简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

9Cents Review 2026: Is this Broker Safe?

Abstract:9Cents is an unregulated brokerage established in 2024 with a low WikiFX rating of 1.84, indicating significant risk for potential clients. This assessment highlights critical concerns regarding fund safety, as evidenced by user reports of missing deposits and the lack of a credible license.

Executive Summary

In this in-depth review, we analyze the key metrics and operational history of 9Cents to determine its viability for traders. The 9Cents broker was established in 2024 and operates out of Saint Lucia. Despite being a relatively new entrant in the financial markets, it has attracted attention due to its reliance on the MetaTrader 5 platform and high leverage offerings. However, safety concerns loom large given its regulatory status.

As a broker headquartered offshore, 9Cents presents a high-risk profile. The WikiFX scoring system has assigned 9Cents a score of 1.84 out of 10, a rating typically reserved for entities with minimal reliability or suspected compliance issues. This review aims to dissect the specific trading conditions, safety protocols, and user feedback that contribute to this verdict.

1. Regulation & Safety Protocols

The most critical aspect of our audit is the regulation 9Cents operates under. According to current data, 9Cents does not hold a valid license from any major Tier-1 regulatory body such as the FCA (UK) or ASIC (Australia). The broker is registered in Saint Lucia, a jurisdiction often favored by offshore entities due to lenient reporting requirements.

Since legitimate regulation is the primary safeguard for client funds, the absence of such oversight means 9Cents clients do not benefit from segregated accounts or compensation schemes in the event of insolvency. Unlike regulated brokers that must adhere to strict capital requirements, an unregulated broker like 9Cents operates with minimal external scrutiny. This significantly elevates the risk of counterparty default or operational malpractice.

2. Forex Trading Conditions

For traders focusing on Forex instruments, 9Cents offers access to currency pairs, commodities, metals, shares, and indices. The broker provides three main account types—Standard, Pro, and ECN—each with varying entry requirements and conditions.

Account Structures & Leverage

- Standard Account: Requires a minimum deposit of $100 and offers leverage up to 1:400.

- PRO Account: Demands a significant deposit of $15,000, reducing leverage to 1:300.

- ECN Account: The highest tier requires $25,000, capping leverage at 1:200.

While the leverage ratios are high, they expose traders to substantial risk, particularly without regulatory caps. We must also ask: Does Forex pricing compete with top-tier providers? The spreads listed are notably high; for example, Gold spreads on the Standard account range from 20 to 35 pips, and currency spreads start as high as 16-20 points. These costs are significantly higher than the industry average, which may erode profitability for high-volume traders.

3. User Feedback & Complaints

To understand the actual client experience, we analyzed specific interaction data. A concerning pattern has emerged regarding fund management. Users have reported difficulties with their login stability and the accuracy of their client portals regarding deposits.

Case Study: Missing Deposit (September 2024)

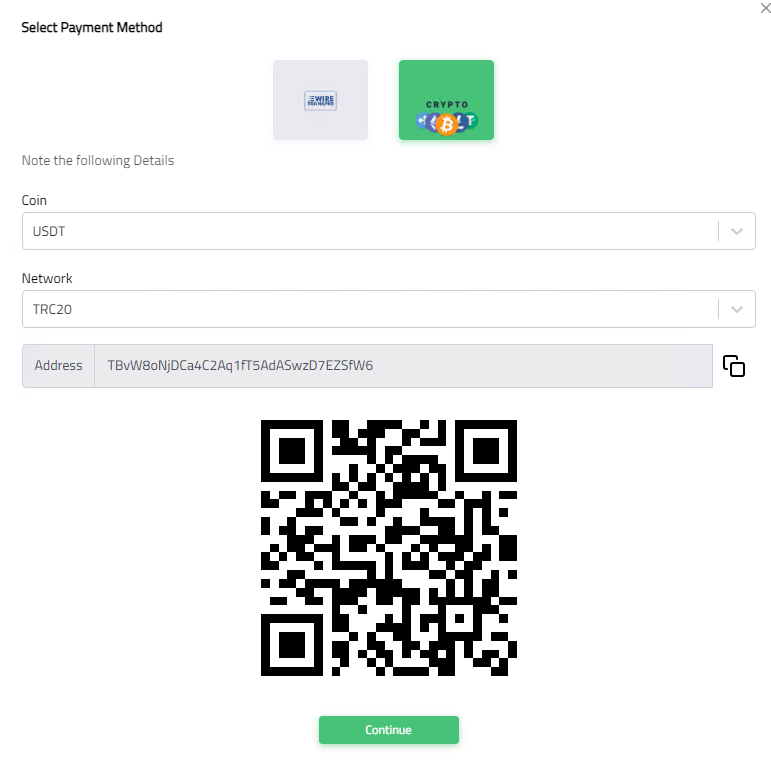

A user from Chile reported a serious issue where a deposit of 200 USD, made via USDT (TRC20), failed to reflect in their trading account. The user stated: “I was depositing 200 USD... 10 days ago to my account 84424 and my money still don't show in my client portal. I was sending them the proof of payment and been emailing them every 2 days but no answer back.”

This complaint highlights a critical failure in the broker's back-office operations. When a client's secure login area fails to confirm a successful blockchain transaction, and customer support remains unresponsive, it constitutes a major warning sign.

4. Software & Access

9Cents utilizes the MetaTrader 5 (MT5) platform, which is a standard choice for modern trading. MT5 offers advanced charting tools and automated trading capabilities. However, the software itself cannot compensate for broker-level risks.

To access the platform, traders must complete the login security steps. While the platform supports standard encryption, the broker's own summary admits a lack of advanced security features, stating it “misses two-step login and biometric authentication for safer login.” In an era where cybersecurity is paramount, the absence of robust 2FA for the login process is a notable technical deficiency.

Final Verdict

9Cents struggles to justify a recommendation for any tier of trader. While it offers the robust MT5 platform and high leverage, these features are overshadowed by severe safety concerns. The broker is unregulated, imposes high spreads, and faces serious allegations regarding withheld deposits and unresponsive support. The extremely low WikiFX score of 1.84 reflects these fundamental weaknesses.

Pros:

- Access to MT5 platform.

- High leverage up to 1:400 available.

Cons:

- No regulatory license (Offshore only).

- High minimum deposits for better account tiers ($15k/$25k).

- Documented complaints of missing funds.

- Lack of advanced security in the login process.

For real-time updates on regulation status or to verify the official login page, consult the WikiFX App.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Amaraa Capital Scam Alert: Forex Fraud Exposure

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

Fed Balance Sheet Mechanics: The Silent Risk to Liquidity

Gold Eclipses $5,070 as China Treasury Shift Hammers the Dollar

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

Currency Calculator