Company Summary

| Tera Yatiriml Review Summary | |

| Founded | 1990 |

| Registered Country/Region | Turkey |

| Regulation | No regulation |

| Market Instruments | Currency Pairs, Precious Metals, Energy Commodities, Indices |

| Demo Account | ✅ |

| Leverage | Up to 1:10 |

| EUR/USD Spread | Average 3.2 pips |

| Trading Platform | MetaTrader 5 (MT5) |

| Minimum Deposit | 50,000 TL |

| Customer Support | Phone: +90 212 365 1000 |

| Email: iletisim@terayatirim.com | |

Tera Yatiriml Information

Tera Yatırım is a Turkish brokerage firm that was created in 1990 and is not regulated by any known financial institution. The MetaTrader 5 platform lets you trade Currency Pairs, Precious Metals, Energy Commodities, and Indices with leverage of up to 1:10 on the MT5 platform.

Pros and Cons

| Pros | Cons |

| Various trading markets | Not regulated |

| Supports MetaTrader 5 platform | Limited leverage |

| Wide EUR/USD spread | |

| Limited payment methods |

Is Tera Yatiriml Legit?

Tera Yatırım is registered in Turkey, but is not regulated by any Turkish financial authority. Please be aware of the risk!

What Can I Trade on Tera Yatırım?

Tera Yatırım lets you invest in over 50 different products, including as currency pairs, precious metals (gold and silver), and energy commodities.

| Tradable Instruments | Supported |

| Currency Pairs (FX) | ✔ |

| Precious Metals | ✔ |

| Energy Commodities | ✔ |

| Indices | ✔ |

| Stocks | ✘ |

| Cryptocurrencies | ✘ |

| Bonds | ✘ |

| Options | ✘ |

| ETFs | ✘ |

Account Type

Tera Yatırım provides two types of accounts: demo and live trading accounts. The demo account allows beginners to practice trading with simulated cash, whilst the real account is for live trading and requires a minimum deposit of 50,000 TL or an equivalent foreign currency. An Islamic (swap-free) account is not mentioned.

Leverage

Tera Yatırım supports trading with leverage up to 1:10, allowing traders to open positions ten times greater than their actual capital. While this has the potential to maximize profits, it also considerably raises the chance of loss.

Tera Yatiriml Fees

Tera Yatırım offers affordable spreads starting at 0.2 pips, which is lower than industry standards. It allows you to trade approximately 50 different Forex items, as well as commodities and indices.

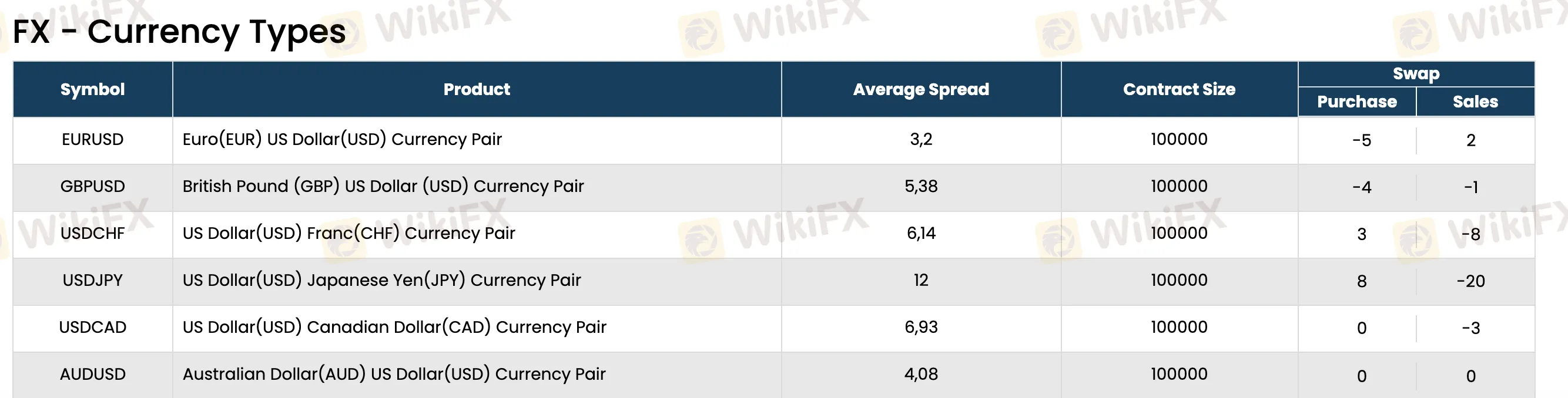

Sample Spread Overview – Forex

| Symbol | Avg. Spread (pips) | Swap (Buy) | Swap (Sell) |

| EURUSD | 3.2 | -5 | 2 |

| GBPUSD | 5.38 | -4 | -1 |

| USDJPY | 12 | 8 | -20 |

| AUDUSD | 4.08 | 0 | 0 |

| USDCHF | 6.14 | 3 | -8 |

Sample Spread Overview – Commodities & Metals

| Symbol | Product | Avg. Spread | Swap (Buy) | Swap (Sell) |

| XAUUSD | Gold (USD) | 19 | -20 | 0 |

| SILVER | Silver (USD) | 20 | -3 | 0 |

| WTI | Crude Oil (US) | 2.98 | 0 | 0 |

| PLATINUM | Platinum | 3797 | -150 | -180 |

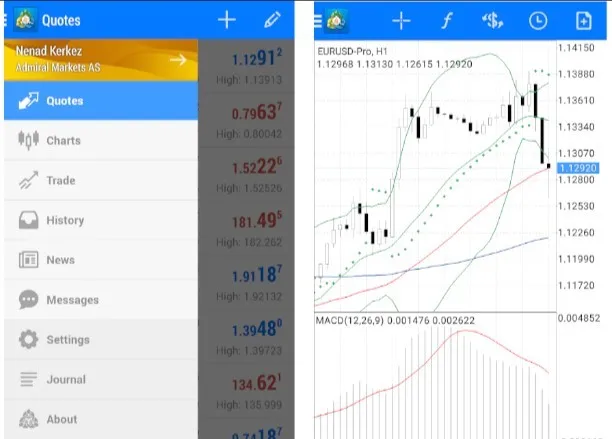

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MetaTrader 5 (MT5) | ✔ | Windows, macOS, iOS, Android | Experienced Traders |

| MetaTrader 4 (MT4) | ✘ | - | - |

| Proprietary App | ✘ | - | - |

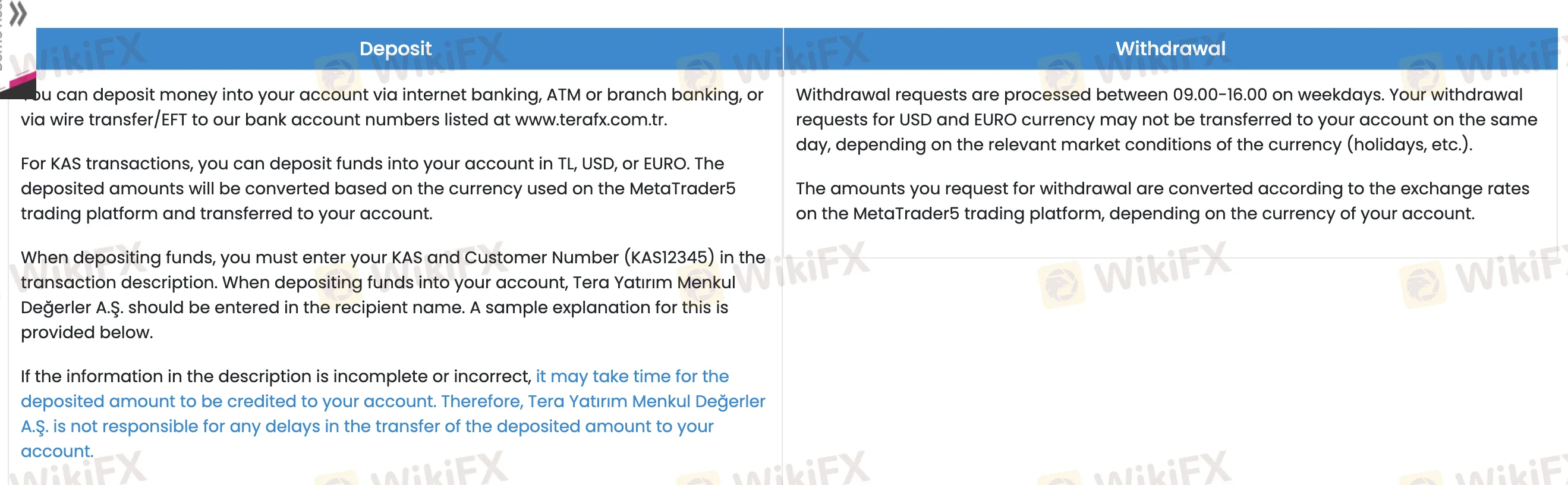

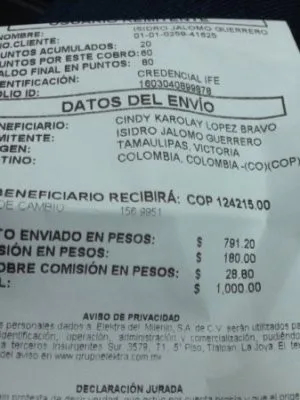

Deposit and Withdrawal

Tera Yatırım does not impose deposit or withdrawal fees. The minimum deposit amount is 50,000 TL, and users can fund accounts with bank transfers in TRY, USD, or EUR.

| Payment Method | Deposit Supported | Withdrawal Supported | Minimum Deposit | Fees | Processing Time |

| Bank Transfer / EFT | ✔ | ✔ | 50,000 TL | Free | Deposit: Based on bank |

| Withdrawal: 09:00–16:00 weekdays | |||||

| Internet Banking / ATM | ✔ | ✘ | 50,000 TL | Free | Deposit: Varies by method |