公司簡介

| Bell Potter檢討摘要 | |

| 註冊時間 | 超過20年 |

| 註冊國家/地區 | 澳洲 |

| 監管 | 受監管 |

| 市場工具 | 股票、衍生品、基金及固定收益等 |

| 交易平台 | Bell Potter 客戶 |

| 客戶支援 | 1300 023 557 |

| Twitter、Facebook、LinkedIn、YouTube | |

Bell Potter 資訊

Bell Potter 是澳洲領先的全方位股票經紀和財務顧問公司,由Bell Financial Group(BFG.ASX)擁有。它為個人投資者、企業和機構客戶提供服務,包括澳洲/國際股票經紀、固定收益、退休金規劃、企業融資(例如首次公開募股、併購)和研究分析。該公司通過其全球網絡支持客戶投資。

優點和缺點

| 優點 | 缺點 |

| 受監管 | 服務門檻不明確 |

| 全方位覆蓋 | 平均費用透明度 |

| 國際市場覆蓋有限 |

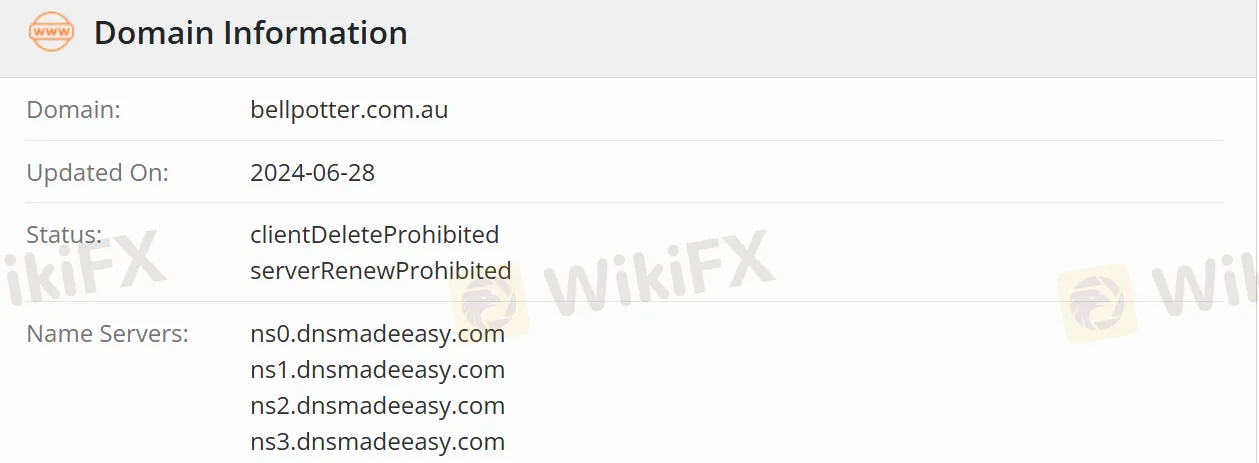

Bell Potter 是否合法?

Bell Potter 擁有澳洲金融服務牌照(AFSL),由上市公司Bell Financial Group擁有,並受澳洲證券及投資委員會(ASIC)監管,牌照號碼為000243480。

Bell Potter 可以交易什麼?

| 交易工具 | 具體類型/描述 |

| 股票 | 澳洲股票(在ASX上市)、國際股票 |

| 衍生品 | 認股權證期貨(需要獲得專業衍生品專家指導) |

| 基金和固定收益 | 上市投資信託基金(LICs)、交易所交易基金(ETFs)、固定收益產品(債券、混合證券)、退休金產品 |

| 其他 | 外匯交易、槓桿交易和mFunds |

帳戶類型

根據官方網站,Bell Potter 提供以下帳戶類型:

個人投資帳戶:適合個人投資者,支持澳洲股票、國際股票、ETF等交易,可配合退休金規劃服務。

企業帳戶:為企業客戶量身定制,提供首次公開募股、股權融資和併購諮詢等服務,需要定制申請。

機構帳戶:針對基金公司和資產管理機構設計,提供交易執行、研究協調和企業接觸服務。

中介服務帳戶:專為財務策劃人員設計,可代表客戶進行基於客戶的交易,並提供研究支持和定制研討會。

交易平台

投資者可以通過網絡訪問 Bell Potter 客戶訪問門戶,查看實時信息,如投資組合估值。此外,第三方平台集成支持通過CHESS系統進行電子結算,實現與其他ASX交易資產的持有統一管理。

存款和提款

存款支持銀行轉帳(澳元和外幣帳戶)。提款將通過原路返回到綁定的銀行帳戶,並需要通過帳戶後端提交申請。澳元交易通常在1-2個工作日內到帳,而國際轉帳可能延長至3-5個工作日。

主要貨幣為澳元,國際交易需要轉換為當地貨幣(適用外匯轉換費)。

dd4516

柬埔寨

SoonTrade5交易软件非常便捷

好評

HxIn

賽普勒斯

好公司,好服務。我的交易經驗很好。存款根本不需要時間,但取款對我來說太花時間了。

好評

阳谷电缆

哥倫比亞

我非常喜歡bellpotter提供的MT4平台。 MT4 如此受歡迎是有道理的,因為它功能豐富且易於使用。

好評

FX1024642656

香港

Bell Potter 貌似值得信賴,但我還沒有決定要不要跟他們一起投資。最低初始資本對我來說很有吸引力。只要投資5美元,我就有機會賺錢。另一點吸引我的是經紀人支持 PayPal 付款,而其他大多數經紀人,至少在我看來,很少有人提供。然而...我也從他們的網站上看到提款通常需要 7 天才能出現在我的帳戶中,所以我猶豫..是的..我也需要 s

好評

...61405

香港

SSSSO 很容易上手!我剛用 5 美元開設了我的帳戶!祝我好運!

好評

你好99363

香港

我需要說,這個經紀人要求一個小的初始資本,這是一個很好的部分。但是,您還應該注意,閒置費是您需要支付的費用。我會說,也許你可以考慮這家公司來幫助你做出一些財務決定。

好評