Buod ng kumpanya

| VPS Pangkalahatang Pagsusuri | |

| Itinatag | 2006 |

| Rehistradong Bansa/Rehiyon | Vietnam |

| Regulasyon | Hindi nireregula |

| Plataforma ng Pagkalakalan | VPS SmartOne, SmartPRO at SmartEasy |

| Suporta sa Customer | Tel: 1900 6457 |

| Email: hotrokhachhang@vps.com.vn | |

| Address: 65 Cam Hoi St., Hai Ba Trung Dist., Hanoi, Vietnam. 3rd Floor, 76 Le Lai St., Dist. 1, HCM City, 112 Phan Chau Trinh St., Hai Chau Dist., Da Nang City | |

| Social media: Facebook, Linkedin, Zalo, Youtube at TIKTOK | |

Itinatag ng VPS Securities ang VPS noong 2006 sa Vietnam. Nagbibigay ito ng ilang mga produkto at serbisyo tulad ng Retail Sales & Brokerage (Growth Investments, Flexible Accumulation, Financial Services, Financial and Lifestyle Utilities at Trading Platform), Institutional Sales & Brokerage at Investment Banking. Gayunpaman, hindi ito nireregula.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Maramihang mga produkto at serbisyo | Hindi nireregula |

| Kawalan ng transparensya |

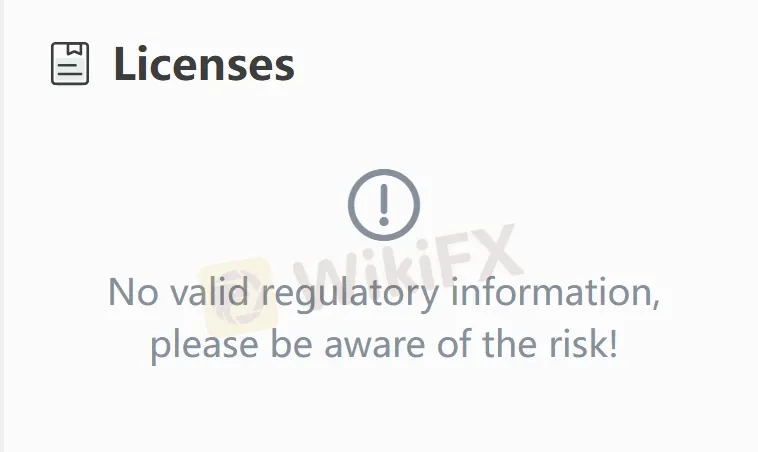

Totoo ba ang VPS?

Hindi, hindi nireregula ng anumang mga awtoridad sa pananalapi ang VPS. At hindi ito kailangang sumunod sa mga patakaran ng anumang regulasyon. Dapat mag-ingat ang mga mangangalakal sa mga panganib sa pondo.

Plataforma ng Pagkalakalan

| Plataforma ng Pagkalakalan | Supported | Available Devices | Suitable for |

| SmartOne | ✔ | Mobile | Mga may karanasan na mangangalakal |

| SmartPRO | ✔ | ||

| SmartEasy | ✔ | ||

| MT4 | ❌ | / | Mga nagsisimula |

| MT5 | ❌ | / | Mga may karanasan na mangangalakal |

chengaohuan

Hong Kong

ang aking account ay naka-log in VPS , at may mga trade bawat buwan. bakit ko ire-renew ang aking subscription kung nagpapakita ito ng hindi sapat na mga kondisyon at zero trade? kung hindi ako makapag-renew, hindi ba sinusubukan ako nitong dayain para maningil ng barya??

Paglalahad

Chen Miyagi

Singapore

Magandang serbisyo, mabilis kong nakuha ang aking credit card. BTW, walang taunang bayad.

Positibo

A&~

Vietnam

Naimpondo sa ilang matatag na plataporma sa pangangalakal at sa iba't ibang mga seguridad na available. Ang mga pagsusuri at mga pahayag sa pananalapi ay laging malinaw at maagap. Sana lang mas responsibo ang serbisyo sa customer tuwing mga oras ng peak.

Positibo

王川岷

South Africa

So far walang problema. May kilala akong masasamang broker kung saan imposibleng gumawa ng mga tugon sa suporta ng pera araw-araw, madalas na nag-freeze ang platform. Hindi ko napansin ang mga ganitong problema dito.

Positibo