Abstract:Plus500 forex trading scam alert: multiple cases of blocked withdrawals. Read the warnings and safeguard your money!

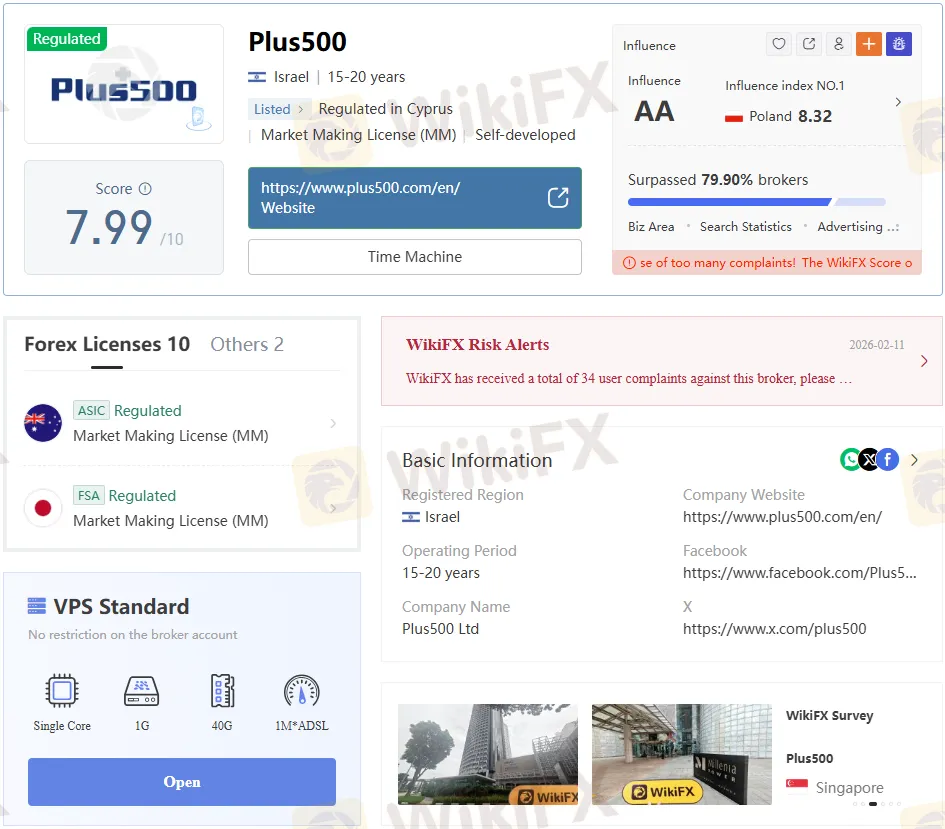

Plus500 presents itself as a regulated forex and CFD broker, but numerous traders report severe withdrawal problems that raise red flags. Despite its licenses from top regulators like FCA and ASIC, user complaints about frozen funds and deceptive tactics suggest deeper issues. Download the WikiFX App to check broker legitimacy before trading.

Broker Overview

Plus500 was founded in 2008 and has headquarters in Israel and offices worldwide. It offers over 2,800 CFDs on forex, stocks, indices, commodities, and cryptos via its proprietary platform. The broker claims tight spreads around 0.5 pips on EUR/USD and no commissions, with a $100 minimum deposit.

Traders can access leverage up to 1:30 for retail clients, plus demo accounts and risk tools such as stop-losses. Payments include Visa, PayPal, and Skrill, with no deposit fees but potential inactivity charges after three months. Still, these features dont shield users from the withdrawal nightmares detailed ahead.

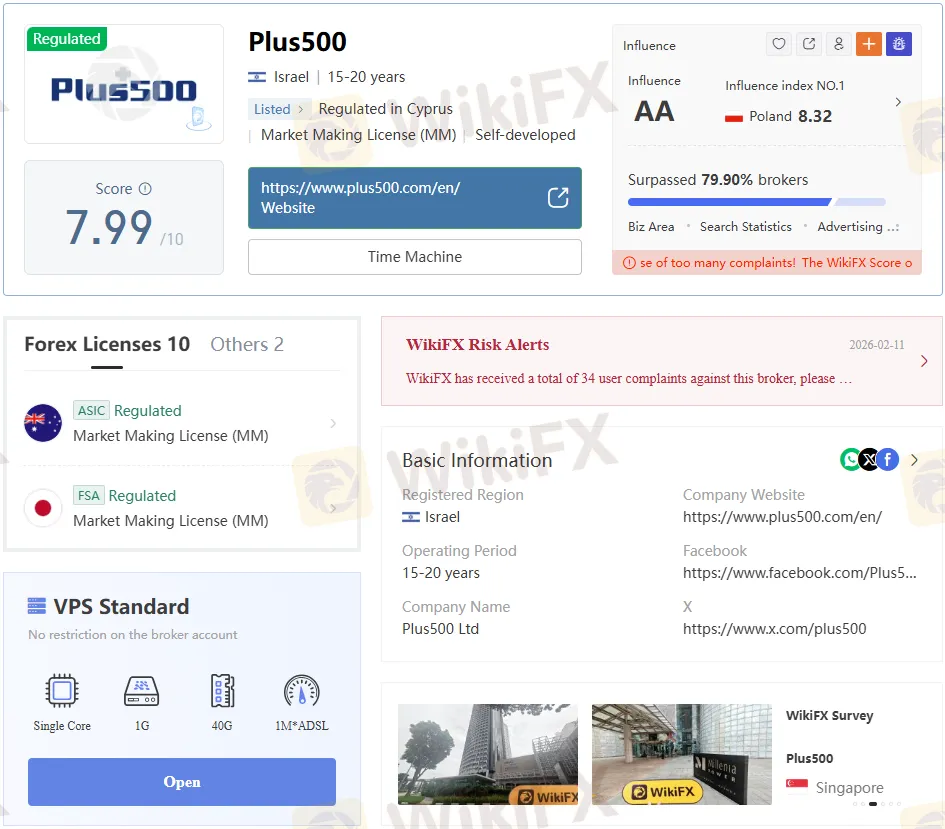

Regulatory Status

Plus500 holds multiple licenses, including FCA (UK, #509909), ASIC (Australia, #417727), CYSEC (Cyprus, #250/14), and ISA (Israel). Its publicly traded on the London Stock Exchange, adding some transparency. Client funds are segregated, protected by SSL encryption, and eligible for investor compensation.

Regulation doesnt mean flawless operations, as scam alerts on WikiFX highlight persistent complaints. Even top-tier oversight fails when brokers allegedly manipulate balances or delay payouts. Use the WikiFX App for real-time exposure on regulated scams.

Trader Complaints Surge

Recent cases expose Plus500s withdrawal blocks, starting with a Belgian trader on December 5, 2025. He held 58.76 USDT but faced a maximum withdrawal limit of 33.76, which rejected withdrawals above that limit even though he had available funds. This forex scam tactic traps capital during shifts in unsupported countries.

Another Belgian user on December 4 couldnt withdraw without explanation, questioning the sudden “protection” after smooth prior payouts. German traders echoed this on the same day, citing unexplained cancellations after years of hassle-free trading. These patterns scream forex investment scam.

Bonus Deception Tactics

German complaints from December 2 reveal sketchy bonuses to hook newbies. One trader received an email promising a 750 SR (~$200) deposit, but only 450 SR was credited, with support dodging queries. This bait-and-switch draws in victims, then blocks exits—classic forex trading scam.

US users repeated this on November 18 and 6, 2025, with £280 or similar balances frozen post-verification, and no responses to statements. Owners labelled “assholes” for personal ethics aside, evidence points to deliberate trader rollback. WikiFX App users spot these red flags early.

Endless Verification Loops

A Hong Kong trader waited over a month for approval of a withdrawal on September 18, 2025. After submitting income proof and address docs, review stalled indefinitely—no timeline given. Such delays erode trust, mimicking the hallmarks of scam brokers despite regulation.

These arent isolated; they form a pattern of stalling tactics post-deposit. Traders pass KYC yet hit invisible walls on payouts. Stay safe—scan with the WikiFX App before funding any platform.

Common Scam Red Flags

This table summarises exposures from global users. Patterns match forex scams: easy deposits, hard withdrawals. Regulated or not, these violate fair trading norms.

Why Withdrawals Fail

Plus500 mandates same-method withdrawals up to deposit amounts, with spreads funding operations. Yet complaints show arbitrary caps and “protection” excuses emerging suddenly. Even verified accounts face £280+ freezes, hinting at liquidity grabs or compliance dodges.

Inactivity fees kick in after three months, but active traders hit walls first. Overnight fees and leverage amplify losses, priming excuses for holds. WikiFX App logs confirm this as a serial issue.

Platform Pros and Pitfalls

Plus500 shines with user-friendly web/mobile apps, 24/7 chat, and multilingual support. Demo accounts help beginners test 2,800 instruments commission-free. Tight spreads and no MT4 needed suit casual CFD traders.

But cons bite hard: no MetaTrader, limited support channels, and now rampant withdrawal woes. Inactivity fees of up to $10/month add insult to injury. For pros seeking reliability, these gaps spell danger—especially amid scam alerts.

Protect Yourself Now

Verify brokers via the WikiFX App before depositing—its your shield against forex scams. Spot withdrawal glitches early, like manipulated max amounts or bonus lies. Demand timelines on requests; escalate to regulators if stalled.

Report issues on WikiFX to expose more cases. Avoid high-leverage CFDs without exit proof. Your funds deserve better than the alleged traps at Plus500.

Final Scam Warning

Plus500s regulation masks user torment from blocked USDT, ghosted verifications, and bonus fraud. Traders worldwide—from Belgium to Hong Kong—cry scam after smooth deposits turn sour. Heed this exposure: withdraw early, check the WikiFX App often, and dodge forex trading scams.