Let's start here

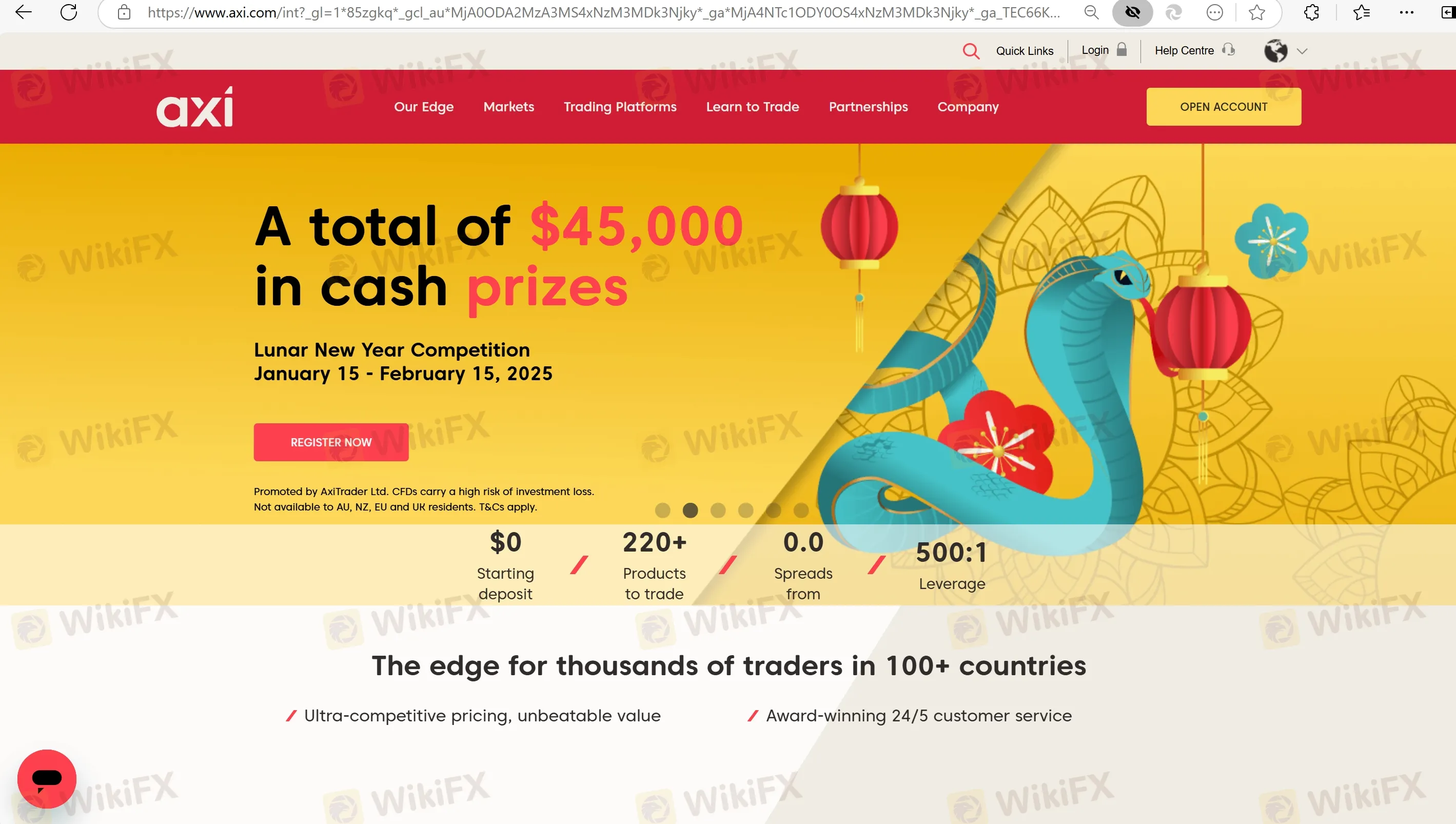

AxiTrader Limited (Axi) is the real deal, with over 220 trading options in forex, shares, indices, commodities, cryptocurrencies, and IPOs – they're all on the menu. Minimum deposits start at $0, the broker offers competitive spreads from 0.0 pips on major currencies on the Pro account, and here is the cool part: traders can use ECN execution for direct market orders. As for the platform, it's none other than the legendary MetaTrader 4 as well as Copy Trading App. With a touch of pride, they served hundreds of thousands of traders across 100 countries. Want to see if Axi's trading environment lives up to its claims? Time for some exploration!

Axi Information

Axi (formerly AxiTrader) was founded in 2007, and has since expanded its presence to include offices in other regions, including Latin America, Asia, and the Middle East. Axi welcomes all kinds of traders of all skill levels. If you're new to trading and want to start without too much capitalspending much, the $0 minimum deposit and user-friendly platform are great. Irrespective of a traders skill, there are many options to trade, good spreads, and lightning-fast execution. And for those inclined towards advanced features, Axi's ECN system and MetaTrader 4 platform are a notable combination.

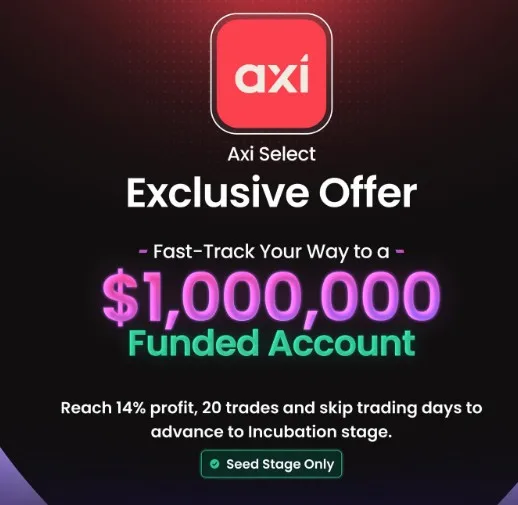

In 2023, Axi also launched their innovative capital allocation program called Axi Select. Axi Select gives talented traders the opportunity to trade their way to the top and get funding of up to $1,000,000 USD and keep up to 90% of their profits.

Pros & Cons

Taking a look at Axi, we spot its share of upsides and downsides. Let's start with the bright side, it's got the backing of multiple solid financial authorities, numerous instruments you can trade, and they let you practice with a demo account. Plus, they've got the MT4 platform. They offer customer support in 13 languages, and deposits and withdrawals are seamless.

Is Axi Legit?

Considering the pivotal aspect for brokers, that is regulation, it's indeed comforting to note that AxiTrader is under the oversight of regulatory bodies from four distinct nations, including Australia, the United Kingdom, Cyprus, New Zealand, and UAE.

Advancing further, let's undertake a more detailed exploration of the regulatory licenses secured by Axi.

Axi's Australian entity, Axi FINANCIAL SERVICES PTY LTD, is regulated by Australia Securities & Investment Commission (ASIC) under regulatory license number 318232, holding a license for Market Making (MM).

Notably, this license's credibility gains support from WikiFX's investigators. They physically traveled to the institution's registered address for thorough verification. At Level 10, 90 Arthur Street, North Sydney, NSW 2060, Australia, they found a functioning office, confirming the broker's operational status and significant scale. Behold, an image capturing the tangible office space of this company.

In addition to being regulated by ASIC, this entity is also regulated by Financial Markets Authority (FMA) in New Zealand, with regulatory number 518226, holding a license for Straight Through processing (STP).

Now, let's examine the third license. Axi's UK branch, known as Axi Financial Services (UK) Limited, is overseen by Financial Conduct Authority (FCA) and has been granted regulatory license number 466201. This license permits them to engage in Market Making (MM) activities as well.

Axi also follows regulations from Dubai Financial Services Authority (DFSA) in the United Arab Emirates under regulatory number F003742, authorized for Retail Forex activities.

Solaris EMEA Limited is regulatd by Cyprus Securities and Exchange Commission (CySEC) with a Market Making (MM) license no 433/23.

Market Instruments

Axi gives you access to 220+ trading choices across 6 categories: forex, shares, indices, commodities, cryptocurrencies, and IPOs.

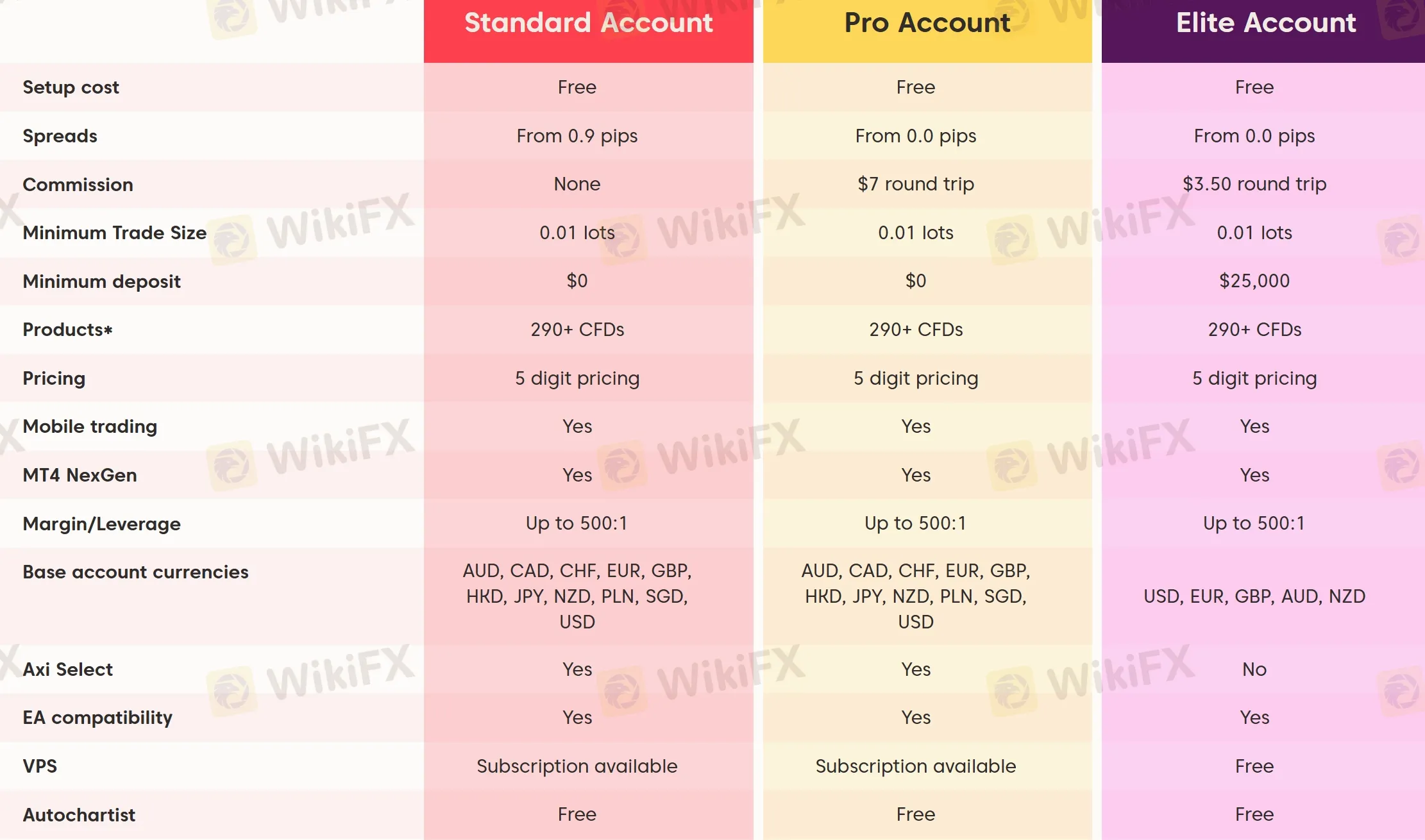

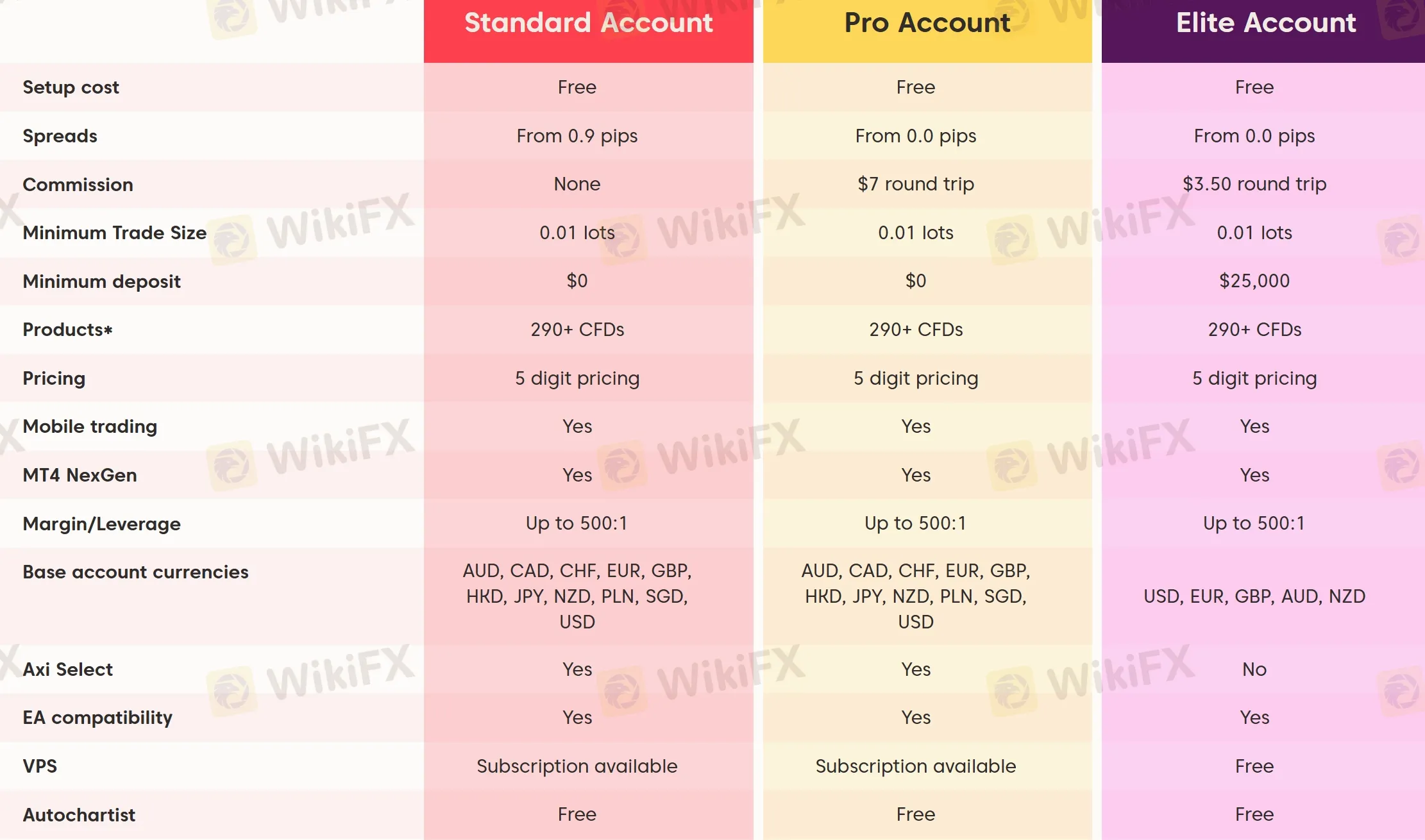

Account Types/Fees

Axi offers three account types tailored to different trading needs, namely Standard, Pro, and Elite. You can find detailed account features in the table below:

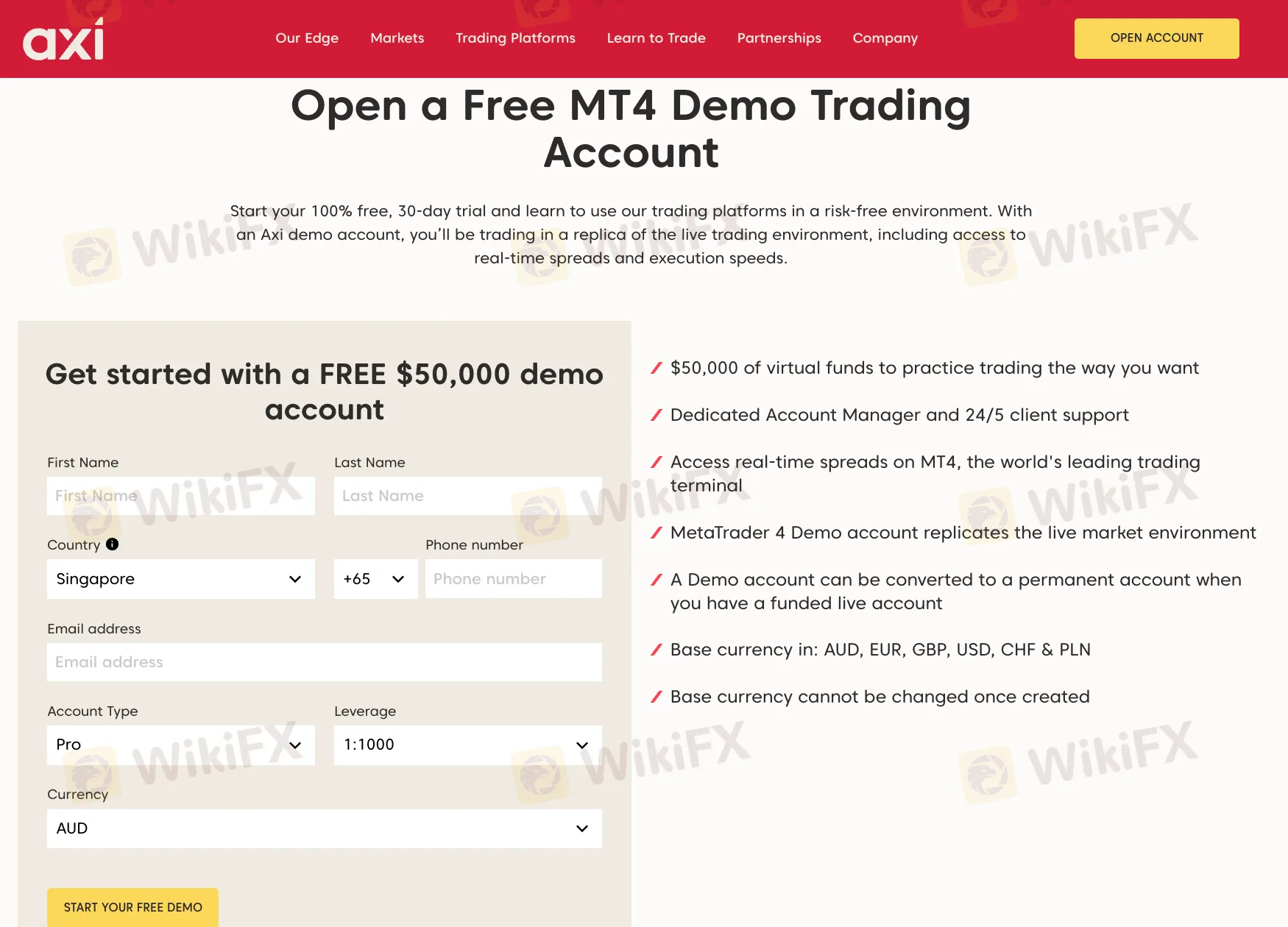

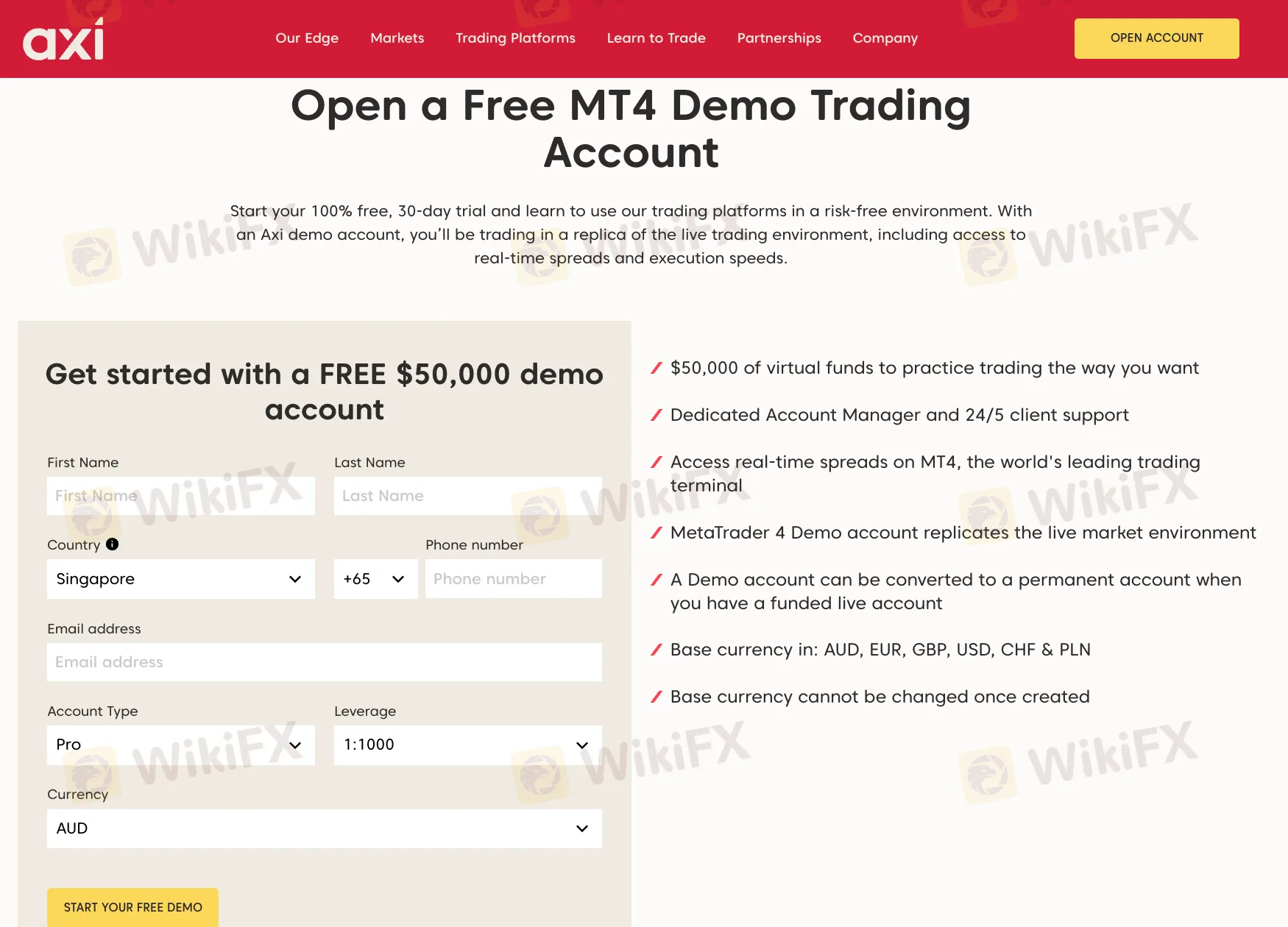

Demo Trading

Also, Axitrader gives users free demo accounts that last for 30 days and include $50,000 in virtual funds. Demo accounts offered by Axitrader shine in these areas:

- Practice Trading: You get $50,000 in virtual money to practice trading however you like.

- Personal Support: You'll have a dedicated Account Manager and support available 24/5 to help you.

- Real-Time Info: You can see live spreads on the popular trading platform, MT4.

- Live-Like Demo: The MetaTrader 4 Demo account mimics the real market, so you can practice effectively.

- Switch to Real: When you're ready, you can turn your demo account into a real one by funding it.

- Currency Options: You can choose your account's base currency from options like AUD, EUR, GBP, USD, CHF, and PLNX.

However, base currency cannot be changed once created.

Besides, they also offer special Islamic trading accounts for Muslim traders that follow Shariah law.

Leverage

The leverage offered by AxiTrader is capped at 500:1. This means that traders can open positions with a much larger amount than their initial investment.

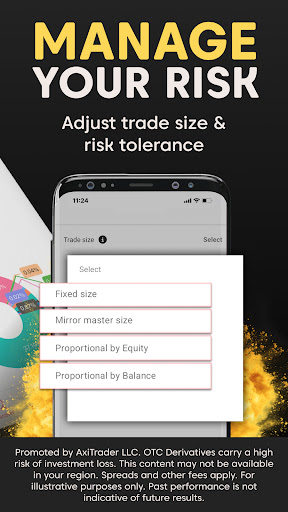

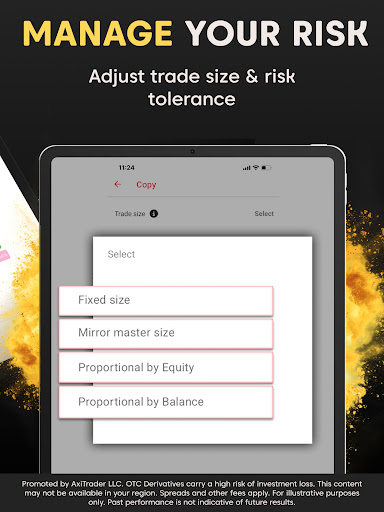

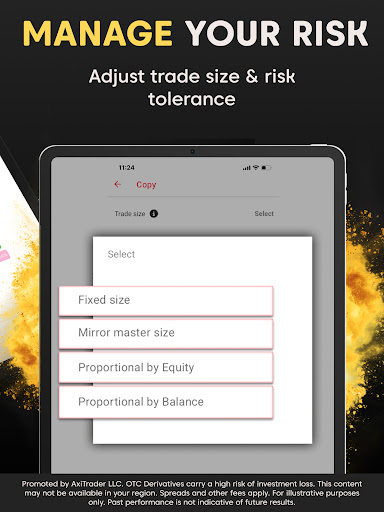

However, high leverage can also lead to significant losses if the trade does not go as expected. Traders should exercise caution and use proper risk management strategies when trading with high leverage. Axi provides educational resources and tools to help traders understand the risks associated with leverage and how to manage them effectively.

Trading Platforms

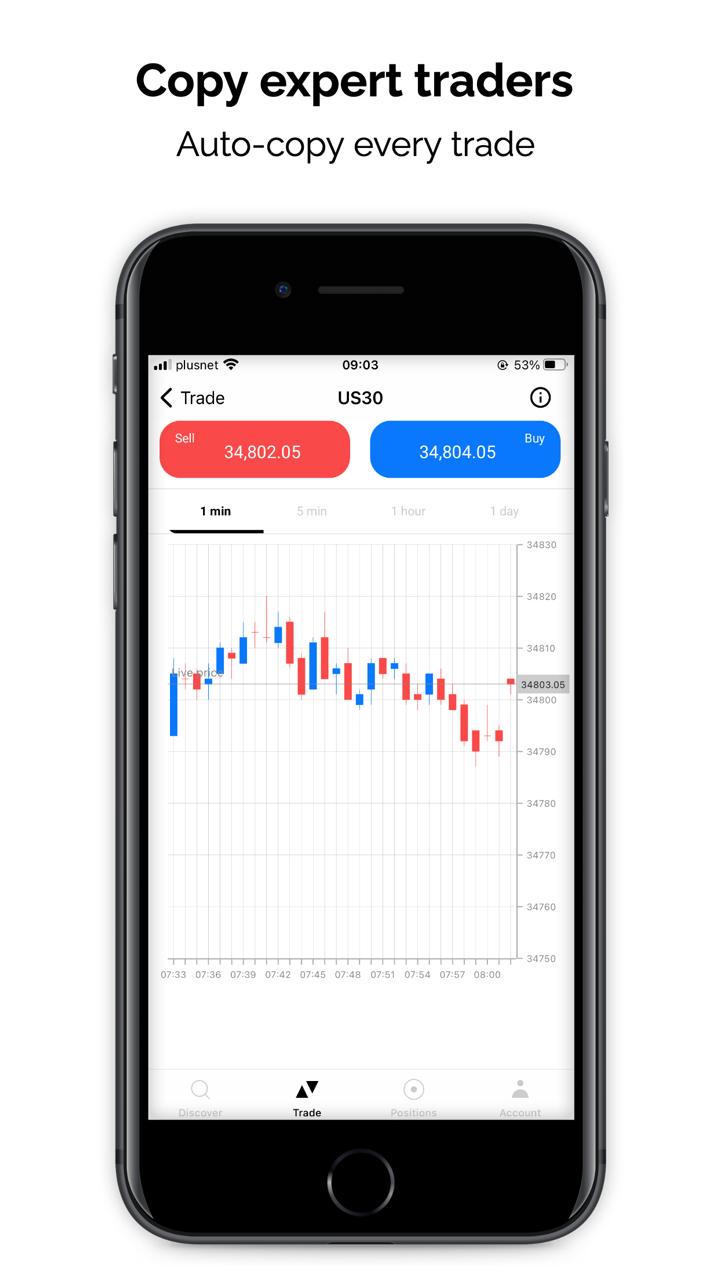

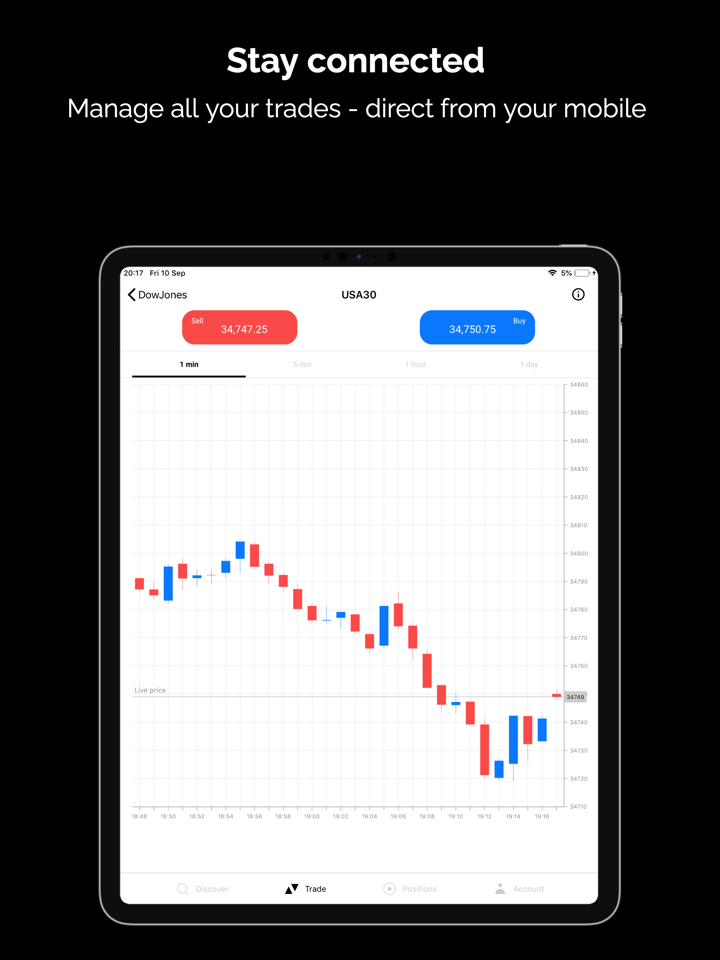

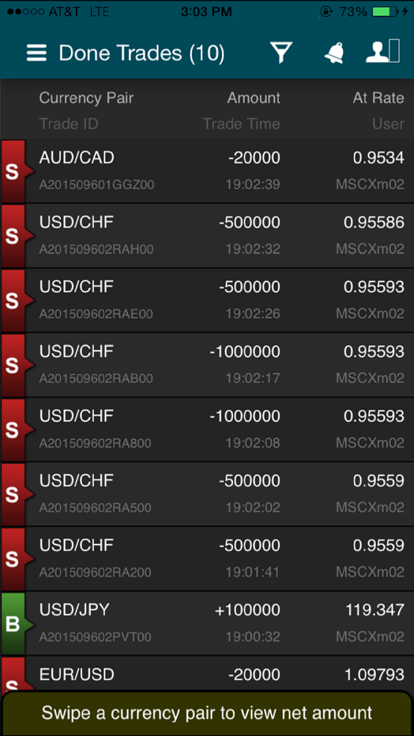

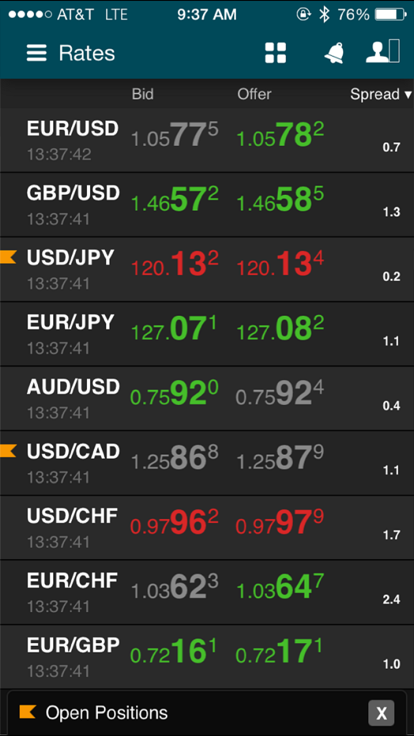

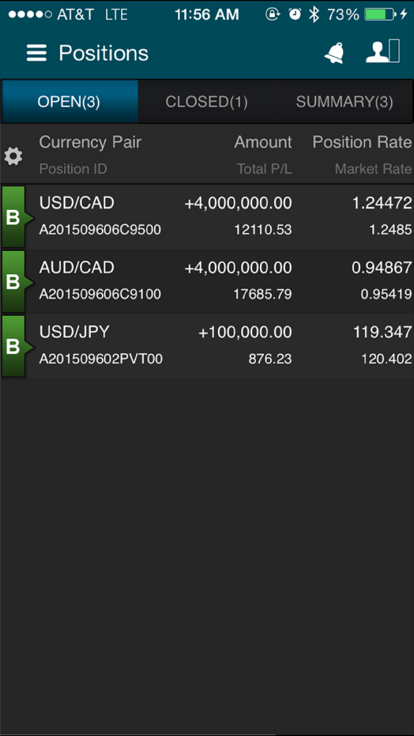

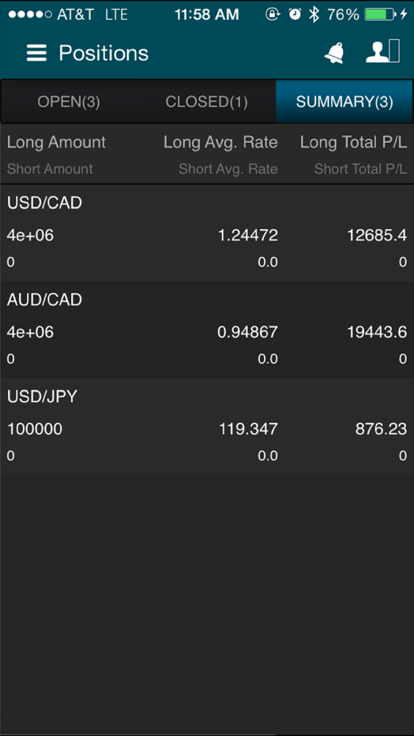

Axi offers traders the popular MetaTrader 4 (MT4), which is a widely used platform that offers a wide range of charting and technical analysis tools, customizable indicators, and the ability to use automated trading strategies through Expert Advisors (EAs). The MT4 platform is available for download on PC and Mac computers, as well as on mobile devices for both iOS and Android.

Additionally, Axi offers the MT4 WebTrader, which allows traders to access the platform directly from their web browser without the need for any downloads or installations.

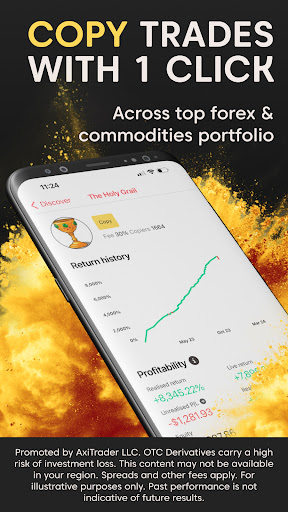

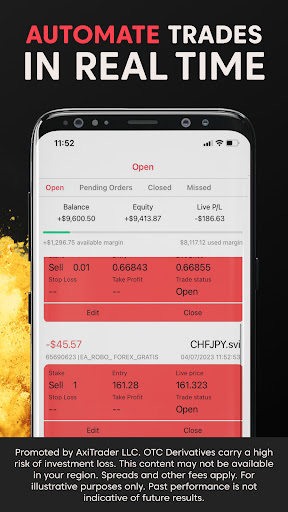

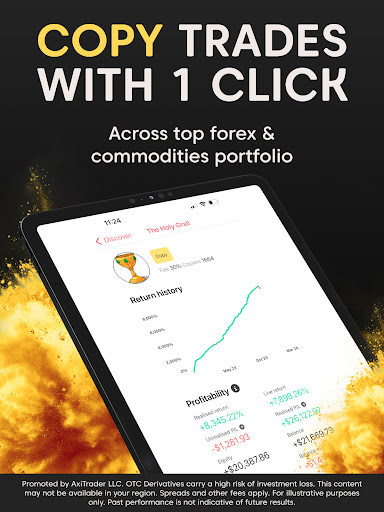

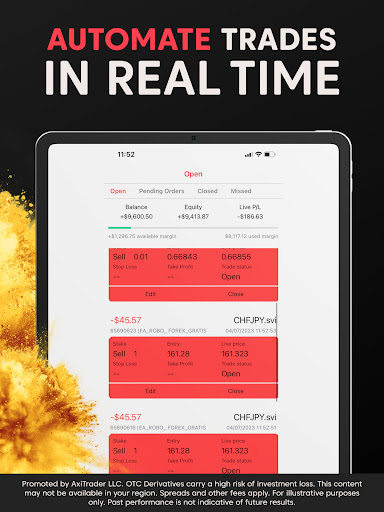

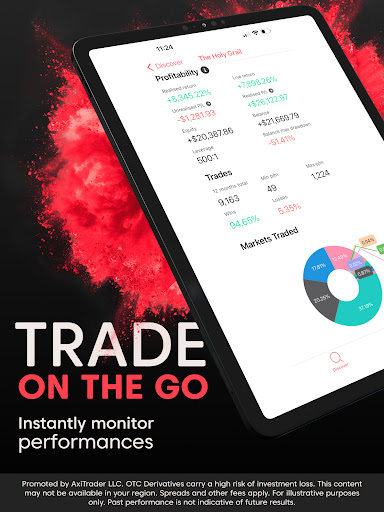

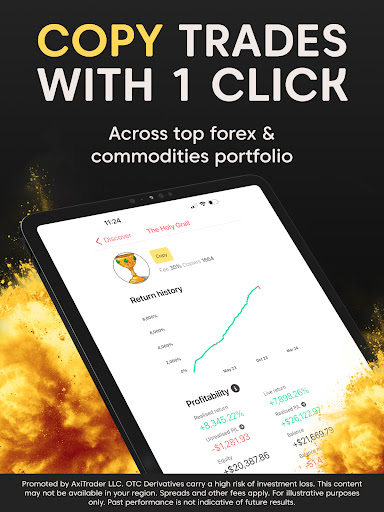

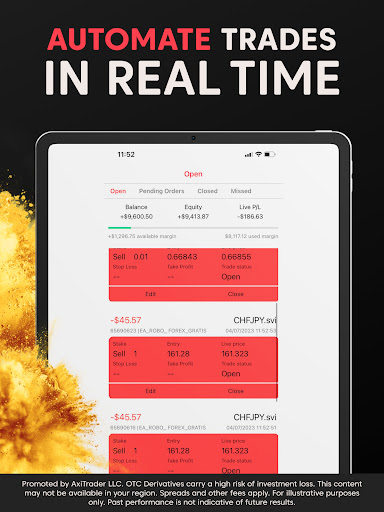

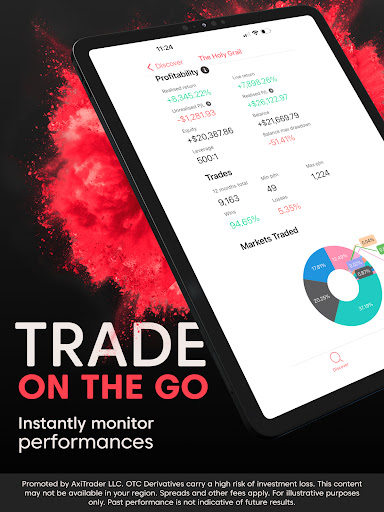

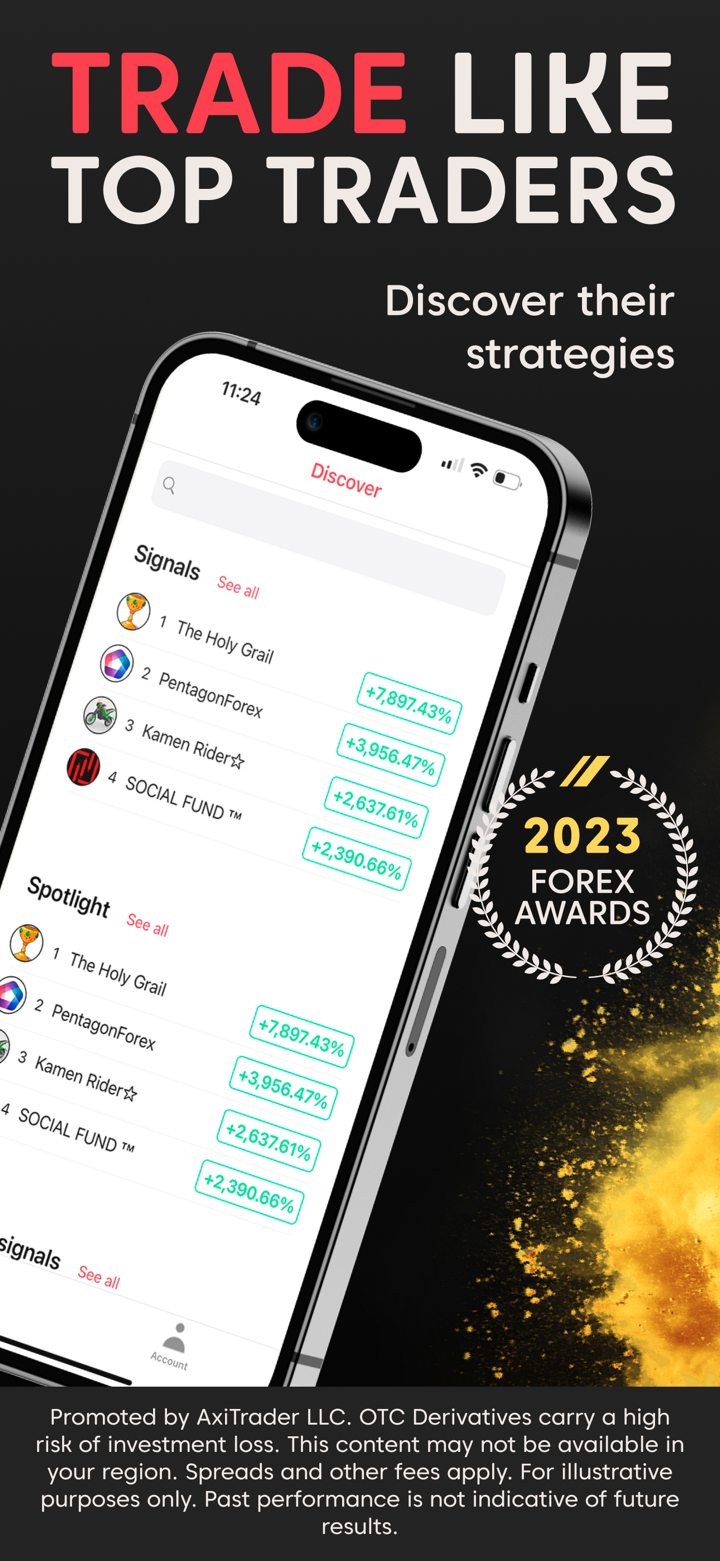

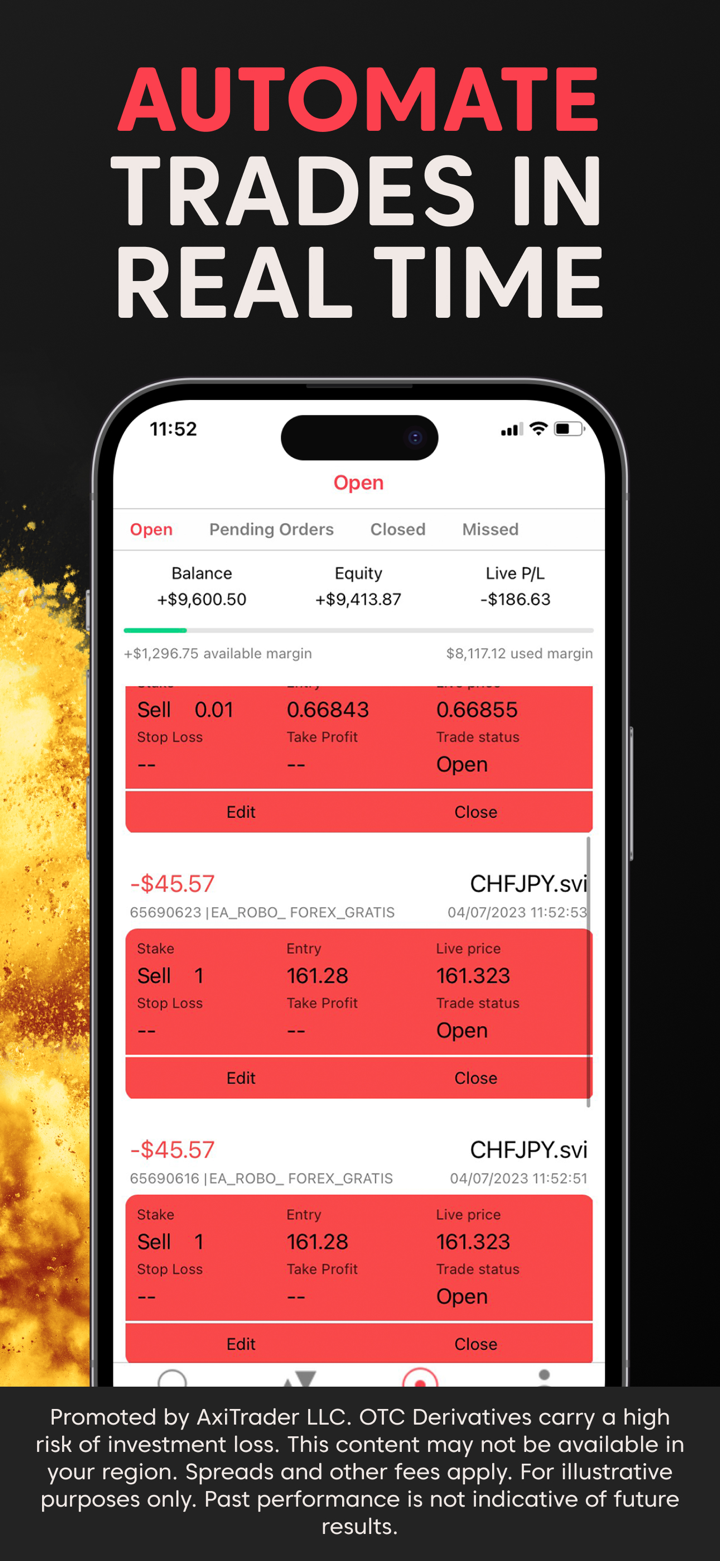

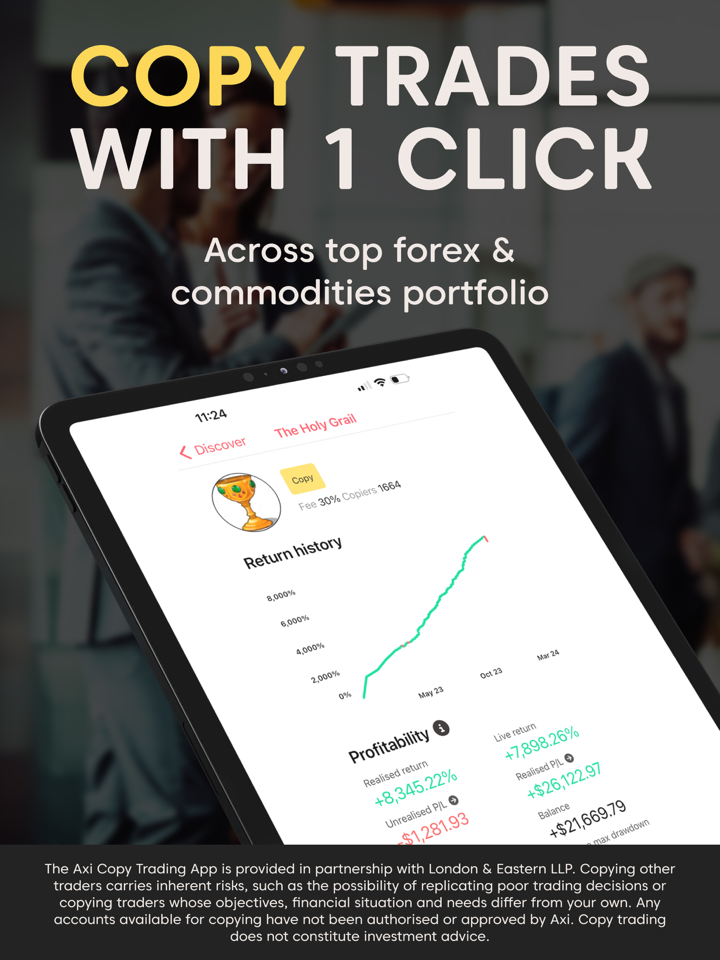

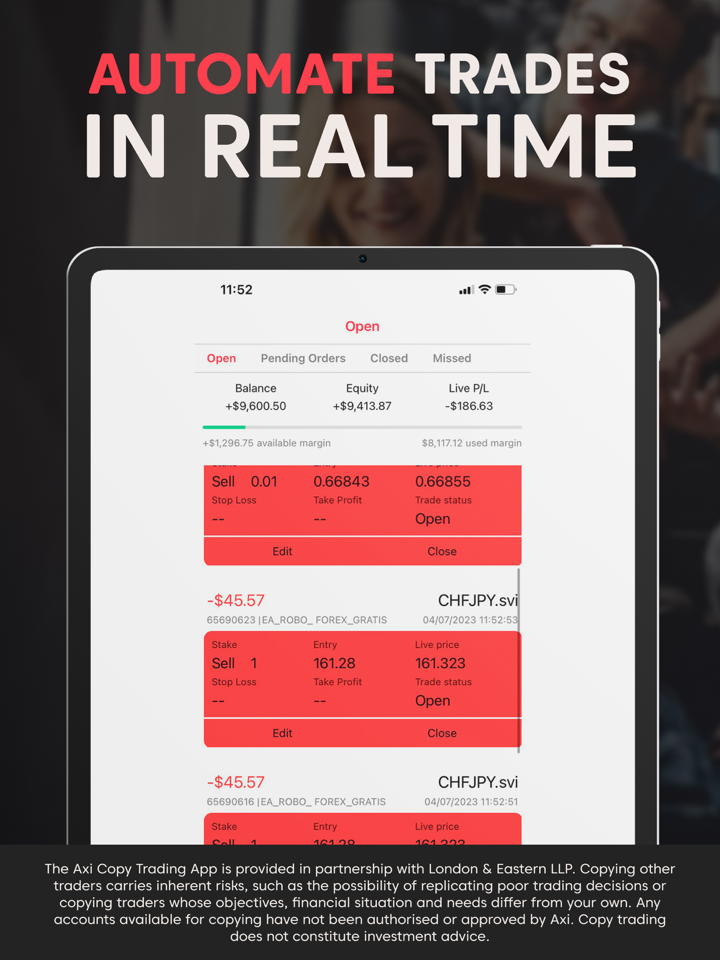

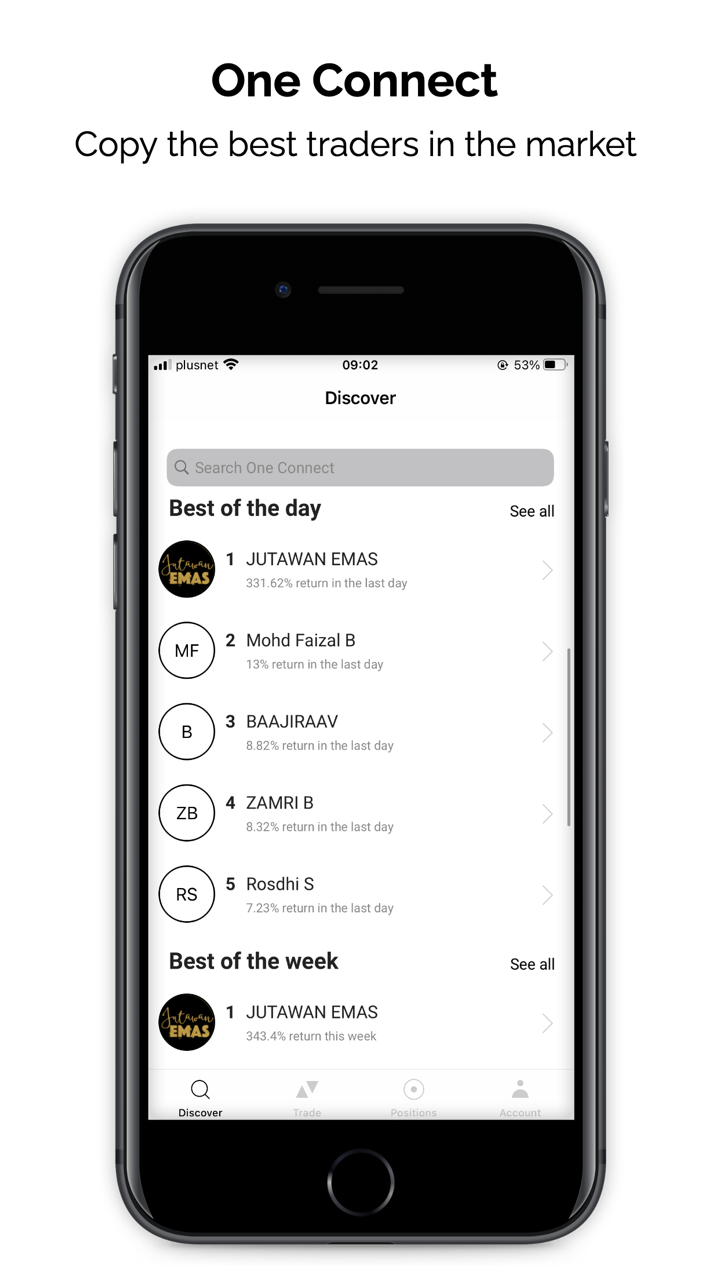

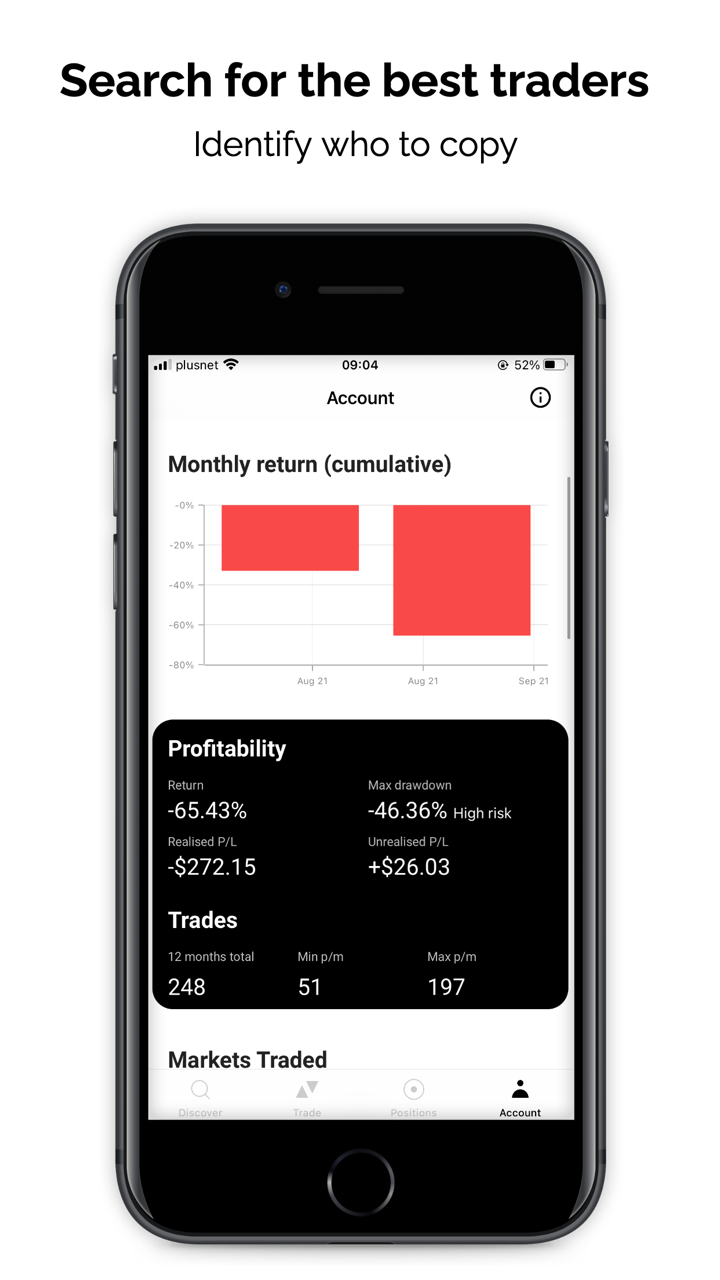

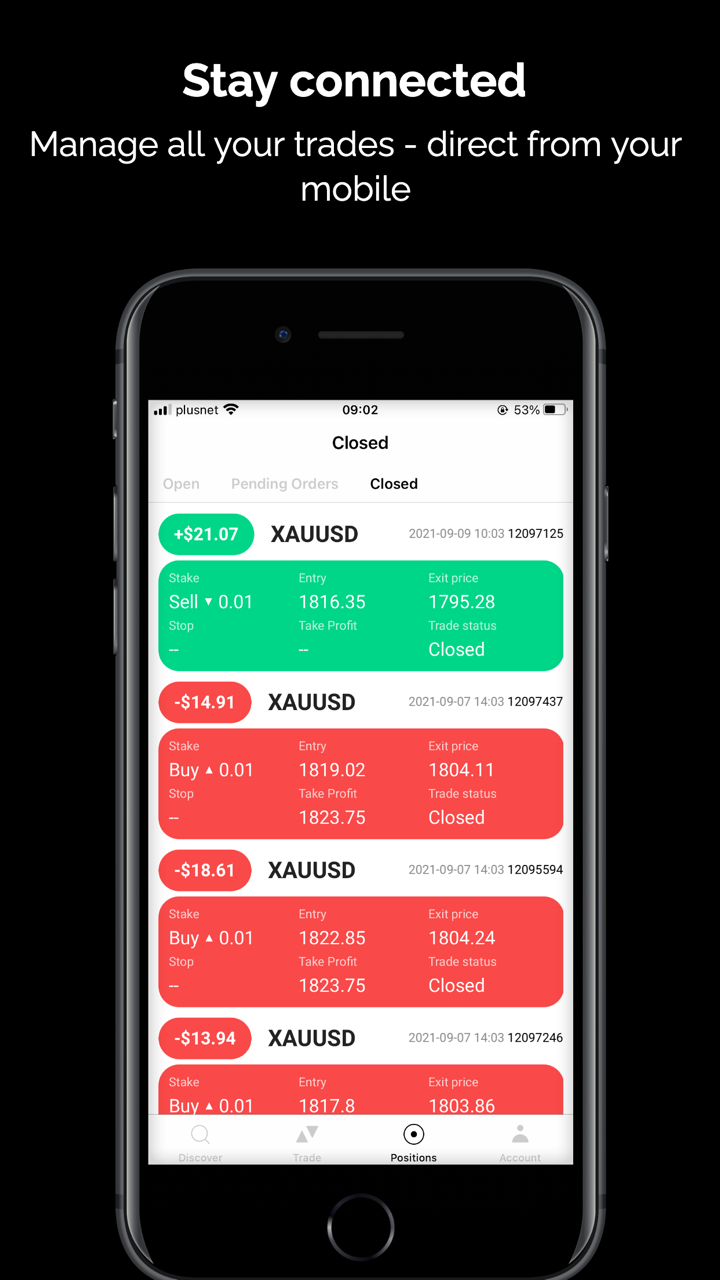

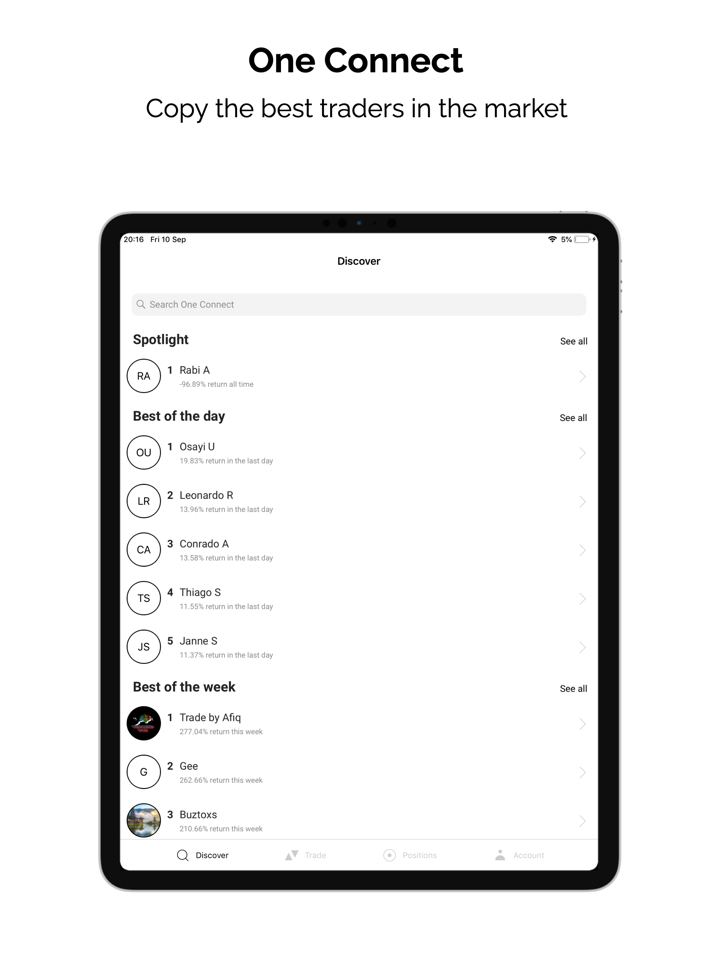

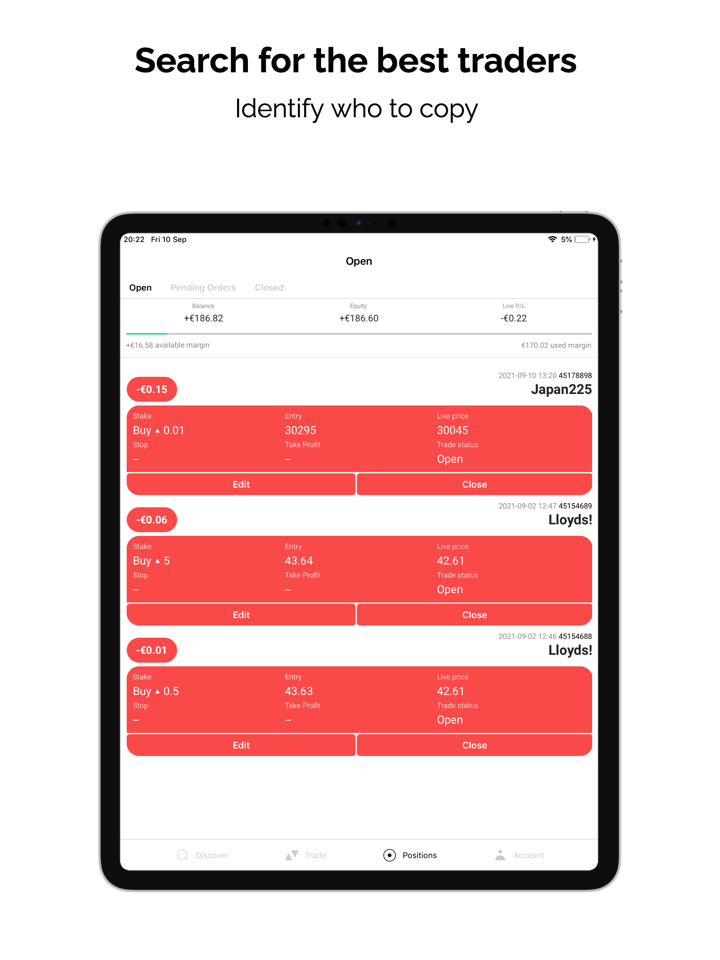

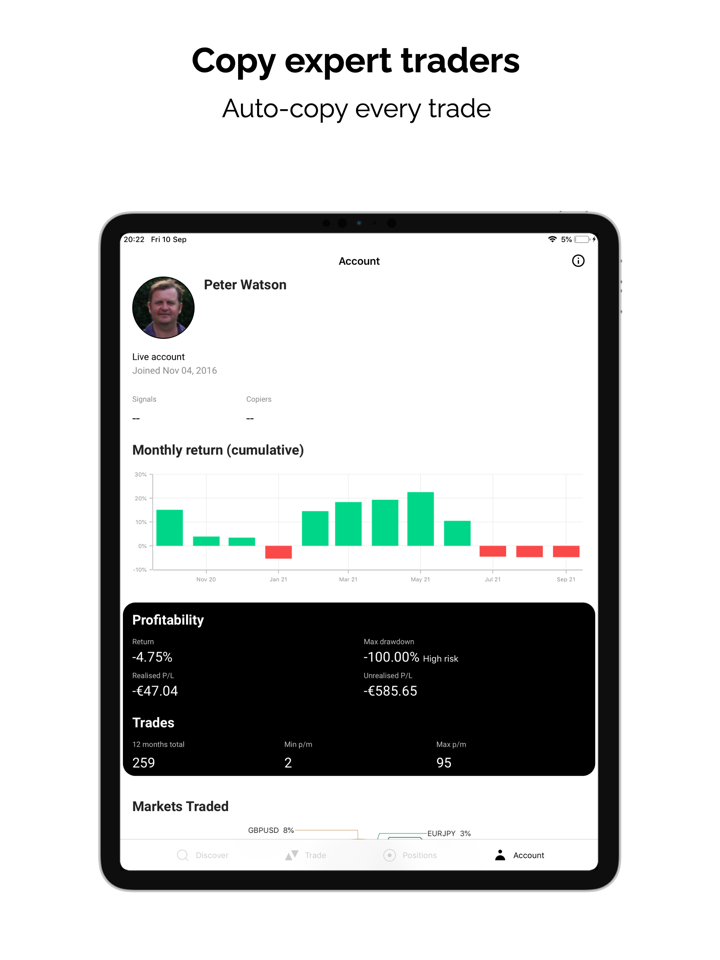

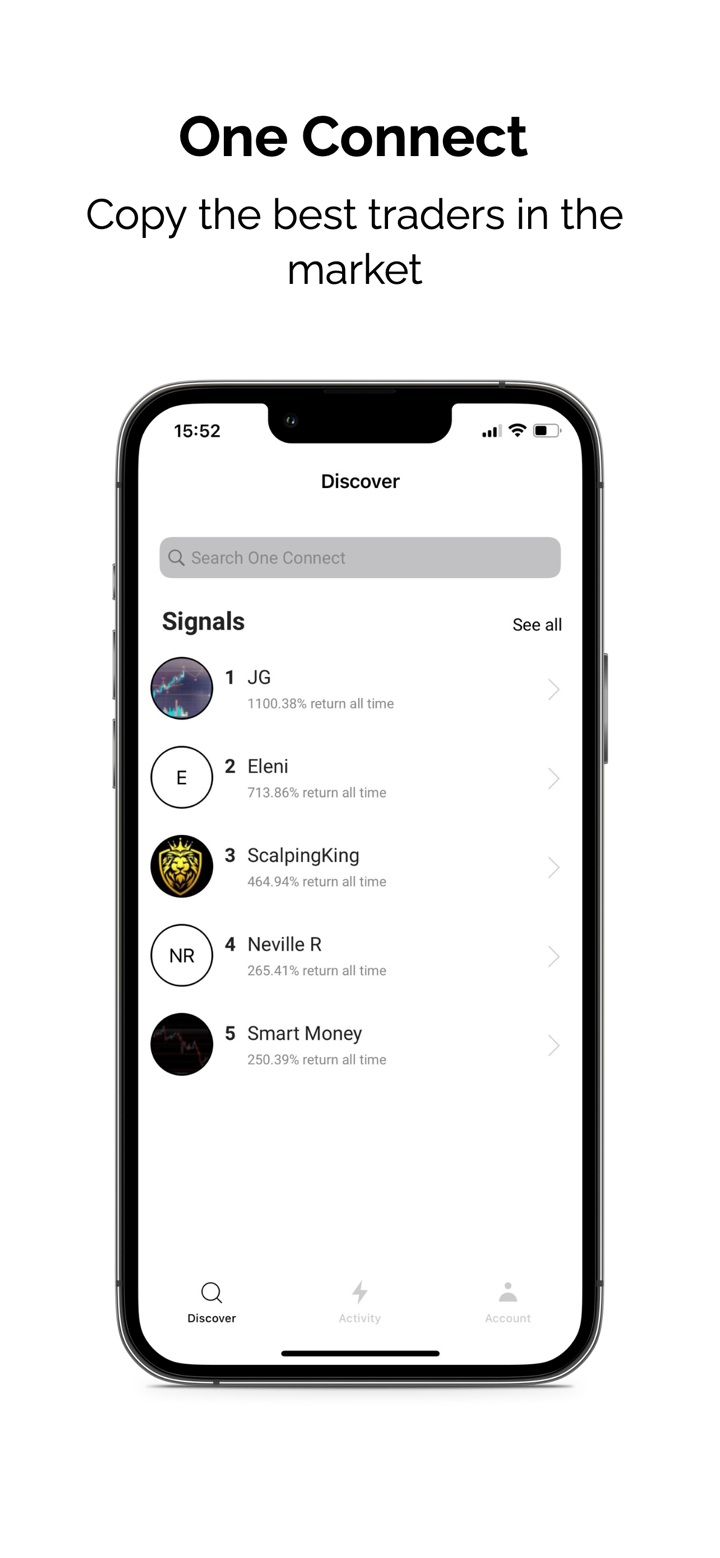

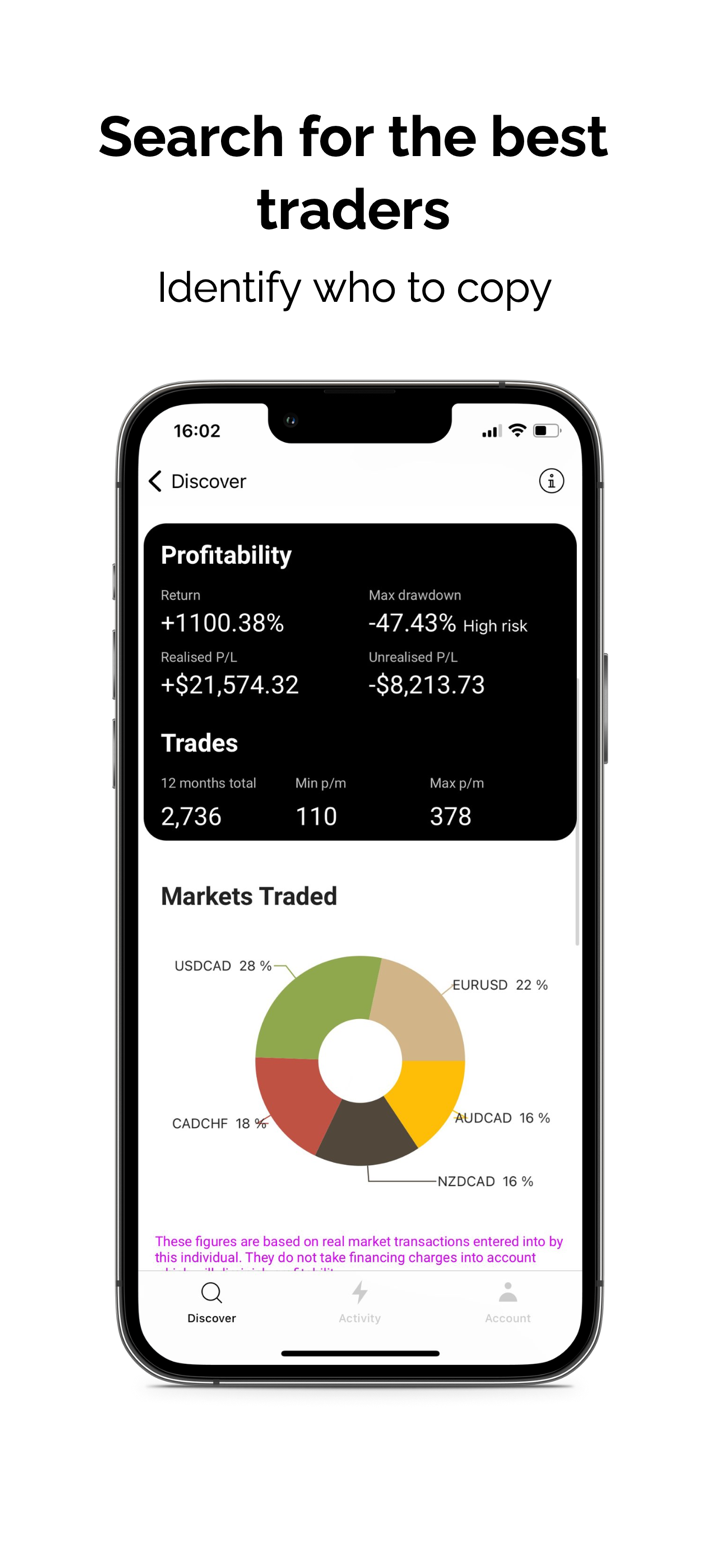

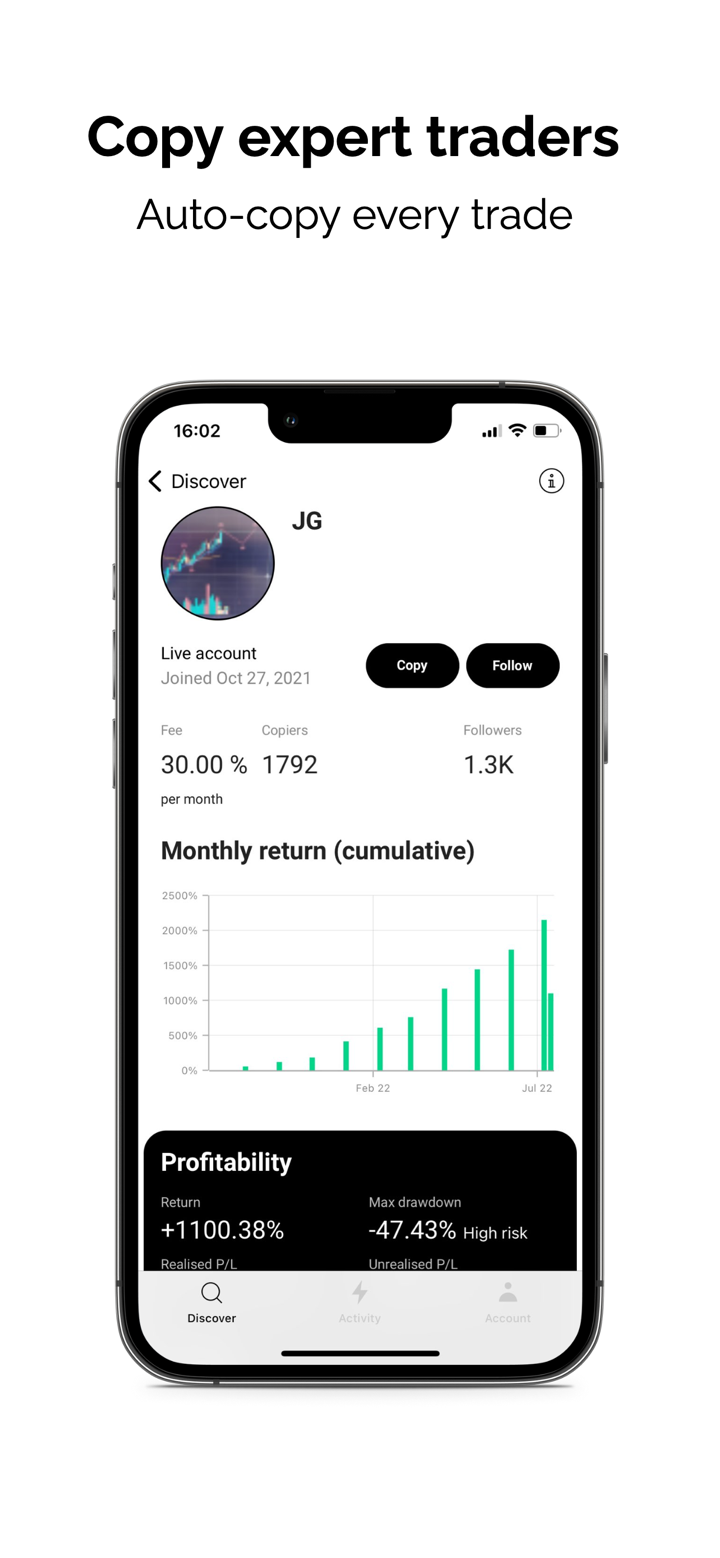

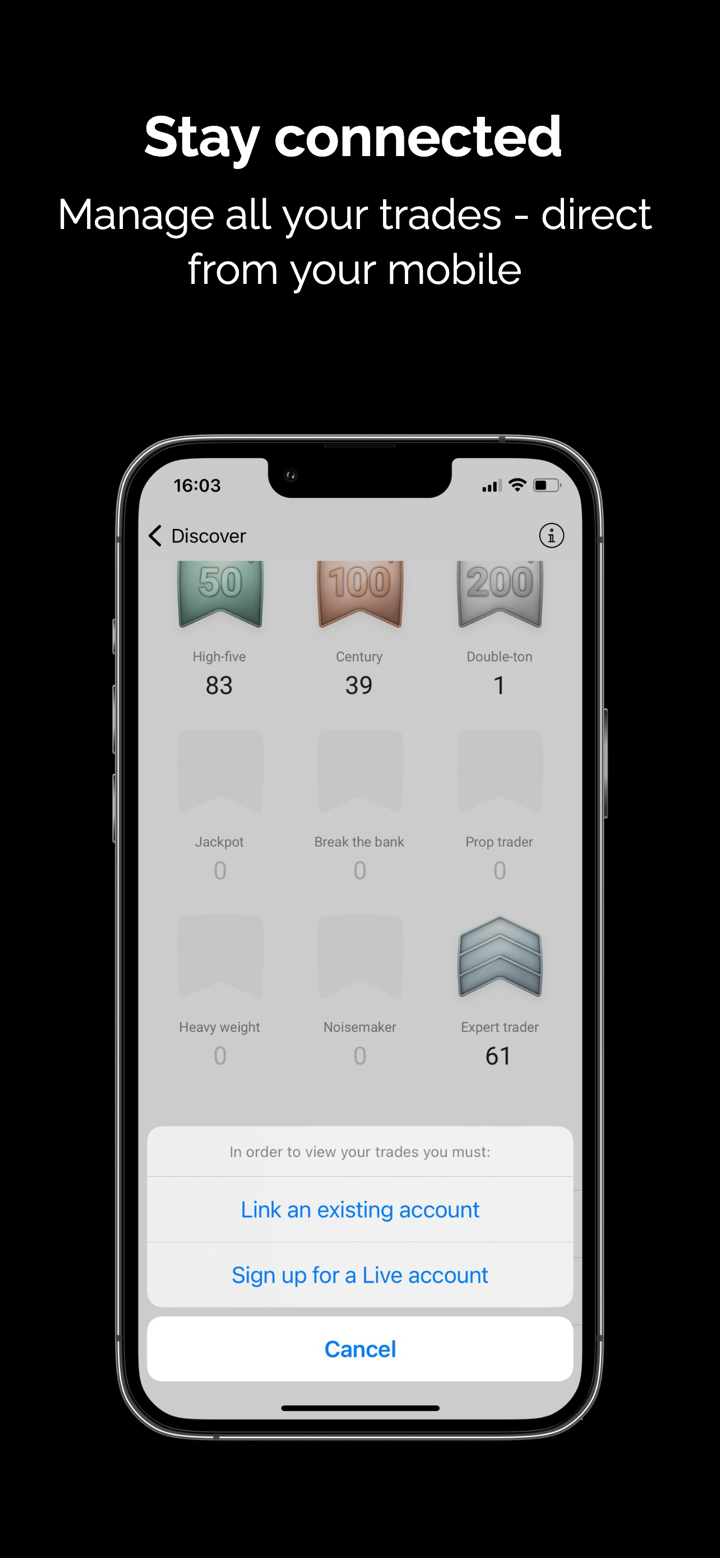

Axi Trading Platform and Copy Trading App are also available.

Trading Tools

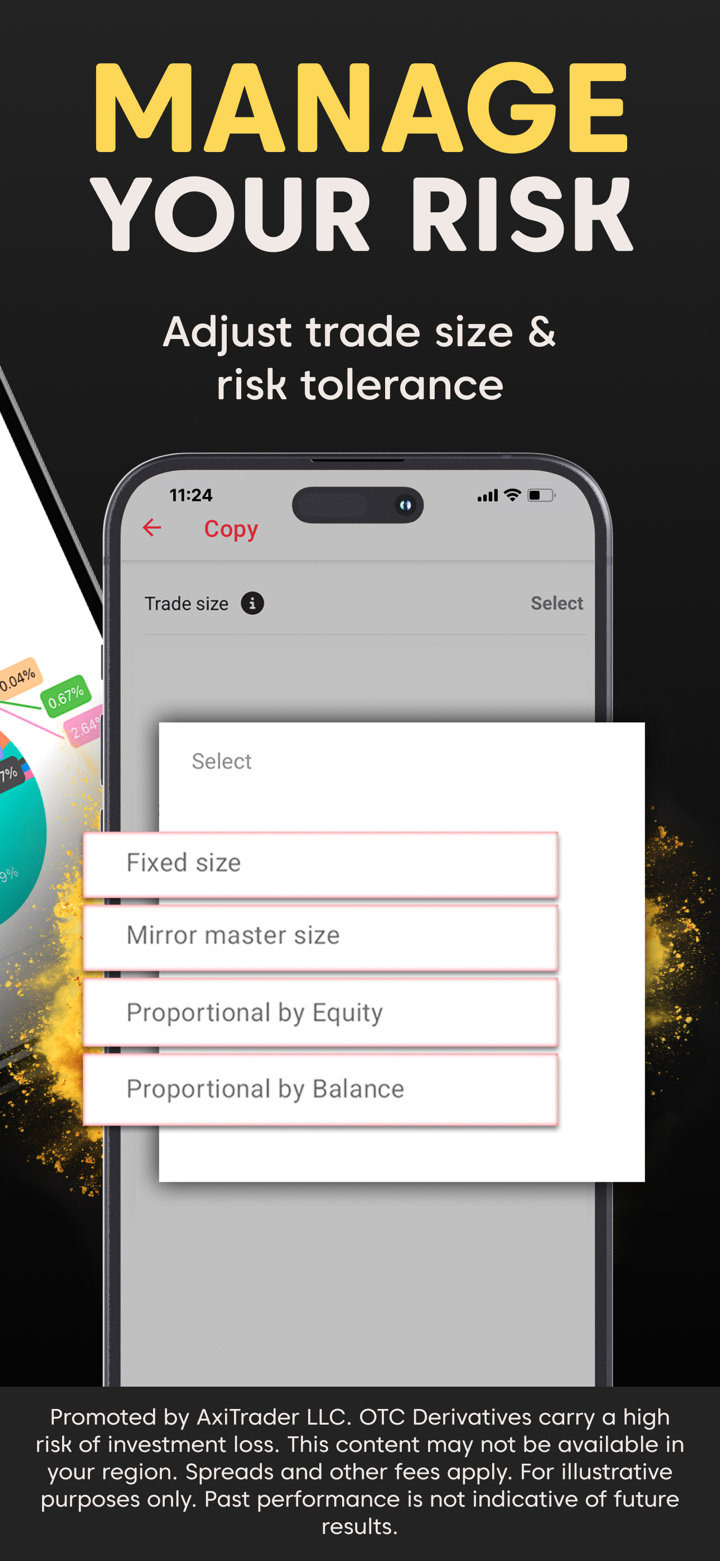

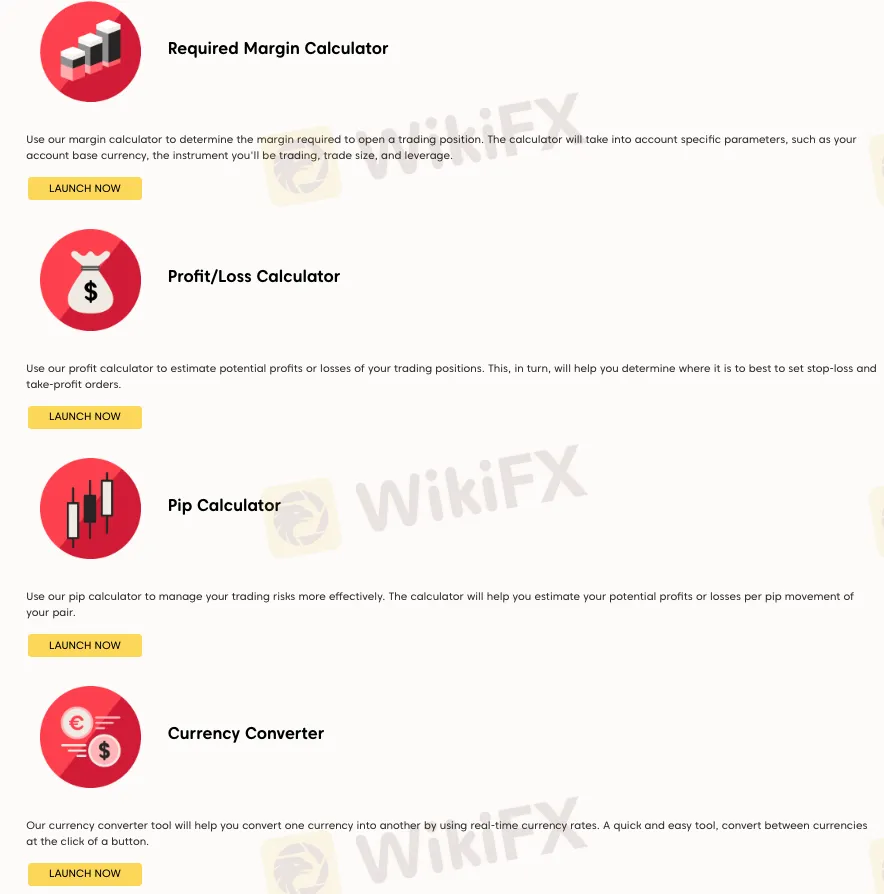

There are a range of trading tools designed to enhance the trading experience for its clients. These include Myfxbook Autotrade, which allows traders to follow and copy the trades of experienced traders, MT4 signals which provide real-time trade ideas and analysis, MT4 VPS hosting which offers a dedicated virtual private server to ensure optimal performance and minimal downtime.

Additionally, the broker offers a suite of calculators to help traders with their risk management and trade analysis, such as Profit/Loss Calculator, Pip calculator, and Currency converter. These trading tools can be very helpful for traders to better understand their trades and manage their risk effectively.

Deposit & Withdrawal

Axi stands out from other brokers as they don't require any money to start trading. Here's why it matters:

- Access: With no minimum deposit, anyone who passed onboarding journey can join and trade. Traders require a low minimum deposit upfront.

- Risk: Starting with a low minimum deposit, you can manage your risk tolerance based on whats best for you.

- No minimum deposit: Traders have the flexibility to deposit an amount they are comfortable with.

- No Pressure: You don't feel pushed to deposit a certain amount. It's more relaxed and trader-friendly.

- Learn and Experiment: You can try different strategies and learn without needing a big investment upfront.

Axi welcomes traders to fund their accounts through the following payment methods: Credit/Debit cards, and Bank Transfers, Skrill, Neteller, Fasapay, Cryptos, with no fees charged by Axi for any payment method. However, traders should be aware that some international banking institutions may charge fees for transfers, for which Axi accepts no responsibility.

Please also note that payments to Axi via credit/debit cards may be viewed as a cash advance by some banks, potentially incurring additional fees. Deposits made via credit/debit cards and POLi are processed instantly, while bank transfer deposits and withdrawals can take 1-3 business days to be processed.

Remember, these fees can change and might be different based on how you're making the payment. To stay updated, it's a smart move to reach out to the broker and get the most recent fee details before you decide to deposit or withdraw any funds.

Education

Axi makes learning easy with a variety of educational resources. If you're using the MT4 platform, their step-by-step video tutorials are there to guide you. They also offer Free eBooks, covering everything from basics to advanced topics. Stay updated on market trends through the Axi Blog, which features expert insights and daily analysis. For structured learning, the Axi Academy provides courses on forex, technical analysis, and risk management. If you're diving into cryptocurrencies, the Crypto Glossary will help you grasp the terms.

Customer Support

Axi's customer service is comprehensive and available 24/5 in multiple languages, with live chat, phone, email, WhatsApp, and a help center. This means that clients can easily get in touch with the Axi support team whenever they need assistance or have any questions. The availability of multiple communication channels ensures that clients can choose the most convenient way to contact support.

Additionally, the Help Center offers a range of resources and frequently asked questions that can help clients find answers to their questions quickly and efficiently.

Conclusion

All things considered, Axi is a well-regulated and reputable broker that offers 220+ instruments for trading, including forex, shares, indices, commodities, cryptocurrencies, and IPOs. They also offer multiple account options, free demo accounts, and leverage up to 500:1. In addition, their MT4 trading platform is robust and feature-rich, with various tools and resources to support traders.

Overall, Axi is a good choice for experienced traders who are looking for a diverse range of trading opportunities and who prioritize a broker's reputation and regulation.

Frequently Asked Questions (FAQs)

Is Axi regulated?

Yes. Axi is regulated by ASIC (Australia), FCA (UK), CySEC (Cyprus), FMA (New Zealand), and DFSA (UAE).

Does Axi offer demo accounts?

Yes.

Does Axi offer the industry-standard MT4 & MT5?

Yes. Axi supports Copy Trading App, MT4, and MT4 WebTrader.

Risk Warning

CFDs carry a high risk of investment loss, this content is for informational purposes only and should not be construed as investment advice.

2025 SkyLine Malaysia

2025 SkyLine Malaysia  2025 SkyLine Thailand

2025 SkyLine Thailand

FX1206856634

Indonesia

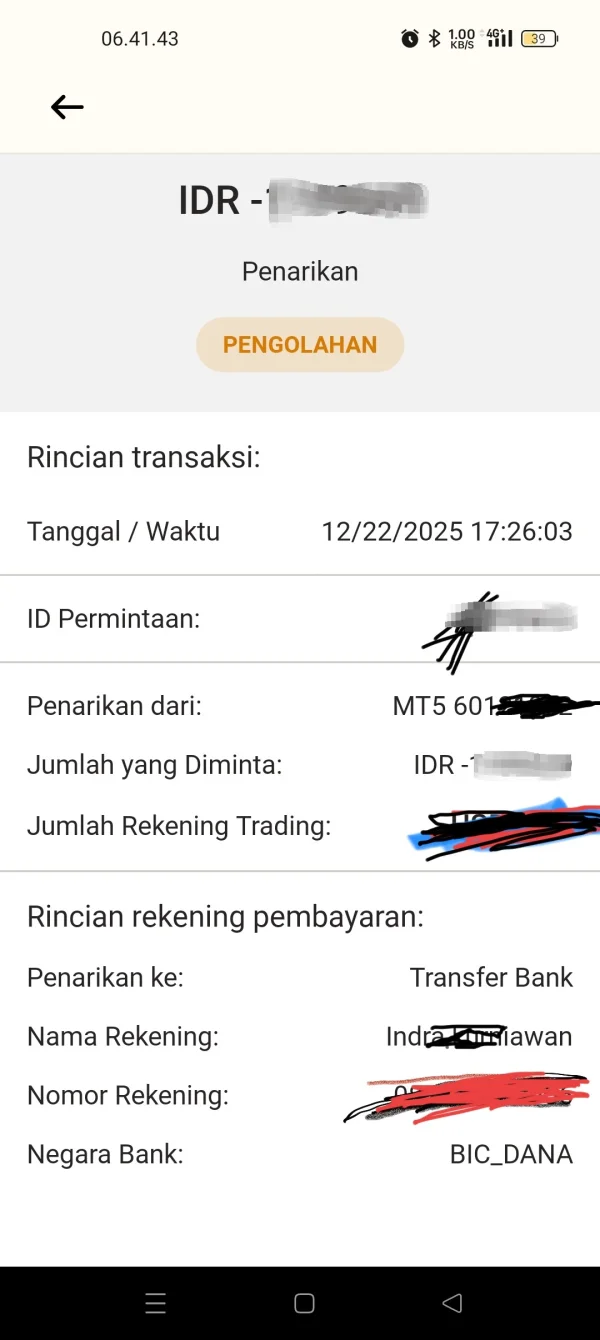

I have submitted several withdrawal requests, but so far none of them have been processed.

Exposure

FX1206856634

Indonesia

I always fail to make a withdrawal.

Exposure

FX2995228648

Japan

I traded with the deposit bonus at axi. It was an auto rebate account linked to an IB, but I lost and ended up with a negative balance. Normally, I would expect it to be reset to zero right away, and the auto rebate for that trade would be credited. However, the auto rebate was granted on top of the negative balance, offsetting it, and as a result, the rebate is also zero. I complained, but nothing was done. Those who use the bonus should be careful.

Exposure

TimTima

Canada

Trading had me anxious—constant fear of losses in demo props. Axi Select shifted that: real stakes but forgiving tiers. Focused on mindset, journaling per their resources. 10 months in, Elite stage, $400k allocation. 90% split feels rewarding. Emotions evolved from dread to discipline; one drawdown demotion was a wake-up, not endgame. Community forums shared similar stories—normalized struggles. Withdrawals seamless, even in volatile weeks. If trading's mental game haunts you, this program heals and scales.

Positive

Groor

Indonesia

Tried Axi Select as a total newbie after watching YouTube tutorials. Deposited $500, started live trading immediately—no endless demos! In two months, my Edge Score hit 60, unlocked $10k allocation. Felt like a pro right away. Withdrawals super easy via bank transfer. Thrilled and hooked—finally a program that doesn't gatekeep!

Positive

FX3995550092

Netherlands

Solid broker, tight spreads on majors, fast execution. Withdrawals in 1 day. Recommended.

Positive

Stellarra

Brazil

Axi is decent: tight spreads, fast platform, good support (even in Ukrainian/Russian). Withdrawals sometimes take 3-4 days for larger amounts, limited crypto options. Slippage during news can happen for HFT. Overall 8/10, still using it.

Positive

Vivkol

Canada

joined Axi Select after blowing challenges elsewhere. Edge Score helps improve, community and live analysis are awesome. Scary at first, but now it's the real path to pro trading. Thanks Axi!

Positive

msssXX

Bulgaria

One year on Axi — crypto CFDs and indices. MT5 didnt crash during dumps. BTC/USD spreads 10–20$, fair. Withdrawals 1–2 days. Built-in economic calendar handy. Support answered in 20 min. Stable.

Positive

hraear

Mongolia

Axi A goldmine for patient traders. 8 months in the program, from $500 to Pro 500. Great no pressure like "make 10% in a month or out." They're interested in long-term growth. Withdrawals fast, crypto option available. Drawback: if you're a scalper with tons of trades, Edge score grows slowly due to risk metrics. But if you trade smart, it's all good.

Positive

3Kalos

South Africa

Six months swinging majors. EUR/GBP spreads 1.0–1.5, swaps acceptable. MT5 handles multi-timeframe without issues. One delay during Brexit vibes, but support fixed it fast. e-Wallet withdrawals in 24h. Reliable.

Positive

Trikotree

Ethiopia

News trades on USD/JPY — MT4 holds, spreads spike to 1.5 then drop back. EAs not blocked. Card deposit instant, withdrawal 36 hours. Clean charts for MACD. Straightforward broker, no tricks.

Positive

MiranaT

Canada

Been trading with Axi for over eight months now, and it’s honestly one of the best experiences I’ve had. MT5 runs flawlessly — my indicators and EAs never glitch, even during wild market moves. Spreads on major pairs usually sit between 0.7–1.0, which is perfect for scalping. Withdrawals to card arrive in 24–36 hours, no extra questions asked. Support actually helps when you need it — not just copy-paste replies, but real answers. Highly recommend if you value reliability above everything else.

Positive

Oppore

United States

Haven't found any serious downsides yet. Regulation is in place, money withdraws without delays. Interface is simple, no need to figure it out for long. Good for those who want no extra hassle.

Positive

Haumber

United States

Works well for scalping. MT5 execution is stable, almost no requotes even during active sessions. Spreads stay reasonable and don’t blow out. Withdrawals are processed weekly without issues. Verification took a few days, but the mobile app and overall trading experience make up for it.

Positive

Aveiroot

Chile

No fees to join, real capital from the start. Grew my allocation nicely. Reliable withdrawals and good support. One of the fairest options out there.

Positive

Kentra

Cyprus

A normal broker with no surprises. Deposit via Skrill went through quickly, spreads on EUR/USD stay around 0.8–1.2. Support replies in 10–15 minutes, though mostly templated. So far so good.

Positive

Silvana1

Spain

Started with almost no experience and managed to scale up significantly over 9 months—real withdrawals in the tens of thousands. Love that there's no time limit or forced lot sizes; it's all about consistency. Payouts are reliable and fast. This feels like actual partnership rather than a one-off challenge.

Positive

Bobbzya2

Canada

There are enough instruments: forex, indices, metals. Everything in one place — convenient.

Positive

Cynthia22

Canada

Support replies quickly and stays polite and professional. The answers are straightforward, but when I needed help, the issue was resolved without hassle. Overall, a solid and reliable support experience.

Positive

FX4013341352

Australia

The mobile app is quite convenient, though it lags a little on a tablet when there are many indicators.

Positive

Voinm

Belgium

So far everything works stably. Deposits and withdrawals went through without issues, though not instantly. For me, that's already a plus.

Positive

Hooga

Spain

Gold spreads are tight (around 20–25 cents average), execution on XAU/USD is quick, no weird jumps. Platform stable, withdrawals processed in under 48 hours. Been using for scalping and swings — everything matches what they promise on the site.

Positive