Fed Focus: Markets Pause for Minutes as 2026 'Dovish Shift' Looms

Market caution prevails ahead of Fed Minutes as traders eye a significant 2026 FOMC voting rotation that could tilt the central bank toward a more dovish stance.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Market caution prevails ahead of Fed Minutes as traders eye a significant 2026 FOMC voting rotation that could tilt the central bank toward a more dovish stance.

A WikiFX review of Zeven Global reveals the absence of regulatory licensing, a low safety rating, and potential risks to investor protection.

The US Dollar stages a technical rebound following divisive FOMC minutes, though the greenback remains weighed down by a nearly 10% annual decline and lingering fiscal concerns.

Indonesia, the world's top nickel producer, has signaled its intention to cut production in 2026 to support prices, triggering a significant rally in nickel futures. This move could dramatically reshape the global nickel market's supply-demand balance.

The Euro faces renewed downside pressure as France's debt-to-GDP ratio swells to 117.4% and credit agencies downgrade its outlook, creating a fiscal drag on the entire Eurozone economy.

A structural supply deficit and anticipatory buying ahead of potential 2026 tariffs have pushed Copper prices to record highs, outperforming Gold, which faces a short-term technical correction after hitting $4,500.

As the Federal Reserve prepares to release minutes revealing internal rifts over rate cuts, the Bank of Japan's aggressive hiking cycle creates a historic policy divergence, signaling heightened volatility for the USD/JPY pair entering 2026.

Silver (

FOMC Minutes reveal a historic policy split with three dissenters, though 'most' officials still favor easing; a $220B T-bill buying program marks a quiet pivot in liquidity management.

Federal Reserve minutes reveal a divided committee regarding the December rate cut, highlighting tensions between stabilizing the labor market and controlling inflation, as the US Dollar suffers its worst annual decline since 2017.

Middle East tensions escalate as Saudi Arabia issues a 'red line' warning to the UAE over Yemen, while the US expands sanctions on Iranian and Venezuelan arms networks.

Despite escalating tensions in the Middle East and a currency crisis in Iran, WTI Crude remains suppressed below $58 due to structural global oversupply. Markets are prioritizing US production resilience over geopolitical risk premiums.

What began as an effort to recover RM1,500 lost to an online scam ended in a devastating financial collapse of RM1.2 million.

China's official Manufacturing PMI unexpectedly returned to expansion in December at 50.1, signaling potential economic stabilization. The Australian and New Zealand Dollars showed a muted but steady response amid thin holiday liquidity.

Copper and silver are surging as the "AI trade" spills into commodities, driven by massive demand for data center infrastructure. However, analysts caution that silver's rapid ascent is flashing technical "bubble" signals despite strong industrial fundamentals.

As the new year begins, WikiFX extends our sincere gratitude to traders worldwide, our industry partners, and all users who have consistently supported us.

Precious metals conclude a historic year with Gold up 66%, while Silver faces a potential physical inventory squeeze in 2026 as industrial demand clashes with supply constraints.

Following President Donald Trumps unveiling of his sweeping global tariffs plan, the consensus on Wa

Following President Donald Trumps unveiling of his sweeping global tariffs plan, the consensus on Wa

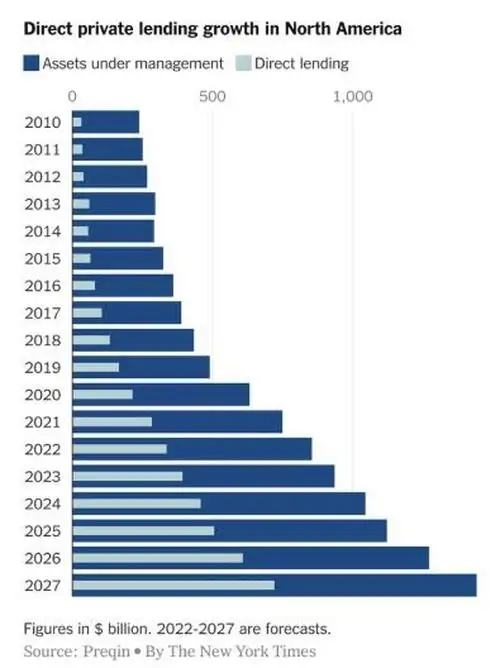

Everyone wants to lend us money now, even though they're not banks:the insurance company Progressive