Company Summary

| Sheer Markets Review Summary | |

| Founded | 2016 |

| Registered Country/Region | Cyprus |

| Regulation | CySEC |

| Market Instruments | Cash NDF CFDs, Forex, Cryptos, Equities, Indices, Commodities |

| Demo Account | ✅ |

| Leverage | Up to 1:30 (retail)/1:100 (professional) |

| Spread | From 1.2 pips (Classic account) |

| Trading Platform | MT5 |

| Minimum Deposit | $/€200 |

| Customer Support | Contact form |

| Tel: +357 25861400 | |

| Email: support@sheermarkets.com | |

| Address: 331, 28th October Avenue, Lido House Block 2, Unit 365, 3106, Limassol, Cyprus | |

Sheer Markets Information

Sheer Markets, founded in 2016 and registered in Cyprus, is regulated by CySEC. It offers the MT5 trading platform and supports a range of instruments including forex, cryptocurrencies, indices, and equity CFDs. The broker provides multiple account types and a demo account, but it does not support MT4 and lacks popular e-wallet or credit card payment options.

Pros and Cons

| Pros | Cons |

| Regulated by CySEC | No support for popular e-wallets or credit card payments |

| Various trading instruments | Inactivity account fee charged |

| Demo accounts available | High minimum deposit |

| MT5 provided | |

| Various account types |

Is Sheer Markets Legit?

Sheer Markets is regulated by the Cyprus Securities and Exchange Commission (CySEC) as a Market Maker (MM) with license number 395/20.

What Can I Trade on Sheer Markets?

Sheer Markets offers different types of trading instruments: cash NDF CFDs, FX and emerging market currency CFDs (FX & EMFX CFDs), cryptocurrency CFDs (Crypto CFDs), and equities, indices, and commodity CFDs (Equity, Indices & Commodity CFDs).

| Tradable Instruments | Supported |

| CFDs | ✔ |

| Forex | ✔ |

| Cryptos | ✔ |

| Equities | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

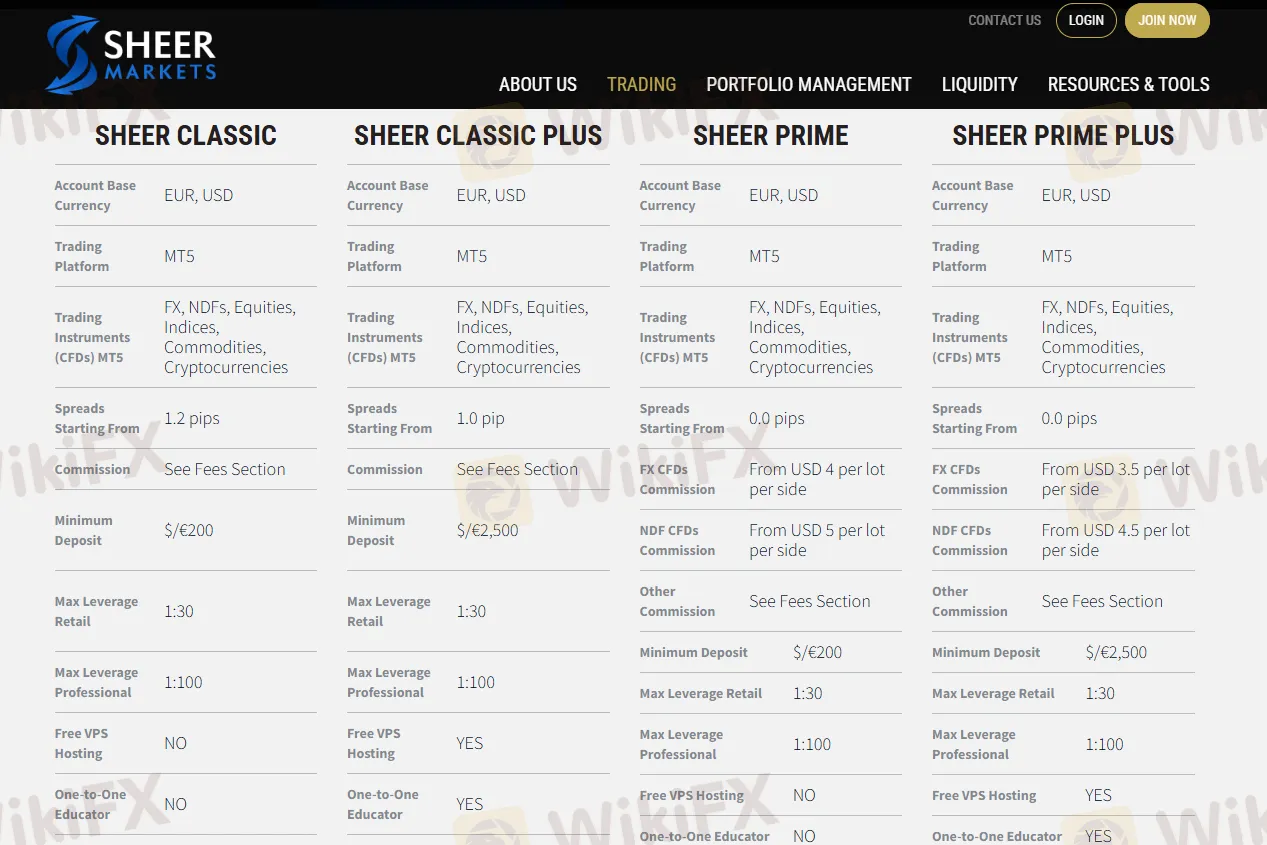

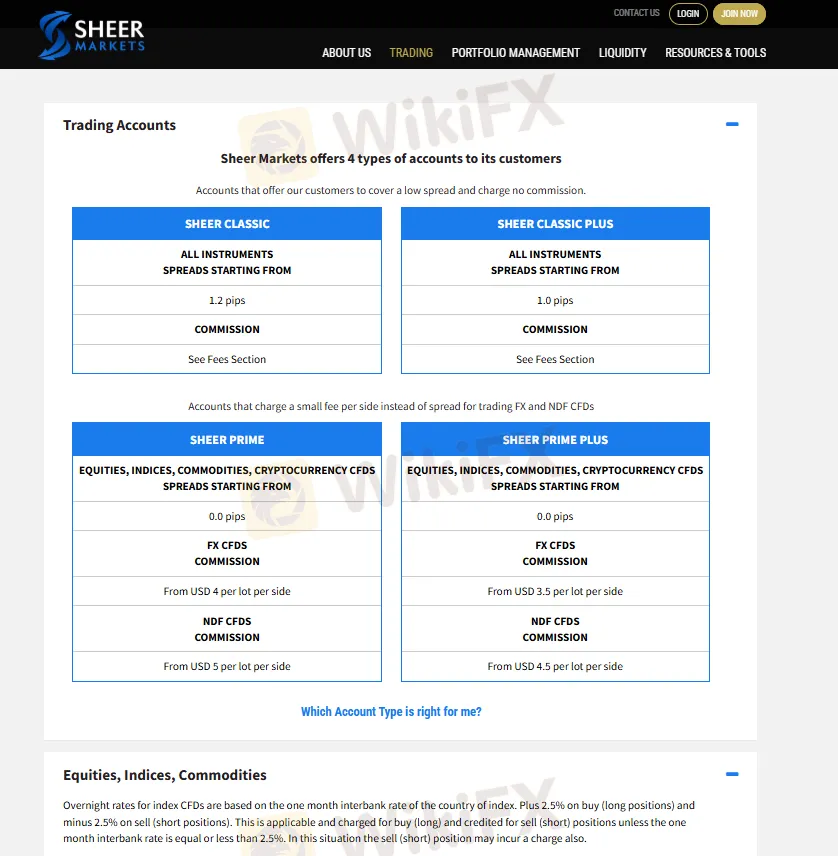

Account Type

Sheer Markets offers four main account types: Sheer Classic, Sheer Classic Plus, Sheer Prime, and Sheer Prime Plus. In addition, Sheer Markets provides professional and Corporate accounts. The Professional account requires meeting specific trading experience and asset criteria, while the Corporate account requires submission of relevant company documents for opening.

| Account Type | Classic | Classic Plus | Prime | Prime Plus |

| Minimum Deposit | $/€200 | $/€2,500 | $/€200 | $/€2,500 |

| Maximum Leverage (Retail) | 1:30 | |||

| Maximum Leverage (Professional) | 1:100 | |||

| Spread | From 1.2 pips | From 1.0 pips | From .0 pips | |

| FX CFDs Commission | See fees section | From USD 4/lot/side | From USD 3.5/lot/side | |

| NDF CFDs Commission | From USD 5/lot/side | From USD 4.5/lot/side | ||

Sheer Markets Fees

Sheer Markets fee structure is relatively high compared to the industry average. The SHEER CLASSIC and CLASSIC PLUS accounts do not charge commissions, but their spreads start from 1.2 and 1.0 pips respectively. The SHEER PRIME and PRIME PLUS accounts follow a low-spread plus commission model, with forex trades incurring a commission of $4 and $3.5 per side per lot, respectively. For stock trading, U.S. equities are charged at $0.05 per share with a minimum execution fee of $10, while European and UK stock indices are charged at 15 basis points (bps), which aligns with industry standards.

Regarding overnight interest, the platform provides detailed information by asset class. For example, the overnight rate for index CFDs is the one-month interbank rate plus or minus 2.5%. Swap points for forex instruments fluctuate depending on the currency pair, while the holding costs for cryptocurrencies are significantly higher, with annualized financing rates for long positions in BTCUSD and ETHUSD reaching up to 45%. Additionally, an inactivity fee of €10 per month is charged for accounts with no trading activity for six months.

Leverage

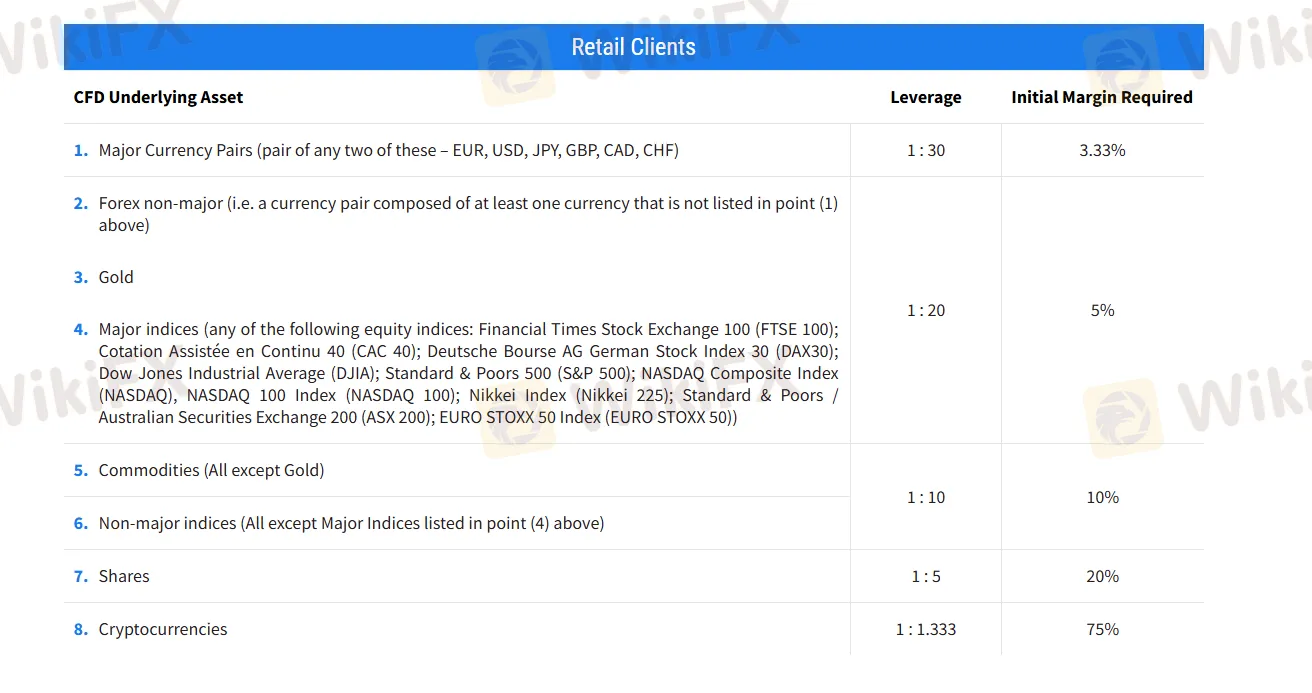

Sheer Markets offers different leverage ratios for retail and professional clients, based on the asset class and in line with regulatory requirements.

Retail Clients:

| Asset Class | Maximum Leverage | Initial Margin |

| Major Forex Pairs (e.g., EUR/USD) | 1:30 | 3.33% |

| Minor/Non-Major Forex Pairs | 1:20 | 5% |

| Gold / Major Indices | 1:20 | 5% |

| Other Commodities / Non-Major Indices | 1:10 | 10% |

| Shares | 1:5 | 20% |

| Cryptocurrencies | 1:1.333 | 75% |

Professional Clients:

| Asset Class | Maximum Leverage | Initial Margin |

| Major Forex Pairs | 1:100 | 1% |

| Minor Forex Pairs | 1:25 | 4% |

| Commodities, Metals, Indices | 1:20 | 5% |

| Shares | 1:10 | 10% |

| Cryptocurrencies | 1:1.333 | 75% |

Trading Platform

Sheer Markets offers the MT5 trading platform.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Windows, macOS, Web, iOS, Android | Experienced Traders |

| MT4 | ❌ | / | Beginners |

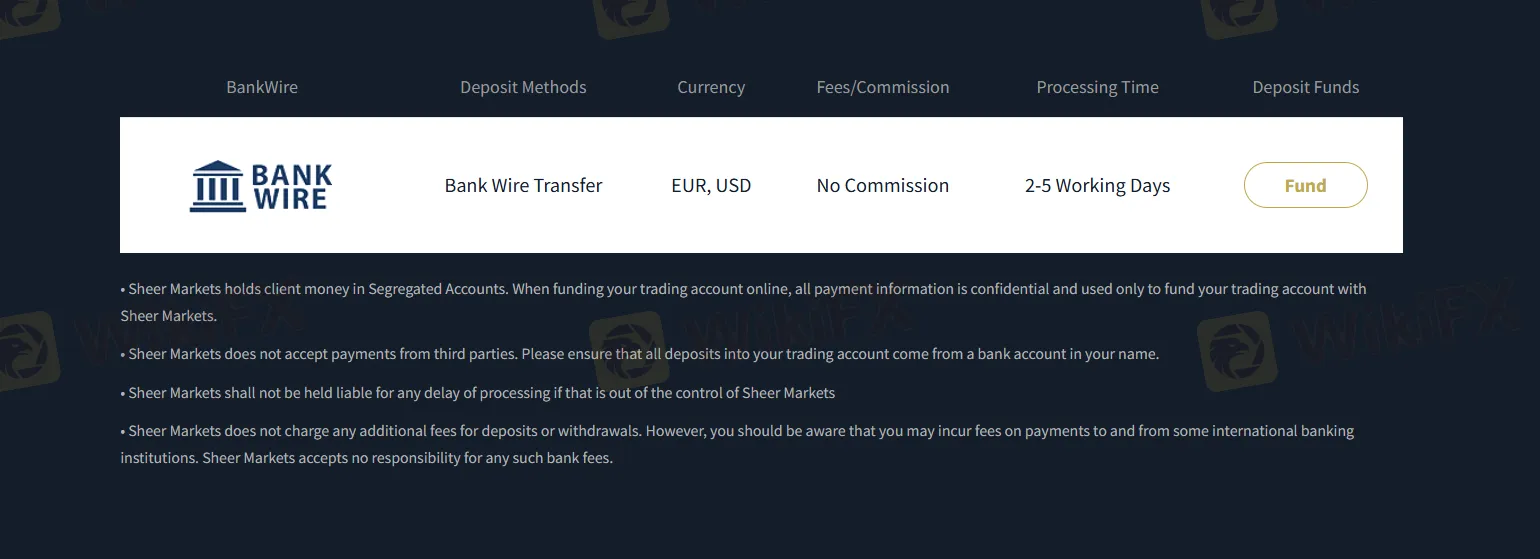

Deposit and Withdrawal

The minimum deposit at Sheer Markets is $/€200.

Sheer Markets supports deposits and withdrawals via bank wire transfers, accepting EUR and USD with no additional fees. Deposits typically take 2-5 business days to process, while withdrawal requests are handled within 24 hours but may take up to 5 business days for funds to reach the bank account.