Company Summary

| Tickmill Review Summary | |

| Founded | 2014 |

| Headquarters | London, UK |

| Regulation | FCA, CySEC, FSCA |

| Market Instruments | 60+ currency pairs, 15+ indices, 500 stocks & ETFs, bonds, commodities (precious metals and energies), cryptos, futures & options |

| Account Type | Classic, Raw, Tickmill Trader, and TradingView |

| Demo Account | ✅ |

| Islamic Account | ✅ |

| Max Leverage | 1:1000 |

| Spread | From 0.0 pips (Classic account) |

| Trading Platform | MT4/5 (Windows, MacOS, Android, iOS, WebTrader), Tickmill Trader (Android, iOS) |

| Copy/Social Trading | ✅ |

| Min Deposit | 100 USD/EUR/GBP/ZAR |

| Payment Method | Local bank transfer, international bank transfer, cryptocurrency payments, VISA and Mastercard, Skrill, Neteller, Sticpay, FasaPay, UnionPay, and WebMoney |

| Deposit & Withdrawal Fee | ❌ |

| Customer Support | support@tickmill.com, LINE @tickmill_thailand, +852 5808 7849, and Live Chat |

| Regional Restriction | US |

Tickmill Information

Tickmill, the trading name of Tickmill Group of companies, is a regulated global forex and CFD brokerage company established in 2014, headquartered in London, UK. Tickmill offers trading in 60+ currency pairs, 15+ indices, 500 stocks & ETFs, bonds, commodities (precious metals and energies), cryptos, futures & options with three choices of trading accounts, which are the Classic, Raw, and Tickmill Trader Raw accounts. The available trading platforms include MetaTrader4/5 and Tickmill Trader.

What Type of Broker is Tickmill?

Tickmill operates as an NDD broker (No Dealing Desk). This means the broker does not take positions against clients trades. All trading orders are sent directly to liquidity providers, ensuring transparent pricing, reduced conflicts of interest, and a stable trading environment. This structure is especially suitable for traders who focus on low trading costs and require high execution stability.

Tickmill serves both retail and institutional clients, offering an account structure designed to support a wide range of trading strategies.

Pros & Cons

| Pros | Cons |

| Regulated by Tier-1 financial authorities | Does not accept clients from the United States |

| Tight spreads and low commission fees | Customer support is available only during business hours |

| Supports popular trading platforms, including TradingView | |

| Client funds are protected by insurance coverage | |

| Negative balance protection | |

| Multiple account types to suit different trading needs | |

| Strong financial stability and a solid reputation |

Tickmill is a well-known and reliable broker that delivers stable trading conditions along with a wide range of popular trading tools. With low spreads and fees, account types suitable for all trading styles, and strong financial stability, Tickmill is an attractive choice for traders at every level. Its overall transparency, high security standards, and quality of service have made Tickmill a popular broker among traders worldwide.

However, Tickmill does not operate in certain countries, and customer support is available only during specified business hours (Monday–Friday, 8:00–24:00 Thailand time). Traders who are interested are advised to verify these details directly with the Tickmill support team.

Is Tickmill Safe?

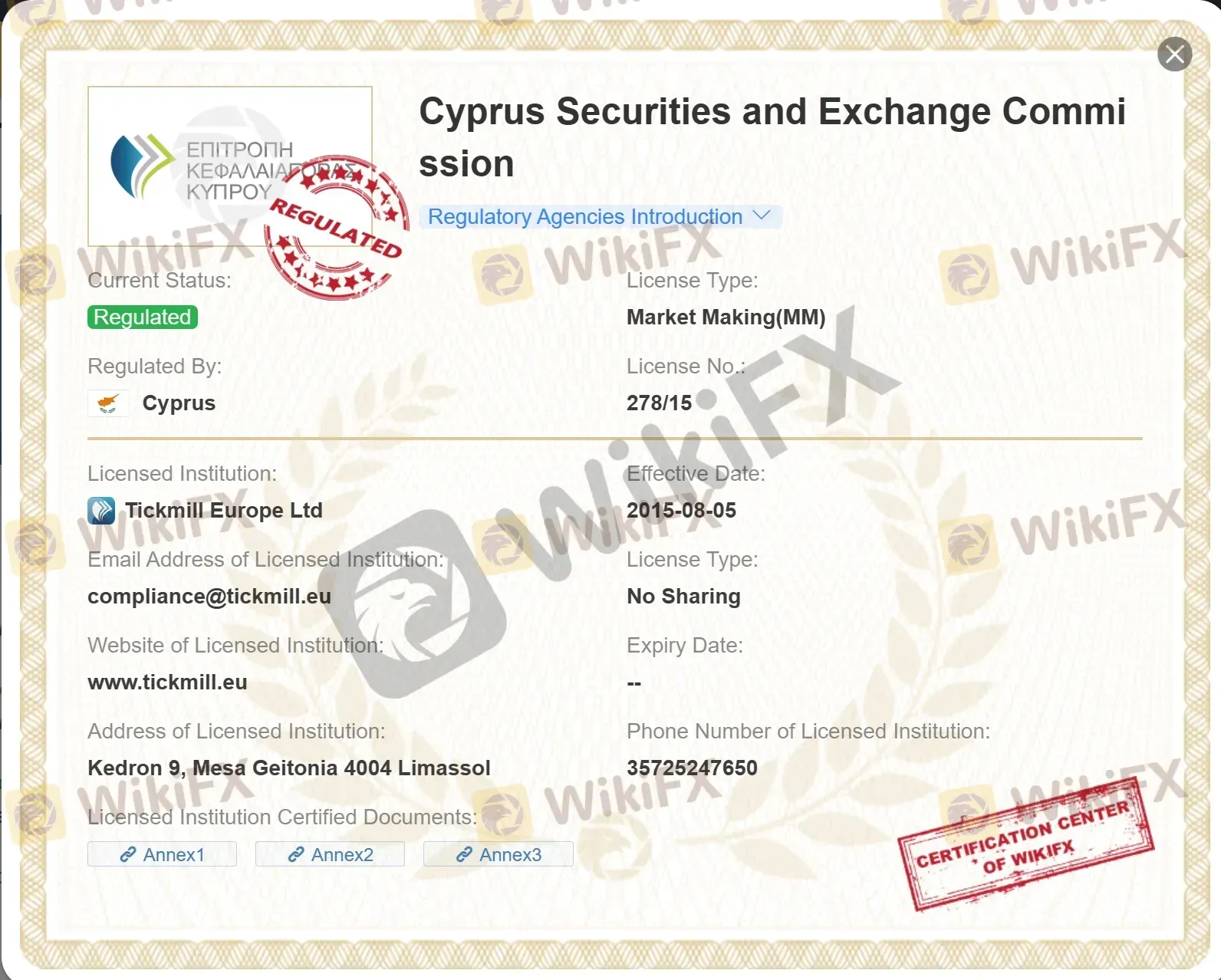

Tickmill is a regulated broker that holds licenses from respected financial authorities, including

Financial Conduct Authority (FCA, No. 717270), Cyprus Securities and Exchange Commission (CYSEC, No. 278/15), Financial Sector Conduct Authority (FSCA, No. 49464), and Labuan Financial Services Authority (LFSA, No. MB/18/0028).

This indicates that it complies with the required regulations and standards to provide financial services to their clients. Additionally, Tickmill has been in operation since 2014 and has gained a good reputation in the industry, which suggests that they are a legitimate broker.

How are You Protected?

Tickmill uses segregated accounts to keep client funds separate from its operational funds, which provides an additional layer of protection in case of the company's insolvency.

Tickmill also uses advanced security protocols and encryption technology to protect clients' personal and financial information.

The company also offers negative balance protection, which ensures that clients cannot lose more than their account balance, and it has a compensation scheme in place that can provide additional protection to eligible clients in case of the company's insolvency.

More details can be found in the table below:

| Protection Measure | Detail |

| Regulation | FCA, CySEC, FSCA |

| Segregated Accounts | Client funds are held in segregated accounts, separated from the company's operating funds |

| Negative Balance Protection | Ensuring clients' accounts cannot go below 0 |

| Investor Compensation Scheme | Client funds are insured by Lloyds of London for up to USD 1,000,000 per client in the event of broker insolvency |

| SSL Encryption | Protecting clients' personal and financial information from unauthorized access |

| Two-Factor Authentication | To add an extra layer of security to clients' accounts |

| Anti-Money Laundering Policy | To prevent money laundering and other illegal activities |

| Privacy Policy | Ensuring clients' personal information is kept confidential and used only for legitimate purposes |

Based on publicly available information, Tickmill has implemented a range of measures commonly found in the industry to support trading performance and the security of client funds. Its key features include:

- Segregation of client funds from the companys own funds

- Negative balance protection

- SSL encryption for data security

- Anti‑Money Laundering (AML) policies and procedures

- Ability to trade a Tickmill account directly on TradingView charts

- Competitive spreads, relatively low capital requirements, and stable chart performance

- According to its public disclosures, Tickmill offers client fund protection through insurance arranged with Lloyd‘s of London, one of the world’s leading financial insurance markets. This insurance provides coverage for client funds of up to USD 1,000,000.

Further details on the fund insurance can be found on Tickmill‘s website: https://www.tickmill.com/th/safety-of-fundsNote: The above is a summary based on Tickmill’s official statements. Specific coverage scope and applicable conditions are subject to the platform‘s latest terms and the insurer’s policies.

Our Conclusion on Tickmill Reliability:

Based on the information available, Tickmill appears to be a reliable and trustworthy broker. It is regulated by reputable authorities, has been in operation for several years, and has received positive reviews from many customers.

However, as with any form of investment, trading always involves risk. It is essential for traders to conduct their own research and carefully consider their options before investing. You can also try trading with a demo account here: https://tickmill.click/signup-th

Market Instruments

Tickmill is a comprehensive trading platform that offers a wide range financial instruments. Their offerings include over 60 forex currency pairs, more than 15 stock indices, 500+ stocks and ETFs, bonds, various commodities including precious metals and energies, cryptocurrencies, as well as futures and options such as S&P 500, DJIA, and NASDAQ. These options provide users with the flexibility to diversify their investment portfolio.

| Tradable Assets | Supported |

| Currency pairs | ✔ |

| Indices | ✔ |

| Stocks & ETFs | ✔ |

| Bonds | ✔ |

| Commodities | ✔ |

| Cryptos | ✔ |

| Futures & Options | ✔ |

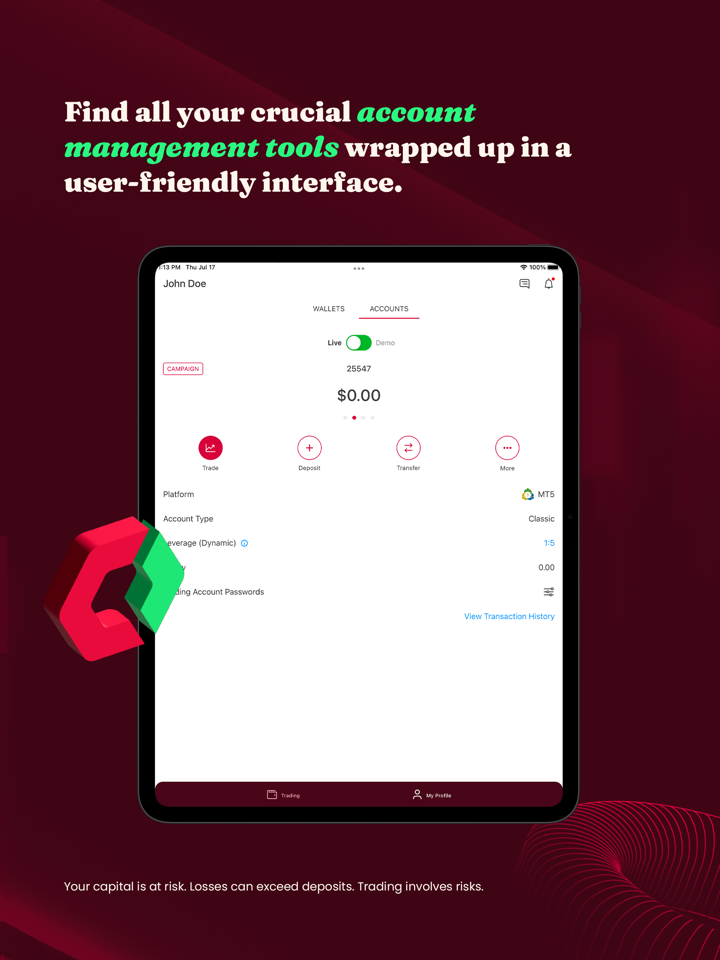

Account Type/Fees

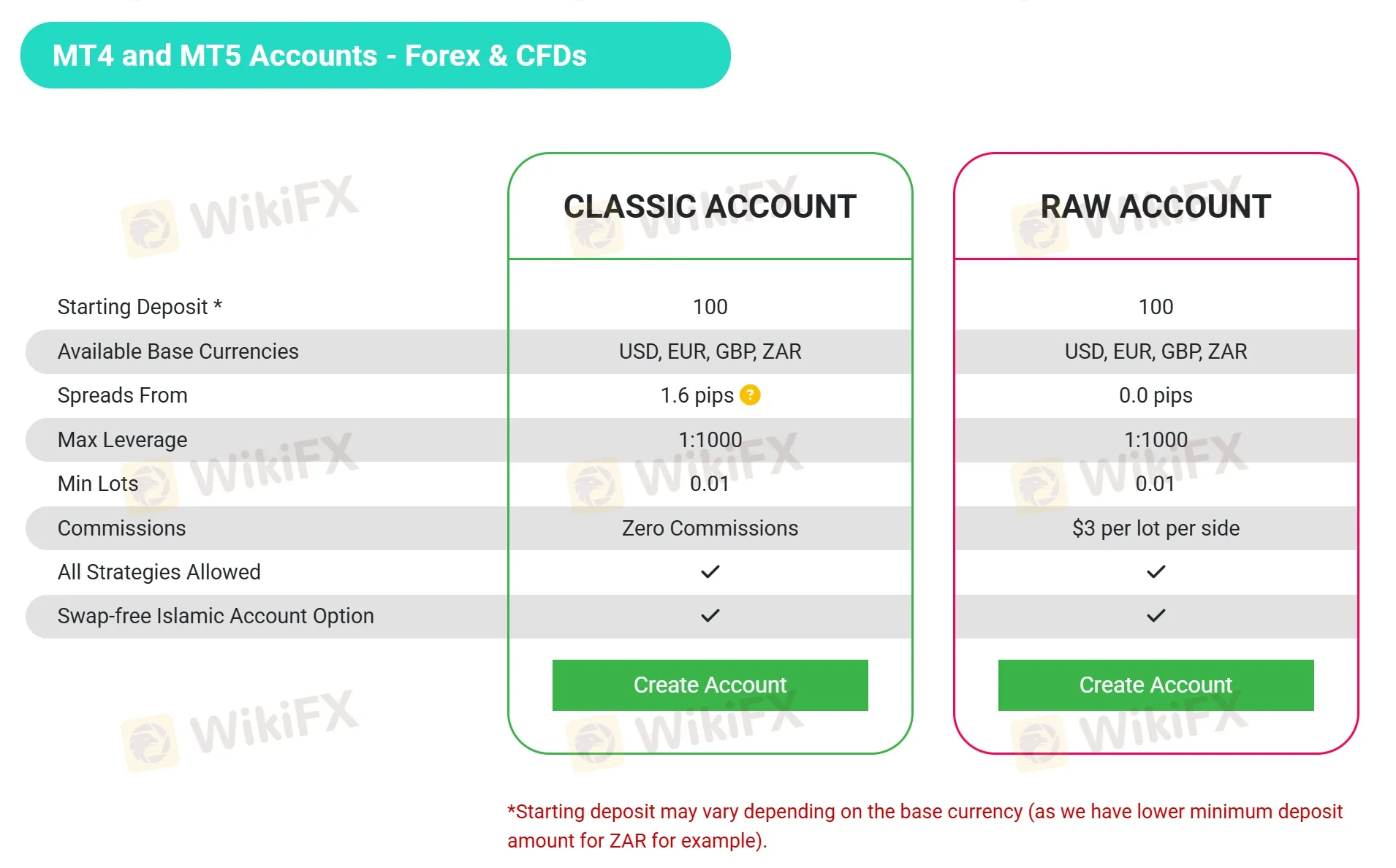

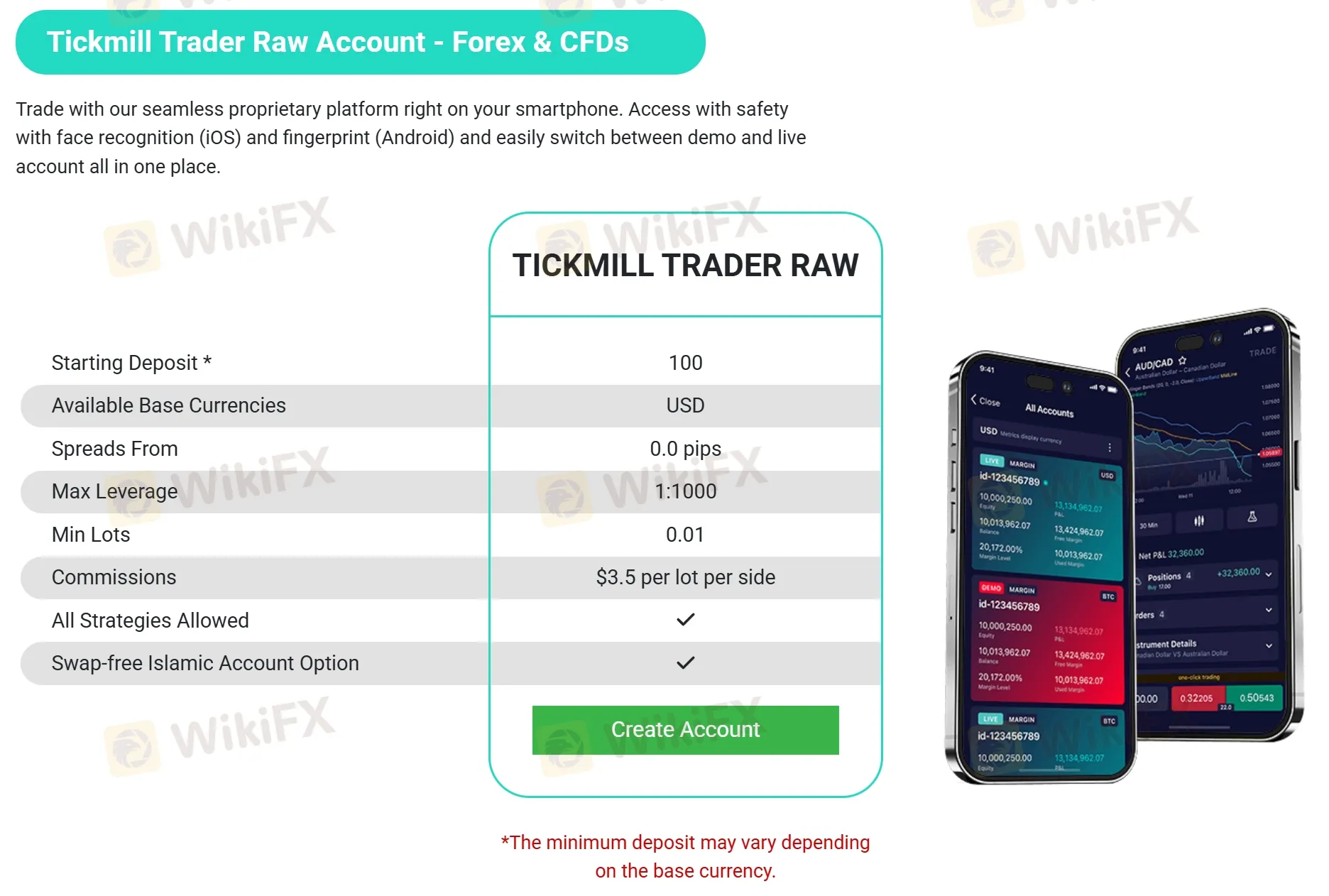

Tickmill offers three account types, including Classic, Raw, and Tickmill Trader Raw.

| Account Type | Classic | Raw | Tickmill Trader/ Tradingview |

| Min Deposit | 100 | ||

| Available Base Currencies | USD, EUR, GBP, ZAR | USD | |

| Max Leverage | 1:1000 | ||

| Spread | From 1.6 pips | From 0.0 pips | |

| Commission | ❌ | $3 per lot per side | $3.5 per lot per side |

All account types at Tickmill offer access to the same range of trading instruments. Additionally, all accounts can be opened as Islamic accounts, which are swap-free accounts for traders who follow Sharia law.

Prior to committing to various live trading accounts, clients have the option to explore Go Markets' offerings through the provided demo accounts, allowing them to familiarize themselves with the trading environment before engaging in real trading activities.

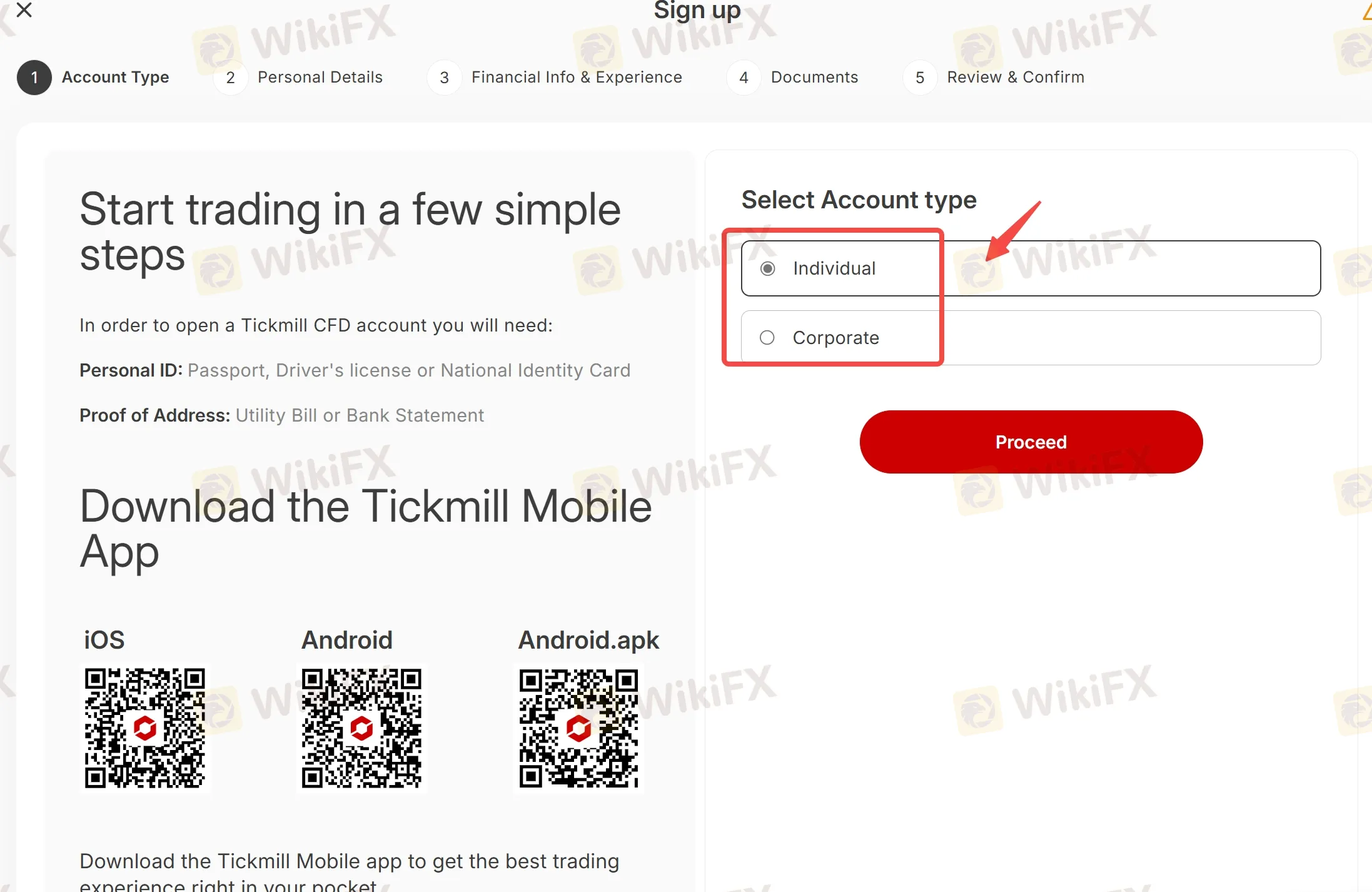

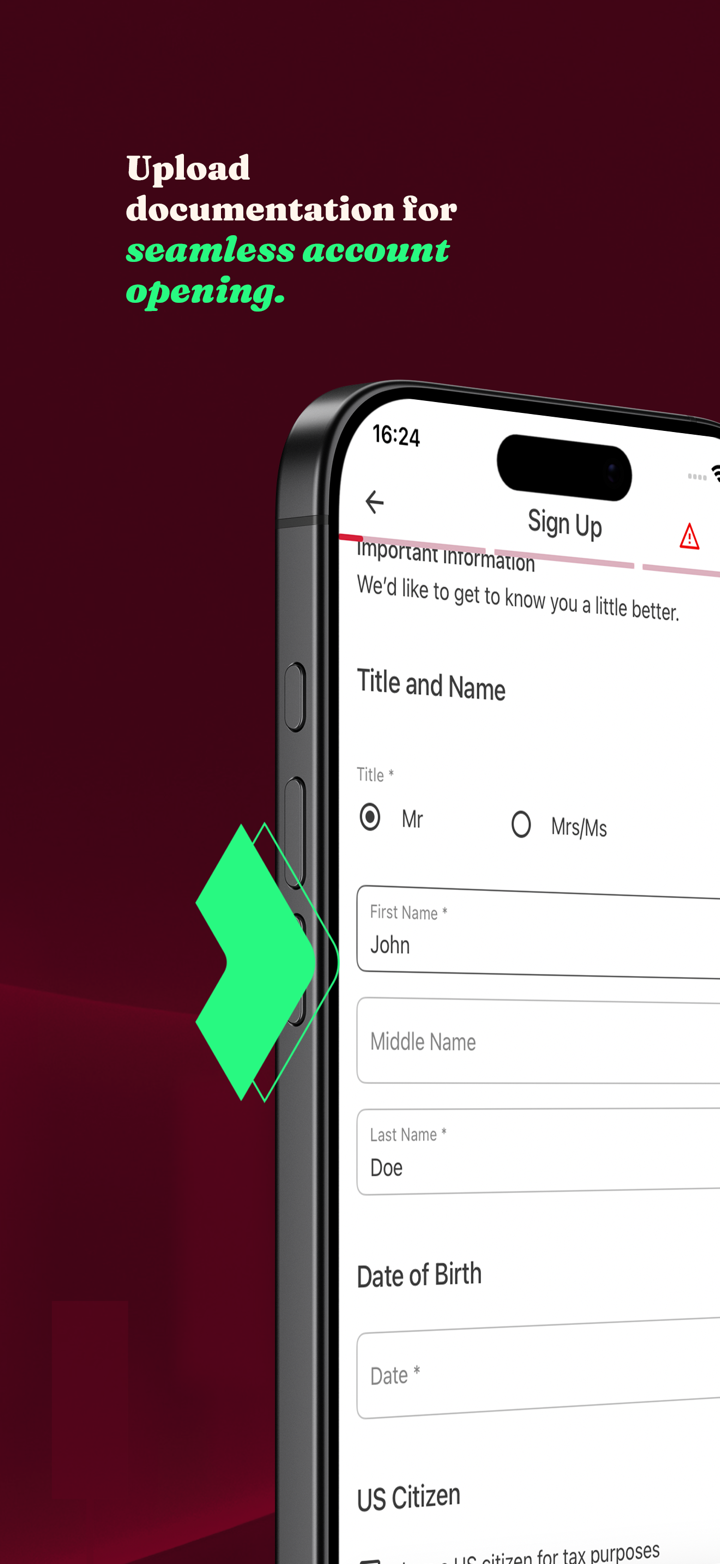

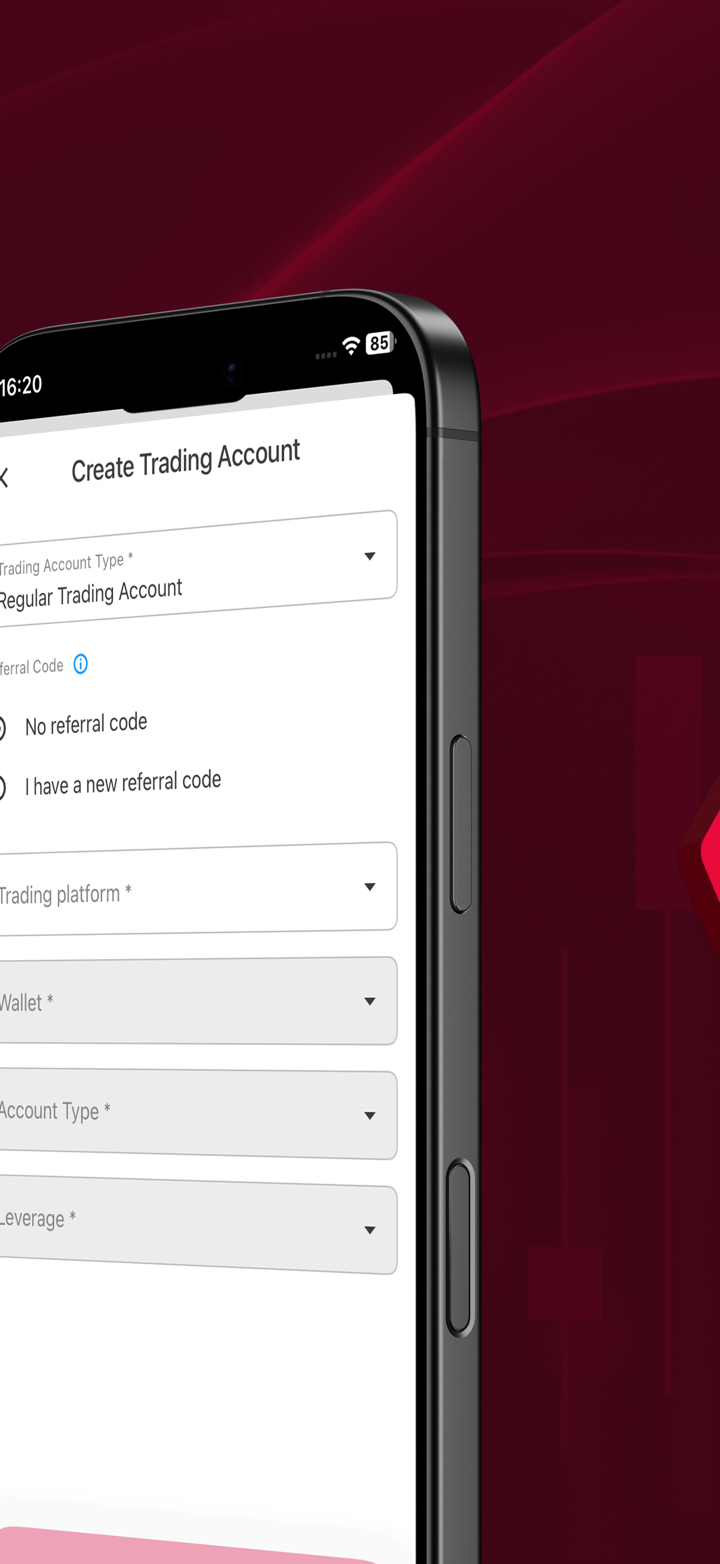

How to Open an Account?

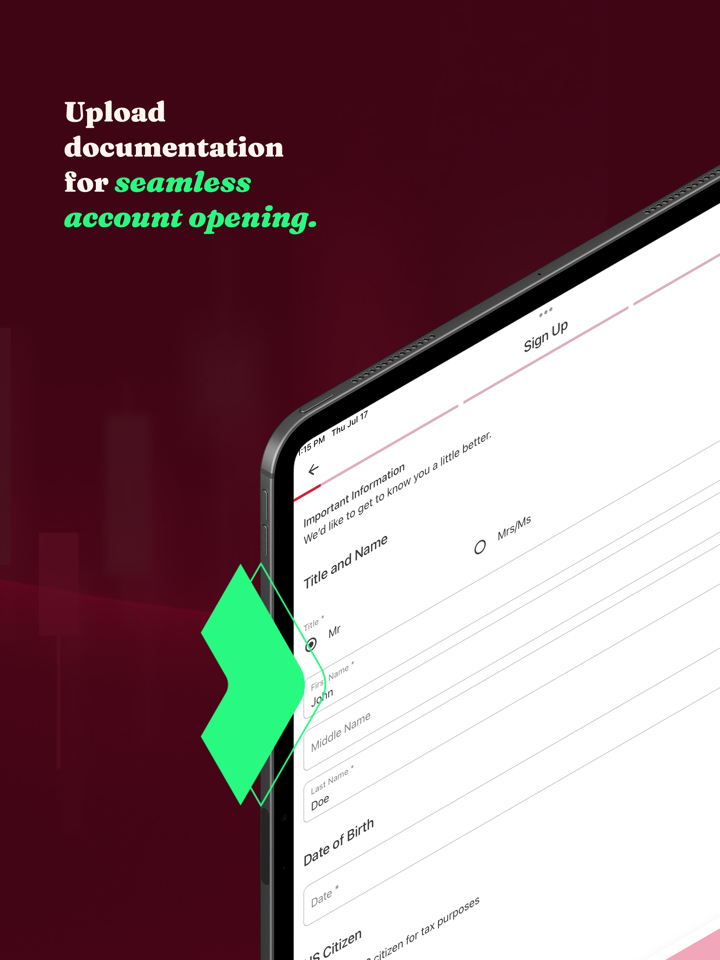

Step 1: Register

Click on ‘Create account’. Enter your personal details and check your email for verification.

Step 2: Upload Documents

Submit your Proof of Identity and Proof of Address to complete registration.

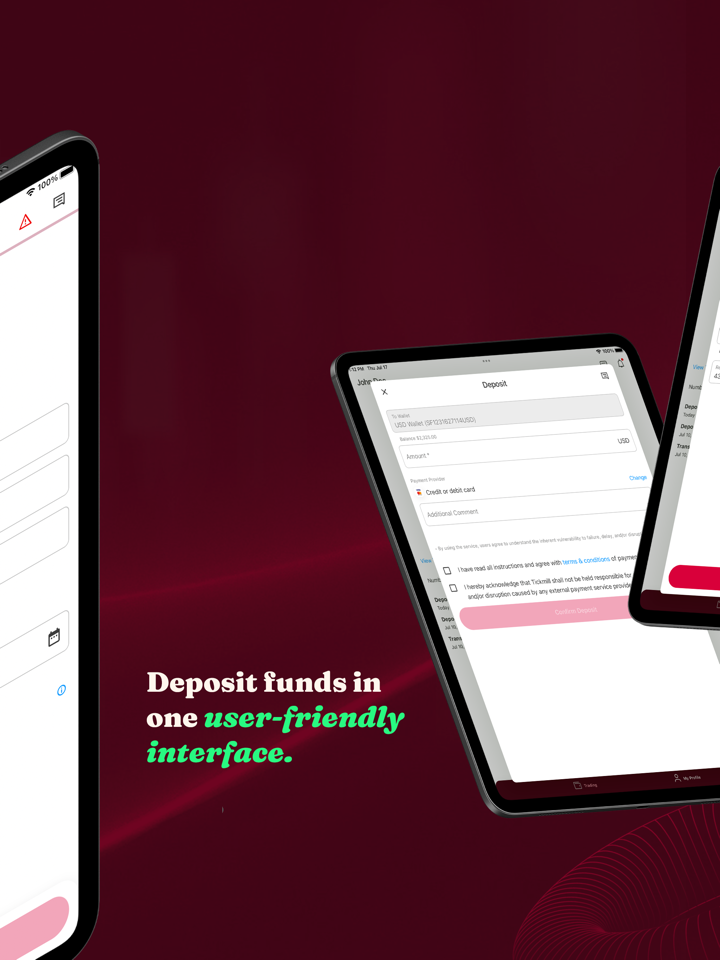

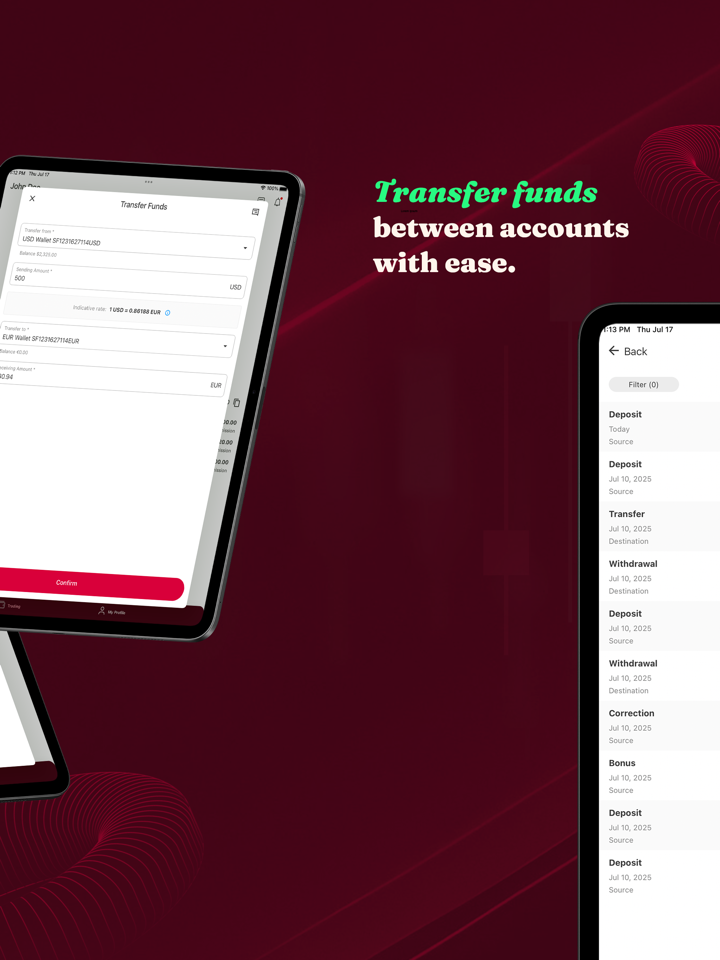

Step 3: Fund and Choose Platform

Open a trading account, deposit to your Tickmill wallet, transfer funds from your Tickmill wallet to your live trading account and download the trading platform of your choice to start trading.

Leverage

Tickmill offers flexible leverage ranging from 1:1 to 1:1000, depending on the account type and the instrument traded.

| Asset Class | Max Leverage |

| Forex | 1:1000 |

| Stock indices | 1:100 |

| Commodities | |

| Bonds | |

| Cryptocurrencies | 1:200 |

Bear in mind that higher leverage levels increase the potential profits but also increase the potential losses, so it's important to use leverage carefully and manage risk appropriately.

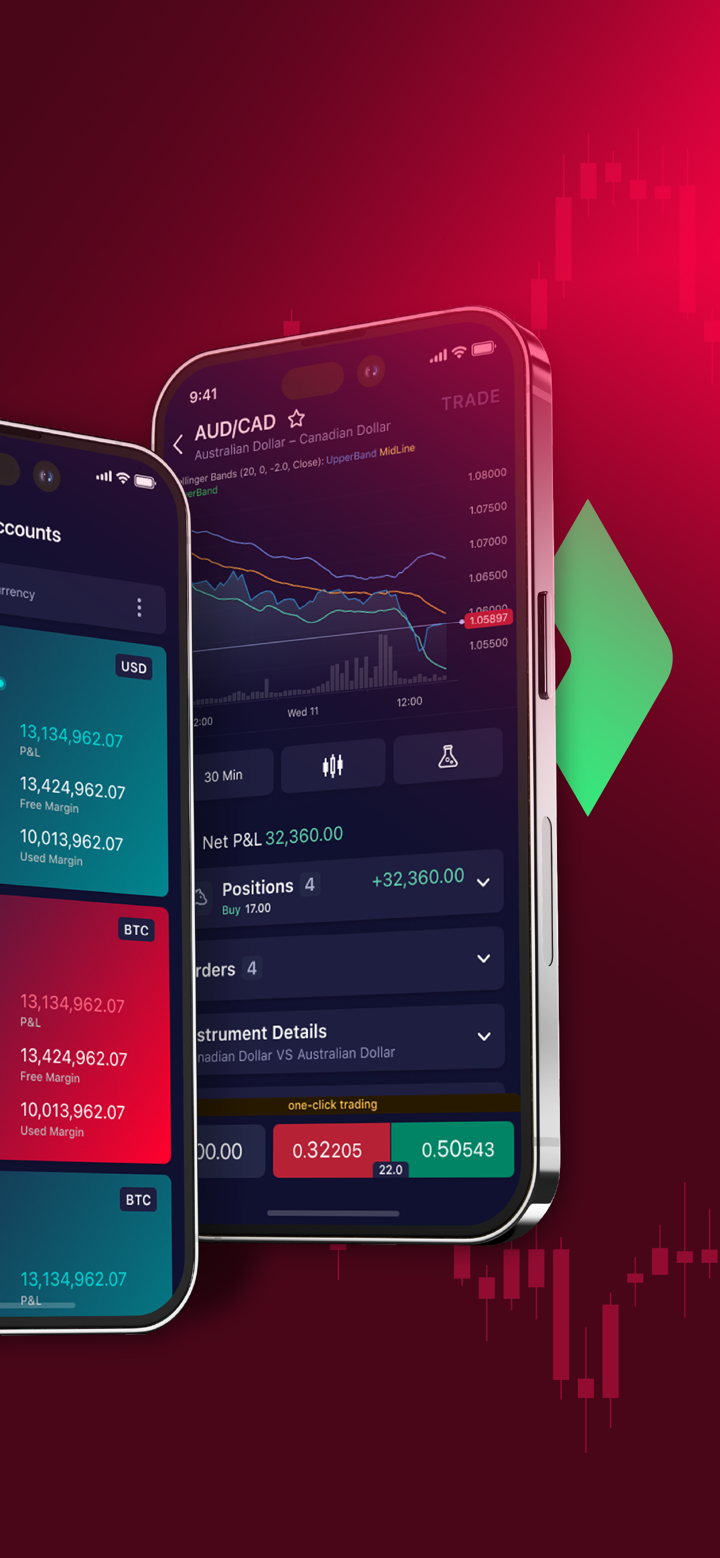

Trading Platforms

Tickmill offers several trading platforms for its clients, including:

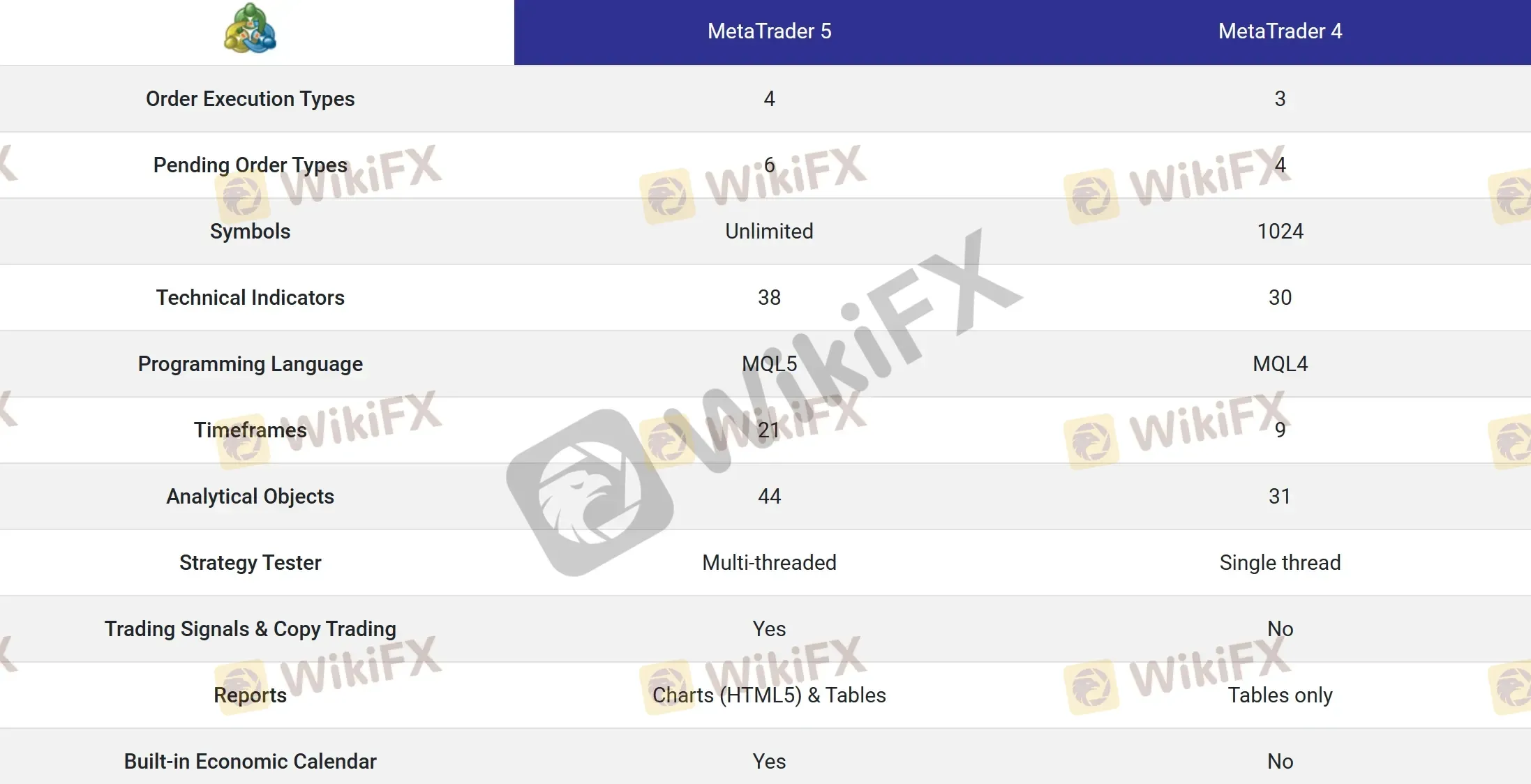

- MetaTrader 4 (MT4): This is a popular trading platform among forex traders due to its advanced charting capabilities, numerous technical indicators, and ability to run automated trading strategies.

- MetaTrader 5 (MT5): This is an upgraded version of MT4, offering additional features such as more timeframes, depth of market, and the ability to trade other instruments such as stocks and commodities.

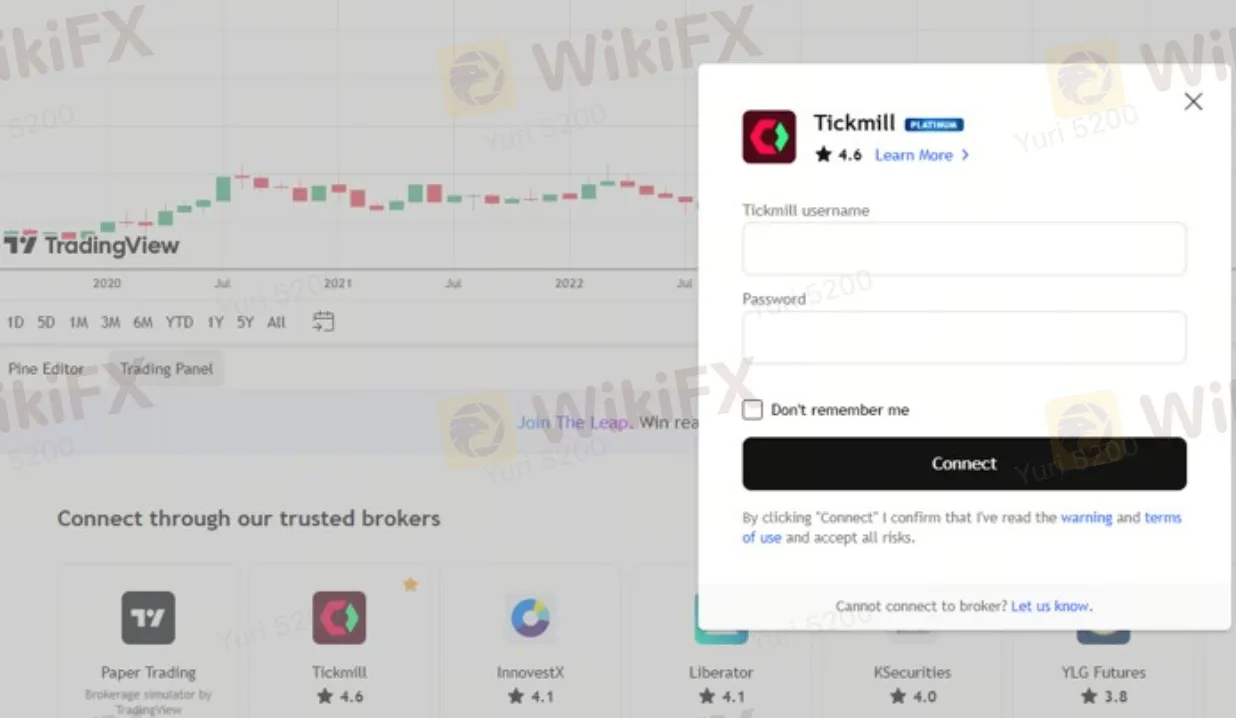

Tickmill TradingView:Tickmill clients can use their Tickmill trading accounts to trade directly on TradingView charts, the world‘s leading charting platform. This integration supports Pine Script and backtesting, allowing traders to build their own strategies with TradingView’s Pine Script and test them under real market conditions to make more data-driven decisions.

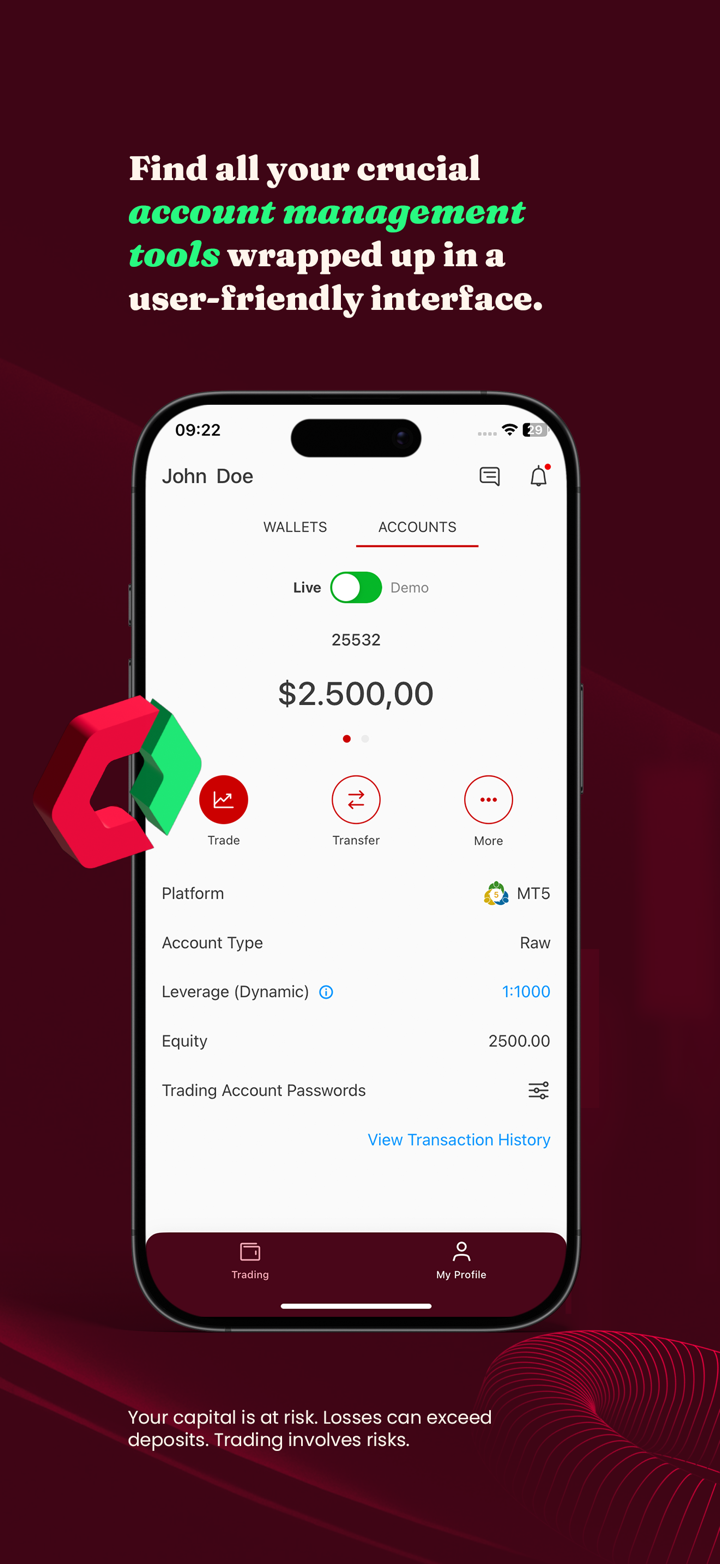

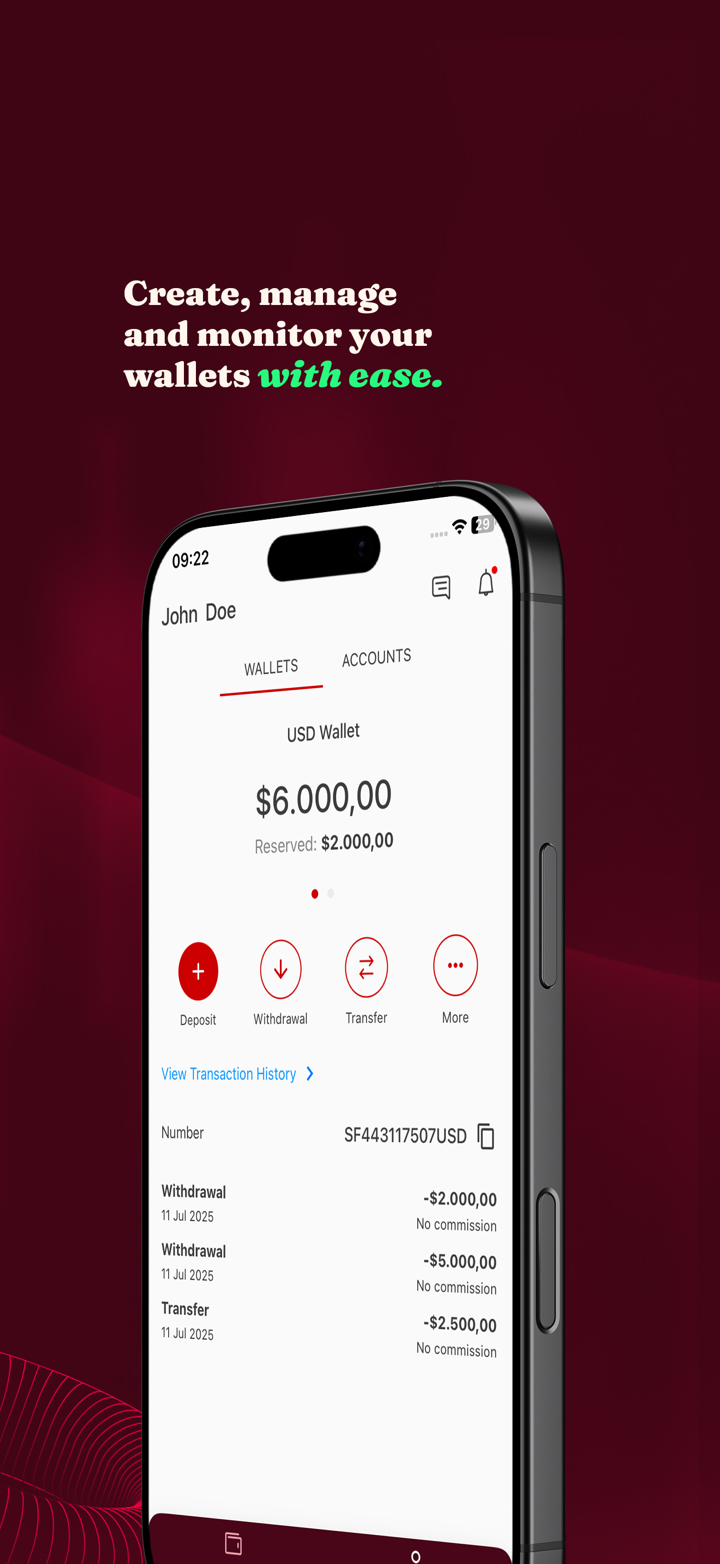

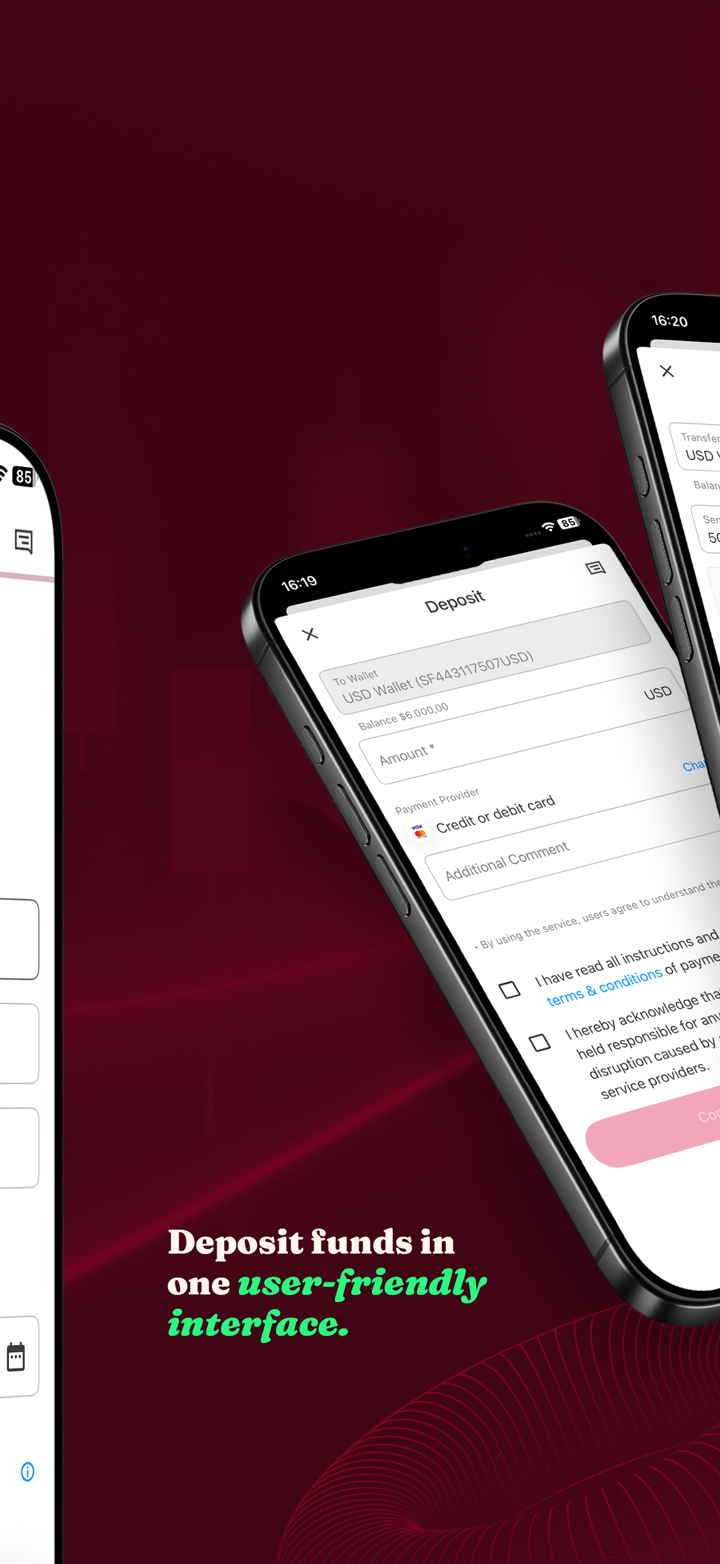

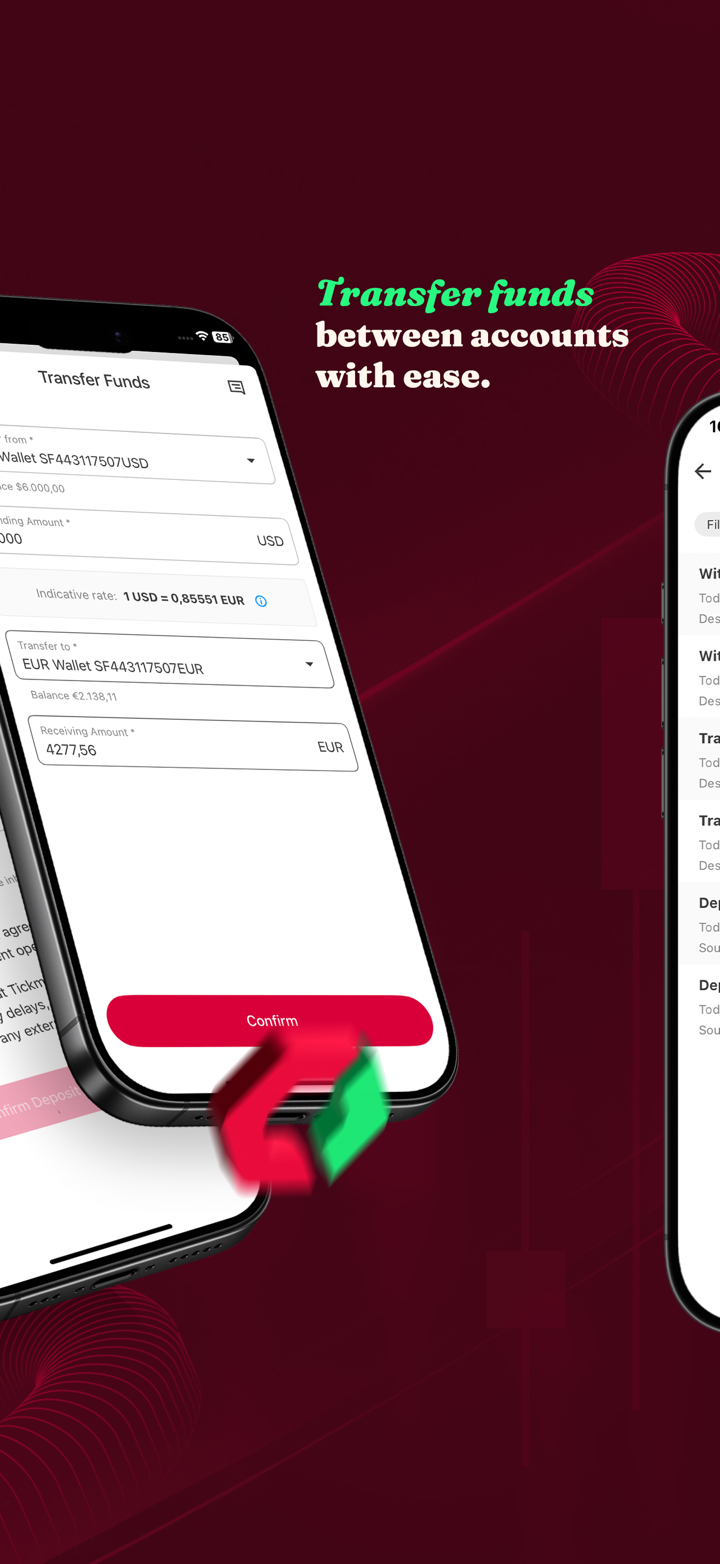

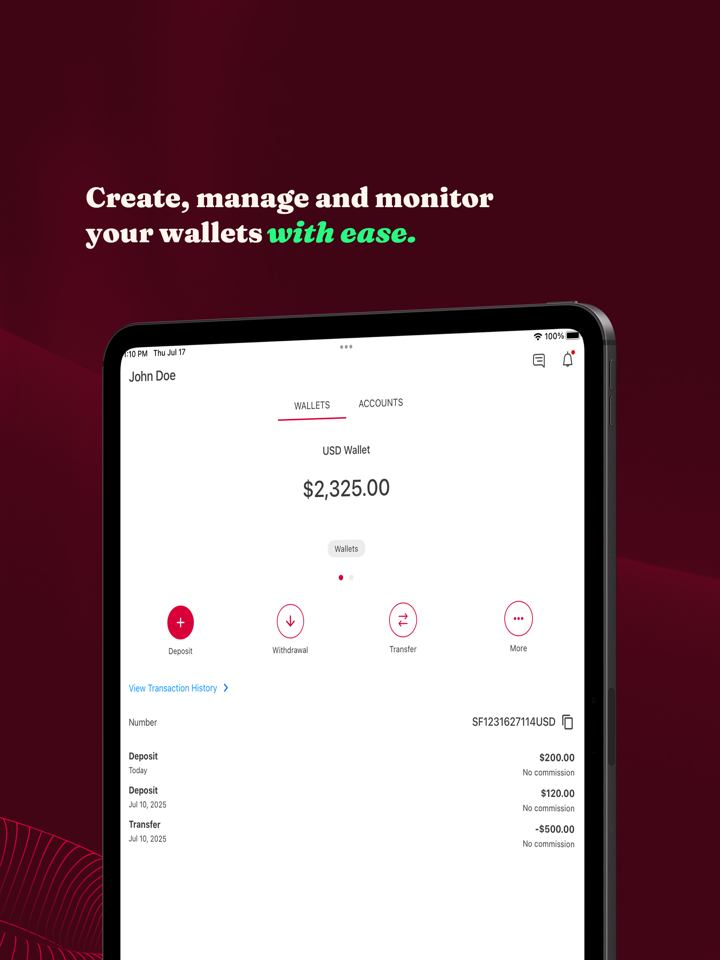

Tickmill Trader: This is a proprietary platform developed by Tickmill, offering a user-friendly interface, advanced charting tools, and the ability to trade directly from charts.

Overall, Tickmill's trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders.

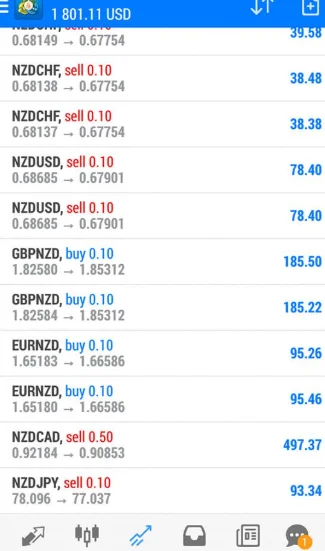

Copy Trading

Tickmill offers copy trading features. This allows less experienced traders to copy the trades of more experienced traders, potentially increasing their chances of making profitable trades. It's a strategy often used by new traders or those looking to diversify their trading. You can copy top traders on Tickmill's website.

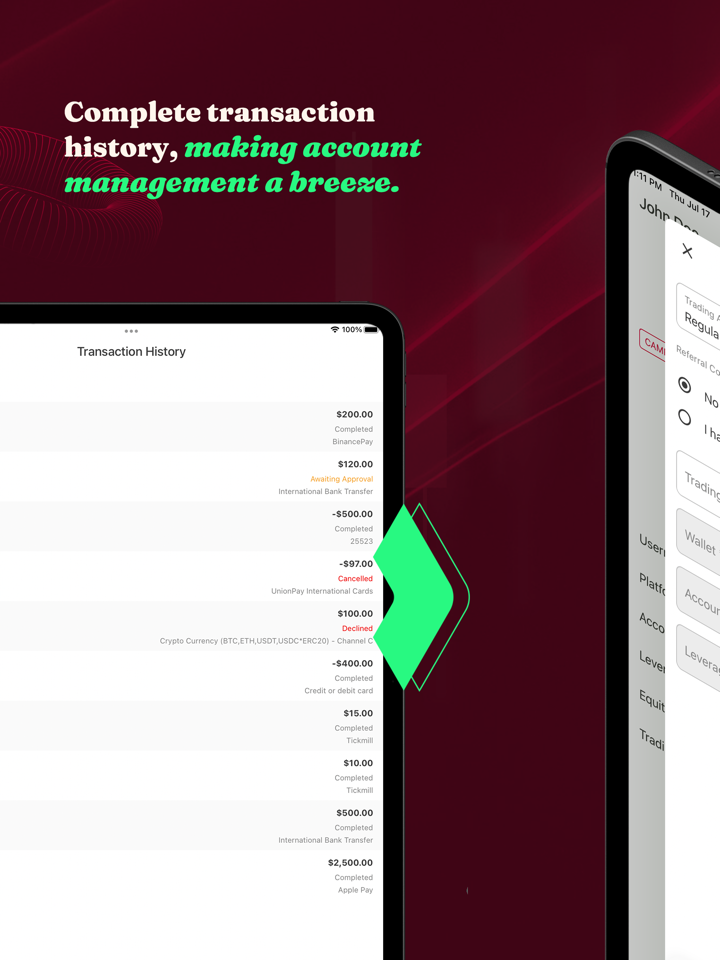

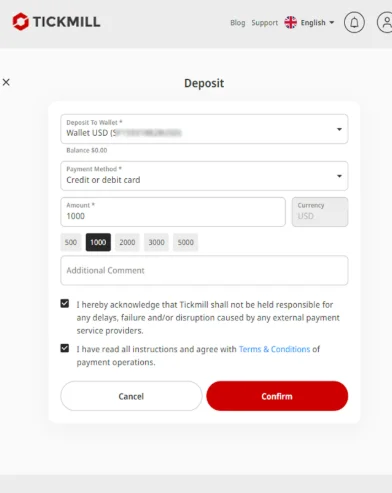

Deposits & Withdrawals

Another important factor when choosing a Forex broker is the convenience of depositing and withdrawing funds from your trading account. Tickmill accepts deposits via local bank QR code payments, cryptocurrencies, VISA and Mastercard, Skrill, Neteller, Sticpay, FasaPay, UnionPay, and WebMoney.

Tickmill does not charge fees for deposits or withdrawals. However, clients should check with their payment service providers to see whether any additional transaction fees may apply. At Tickmill, most deposits are processed instantly, while withdrawals are generally processed within 24 hours.

Conclusion

Overall, Tickmill is a good option for traders who are looking for a reliable and transparent broker with competitive trading conditions. Some of the advantages of Tickmill include its strong regulatory framework, low trading fees, a wide range of trading instruments, multiple trading platforms, and excellent customer support.

It is particularly suitable for experienced traders who are looking for a broker that provides access to a variety of markets and trading instruments, as well as competitive trading conditions. Additionally, Tickmill's demo account allows traders to test their strategies and trading skills before investing real money.

FX3181047688

Australia

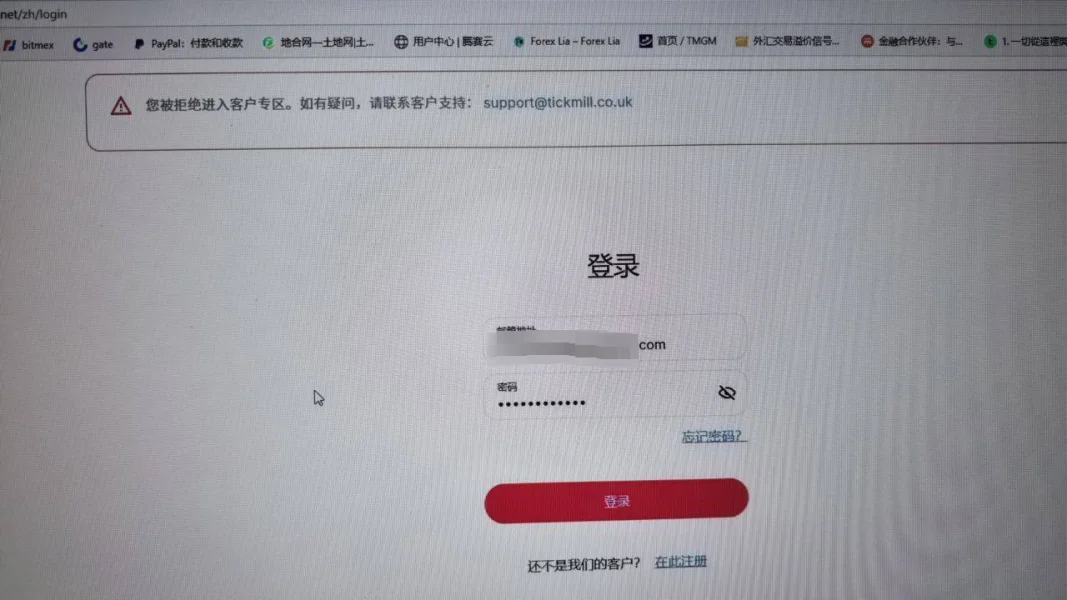

This platform is terrible. I deposited $5,000, and after losses, my balance is down to $3,500. Not only are they not processing my withdrawal, but they've also locked me out of my account.

Exposure

FX2793571131

Indonesia

I export coffee beans, and to mitigate exchange rate risk, I opened an account on your platform to trade USD/IDR. However, the data provided by your Indonesian team is severely delayed! While it performs normally when the international market is stable, your quotes lag by 3-5 minutes when important data is released, causing all my hedging orders to be executed at the worst possible prices! Even worse, you deliberately widen the spreads in the backend, increasing the normal 5-point spread to 25 points during critical periods! I contacted customer service, but your Indonesian manager brazenly claimed, "This is normal market behavior!" We export agricultural products, and our profits are already slim. This deception has resulted in a direct loss of 350 million rupiah! Now that harvest season has arrived, I don't even have the funds to pay farmers their advances. My entire supply chain is on the verge of collapse!

Exposure

FX3116939309

Malaysia

Slippage and spread traps lead to huge losses. On the night of the non-farm payroll data release on March 7, 2025, I traded the GBP/USD currency pair on Tickmill and set a take-profit point of 1.2600. When the market hit 1.2605, the platform showed a slippage to 1.2520, forcing a liquidation. The original profit of RM12,000 instantly turned into a loss of RM9,800. What's even more outrageous is that the normal spread suddenly soared from 2.3 points to 18.7 points during the transaction, and immediately returned to normal after the position was closed. This is clearly malicious manipulation by the platform. This is completely contrary to the promise of "ECN low spread, zero slippage" in their advertisements. Scammer

Exposure

FX3936240664

Malaysia

As a regular Malaysian trader, I chose Tickmill for its advertised advantages of "FCA regulation and low spreads." However, my actual experience has been mixed. The platform does hold a Labuan FSA license, and funds are segregated in a Malayan bank account, which initially reassured me. However, during my trading from March to May 2025, a series of hidden issues gradually emerged. While these didn't result in significant losses, they severely impacted my trading experience. The official website boasts "spreads on major currency pairs as low as 0.1 pips," but in actual trading, the EUR/USD spread remained stable at 1.2-1.5 pips during off-peak hours. This selective execution repeatedly caused my strategy to fail.

Neutral

FX1048836099

Indonesia

The crappy Indonesian-operated system, coupled with a hilariously fake "data foundation," is practically driving users into a fire pit! Yesterday, I traded based on the EUR/USD data your system pushed, and the real-time price was clearly stable. Just as I entered a large position, the market suddenly plummeted! When I tried to close my position and stop my loss, the crappy Indonesian system froze. When it finally recovered, my account was liquidated, with over $50,000 wiped out in an instant! I complained to Indonesian customer service, but they played dumb in their broken English, saying, "Data delays are normal!" You're using delayed data to trick users into placing orders, then system lags prevent stop-loss orders, and then you're blaming them when things go wrong. This Indonesian team isn't providing service; they're simply stealing money!

Exposure

FX3113770422

Malaysia

Tickmill, are you executing orders on purpose? Slippage is always bad, never good! You're driving me crazy! The data speaks for itself: when the non-farm payroll data was released, my EURUSD stop-loss order, set at 50 pips, slipped by 70 pips! A 20-pip loss is equivalent to a 2% loss on my principal! And what about my take-profit orders? I've never seen them slip even a single bit! How is that possible? Is market liquidity one-way? This is clearly your execution desk messing around, deliberately magnifying your clients' losses! Do you have an AI behind the scenes watching my account operations? They're specifically trying to make me lose money! Tickmill, you're a fake ECN company you can't afford to play with. You claim to be fair, but you're doing the dirtiest things behind the scenes! Malaysian brothers, don't be fooled by their propaganda

Exposure

FX3831294706

India

टिकमिल के दुर्भावनापूर्ण स्प्रेड की वजह से मुझे 480,000 रुपये का नुकसान हुआ। जब भारतीय रिज़र्व बैंक ने अपनी ब्याज दर संबंधी घोषणा की, तो मैंने USD/INR पर 83.50 का स्टॉप-लॉस लगाया। बाज़ार अचानक पाँच सेकंड के लिए रुक गया, और जब वह संभला, तो उसने 83.80 पर एक ट्रेड दिखाया—30 अंकों की असामान्य गिरावट। इससे मुझे 60,000 रुपये का नुकसान हुआ, जो 2,000 मीटर सूती धागे की कीमत के बराबर है। मेरे 15 में से 11 ट्रेड 25 अंकों से ज़्यादा गिर गए, जिससे कुल 525,000 रुपये का नुकसान हुआ। हालाँकि, मैं ICICI बैंक के प्लेटफ़ॉर्म पर भी ट्रेडिंग कर रहा था, और स्प्रेड लगातार 5 अंकों के दायरे में रहा। सेबी की जाँच से पता चला कि टिकमिल भारत में पंजीकृत भी नहीं है; इसका तथाकथित "नियमन" केवल सेशेल्स FSA द्वारा किया जाता है—बिल्कुल दिल्ली की सड़कों पर नकली डिप्लोमा बेचने वालों की तरह। इस ब्रोकर पर मेरी तरह भरोसा मत करना।

Exposure

FX2577613256

Indonesia

Tickmill's spreads can spike when Bank Indonesia (BI) announces interest rates. On the 15th, I traded USD/IDR. The spread, which is usually 10 pips, suddenly jumped to 55 pips after the central bank data was released. I immediately lost 6.6 million rupiah after placing the order. Withdrawals were even worse. I requested an 80 million rupiah withdrawal in March but only received 68 million rupiah by mid-April. They deducted a 'fund custody fee' of 15%. I asked to see the fee documentation, but they couldn't provide it, citing 'platform regulations.' BAPPEBTI's announcement stated that 'Tickmill operates without a license,' but I initially ignored it.

Exposure

FX3900122844

Malaysia

Tickmill's slippage only hurts profitable trades. It's disgusting! In the past 30 days, I've made 32 USD/MYR trades, and 19 of them saw slippage exceeding 25 pips, while the slippage on losing trades never exceeded 5 pips. When I was making a profit of RM2,800, USD/MYR suddenly gapped down 30 pips, triggering my stop-loss, wiping out all my profits and leaving me with a RM1,200 loss. It's so blatant. I checked the BNM website, and Tickmill doesn't have any forex trading registrations, yet customer service insists it's "regulated in Malaysia." I once asked for the regulatory number in Malay, but they hemmed and hawed, unable to produce it, and hung up on me. Now, I'm down to RM28,000 of the RM75,000 I had with Tickmill. Be wary of brokers like this.

Exposure

FX1498690473

Indonesia

Tickmill has always had a good reputation in the Indonesian forex community, which attracted me to open an account. Their so-called "low spreads" are conditional, but their real killer feature is slippage! On the night of the non-farm payroll report, I placed a short position in gold with a stop-loss at 2640.5. After the release of the non-farm payroll data, gold prices skyrocketed. Normally, my stop-loss should have been triggered between 2641 and 2642, but the platform's transaction price was directly at 2645, a 4-point slip. My account was completely liquidated, with a loss of nearly $1,500! I took screenshots of the Reuters market data and the platform's transaction records at the time, and the two completely mismatched. I also placed the same position on other platforms (such as IC Markets and Pepperstone), and they executed at almost the same stop-loss price, while Tickmill's slipped by 4 points. If you're looking for a stable trading environment, Tickmill is definitely not the

Exposure

FX6500637832

Indonesia

During my time trading with Tickmill, slippage has become incredibly frequent. Market fluctuations are relatively stable, and trading should normally proceed smoothly. However, when I placed a buy order, the price I set was $1,850 per ounce, but the actual transaction price was $1,855 per ounce, resulting in a $5 slippage. Instead of making a profit, I actually suffered a loss. I initially thought it was just a fluke, but subsequent trades left me completely devastated. In one crude oil trade, I set a stop-loss price of $55 per barrel and a take-profit price of $60 per barrel. But when the market price quickly rose to $59 per barrel, I suddenly experienced abnormal slippage. Over the past month, at least 15 of my 20 trades have experienced varying degrees of slippage, with each trade resulting in an average loss of over $200. In total, I've lost over $3,000 due to slippage.

Exposure

FX2894154961

Malaysia

I'm extremely disappointed with Tickmill. They constantly boast about "ultra-fast execution" and "no requotes," which is the most ironic advertising slogan I've ever heard! In reality, their order execution issues are numerous! In volatile markets, submitting a market order often results in the platform "hanging," meaning the order remains stuck for several seconds, neither executed nor rejected. Furthermore, I experienced severe slippage. Every trade was executed at a significantly different price from my set price, and this deviation was always against me, leading to frequent unnecessary losses. My trading experience with Tickmill was extremely negative, and I strongly recommend that everyone carefully consider choosing a trading platform and avoid platforms with such numerous issues as Tickmill.

Exposure

FX3518188664

Indonesia

Slippage and margin calls on the Tickmill Forex platform are a double whammy of despair. I'm incredibly angry about your actions! During my time trading on this platform, I've been plagued by both slippage and margin calls, sinking into despair. Slippage haunts every trade like a ghost. In one GBP/JPY trade, the market was stable, but my order slipped by over 30 pips, resulting in significant losses from the outset. And when the market moved against me, the platform's malicious manipulation made me even more miserable. I reported the issue to the platform, but not only did they refuse to acknowledge their mistakes, they also verbally abused me. Tickmill, your treatment of investors has seriously disrupted the order of the forex market. I hope regulators will intervene swiftly and severely investigate you, so that victims like me can receive the compensation and justice they deserve.

Exposure

FX1639344691

Malaysia

The Tickmill forex platform is a complete black hole of fraud! Trading on this platform, I've experienced extremely severe slippage. It's like a dark hand, ruthlessly plundering my wealth. A few days ago, I traded the EUR/USD. During normal market fluctuations, I followed my established strategy and placed an order at a suitable price. However, the moment the trade was executed, the slippage was shocking. The price was far from my expected price, slipping by over 20 pips. This instantly turned a potentially profitable trade into a loss. When the market moved against me, the slippage became even worse, further exacerbating my losses. I've repeatedly reported this to the platform's customer service, but they've consistently offered various excuses, either blaming market fluctuations or simply refusing to respond. This frequent and severe slippage is no accident; it's malicious manipulation, allowing investors to profit at their own peril. Tickmill will undoubtedly be condemned by the mar

Exposure

FX9881695820

Thailand

This mobile application runs very smoothly with a simple command interface. I can adjust the lot size just by swiping my finger and close positions anytime even offline. I particularly like the offline notification feature. After setting a stop-loss point, I receive alerts when the price reaches it even without an internet connection. However, there is occasional lag when switching between windows, especially when viewing time-based charts. I hope the next update will improve performance.

Neutral

FX1586130582

Thailand

The platform's built-in analytical tools are very useful, including a real-time economic calendar and a comprehensive set of technical indicators. I check the daily market summary before the market opens to quickly grasp the day's key data. The multi-timeframe comparison feature is excellent, allowing you to view trends on both 4-hour and 1-hour charts simultaneously. However, some advanced indicators require a paid subscription, making the free version sufficient but not comprehensive, which is quite disappointing for professional traders.

Neutral

FX2724309557

Thailand

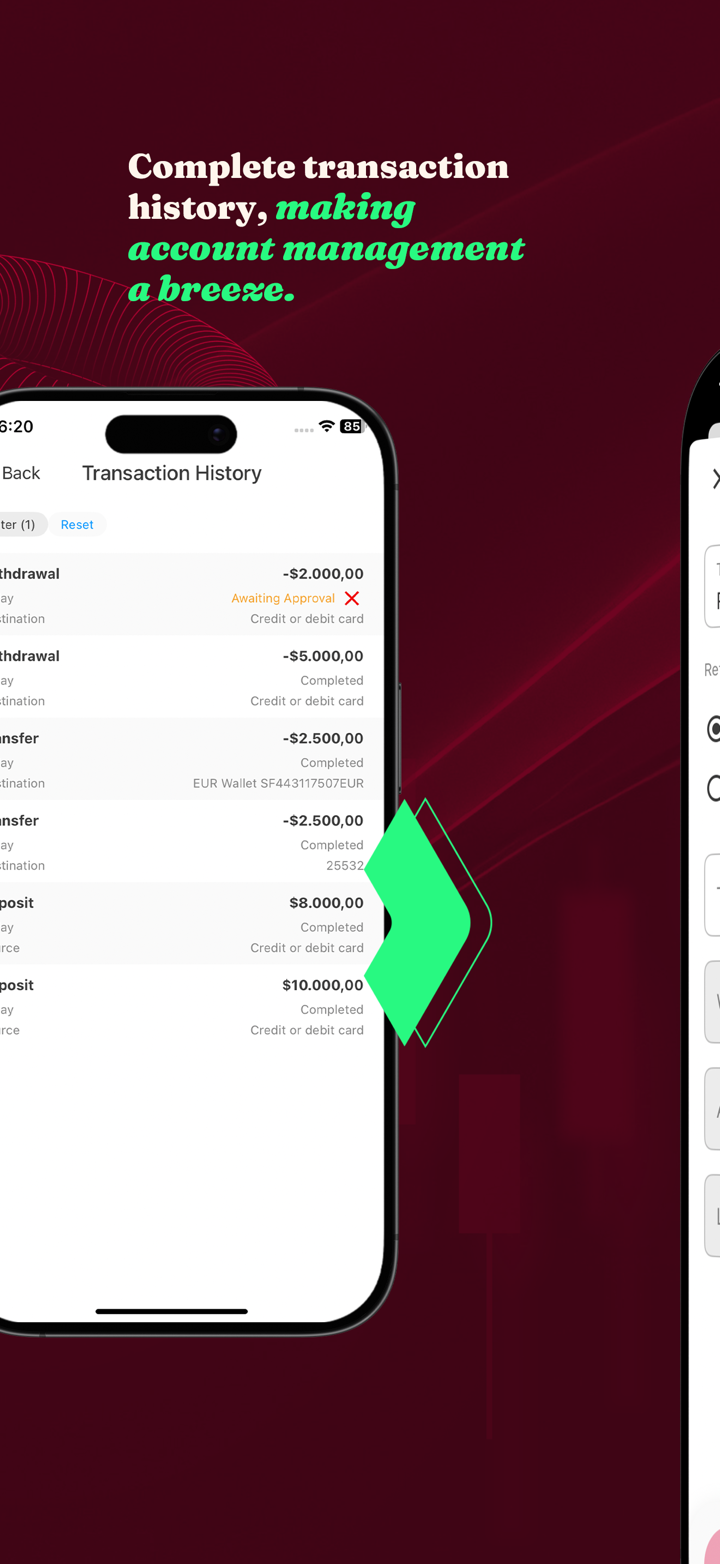

Tickmill's account statement is very detailed. You will not only see the details of profits and losses, but also be able to calculate various data such as win rate and average holding time.

Positive

FX4078119370

Thailand

Tickmill offers highly flexible leverage options, ranging from 1:100 to 1:500 for forex and 1:100 for gold. For someone like me who enjoys adjusting positions based on market conditions, this platform is very user-friendly. I initially used 1:100 when I was practicing and gradually increased it to 1:300 as my capital grew. This method proved highly effective for risk management. However, adjusting leverage requires a one-day advance notice and does not take effect immediately. I once needed to change leverage at the last minute but ran out of time. I’d like to see an improvement allowing instant adjustments.

Positive

FX2987162943

Thailand

The most user-friendly experience when trading with Tickmill is speed, especially for day trading. Market orders are executed almost instantly with minimal delay. During the latest Non-Farm Payroll data release, I placed three simultaneous orders for Europe and the US, all of which were executed at prices very close to my expectations with no slippage. However, during extreme market conditions, such as the sudden volatility of the Swiss Franc, one sell order was delayed by 0.5 seconds, but fortunately, the impact was minimal. Overall, this execution speed is considered the best among similar platforms, making it very easy to use for traders looking to take advantage of spreads.

Positive

FX1684399292

Turkey

On December 7, 2023, I transferred 23,000 USDT to my Tickmill account via the OKX exchange. Despite providing Tickmill with all the necessary information, including the full transaction ID, this amount has not been credited to my account and it appears that my funds have been withheld. For approximately three days, I have repeatedly contacted customer service via both email and phone, but no concrete solution has been offered. I am only experiencing a process of being kept waiting and stalled, which is undermining trust and creating victimization. My request is for the $23,000 USDT to be transferred to my Tickmill account without delay and in full, or for the same amount to be refunded to me. I want this injustice to be rectified immediately and for the process to be explained transparently.

Exposure

蔡菲特

Taiwan

Overall, it is very convenient, with diverse channels for deposit and withdrawal payments, which are relatively fast and convenient.

Positive

FX2993401222

Philippines

Unable to withdraw funds, account was directly wiped clean. Scam platform.

Exposure

Fluke Sayonara

Thailand

Please verify the website to determine if it is genuine or fake. Because if it is a real website regulated by the FCA, there will certainly be no issues with trading. I guarantee it, as I have been using it and have withdrawn funds multiple times.

Positive