Company Summary

| Cerus Markets Review Summary | |

| Founded | 2022 |

| Headquarters | Malaysia |

| Regulation | Labuan Financial Service Authority (LFSA) |

| Market Instruments | 200+, forex, commodities, stocks, indices, cryptocurrencies |

| Account Types | Single account |

| Leverage | Up to 400:1 (forex, commodities, indices), 100:1 (cryptocurrencies) |

| Commission | No |

| Trading Platforms | Trade room, Cerus platform, MT5 |

| Payment Methods | Wire transfer, credit/debit cards (MasterCard, Visa), e-Money, scan the QR, crypto wallet |

| Bonus | 100% deposit bonus (deposit at least $60) |

| Educational Resources | Trading guide, market news |

| Customer Support | Contact form, email: support@cerusmarkets.com |

What is Cerus Markets?

Cerus Markets is a brokerage firm based in the Labuan Federal Territory of Malaysia. They offer a diverse range of market instruments, including trading pairs featuring popular cryptocurrencies and traditional assets like forex, commodities, stocks, indices, and cryptocurrencies. Cerus Markets provides Trade room, Cerus platform, and MT5 with features like real-time market data, advanced charting tools, and an intuitive interface.

Is Cerus Markets Legit?

Cerus Markets operates under the regulation of the Labuan Financial Services Authority (LFSA) in Malaysia, holding a license with registration number MB/148/2021.

Additionally, the firm enhances its credibility by holding all client funds in segregated accounts at some of the world's largest and most reputable banks. This practice not only complies with regulatory requirements but also provides an extra layer of security for client assets, safeguarding them from company insolvency or misuse.

Pros & Cons

| Pros | Cons |

| Regulated under Labuan Financial Service Authority | Limited account types |

| Diverse range of market instruments | Proprietary platform risks |

| MT5 supported |

Market Instruments

Cerus Markets provides a comprehensive array of trading instruments, totaling over 200 options that cater to a wide spectrum of traders' interests and investment strategies. This extensive portfolio includes forex, which features major, minor, and exotic currency pairs.

Additionally, Cerus Markets offers a selection of commodities, such as precious metals like gold and silver, energy commodities including oil and natural gas, and various agricultural products. The platform also includes an impressive range of stocks from leading global companies, enabling participants to tap into equity markets.

Moreover, indices are available for those interested in broader market movements across major economies. Expanding into the digital age, Cerus Markets also provides trading in cryptocurrencies.

Account Types

Cerus Markets adopts a straightforward approach by offering a single type of trading account, providing uniform access to its range of financial instruments and services.

Leverage

Cerus Markets offers traders the opportunity to engage in a wide range of financial instruments, including FX, Commodities, Indices, Stocks, and Cryptocurrencies, with varying levels of leverage. For the conventional asset classes such as FX, Commodities, and Indices, traders can access leverage of up to 400:1. This high leverage allows traders to potentially amplify their trading positions, potentially magnifying both gains and losses.

In the case of Cryptocurrencies, Cerus Markets offers leverage of up to 100:1. Cryptocurrency markets are known for their high volatility. While leverage can enhance potential profits, it also exposes traders to increased risk.

Commissions

Cerus Markets distinguishes itself by offering a fee structure that is notably straightforward and transparent. Traders using Cerus Markets can enjoy commission-free trading, which means that there are no charges imposed on their transactions beyond the spread.

Trading Platforms

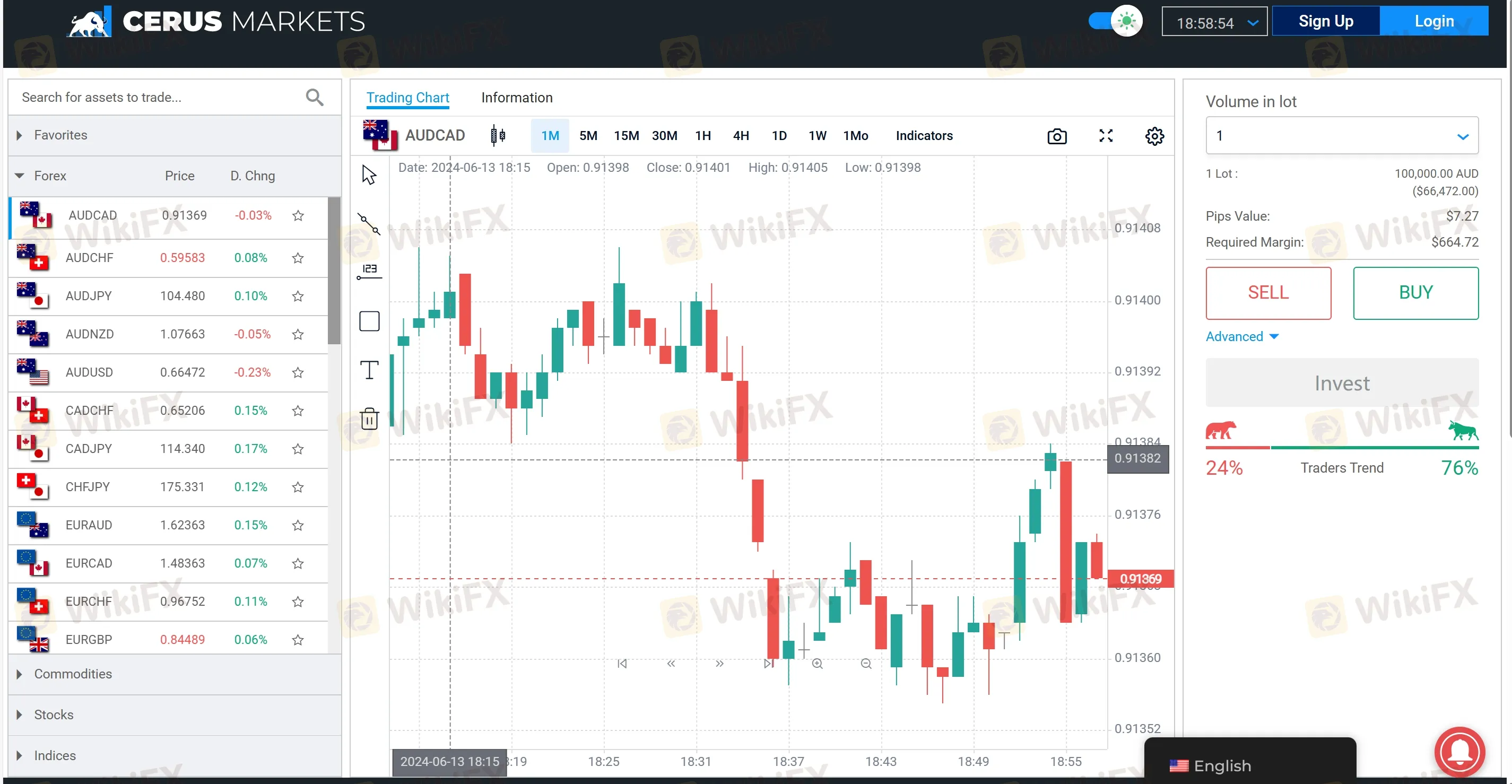

Cerus Markets equips its clients with a selection of robust trading platforms, ensuring that traders of all levels have access to advanced tools and features to enhance their trading experience. The offerings include the proprietaryCerus platform, which is designed with user-friendly interfaces and innovative functionalities tailored specifically for Cerus Markets' clientele. This platform allows for efficient management of trades, real-time market analysis, and access to all 200+ trading instruments offered by Cerus Markets.

Additionally, Cerus Markets provides the widely acclaimed MetaTrader 5 (MT5) platform, renowned for its powerful analytical tools, technical indicators, and the ability to support automated trading systems through Expert Advisors (EAs). MT5 is particularly favored for its multi-asset capabilities, enabling trading in forex, stocks, indices, commodities, and cryptocurrencies all from a single platform.

Lastly, the Trade room offers a more immersive and interactive environment where traders can engage directly with market data, execute trades swiftly, and stay updated with the latest financial news and trends.

Deposit & Withdrawal

Cerus Markets provides a versatile and convenient array of options for deposits and withdrawals, catering to the diverse preferences of its global clientele. Clients can utilize traditional wire transfers, which are reliable for moving large sums of money securely, although processing times may vary. For quicker and more convenient transactions, Cerus Markets accepts major credit and debit cards such as MasterCard and Visa, allowing instant deposits that enable traders to act swiftly on market opportunities.

Additionally, the platform supports modern payment methods including e-Money solutions and QR code scanning, which offer fast and user-friendly ways to manage funds directly from mobile devices or digital wallets. For those invested in the digital currency space, Cerus Markets also accommodates deposits and withdrawals via crypto wallets, providing a seamless integration for trading cryptocurrencies.

Bonus

Cerus Markets offers an attractive incentive for new and existing clients with its 100% deposit bonus, designed to enhance trading capabilities and increase potential returns. To qualify for this bonus, traders need to make a minimum deposit of at least $60, after which the bonus is applied directly to their trading account. This generous offer effectively doubles the trading capital available to clients, allowing them to take larger positions and gain more exposure in the market without additional risk to their initial investment. It's an excellent opportunity for traders to maximize their trading strategies and explore a wider range of instruments offered by Cerus Markets.

However, as with all promotions, it is important for traders to understand the terms and conditions associated with the bonus, such as any specific trading volume requirements or withdrawal restrictions that might apply.

Education

Cerus Markets is committed to empowering its traders through education, offering comprehensive resources that cater to both novice and experienced market participants. The platform provides a detailed trading guide, which serves as an invaluable tool for new traders to understand the basics of trading and for seasoned traders to refine their strategies.

Additionally, Cerush Markets keeps its clients informed and ahead of market trends through regular updates on market news.

Customer Support

Cerus Markets is dedicated to providing exceptional customer service, ensuring that all client needs are addressed promptly and efficiently. Clients can reach out for support through various channels, including a user-friendly contact form on their website, which allows for easy submission of inquiries or issues.

Additionally, Cerus Markets offers direct email support at support@cerusmarkets.com, where clients can expect detailed and helpful responses to their queries. The physical office located at U0065, 3rd Floor, Jalan OKK Awang Besar, 87000 F.T. Labuan, Malaysia, also serves as a base for more localized client services.

Cerus Markets extends its engagement through social media platforms such as Facebook, Instagram, Twitter, and LinkedIn, providing updates and support while facilitating a community environment among traders. Moreover, the help center available on their website is a comprehensive resource offering answers to frequently asked questions and valuable information that enhances the customer experience by providing immediate assistance and guidance.

Conclusion

Cerus Markets is a brokerage firm headquartered in the Labuan Federal Territory of Malaysia. They are regulated by the Labuan Financial Service Authority (LFSA), providing a sense of security for traders. The broker offers a range of market instruments, including forex, commodities, stocks, indices, and cryptocurrencies. Cerus Markets provides a single account type with leverage of up to 400:1. They operate with zero commission fees and offer bonuses based on the initial deposit.

FAQs

Is Cerus Markets regulated?

Yes, Cerus Markets is regulated by the Labuan Financial Service Authority in Malaysia.

What types of market instruments are available for trading?

Forex, commodities, stocks, indices, and cryptocurrencies.

What trading platform does Cerus Markets offer?

Trade room, Cerus platform, and MT5.

Does Cerus Markets offer bonus?

Yes. But you have to deposit at least $60.