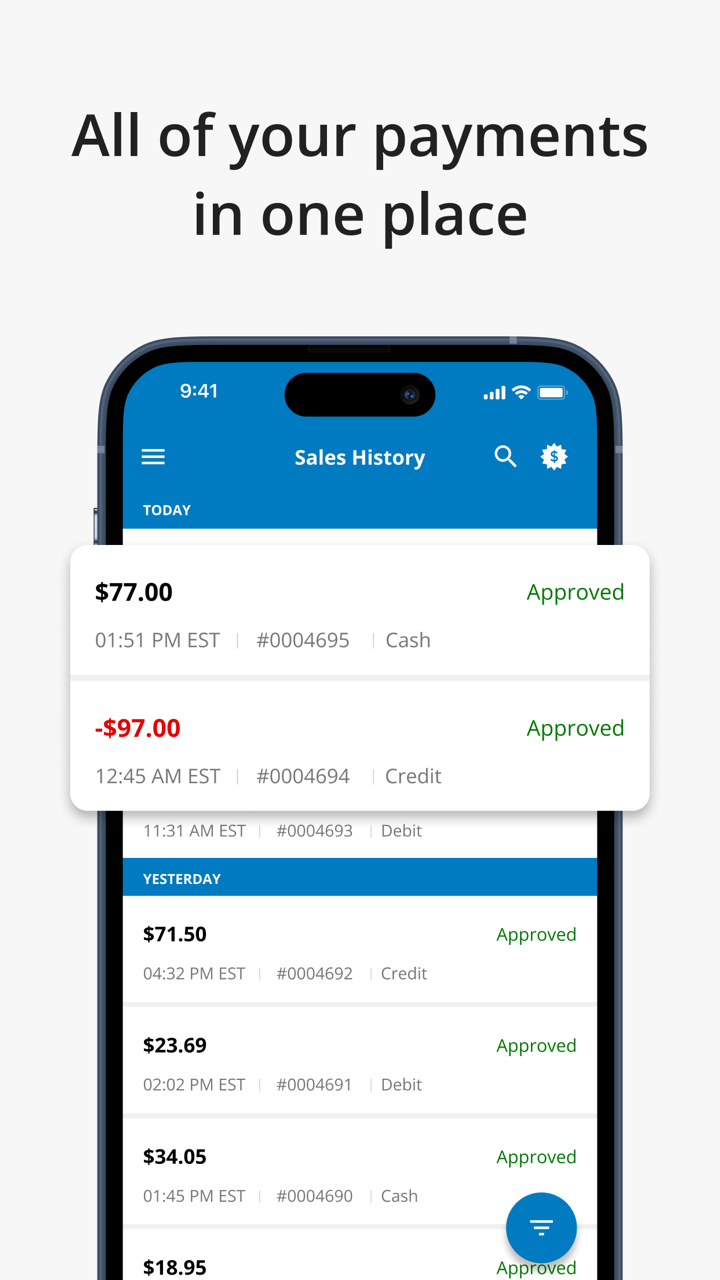

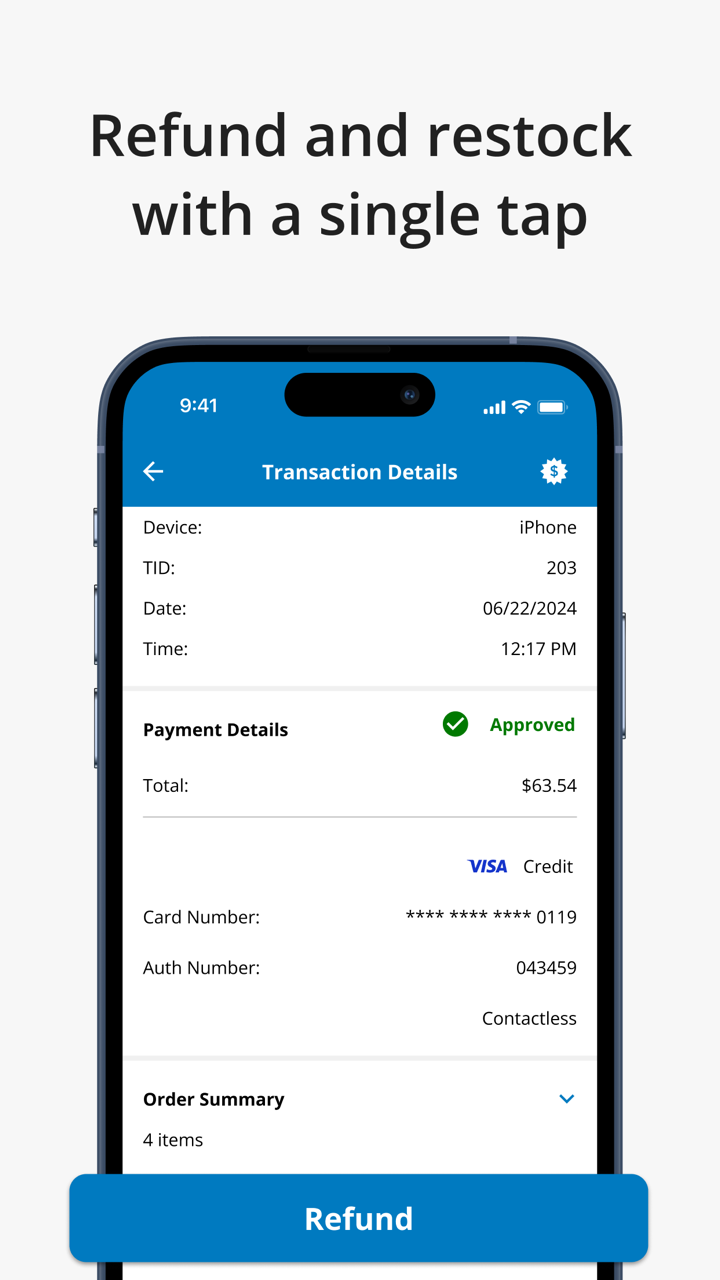

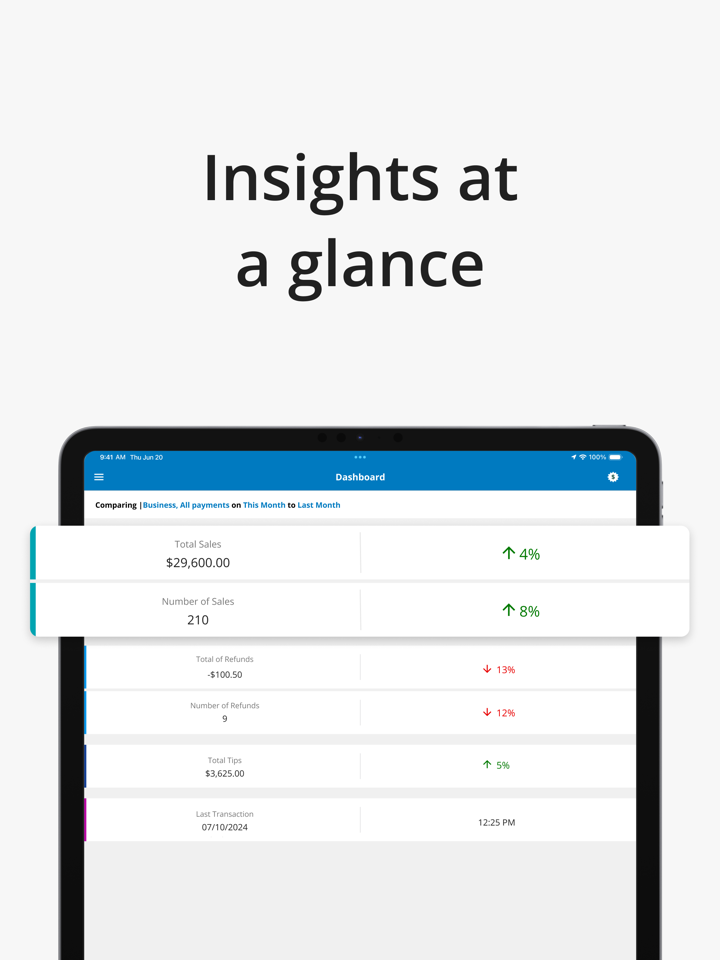

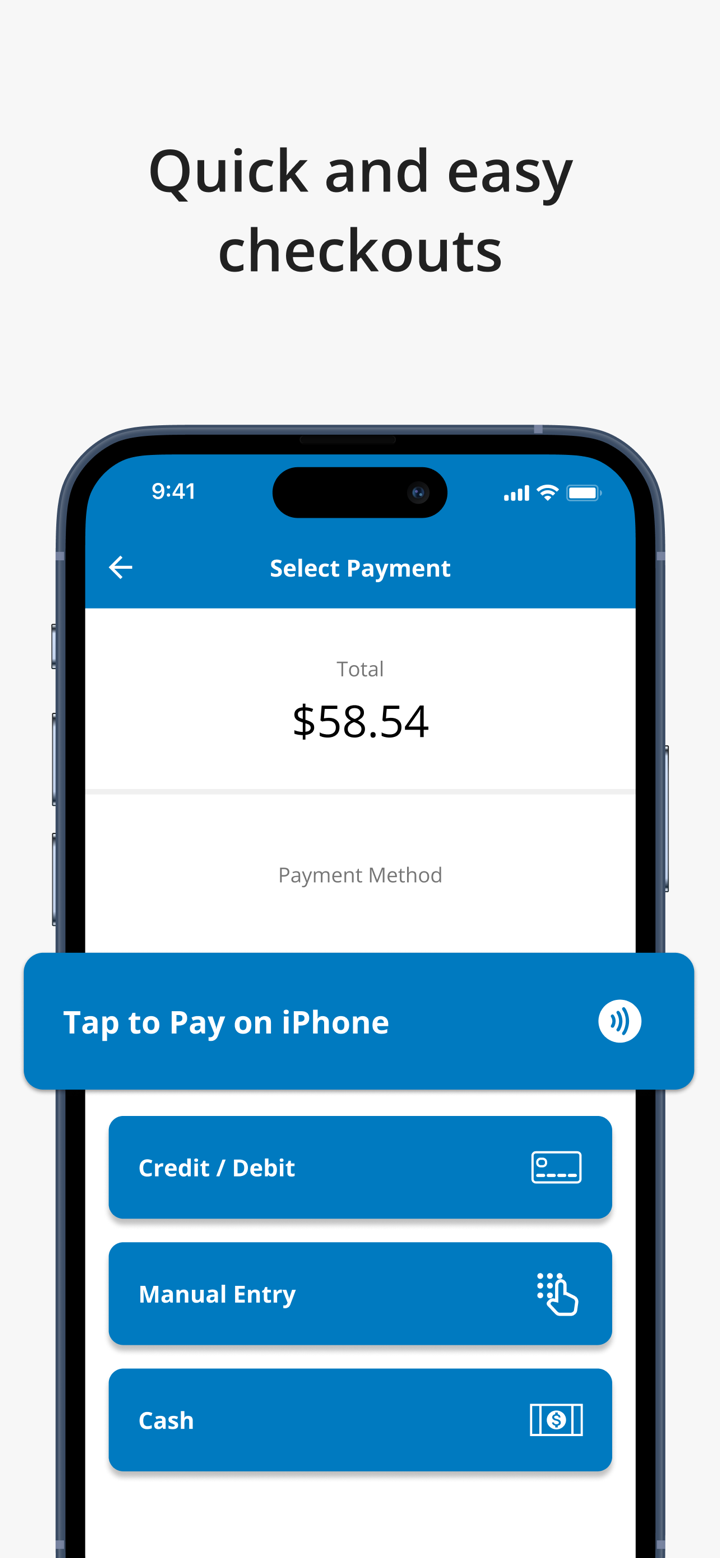

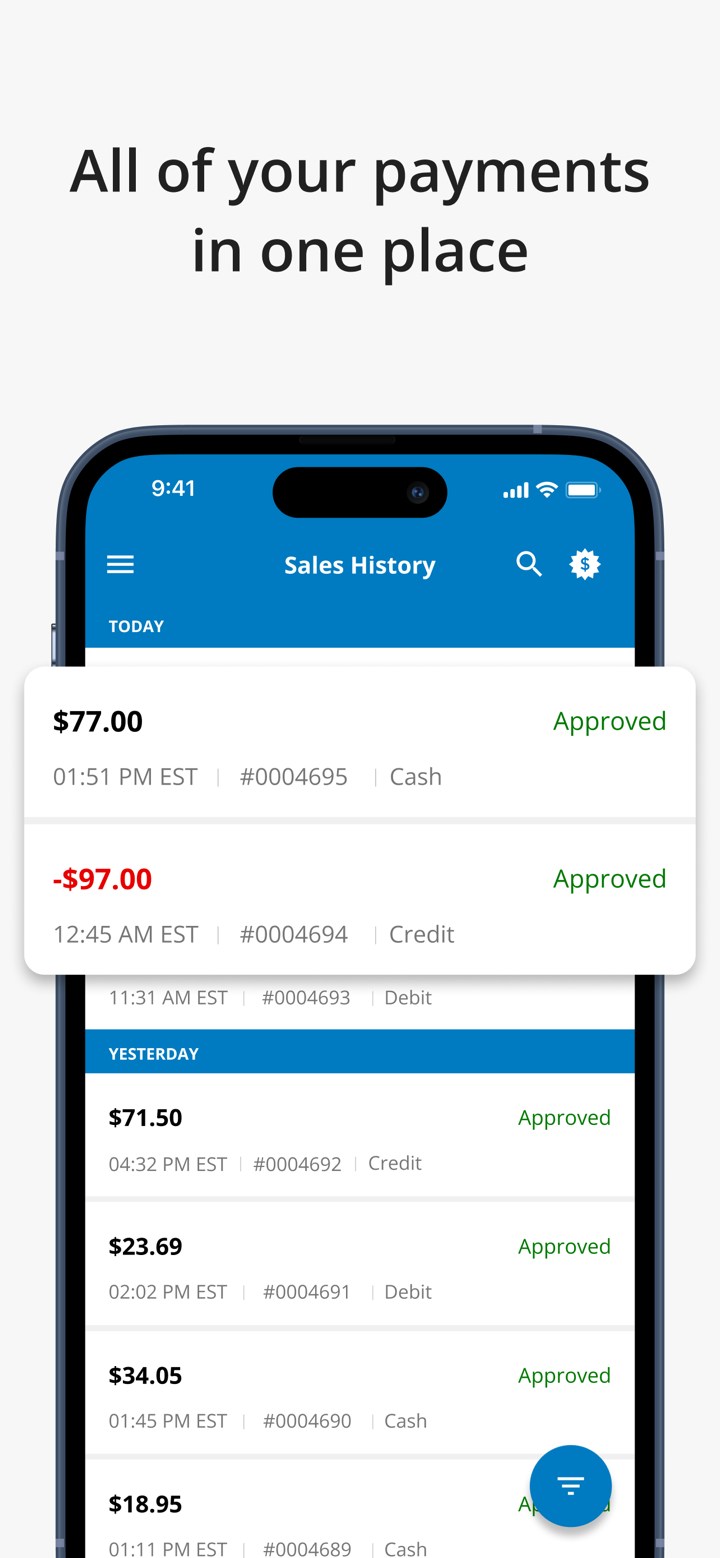

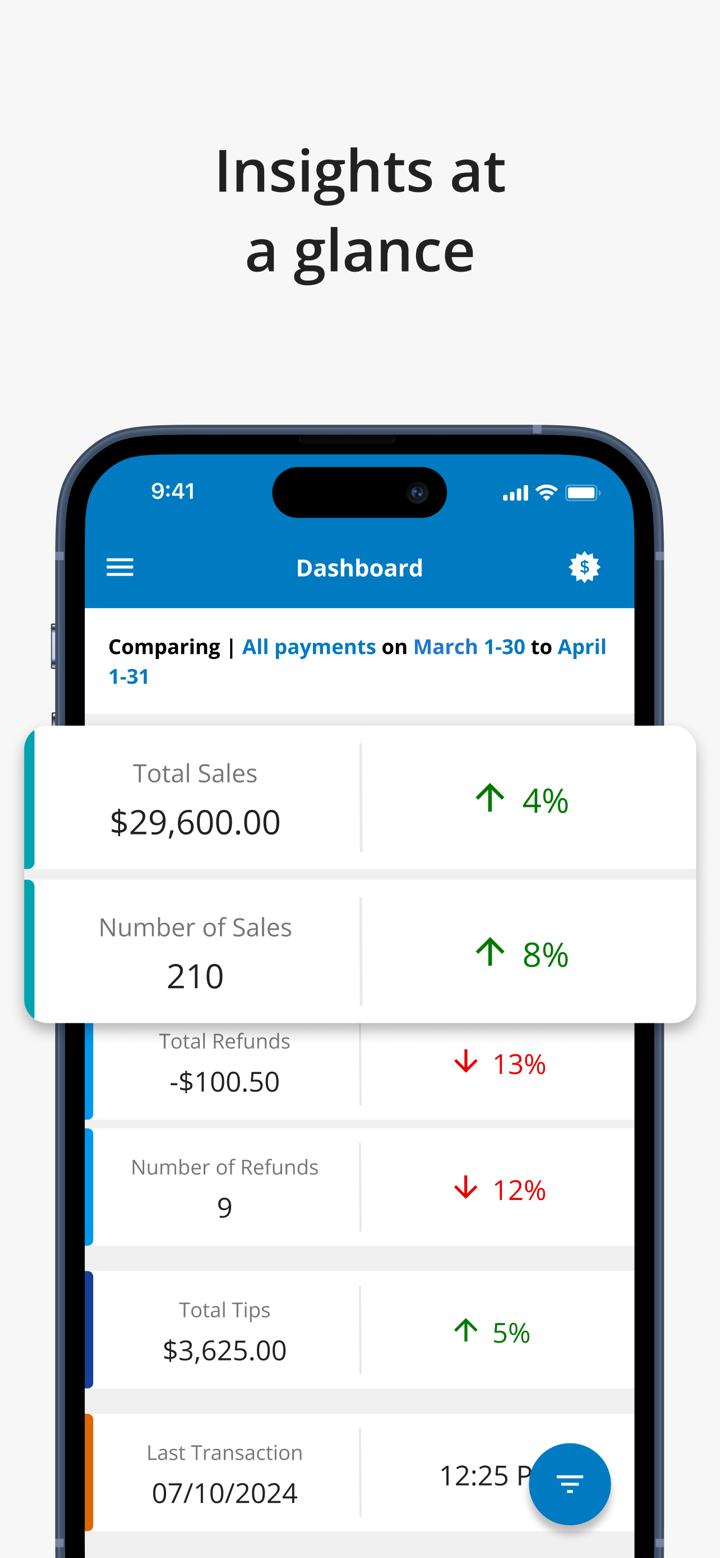

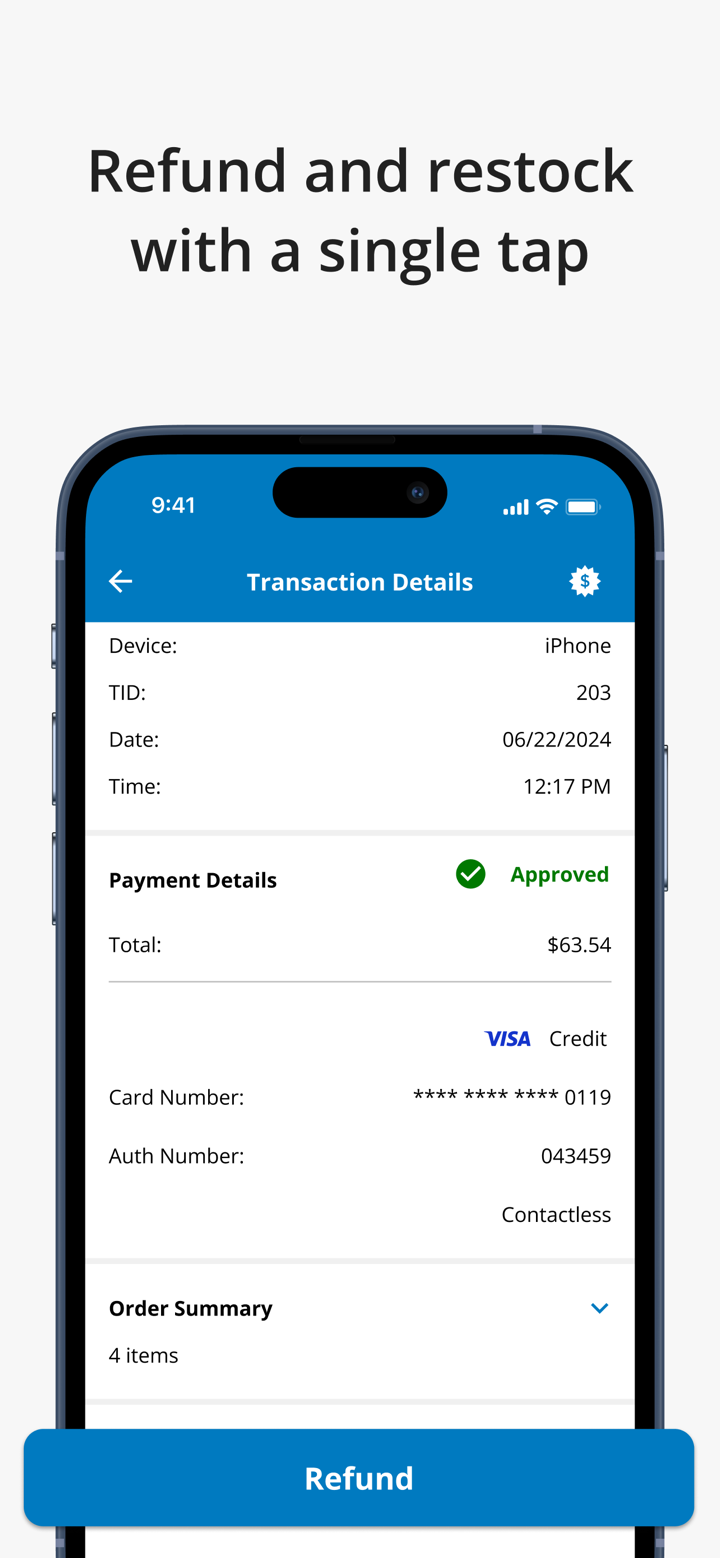

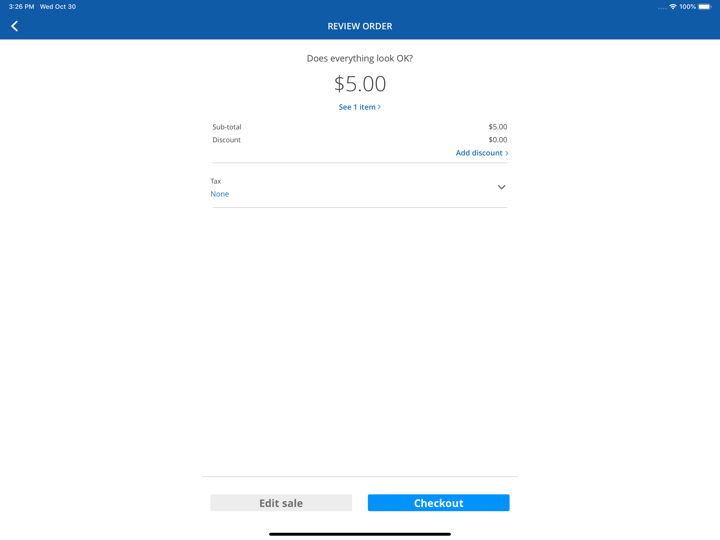

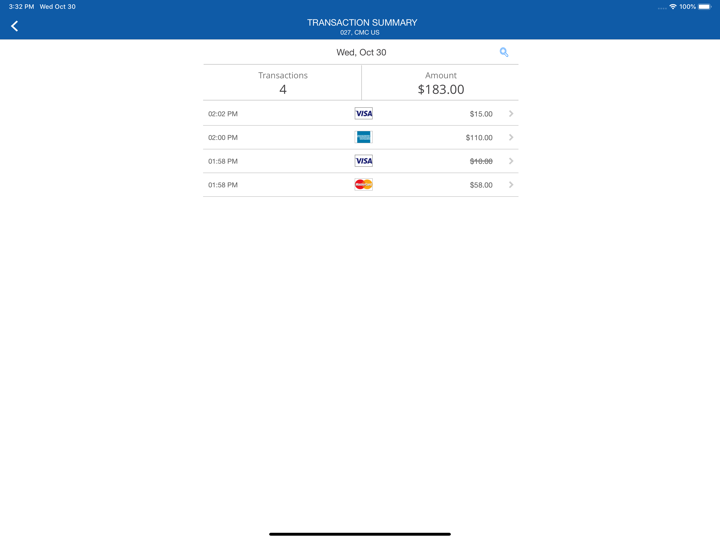

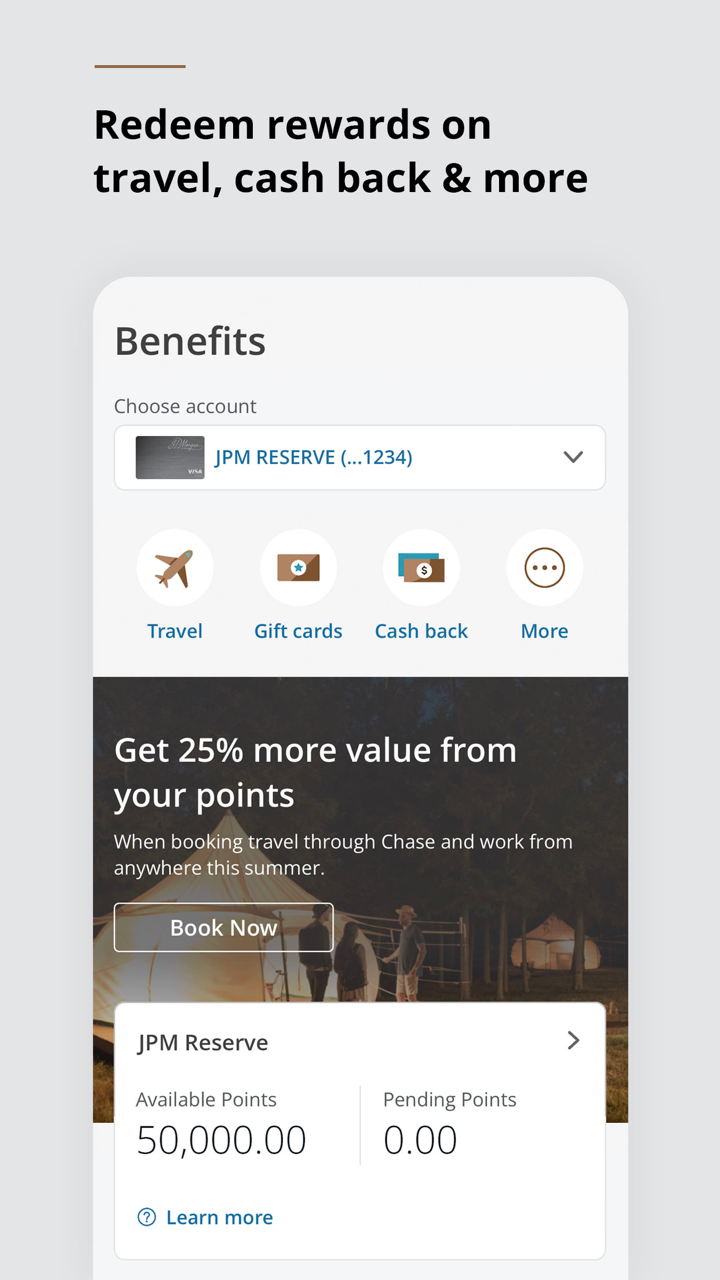

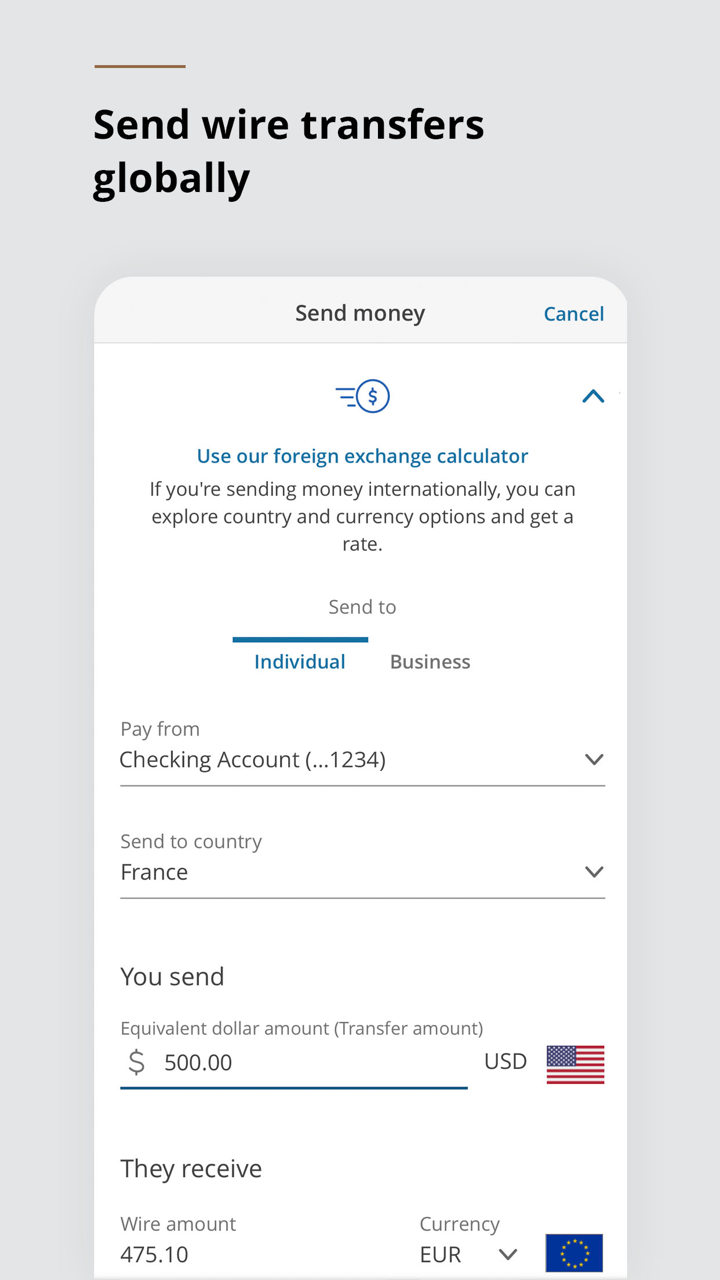

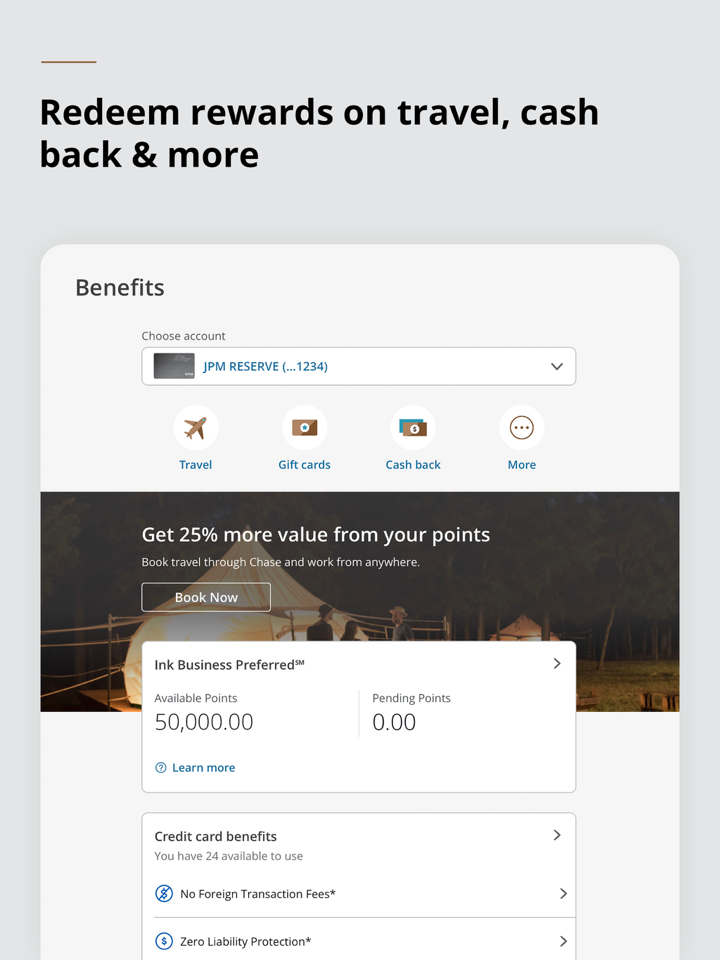

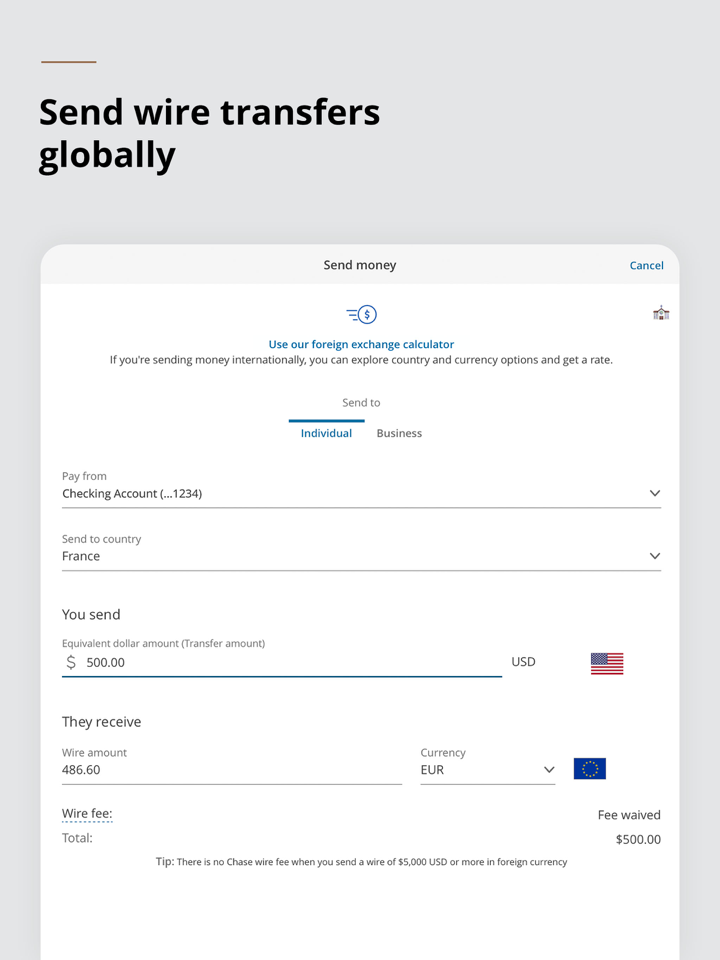

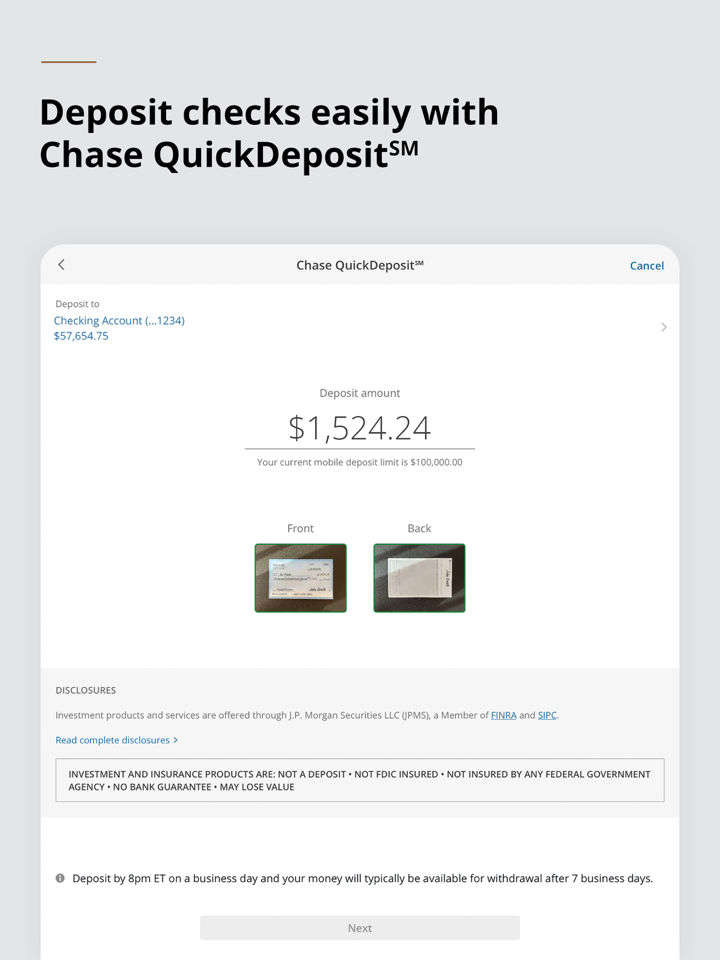

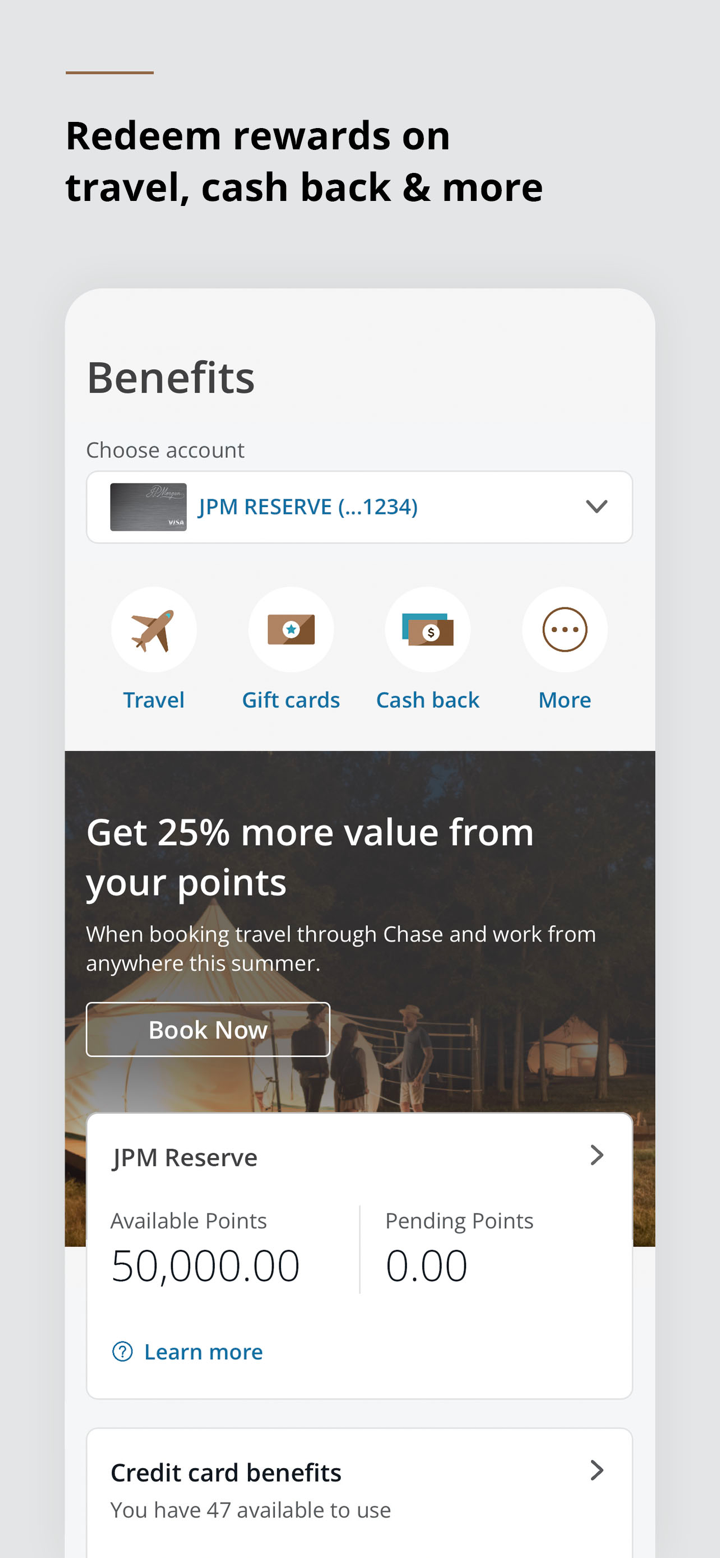

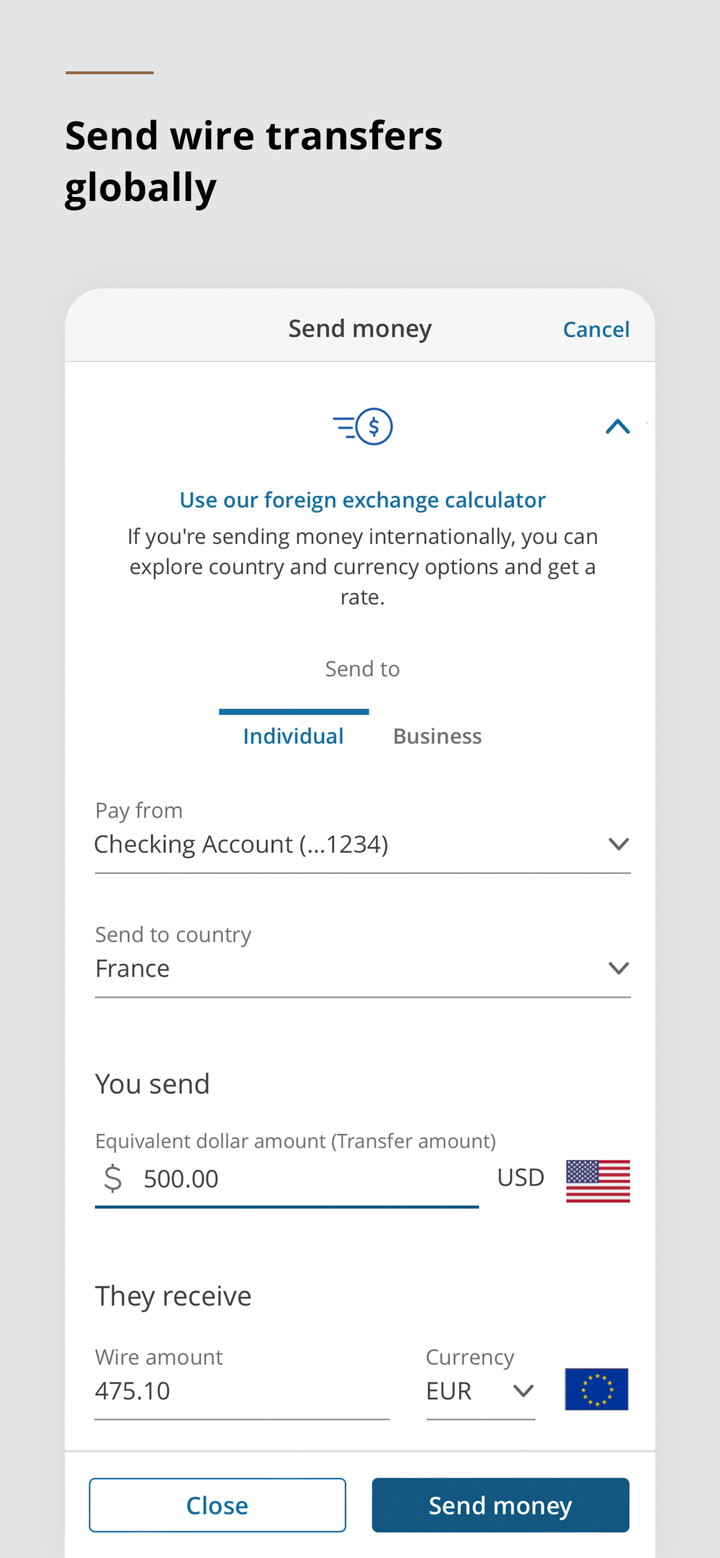

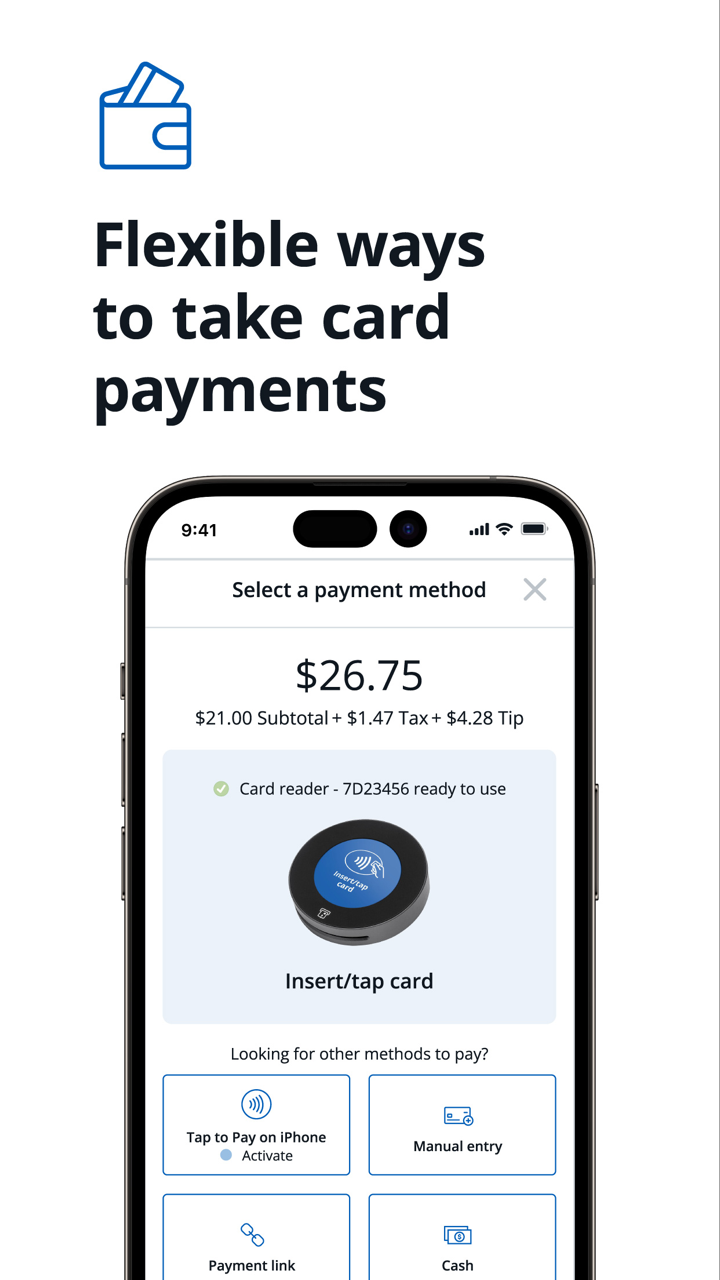

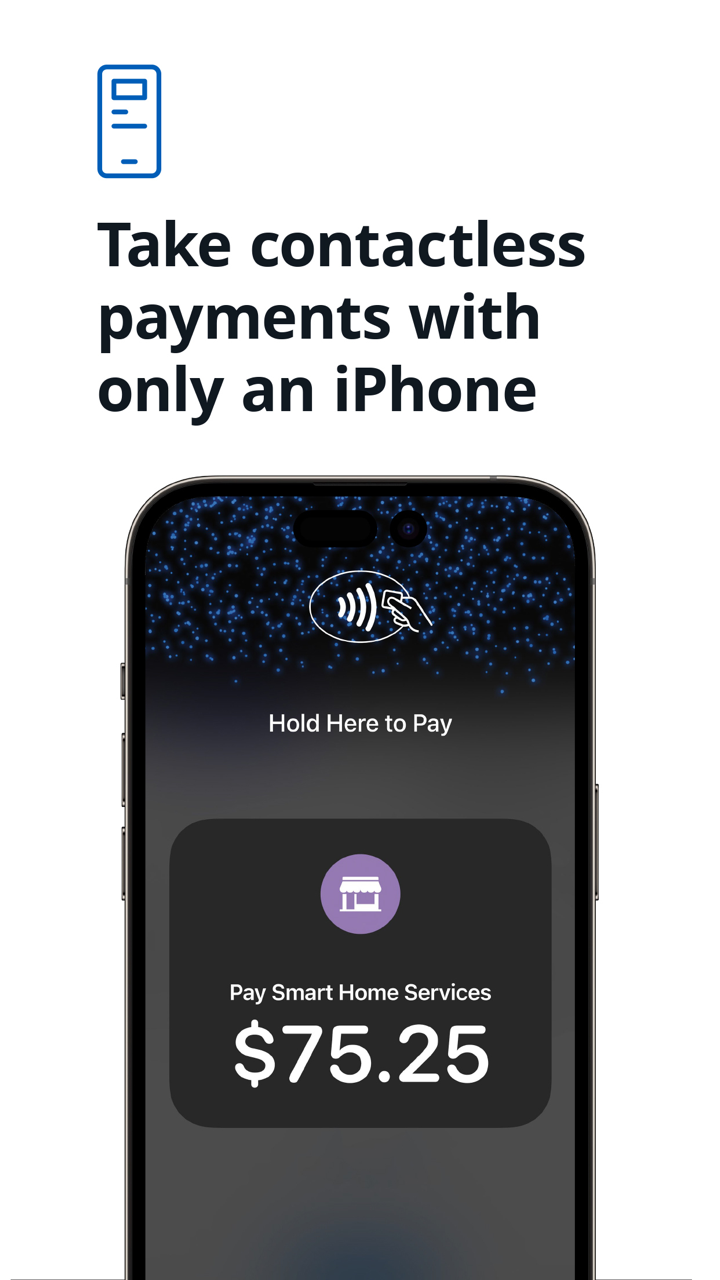

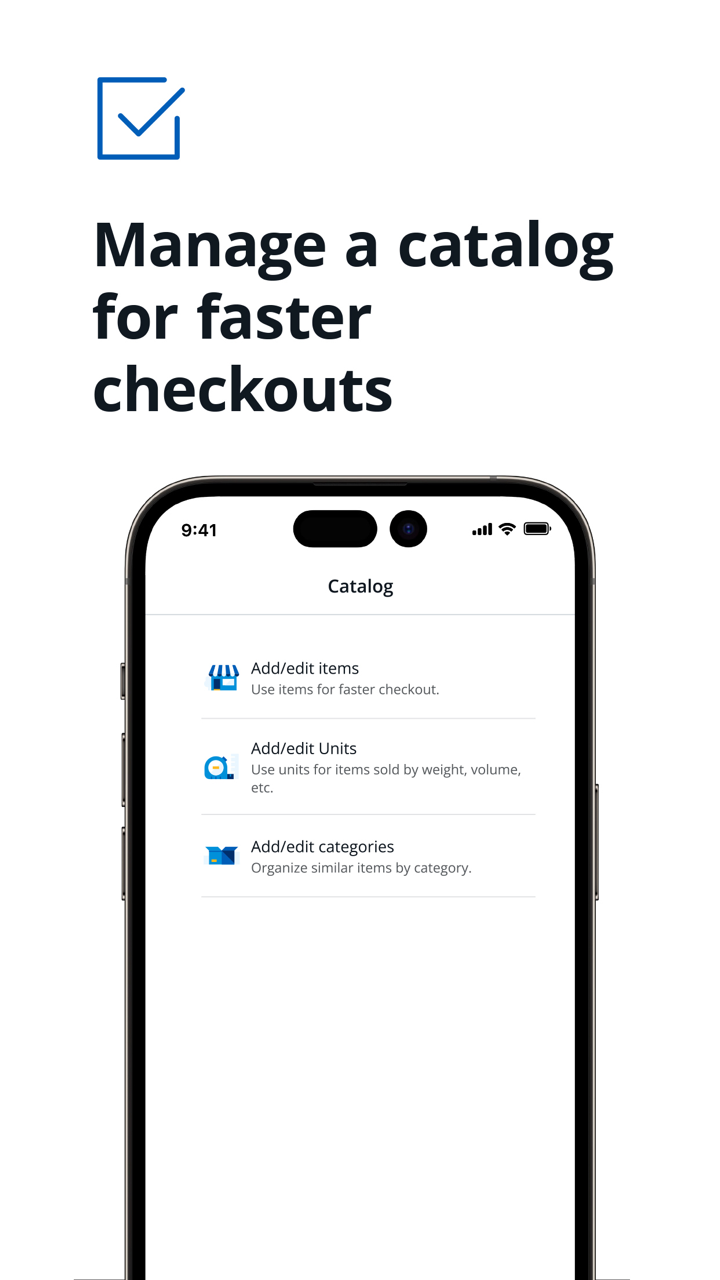

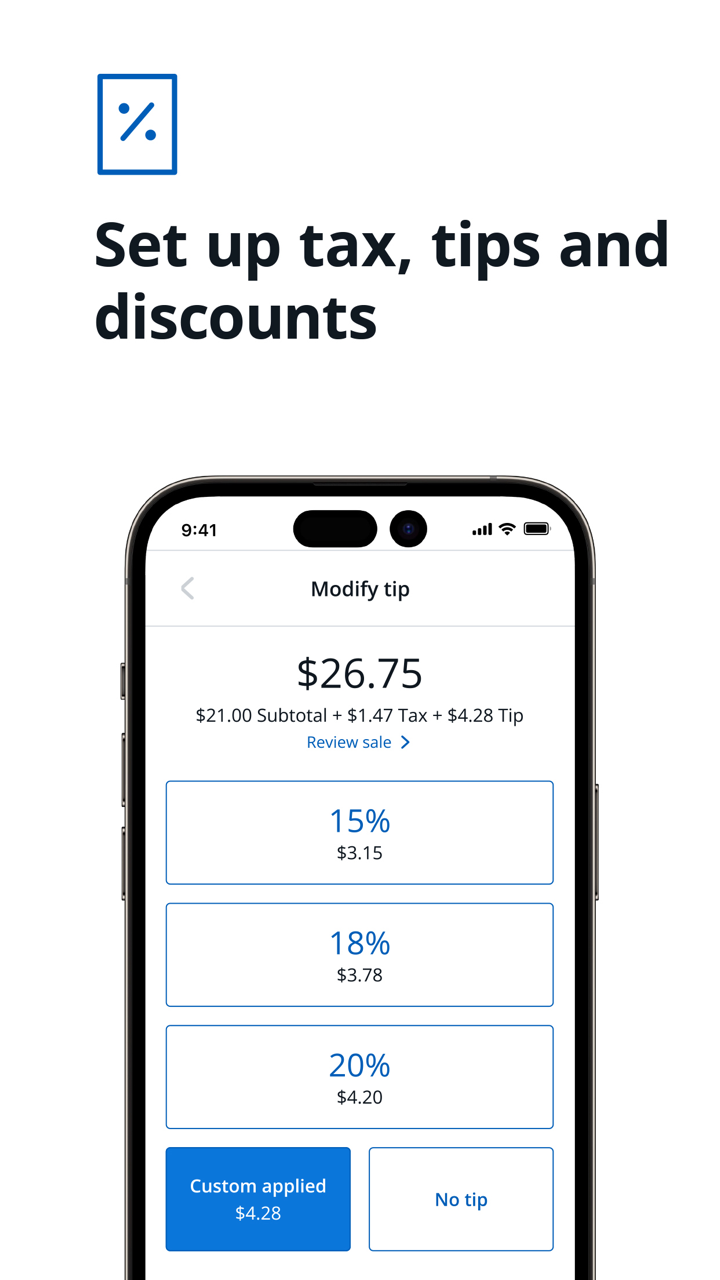

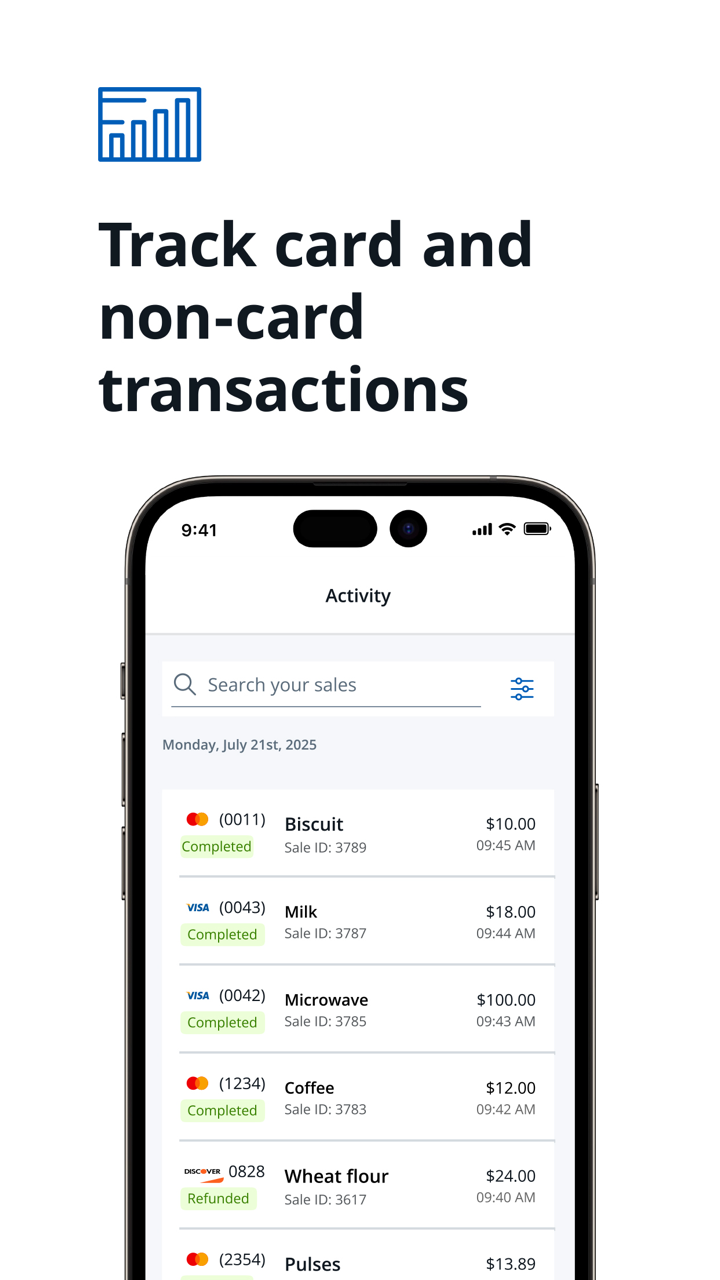

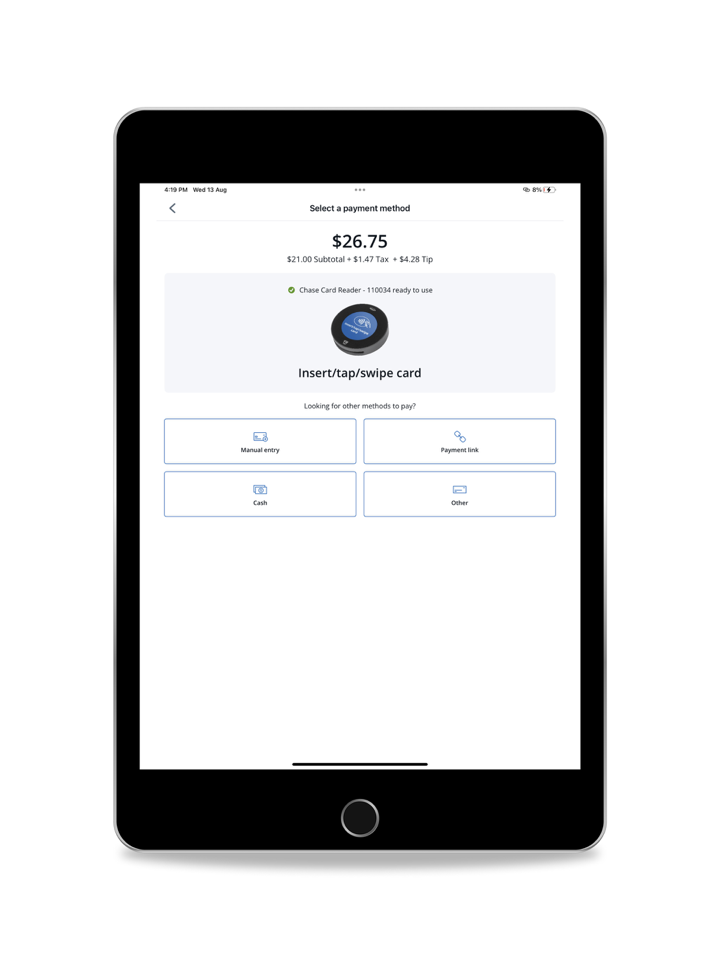

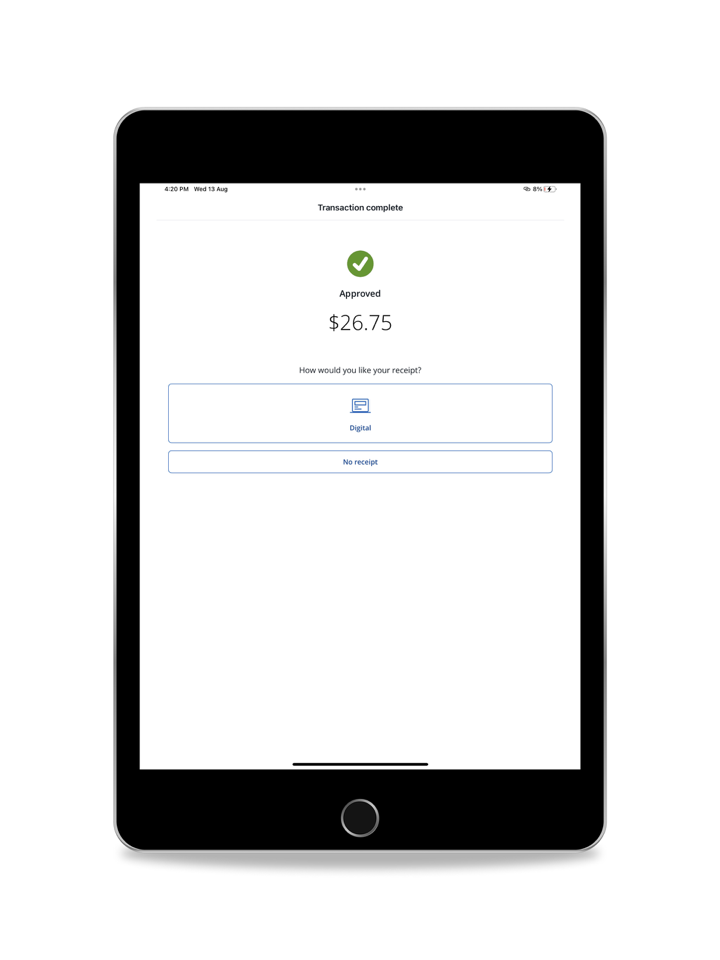

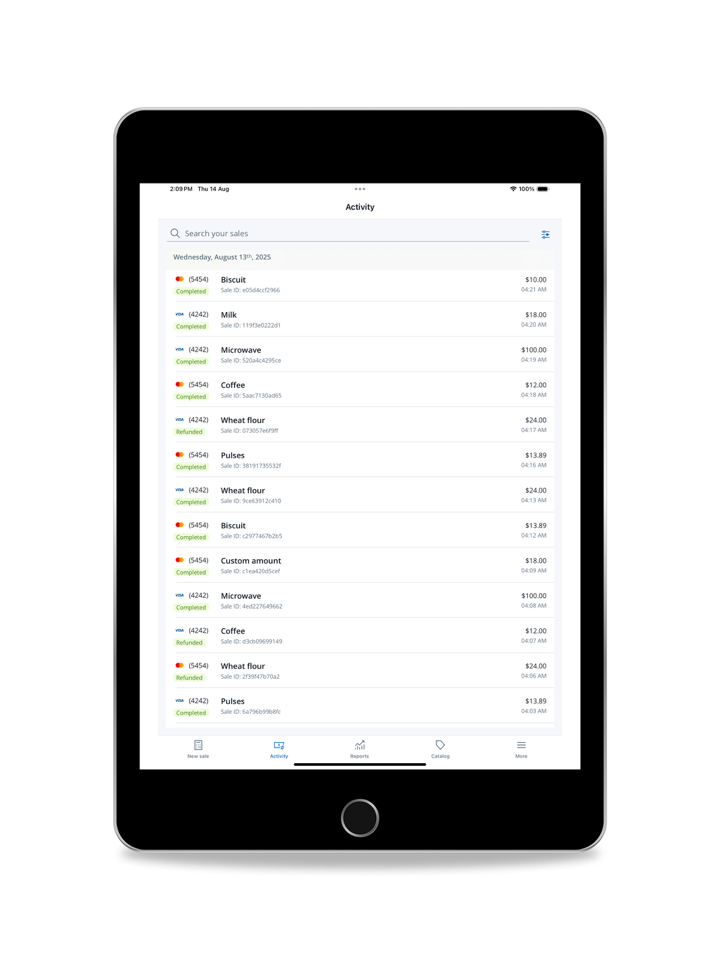

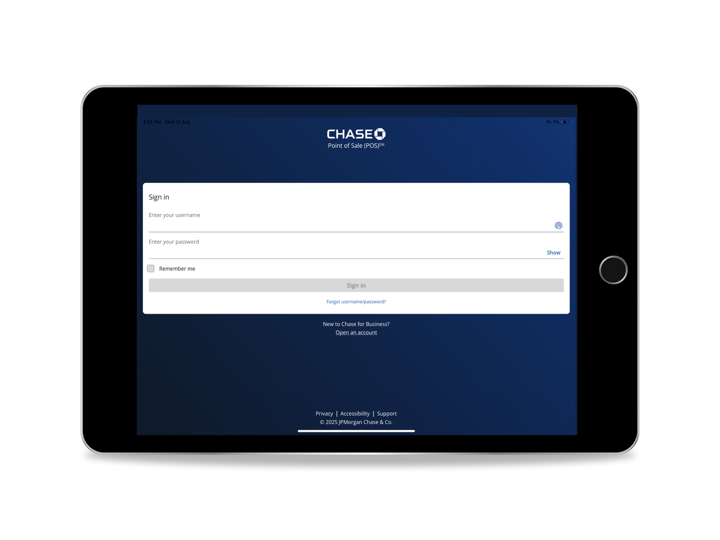

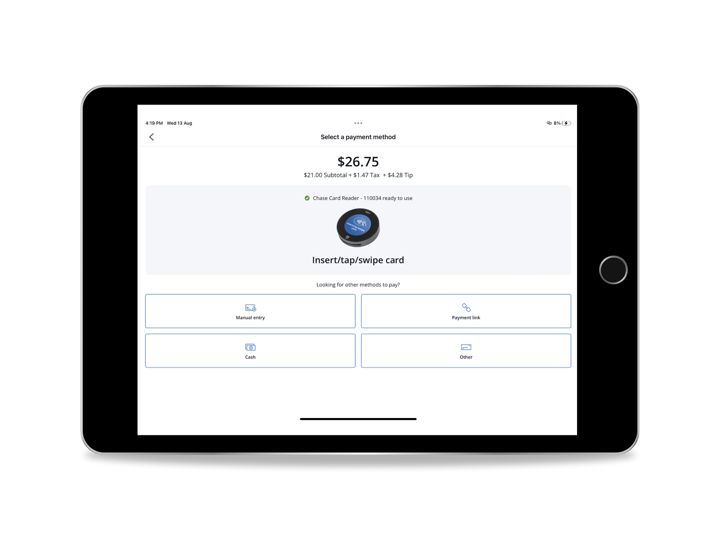

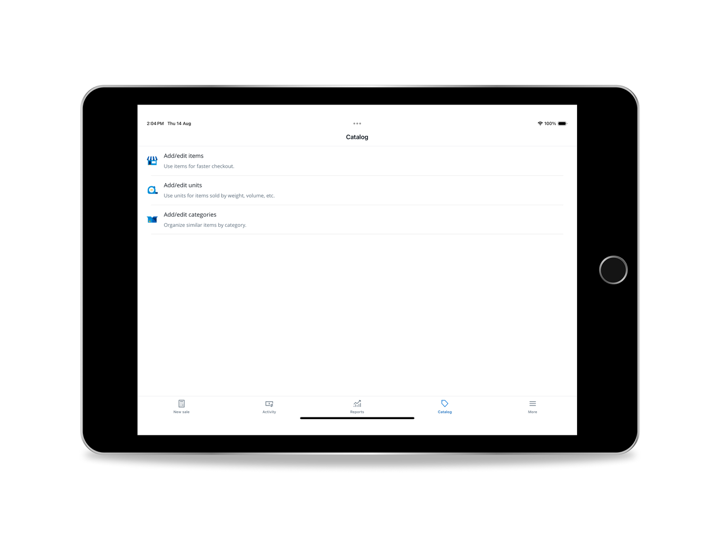

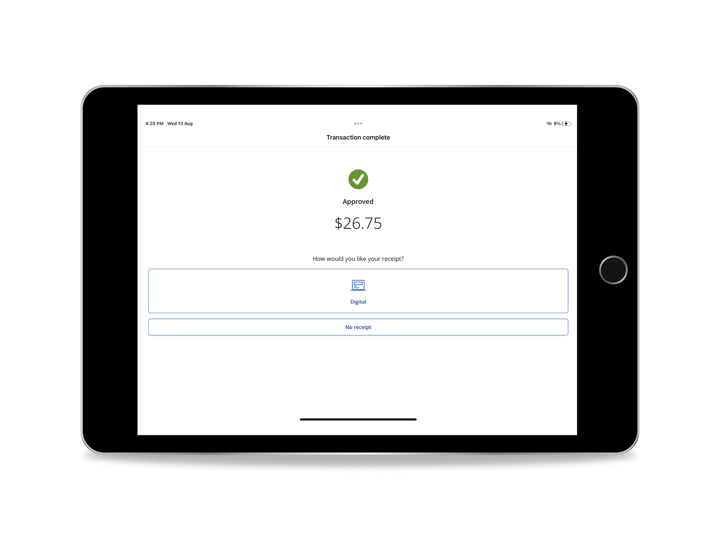

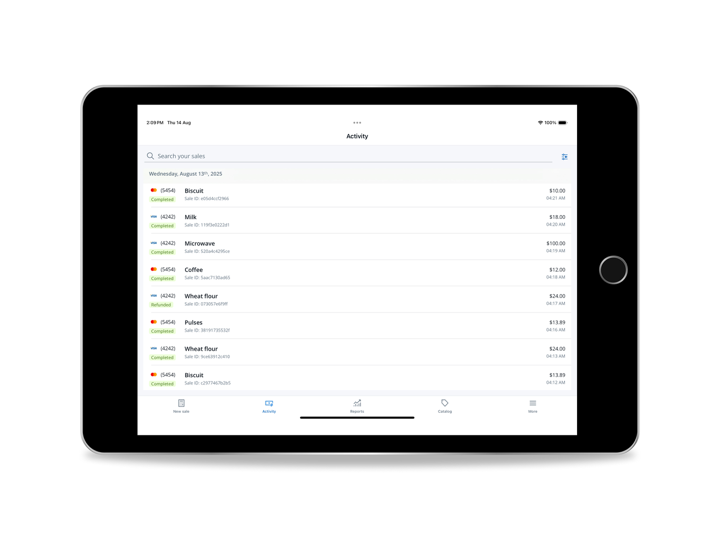

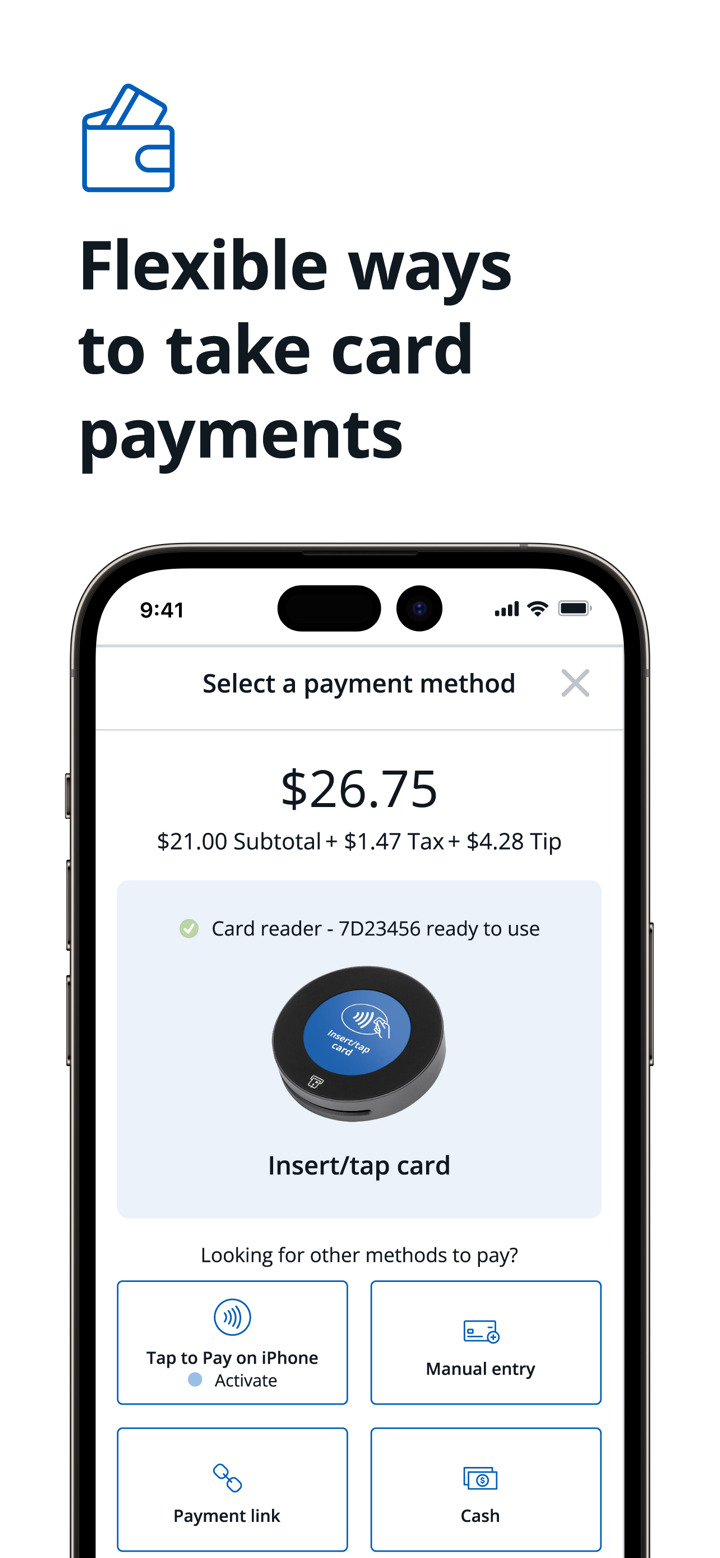

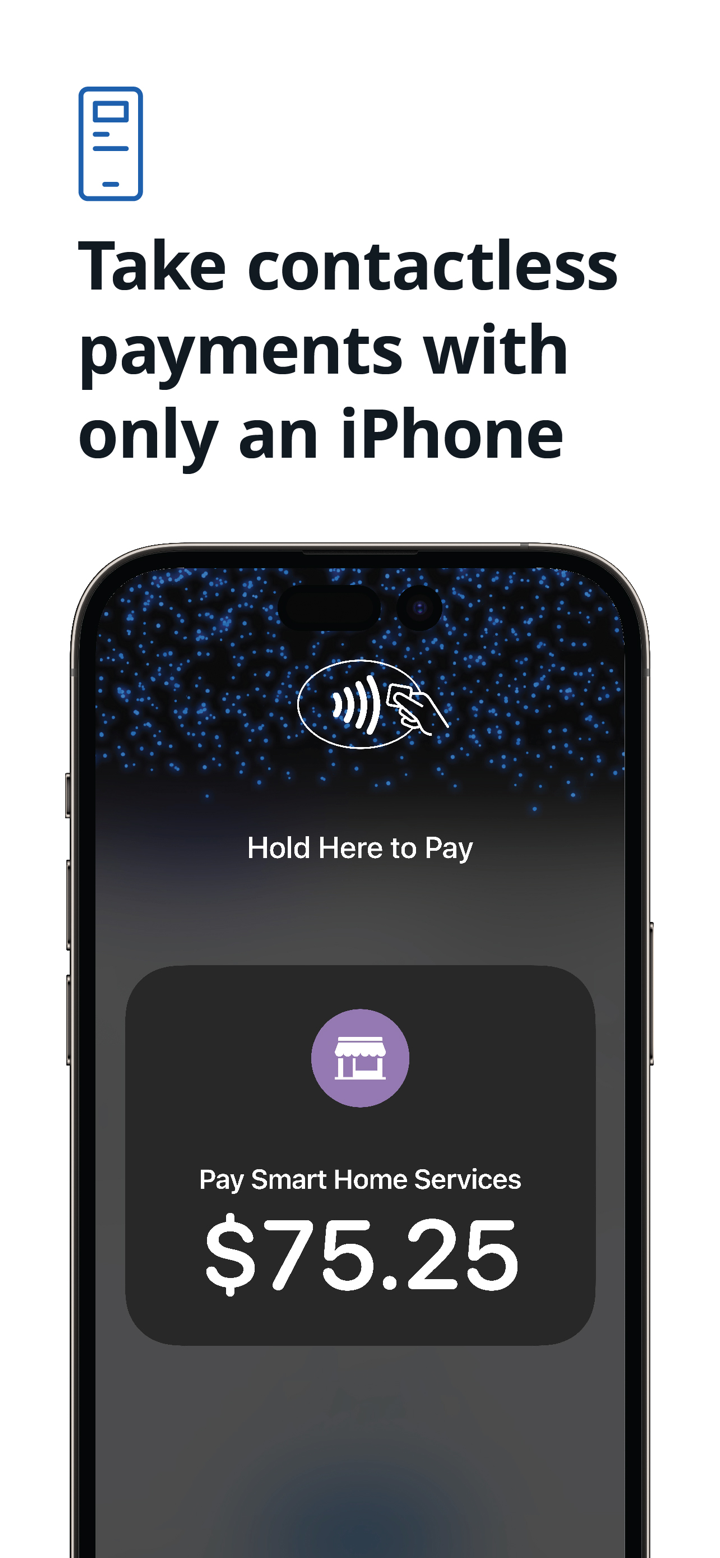

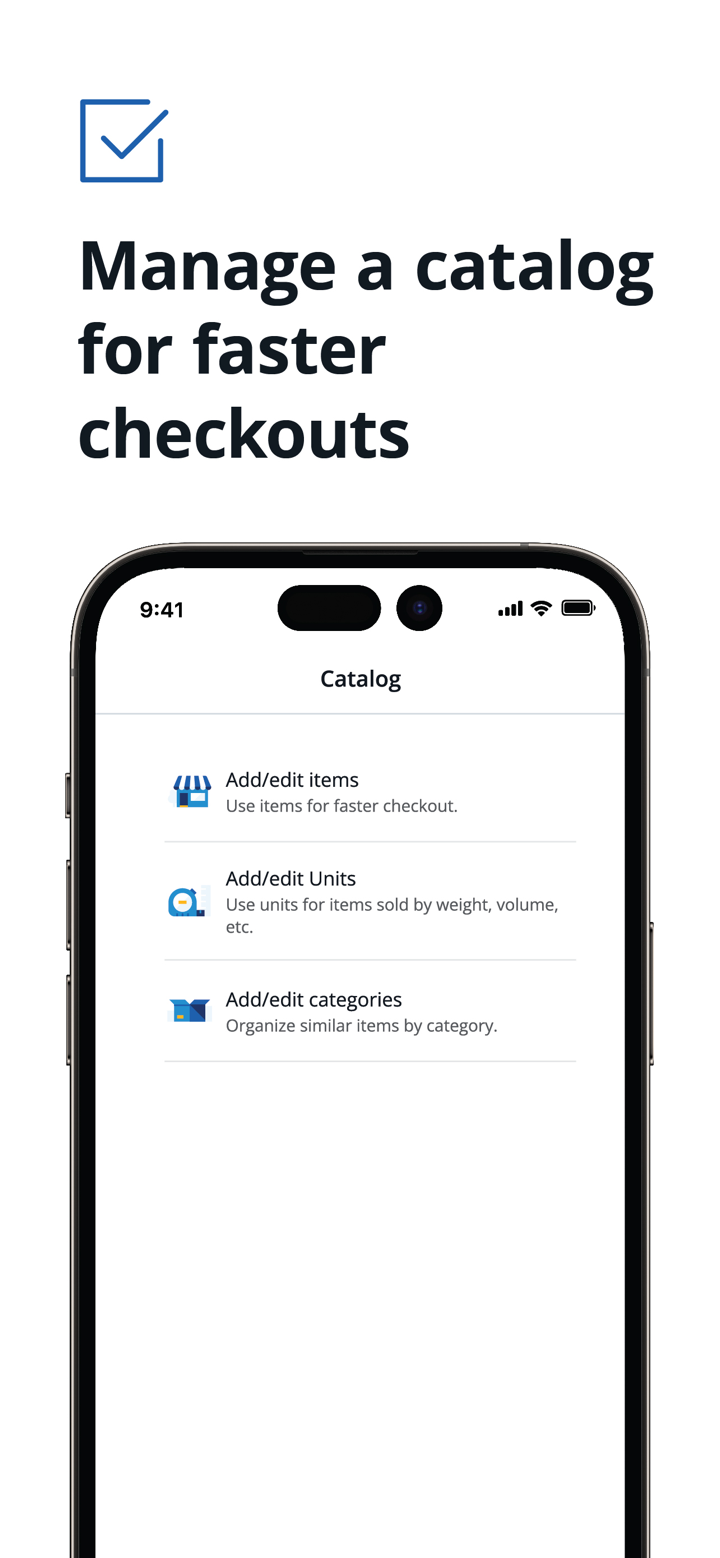

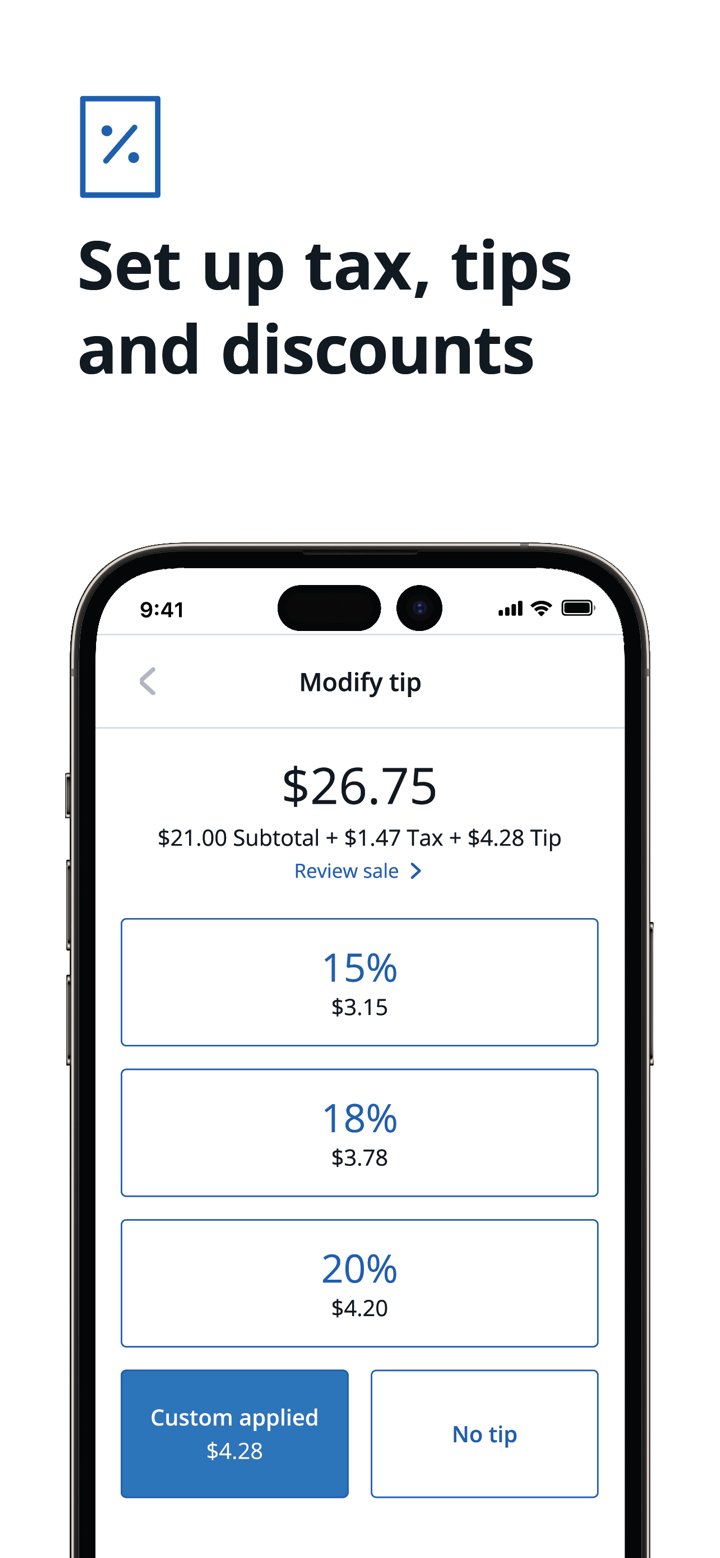

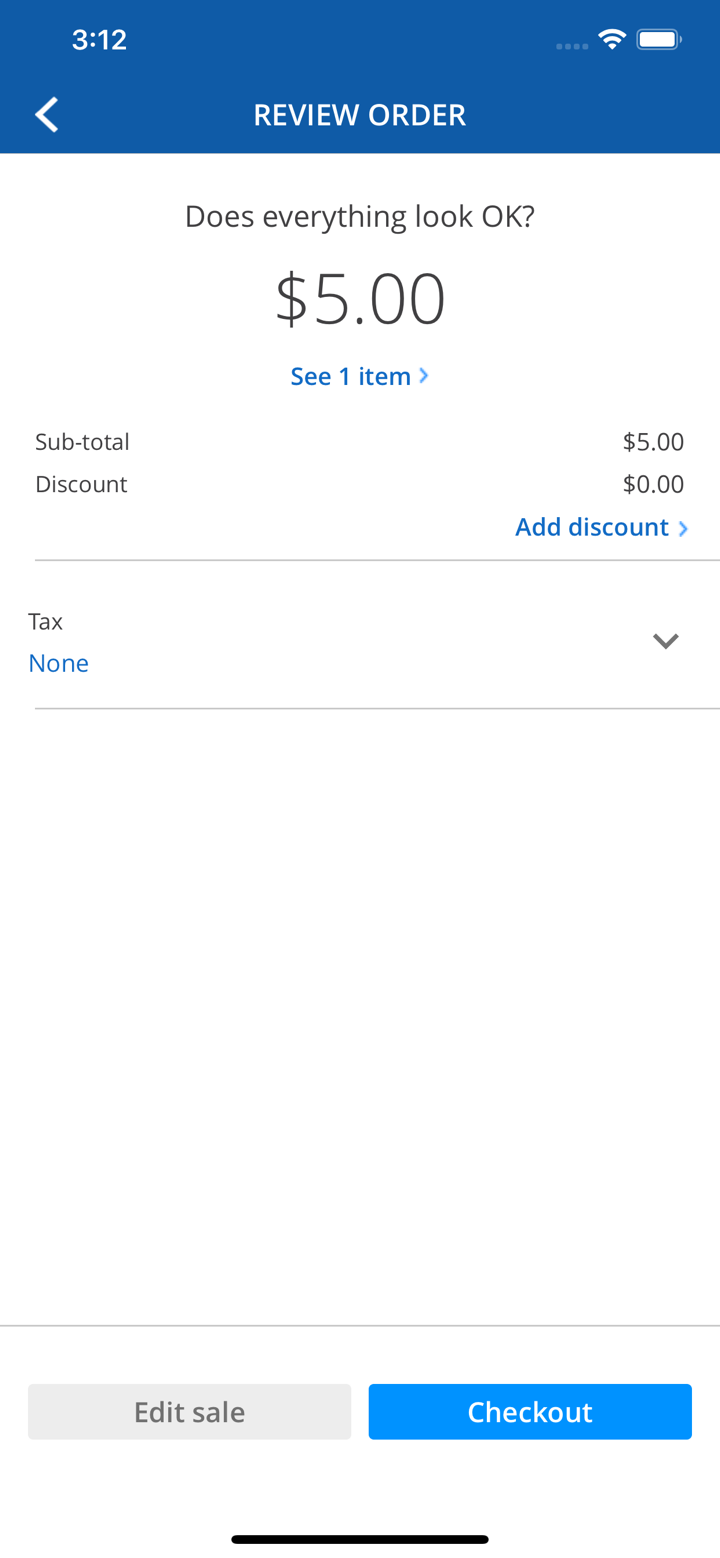

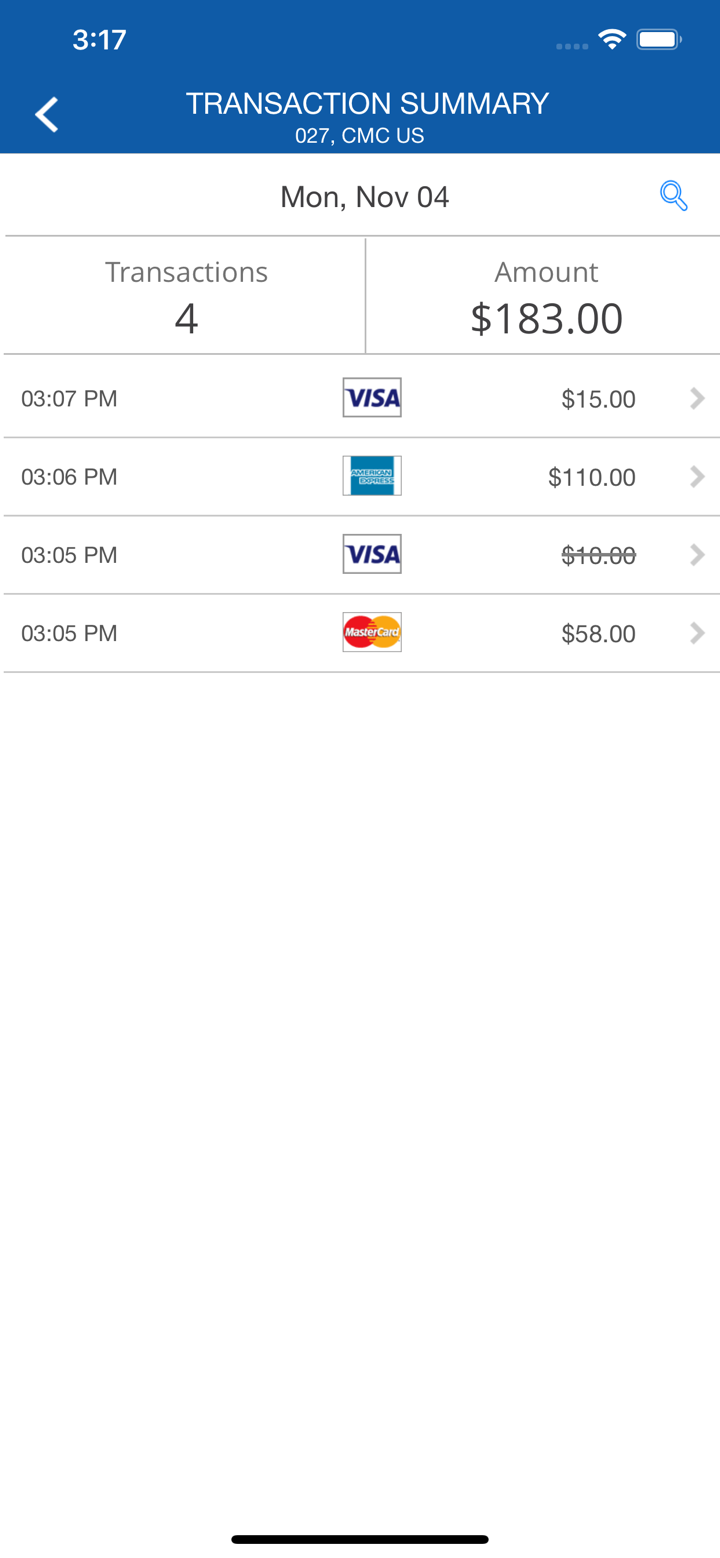

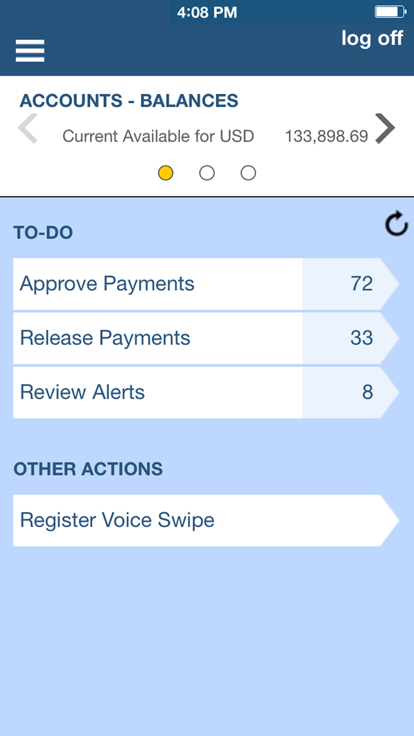

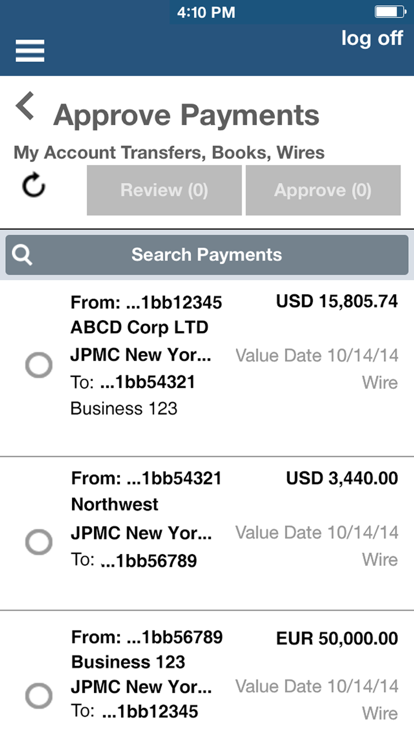

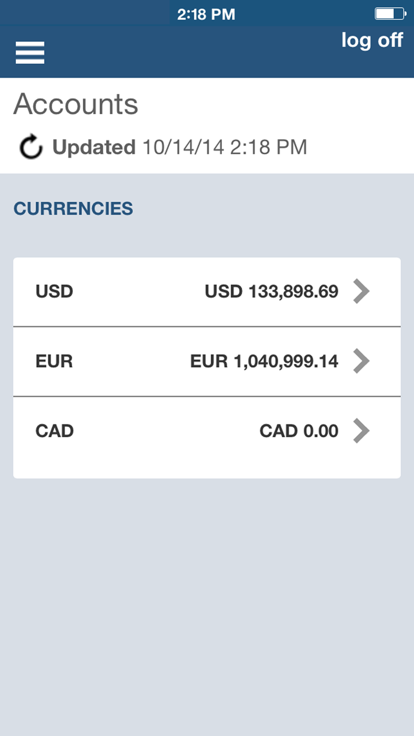

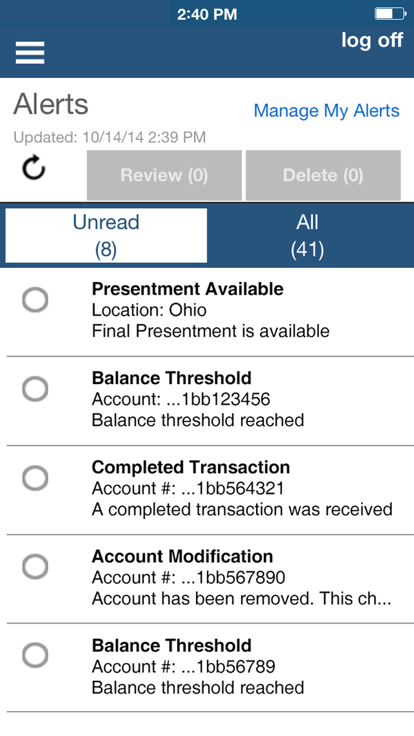

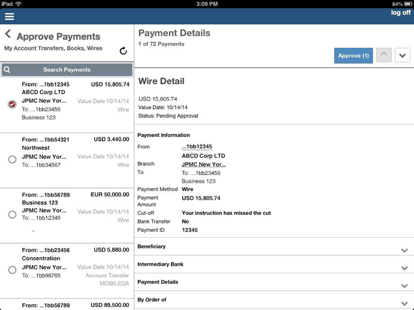

- Paiements: J.P. Morgan propose des solutions de paiement conçues pour aider les entreprises à naviguer dans un environnement de paiement complexe et en évolution rapide, leur permettant de gérer les risques, d'innover pour la croissance et de fournir d'excellentes expériences client.

Secteurs desservis

J.P. Morgan sert un large éventail d'industries, y compris l'immobilier commercial, la consommation et la vente au détail, les industries diversifiées, l'énergie, l'électricité et les énergies renouvelables, les services financiers, les soins de santé, les médias, les télécommunications et le divertissement, les métaux et l'exploitation minière, le secteur public et la technologie.