简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

evest Review 2025: Is This Forex Broker Safe?

Abstract:A detailed review of evest, a forex broker regulated by VFSC and FSCA with a WikiFX score of 5.23. The analysis covers its regulatory status, trading conditions on MT5, and significant user complaints regarding withdrawals and account management.

evest is a forex broker established in 2020, primarily serving the MENA region with a presence in the UAE and Saudi Arabia. The broker operates under the oversight of the Vanuatu Financial Services Commission (VFSC) and the Financial Sector Conduct Authority (FSCA) in South Africa. Despite its regulatory status, potential clients should note its WikiFX Score of 5.23, which falls into a medium range, reflecting a mix of regulatory compliance and recent user feedback issues.

Pros and Cons of evest

Based on the available data, here are the key advantages and disadvantages:

- ✅ Regulation: Holds active licenses from the FSCA (South Africa) and VFSC (Vanuatu).

- ✅ Platform Support: Offers the popular MetaTrader 5 (MT5) platform alongside a proprietary web solution.

- ✅ Account Variety: Four account tiers (Silver, Gold, Platinum, Diamond) catering to different deposit levels.

- ❌ High Fees: The entry-level “Silver” account has wide spreads starting from 1.8 pips.

- ❌ User Complaints: A significant number of complaints alleging fraud and withdrawal refusals.

- ❌ Platform Limitations: Reports indicate a lack of dedicated desktop applications for Windows/MacOS (Web/Mobile focus).

evest Regulation and License Safety

Regulation is a critical factor in determining the safety of a broker evest. The company operates under two main entities:

Vanuatu VFSC (Offshore)

The broker is regulated by the Vanuatu Financial Services Commission (License No. 17910). While this allows the broker to operate legally, offshore regulation generally offers less stringent client protection compared to top-tier authorities like the FCA or ASIC.

South Africa FSCA

evest is also regulated by the Financial Sector Conduct Authority in South Africa (License No. 36060). This adds a layer of credibility, as the FSCA is a respected regulator in the African continent.

Risk Warning

Although the broker holds valid licenses, the “Safety” score is impacted by the offshore nature of its primary entity and the volume of client complaints. Traders should be aware that regulatory protection may vary significantly depending on which entity they are registered with.

Real User Feedback and Complaints

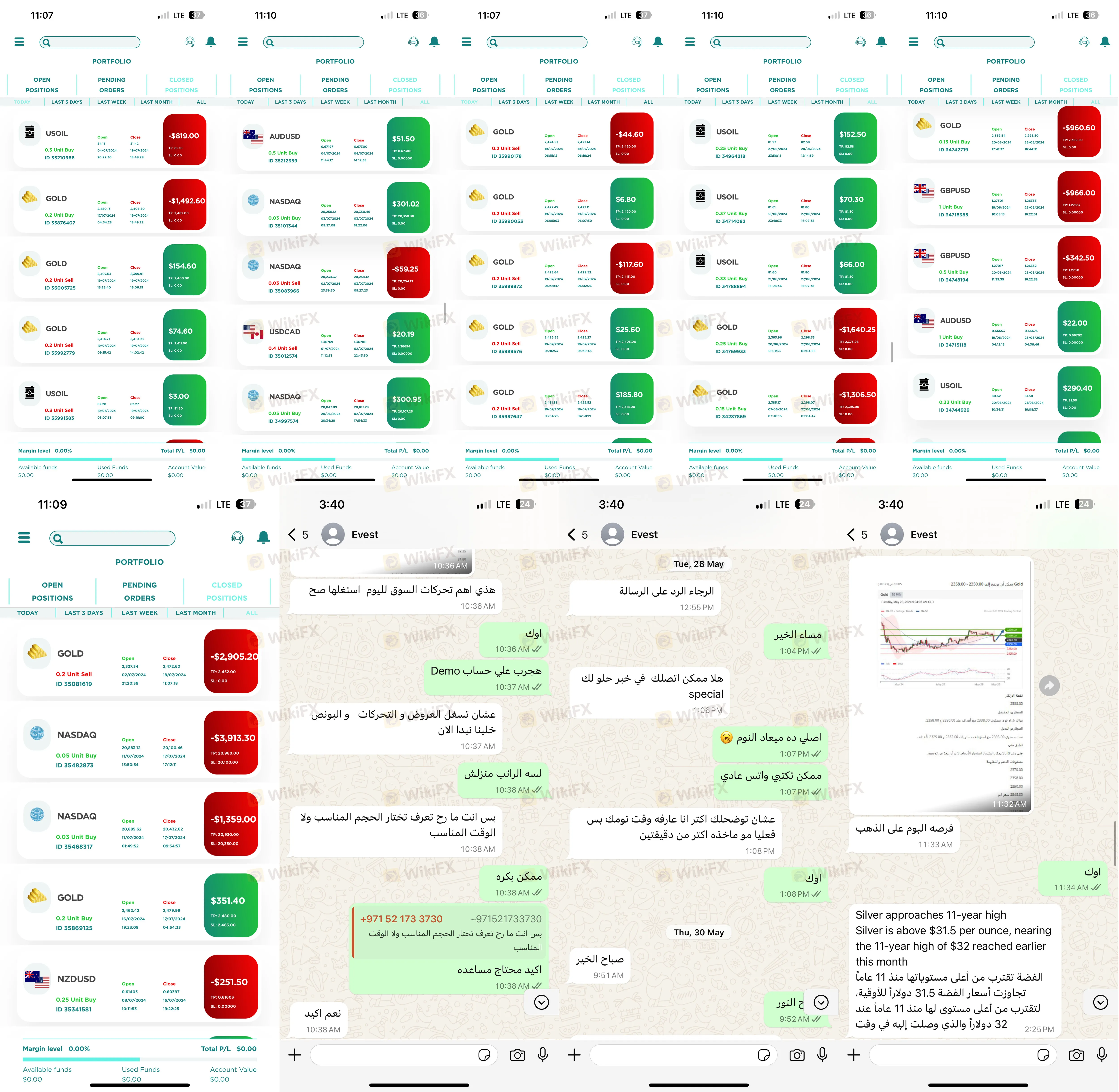

The WikiFX exposure center has received multiple serious complaints about this broker, primarily from the Middle East (Kuwait, Saudi Arabia, UAE).

Common Issues Reported:

- Withdrawal Refusals: severals clients claim they were unable to withdraw their funds after making profits.

- Account Manager Pressure: Users reported that account managers aggressively pressured them to deposit more funds to “recover losses” or “seize market opportunities,” which eventually led to total loss.

- Scam Allegations: Descriptions often use strong language such as “professional fraud” and “fake company.”

User Story:

One user from Kuwait reported following the instructions of an account manager who encouraged keeping positions open to avoid market drops, only to lose all capital. When attempting to contact the manager, they were passed to another agent asking for more deposits to “compensate for the loss.”

evest Forex Trading Conditions and Fees

Accounts and Spreads

The broker offers tiered accounts based on minimum deposits:

- Silver ($250+): Spreads from 1.8 pips, which is relatively high for the industry.

- Gold ($5,000+): Spreads from 1.4 pips.

- Diamond ($50,000): Spreads from 0.5 pips.

The pricing structure penalizes smaller traders with wider spreads compared to the high-deposit Diamond account.

Platforms

Traders can access the markets via the evest login on MetaTrader 5 (MT5) or the broker's proprietary mobile app. The platform supports Web, iOS, and Android, offering flexibility for traders on the go, though the lack of support for biometric authentication has been noted as a downside.

Final Verdict

evest presents a conflicting profile. On one hand, it holds valid regulations from the FSCA and VFSC and offers the robust MT5 platform. On the other hand, the entry-level trading costs are high, and there is an alarming volume of user complaints alleging unethical practices by account managers and withdrawal blocks.

For safety, traders are advised to thoroughly verify the domain URL before entering their credentials.

To stay safe and view the latest regulatory certificates, check evest on the WikiFX App.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Gold Rally Validated as Miners Forecast Doubled Earnings

Renewable Grid Integration: Economics and Technology

US Labor Market 'Noise' vs. Reality; Trump Trade Agenda Looms Over Outlook

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

Central Bank Divergence: BoE Dovish Tilt Pressures Sterling as Global Policy Paths Fork

Emerging Markets: Naira Strengthens Against Euro as FDI Pledges Bolster Sentiment

Bitcoin Reclaims $71,000: Volatility as a Proxy for Global Risk Appetite

evest Review 2025: Is This Forex Broker Safe?

WikiFX Elite Club Focus | Jimmy: Trust is the Most Valuable Asset

Currency Calculator