Informasi Dasar

Bangladesh

Bangladesh

Skor

Bangladesh

|

5-10 tahun

|

Bangladesh

|

5-10 tahun

| https://www.nccbank.com.bd

Website

Peringkat indeks

Pengaruh

C

Indeks pengaruh NO.1

Bangladesh 4.24

Bangladesh 4.24 Lisensi

LisensiTidak ada informasi regulasi yang valid, harap waspada!

Bangladesh

Bangladesh nccbank.com.bd

nccbank.com.bd Amerika Serikat

Amerika Serikat| NCC Bank Ringkasan Ulasan | |

| Dibentuk | 1985 |

| Negara Terdaftar | Bangladesh |

| Regulasi | Tidak diatur |

| Produk & Layanan | Perbankan ritel, perbankan UMKM, perbankan korporat, layanan keuangan digital, perbankan NRB, kartu, perbankan luar negeri |

| Platform | NCC Always (Perbankan Internet & Seluler), NCC ICON (Perbankan Internet Korporat), NCC Green PIN, NCC Sanchayee (Pendaftaran Digital), Layanan Diri Pelanggan (CSS), Portal Pernyataan |

| Deposit Minimum | Tk. 500 |

| Dukungan Pelanggan | Telepon: 09666700008 |

| PABX: 8802-223381903-4, 8802-223383981-3 | |

| Fax: 8802-223386290 | |

| Email: info@nccbank.com.bd | |

| SWIFT: NCCLBDDH | |

NCC Bank adalah bank komersial Bangladesh yang telah berdiri sejak tahun 1985. Bank ini menawarkan berbagai layanan perbankan kepada individu, bisnis kecil dan menengah, perusahaan, dan pelanggan dari negara lain. Bank ini menawarkan layanan perbankan ritel dan korporat yang baik, tetapi tidak diizinkan untuk menawarkan layanan pialang forex atau investasi.

| Pro | Kontra |

| Bank yang telah lama berdiri | Tidak diatur |

| Berbagai layanan ritel dan korporat | Struktur biaya kompleks |

| Platform perbankan digital dan seluler yang kuat |

Tidak, NCC Bank tidak diatur sebagai pialang forex atau investasi. Komisi Sekuritas dan Bursa Bangladesh (BSEC) dan Bank Bangladesh tidak memberikan izin kepada perusahaan ini untuk menawarkan layanan forex atau investasi, meskipun berbasis di Bangladesh.

NCC Bank berfokus pada individu, bisnis, dan klien dari negara lain. Ini menawarkan berbagai layanan perbankan, seperti perbankan ritel, perbankan korporat, perbankan UMKM, layanan keuangan digital, perbankan NRB (Bangladeshi non-residen), dan layanan kartu.

| Produk dan Layanan | Didukung |

| Perbankan Ritel | ✔ |

| Perbankan UMKM | ✔ |

| Perbankan Korporat | ✔ |

| Layanan Keuangan Digital | ✔ |

| Perbankan NRB (Klien Luar Negeri) | ✔ |

| Kartu | ✔ |

| Informasi Tingkat Indikatif | ✔ |

| Unit Perbankan Offshore (OBU) | ✔ |

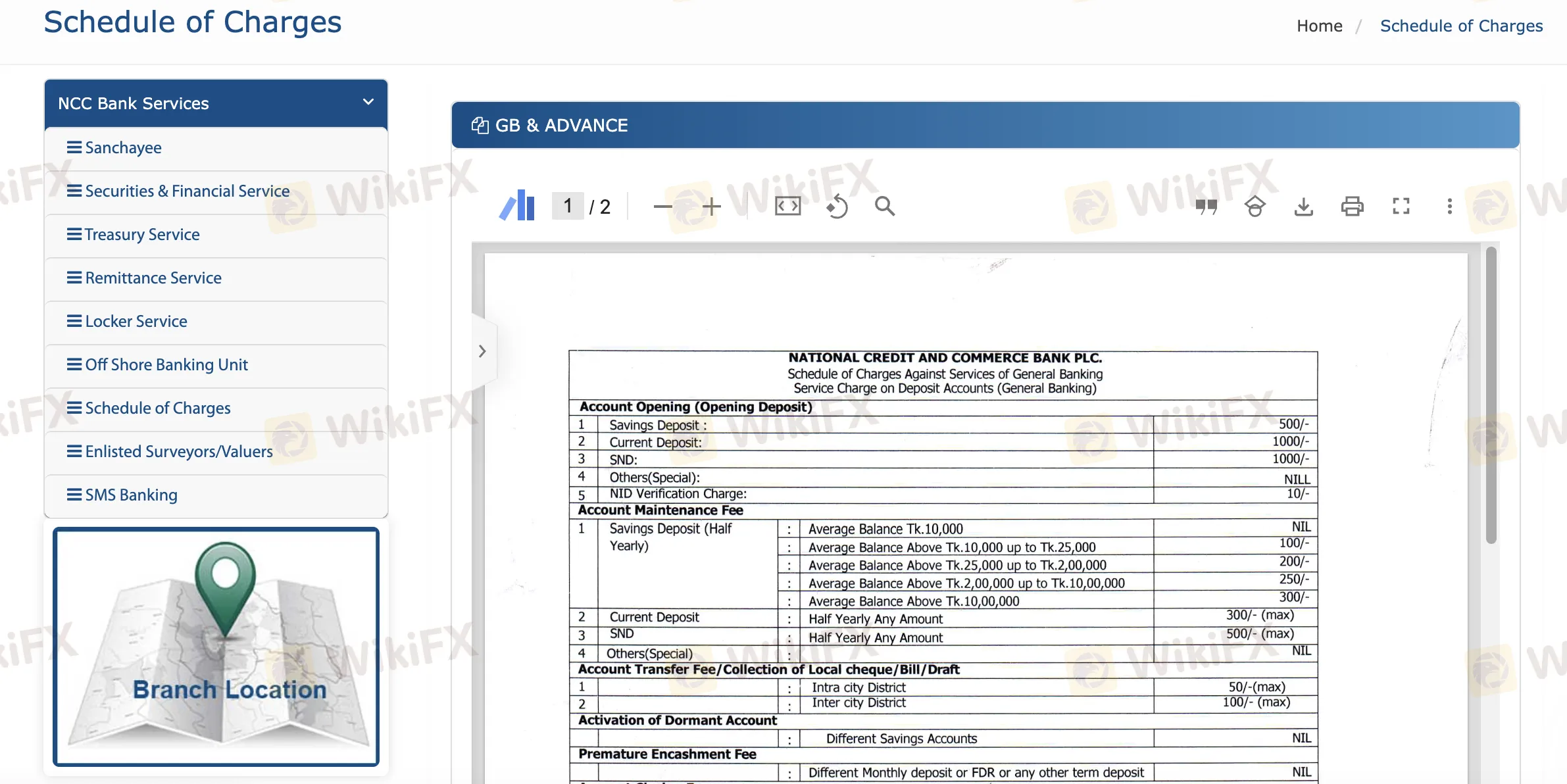

Harga-harga NCC Bank biasanya cukup masuk akal dibandingkan dengan apa yang dikenakan oleh bank lain di daerah tersebut. Beberapa layanan, seperti menjaga akun Anda tetap terkini dan melakukan transaksi sederhana, gratis atau berbiaya rendah. Namun, layanan yang lebih khusus, seperti pinjaman, jaminan, atau transaksi besar, lebih mahal.

| Jenis Biaya | Jumlah / Rentang |

| Pembukaan Rekening (Tabungan) | Tk. 500 |

| Pembukaan Rekening (Giro) | Tk. 1,000 |

| Biaya Pemeliharaan Rekening (Tabungan) | NIL hingga Tk. 300 (setengah tahunan, berdasarkan tier saldo) |

| Biaya Pemeliharaan Rekening (Giro) | Hingga Tk. 300 (setengah tahunan) |

| Biaya Transfer Rekening (Dalam Kota) | Maks Tk. 50 |

| Biaya Transfer Rekening (Antar Kota) | Maks Tk. 100 |

| Aktivasi Rekening Tidur | Gratis |

| Biaya Penutupan Rekening (Tabungan) | Tk. 200 |

| Penerbitan Buku Cek (Hilang) | Tk. 7 per lembar |

| Konfirmasi Saldo / Laporan | Tk. 100–200 (per kejadian, catatan tahun lalu) |

| Instruksi Pemblokiran Pembayaran | Tk. 100 per instruksi |

| Perintah Pembayaran (PO) | Tk. 20–100 (berdasarkan jumlah) |

| DD, TT, MT | Tk. 20–300 (berdasarkan jumlah) |

| Biaya Pengolahan Pinjaman | Maks 0,50% hingga Tk. 50 lakh (maks Tk. 15,000); 0,30% di atas Tk. 50 lakh (maks Tk. 20,000) |

| Penjadwalan Ulang / Restrukturisasi Pinjaman | Hingga 0,25%, maks Tk. 10,000 (non-CMSME) |

| Biaya Penyelesaian Awal | NIL (CMSME); Maks 0,50% (pinjaman lainnya) |

| Biaya Denda | 2% |

| Komisi Jaminan Bank | 0,30–0,50% per kuartal, min Tk. 1,000 |

| Biaya Online (Dalam Kota) | Gratis (jumlah kecil), Tk. 50 (lebih besar) |

| Biaya Online (Antar Kota) | Gratis (kecil), Tk. 100 (lebih besar) |

| Platform | Didukung | Perangkat Tersedia |

| NCC Selalu (Internet & Mobile Banking) | ✔ | PC, Mobile |

| NCC ICON (Corporate Internet Banking) | ✔ | PC, Web |

| NCC Green PIN (Aktivasi Kartu & PIN) | ✔ | ATM, Internet Banking, Mobile Banking |

| NCC Sanchayee (Pendaftaran Digital) | ✔ | Web, Mobile |

| Layanan Mandiri Pelanggan (CSS) | ✔ | Web, Mobile |

| Portal Laporan | ✔ | Web |

As mentioned earlier, NCC Bank does not offer a demo account. The bank’s services are primarily geared toward retail banking, corporate banking, and digital financial services, rather than trading or investment services. If you're looking for a platform to practice trading or investments, I would suggest looking for specialized brokers or financial institutions that offer demo accounts. However, you can always manage your ncc bank account easily by logging in via their ncc bank login platform.

NCC Bank operates as a legitimate commercial bank offering various banking services, such as retail, SME, and corporate banking. However, it is important to note that the bank is not licensed to provide forex or investment services. This limits its legitimacy when it comes to investment opportunities. As an established institution, the bank has been around for decades and offers strong digital and mobile banking platforms. Yet, for clients seeking investment opportunities, the absence of regulatory oversight might be a significant drawback. While it is safe for regular banking, I would advise caution if you're seeking investment or forex services. You can manage your day-to-day banking tasks conveniently through the ncc bank login page.

NCC Bank provides a wide range of banking services including retail banking, SME banking, corporate banking, and digital financial services. They also offer specialized services for non-resident Bangladeshis (NRB) and offshore banking, which allows international clients to manage their finances. However, it is important to note that NCC Bank does not provide forex or investment brokerage services. If you are looking for a bank account to manage your personal or business finances, you can open a ncc bank account through their online platforms.

One of the main drawbacks of NCC Bank is its lack of regulation in the investment sector. The absence of a regulatory license from the Bangladesh Securities and Exchange Commission (BSEC) and the Bangladesh Bank makes it unsuitable for forex or investment trading. Additionally, while the bank provides many digital services, its fees can become quite complex, especially for services like loans, guarantees, and major transactions. While NCC Bank is a trusted institution in the banking sector, it is not a viable option for investment banking services, in my opinion. To access your ncc bank account, you can use their convenient ncc bank login option available on both mobile and web platforms.

Silakan masukan...

TOP

TOP

Chrome

Plugin Chrome

Pertanyaan Regulasi Pialang Forex Global

Jelajahi situs web broker forex dan kenali broker resmi dan penipu secara akurat

Pasang sekarang