Company Summary

| First State Futures Review Summary | |

| Founded | 2022 |

| Registered Country/Region | Indonesia |

| Regulation | Regulated by ICDX |

| Market Instruments | American single stocks, currencies, metals & energy, stock indices, micro multilateral, commodities (CPO, Olein, Cocoa, coffee) |

| Demo Account | ✅ |

| Leverage | / |

| Spread | / |

| Trading Platform | JAFeTS NOW and MT4 trading platform |

| Min Deposit | / |

| Customer Support | 09:00 - 05:00 WIB |

| Tel: +6231-505-5599 (ext: 212) | |

| Fax: +6231-503-8885 | |

| Email: info@firststate-futures.com | |

| Facebook, Twitter, Linkedin, Telegram | |

| Address: Jl. Sulawesi No. 48, Surabaya, East Java, Indonesia PPFX+4F | |

| Regional Restrictions | British Columbia, Quebec, and Saskatchewan in Canada, as well as the Democratic People's Republic of Korea (North Korea), Iran, the United States, and Hong Kong. |

PT. First State Futures, based in Surabaya, operates multiple branch offices in cities such as Bali, Jember, and Solo. As a licensed member of the futures exchange and with BAPPEBTI endorsement, the company offers trading platforms like JAFeTS NOW and MT4.

Here is the home page of this brokers official site:

Pros and Cons

| Pros | Cons |

| Regulated by ICDX | Revoked BAPPEBTI license |

| Security measures provided | Suspicious clone JFX license |

| Diverse market instruments | Regional restrictions |

| Demo accounts | Limited info on trading conditions |

| MT4 platform | Inactivity fee charged |

| No fees for deposits and withdrawals | Limited payment options |

| Multiple contact channels |

Is First State Futures Legit?

First State Futures is regulated by Indonesia Commodity and Derivatives Exchange (ICDX). It holds Retail Forex License with No. 037/SPKB/ICDX/Dir/VIII/2010. Besides, it also offers security measures including segregated accounts.

| Indonesia Commodity and Derivatives Exchange (ICDX) |

| Regulatory Status | Regulated |

| Regulated by | Indonesia |

| Licensed Institution | First State Futures, PT |

| Licensed Type | Retail Forex License |

| Licensed Number | 037/SPKB/ICDX/Dir/VIII/2010 |

However, their license of Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan (BAPPEBTI) is revoked and Jakarta Futures Exchange (JFX) is suspicious clone.

| Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan (BAPPEBTI) |

| Regulatory Status | Revoked |

| Regulated by | Indonesia |

| Licensed Institution | PT. First State Futures |

| Licensed Type | Retail Forex License |

| Licensed Number | 18/BAPPEBTI/PN/3/2010 |

| Jakarta Futures Exchange (JFX) |

| Regulatory Status | Suspicious Clone |

| Regulated by | Indonesia |

| Licensed Institution | First State Futures |

| Licensed Type | Retail Forex License |

| Licensed Number | SPAB-058/BBJ/01/04 |

What Can I Trade on First State Futures?

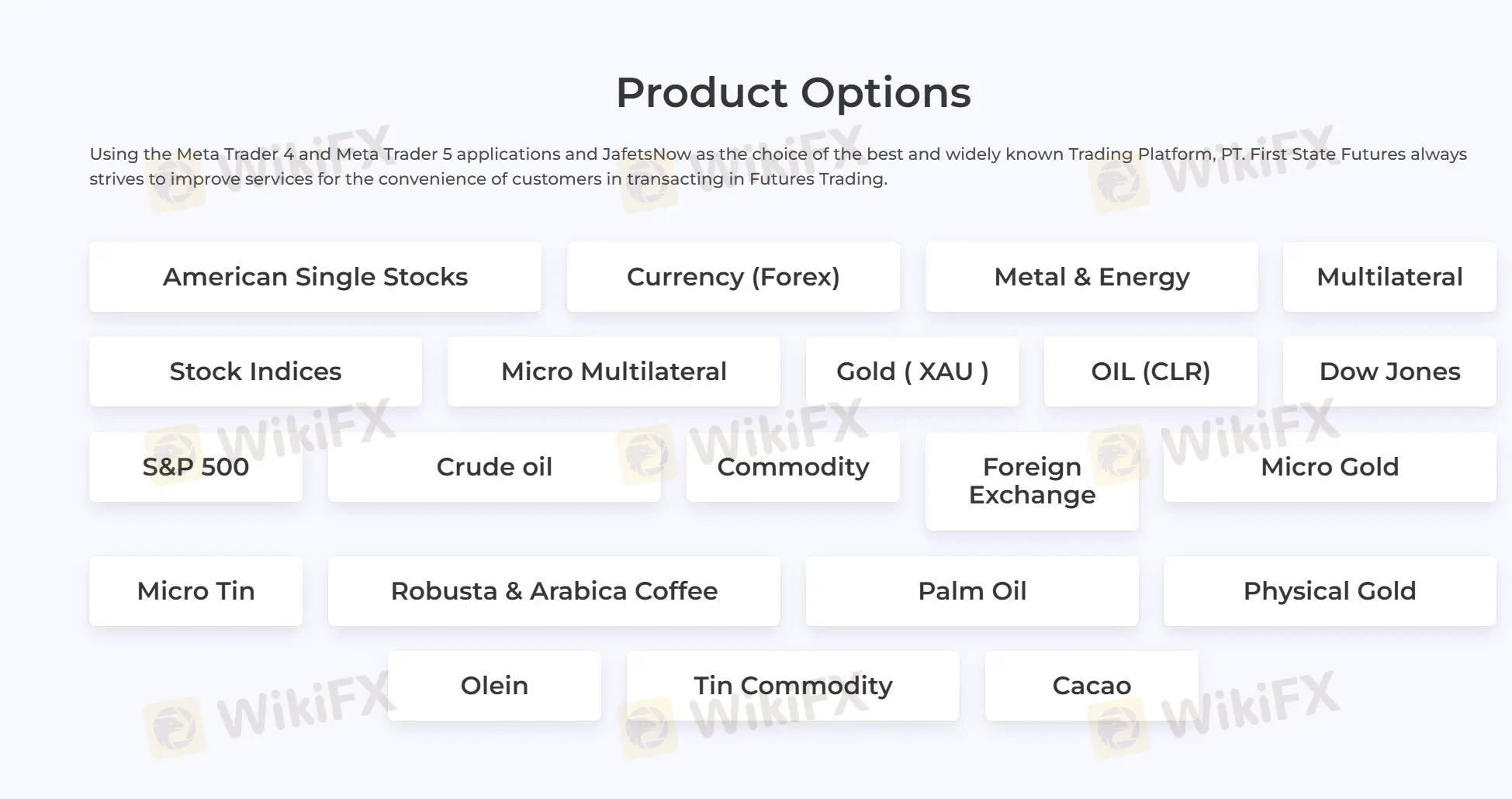

First State Futures offers American single stocks, currencies, metals & energy, stock indices, micro multilateral, and commodities (CPO, Olein, Cocoa, coffee).

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Metals | ✔ |

| Energy | ✔ |

| American Single Stocks | ✔ |

| Stock Indices | ✔ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

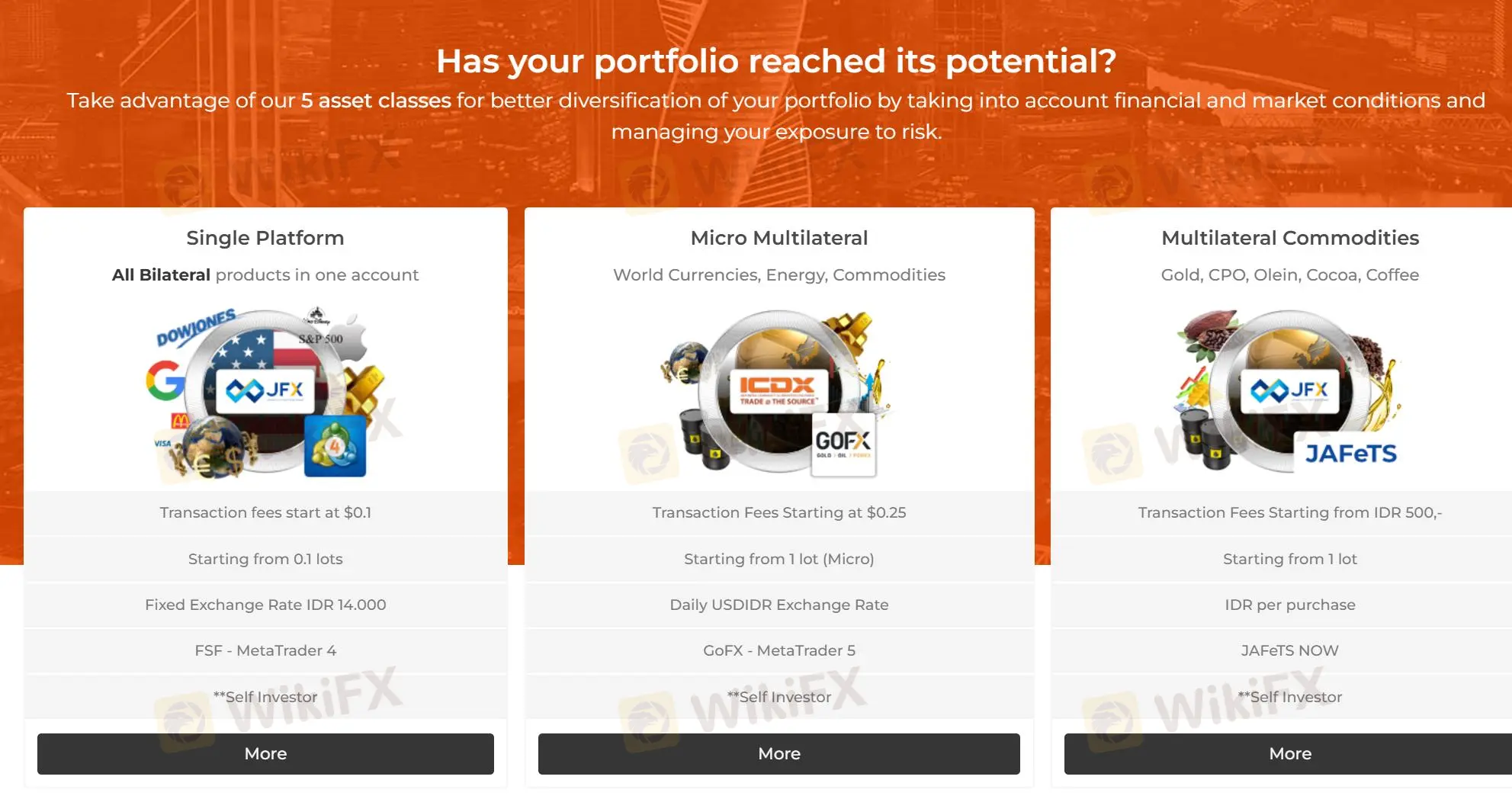

First State Futures offers three kinds of accounts: Single Platform Account, Micro Multilateral Account and Multilateral Commodities Account. Also, demo accounts are also available.

| Account Type | Products Covered | Lot Size | Exchange Rate/Currency |

| Single Platform Account | All Bilateral products | From 0.1 lots | Fixed at IDR 14,000 |

| Self Investor - Micro Multilateral Account | World Currencies, Energy, Commodities | From 1 lot (Micro) | Daily USDIDR rate |

| Self Investor - Multilateral Commodities Account | Gold, CPO, Olein, Cocoa, Coffee | From 1 lot | IDR per purchase |

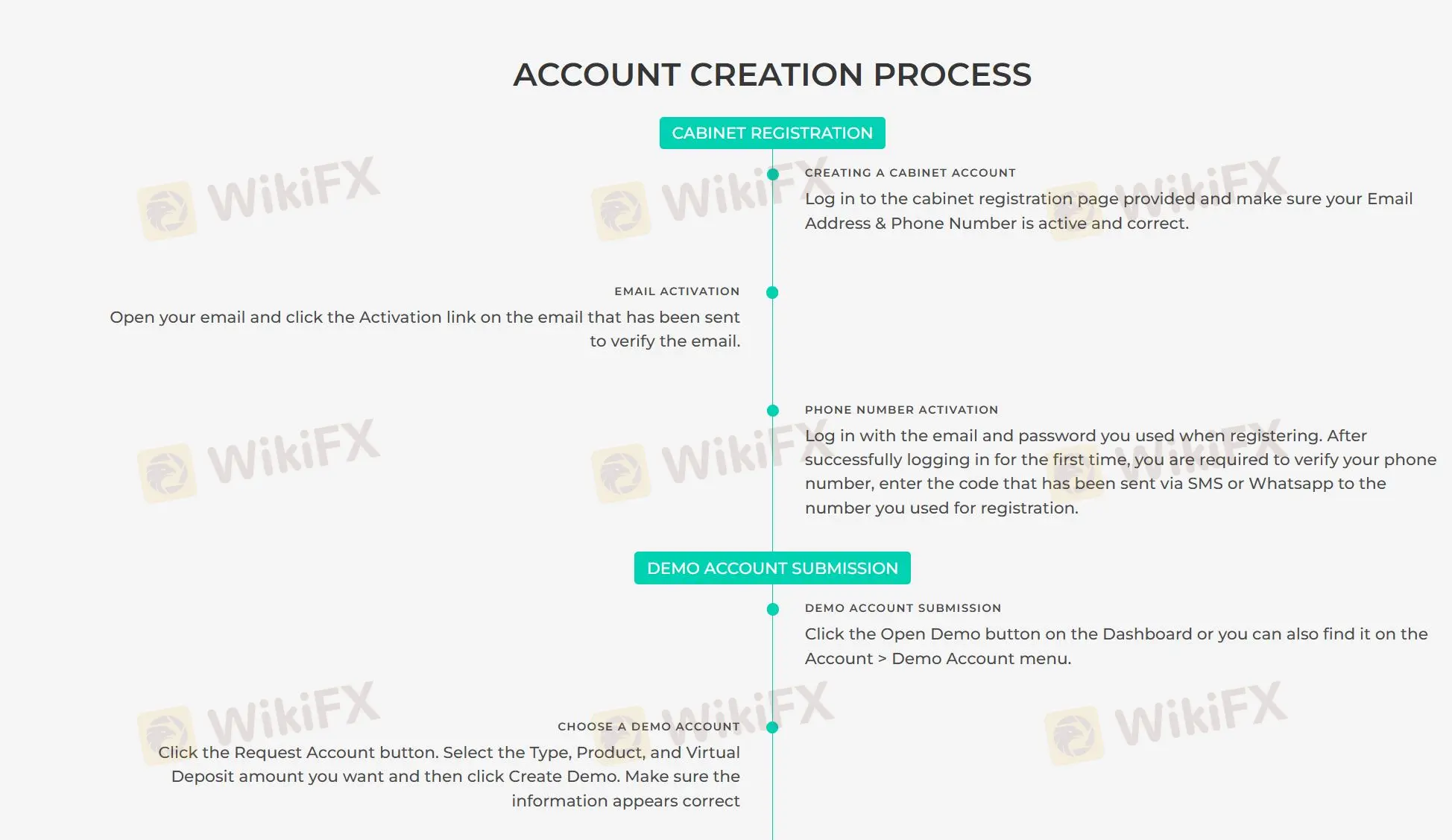

To open an account of First State Futures, you need to have a demo account before applying for a live account. Additionally, log in to the cabinet registration page provided. Open your email and click the Activation link on the email that has been sent to verify the email.

First State Futures Fees

| Account Type | Transaction Fees |

| Single Platform Account | From $0.1 |

| Self Investor - Micro Multilateral Account | From $0.25 |

| Self Investor - Multilateral Commodities Account | From IDR 500 |

Besides, it charges an inactivity fee of USD 50 when the client's account has been inactive for 30 (thirty) consecutive days of inactivity.

Trading Platform

First State Futures offers JAFeTS NOW and MT4 trading platform.

| Trading Platform | Supported | Available Devices | Suitable for |

| JAFeTS NOW | ✔ | Electronic-based | / |

| MT4 | ✔ | Web, desktop, phone | Beginners |

| MT5 | ❌ | / | Experienced traders |

JAFeTS NOW Trading Platform:

This platform is built on the latest technology to support future technological developments and can be further developed as market needs change. It also supports the simulation of multilateral commodity trading.

MetaTrader 4 (MT4) Trading Platform:

Based on software from Metaquotes Software Corp, MT4 is a versatile platform that supports all types of devices. The platform provides real-time quotes, charts, market news, and offers full instant execution of trades.

Deposit and Withdrawal

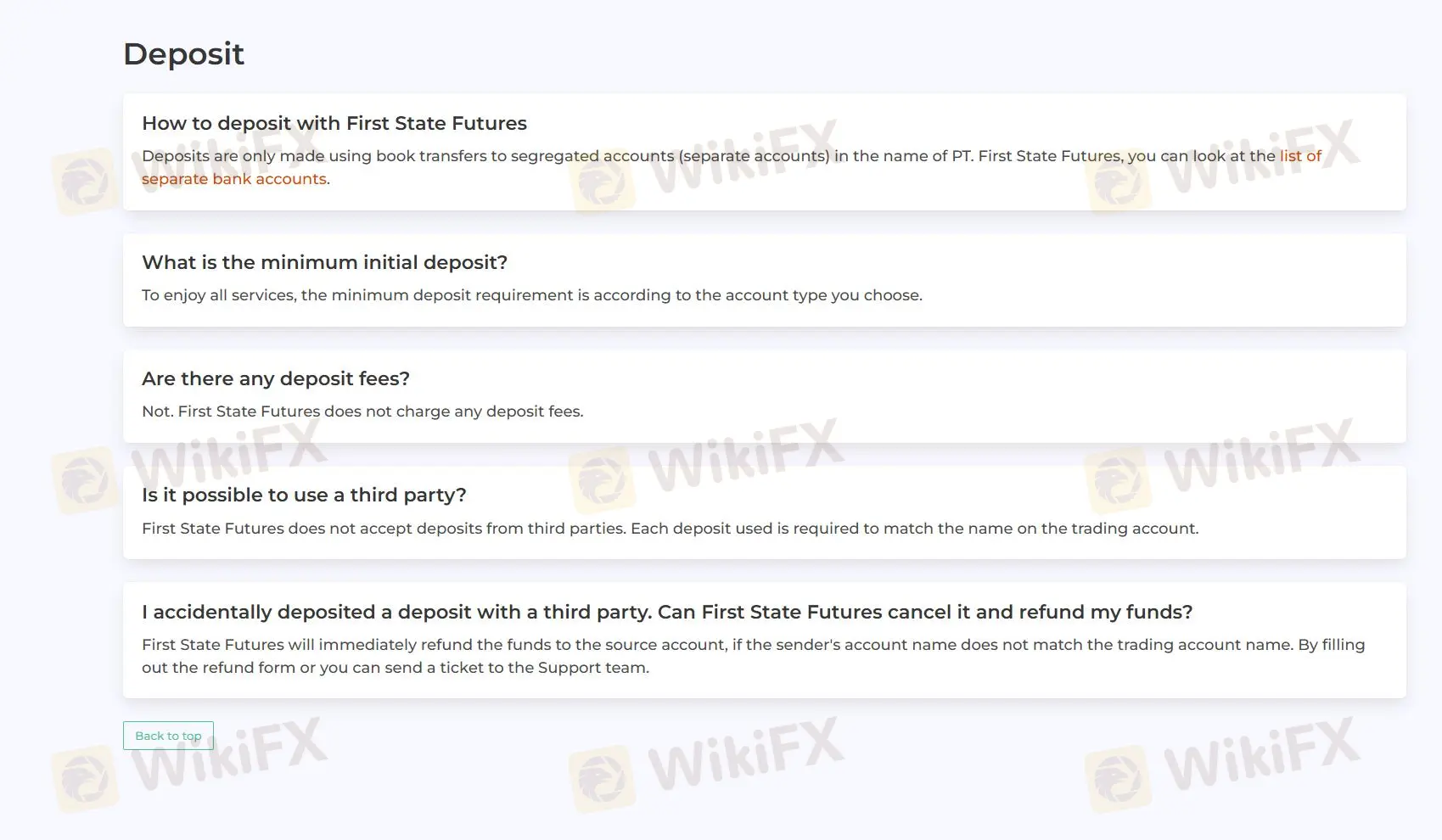

In First State Futures, deposits are only made using book transfers to segregated accounts (separate accounts) in the name of PT. It does not charge deposit or withdrawal fees.

Withdrawals can only be processed and transferred through the payment method you used to deposit the deposit.