Abstract:Mazi Finance is a trading company registered in Saint Lucia, an offshore location. Recently, it has received a lot of attention in the trading world. The company shows off many modern trading features, but when we look closer, we find many potential dangers. Before any trader thinks about opening an account, they need to understand the most important finding from our research: Mazi Finance does not have proper regulation. This single fact creates major warning signs about whether client capital is safe.

What You Need to Know

Mazi Finance is a trading company registered in Saint Lucia, an offshore location. Recently, it has received a lot of attention in the trading world. The company shows off many modern trading features, but when we look closer, we find many potential dangers. Before any trader thinks about opening an account, they need to understand the most important finding from our research: Mazi Finance does not have proper regulation. This single fact creates major warning signs about whether client capital is safe.

Making this problem worse is the company's extremely low score of 1.92 out of 10 from independent watchdog websites such as WikiFX. This low score comes directly from its lack of regulation and a growing number of serious complaints from users. These reports show major problems, including people being unable to take out their capital and serious failures when executing trades. This article provides a complete Mazi Finance review, looking at available information and user experiences to help you understand the serious risks involved.

The Critical Verdict

The most important question for any potential client is whether a broker is legitimate and if their capital is safe. In the case of Mazi Finance, the evidence points toward an extremely high-risk situation. This judgment is not based on opinion but on facts we can verify about its regulatory standing and official warnings from financial authorities.

The Unregulated Status

A main foundation of trust in the financial industry is regulation. Mazi Finance does not have valid regulation from any top-level financial authority. It is registered in Saint Lucia, an offshore location known for its relaxed financial oversight compared to strict areas such as the United Kingdom (FCA) or Australia (ASIC).

For a trader, this lack of regulation means:

· No Investor Protection: There is no safety fund to protect your capital if the broker goes out of business.

· No Dispute Resolution: You have no access to an independent third-party group to help solve disputes over trades, withdrawals, or other issues.

· No Operational Oversight: The broker's internal processes, financial strength, and handling of client funds are not watched by a credible authority, creating a significant risk of wrongdoing.

Official Warnings and Score

The lack of regulation is made worse by official warnings. Mazi Finance has been marked with tags like “Suspicious Regulatory License” and “High potential risk” on verification websites.

Most importantly, the Central Bank of Russia (RU CBR) has officially listed Mazi Finance among companies showing signs of illegal activities in the financial market. A warning from a national central bank is a serious accusation and should not be ignored by any potential investor. This action by a state-level financial institution serves as a powerful, independent warning about the broker's operations.

Your Research Checkpoint

These findings are based on information available when this was written. For a current view of Mazi Finance's regulatory status and the full list of official warnings, every trader must check their up-to-date profile on a verification website, such as WikiFX, before moving forward.

Mazi Finance Pros and Cons

While Mazi Finance markets several attractive features, a balanced assessment requires weighing these advertised benefits against the severe, evidence-based risks. The fundamental issue of no regulation creates a dark cloud over any potential advantages the broker might offer. An objective look shows that the cons, particularly those related to fund safety and operational integrity, are far more significant than the pros.

Review of User Complaints

A broker's marketing materials promise a smooth experience, but its true character is often shown in how it handles client funds and executes trades under real market conditions. The user complaints filed against Mazi Finance provide a sobering, first-hand look into the potential problems of trading with this company. These are not just generic negative reviews; they are detailed accounts of specific financial and operational failures.

The Inability to Withdraw

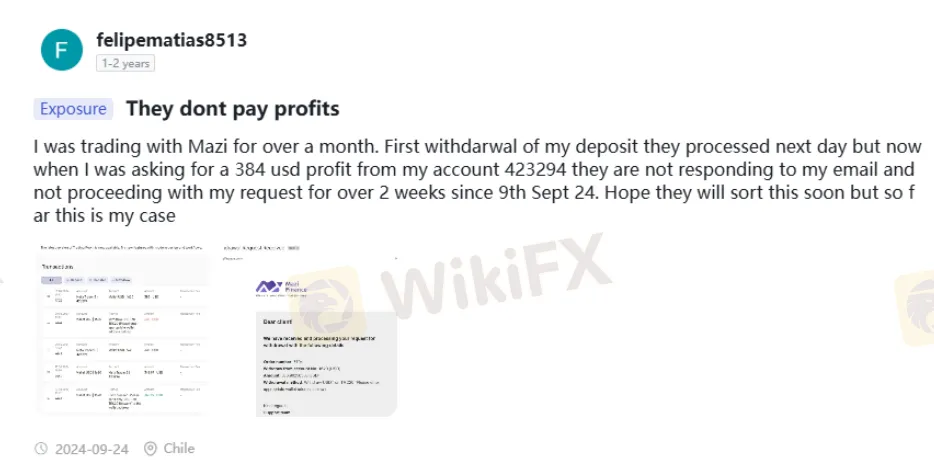

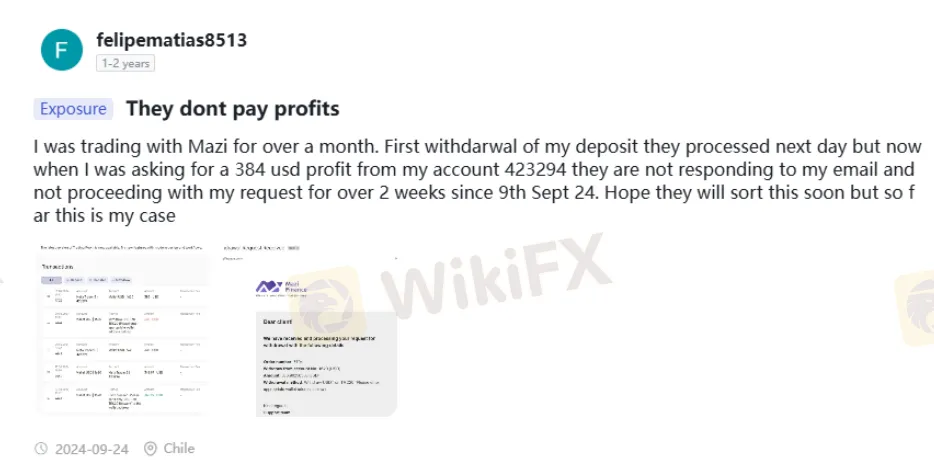

One of the most frequent and alarming complaints involves the inability to withdraw funds, particularly profits. This is a classic warning sign for a problematic brokerage.

A trader from Chile, identified by the username `felipematias8513`, shared a troubling experience. While the broker processed the initial withdrawal of his deposit, a later request to withdraw a profit of $384 from his account was allegedly ignored for over two weeks, with no response to his emails.

Another user, `fx6034` from India, made a more direct accusation, claiming their live trade balance was unavailable for withdrawal and labeling the broker and its owner as cheats. These experiences suggest a pattern where accessing earned profits can become a significant, if not impossible, challenge.

Critical Trade Execution Failures

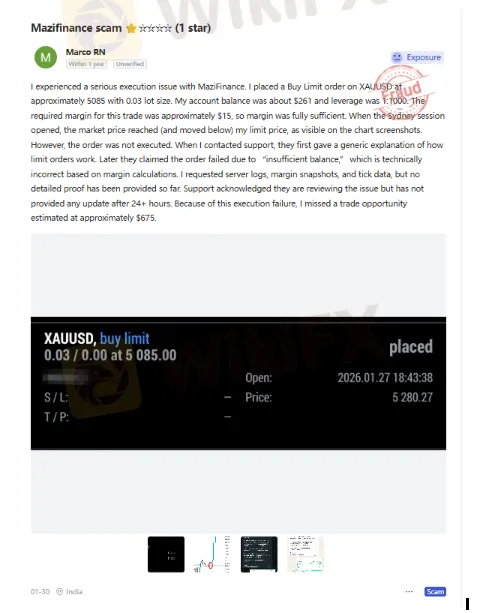

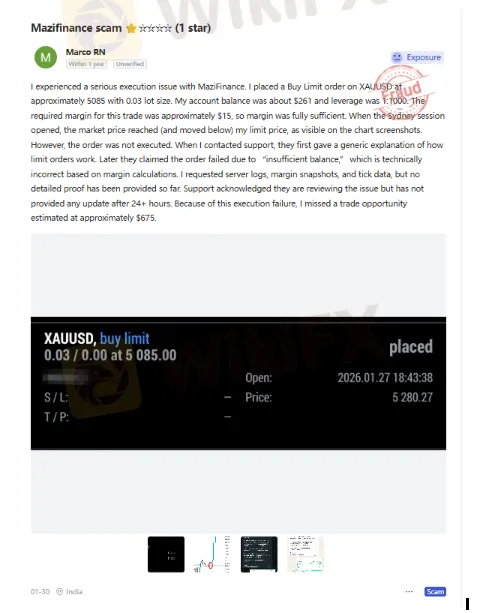

Beyond withdrawal issues, there are serious complaints about the core function of the brokerage: trade execution. A highly detailed report from user `Marco RN` in India shows a critical operational failure. The trader placed a Buy Limit order on XAUUSD with sufficient margin in their account. The market price clearly hit and moved below the specified limit price, which should have triggered the order. However, the trade was never executed.

When the trader contacted support, they were met with generic responses and later an unsubstantiated claim of “insufficient balance,” which the trader's calculations proved to be incorrect. The broker reportedly failed to provide server logs or other evidence to support its claim. This single execution failure resulted in an estimated missed profit of approximately $675 for the trader, highlighting a severe lack of reliability and transparency in the trading environment.

Direct Allegations of Scams

Some user reports go beyond complaints of poor service and make direct accusations of fraud. A user named `Dinesh` from India issued a stark warning, calling Mazi Finance a “scam new company with no license” and advising everyone to stay away. The user even named specific individuals alleged to be the “masterminds of the scam.” While these are user allegations, they contribute to the overwhelming high-risk profile of the broker and reflect a deep level of distrust among its clientele.

A Note on Positive Reviews

To provide a full picture, it is worth noting that some positive reviews for Mazi Finance exist. Users have mentioned fast withdrawals, good customer service, and tight spreads. However, these reviews are often brief and generic. They stand in stark contrast to the highly specific, detailed, and evidence-backed negative reports concerning fundamental issues like withdrawals and trade execution. The weight and detail of the negative experiences present a far more compelling case for caution.

See the Full Picture

These are just a few examples documented by users. To read all user-submitted reviews, positive and negative, and view the exposure reports filed against Mazi Finance, we strongly advise visiting their detailed page on WikiFX.

Trading Conditions Breakdown

To provide a complete Mazi Finance review, we will objectively break down the trading conditions as advertised by the broker. It is essential to view this information through the cautionary lens established by its unregulated status and the user complaints. Appealing features on paper do not guarantee a safe or fair trading experience in practice.

Account Types and Deposits

Mazi Finance offers a tiered account structure, seemingly designed to cater to traders with different capital levels and needs. The minimum deposit starts at a relatively low $50, which can be tempting for new traders.

Leverage - A Double-Edged Sword

The broker offers a leverage of up to 1:2000. More importantly, traders must understand that high leverage is extremely risky. When offered by an unregulated broker, this risk is amplified exponentially. High leverage can magnify losses just as quickly as it can magnify gains, and without regulatory oversight, there is a greater danger of practices that can lead to catastrophic losses for the client.

Trading Platform

Mazi Finance provides its clients with the MetaTrader 5 (MT5) platform, available for PC, web, and mobile devices. MT5 is a globally respected and powerful trading platform, known for its advanced charting tools, technical indicators, and support for automated trading.

However, a critical distinction must be made: the quality of the trading platform does not guarantee the integrity of the broker that provides it. A fraudulent or unreliable broker can manipulate a perfectly good platform. Therefore, the availability of MT5 should not be seen as an endorsement of Mazi Finance itself.

Deposit and Withdrawal Methods

The broker lists several methods for deposits and withdrawals, including MaziMatic, VISA, MasterCard, MaziWorld, and MaziRewardz. The presence of well-known brands like VISA and MasterCard might offer a false sense of security. As highlighted by numerous user complaints, the availability of a withdrawal method does not ensure that the request will be processed, especially when it comes to profits. The consistent reports of ignored or failed withdrawal requests should be the primary consideration for any trader.

Conclusion: A Final Verdict

After a thorough analysis of the available evidence, our conclusion regarding Mazi Finance is decisive and clear. This broker presents an unacceptably high level of risk to its clients.

The core findings are severe. Mazi Finance is an unregulated broker operating from an offshore location with relaxed oversight. It has been officially flagged by a national financial authority, the Central Bank of Russia, for signs of illegal activity. Most importantly, there is a significant body of credible, detailed user complaints documenting severe and recurring problems with two of the most critical functions of any brokerage: profit withdrawals and trade execution.

While the advertised features, such as MT5 support, a wide range of instruments and tiered accounts, may appear attractive on the surface, they are completely overshadowed by the fundamental and undeniable risks. The lack of regulation removes all safety nets for investors, and the user experiences suggest that a trader's capital and profits could be in serious danger. Based on our comprehensive review, we cannot recommend Mazi Finance. The risk to trader capital appears to be exceptionally high.

The Ultimate Precaution

Our final verdict is one of extreme caution. The decision of where to invest your capital is critical, and the evidence surrounding Mazi Finance points to significant dangers. Before depositing funds with any broker, we urge you to perform your own thorough research. Start by verifying their regulatory credentials and reading unfiltered user feedback on a comprehensive and independent platform such as WikiFX. This simple step can be the most important trade you ever make.