Présentation de l'entreprise

| Mandiri Investindo Futures概要 | |

| 設立年 | / |

| 登録国/地域 | インドネシア |

| 規制 | BAPPEBTI |

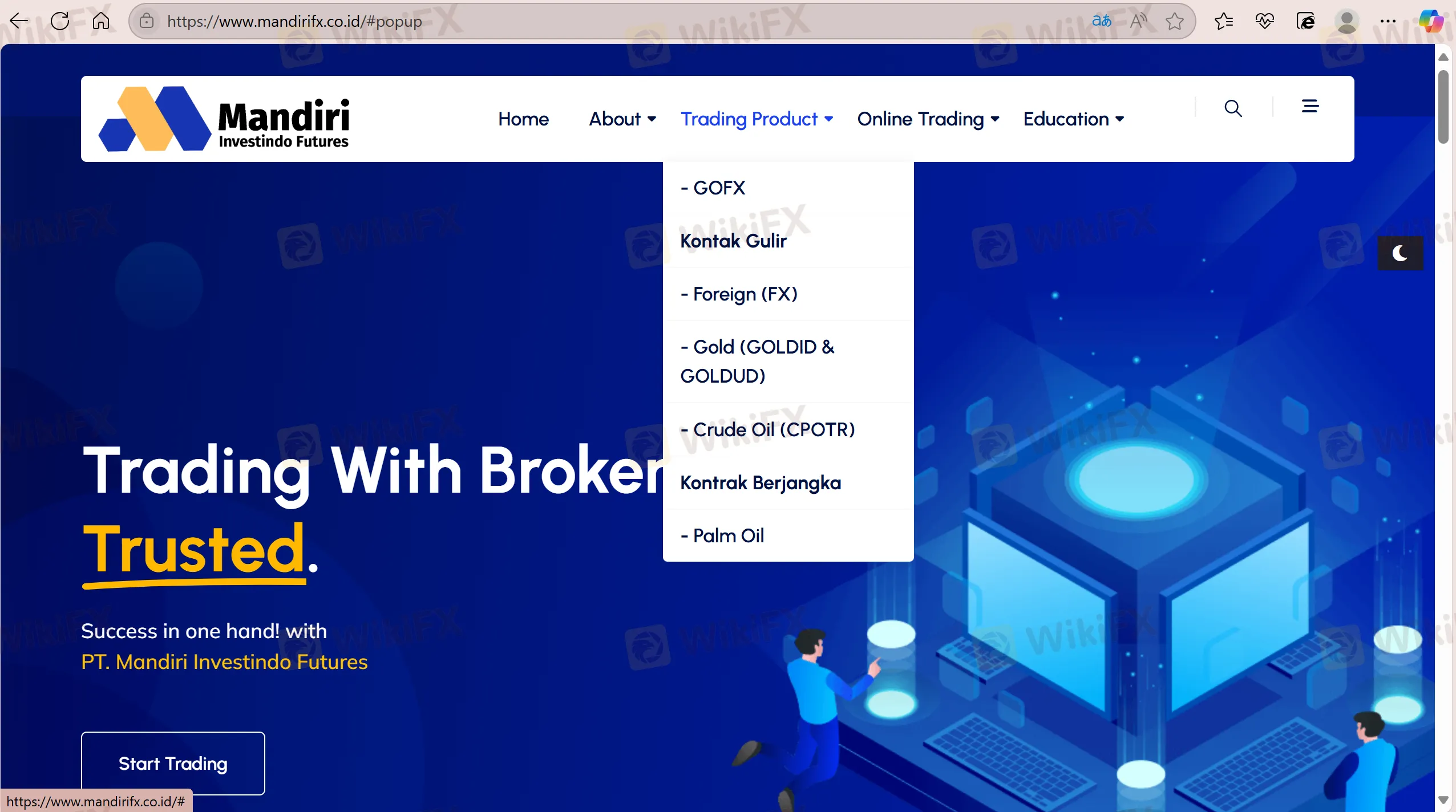

| 取引商品 | 外国為替、金、原油、パーム油 |

| デモ口座 | / |

| レバレッジ | / |

| スプレッド | / |

| 取引プラットフォーム | MT5 |

| 最低入金額 | / |

| カスタマーサポート | コンタクトフォーム |

| 電話: 031 3360 1175 | |

| メール: support@mandirifx.co.id | |

| 住所: イーストジャワ州スラバヤ市テガルサリ地区/支部テガルサリ村、バスキ・ラフマット通り58-60番地、グラハHSBCビル9階、60262 | |

| 地域制限 | アメリカ、イラン、北朝鮮 |

Mandiri Investindo Futures 情報

Mandiri Investindo Futures はインドネシアに登録されたブローカーです。提供される取引商品は外国為替、金、原油、パーム油をカバーしています。2つの口座タイプを提供し、BAPPEBTIによって規制されています。ただし、公式ウェブサイトでは取引の詳細情報はほとんど開示されておらず、米国、イラン、北朝鮮の居住者向けのサービスは提供されていません。

利点と欠点

| 利点 | 欠点 |

| BAPPEBTIによる規制 | 提供される情報が限られている |

| MT5 対応 | 地域制限 |

| 商品取引に特化 | |

| さまざまな連絡手段 |

Mandiri Investindo Futures は信頼できるか?

| 規制国 | 規制機関 | 現在の状況 | 規制エンティティ | ライセンスタイプ | ライセンス番号 |

| インドネシア | Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan (BAPPEBTI) | 規制済み | MANDIRI INVESTINDO FUTURES | 小売外国為替ライセンス | 01/BAPPEBTI/SI/01/2023 |

Mandiri Investindo Futures で取引できるものは何ですか?

Mandiri Investindo Futures offre aux traders la possibilité de trader le forex, l'or, le pétrole brut et l'huile de palme.

| Instruments négociables | Pris en charge |

| Forex | ✔ |

| Or | ✔ |

| Pétrole brut | ✔ |

| Huile de palme | ✔ |

| Obligations | ❌ |

| Indices | ❌ |

| Actions | ❌ |

| Cryptomonnaies | ❌ |

| Options | ❌ |

Types de compte

Mandiri Investindo Futures propose 2 types de comptes différents aux traders, à savoir le Compte Micro et le Compte Mini.

Plateforme de trading

La plateforme de trading de Mandiri Investindo Futures est ICDX Metatrader 5, qui prend en charge les traders sur PC et appareils mobiles.

| Plateforme de trading | Pris en charge | Appareils disponibles | Convient pour |

| MT5 | ✔ | PC, Web, Mobile | Traders expérimentés |

| MT4 | ❌ | / | Débutants |