기본 정보

인도네시아

인도네시아점수

인도네시아

|

2-5년

|

인도네시아

|

2-5년

| https://www.mandirifx.co.id/

공식 사이트

평점 지수

MT4/5

백지 표시

MandiriInvestindo-Server

영향력

D

영향력 지수 NO.1

인도네시아 2.48

인도네시아 2.48

MT4/5 감정

백지 표시

인도네시아

인도네시아영향력

D

영향력 지수 NO.1

인도네시아 2.48

인도네시아 2.48 라이선스

라이선스라이선스 기관:MANDIRI INVESTINDO FUTURES

라이선스 번호:01/BAPPEBTI/SI/01/2023

인도네시아

인도네시아

정식 MT4/5 마스터 레이블 브로커는 건전한 시스템 서비스와 사후 기술 지원을 제공합니다. 보통 비즈니스와 기술이 성숙하고 리스크 관리 능력이 강합니다.

mandirifx.co.id

mandirifx.co.id 미국

미국

| Mandiri Investindo Futures리뷰 요약 | |

| 설립 연도 | / |

| 등록 국가/지역 | 인도네시아 |

| 규제 | BAPPEBTI |

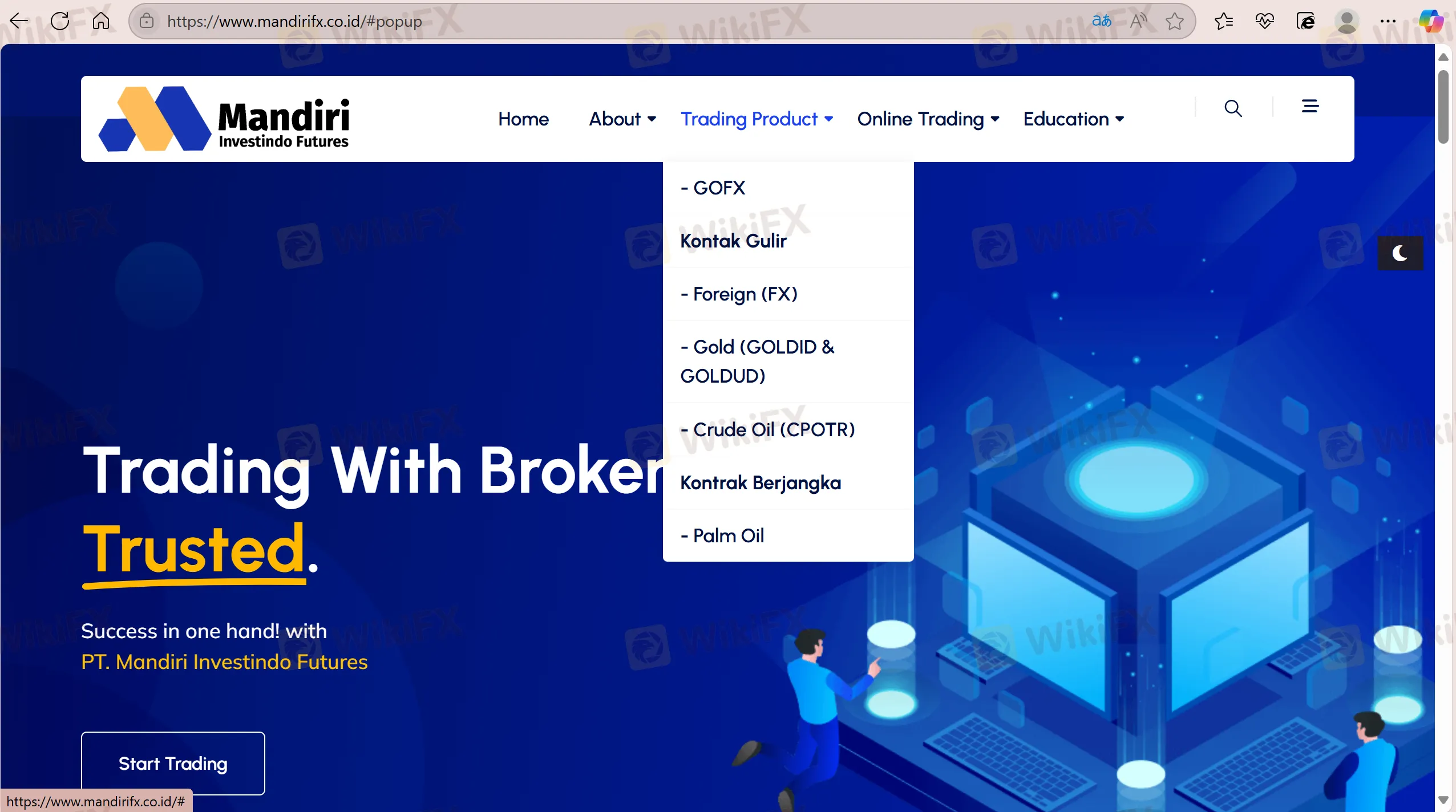

| 거래 상품 | 외환, 금, 원유, 팜오일 |

| 데모 계정 | / |

| 레버리지 | / |

| 스프레드 | / |

| 거래 플랫폼 | MT5 |

| 최소 입금액 | / |

| 고객 지원 | 문의 양식 |

| 전화: 031 3360 1175 | |

| 이메일: support@mandirifx.co.id | |

| 주소: Graha HSBC Building, 9th Floor, Jalan Basuki Rahmat No. 58-60, Tegalsari Village/Sub-district, Tegalsari District, Surabaya City, East Java Province, 60262 | |

| 지역 제한 | 미국, 이란 및 북한 |

Mandiri Investindo Futures은 인도네시아에 등록된 중개업체입니다. 제공하는 거래 상품은 외환, 금, 원유 및 팜오일을 포함합니다. 두 가지 계정 유형을 제공하며 BAPPEBTI에 의해 규제를 받고 있습니다. 그러나 공식 웹사이트에서는 거래 세부 정보를 많이 공개하지 않으며 미국, 이란 및 북한 거주자를 대상으로 서비스를 제공하지 않습니다.

| 장점 | 단점 |

| BAPPEBTI 규제 | 제한된 정보 제공 |

| MT5 지원 | 지역 제한 |

| 상품 거래 전문화 | |

| 다양한 연락 수단 |

| 규제 국가 | 규제 기관 | 현재 상태 | 규제 업체 | 라이선스 유형 | 라이선스 번호 |

| 인도네시아 | Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan (BAPPEBTI) | 규제됨 | MANDIRI INVESTINDO FUTURES | 소매 외환 라이선스 | 01/BAPPEBTI/SI/01/2023 |

Mandiri Investindo Futures은 트레이더들에게 외환, 금, 원유, 야자유를 거래할 수 있는 기회를 제공합니다.

| 거래 가능한 상품 | 지원 여부 |

| 외환 | ✔ |

| 금 | ✔ |

| 원유 | ✔ |

| 야자유 | ✔ |

| 채권 | ❌ |

| 지수 | ❌ |

| 주식 | ❌ |

| 암호화폐 | ❌ |

| 옵션 | ❌ |

Mandiri Investindo Futures은 트레이더들에게 마이크로 계정과 미니 계정 두 가지 유형의 계정을 제공합니다.

Mandiri Investindo Futures의 거래 플랫폼은 ICDX Metatrader 5로 PC 및 모바일 기기에서 트레이더를 지원합니다.

| 거래 플랫폼 | 지원 여부 | 사용 가능한 기기 | 적합 대상 |

| MT5 | ✔ | PC, 웹, 모바일 | 경험 있는 트레이더 |

| MT4 | ❌ | / | 초보자 |

In my experience as an independent trader, whether I can use Expert Advisors (EAs) for automated trading is a vital consideration before opening an account. Looking at Mandiri Investindo Futures, I see that they operate on the MetaTrader 5 (MT5) platform, and specifically, a white-label version for the Indonesian market. MT5 is well-recognized in the trading community for supporting automated strategies via EAs, which generally means algorithmic trading is technically feasible. However, just because a broker offers MT5 doesn't guarantee total freedom in running EAs—sometimes there are broker-imposed restrictions, limitations on strategy types, or even execution constraints. For Mandiri Investindo Futures, the available information highlights that the broker supports MT5 and aims for experienced traders, but it does not explicitly confirm support for EAs or detail any restrictions around their use. In my own assessment, this lack of clear communication from their official materials gives me pause. If using EAs is central to my trading approach, I would exercise caution. I’d strongly advise contacting their customer support directly—via the listed phone, email, or contact form—to verify current EA policies and any potential conditions or limitations before committing significant capital. Until such direct confirmation is obtained, I would remain cautious with automated strategies on this platform.

As an experienced trader, I take a particularly cautious approach when assessing any broker, and Mandiri Investindo Futures raises a few considerations I can't overlook. While they are regulated by BAPPEBTI in Indonesia—which does provide a significant level of legitimacy and regulatory oversight—I've noticed that the publicly available information is quite limited. For me, the lack of transparency regarding core trading conditions such as minimum deposit requirements, spreads, leverage, and detailed fee structures presents a major concern. Without clear disclosure, it becomes challenging to assess the true trading costs and risks involved. Additionally, Mandiri Investindo Futures only supports MetaTrader 5, with no MT4 option; some traders might find this limiting, especially if they're accustomed to the older platform. Their product range is focused on forex and a few commodities (gold, crude oil, and palm oil), but there's no access to indices, stocks, bonds, or cryptocurrencies. This relatively narrow offering might not suit those looking for broader diversification. Furthermore, as a white label MT5 provider operating for just 2-5 years, Mandiri Investindo Futures lacks the established track record I usually look for in a broker. Finally, there are regional service restrictions, and customer support details are sparse. For me, these issues combine to create an environment where extra diligence and conservative allocation are absolutely essential.

In my experience as a forex trader, Mandiri Investindo Futures presents a few clear strengths, especially for those prioritizing regulation and platform reliability. The fact that Mandiri Investindo Futures is registered in Indonesia and regulated by BAPPEBTI reassures me regarding a baseline of oversight and legal accountability—an essential factor when dealing with brokers in emerging markets. I also appreciate that they offer MetaTrader 5 (MT5), as this is a robust, industry-standard platform supporting both desktop and mobile access, which is important for flexibility and fast execution. Their range of tradable instruments—specifically forex, gold, crude oil, and palm oil—reflects a certain level of niche expertise, particularly in commodities, which might appeal to traders like myself looking to diversify beyond traditional forex pairs. Having multiple account types such as Micro and Mini can be practical for tailoring risk and capital exposure, though concrete details on account conditions seem lacking. However, my main hesitation with Mandiri Investindo Futures is the limited amount of publicly available information. Key details like minimum deposit, spreads, leverage, and trading costs are not clearly disclosed. As someone who makes decisions based on transparency and comparative analysis, this withholding of specifics poses a significant challenge. Additionally, their restriction on servicing traders from certain countries further narrows accessibility. The broker seems geared towards more experienced traders familiar with the Indonesian market, but the information gaps make it difficult for me to thoroughly assess all risks and benefits. For me, extra caution and diligent verification would be prudent before committing real funds.

In my research and experience with Mandiri Investindo Futures, I have found that their available information about deposit methods is quite limited. From everything I could gather regarding their regulatory status, platform details, and market focus, there is no mention or indication that they support deposits using cryptocurrencies such as Bitcoin or USDT. The broker is regulated by BAPPEBTI in Indonesia and primarily supports traditional instruments like forex, gold, crude oil, and palm oil on the MetaTrader 5 platform. Given the regulations governing Indonesian brokers and what Mandiri Investindo Futures discloses, it is far more likely that they rely only on conventional funding methods—such as bank transfers—rather than supporting crypto deposits. Personally, I am always extra cautious when a broker doesn’t provide transparent, detailed information about its funding channels on its official site. For me, a lack of clear guidelines about deposit methods is a sign to reach out to their official customer support directly—using their published phone or email—before proceeding with any financial commitment. In my professional opinion, until Mandiri Investindo Futures formally announces support for cryptocurrencies as a funding option, I would not assume that such methods are possible or available. Ultimately, I would never deposit funds until I had direct confirmation and clarity from the broker itself.

입력해 주세요....