Company Summary

| Bell PotterReview Summary | |

| Registered On | Above 20 years |

| Registered Country/Region | Australia |

| Regulation | Regulated |

| Market Instruments | Stocks, Derivatives, Funds & Fixed Income, and Others |

| Trading Platform | Bell Potter Client |

| Customer Support | 1300 023 557 |

| Twitter, Facebook, LinkedIn, YouTube | |

Bell Potter Information

Bell Potter is a leading full-service stockbroking and financial advisory firm in Australia, owned by Bell Financial Group (BFG.ASX). It serves individual investors, corporate, and institutional clients, offering services such as Australian/international stockbroking, fixed income, superannuation planning, corporate financing (e.g., IPOs, mergers, and acquisitions), and research analysis. The firm supports client investments through its global network.

Pros and Cons

| Pros | Cons |

| Regulated | Unclear service thresholds |

| Full-service coverage | Average fee transparency |

| Limited international market coverage |

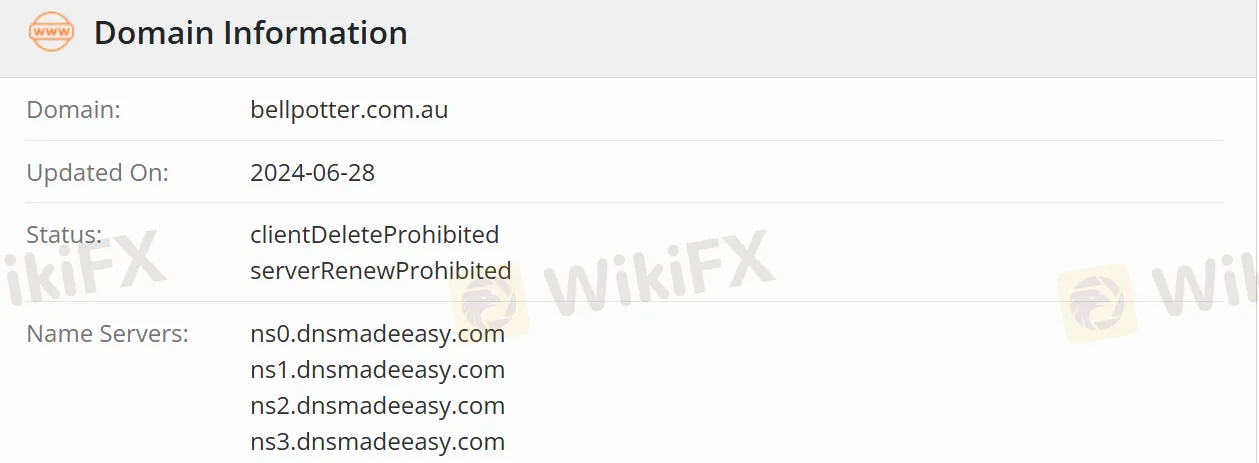

Is Bell Potter Legit?

Bell Potter is a holder of the Australian Financial Services License (AFSL), owned by the listed company Bell Financial Group, and regulated by the Australian Securities and Investments Commission (ASIC), with the license number 000243480.

What Can I Trade in Bell Potter?

| Trading Instruments | Specific Types/Descriptions |

| Stocks | Australian stocks (listed on ASX), International stocks |

| Derivatives | WarrantsFutures (requires guidance from an accredited derivatives specialist) |

| Funds and Fixed Income | LICs, ETFs, Fixed income products (bonds, hybrid securities), Superannuation products |

| Others | Forex trading, Gearing, and mFunds |

Account Type

According to the official website, Bell Potter offers the following account types:

Personal Investment Account: Suitable for individual investors, supporting trading in Australian shares, international stocks, ETFs, etc., and can be paired with superannuation planning services.

Corporate Account: Tailored for corporate clients, providing services such as IPOs, equity financing, and merger & acquisition consulting, requiring customized applications.

Institutional Account: Designed for fund companies and asset management institutions, offering trade execution, research coordination, and Corporate Access services.

Intermediary Services Account: Specifically designed for financial planners, enabling client-based trading on behalf of clients, along with research support and customized seminars.

Trading Platform

Investors can access the Bell Potter Client Access portal via the web to view real-time information such as portfolio valuations. Additionally, third-party platform integration supports electronic settlement through the CHESS system, enabling unified management of holdings with other ASX-traded assets.

Deposit and Withdrawal

Deposit is supported via bank transfer (AUD and foreign currency accounts). Withdrawal is returned to the bound bank account via the original route, and an application needs to be submitted through the account backend. AUD transactions typically arrive within 1-2 business days, while international transfers may be extended to 3-5 business days.

The primary currency is AUD, and international transactions require conversion to local currency (foreign exchange conversion fees apply).

dd4516

Cambodia

SoonTrade5 trading software is very convenient

Positive

HxIn

Cyprus

Good company and good service. My trading experience is good. Deposit takes no time at all, but withdrawal takes too much time for me.

Positive

阳谷电缆

Colombia

I really like the MT4 platform provided by bellpotter. It makes sense that MT4 is so popular as it is feature rich and easy to use.

Positive

FX1024642656

Hong Kong

Bell Potter seems to be trustworthy, but i havent decided whether to invest with them. The minimum initial capital is quite attractive for me. Only invest 5 dollars, then i can have a chance to make money. The other thing that appeals to me is that the broker supports PayPal payments, while other most brokers, at least at my opinion, very few of them offer. However...i also read from their website that withdrawals usually require 7 days to appear in my account, so i hesitate..yeah..i also need s

Positive

...61405

Hong Kong

SSSSO EASY TO GET STARTED! I JUST OPEN MY ACCOUNT WITH 5 DOLLARS! GOOD LUCK FOR ME GUYS!

Positive

你好99363

Hong Kong

I need to say, this broker asks for a small initial capiatal, which is a good part. However, you should also notice that inactivity fee is what you need to pay. I would say, maybe you can consider this company to help you make some financial desicisions.

Positive