SuperForex

Belize

Belize

Time Machine

Check whenever you want

Download App for complete information

Exposure

2 pieces of exposure in totalSuperForex · Company Summary

| Feature | Details |

| Company Name | SuperForex |

| Registered Country/Area | Belize |

| Founded year | 2013 |

| Regulation | Unregulated |

| Minimum Deposit | $1 |

| Maximum Leverage | Up to 1:3000 |

| Spreads | Variable, depending on account type (fixed or floating) |

| Trading Platforms | MetaTrader 4 |

| Tradable assets | Forex, cryptocurrencies, metals, stocks, indices, energies |

| Account Types | Standard, Swap-Free, No Spread, Micro Cent, Profi STP, Crypto, Super STP, STICPAY, ECN Standard, ECN Swap-Free Mini, ECN Standard Mini, ECN Crypto, ECN Swap-Free |

| Demo Account | Yes |

| Customer Support | Phone, email, text |

| Deposit & Withdrawal | Bank transfers, credit/debit cards, e-wallets, cryptocurrencies |

SuperForex Information

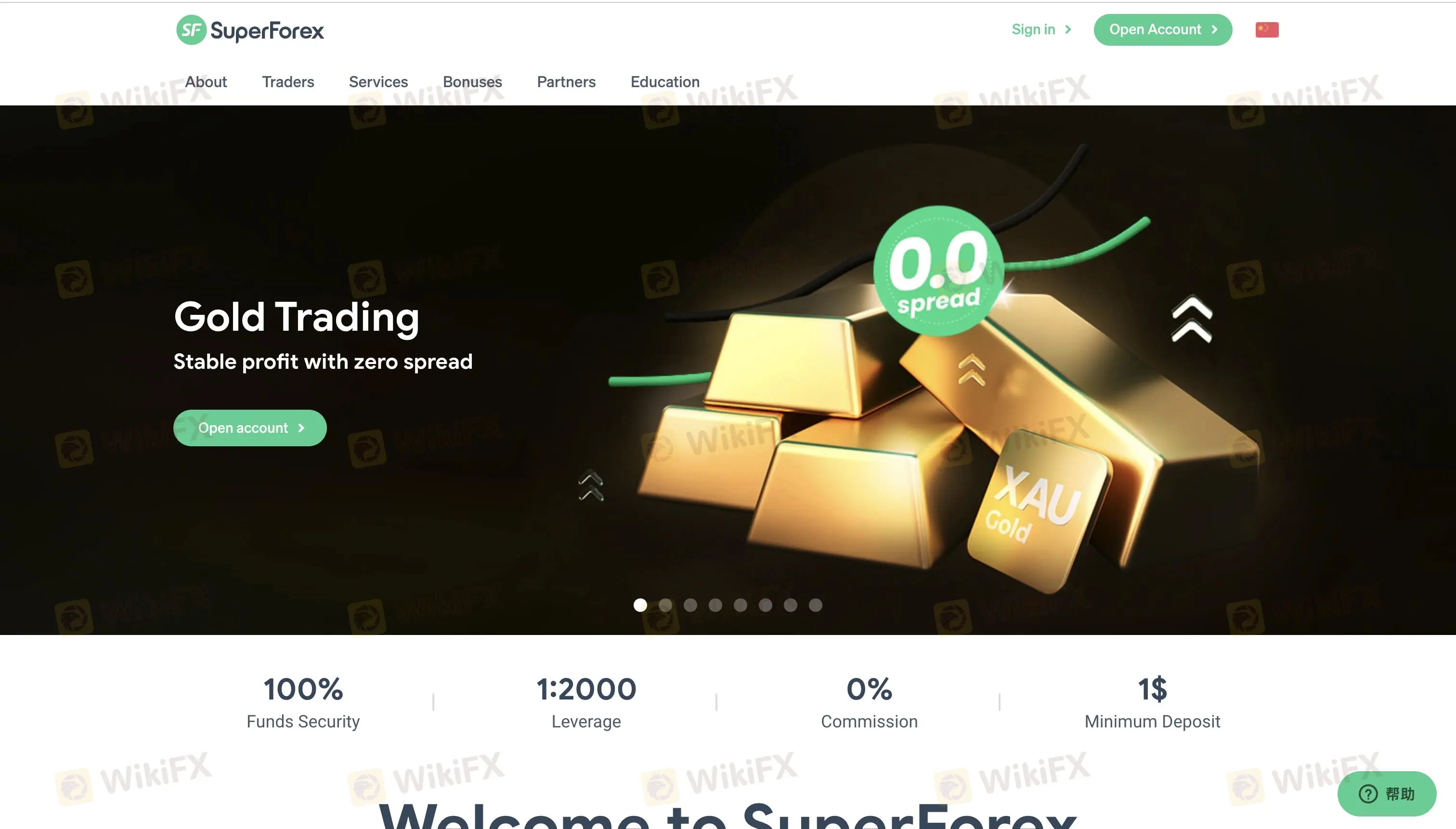

SuperForex is an unregulated broker established in 2013, based in Belize. It provides a MetaTrader 4 platform for trading a variety of assets including forex, cryptocurrencies, metals, stocks, indices, and energies. The broker offers multiple account types with varying spreads, leverage up to 1:3000, and deposit options. However, the absence of regulation poses significant risks to traders.

Pros and Cons

| Pros | Cons |

| Wide range of tradable assets | Unregulated |

| Variety of account types | Mixed reviews on customer support quality |

| High leverage options | Some accounts have commission-based fees |

| Low minimum deposit | |

| Multiple deposit and withdrawal methods |

Pros:

- Wide Range of Tradable Assets: SuperForex offers a diverse array of tradable assets, including forex, cryptocurrencies, metals, stocks, indices, and energies. This variety allows traders to diversify their portfolios and explore different markets.

- Variety of Account Types: SuperForex provides multiple account types to satisfy various trading styles and preferences. From Standard and Swap-Free accounts to ECN and Crypto accounts, traders can choose the account that best suits their needs.

- High Leverage Options: The broker offers leverage options up to 1:3000, allowing traders to maximize their trading potential. This high leverage can be particularly beneficial for those looking to increase their market exposure with a smaller initial investment.

- Low Minimum Deposit: SuperForex has a very low minimum deposit requirement, starting at just $1 for standard accounts. This makes it accessible for traders with limited initial capital.

- Multiple Deposit and Withdrawal Methods: SuperForex supports a variety of deposit and withdrawal methods, including bank transfers, credit/debit cards, e-wallets, and cryptocurrencies. This flexibility ensures that traders can choose the most convenient and secure option for their transactions.

Cons:

- Unregulated: SuperForex operates without a valid regulatory license, as its license from the International Financial Services Commission (IFSC) of Belize has been revoked. The absence of regulation poses significant risks to traders, including potential exposure to fraudulent activities and limited protection in case of disputes.

- Mixed Reviews on Customer Support Quality: There are mixed reviews regarding the quality of customer support provided by SuperForex. While some traders have had positive experiences, others have reported difficulties in getting timely and effective assistance.

- Some Accounts Have Commission-Based Fees: While many of SuperForex's accounts offer competitive spreads without additional commissions, some account types, particularly the ECN accounts, do have commission-based fees. Traders need to be aware of these potential costs when choosing an account type.

Regulatory Status

SuperForex claims is regulated by the International Financial Services Commission (IFSC) of Belize. However, it's crucial to note that this license has been revoked. As of now, SuperForex operates without a valid regulatory license. This lack of regulation could potentially expose traders to increased risks, including fraudulent activities, loss of funds, and limited recourse in case of disputes.

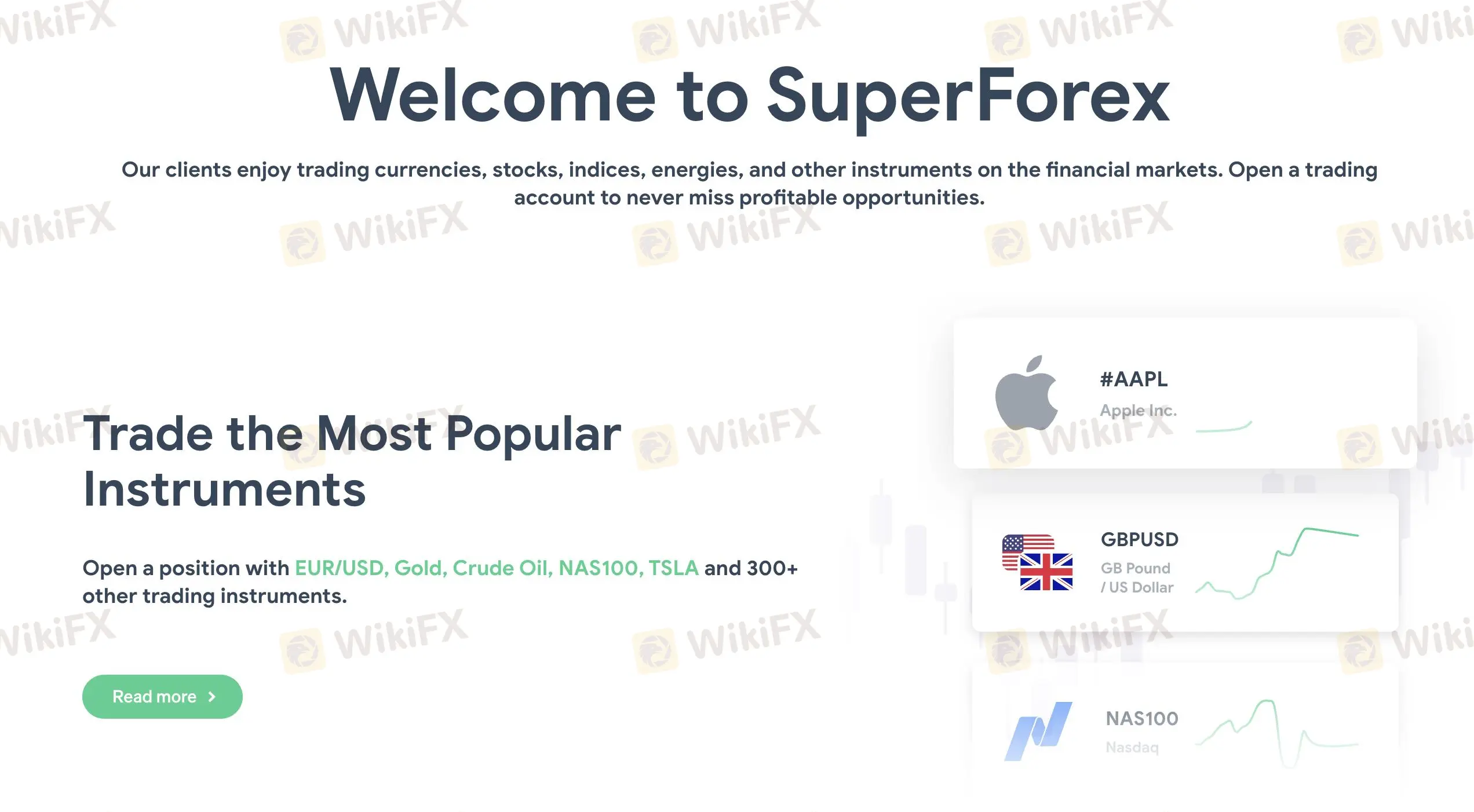

Market Instruments

SuperForex offers a wide range of trading instruments, including forex, cryptocurrencies, metals, stocks, indices, and energies. Traders can benefit from features like leverage, various account types, and a user-friendly MT4 platform. The broker emphasizes competitive spreads, low commissions, and a variety of payment methods.

Account Types

SuperForex offers a variety of account types to satisfy different trading styles and preferences. These accounts are primarily divided into two main categories: STP (Standard Transaction Processing) and ECN (Electronic Communications Network).

STP Accounts

SuperForex offers various STP (Straight Through Processing) accounts to satisfy different trader needs. These accounts provide direct market access and typically offer tighter spreads compared to traditional market maker accounts.

Compare Types of Accounts

| Standard | Swap-Free | No Spread | Micro Cent | Profi STP | Crypto | |

| Account currency | USD, EUR, GBP, CNY, AED, MYR, IDR, RUB, ZAR, NGN, INR, THB, BRL, BDT, EGP, CHF, MXN, JPY, PHP, HKD, SGD, PEN, TZS, KES, GHS, UGX, ZMW, RWF, VND, XAF, PLN, AUD, CAD, JOD | USD, EUR, GBP, CNY, AED, MYR, IDR, RUB, ZAR, NGN, INR, PKR, BDT, EGP, CHF, JPY, TRY, PHP, HKD, SGD, ILS, TZS, KES, GHS, UGX, ZMW, RWF | USD, EUR | USD, EUR, ZAR | USD, EUR, GBP | USD |

| Minimum deposit | 5 USD | 5 USD | 50 USD | 1 USD | 500 USD | 50 USD |

| Maximum deposit | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited |

| Recommended deposit | 50 USD | 50 USD | 500 USD | 10 USD | 1000 USD | 1000 USD |

| Compatible with bonuses | Welcome, Energy, Hot, No deposit | Welcome, Energy, Hot, No deposit | Welcome, Energy, Hot | Welcome, Energy, Hot | Welcome, Energy, Hot | Welcome, Energy, Hot |

| Lot size | 10,000 USD | 10,000 USD | 100,000 USD | 10,000 cents | 100,000 USD | 10 BTC / LTC / ZEC / DASH / NEO / EOS / BCH / XMR |

| Maximum leverage | 1:1000 | 1:1000 | 1:1000 | 1:1000 | 1:3000 | 1:10 |

| Swaps | Yes | No | No | Yes | No | No |

| Spreads | Fixed | Fixed | 0 | Fixed | from 0.01 pips | Fixed |

| Compatible with Forex Copy | Yes | Yes | No | No | No | No |

ECN Accounts

ECN (Electronic Communication Network) accounts provide traders with direct access to the interbank market. These accounts often feature floating spreads, low commissions, and faster execution speeds, making them popular among experienced traders.

Compare Types of Accounts

| ECN Standard | ECN Standard-Mini | ECN Swap-Free | ECN Swap-Free Mini | ECN Crypto | |

| Account currency | USD, EUR, GBP, CNY, ZAR, NGN, INR, BRL, JPY, CLP, TZS, KES, GHS, UGX, ZMW, RWF, CZK, SEK, DKK, NOK, HUF, KZT, KRW, COP, TWD | USD, EUR, GBP, CNY, MYR, ZAR, NGN, BRL, TZS, KES, GHS, UGX, ZMW, NZD, KRW, COP, TWD | USD, EUR, GBP, CNY, MYR, IDR, EGP, TRY, CLP, CZK, SEK, DKK, NOK, HUF, KRW, COP, TWD | USD, EUR, GBP, CNY, MYR, IDR, NGN, TZS, GHS, UGX, ZMW, KZT, KRW, COP, TWD | TTR, DGE, LTC, BCH |

| Minimum deposit | 100 USD | 5 USD | 100 USD | 5 USD | 50 USD |

| Maximum deposit | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited |

| Recommended deposit | 500 USD | 50 USD | 500 USD | 50 USD | 1000 USD |

| Compatible with bonuses | Welcome, Energy, Hot | All bonuses | Welcome, Energy, Hot | Welcome, Energy, Hot | Welcome, Energy, Hot |

| Lot size | 100,000 USD | 10,000 USD | 100,000 USD | 10,000 USD | 10 BTC / LTC / ZEC / DASH / NEO / EOS / BCH / XMR |

| Maximum leverage | 1:1000 | 1:1000 | 1:1000 | 1:1000 | 1:10 |

| Swaps | Yes | Yes | No | No | No |

| Spreads | Floating | Floating | Floating | Floating | Floating |

| Compatible with Forex Copy | No | No | No | No | No |

Leverage

SuperForex offers a maximum leverage of 1:1000 for most of its account types. This includes popular options like Standard, Swap-Free, and Micro Cent accounts.

However, there are exceptions, Profi STP account provides a higher maximum leverage of 1:3000, and Crypto account offers a maximum leverage of 1:10.

Spreads & Commissions

SuperForex offers a variety of account types with different spread and commission structures. Generally, spreads are the difference between the bid and ask price of a currency pair, while commissions are additional fees charged for trading.

Spread and Commission Structure

| Account Type | Typical Spreads | Commissions |

| Standard | Fixed | No commission |

| Swap-Free | Fixed | No commission |

| No Spread | 0 pips | Commission-based |

| Micro Cent | Fixed | No commission |

| Profi STP | From 0.01 pips | No commission |

| Crypto | Fixed | No commission |

| ECN Accounts | Floating | Commission-based |

Trading Platform

SuperForex primarily utilizes the MetaTrader 4 (MT4) platform for trading, offering traders a reliable and feature-rich environment for executing orders and conducting market analysis. Additionally, SuperForex provides a mobile app for Android devices, allowing traders to manage their accounts, fund deposits and withdrawals, access trading history, and utilize other SuperForex services on the go.

Deposit & Withdrawal

SuperForex offers a variety of deposit and withdrawal methods to ensure secure and convenient transactions. These include bank transfers, credit/debit cards, e-wallets, and cryptocurrency options. The platform supports accounts in USD, EUR, and GBP. SuperForex does not charge additional fees for transactions; however, users should check with their banks or payment systems for any potential fees related to currency conversion. The minimum deposit amount for a standard account is just $1.

For more details, visit the SuperForex Deposit and Withdrawal page.

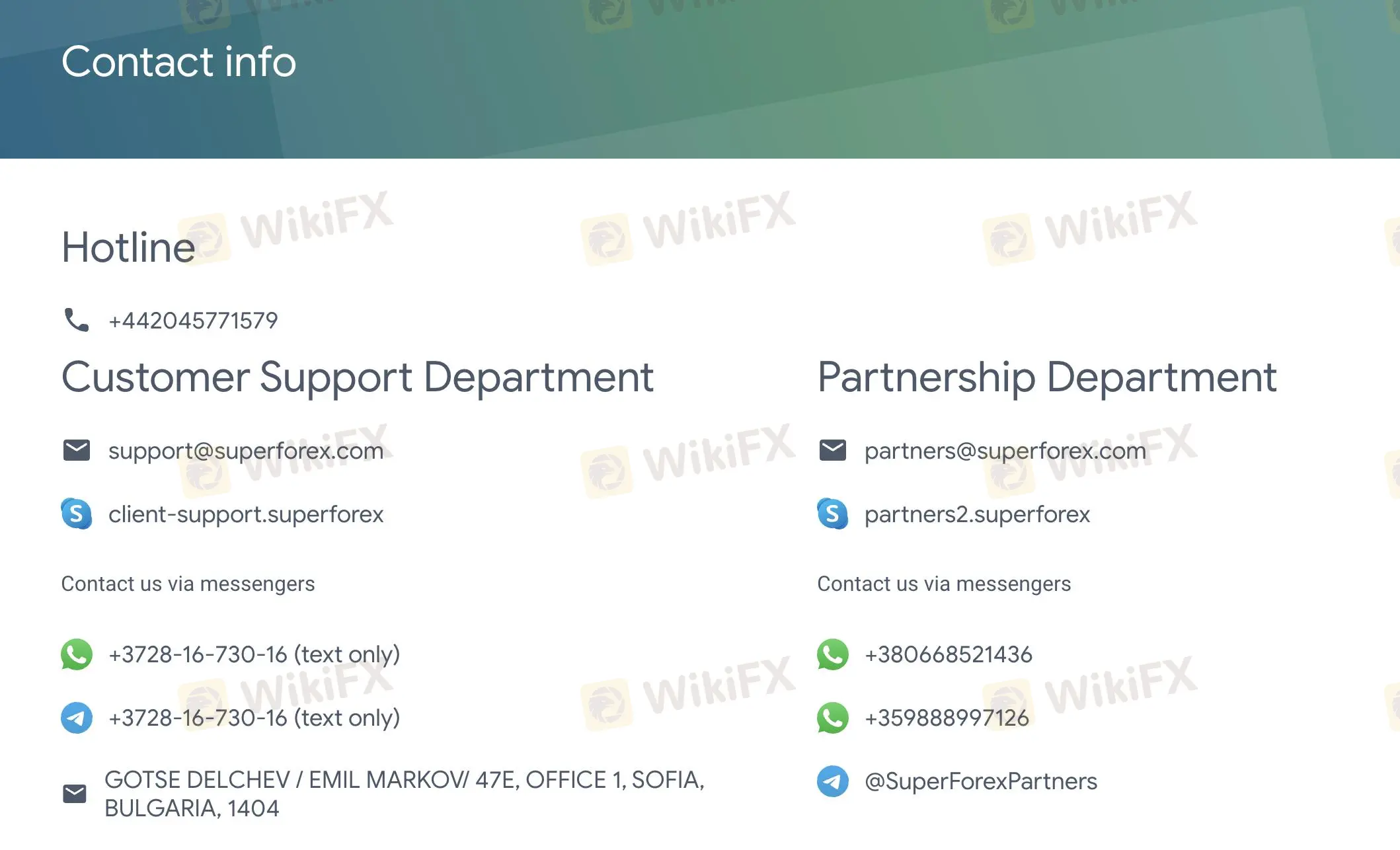

Customer Support

SuperForex offers multiple channels for customer support. Traders can contact the Customer Support Department via phone (+442045771579), email (support@superforex.com, client-support.superforex), or text (+3728-16-730-16). For partnership inquiries, contact the Partnership Department at partners@superforex.com, partners2.superforex, or via phone (+380668521436, +359888997126) and social media (@SuperForexPartners).

Conclusion

SuperForex offers a diverse range of tradable assets and account types, providing high leverage options and a low minimum deposit, which makes it accessible to a wide range of traders. Additionally, the broker supports multiple deposit and withdrawal methods for added convenience. However, the lack of regulation poses significant risks, and there are mixed reviews regarding the quality of customer support. Furthermore, some accounts come with commission-based fees, which traders need to consider when evaluating the overall cost of trading with SuperForex.

FAQs

Is SuperForex regulated?

SuperForex is currently unregulated as its license from the International Financial Services Commission (IFSC) of Belize has been revoked.

What leverage does SuperForex offer?

SuperForex provides leverage up to 1:3000, allowing traders to significantly increase their market exposure with a smaller investment.

Are there any fees associated with SuperForex accounts?

While many accounts have competitive spreads without additional commissions, some, particularly ECN accounts, do charge commission-based fees.

What customer support options does SuperForex offer?

SuperForex provides customer support via phone, email, and text. However, there are mixed reviews regarding the quality of their customer service.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

News

No data