Company Summary

| HAITONG FUTURESReview Summary | |

| Founded | 2007 |

| Registered Country/Region | China |

| Regulation | CFFEX |

| Market Instruments | Macro Finance, Energy and Chemicals, Metals, Agricultural Products, and Shipping |

| Demo Account | ✅ |

| Leverage | \ |

| Spread | \ |

| Trading Platform | \ |

| Minimum Deposit | \ |

| Customer Support | Email: services@htfutures.com |

| Phone: 400-820-9133; 021-61871678; 021-38917383; 021-38917385 | |

| Social Media: WeChat | |

| Address: Unit 02-04, 5th Floor, 11th Floor, 12th Floor, No. 799 Yanggao South Road, China (Shanghai) Pilot Free Trade Zone | |

| Regional Restriction | the United States, Japan, Canada, Australia, North Korea, the United Kingdom, Iran, Syria, Sudan, and Cuba. |

HAITONG FUTURES Information

HAITONG FUTURES was established on November 28, 2007, and is headquartered in the Shanghai Pilot Free Trade Zone, China. It is a licensed futures company regulated by the China Financial Futures Exchange (CFFEX) and holds a futures license (license number 0133). The company provides a variety of trading products, covering macro finance, energy and chemical industry, non-ferrous metals, ferrous metals, agricultural products, and shipping and other fields, and supports stock options, commodity futures, financial futures, and other account types. Its business strictly abides by Chinese laws and regulations, is committed to maintaining market order and investors' rights and interests, and provides demo accounts, API access, and multi-bank fund deposit and withdrawal services to meet the diverse needs of customers.

Pros & Cons

| Pros | Cons |

| Demo Account available | Limited payment options |

| Regulated | Regional restrictions |

| Five types of accounts | |

| Various trading products | |

| Long operational history |

Is HAITONG FUTURES Legit?

Haitong Futures Co., Ltd. is a regulated entity of the China Financial Futures Exchange and holds a Futures License with license number 0133. The company's operations in China's financial markets are strictly regulated to ensure that its business activities comply with the requirements of relevant laws and regulations. This regulatory mechanism helps to maintain market order and investors' rights and interests.

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| China Financial Futures Exchange | Regulated | Haitong Futures Co., Ltd | Futures License | 0133 |

What Can I Trade on HAITONG FUTURES?

HAITONG FUTURES's trading products cover various fields such as macro finance, energy and chemicals, ferrous metals, non-ferrous metals, agricultural products, and shipping.

Account Types

HAITONG FUTURES provides 5 types of live accounts: stock options account, commodity futures account, financial futures account, Internet account, specific products and futures and options account.

Stock Options Account: A dedicated account for trading stock options, allowing investors to buy and sell call or put options.

Commodity Futures Account: An account used to trade futures contracts for commodities (such as gold, crude oil, agricultural products, etc.) to help investors participate in the derivatives market of physical commodities.

Financial futures account: An account used to trade financial futures contracts (such as stock index futures, interest rate futures, etc.), mainly serving the investment needs related to the financial market.

Internet account: The futures account opened through the online platform supports investors to open accounts, trade, and manage funds through the Internet, which is convenient and fast.

Specific Varieties and Futures and Options Accounts: Accounts designed for specific varieties (such as international futures varieties) and futures and options trading to meet the investment needs of cross-border transactions or special varieties.

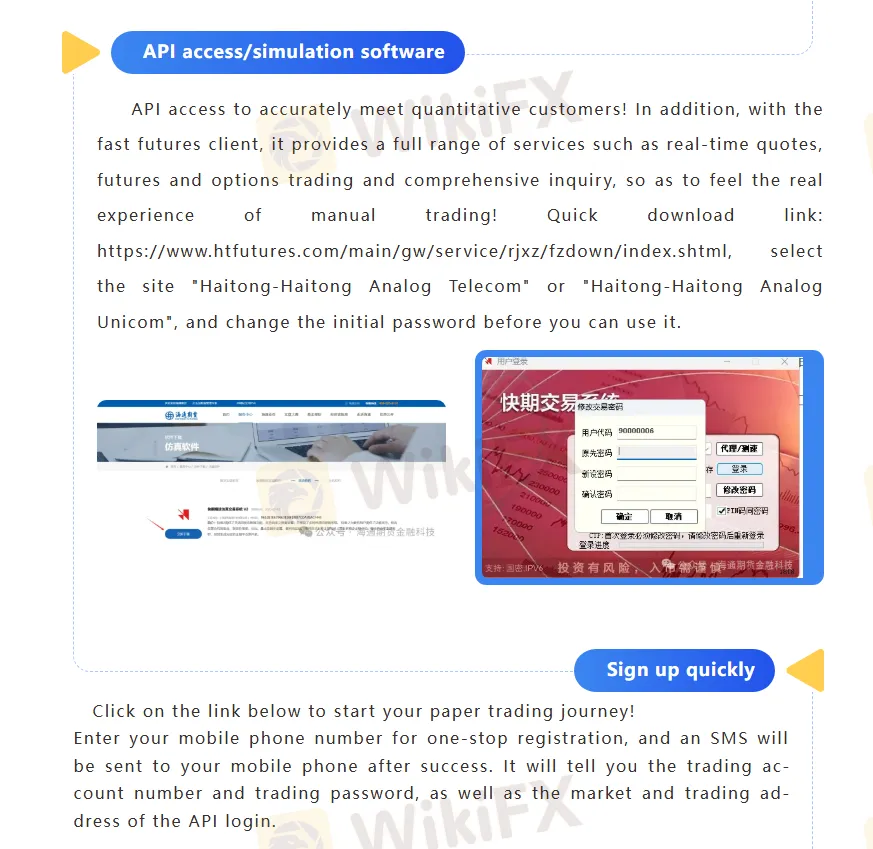

HAITONG FUTURES provides demo account services to help customers experience a real trading environment. Users can download the simulation software through the official website link, quickly register through their mobile phone number, and receive an SMS notification containing the trading account number and password after successful registration. In addition, the company also supports API access to meet the personalized needs of quantitative customers, providing comprehensive functions such as real-time quotes, futures and options trading, and comprehensive inquiries to help users familiarize themselves with the manual trading process.

Deposit and Withdrawal

At present, Haitong Futures customers can deposit and withdraw funds through bank-futures transfer and bank transfer. The deposit and withdrawal of bank-futures contracted customers through online banking, mobile banking, and futures software have been handled, and the deposit and withdrawal of bank-futures contracted customers through bank remittance have not been handled.

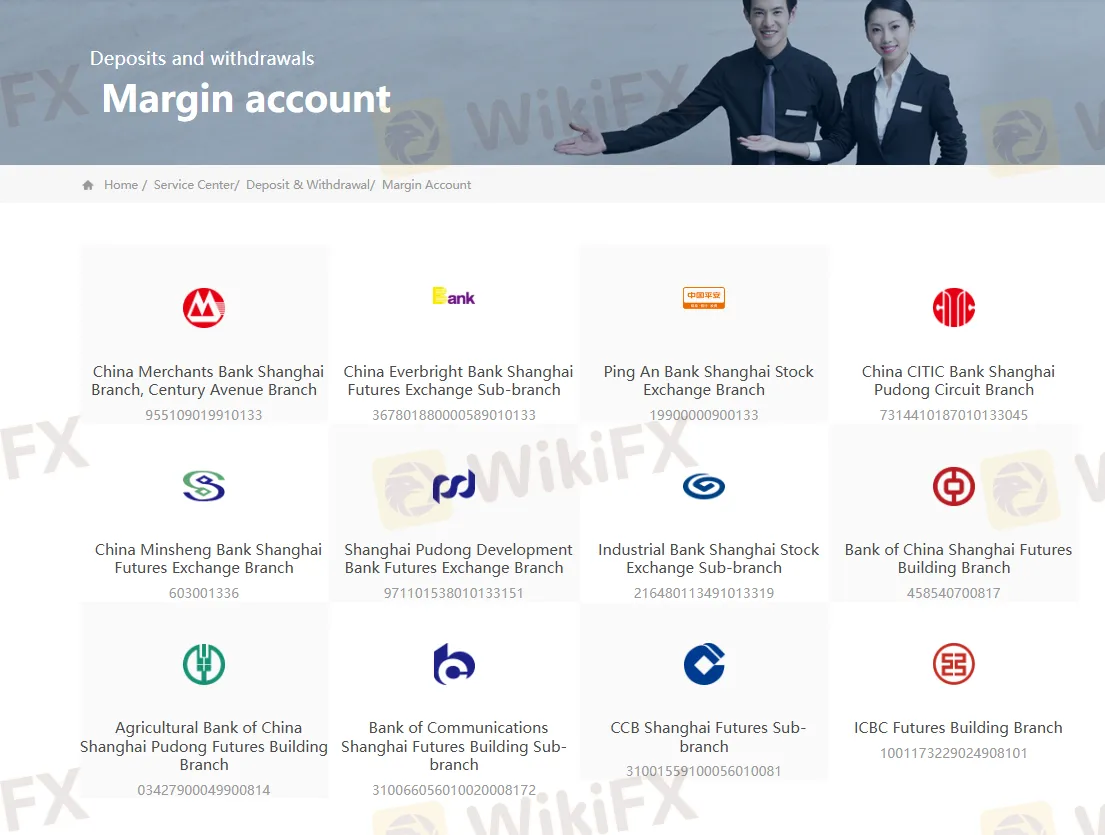

HAITONG FUTURES's deposit and withdrawal operations are mainly carried out through its margin account, which supports cooperation with several banks, including China Merchants Bank, China Everbright Bank, Ping An Bank, China CITIC Bank, China Minsheng Bank, Shanghai Pudong Development Bank, Industrial Bank, Bank of China, Agricultural Bank of China, Bank of Communications and China Construction Bank. Each cooperative bank provides a special account with the Futures Exchange or the Futures Building sub-branch for the deposit and withdrawal of customer funds to ensure the safety and convenience of trading funds.