Company Summary

| GF Securities (Hong Kong) Review Summary | |

| Founded | 2006 |

| Registered Country/Region | Hong Kong |

| Regulation | Regulated by SFC |

| Services | Global securities, investment banking, wealth management and brokerage, investment management |

| Customer Support | Tel: +852 3719 1111 |

| Fax: +852 2907 6171 | |

| Social media: WeChat, LinkedIn | |

| Address: 27/F, GF Tower, 81 Lockhart Road, Wan Chai, Hong Kong | |

GF Securities (Hong Kong) Information

GF Securities (Hong Kong) is the core part of GF Securities Co., Ltd., which was founded in 2006 following the approval of China Securities Regulatory Commission to conduct business in Hong Kong and overseas markets. It wholly owns GF Holdings (Hong Kong) Corporation Limited and its subsidiaries. With Asia focus, Chinese expertise, and Greater Bay Area characteristics, the company offers financial services including global securities, investment banking, wealth management and brokerage, and investment management to global clients.

Pros and Cons

| Pros | Cons |

| Long history | / |

| SFC regulated | |

| Various financial services |

Is GF Securities (Hong Kong) Legit?

GF Securities (Hong Kong) claims to be regulated by SFC (Hong Kong Securities and Futures Commission) with license number No. AOB369. However, we have not found the details about the licenses that we cannot conclude that the company is well regulated so far.

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| Securities and Futures Commission of Hong Kong (SFC) | Regulated | GF Futures (Hong Kong) Co., Limited | Dealing in futures contracts | AOB369 |

Services

GF Securities (Hong Kong) offers a series of financial services to global clients.

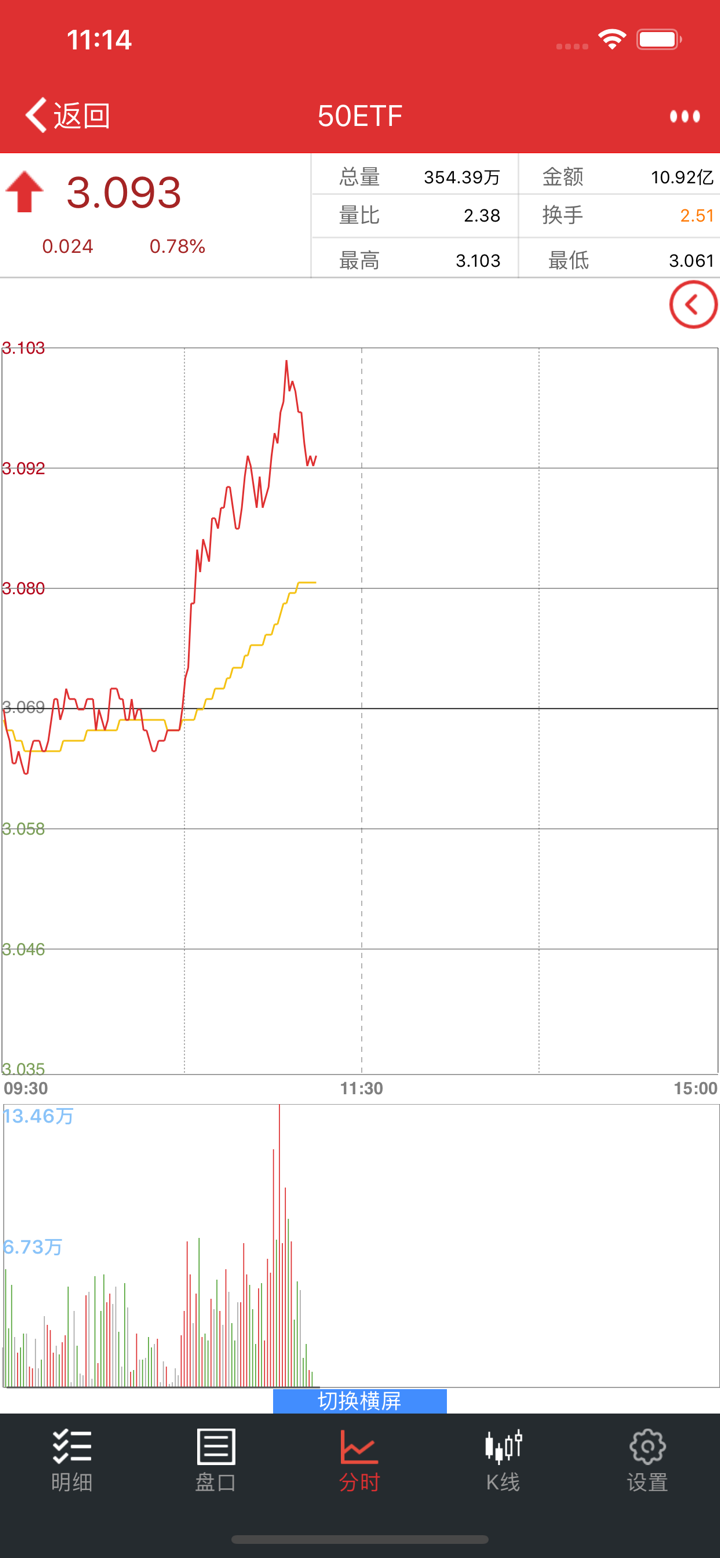

Global Securities: Equity and bond trading across Asia-Pacific markets, structured products like leveraged and FX-hedged notes, cross-border yield enhancement swaps, and research on A-shares and H-shares.

Investment Banking: M&A and privatization advisory, equity and debt capital market services, and support for cross-border listings and financing.

Wealth Management & Brokerage: Tailored services for trading equities, bonds, ETFs, and derivatives.

Investment Management: Multi-asset funds, venture capital, private equity, cross-border M&A, and integrated asset management solutions for diverse client needs.