简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

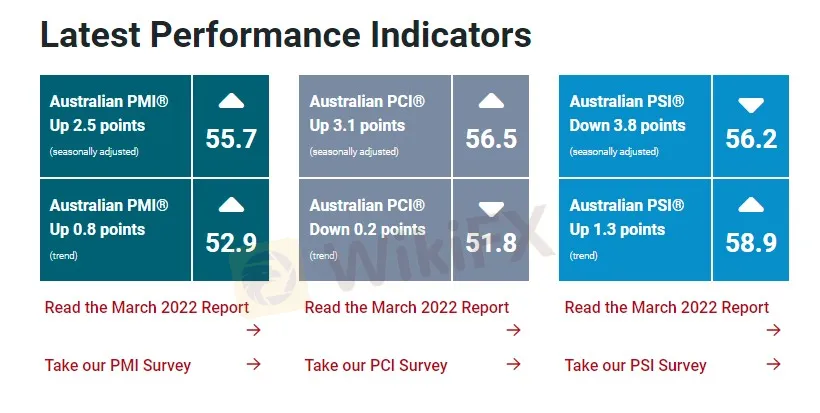

Australian PSI®: Services recovery dampened by supply issues and input costs in March

Abstract:The Australian Industry Group Australian Performance of Services Index (Australian PSI®) fell by 3.8 points to 56.2 in March, indicating growth but at a slower pace than in February (results above 50 points indicate expansion, with the distance from 50 points indicating the strength of the increase).

“Australia's services sector continued its positive run in March although the pace of growth slowed in the face of intensifying input price pressures, difficulties in finding staff and further wage pressures. Growth in the services sector was more narrowly based than in February with the business & property services and personal, recreational & other services groups contracting and the health & education sector broadly unchanged from its performance in the previous month. It was left to the strong-growing logistics and retail trade & hospitality sectors to pull the broader sector into overall expansion. For the services sector as a whole, sales and employment continued to rise. Sales growth pulled back from the very high levels reported in February. The strong lift in new orders reported in March will see the capacity of many businesses stretched over coming months while the availability of staff and the supply of inputs are expected to remain constrained,” Mr Willox said.

Australian PSI® – Key Findings for March 2022:

Three of the five sectors available in the Australian PSI® expanded in March. Business-oriented sectors reported mixed results, with business & property slipping into contraction (down 6.5 points to 47.9) while logistics maintained last month's strong expansion (up 0.1 point to 60.8). All consumer-focused sectors reported lower readings compared to February's strong results (see table below).

All five activity indices in the Australian PSI® expanded in March (see table below), with the new orders index rising again to its highest result since May 2021 (up 2.4 points to 63.5). The sales index fell 14.9 points to 53.7, offsetting February's strong result, while employment growth moderated slightly but remained positive (down 0.3 points to 54.4).

The input prices index rose substantially in March to reach a series high (up 11.5 points to 77.5), while the average wages index also recorded strong growth (up 11.8 points to 67.7). The selling prices index rose to its highest level since July 2021 (up 4.2 points to 64.5). Taken together, these results suggest inflationary pressures are increasing.

View all Economic Indicators

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top Tips to Avoid Forex Margin Calls and Protect Your Capital

While technical indicators or chart patterns often capture the attention of forex traders, especially new ones, aspects such as margin requirements, equity, used margin, free margin, and margin levels are often overlooked. So, if you have received a margin call from your forex broker and are wondering how to deal with it, you probably do not know the concept of a forex margin call - what triggers it and how to avoid it. Being unaware of this concept can make you lose your hard-earned capital. In this article, we will provide you with all the information you need to know. Keep reading!

A Guide to Determining the Optimum Forex Leverage

Want to gain a wider forex market position control by investing a minimal amount? Consider using leverage in forex. It implies using borrowed funds to raise your trading position more than your cash balance can let you do it. Forex traders usually employ leverage to churn out profits from relatively small currency pair price changes. However, there is a double-edged sword with leverage since it can multiply profits as well as losses. Therefore, using leverage in the right amount is key for traders. Forex market leverage can be 50:1 to 100:1 or more, which remains significantly greater than the 2: leverage usually offered in equities and 15:1 leverage in futures.

What is NFP in Forex? An Insightful Guide for Traders

The Non-farm Payroll (NFP) report may be for the US. However, the report, which is issued every month, impacts the forex market globally. The monthly report estimates the number of jobs gained in the US in the previous month. The job numbers stated on this report exclude those of farms, private households, and non-profit organizations. Usually released on the first Friday of the month, the report also includes the US unemployment rate, average hourly earnings, and participation rate. In this article, we have answered the question - what is NFP in forex - and shared other pertinent details. Read on!

Forex Exchange Trading Explained: Key Concepts, Price Triggers & Profitable Methods

Excited to make a mark in forex trading by benefiting from currency price fluctuations? You have come to the right place to learn the art of forex trading. With Forex being the largest financial market globally, it is only natural to see the exchange of trillions of dollars daily by numerous participants, including commercial banks, individual retail traders, and central banks. Seeing the massive scope for growth, traders invariably inquire about the forex market dynamics, including its working methodology, key concepts, and profitable methods. In this article, we have discussed these points. Read on to understand these and implement them in real time.

WikiFX Broker

Latest News

WikiFX Elites Club Committee Concludes Voting! Inaugural Lineup Officially Announced

Fake Trading Platforms Are Spreading Fast Across Asia | How Investors Are Being Tricked

eToro CopyTrader Expands to U.S. Investors

Is MH Markets Safe or a Scam? Regulation and Fund Security Explained

How to Add and Take Out Money from Amillex Broker: A Complete Guide

FCA warning: These Firms are on the list

Ponzi Scheme Operator Sentenced to 14 Years in Western Australia

Dubai VARA Warns Against Vesta Investments

Don’t Get Scammed: A Roundup of Common Online Fraud Tactics in Forex

T4Trade broker Review 2025: Is T4Trade Regulated?

Currency Calculator