Profil perusahaan

| NOMURA Ringkasan Ulasan | |

| Didirikan | 1994 |

| Negara/Daerah Terdaftar | Jepang |

| Regulasi | FSA |

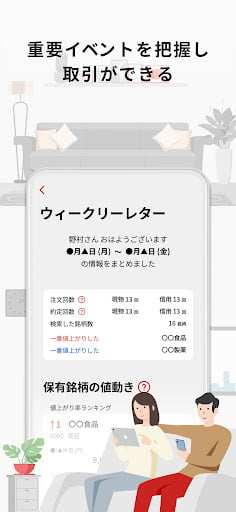

| Instrumen Pasar | Saham Domestik, Saham Asing, Investasi Amanah, Obligasi, FX, Real Estate ST |

| Akun Demo | / |

| Leverage | 1:25 |

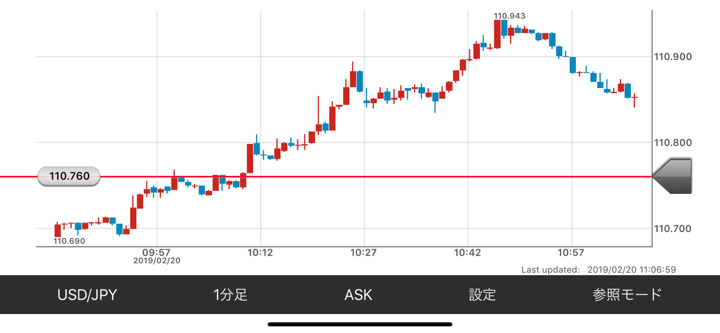

| Spread | USD/JPY: 2.8pips |

| Platform Trading | Aplikasi Manajemen Aset Nomura ("NOMURA"), Aplikasi Manajemen Aset ("OneStock"), Aplikasi FX Nomura |

| Deposit Minimum | / |

| Dukungan Pelanggan | - Panggilan Umum: 0570-077-000 |

| - Alternatif: 042-303-8100 | |

Informasi NOMURA

Nomura Securities menawarkan saham, investasi amanah, perdagangan FX, dan real estate terstruktur. Sistem perdagangan canggih dan kontrol regulasi yang ketat melayani klien ritel dan institusional. Struktur biaya perusahaan bervariasi berdasarkan saluran layanan, dengan tarif di cabang jauh lebih tinggi daripada tarif online.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Diatur oleh FSA | Biaya lebih tinggi untuk transaksi di cabang |

| Aplikasi dan platform perdagangan lengkap | Leverage terbatas dibandingkan pesaing |

| Banyak instrumen yang dapat diperdagangkan | Tidak ada akun demo yang tersedia |

Apakah NOMURA Legal?

Ya, Nomura diatur. FSA Jepang mengawasinya dengan Lisensi Forex Ritel. Nomor lisensi tersebut adalah 関東財務局長(金商)第142号, dengan tanggal efektif 2007-09-30.

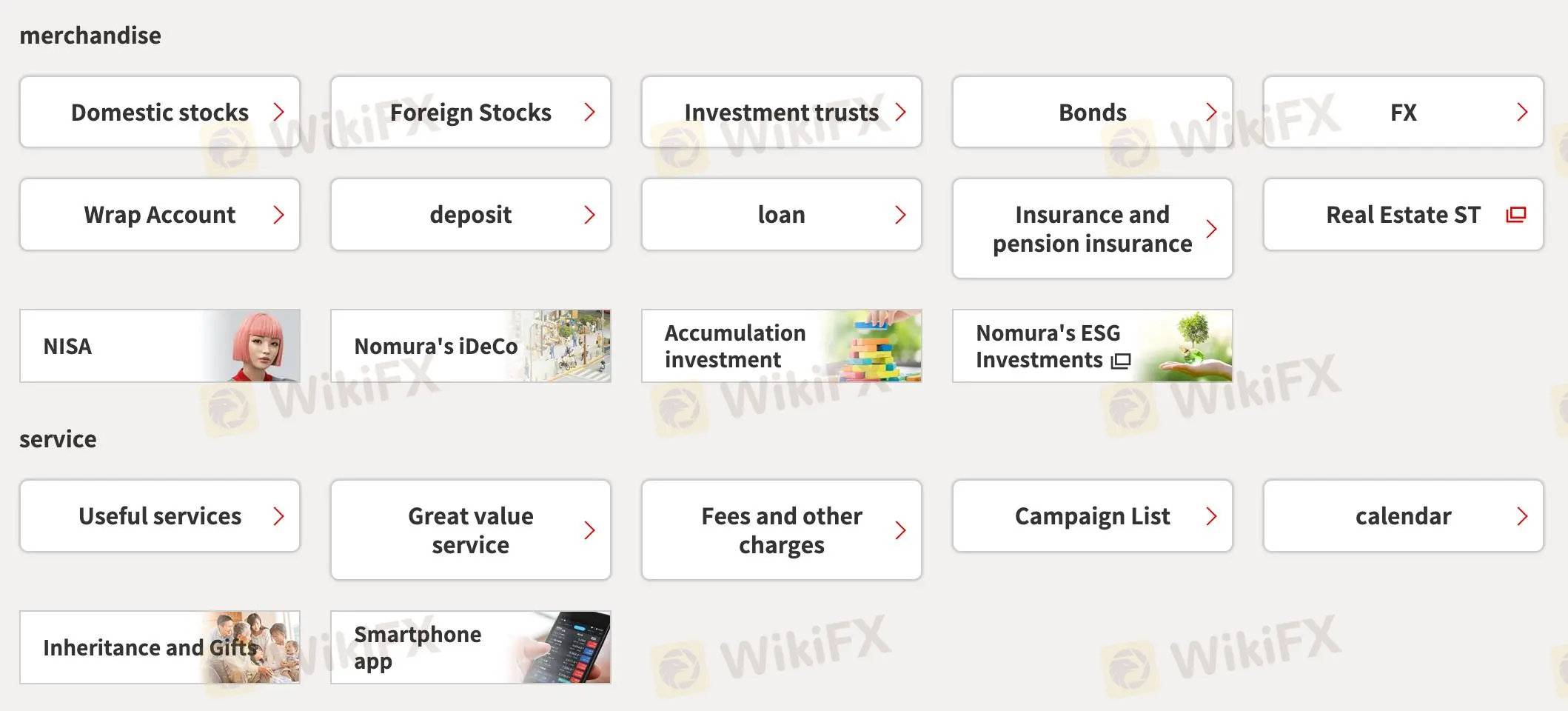

Layanan dan Produk

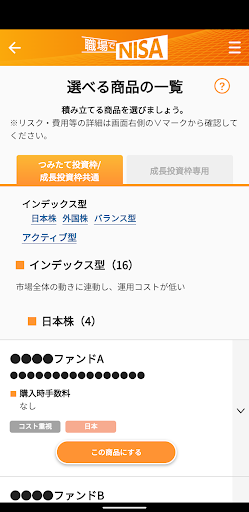

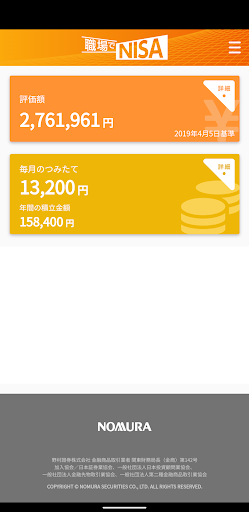

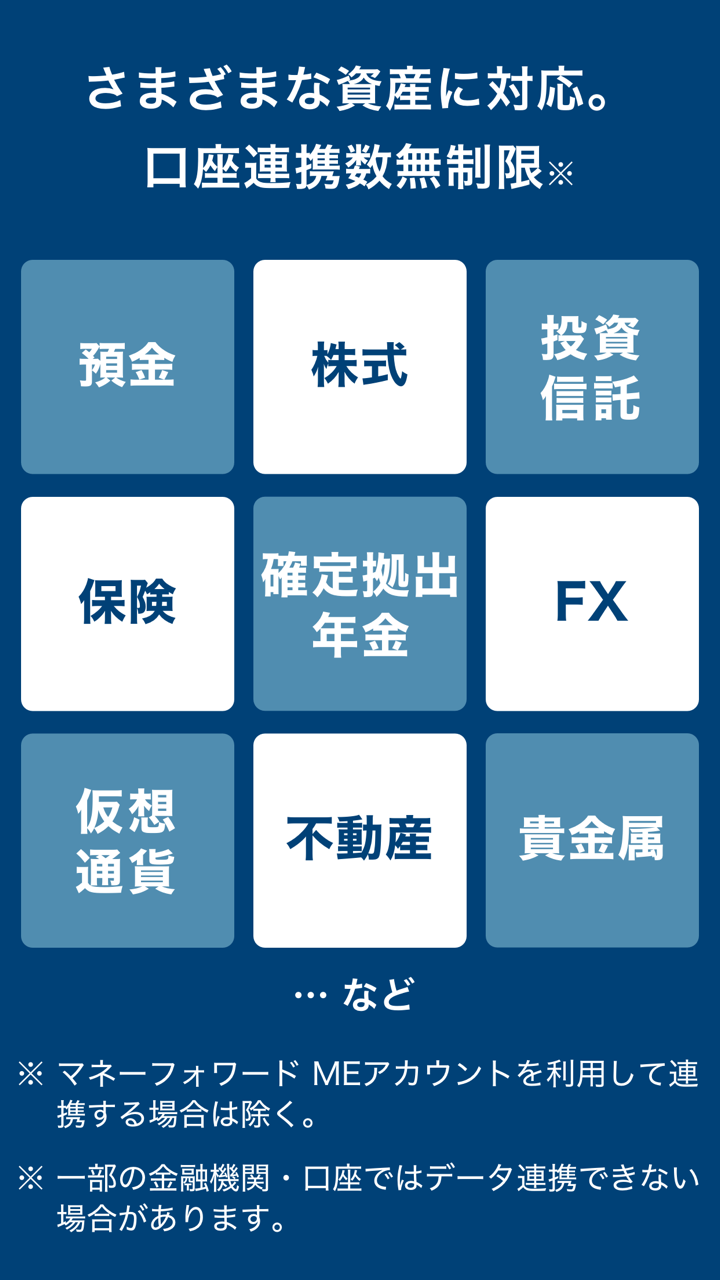

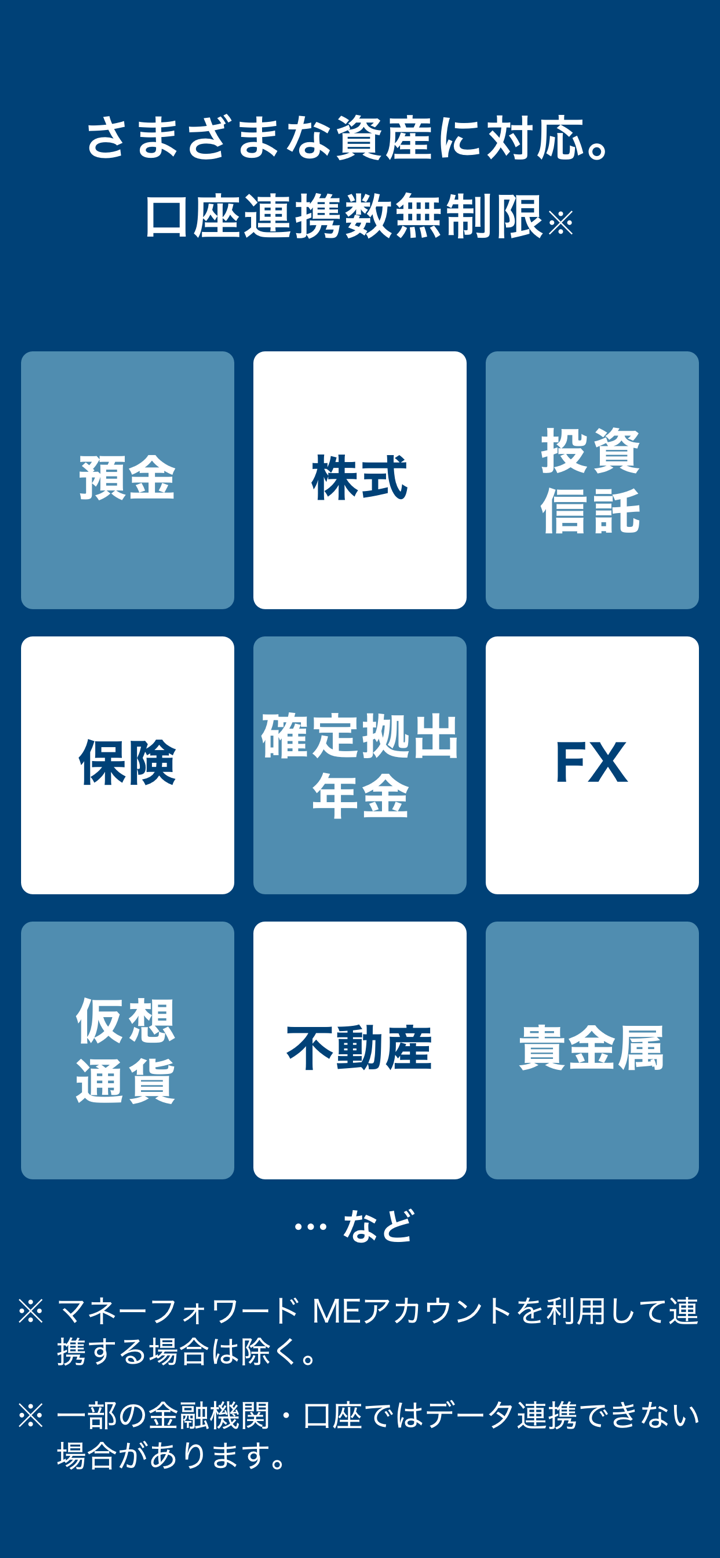

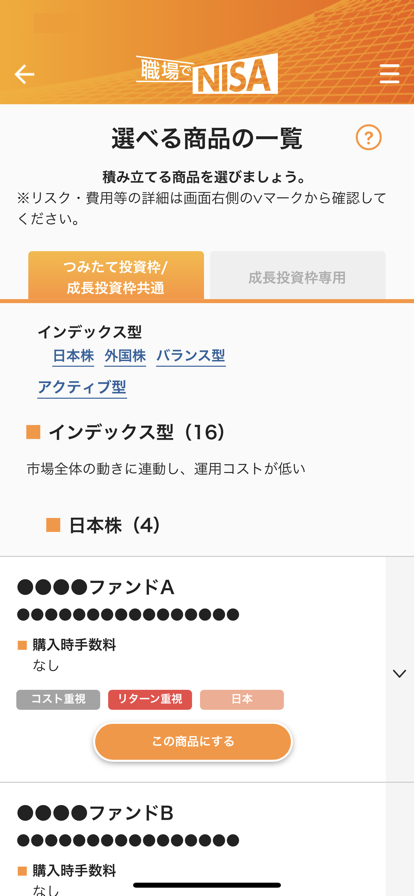

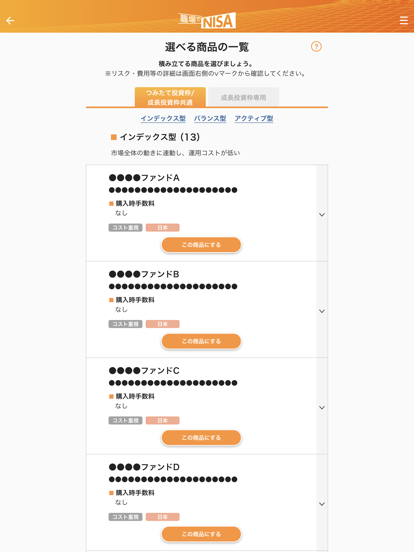

Broker ini menyediakan saham lokal dan asing, investasi amanah, obligasi, perdagangan FX, dan produk asuransi di antara berbagai produk dan layanan keuangan. Mereka menyediakan layanan dukungan termasuk promosi kampanye, persiapan warisan, dan aplikasi smartphone.

| Instrumen yang Dapat Diperdagangkan | Didukung |

| Saham Domestik | ✔ |

| Saham Asing | ✔ |

| Investasi Amanah | ✔ |

| Obligasi | ✔ |

| FX | ✔ |

| Produk Real Estate Terstruktur (ST) | ✔ |

| Komoditas | ❌ |

| Kripto | ❌ |

| ETF | ❌ |

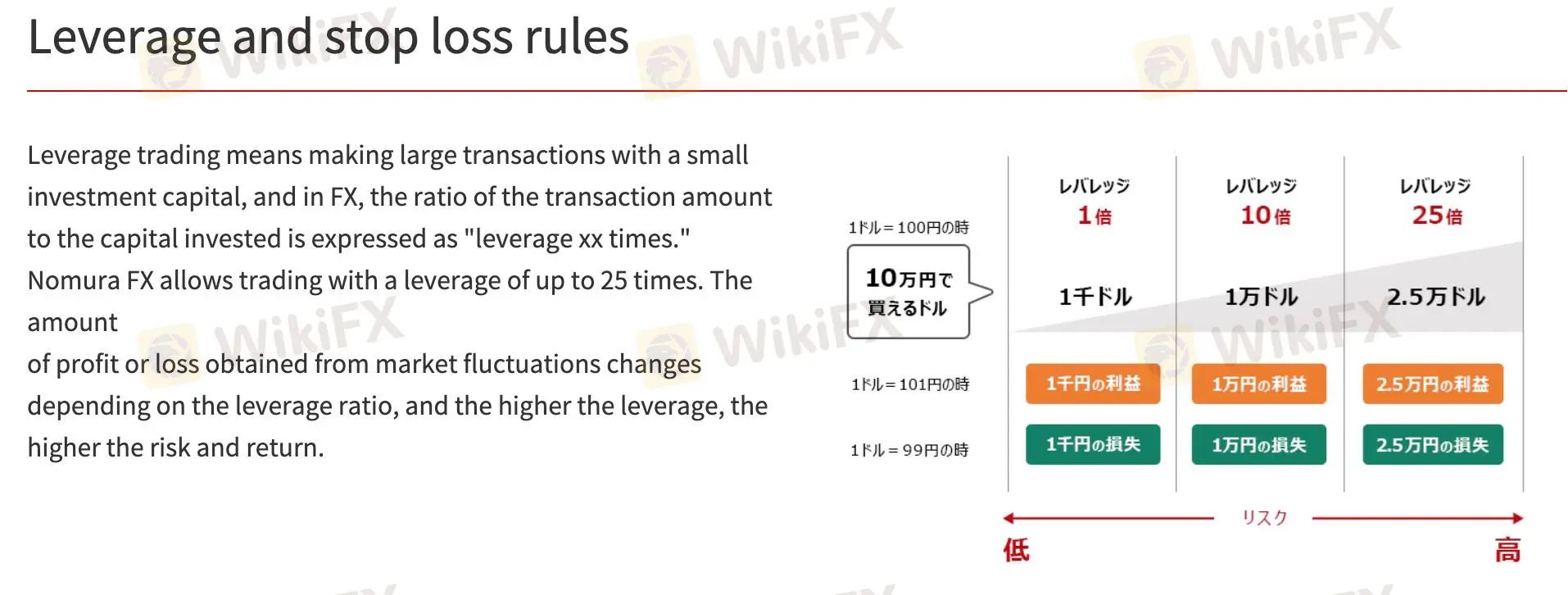

Leverage

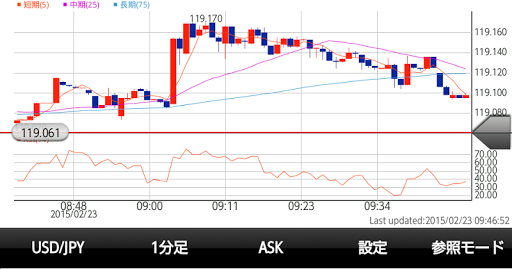

Nomura FX memungkinkan para trader untuk melakukan perdagangan yang lebih besar dengan modal yang lebih sedikit dengan leverage 25x. Leverage tinggi meningkatkan keuntungan tetapi juga meningkatkan kerugian. Aturan "loss cut," yang secara otomatis menutup posisi ketika "margin maintenance rate" turun di bawah 100%, mengurangi risiko di Nomura FX. Para trader harus berhati-hati karena perubahan pasar yang tiba-tiba dapat menyebabkan kerugian yang lebih besar dari jumlah uang yang didepositkan, bahkan dengan stop-loss.

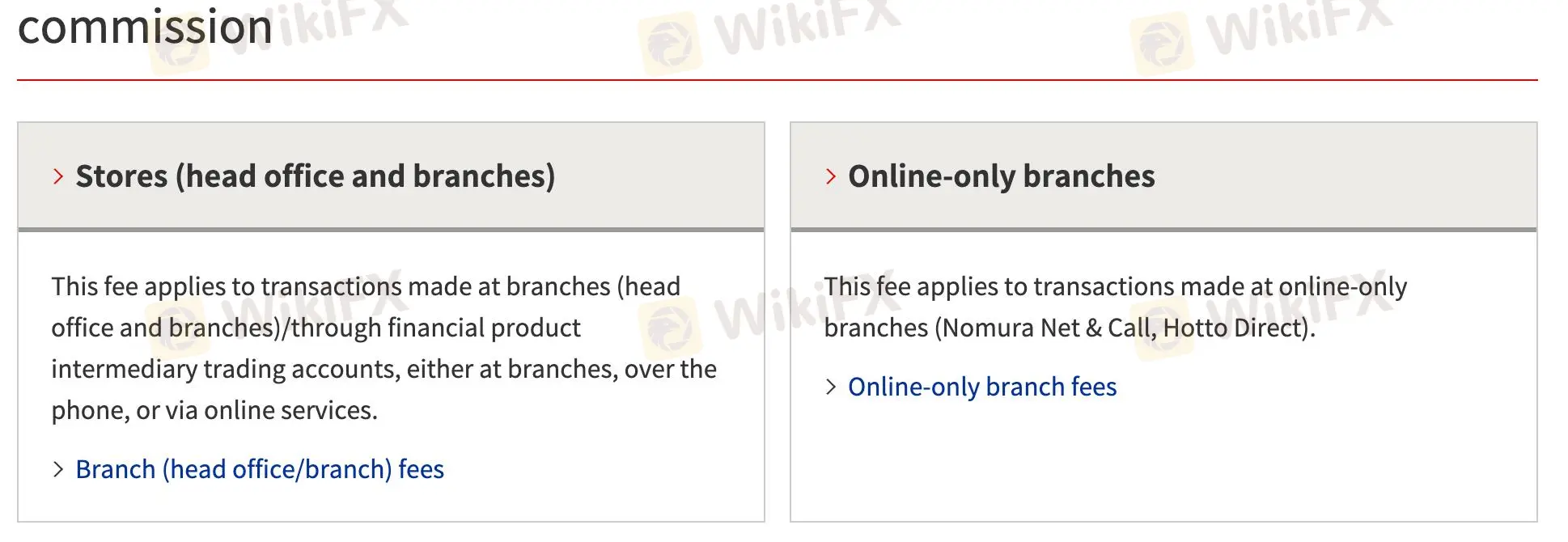

NOMURA Biaya

Tarif Nomura bervariasi berdasarkan layanan, dengan transaksi di cabang fisik dan hanya daring memiliki biaya yang berbeda. Cabang fisik mengenakan biaya yang jauh lebih tinggi untuk perdagangan saham domestik daripada akun internet.

| Jenis Biaya | Biaya |

| Transfer saham ke perusahaan lain (<20 unit) | Biaya dasar: 550 yen + 550 yen/unit (minimum 1,100 yen). |

| Transfer saham ke perusahaan lain (>20 unit) | Biaya seragam: 11,000 yen. |

| Pembelian tambahan saham | 330 yen per saham. |

| Sertifikat saldo atau transaksi | Gratis untuk transaksi individu; 1,000 yen untuk transaksi ganda per akun. |

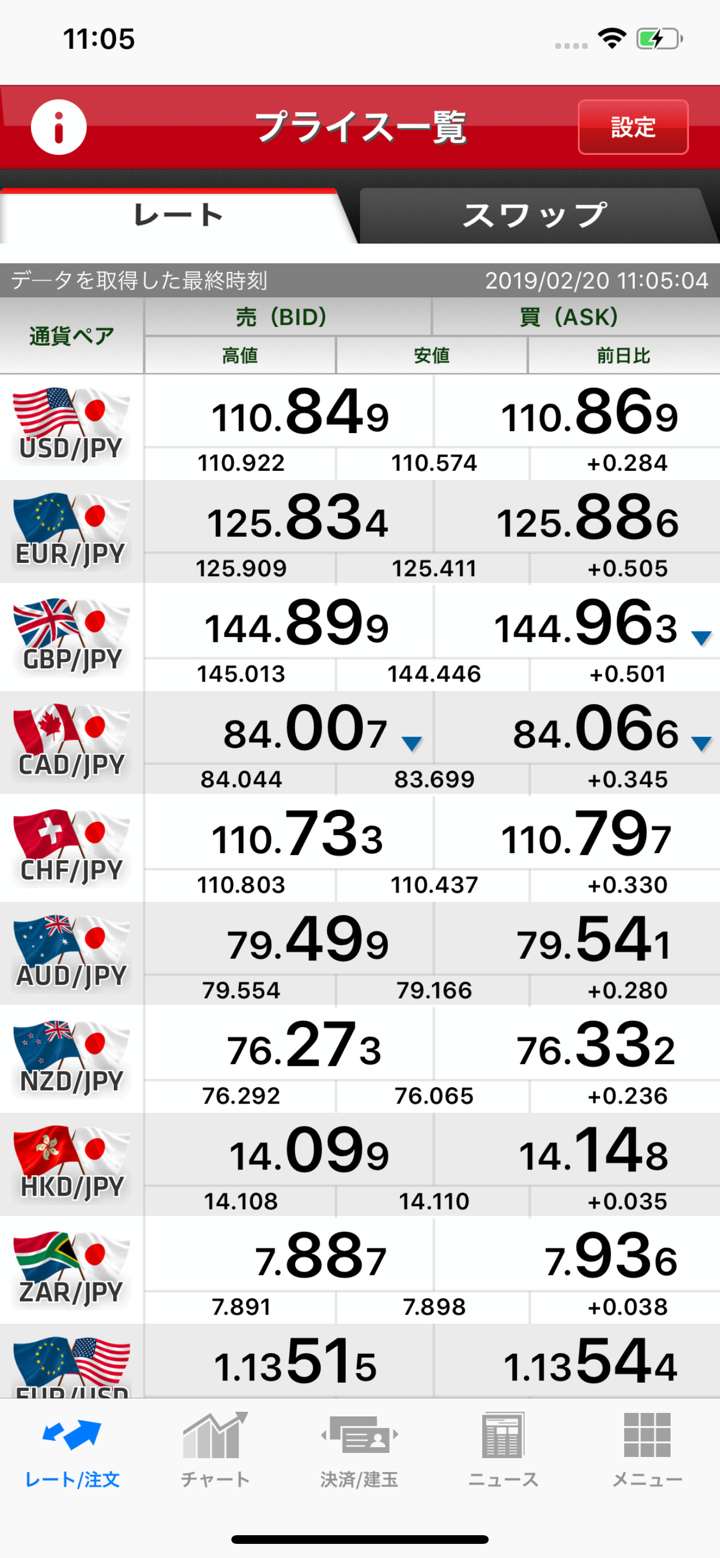

Tidak Ada Biaya Transaksi: Nomura FX tidak mengenakan biaya transaksi eksplisit tetapi mendapatkan pendapatan dari spread.

Swap Rates: Para trader dapat mendapatkan atau membayar poin swap tergantung pada selisih suku bunga antara mata uang yang diperdagangkan. Poin swap fluktuatif berdasarkan kondisi pasar.

Konversi Mata Uang: Untuk perdagangan mata uang non-yen, spread tambahan untuk konversi yen mungkin berlaku.

| Pasangan Mata Uang | Spread (pips) |

| USD/JPY | 2.8 |

| EUR/JPY | 5.3 |

| GBP/JPY | 6.9 |

| AUD/JPY | 4.9 |

| EUR/USD | 2.9 |

Platform Perdagangan

| Platform Perdagangan | Didukung | Perangkat yang Tersedia | Cocok untuk Jenis Trader Apa |

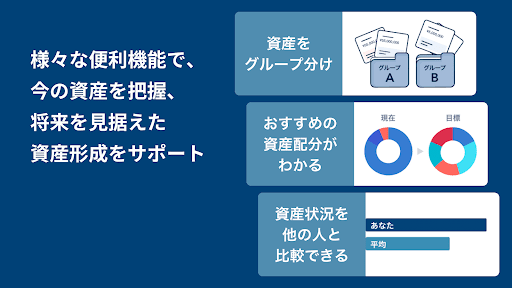

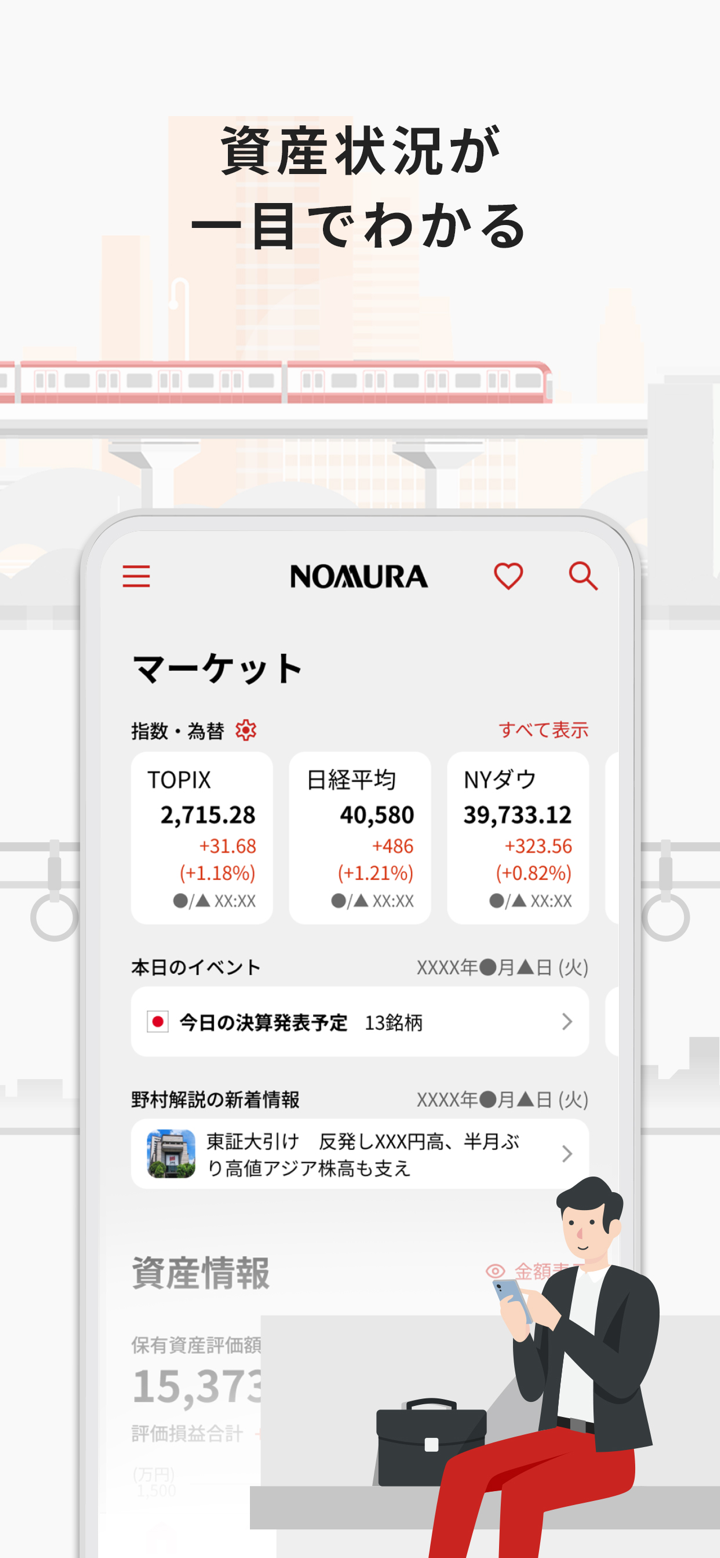

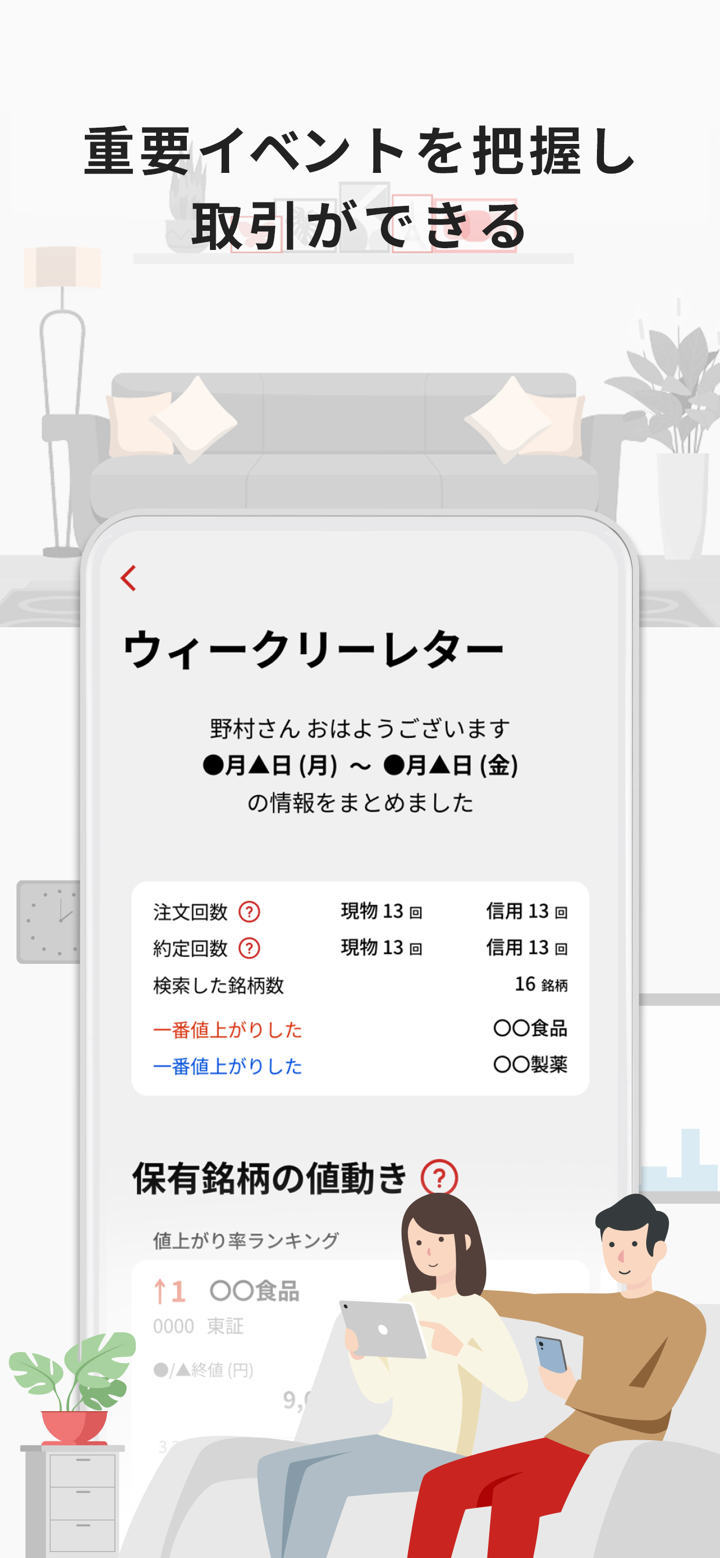

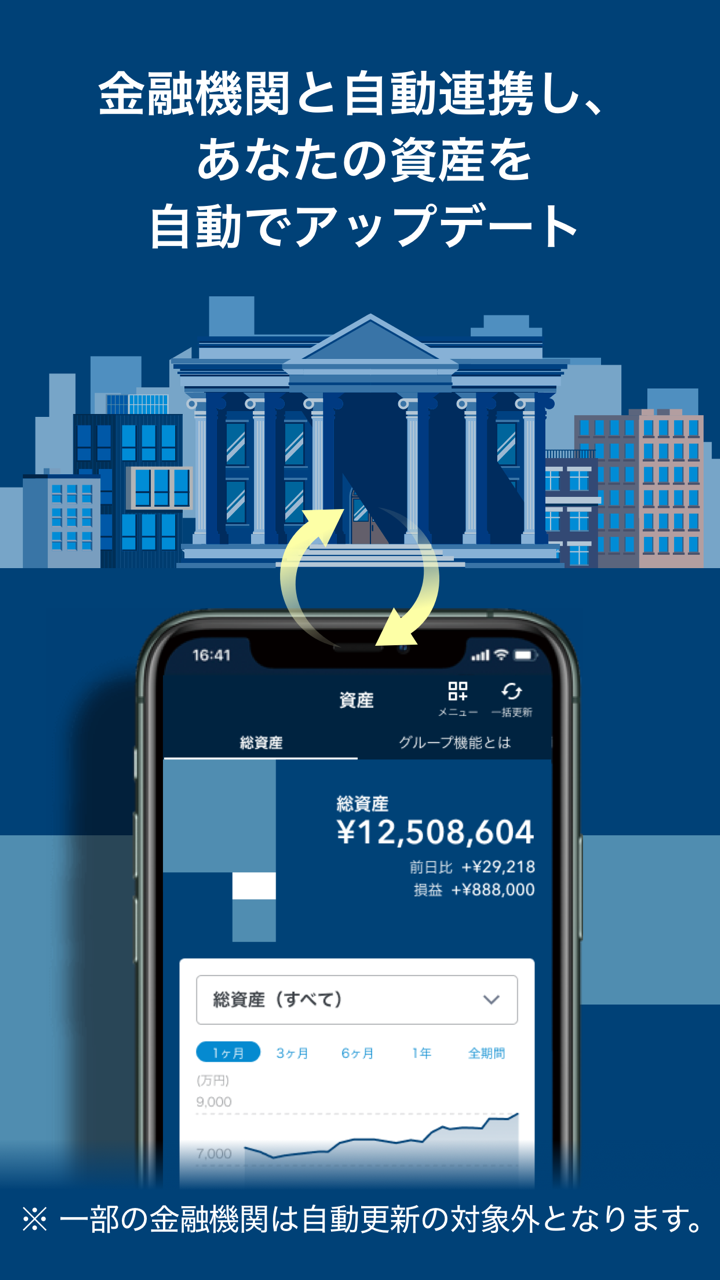

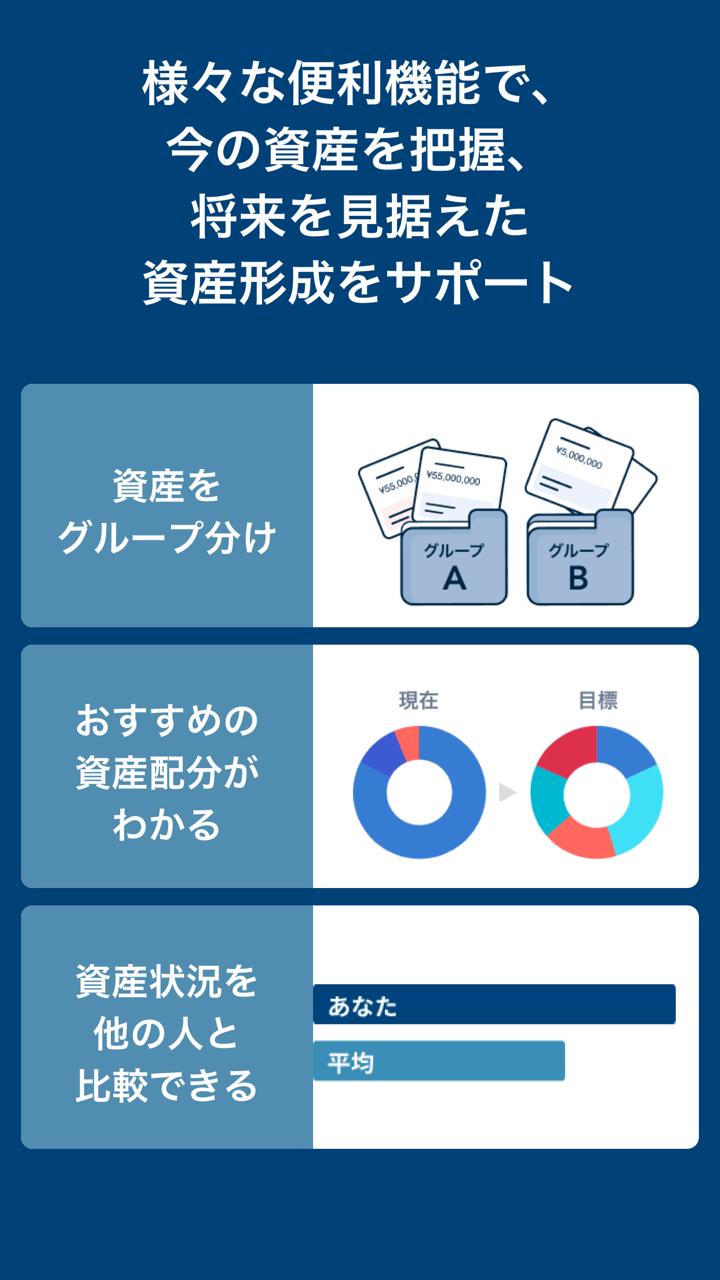

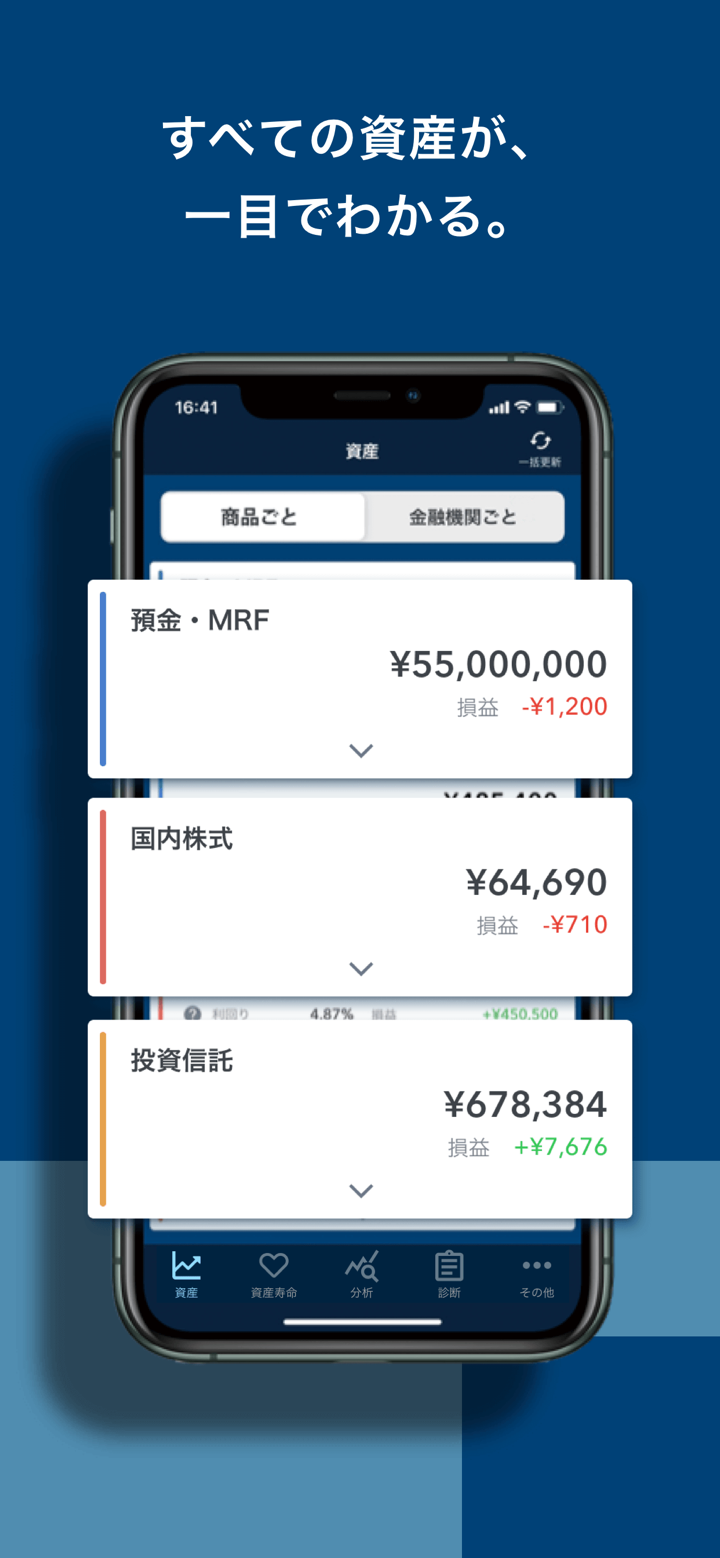

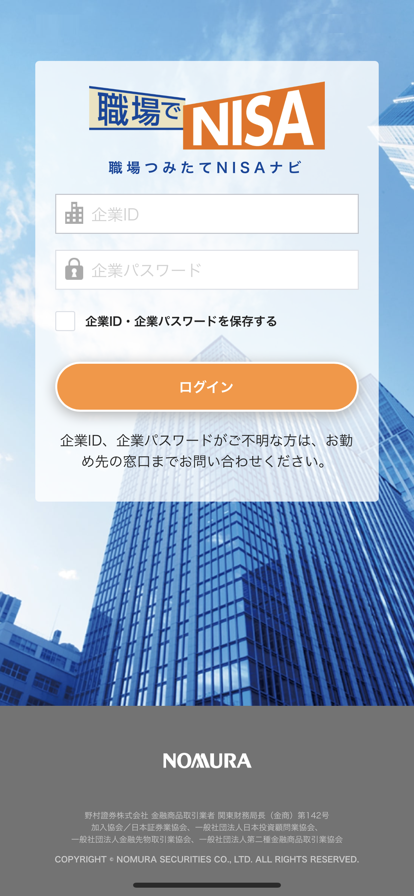

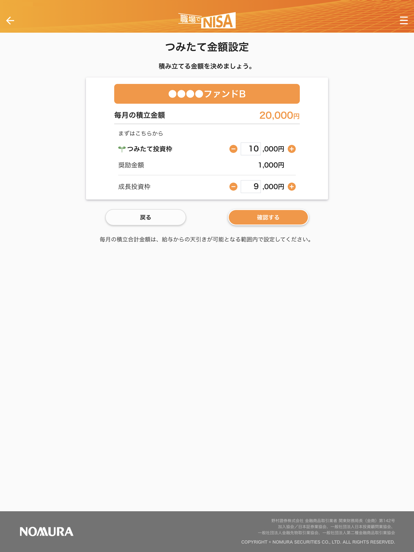

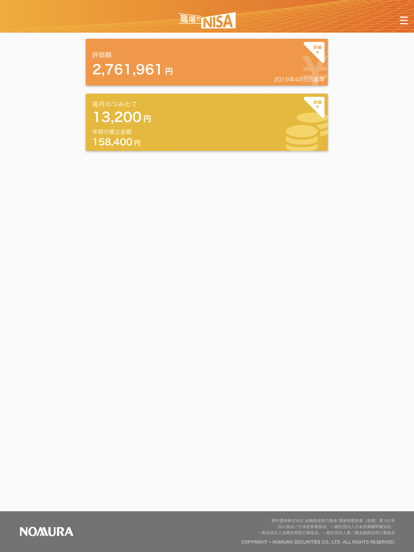

| Aplikasi Manajemen Aset Nomura "NOMURA" | ✔ | iPhone, Android | Para trader dan investor yang mengelola beberapa aset keuangan dan mencari alat perdagangan yang dipersonalisasi. |

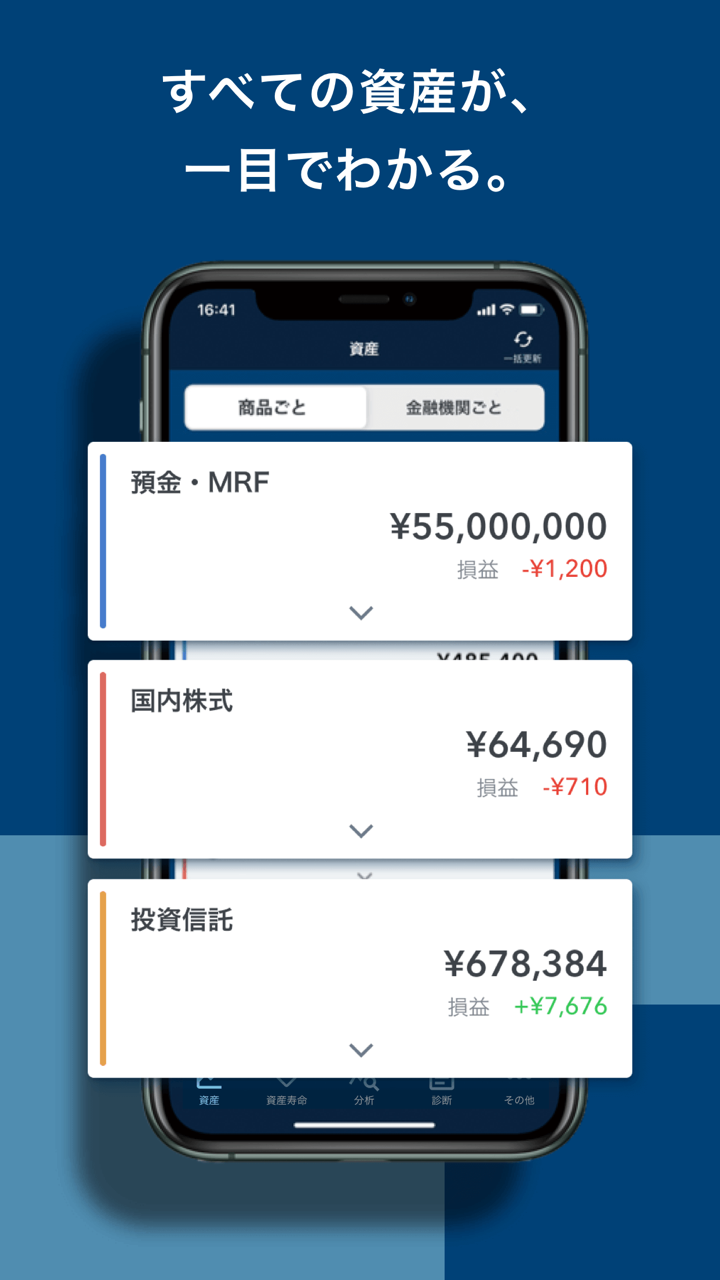

| Aplikasi Manajemen Aset "OneStock" | ✔ | iPhone, Android | Investor yang ingin melihat gambaran umum aset mereka, dengan fitur tambahan seperti diagnosis aset. |

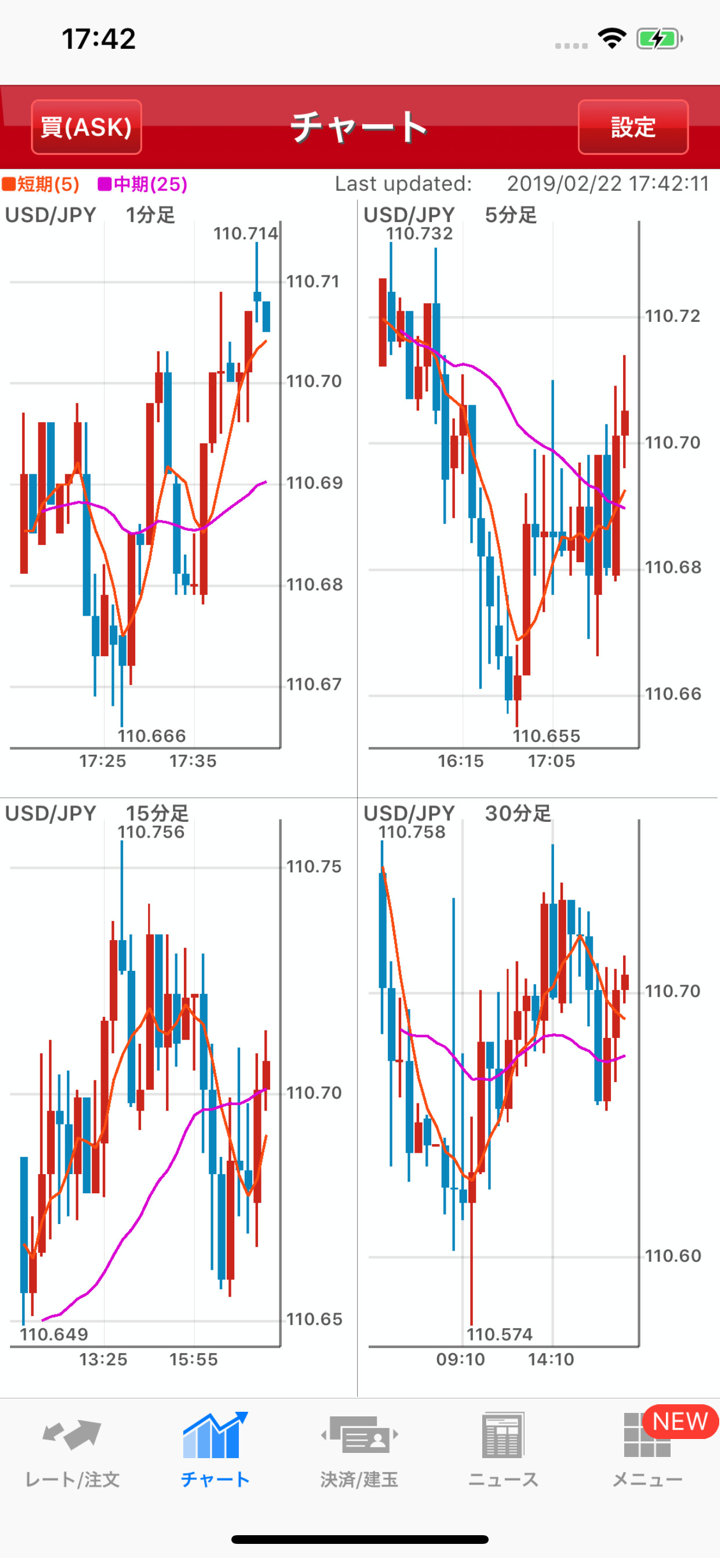

| Aplikasi Nomura FX | ✔ | iPhone, Android | Para trader forex yang lebih suka melakukan perdagangan di perangkat seluler dengan operasi yang intuitif dan terfokus. |