Company Summary

General Information & Regulation

GTCM (www.gtcm.com) is a registered EU trademark (no. 018006764) exclusively used as a brand name of Depaho Ltd, a registered Cyprus Investment Firm regulated by CySEC with license no. 161/11 and authorised by the FSCA with license no. 47709 and with an established branch in Spain with registration no. 123 under the CNMV.

Market Instruments

GTCM provides investors with popular financial tradable instruments, including forex currency pairs, precious metals, commodities, stocks, indices, exchange-traded funds(ETFs), etc.

GTCM Minimum Deposit

To meet different types of investors' investment needs and trading, GTCM offers six different accounts for retail users, namely Basic Account ($200-$1999 deposit), Discovery Account ($2,000-$4,999 deposit), Silver Account ($10,000-$14,999 deposit), Diamond Account ($15,000-$29. 999 deposit) and VIP Account ($10,000-$14,999 deposit), 999) and VIP accounts ($30,000-$49,999). Additionally, GTCM has set up professional accounts for professional traders.

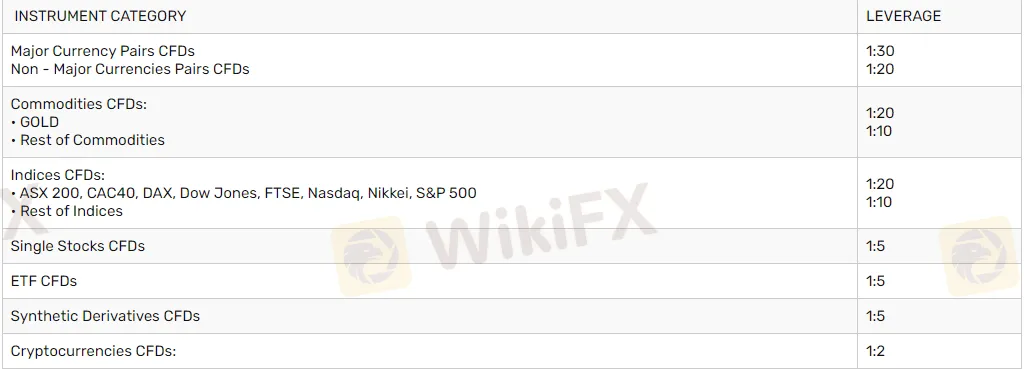

GTCM Leverage

GTCM, as a Cyprus-regulated broker, offers different leverage level for retail traders and professsional traders. For retail traders, teh maximum leverage on major currency pairs is up to 1:30, 1:20 for non major pairs, 1:20 for gold products, and 1:10 for rest of commodities, 1:5 for single stock CFDs. While for professionals, the maximum leverage soar to 1:200 for forex instruments.

GTCM Spreads

Spreads on retail accounts are 3 pips on EURUSD, 3 pips on EURGBP, 1 pip on Gold, 0.06 pips on Silver, 0.12 pips on Brent Crude Oil, 0.16 pips on Natural Gas, 1.5 pips on Adidas stock, and 1.5 pips on Airbnb stock. In terms of the spread on EURUSD, truly high, many broker offers spread on EURUSD usually between 1 pip to 1.5 pips.

Trading Platforms

GTCM offers traders the WebPROfit trading platform, a user-friendly interface, an easily customizable trading environment, powerful charting capabilities, and sophisticated order management features to help traders trade with ease. However, lack of industry-leading trading platoforms like MT4 & MT5 can be a big drawback for this broker.

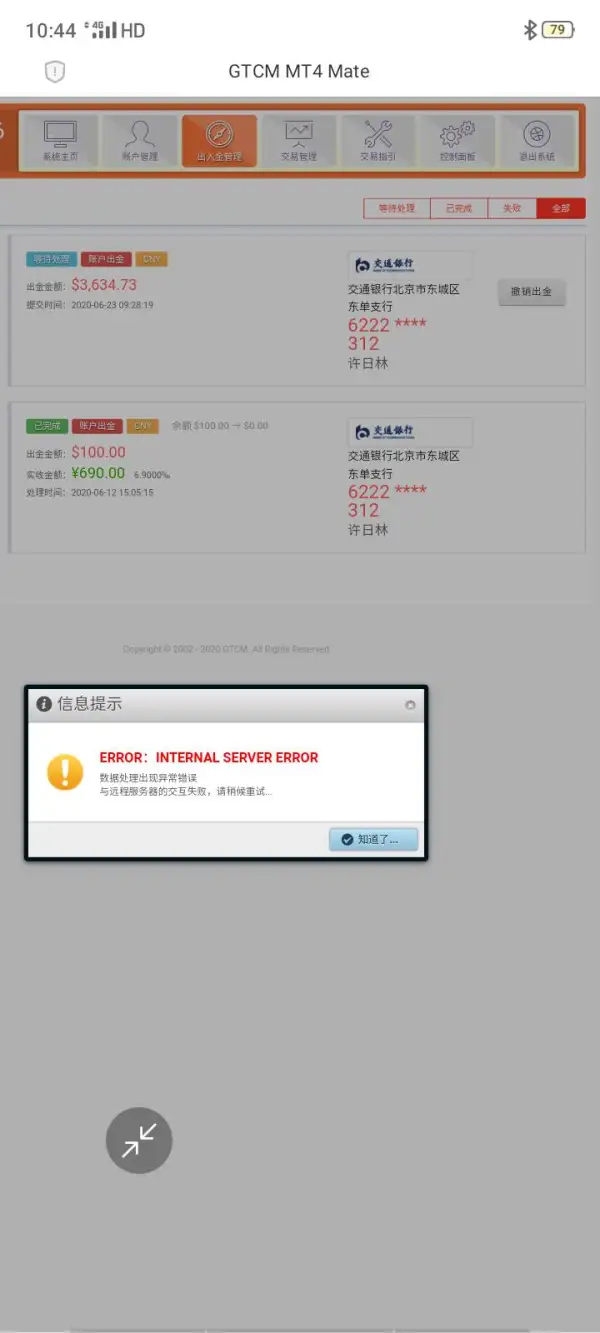

Deposit & Withdrawal

GTCM welcomes various deposit and withdrawal methods, including VISA, MasterCard, Maestro, Skrill, Neteller, SafeCharge, 3DS, PayPal, etc.

Customer Support

The GTCM customer support team can be reached through email, telephone, a contact form, as well as some social media platforms, like instagram, Facebook, Twitter.