Buod ng kumpanya

| Finansia Buod ng Pagsusuri | |

| Itinatag | 2002 |

| Rehistradong Bansa/Rehiyon | Thailand |

| Regulasyon | Walang regulasyon |

| Produktong Pangkalakalan | Mga Securities |

| Demo Account | ❌ |

| Platform ng Pangangalakal | Finansia HERO (PC, iOS, Android) |

| Minimum na Deposit | / |

| Suporta sa Customer | Tel: 02 782 2400 |

| Email: cxcenter@fnsyrus.com | |

Impormasyon Tungkol sa Finansia

Itinatag noong 2002 at may punong tanggapan sa Thailand, ang Finansia Syrus Securities ay isang kumpanya ng brokerage na nagbibigay ng malawak na hanay ng mga serbisyo kabilang ang pagtitingi ng securities, pag-subscribe sa IPO, at seminar sa edukasyon. Bagaman tumatakbo ito bilang Broker No. 24 sa Stock Exchange of Thailand, hindi ito kontrolado sa pandaigdig at walang mga pagpipilian para sa demo o Islamic account.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Libreng seminar sa pamumuhunan | Walang regulasyon |

| Nag-aalok ng maraming uri ng account | Walang demo account para sa pagsasanay |

| Makapangyarihang in-house trading platform (Finansia HERO) | Ditiyak na minimum na deposito |

| Mahabang kasaysayan ng operasyon |

Tunay ba ang Finansia?

Ang Finansia ay hindi lisensyado o regulado ng anumang pangunahing ahensiyang pampinansyal na nagreregula. Bagaman nakarehistro ito sa Thailand, hindi kontrolado ng Thai Securities and Exchange Commission (SEC) ang mga internasyonal o currency brokerage services nito.

Ipakita ng mga rekord ng WHOIS na ang domain na fnsyrus.com ay nirehistro noong Mayo 26, 2009 at huling binago noong Mayo 16, 2025. Magwawakas ito noong Mayo 26, 2026. Ang kasalukuyang kalagayan nito ay "client transfer prohibited", na nagpapahiwatig na ito ay aktibo at pinoprotektahan mula sa hindi awtorisadong mga pagbabago o paglilipat, na nagpapahiwatig na ito ay isang buhay at gumagana na domain sa ilalim ng mga karaniwang patakaran ng proteksyon.

Finansia Mga Serbisyo

Nakatuon sa securities brokerage para sa parehong mga retail at institutional na customer sa Thailand, nagbibigay ang Finansia Syrus Securities ng isang malawak na hanay ng mga serbisyo sa pamumuhunan. May malaking presensya sa Stock Exchange of Thailand (Broker No. 24), nag-aalok ito ng mga digital na tool sa pangangalakal, pananaliksik sa merkado, at suporta sa edukasyon.

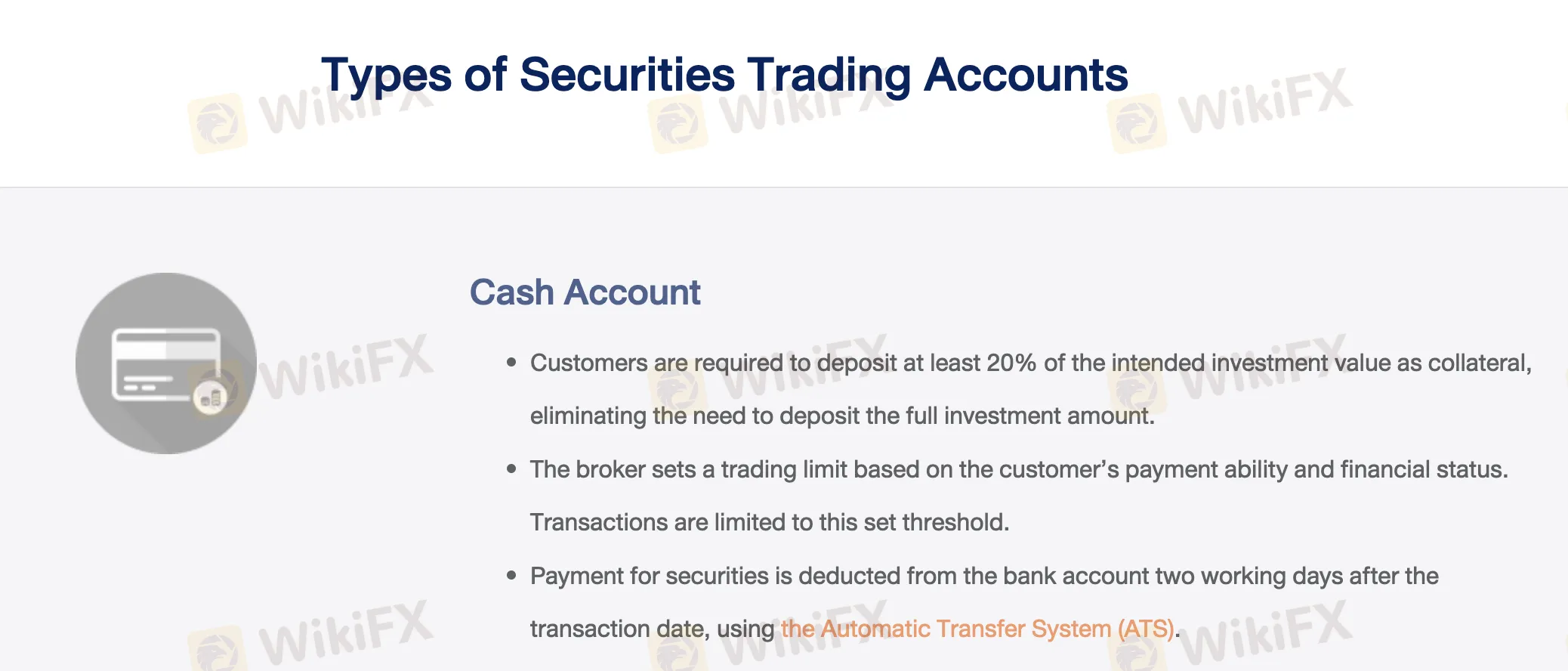

Uri ng Account

Finansia ay nagbibigay ng tatlong uri ng tunay na mga trading account: Cash Account, Cash Balance Account, at Credit Balance Account. Bawat isa ay angkop sa iba't ibang mga pangangailangan sa trading depende sa financial flexibility at risk attitude. Walang anumang tanda ng demo o Islamic (swap-free) accounts sa opisyal na website.

| Uri ng Account | Key Feature | Angkop para sa |

| Cash | Magdeposit ng ≥20% ng halaga ng kalakalan bilang collateral; bayaran mamaya sa pamamagitan ng ATS | Mga trader na may flexible na kapital |

| Cash Balance | Mag-pre-fund ng 100% ng halaga ng kalakalan; kumita ng interes | Konservatibong mga investor, naghahanap ng interes |

| Credit Balance | Margin trading na may collateral; awtomatikong pautang mula sa broker | May karanasan, mga trader na may mataas na tolerance sa risk |

Mga Bayad ng Finansia

Lalo na para sa mga customer na gumagamit ng internet trading channels, kung saan maaaring maging mababa hanggang 0.10% ang mga brokerage cost para sa mga high-volume traders, ang mga trading fees ng Finansia Syrus Securities ay medyo murang-mura kumpara sa Thai industry average. Ang sistema ng singil ay tiered, kaya ang mas mababang mga rate ay nagbibigay ng mas maraming aktibidad sa kalakalan.

| Araw-araw na Bolumen ng Kalakalan (THB) | May Investment Advisor (Cash A/C) | Cash Balance / Credit Balance A/C | Online Channel |

| ≤ 5 milyon | 0.25% | 0.20% | 0.15% |

| 5M < halaga ≤ 10 milyon | 0.22% | 0.18% | 0.13% |

| 10M < halaga ≤ 20 milyon | 0.18% | 0.15% | 0.11% |

| > 20 milyon | 0.15% | 0.12% | 0.10% |

Platform ng Kalakalan

Suportado sa PC, iOS, at Android, nagbibigay ng Finansia Syrus Securities ng Finansia HERO trading system. Ang mga aktibong at tech-savvy na mga trader na naghahanap ng real-time statistics, auto orders, backtesting, at configurable stock scans ay magiging perpekto ang platform na ito.

| Platform ng Kalakalan | Supported | Available Devices | Angkop para sa |

| Finansia HERO | ✔ | PC, iOS, Android | Mga aktibong trader na naghahanap ng AI-driven tools, automation, at real-time picks |

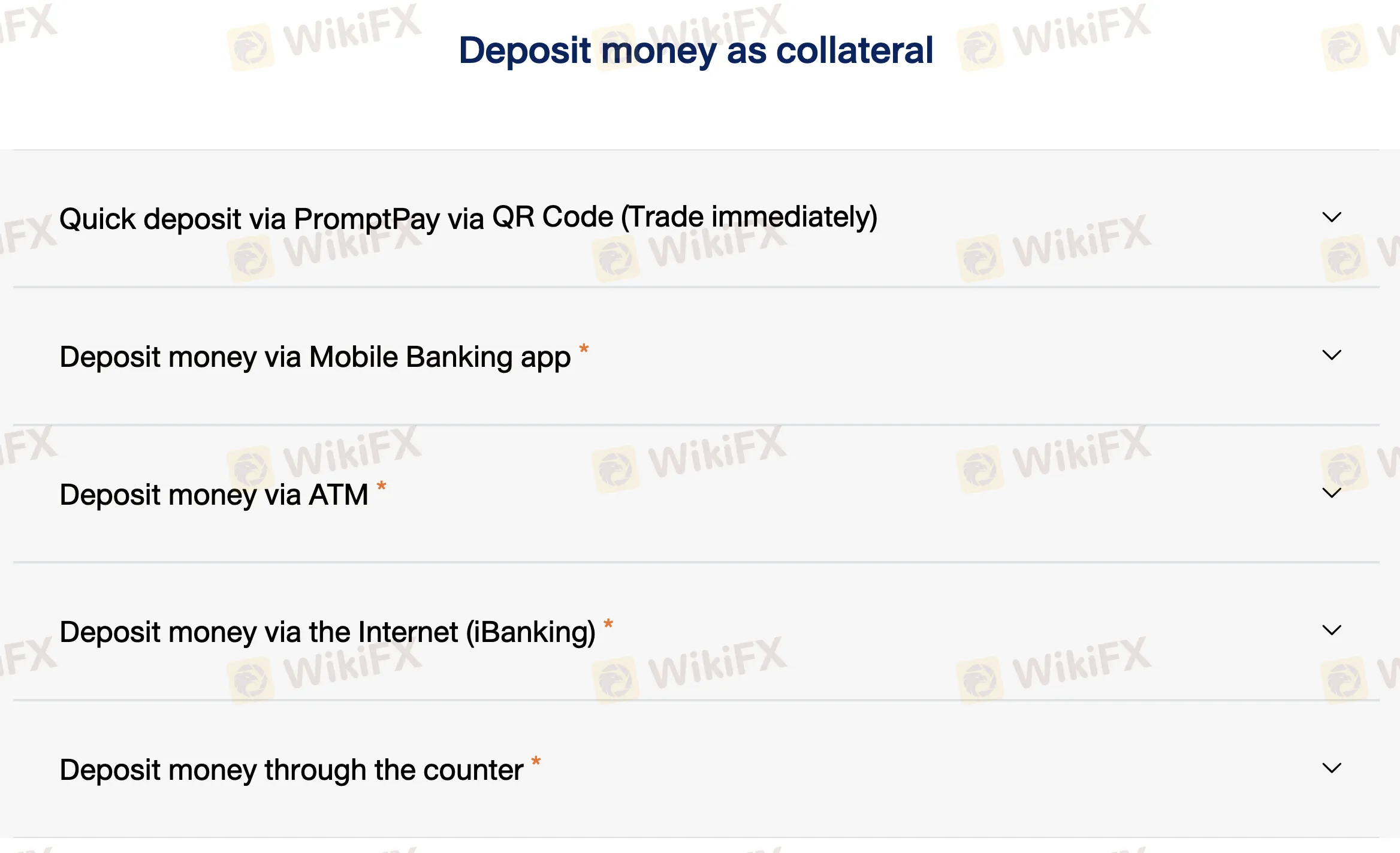

Pagdedeposito at Pagwiwithdraw

Bagaman suportado ang mga deposito hanggang 2,000,000 THB sa pamamagitan ng PromptPay QR, hindi nagpapataw ng deposit fees ang Finansia at hindi eksplisit na itinakda ang minimum deposit requirement. Ang mga deposito ay dapat manggaling sa isang account sa ilalim ng parehong pangalan ng may-ari ng securities trading account.

| Pamamaraan ng Pagbabayad | Fees | Oras ng Paghahandle |

| PromptPay QR Code | Libre | Agad (8:00–18:00) |

| Mobile Banking App | Nag-iiba depende sa bangko | |

| ATM Transfer | ||

| Internet Banking (iBanking) | ||

| Bank Counter Deposit |