Company Summary

Company Summary

Company Profile

| Trive Review Summary | |

| Founded | 5-15 years |

| Registered Country/Region | BVI |

| Regulation | FINRA, ASIC, MFSA, MNB, CMB, BAPPEBTI, FSCA, Mauritius FSC, BVI FSC |

| Market Instruments | Forex, stocks, indices, commodities, cryptocurrency |

| Leverage | 1:2000 |

| EUR/USD Spread | 1.2 pips (Std) |

| Trading Platforms | MT4, MT5 |

| Minimum Deposit | Depends on region and payment methods |

| Customer Support | Monday through Friday, 9 am - 7 pm (Email and phone) |

What is Trive?

Trive Financial Holding, based in the Netherlands, is a group of financial companies providing investment, credit, banking, wealth management and insurance services on a global scale.

Trive Investment B.V. delivers investment services through its investment platform. It has wholly owned subsidiaries spanning the globe from the United States to Europe, Africa, the Middle East, Indonesia, Australia, and Southeast Asia.

Offering investors agile customer support and rich investment experience, Trive provides constant innovation based on the client's needs. Trive keeps evolving continuously to meet market challenges and to provide a competitive edge in an ever-changing investment environment.

Trive also provides credit, banking, wealth management and insurance.

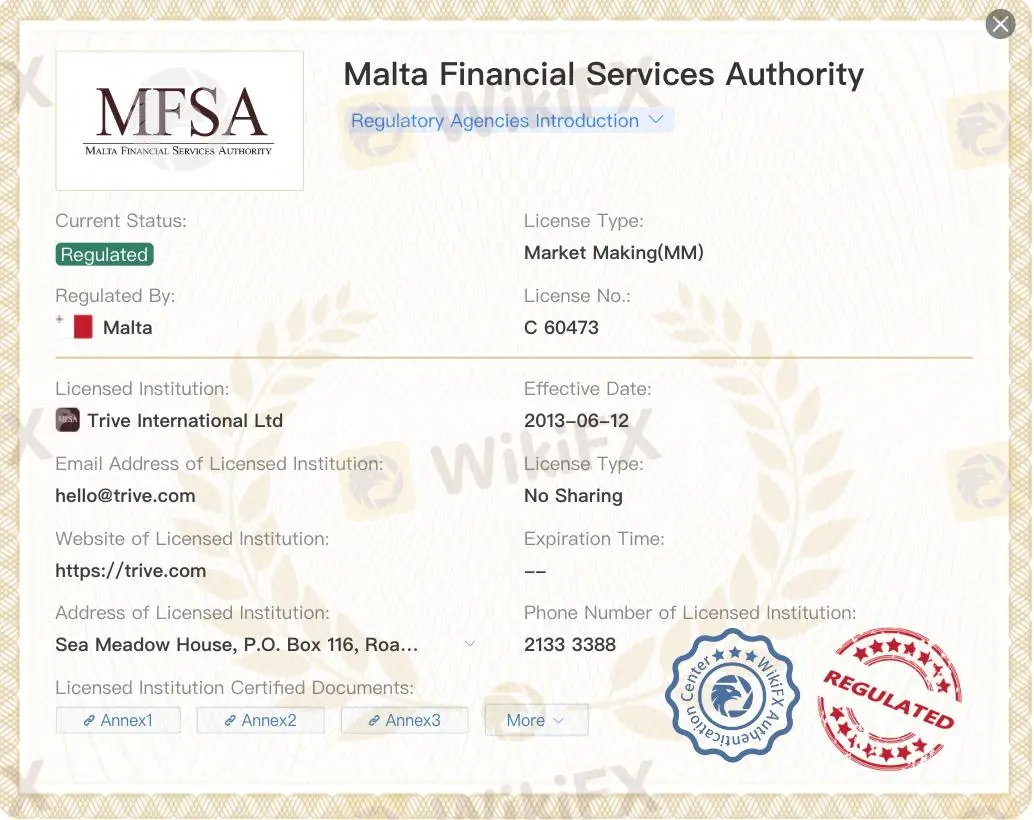

Regulatory Status

Upholding the trust of tens of thousands of investors, Trive-named companies hold licences from reputable regulatory authorities worldwide, including the Financial Industry

Regulatory Authority (FINRA) in the United States, the Australian Securities and Investments Commission (ASIC) in Australia, the Malta Financial Services Authority (MFSA) in Malta, the Capital Markets Board (CMB) in Türkiye, the Commodity Futures Trading Regulatory Agency (BAPPEBTI) in Indonesia, the Financial Sector Conduct Authority (FSCA) in South Africa, the Financial Services Commission (FSC) in Mauritius, and the Financial Services Commission (FSC) in the British Virgin Islands.

Here are the displayed licenses:

Pros and Cons

| Pros | Cons |

| 9 licenses | No 24/7 customer support |

| Competitive spreads | |

| A range of trading instruments | |

| MT4 and MT5 supported | |

| A wide variety of payment options and methods | |

| 24/5 customer support | |

| No fees from deposits and withdrawals |

Market Instruments

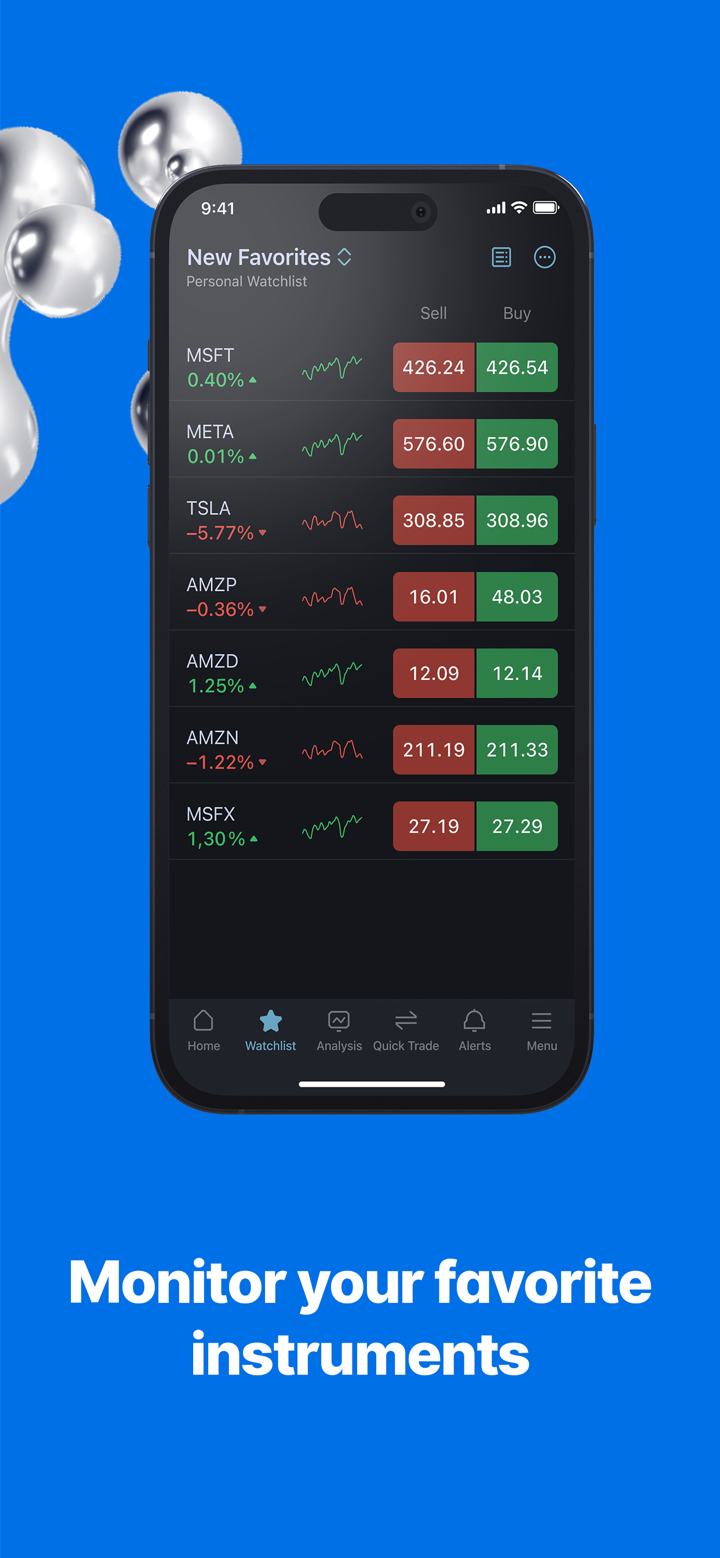

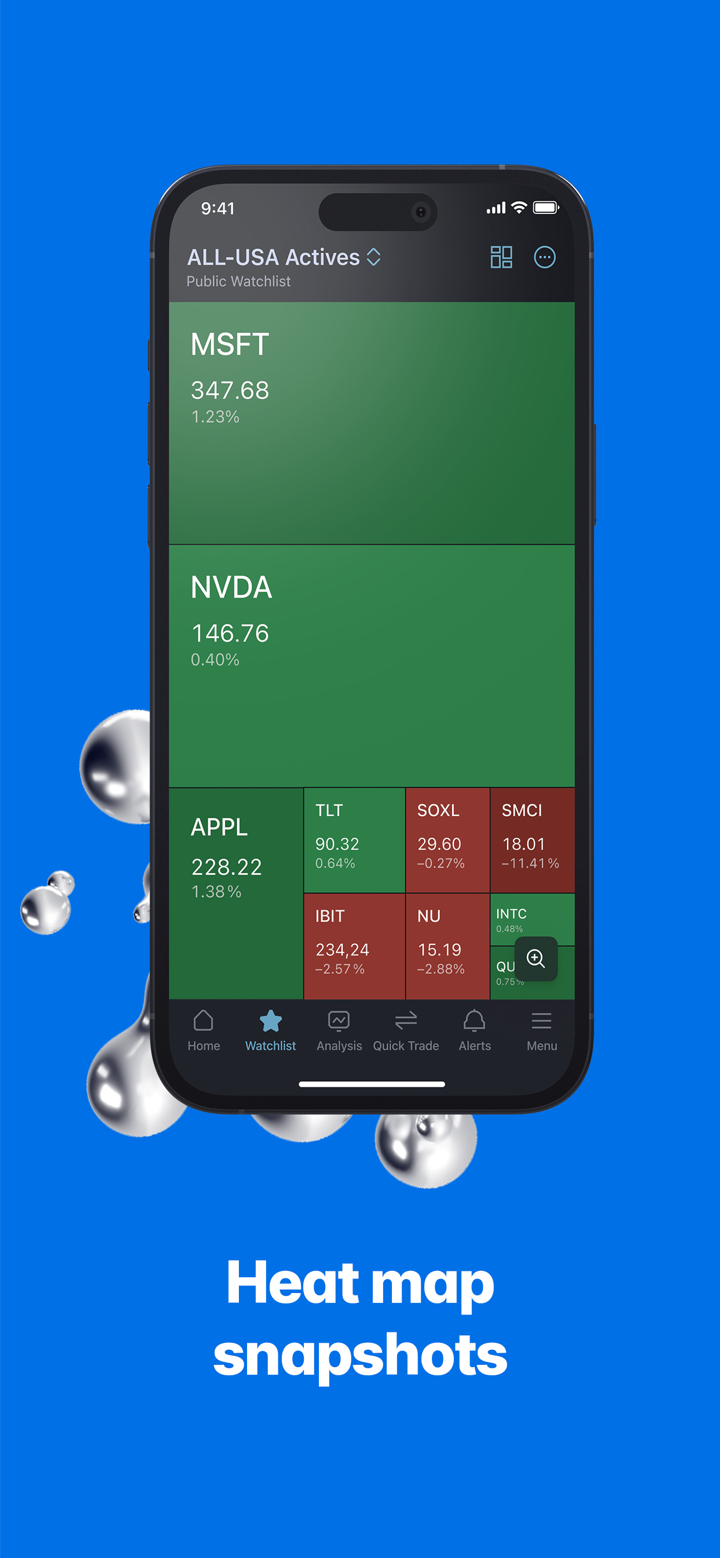

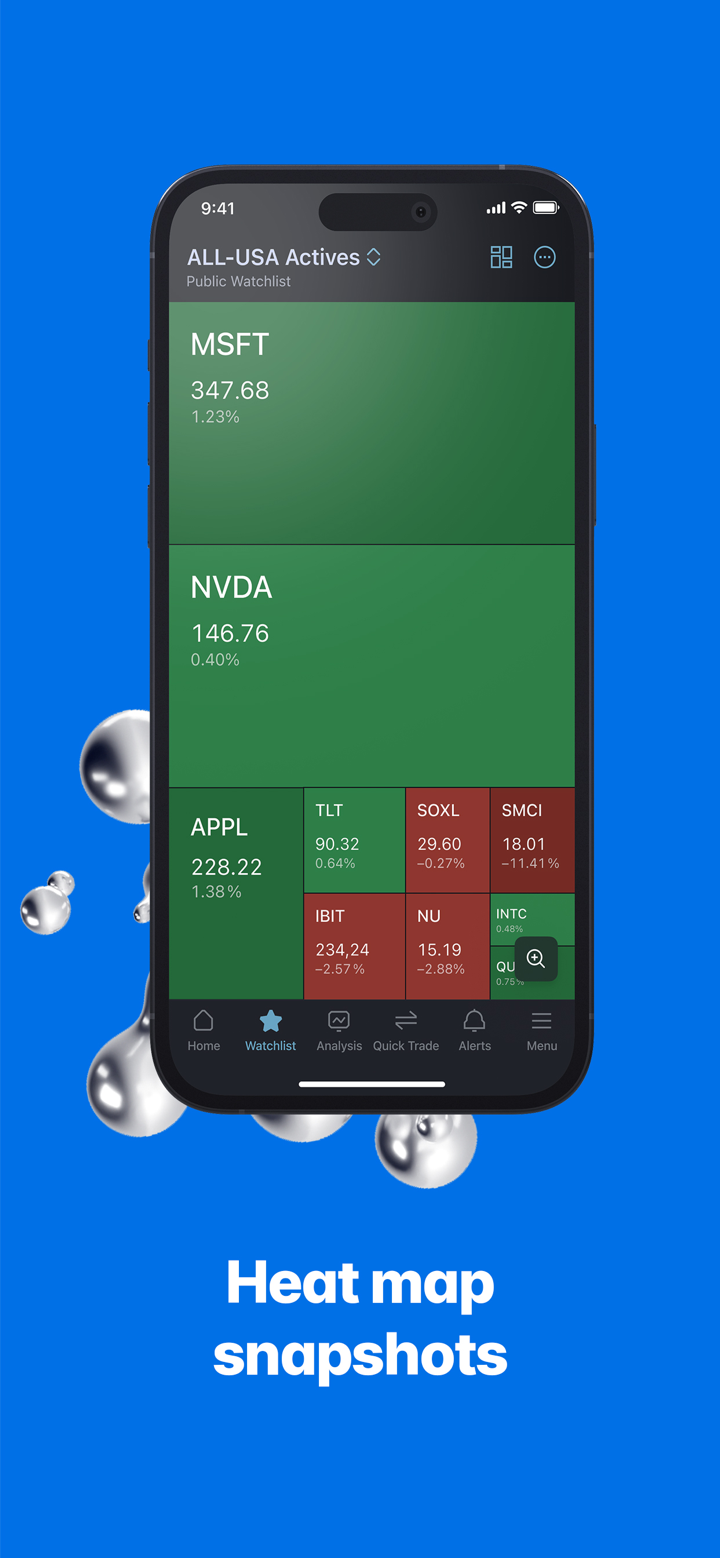

Trive offers a range of trading instruments across several asset classes, making it a diverse trading platform that caters to the needs of many traders.

- Forex: Trive offers traders access to the world's largest and most liquid financial market, the forex market. This allows traders to speculate on the price movements of currency pairs, including major, minor, and exotic currency pairs.

- Stocks: The platform provides access to global equity markets, including those listed on major exchanges. This includes many of the world's most well-known companies, such as Apple, Amazon, and Microsoft.

- Indices: Trive offers traders access to global stock market indices, including the S&P 500, Dow Jones Industrial Average and NASDAQ, among others

- Commodities: Trive also offers traders access to commodity markets, including precious metals such as gold, silver and platinum.

- Cryptocurrency: Trive provides traders with access to cryptocurrency markets, including Bitcoin, Ethereum, Litecoin, and Ripple, among others.

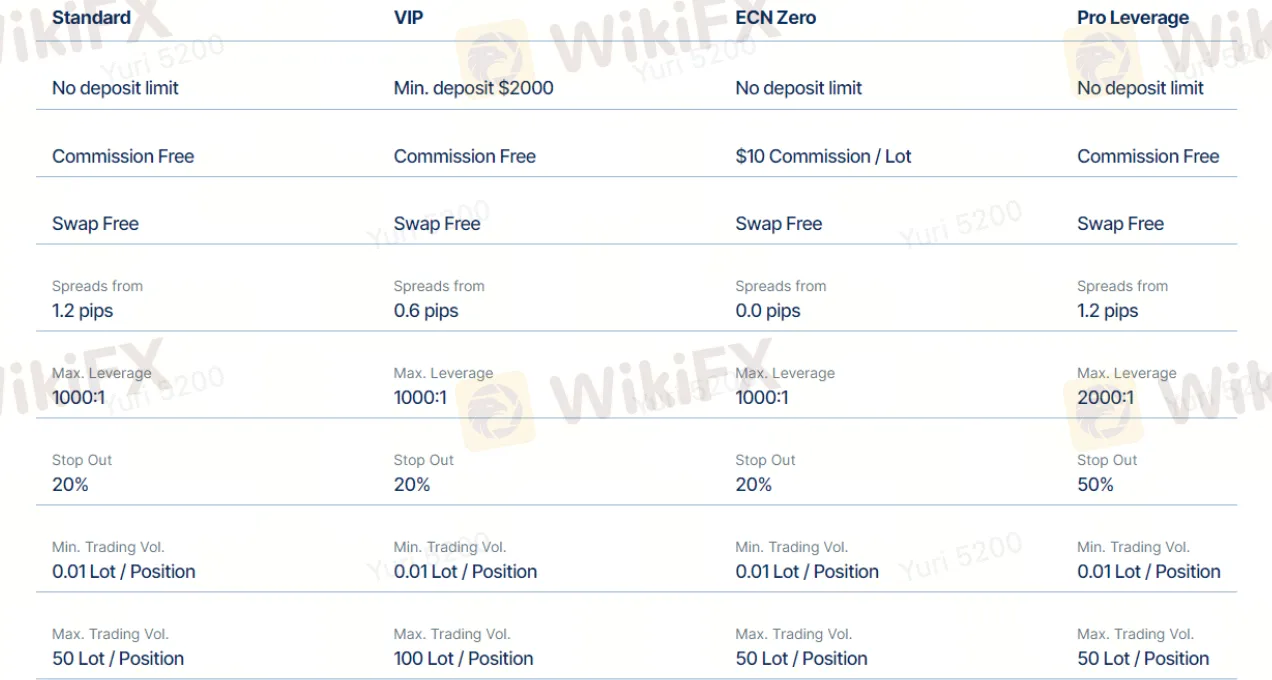

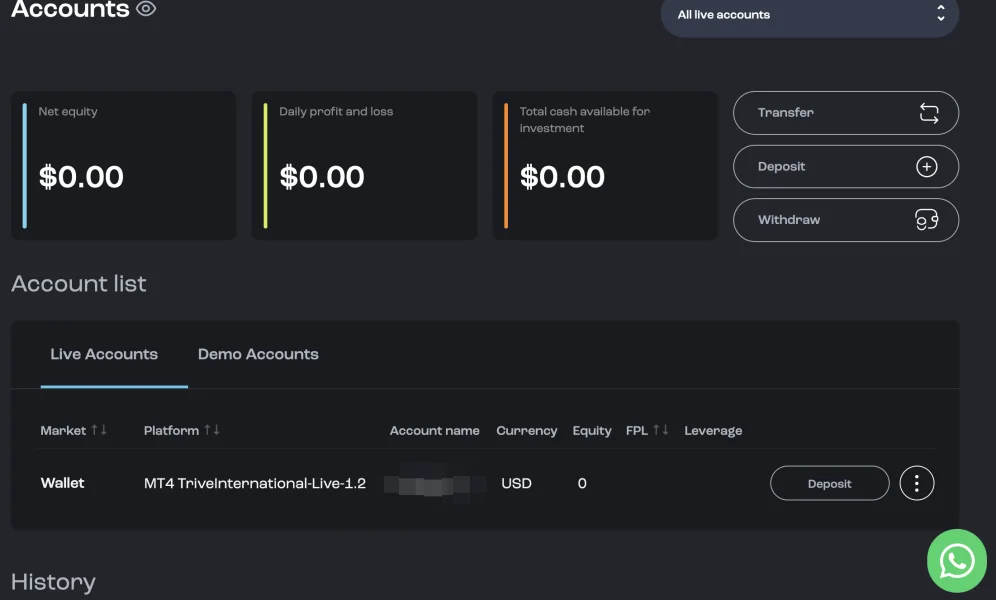

Account Types

Standard Account:

The Standard Account is designed for new traders who are just starting in forex trading. It requires no minimum deposit.

Pro-Leverage Account:

The Pro-Leverage Account is designed for more experienced traders who are looking for a wider range of trading instruments. It requires no minimum deposit

VIP Account:

The VIP Account is designed for advanced traders who are looking for superior trading conditions. It requires a minimum deposit of $2,000 and offers traders access to trading, as well as lower spreads and commissions.

ECN Zero Account:

The ECN Zero Account is designed for high-volume traders who require competitive spreads and faster order execution. It requires no minimum deposit.

The following is a table comparing the features of each account:

| Feature | Standard Account | VIP | ECN Zero | Pro Leverage |

| Trading Varieties | Major, minor, exotic currency pairs, commodities, indices, stocks & cryptocurrency | Major, minor, exotic currency pairs, commodities, indices, stocks & cryptocurrency | Major, minor, exotic currency pairs, commodities, indices, stocks & cryptocurrency | Major, minor, exotic currency pairs, commodities, indices, stocks & cryptocurrency |

| Major Spreads | From 1.2 pips | From 0.6 pips | From 0.0 pips | From 1.2 pips |

| Spread Type | Floating | Floating | Floating | Floating |

| Explosion Rate | 20% | 20% | 20% | 50% |

| Maximum Leverage | 1:1000 | 1:1000 | 1:1000 | 1:2000 |

| Deposit Requirement | No deposit limit | 2000 USD | No deposit limit | No deposit limit |

| Minimum Position | 0.01 lot | 0.01 lot | 0.01 lot | 0.01 lot |

| Scalping Allowed | Allowed | Allowed | Allowed | Allowed |

| EA Trading Allowed | Allowed | Allowed | Allowed | Allowed |

| Locking Allowed | Allowed | Allowed | Allowed | Allowed |

Leverage

Trive offers leverage of up to 1:2000, allowing traders to control larger market positions than their account balance would permit. This can lead to greater returns, as small price movements can yield significant profits. However, it also increases potential losses, risking more than the initial investment.

To manage these risks, Trive advises traders to use leverage responsibly by understanding the associated risks and ensuring they have adequate experience. Traders should avoid over-leveraging and only risk what they can afford to lose. Utilizing risk management tools, like stop-loss orders, is also recommended to limit potential losses.

Spreads & Commissions

Trive offers various spread options for its clients. The Standard and Pro accounts have a spread of 1.2 pips with no additional commission, while the VIP account features a spread of 0.6 pips, also with no commission. Traders pay a fixed spread for each trade, regardless of size.

Additionally, the ECN Zero account offers a spread of 0.0 pips, but incurs a commission fee of $10 per lot traded, catering to those who prioritize tight spreads and are willing to pay for this benefit.

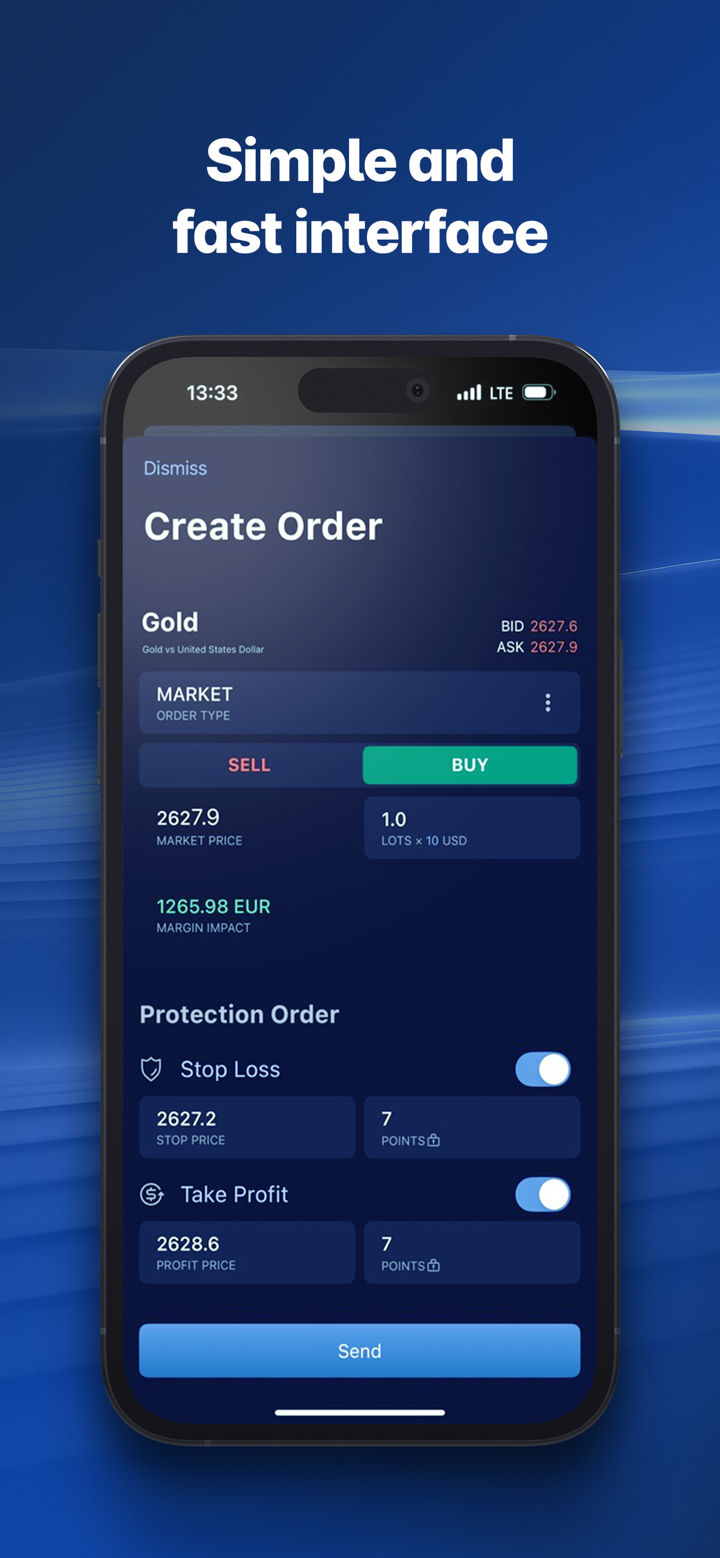

Trading Platforms

Trive provides its clients with the popular trading platforms MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms offer a wide range of features and tools that cater to the needs of different types of traders, from beginners to experienced professionals.

MetaTrader 4 (MT4)

MT4 is a widely recognized and established platform in the forex and CFD trading industry. Trive clients using MT4 can access real-time market quotes, execute trades, and manage their positions with ease. The platform supports various types of orders, including market, pending, and stop orders. Traders can also utilise automated trading strategies with the help of expert advisors (EAs), which can be developed or downloaded from the MetaTrader's extensive library.

MetaTrader 5 (MT5)

MT5 offers an enhanced trading experience, building upon MT4's foundation. Traders using MT5 can access a broader range of financial instruments, including stocks, futures, and options, in addition to forex and CFDs. The platform also offers more advanced charting tools and technical indicators, enabling traders to perform in-depth market analysis. MT5 introduces a revised MQL programming language, allowing for more efficient development and customization of indicators and trading robots.

Deposits & Withdrawals

Trive prioritises client satisfaction by offering a variety of convenient and secure deposit and withdrawal methods that ensure seamless transactions. Clients can effortlessly fund their trading accounts via diverse payment options including credit cards and debit cards (such as Visa and MasterCard), electronic payment systems (Alipay, E-CNY, Neteller, Skrill, Sticpay, AstroPay, Perfect Money), international bank transfer (SWIFT) for USD, EUR, GBP available while local transfers for INR,

CNY, THB, VND, KRW, ZAR, PHP available, and digital assets (Tether - ERC20, TRC20, and BinancePay).

Importantly, there are no deposit fees associated with any of these funding options, enhancing overall client experience. Each funding option supports different currencies - credit cards accommodate all famous currencies, e-payments cater to USD and EUR, local bank transfers are available for INR, CNY, THB, VND, KRW, PHP and TWD, while Tether supports ERC20, TRC20, and BinancePay.

Here is the table that includes the detailed information on deposit and withdrawal methods:

| Deposit & Withdrawal Method | Handling Fee | Deposit Rate | Minimum Deposit | Withdrawal Process Time | Supported Currencies |

| Local Bank Transfer | 0 | Market rate | Depends on region | 1 business day (may take up to 2-3 business days) | INR, CNY, THB, VND, KRW, ZAR, PHP |

| International Bank Transfer (SWIFT) | 0 | Market rate | 300 | 2-5 business days | USD, EUR, GBP |

| Electronic Payment Systems | 0 | Market rate | 10 | 1 business day | USD, EUR |

| E-Wallet - AliPay | 0 | Market rate | 150 | N/A | USD, CNY |

| E-Wallet - DC/EP | 0 | Market rate | 15 | 1 business day | USD, EUR |

| Cryptocurrency | 0 | Market rate | 5 | 1 business day | USDT ERC20, USDT TRC20 |

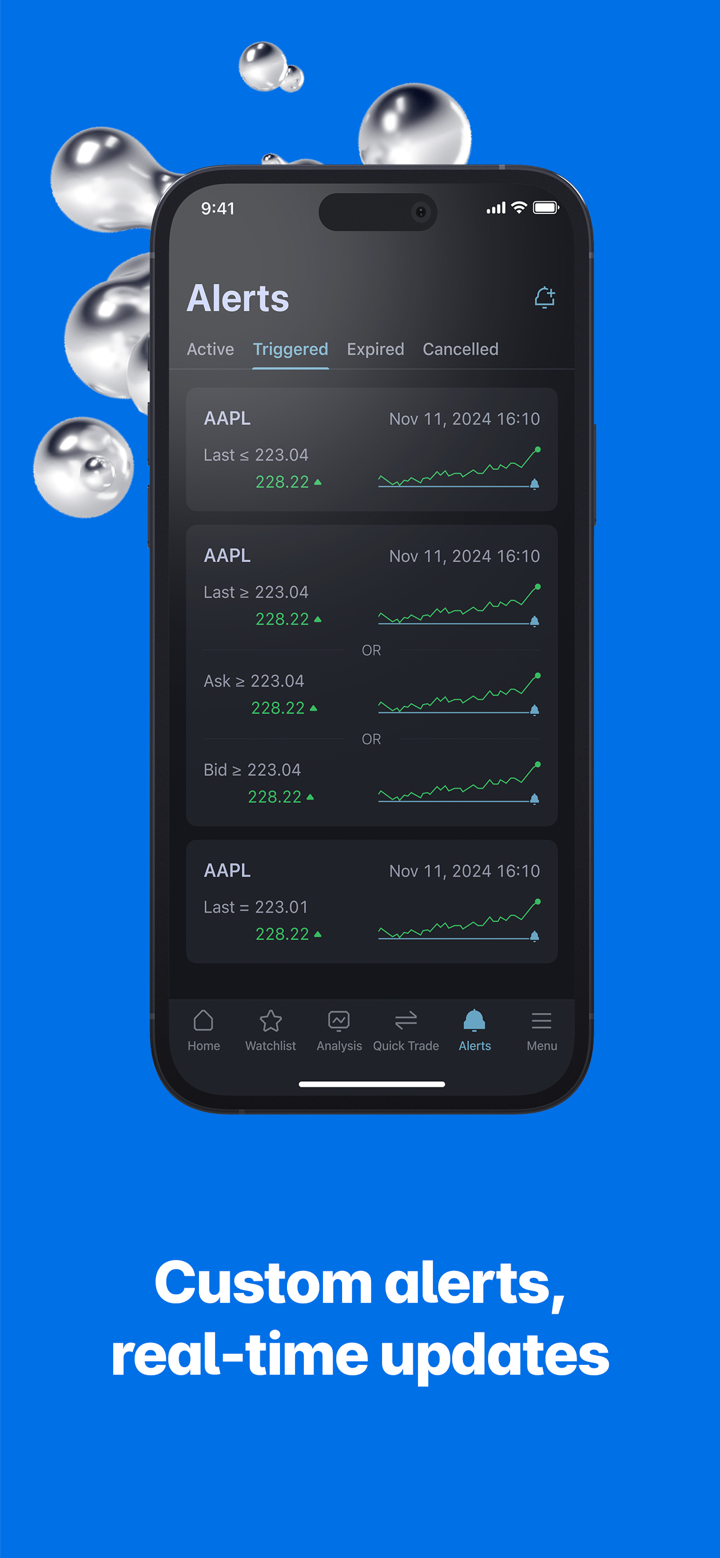

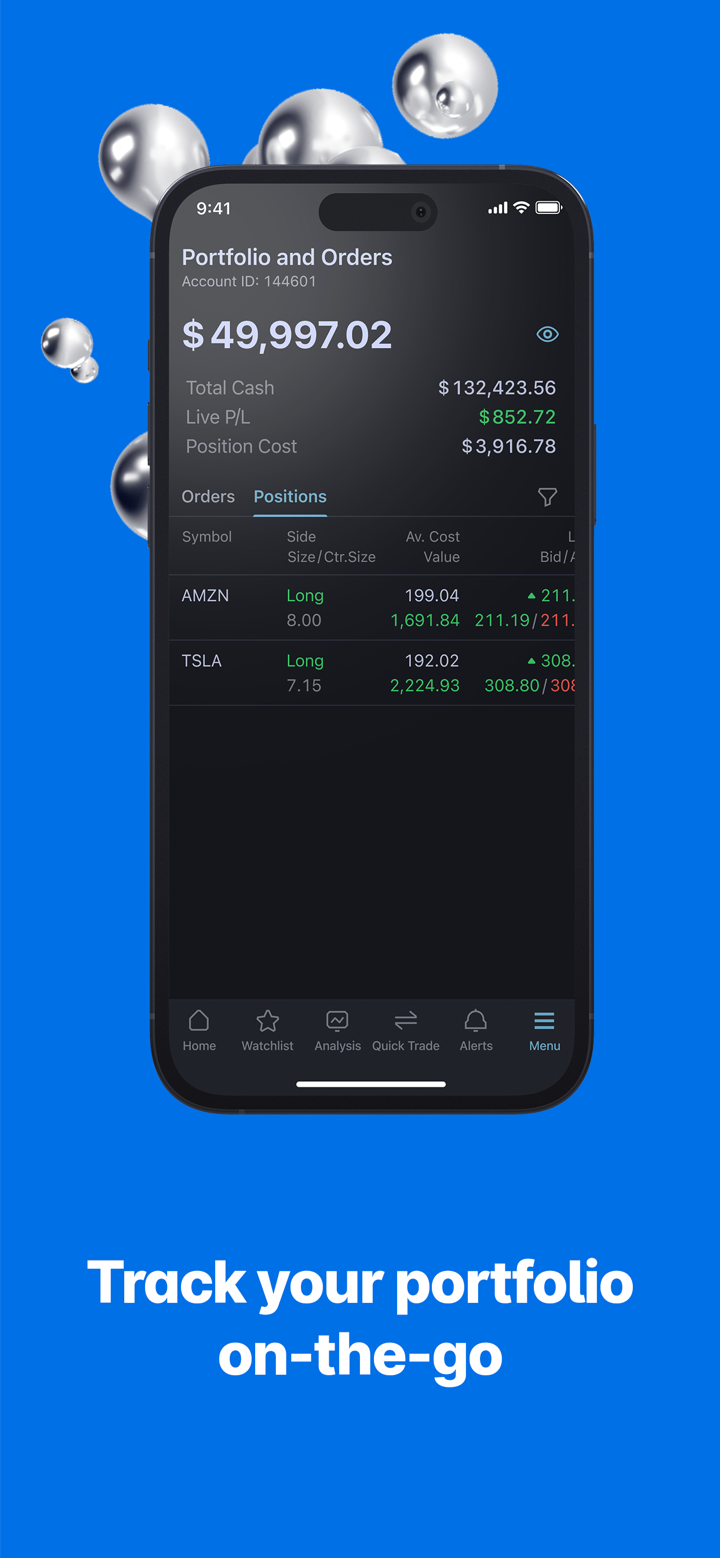

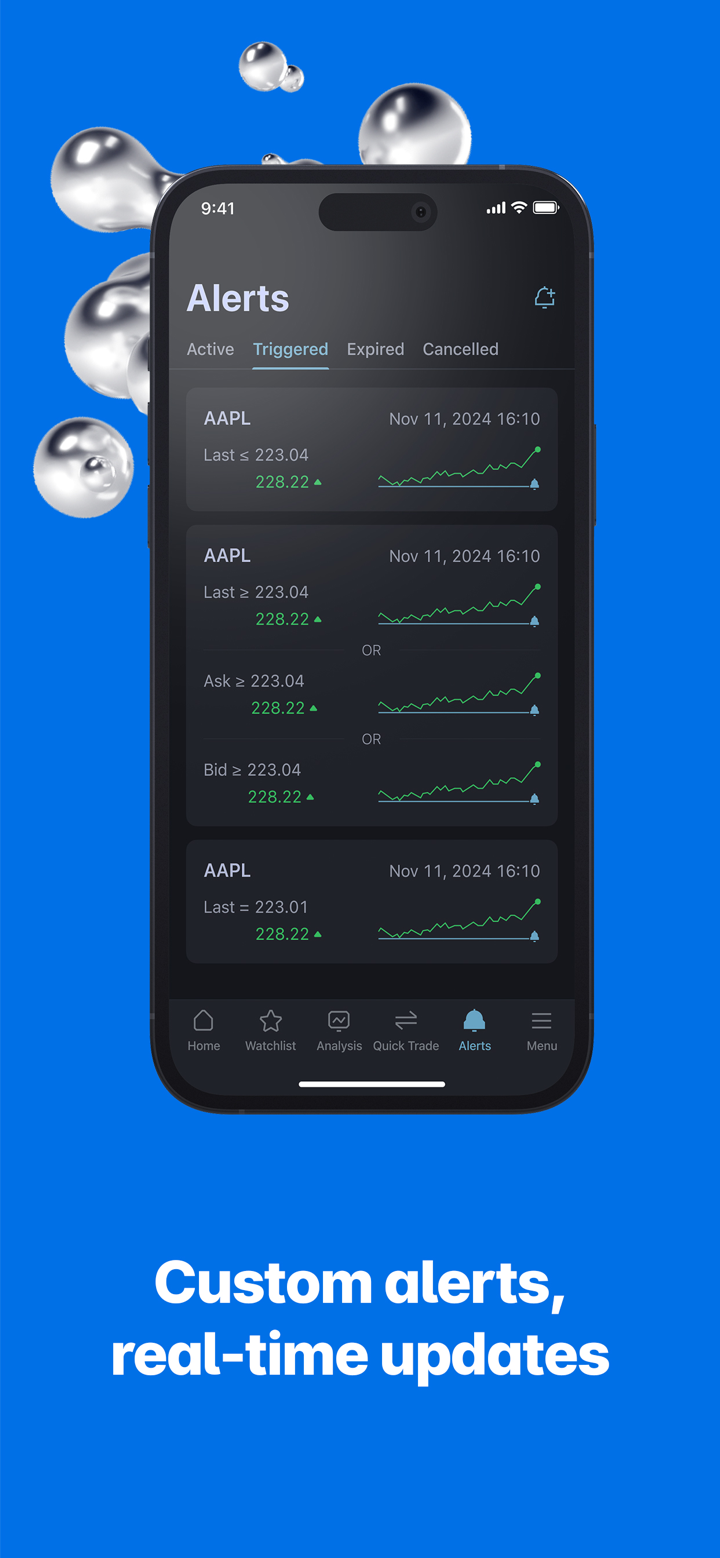

Trading Central

Trading Central is accessible to all Trive customers with a live account, offering valuable insights and analysis. Simply log in to your secure client area and click the analysis tab. From there, you can seamlessly log in to view the latest market feed, expert analysis, and cutting-edge research tailored to your needs.

Additionally, TC Alpha Generation Indicators are available for download as a plugin, enabling installation directly onto your MetaTrader platform for enhanced trading capabilities.

Trive offers economic calenders as well to all traders. This ensures proper information is reached to traders in a timely and accurate manner.

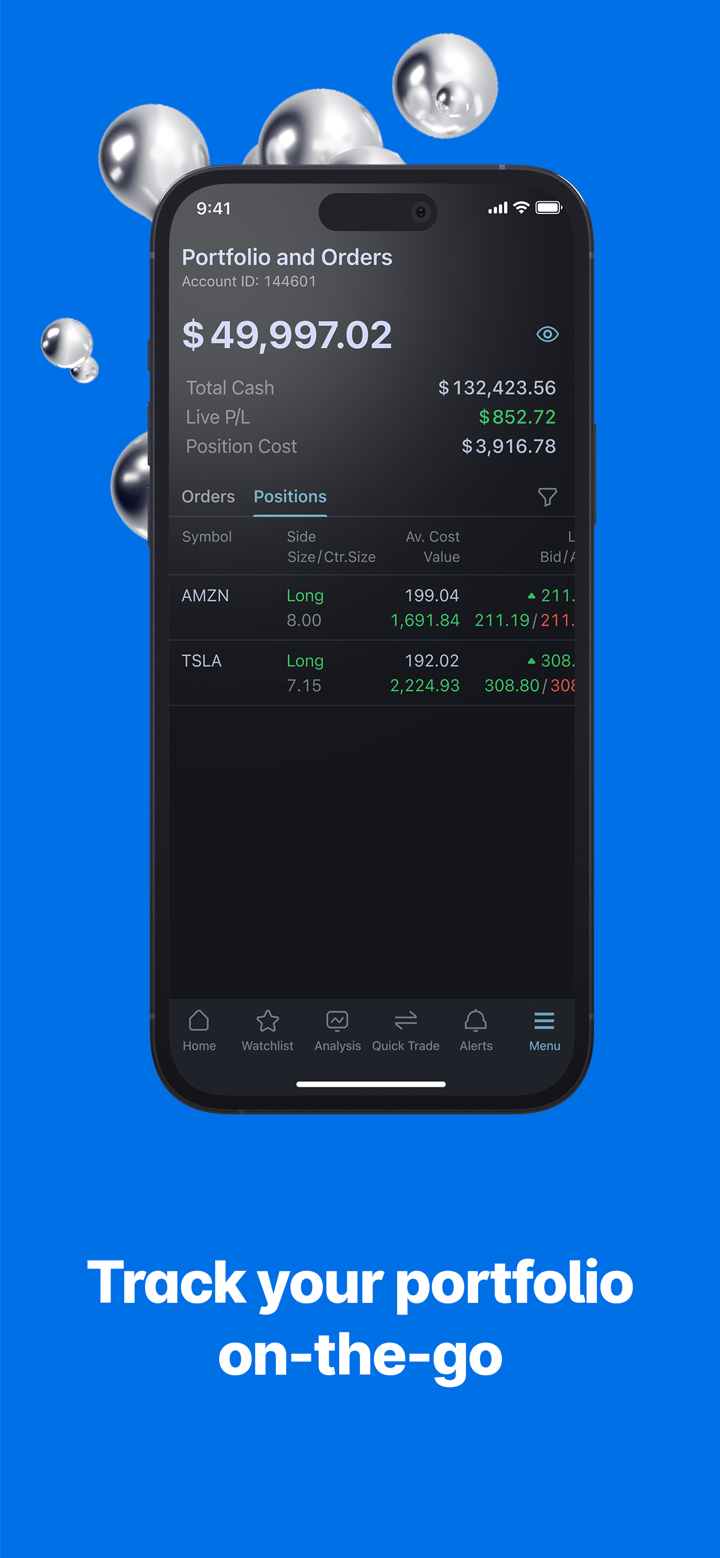

Trive PAMM

Trive PAMM Service is an investment solution that enables traders of all levels to collaborate and take advantage of market opportunities. Our service empowers you to trade alongside experienced money managers (Masters) with verified track records. You can choose a Master whose investing strategy aligns with your goals. If you join us as a Master, you can attract followers who invest in your trading expertise and monetize your strategies with performance fees.

Trive MAM

Trive offers Multi Account Manager (MAM) for substitute fund and account management.

A MAM account allows all ordinary order types to be simultaneously executed, securely across multiple accounts from just one master account. Our MAM technology lets you allocate your trades in five different modules.

Trive HUB

Explore our comprehensive financial education platform, where market insights, expert guidance, and premium content come together to shape your investment journey. Whether it's stocks, currencies, or cryptocurrencies that pique your interest, we provide the knowledge you need to make informed decisions.

Promotions Available

(Hold for Now)

Become a partner (IB)

Join Trive's partner program today for a rewarding affiliate experience with the highest payouts and a globally regulated broker.

Partners have the power to set their contracts with unprecedented flexibility to meet unique business needs. Define every aspect of your contracts - markup, rates, and more - based on your business model. Customize in just a few clicks, making it easier than ever to adapt to market and client demands.

By joining our competition-beating affiliate program, you can earn attractive commissions, revenue for promoting our offers in a variety of ways: website promotions, emails, social media campaigns, and more!

Frequently asked questions about Trive

Is Trive a regulated company?

Yes, Trive is regulated by multiple agencies such as FINRA, ASIC, MFSA, MNB, CMB, BAPPEBTI, FSCA, Mauritius FSC, BVI FSC.

What are the account types offered by Trive?

Trive offers four account types: Standard Account, VIP Account, ECN Zero, Pro Leverage Account.

What is the minimum deposit required to open a Trive account?

There is no minimum deposit for Standard Account, ECN Zero, and Pro Leverage Account. Meanwhile for VIP account a minimum deposit of $2000 is required.

What trading platforms does Trive offer?

Trive offers the most popular trading platforms in the industry: MT4 and MT5.

What is the maximum leverage offered by Trive?

The maximum leverage offered by Trive is 1:2000.

Does Trive offer a demo account?

Yes, Trive offers a demo account for clients to practice without risking their own money.

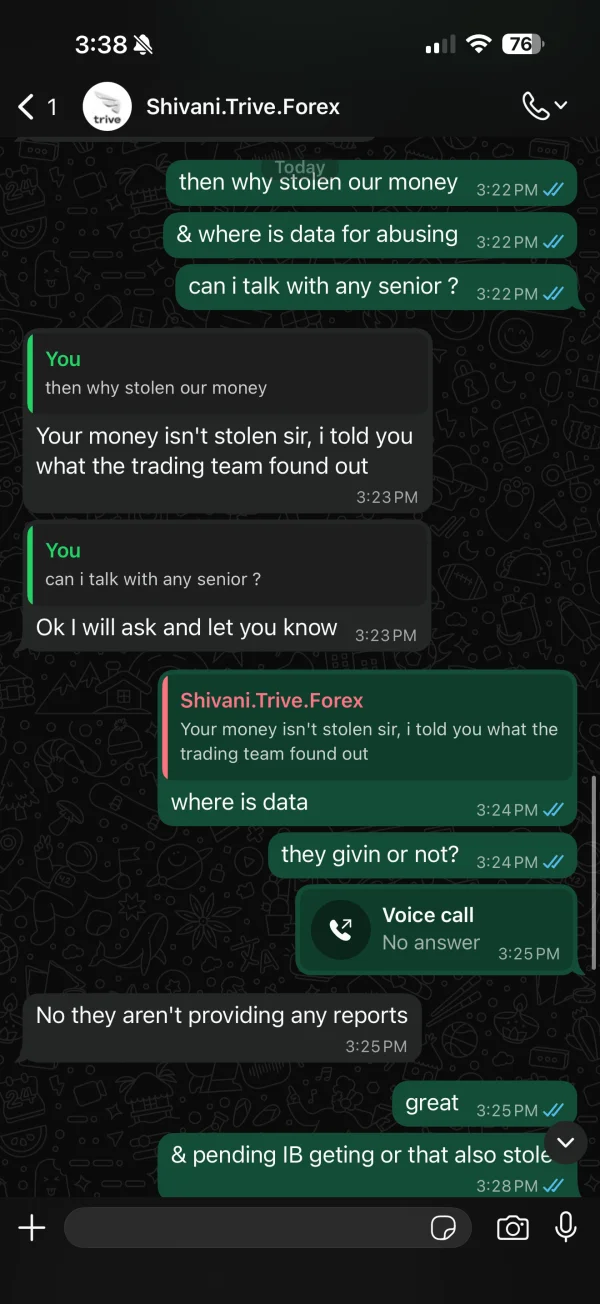

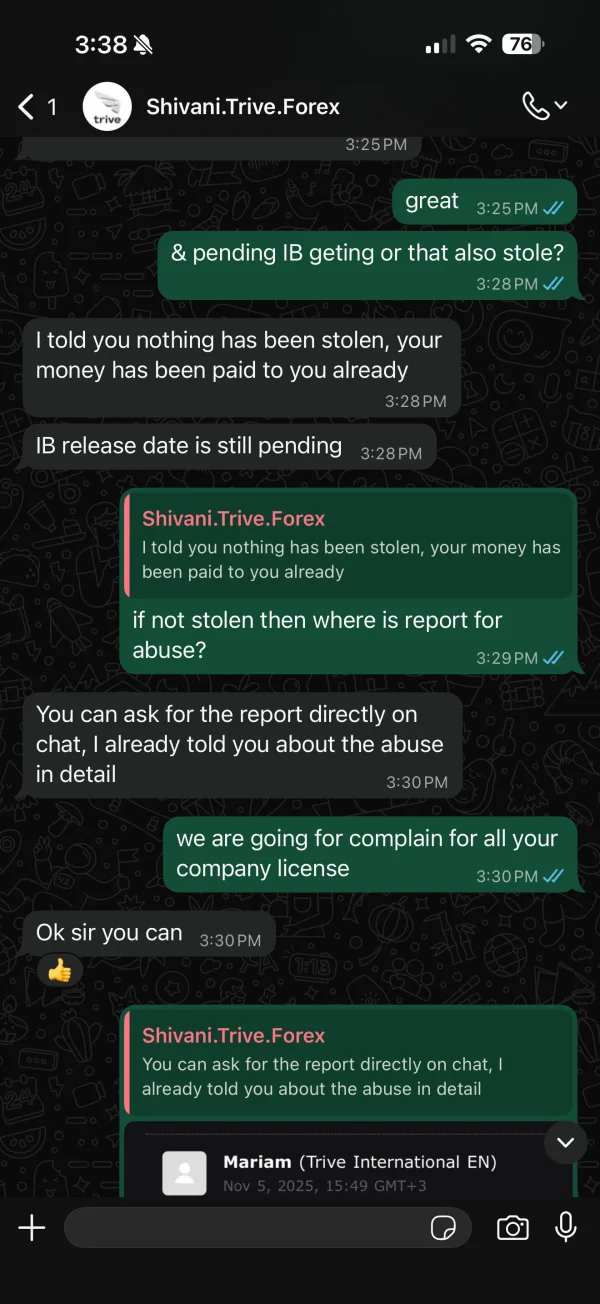

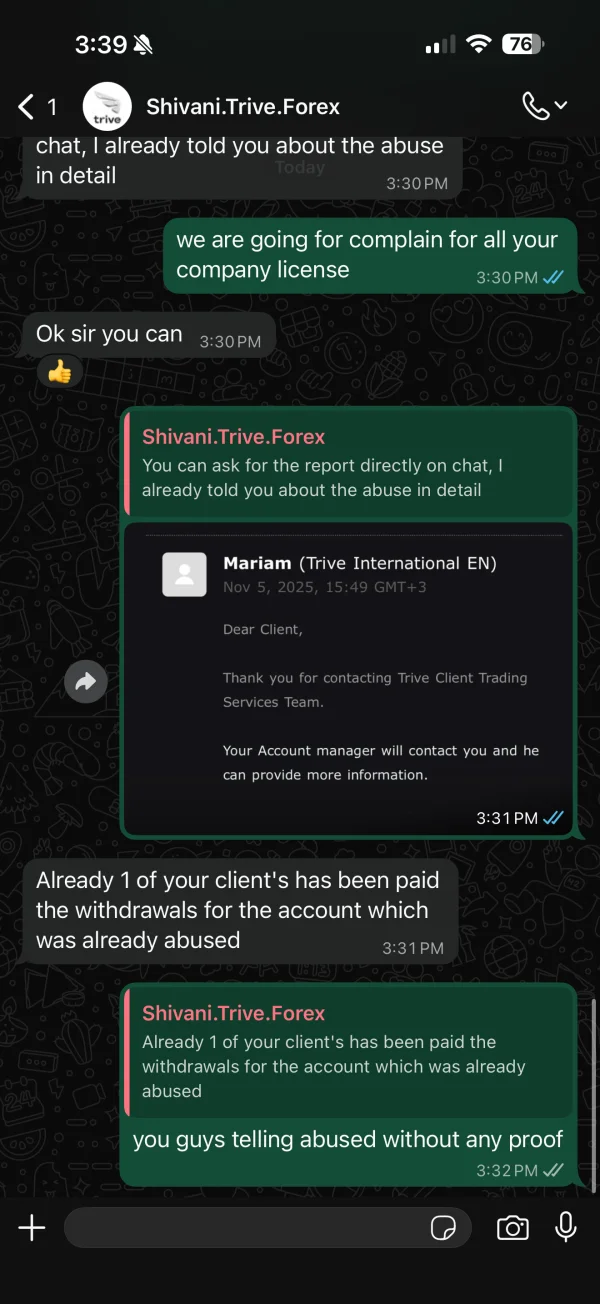

Hilesh Mangroliya

India

This Broker is stole clients money if you do profit then not givin & tell abuse if you ask for abuse details the told we cant give they stole my almost 5000$ so avoid this broker

Exposure

FX3963315941

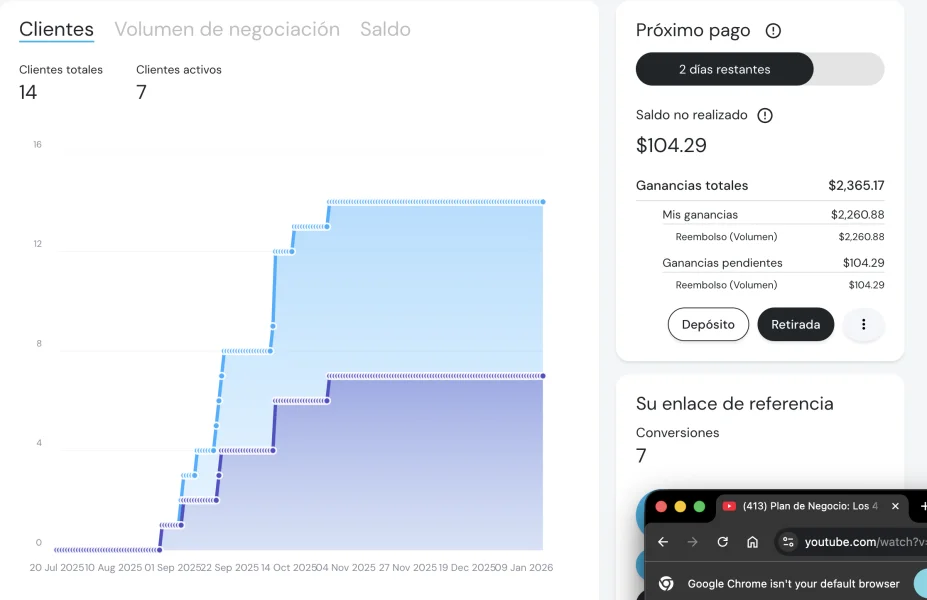

Mexico

Yo soy cliente de Trive desde agosto, dejé de operar con ellos por los siguientes motivos: 1. A los trabajadores no les empezaron a pagar, eso lo se porque mi asesor de cuentas me lo comentó (les deben 3 meses de sueldo) 2. Los 104.29 USD que se muestran en la imagen, me los debieron de haber pagado desde octubre que fue cuando dejé de ser cliente de Trive, pero no lo hicieron, en soporte ya no me contestan 3. Supe que tuvieron un problema con la regulación FINRA, entonces además de estafadores, mediocres en su gestión interna para regulación

Exposure

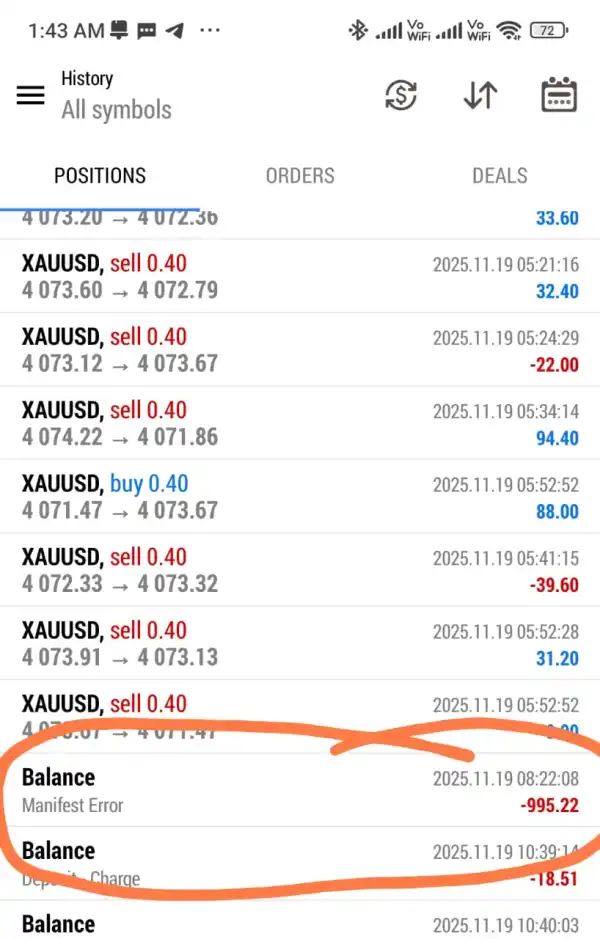

柠467

Hong Kong

This platform is completely useless—it only lets you lose money. If you make a profit, they deduct it.

Exposure

FX1265224118

India

Trive Broker is stole clients money if you do profit then not givin & tell abuse if you ask for abuse details the told we cant give they stole my almost 955$ so avoid this broker & dont use

Exposure

FX1247187896

Hong Kong

Don't withdraw profits, everyone. Stay away from this platform.

Exposure

白日见鬼

Hong Kong

The so-called bonus offered by this platform is fake, they can closeout your orders at any time. Don't be fooled by their high rating! It's a complete scam platform.

Exposure

FX2155944359

Hong Kong

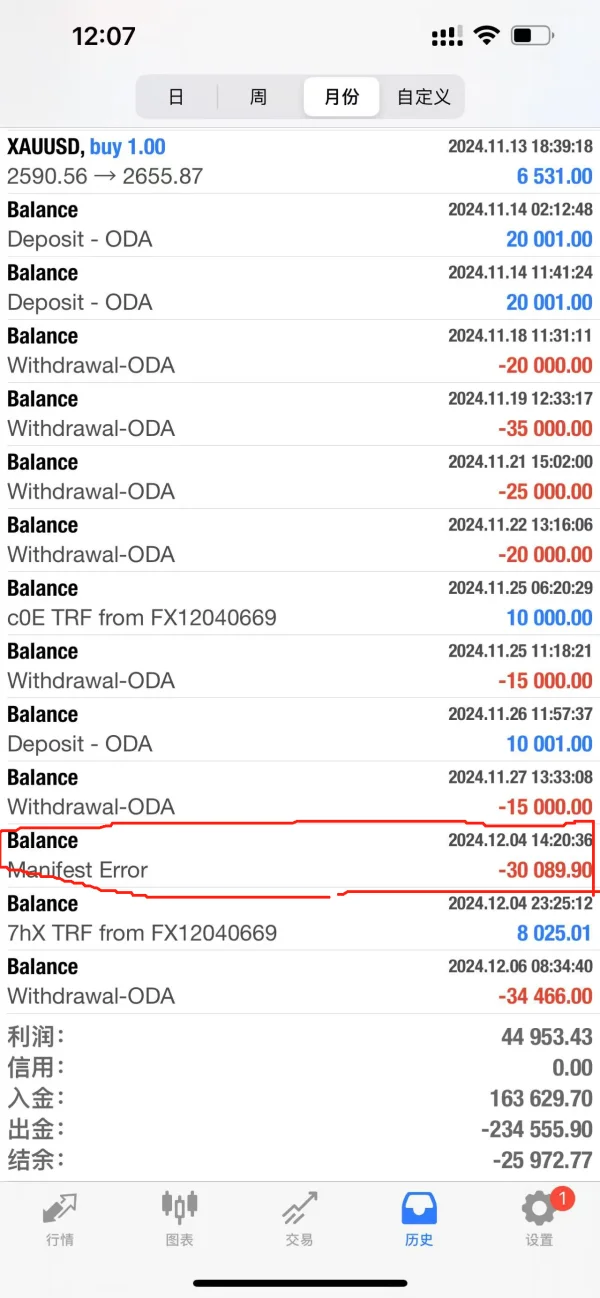

My trading account 12039937 was allowed a swap-free status through an application approved by your company, and the trading method was also agreed upon by you. All transactions were conducted with your company's agreement and approval. I engaged in trading on the Tive platform only after Tive sales representatives came to China and assured me that my funds would be 100% safe and that I could open a swap-free account. Later, when I attempted to withdraw funds, the platform's risk control department retrospectively charged me an overnight fee of $30,089.90 after the fact, which is completely unreasonable and constitutes fraudulent behavior. This also shows that the Tive platform does not support swap-free accounts. My request is simple: return the deducted funds totaling $30,089.90 to me.

Exposure

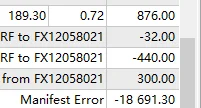

FX1919911516陈博

Hong Kong

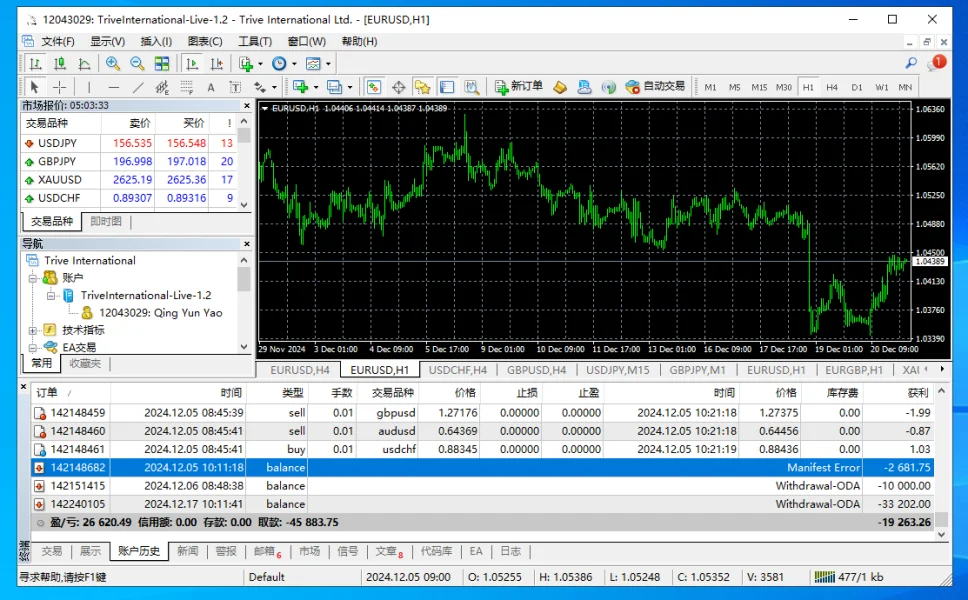

My name is Yao Qingyun, MT4 account number: 12043029. On December 5, 2024, the platform deducted $2681.75 from my account without any reason. I did not request a withdrawal, but the funds were directly taken by the backend, and I have not received them to this day. Realizing something was amiss, I applied for a withdrawal of the remaining funds on December 6, which was not processed. I contacted online customer service daily, and they kept saying it was being processed, but the funds never arrived until December 17 when I told customer service that I intended to file a complaint. Only then were the funds credited to my account. This platform is unreliable. I hope all fellow traders take caution and avoid falling into this trap.

Exposure

FX2230392857

Hong Kong

My name is Wu Siyu. In October 2024, I opened an account and started trading on the TRIVE platform, introduced by a salesperson, with the account number: 12042547. Initially, due to incorrect market predictions, my account suffered losses, and I continued depositing funds to prevent the account from being liquidated. Midway through trading, there were both losses and gains, and all transactions including deposits and withdrawals were normal (at this time, the account was at a loss overall, with deposits exceeding withdrawals). Later, as market conditions turned favorable, my account shifted from a loss to a profit. At this point when I applied for profit withdrawal, the platform unreasonably froze my account and did not process the withdrawal. Subsequent negotiations were fruitless, and the platform directly deducted $18,698.72 from my account. I am determined to expose TRIVE's unreasonable actions and warn all users to stay away from this scam platform that only allows losses but not profits. Let's drive these types of platforms out of the market. I hope regulatory bodies and media will urge this platform to return my $18,698.72. Thank you! Let's resolutely resist scam platforms and start by informing our friends.

Exposure

FX1732420093

Hong Kong

My name is Xie Huaying, and my account is dpplwwv885bbg@163.com with login ID: 12042774. In 2024, I was introduced by a salesperson to open an account and trade on the TRIVE platform (https://www.trive-cn.com/). I continued trading on this platform for a month. Initially, due to misjudgments about market trends, my account incurred losses. I kept depositing funds to prevent the account from being liquidated. Midway through, both my opening and closing positions had losses and gains, and all transactions including deposits and withdrawals were normal (at this time, the account was at a loss overall, with deposits exceeding withdrawals). Later on, as the market moved in a favorable direction and my account shifted from a loss to a profit, I applied for a profit withdrawal. The platform then froze my account control. Subsequent negotiations were fruitless, and they directly deducted $5,951.26 from my account. I am determined to expose TRIVE's unreasonable actions and warn all traders to stay away from this scam platform that only allows losses but not profits. Let's drive these types of platforms out of the market that exploit users' positions and prevent them from profiting.

Exposure

FX2230392857

Hong Kong

My name is Wu Siyu. In October 2024, I opened an account on the TRIVE platform and started trading through an introduction by a salesperson. My account number is 12042547. Initially, due to misjudgments about market trends, my account suffered losses. I continued to deposit funds to prevent the account from being liquidated. Midway through, both my opening and closing positions had losses and gains, and all transactions including deposits and withdrawals were normal (at this time, the account was at a loss overall, with deposits exceeding withdrawals). Later on, as the market moved in a favorable direction, my account shifted from a loss to a profit. When I applied for a profit withdrawal, the platform unreasonably froze my account and did not process the withdrawal. Subsequent negotiations were fruitless, and the platform directly deducted $18,698.72 from my account. I am determined to expose TRIVE's unreasonable actions and warn all users to stay away from this scam platform that only allows losses but not profits. I hope regulatory bodies and media will urge this platform to return my $18,698.72. Thank you! I firmly oppose such scam platforms and encourage everyone to start by informing their friends.

Exposure

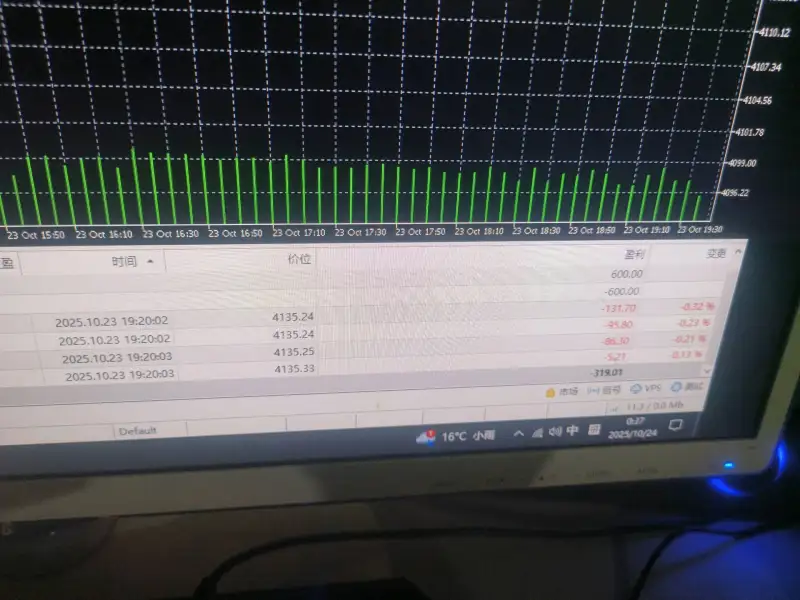

职业外汇交易

Hong Kong

Trading accounts: 12041737, 12042491, 12041740, all using the same trading strategy. Among them, account 12041737 is in a loss, and the withdrawal has been approved, which means you acknowledge that the trading method is reasonable and compliant. Account 12042491 is profitable, but full withdrawal is not allowed. Since you acknowledge the rationality and compliance of the trading method, it is unreasonable to deduct a profit of $11,318. Account 12041740 is even more excessive. The remaining $6,902 was directly deducted and not allowed for withdrawal, which is very unreasonable. The interest-free condition was approved by your company, and the trading method was also agreed upon by you. All the trades were conducted with your company's consent and recognition. It is truly unbelievable to deduct all the profits. It can only be said that the risk control department of your company is very incompetent, disregarding the interests of customers and the reputation of the company, and engaging in such shameful behavior within the industry. If the risk control department continues to deduct profits in this way, it can only indicate that your company only allows customers to incur losses and does not allow customers to make profits. As long as there is profit, customers are not allowed to withdraw in full, otherwise it will be deducted. This is how you treat B-Book customers, and it also shows that your risk control department is too weak and has not placed customers in the A-book, causing customers to bear the losses, which is obviously unreasonable. It is inevitable for losing accounts to withdraw normally, which means acknowledging that the trading method is reasonable. The profits of these two profitable accounts were directly deducted, indicating that this platform does not support profitability. My request is simple, return the deducted funds to me!

Exposure

FX9999606257

Hong Kong

On September 28th, TRIVE transferred all of my $2155 funds without any reason. My agent account was also transferred $373. Now both my fund account and agent account have a balance of 0. There was no notification, I don't know if they have run away? I strongly demand that TRIVE return all of my funds, provide an explanation, and apologize! Contact number: 18937190669, email: 18937190669@189.CN

Exposure

omar9326

Syria

be carful.. dont invest with TRIVE.. you will not withdrawal your money i asked the support more than 6 times.. same answer .. wait

Exposure

只是一个简单的事

Malaysia

Platform accounts are free to choose the type of account

Positive

Chris Low 刘

Malaysia

The trading spreads and commission rebates are good, and withdrawals are also credited on the same day.

Positive

FX1698907698

Pakistan

My primary suggestion for improvement is related to the browser-based trading software. As a Linux user, I find that while the flash-based browser software functions adequately, it becomes quite resource-intensive when multiple charts are opened in separate windows.

Neutral

Liam Wilson

New Zealand

Everything's clear and easy to find.❣️❣️❣️ Plus, the performance tab gives you all the data you need. And let's not forget the awesome web terminal – entering and exiting trades is a snap.

Positive

LYM

United States

I have to say I'm quite disappointed with Trive. The search results are often inconsistent and sometimes irrelevant to the queries I input. The user interface feels a bit outdated and clunky, making it less intuitive to navigate. Additionally, I've encountered some technical glitches that have hindered my user experience. Overall, I expected more from Trive, and I'm currently exploring other options for my research needs.

Neutral

Una丶Daddy

Peru

I absolutely love using Trive! The platform provides me with insightful and reliable information, making my research process incredibly efficient. The user-friendly interface and comprehensive search features make it a go-to tool for finding accurate and relevant data. Trive has definitely enhanced my overall experience in gathering information, and I highly recommend it to anyone seeking a reliable research companion.

Neutral

yanzhixulei

Malaysia

Available trading platforms: Provide a variety of trading platforms, including WebTrader, MT4, MT5, etc., which have stability, ease of use and security. Supported stock market: It covers a number of stock markets in the world, including the United States, Canada, the United Kingdom and other markets, providing investors with diversified investment choices. Customer Service: Provide 24 hour customer support through a variety of means including phone, mail and live chat. Overall, Trive is a trust

Positive

yanzhixulei

Malaysia

Trive is a well-regulated and reliable stockbroker. Regulatory status: Trive is certified and authorised by the Malta Financial Services Authority (MFSA) regulatory body in Malta and its clients' funds are secured. Commissions and fees: Commissions and fees in stock trading are more transparent. Commissions, transaction fees and interest fees are usually charged, and the commission level is relatively low.

Positive

土地爷

Venezuela

I can't understand the content of this website... It's okay if you don't have Spanish, but there's no English. Maybe only local residents can "enjoy" this company.

Positive