Germany's Banking Sector Faces Growing Crisis Amid Record Insolvencies

The German economic crisis is slowly but surely making its way into the balance sheets of banks. Abo

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The German economic crisis is slowly but surely making its way into the balance sheets of banks. Abo

The German economic crisis is slowly but surely making its way into the balance sheets of banks. Abo

The US Dollar faces headwinds as economists warn of a 'fragile' labor market and markets price in a dovish pivot, compounded by political maneuvering over the next Federal Reserve Chair.

Gold and Silver are rallying on a convergence of central bank accumulation and dovish Federal Reserve expectations, with analysts warning of a structural shift in global commodity dominance. Market veterans draw parallels to the 1970s, citing the absence of aggressive monetary tightening as a key driver for prolonged upside.

The US Dollar has softened against major peers, allowing the NZD to reclaim 0.5750, while resilient Asian economic data suggests global trade can withstand tariff pressures. Singapore's strong GDP print, driven by the AI boom, signals that manufacturing recovery may offset protectionist headwinds.

Iran faces intensifying internal instability as post-war economic conditions worsen, sparking five days of deadly protests. The potential for harsh regime crackdowns adds a new layer of geopolitical risk premium to energy markets and safe-haven assets.

Despite a history of unfulfilled tariff threats, the US administration's aggressive trade rhetoric continues to provide a floor for the Dollar Index (DXY).

Goldman Sachs reviews a stellar 2025 but warns 2026 will be "wilder," characterized by 0DTE option-driven volatility and thinning market breadth despite strong earnings.

As 2026 trading begins, US Bond yields and the Dollar stage a recovery while markets digest the potential replacement of Jerome Powell with a dovish Trump ally in May.

Gold and Silver face a $11 billion technical sell-off next week due to annual index rebalancing, creating a clash between short-term flows and long-term central bank demand.

Geopolitical risk premiums return to energy markets as Tehran issues a 'red line' warning in response to US intervention threats, threatening oil supply stability.

Reports of a US military strike in Venezuela and the capture of President Maduro have triggered an immediate risk-off sentiment, driving volatility in Crude Oil and safe-haven assets like Gold and the Japanese Yen. Market participants are bracing for potential supply chain disruptions and broader geopolitical fallout in the Latin American region.

Upcoming revisions to Non-Farm Payrolls data and commodity index rebalancing are creating a complex liquidity environment for the US Dollar, potentially forcing a reassessment of the Federal Reserve's rate cut trajectory.

US military forces captured Venezuelan President Nicolás Maduro in a dawn raid, prompting President Trump to announce plans for US oil majors to manage the nation's energy infrastructure. Despite the geopolitical shock, crude markets remain subdued due to global supply gluts.

Philadelphia Fed President Anna Paulson signaled that interest rate cuts may be delayed until later in the year or 2026, defying aggressive market pricing. She cited strong GDP growth and sticky inflation risks as reasons to maintain a restrictive policy stance.

At the turn of the year, the Foundation for Family Businesses, together with the ifo Institute, pres

MagnetFX, operated by PT MAGNET BERJANGKA INDONESIA, currently holds a WikiFX Score of 6.99/10, indicating a moderately secure operational status within its primary jurisdiction. The entity is fully Regulated, holding active licenses from Indonesian regulatory bodies. Based on the 2025 audit data, MagnetFX represents a secure counterparty for traders within the Indonesian market, benefiting from verified local oversight. However, the brokerage exhibits potential inefficiencies regarding trading costs and cybersecurity features on its platform, suggesting it is a stable but potentially higher-cost venue associated with traditional brokerage models rather than low-cost discount trading.

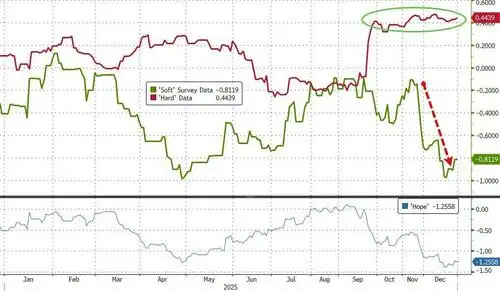

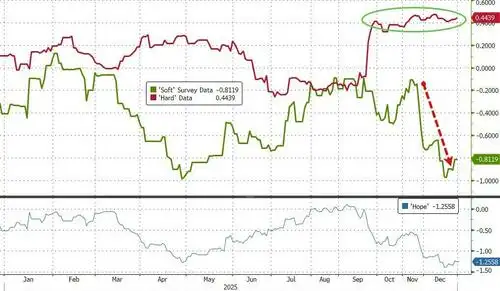

With 'hard' data showing resilience into year-end, 'soft' survey data has cratered (not helped by th

With 'hard' data showing resilience into year-end, 'soft' survey data has cratered (not helped by th

Spread Meaning in Forex Guide: Forex spread defines the bid-ask price differential, representing the cost of entering a trade instantly.