How to Place Your Stop Using Fibonacci to Lose Less Money

Knowing where to enter or exit profits is probably just as critical as knowing where to position your stop loss.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Knowing where to enter or exit profits is probably just as critical as knowing where to position your stop loss.

Taking gains on a long trade at a Fibonacci Price Extension Level is a good strategy in an uptrend. Three mouse clicks are used to determine the Fibonacci extension levels.

If you've been paying attention in class, you've already learned how to use the Fibonacci retracement tool in conjunction with support and resistance levels, as well as trend lines, to develop a principal but effective trading strategy.

Trend line analysis is another useful technique to use in conjunction with the Fibonacci retracement tool. After all, Fibonacci retracement levels are most effective when the market is moving, so this makes sense.

Using Fibonacci levels, as we discussed in the last session, can be quite subjective. However, there are several things you may do to improve your chances.

This also applies to Fibonacci, because Fibonacci levels are utilized to find support and resistance levels. Fibonacci retracements aren't always successful. They aren't without flaws.

Fibonacci retracement levels are horizontal lines that show potential price reversal levels. The Fibonacci technique works best when the market is trending, which is the first thing you should know about it.

We'll be employing Fibonacci ratios a lot in our trading, so learn them and love them as much as you love your mother's cuisine. We'll stick to two Fibonacci studies: retracement and extension. Fibonacci is a huge subject with many different Fibonacci studies with strange-sounding names.

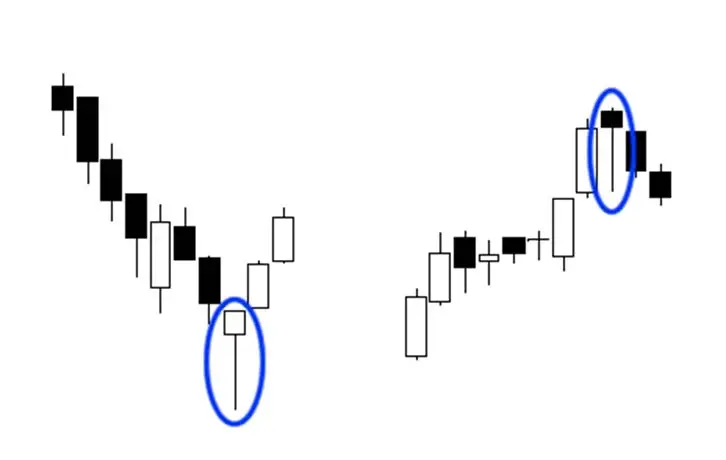

We've learned a when it comes to Japanese candles. Ideally, you're not at wick's end but rather are very started up with regards to candlestick charts. Possibly we've even touched off a fire that turns into a deep rooted energy for Japanese candles.

Here are some common mistakes new traders make when using Japanese candlesticks.

Remember that candlesticks are meaningless unless you examine the market situation and what the price is showing you. As with every benchmark index or tool, just because candlesticks indicate a reversal or continuance does not mean it will occur.

Did you start clicking here? If so, stop reading immediately and take a Japanese candlestick lesson first! Once that's done, here's a one-page cheat sheet for single, dual, and triple Japanese candle formations. This cheat sheet will help you quickly determine the type of candlestick pattern you are looking at when trading.

To recognize quadruple Japanese candlestick patterns, look for specific formations that include three candlesticks in total. These candlestick formations assist traders in predicting how the price will behave in the future. 3 candlestick patterns are reversion patterns, that demonstrate the conclusion of a trend and the beginning of a new trend in the reverse.

What could be better than a single candlestick pattern? DUAL candlestick designs! To recognize multiple Japanese candlestick patterns, search for certain formations that include TWO candlesticks in total.

What do marubozus, spinning tops, and dojis have in common? They're all Japanese candlesticks in their most basic form! Let's look at each of the many types of candlesticks and what they signify in terms of price activity.

let's move on to individual candlestick patterns. If these candles are displayed on the chart, they may indicate a potential market reversal. The four basic single Japanese candlestick patterns are:

Like humans, candlesticks have different body sizes. And when it comes to forex trading, there's nothing worse than looking at the candlestick itself!

While we discussed Japanese candlestick charting analysis briefly in the previous forex class, we'll now go over it in greater depth.

The peak reached before the price falls back is now resistance when it moves up and then retracts. As the price climbs back up, the lowest position hit before the climb is now considered support.

As the name implies, one approach for trading support and resistance levels is soon after the rebound. Many Forex retail traders make the mistake of placing an order at a bullish level and then sitting down and waiting for the transaction to be executed.