Abstract:If you're wondering "Is LTI legit?" or worried about a possible "LTI scam," you're asking smart questions. Being careful is the most important skill a trader can have. To save your time, we will give you our answer right away: after carefully checking its legal status, company information, and how it operates, London Trading Index (LTI) shows serious warning signs that any potential trader needs to know about. The dangers are real and well-documented.

This article won't be based on opinions. We'll show you the proof step by step, focusing on facts you can check yourself. We'll examine official warnings, look at the broker's information, and study its trading rules. By the end, you'll have a clear picture based on evidence, helping you make a smart and safe choice for your capital.

Answering Your Main Question

If you're wondering “Is LTI legit?” or worried about a possible “LTI scam,” you're asking smart questions. Being careful is the most important skill a trader can have. To save your time, we will give you our answer right away: after carefully checking its legal status, company information, and how it operates, London Trading Index (LTI) shows serious warning signs that any potential trader needs to know about. The dangers are real and well-documented.

This article won't be based on opinions. We'll show you the proof step by step, focusing on facts you can check yourself. We'll examine official warnings, look at the broker's information, and study its trading rules. By the end, you'll have a clear picture based on evidence, helping you make a smart and safe choice for your capital.

The Most Important Test

The single most crucial thing when checking any broker is whether it is properly regulated. This isn't just a nice-to-have feature; it is absolutely necessary for your financial safety. Whether a broker follows strict rules determines if your capital is protected, if the business operates fairly, and if you have any legal help if something goes wrong. Here, we'll look closely at what LTI claims versus what's actually true.

What It Says vs What's Real

On its website, LTI presents itself as a professional company, claiming to be “regulated across multiple jurisdictions.” This language is meant to make you feel confident. However, our research shows a very different story. LTI's parent company, Equivest (Mauritius) Limited, is registered in Mauritius. This is called an “offshore” registration.

For a trader, an offshore registration gives you almost none of the protections offered by top-level regulators such as the UK's Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC). These top agencies enforce strict rules about keeping client funds separate, having enough capital, and fair dealing. An offshore company operates outside of this strong protection system. Simply put, if something goes wrong, your investments are in extreme danger, and you have almost no legal options. Our research is clear: LTI has no valid forex regulation from a respected authority.

The Biggest Warning Sign

The most damaging evidence against LTI isn't just the lack of a proper license, but an actual official warning. On July 29, 2024, the UK's Financial Conduct Authority (FCA) issued a public warning against London Trading Index Limited.

When a regulator as important as the FCA issues such a notice, it's like a loud financial alarm. The warning clearly states that this company is not authorized to provide financial services or products in the UK. The FCA is actively telling the public that LTI is operating without permission. The results for a customer are serious: you won't have access to the Financial Ombudsman Service for solving disputes, and you won't be protected by the Financial Services Compensation Scheme (FSCS), which can pay back clients if a company fails. This isn't a small rule-breaking issue; it's the biggest warning sign, showing clear danger to potential investors.

First Action You Should Take

Checking a broker's regulatory status is the most important step any trader must take before opening an account. The evidence about LTI is clear and available to everyone. You can see the full regulatory breakdown and the official FCA warning for LTI yourself by checking its profile on a comprehensive broker verification platform such as WikiFX. This simple check is your first line of defense.

Breaking Down the LTI Profile

Beyond the critical problem of regulation, a broker's data profile gives you multiple views of its operational risk. Independent verification platforms gather various data points to create a comprehensive score, offering a quick but powerful risk assessment. LTI's profile shows more warning signs that support the initial regulatory findings.

What a Low Score Means

On a scale of 1 to 10, LTI receives a score of just 2.21. Such a low score is an immediate and clear signal to stay away. These scores aren't random; they result from analyzing five key areas: the license index, business index, risk management index, software index, and regulatory index. A score in the 1-3 range typically means a broker with serious problems, usually a complete lack of credible regulation and many risk factors. For any trader, seeing such a low score should end the evaluation process immediately.

Key Risk Factors

Looking deeper into the data, several keywords are flagged that show high risk. We can present these as a quick checklist of warnings:

· High potential risk: This is the overall assessment based on combining all available data points. It serves as a general summary of the broker's questionable standing.

· Suspicious Regulatory License: This directly supports our findings from the previous section. The broker's registration in an offshore location, such as Mauritius, combined with the lack of any valid license from a major regulator, is correctly flagged as suspicious.

· 5-10 Operational Years: For a legitimate broker, being around for a long time can show stability. However, for an unregulated company, operating for 5-10 years is a major red flag. It suggests the company has been operating “under the radar” for a long time, successfully avoiding regulatory oversight while potentially exposing clients to risk without any accountability.

Why Independent Verification Matters

These data points and scores are designed to provide a quick, unbiased risk assessment that cuts through a broker's marketing language. They offer a snapshot of the facts. To explore these factors in detail and understand how they contribute to LTI's low score, we highly recommend reviewing the complete LTI report available on WikiFX before making any decisions. This empowers you to see the raw data for yourself.

Looking at Trading Conditions

A broker's legitimacy isn't only shown in its regulatory status but also in how practical and fair its trading conditions are. Questionable brokers often hide red flags within their account structures, fees, and product offerings. Looking at LTI's services reveals several practices that differ greatly from industry standards and should be concerning.

Platforms and Instruments

LTI offers its services on the MetaTrader 5 (MT5) platform, a respected, industry-standard platform known for its strong charting tools and support for automated trading. However, this is a crucial point for all traders to understand: a good platform does not make a broker legitimate.

Scammers and unregulated companies frequently use popular, trusted software, such as MT4/MT5, to create a false appearance of credibility. They use the platform's good reputation to attract unsuspecting traders. The true foundation of trust is not the software a broker uses, but the regulatory framework that governs its operations. Furthermore, LTI's product range is surprisingly limited, offering only commodities and indices. The absence of major asset classes, such as Forex, individual stocks, or cryptocurrencies, means it is unsuitable for traders seeking a diversified portfolio.

Your Active Legitimacy Checklist

This investigation into LTI provides a powerful case study, but its lessons apply to everyone. To protect yourself from similar high-risk companies in the future, it is essential to have a systematic process for evaluating any broker. We have simplified this process into a simple, three-step checklist. Making this a habit will be the most effective long-term strategy for protecting your trading capital.

Step 1: Verify Regulation

Before you analyze spreads, platforms, or promotions, you must verify regulation. This is the first and most important step. Look for regulation from a respected, top-tier authority. These include the UK's FCA, Australia's ASIC, Cyprus's CySEC, and other major global regulators. Do not accept claims of being “registered” or “incorporated” as a substitute for active regulation. If a broker is “unregulated” or only holds a license from a small, offshore location, the evaluation should stop. The risk is unacceptable.

Step 2: Examine Conditions

Once a broker passes the regulatory test, examine its trading conditions for practical red flags. Be wary of:

· Unclear or overly complex fee structures related to withdrawals or account inactivity.

· Unrealistic promises of guaranteed high returns or “risk-free” trading.

· Aggressive sales tactics that pressure you into making large, immediate deposits.

Legitimate brokers compete on the quality of their service and technology, not on pressure tactics or by creating high barriers to entry and exit.

Step 3: Use Verification Tools

Before considering opening an account or depositing funds, make it a habit to use a comprehensive broker inquiry tool. This is your final safety net. Platforms, such as WikiFX, are built for this exact purpose. They bring together regulatory data, license details, operational history, user reviews, and expert evaluations into a single, easy-to-understand profile. A simple search for 'LTI' on their platform would have instantly revealed the FCA warning and the critically low score, providing a clear 'stay away' signal and protecting your capital. This step takes only a minute but can save you from months of financial and emotional distress.

Conclusion: The Final Decision on LTI

Our investigation was started to answer a simple question: “Is LTI legit?” After a thorough review of the available, verifiable evidence, the conclusion is definitive and clear.

The Final Decision

LTI is a high-risk, unregulated company. The combination of its lack of valid regulation from a reputable location, a direct and public warning from the UK's Financial Conduct Authority, and trading conditions that feature multiple red flags (such as exceptionally high minimum deposits) makes it unsafe for any trader. The concerns driving searches for “LTI scam” are not baseless; they are supported by a clear lack of regulatory oversight and accountability. Based on all available evidence, LTI cannot be considered a legitimate or safe trading partner.

Your Next Step

The key lesson from this analysis goes beyond LTI. Your financial safety is most important, and the responsibility for careful research rests with you. The online trading world is filled with opportunities, but it also contains hidden risks. The best way to navigate it is with healthy skepticism and a commitment to verification.

Always verify before investing. Use trusted resources, such as WikiFX, to check every broker, every time. By making this a core part of your trading strategy, you can navigate the markets with confidence, avoid potential pitfalls, and focus on what truly matters: building your skills as a trader.

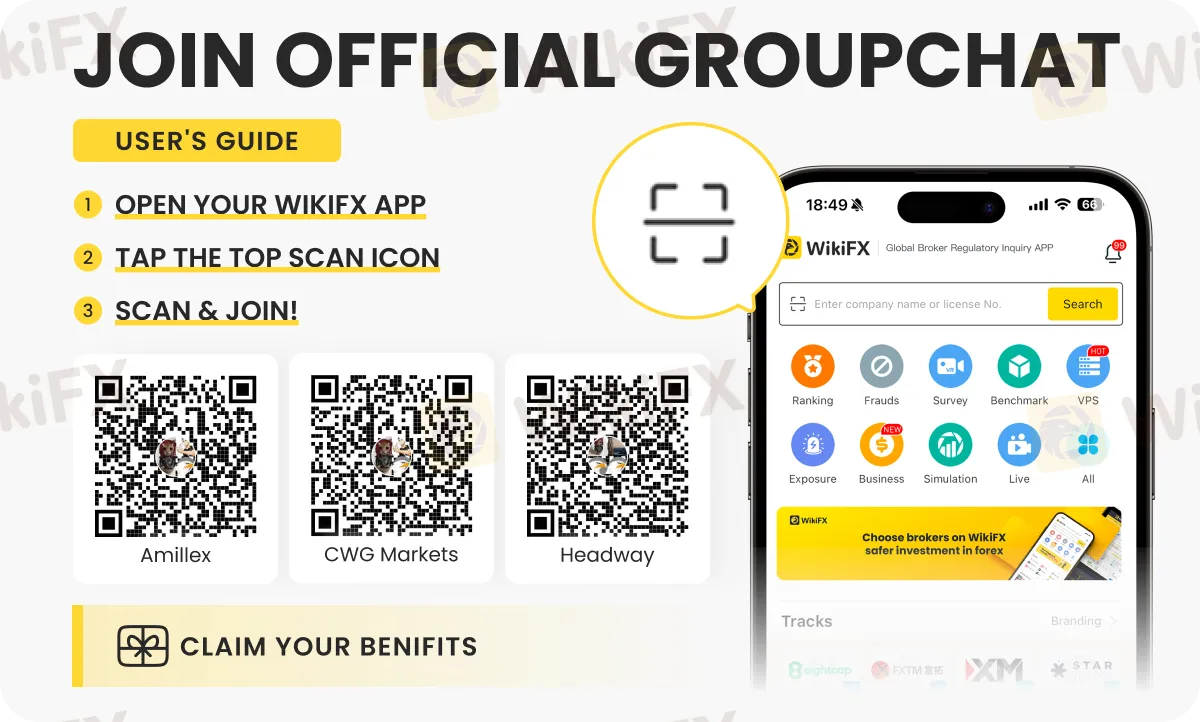

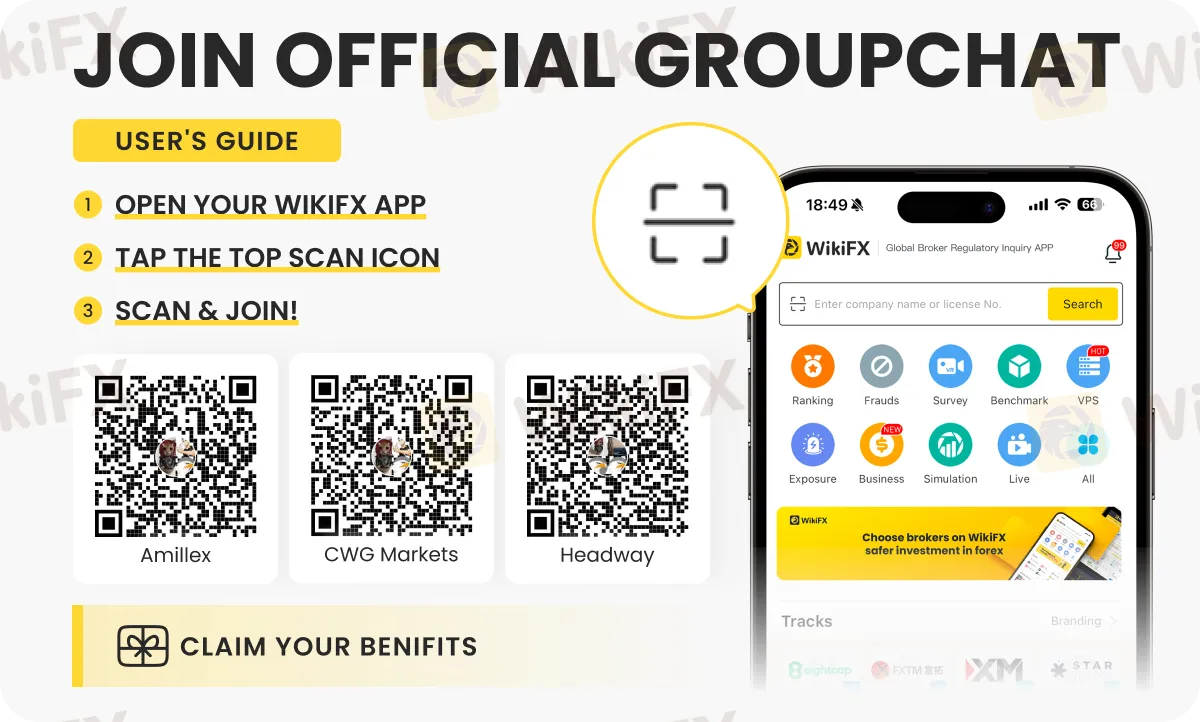

For more forex updates, do not forget to join any of these special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G - today. Follow the instructions below to get started.