公司簡介

| Purple Trading 綜述 | |

| 成立年份 | 2016 |

| 註冊國家/地區 | Cyprus |

| 監管機構 | CYSEC |

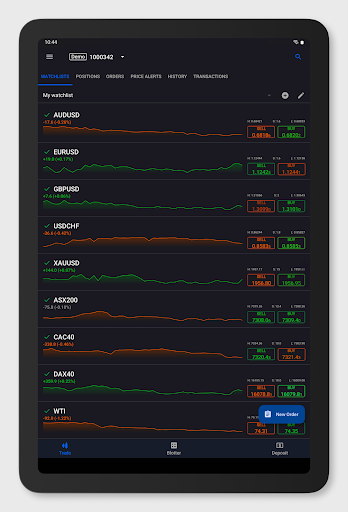

| 可交易資產 | 外匯、指數、商品、股票、期貨 |

| 模擬帳戶 | ✅ |

| 伊斯蘭帳戶 | ❌ |

| 帳戶類型 | STP、ECN、PRO |

| 最大槓桿 | 1:30(零售)/1:500(專業) |

| 歐元/美元點差 | 從0.3點差 |

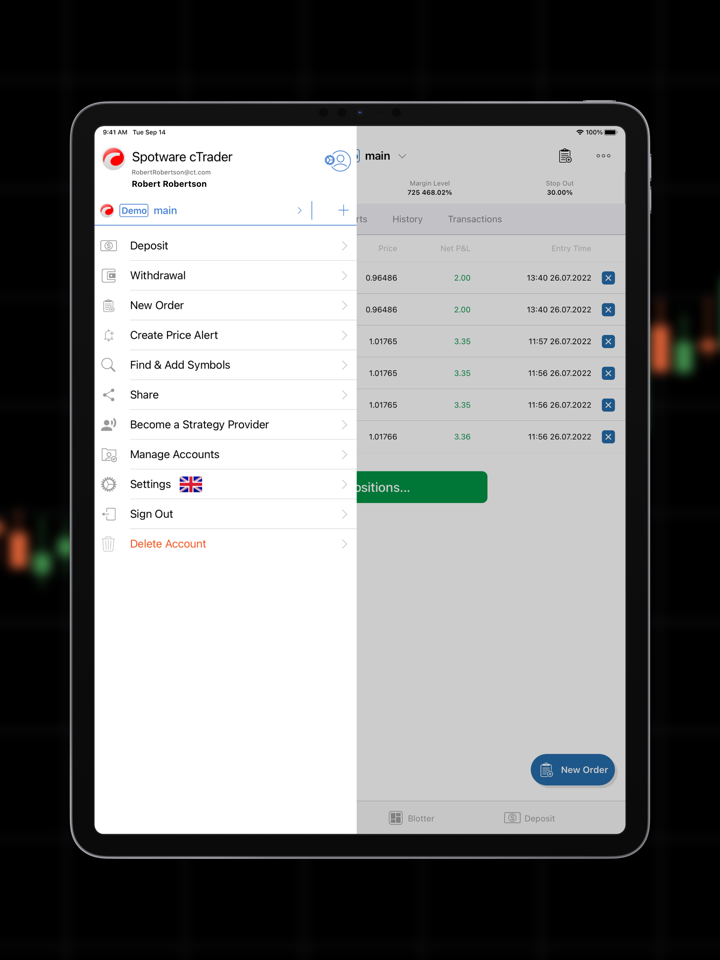

| 交易平台 | MT4/5、cTrader |

| 付款方式 | Visa、MasterCard |

| 存款和提款費用 | ❌ |

| 客戶支援 | 週一至週五,8-16時(CET) |

| 在線聊天 | |

| 電話:+420 228 884 711 | |

| 電子郵件:support@purple-trading.com(現有客戶) | |

| info@purple-trading.com(新客戶) | |

| 區域限制 | 不接受來自歐洲經濟區以外、比利時、瑞士和美國的客戶 |

Purple Trading 資訊

Purple Trading 的總部位於塞浦路斯,受塞浦路斯證券交易委員會(CYSEC)的監管。它為零售客戶提供最高1:30的槓桿,為專業客戶提供最高1:500的槓桿,具體槓桿比例因工具而異。STP帳戶的點差從1.3點差起,ECN帳戶的點差從0.3點差起。客戶可以交易包括外匯、指數、商品、股票和期貨在內的多樣化資產。Purple Trading 提供多種帳戶類型,如ECN、STP和PRO,每種帳戶類型都有自己的費用結構和優勢。它還提供免費的模擬帳戶供用戶練習交易策略。

優點和缺點

| 優點 | 缺點 |

|

|

|

|

|

|

| |

| |

| |

|

Purple Trading 是否合法?

Purple Trading受塞浦路斯證券交易委員會(CYSEC)監管,許可證號碼為271/15,確保符合嚴格的金融標準和協議。這種監管監督為客戶帶來信心,因為它表明Purple Trading在受監管的框架內運營,為投資者提供更大的透明度和保護。CYSEC的監督確保Purple Trading遵守金融行業的法律和道德慣例。

市場工具

Purple Trading提供全面的市場工具,涵蓋外匯、指數、商品、股票和期貨等各個類別。

| 可交易資產 | 支援 |

| 外匯 | ✔ |

| 指數 | ✔ |

| 商品 | ✔ |

| 股票 | ✔ |

| 期貨 | ✔ |

| 加密貨幣 | ❌ |

| 債券 | ❌ |

| 期權 | ❌ |

| ETF | ❌ |

帳戶類型/費用

Purple Trading提供免費模擬帳戶,最低初始虛擬存款為1,000(歐元、英鎊、美元、捷克克朗或波蘭茲羅提)。

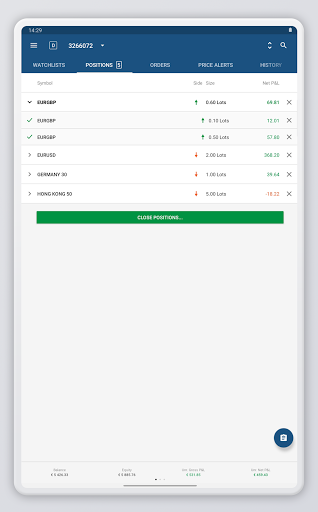

它還提供三種真實帳戶類型,包括STP、ECN和PRO,最低存款要求為100美元。您可以在下表中找到不同帳戶類型之間的相似之處和差異:

| STP | ECN | PRO | |

| 適合對象 | 持倉/擺盪交易者 | 日內/快速交易者 | 專業交易者 |

| 交易平台 | MT4 / MT5 / cTrader | ||

| 開戶費用 | ❌ | ||

| 最低存款 | $100 | ||

| 接受貨幣 | 歐元/英鎊/美元/捷克克朗/波蘭茲羅提 | ||

| 點差 | 從1.3點 | 從0.3點 | - |

| 佣金 | ❌ | 5-10美元/手 | - |

此外,Purple Trading還提供管理帳戶,作為您與Purple Trading為客戶提供的廣泛投資產品之間的聯繫,包括由專業交易者創建的被動ETF組合、動態投資策略,以及更適合較小投資的“迷你”版本,因為他們可以投資至少100歐元。

槓桿

Purple Trading 根據交易工具和客戶分類提供不同水平的槓桿:

- 對於零售客戶,所有工具(包括外匯、指數、商品、股票和期貨)的最大交易槓桿為1:30。

- 對於符合專業客戶分類要求的客戶,某些工具的最大槓桿可達1:500。

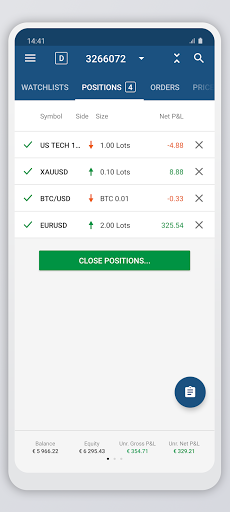

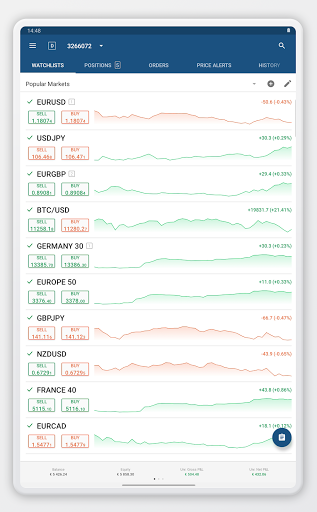

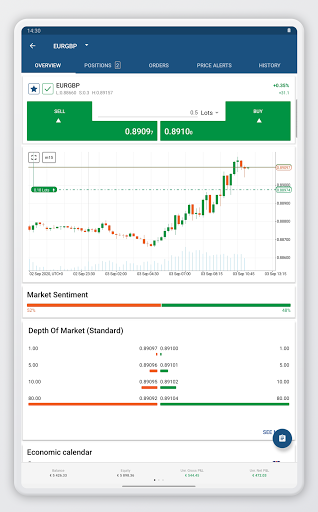

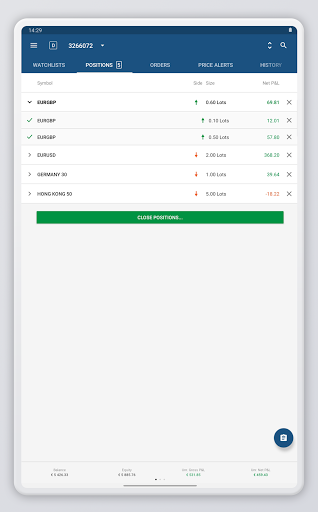

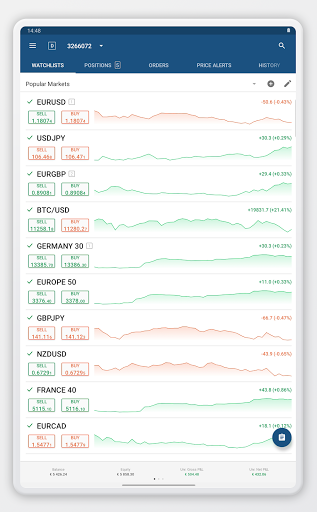

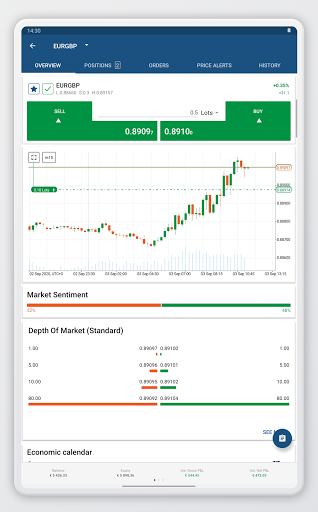

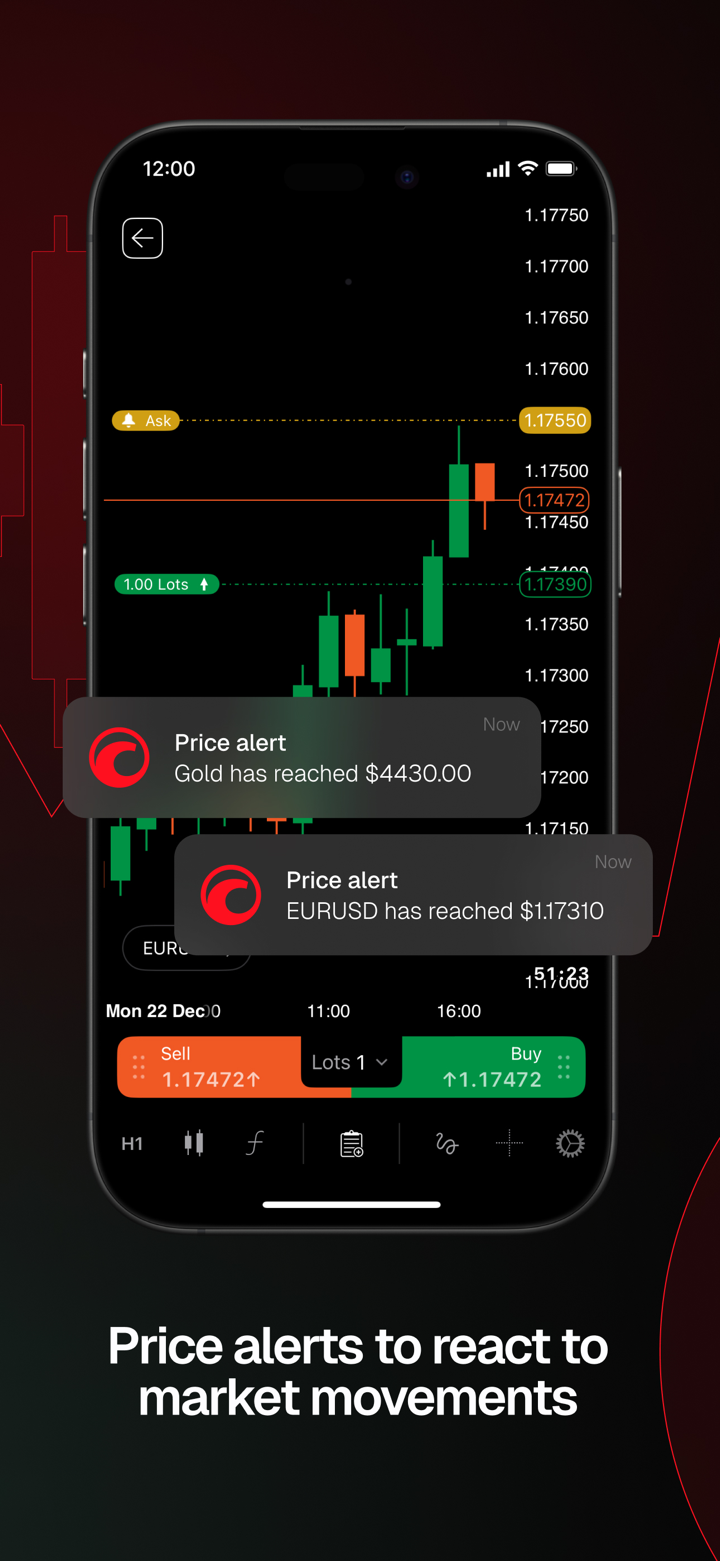

交易平台

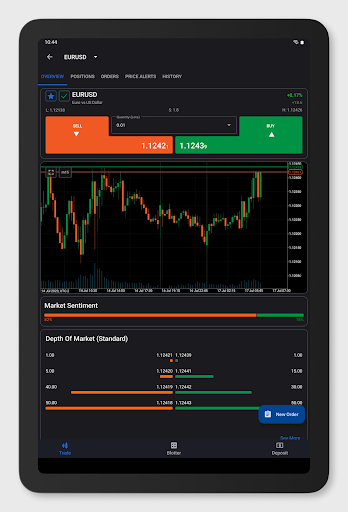

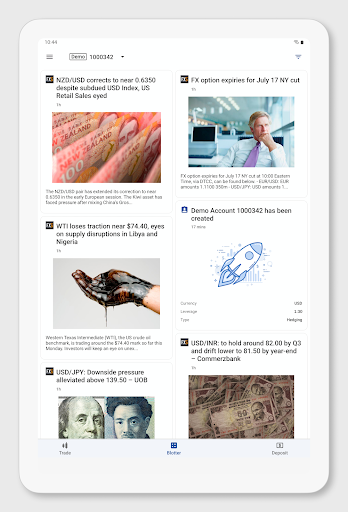

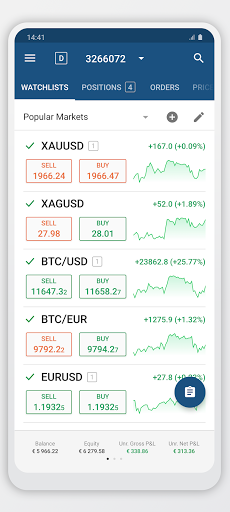

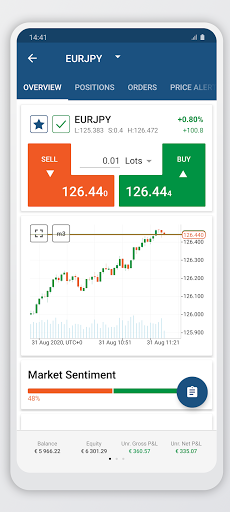

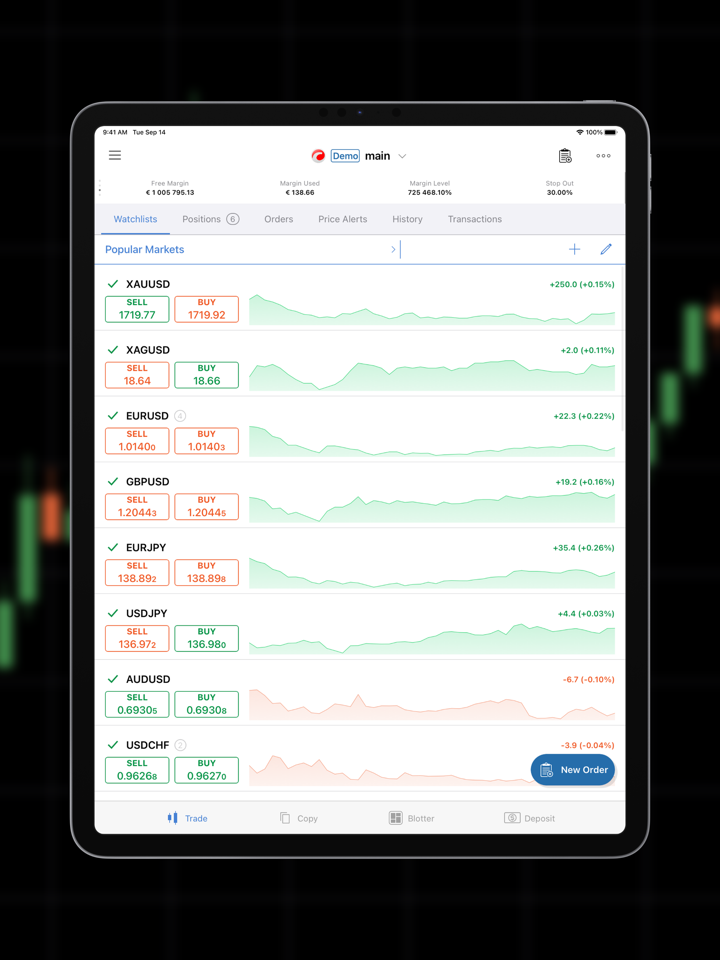

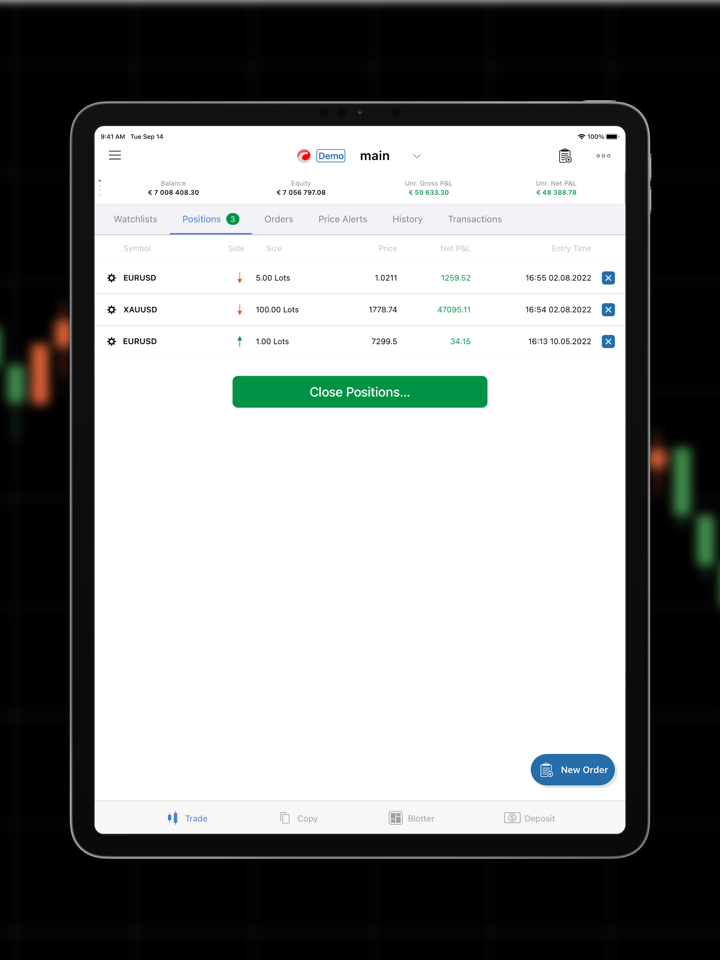

Purple Trading 提供三個領先的交易平台,包括MetaTrader 4/5(MT4/5)和cTrader,為客戶提供全面的工具和功能,實現有效的交易。

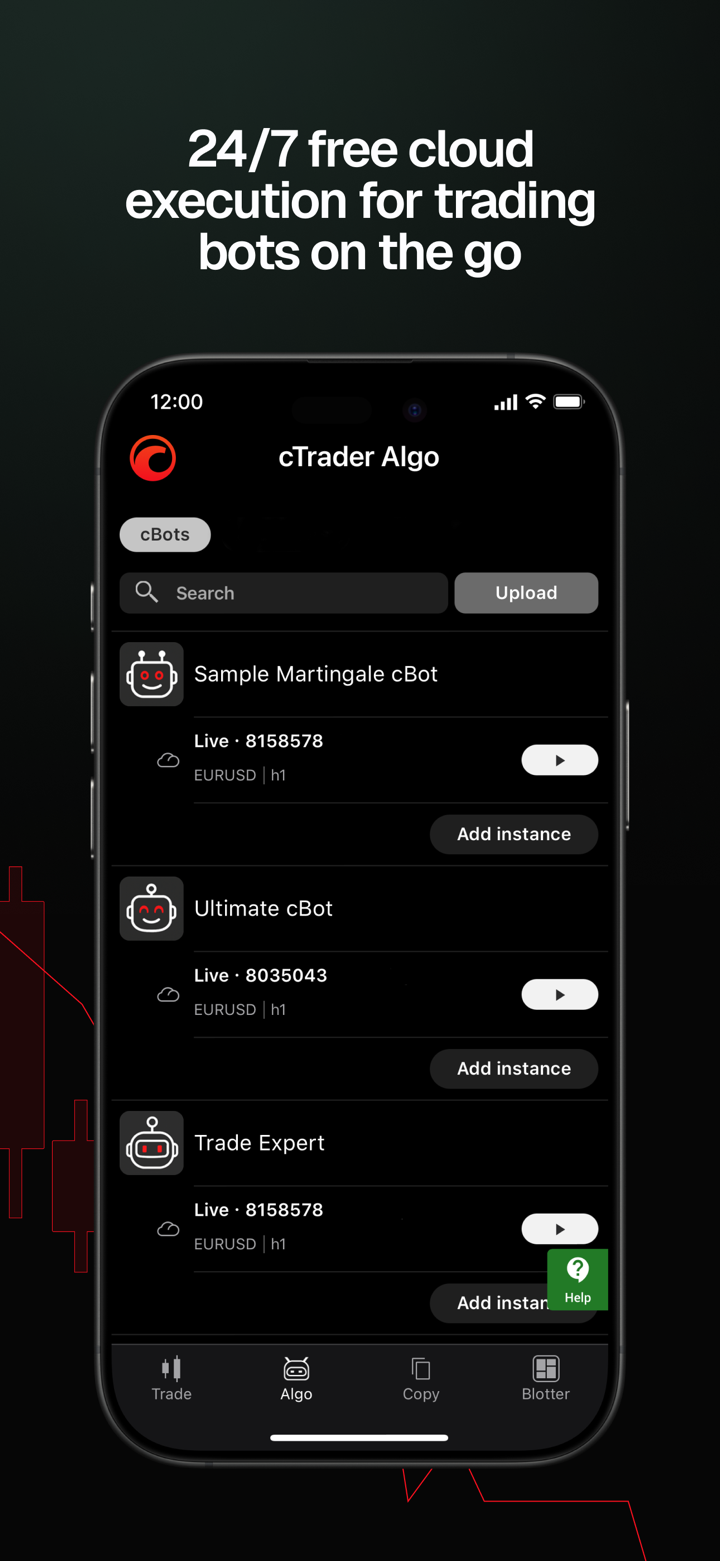

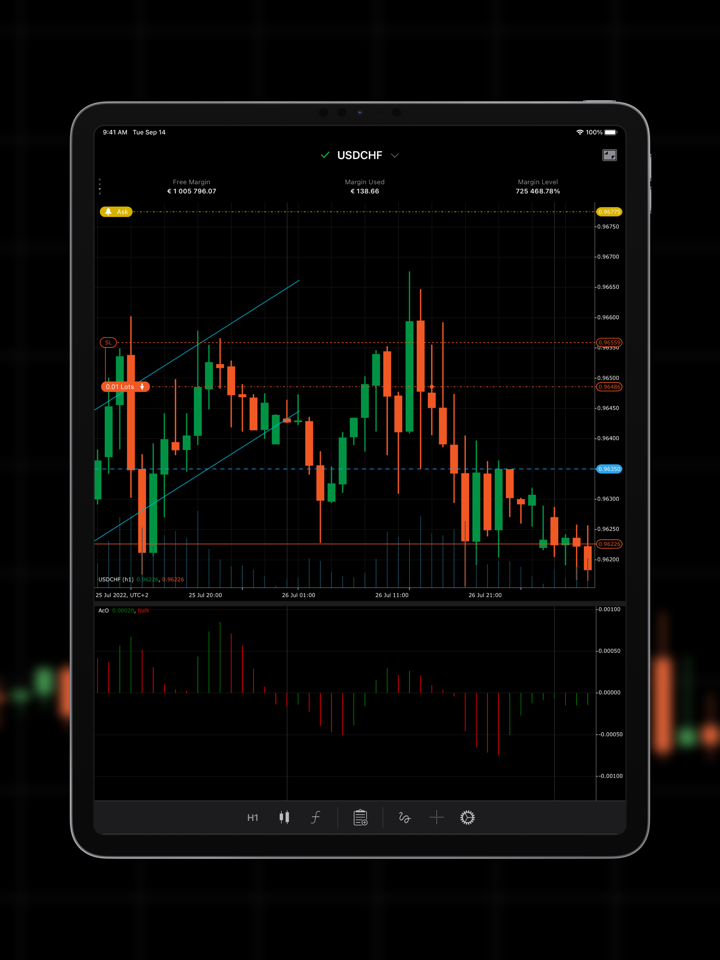

在行業中廣受好評的MetaTrader 4/5平台提供先進的圖表功能、可自定義的指標和通過專家顧問(EA)進行自動交易,為交易者提供強大的技術分析工具。

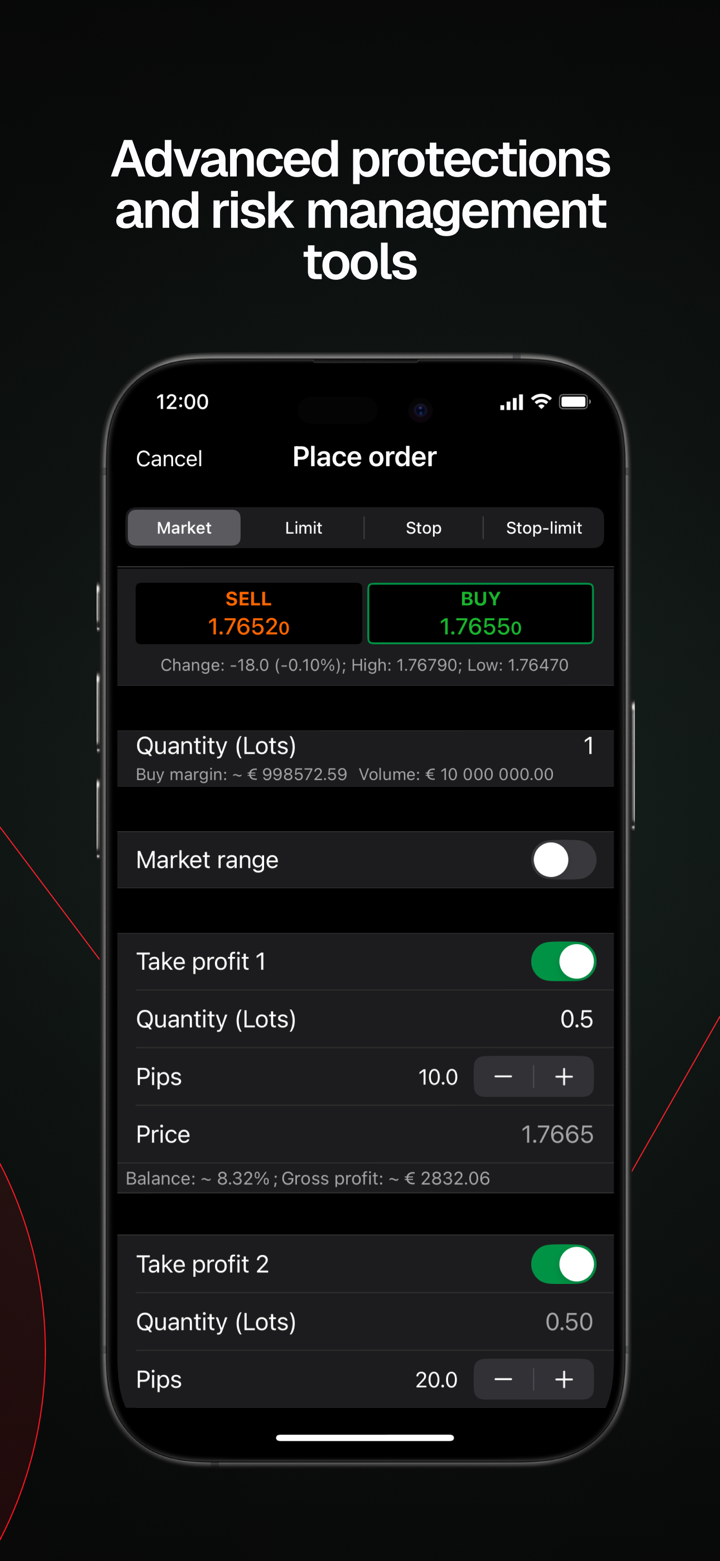

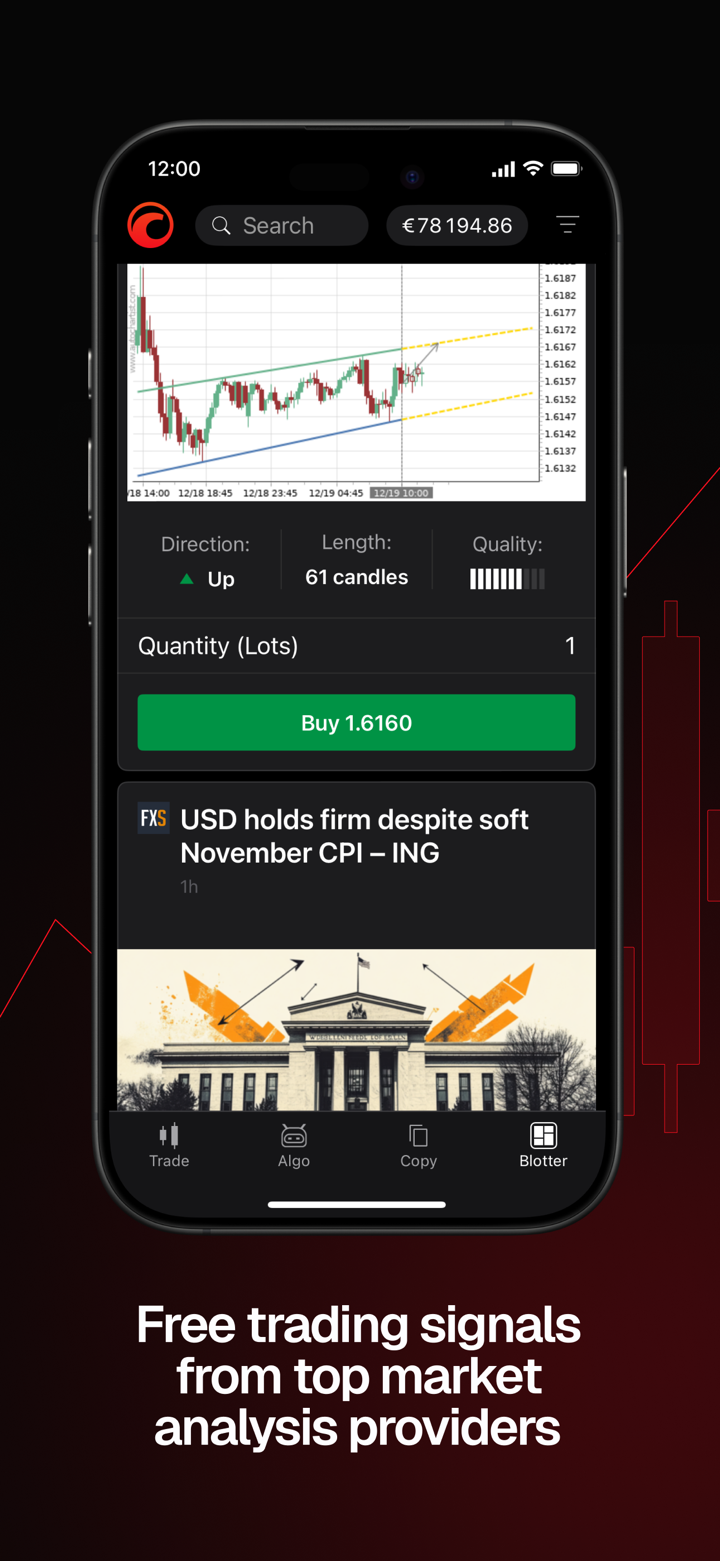

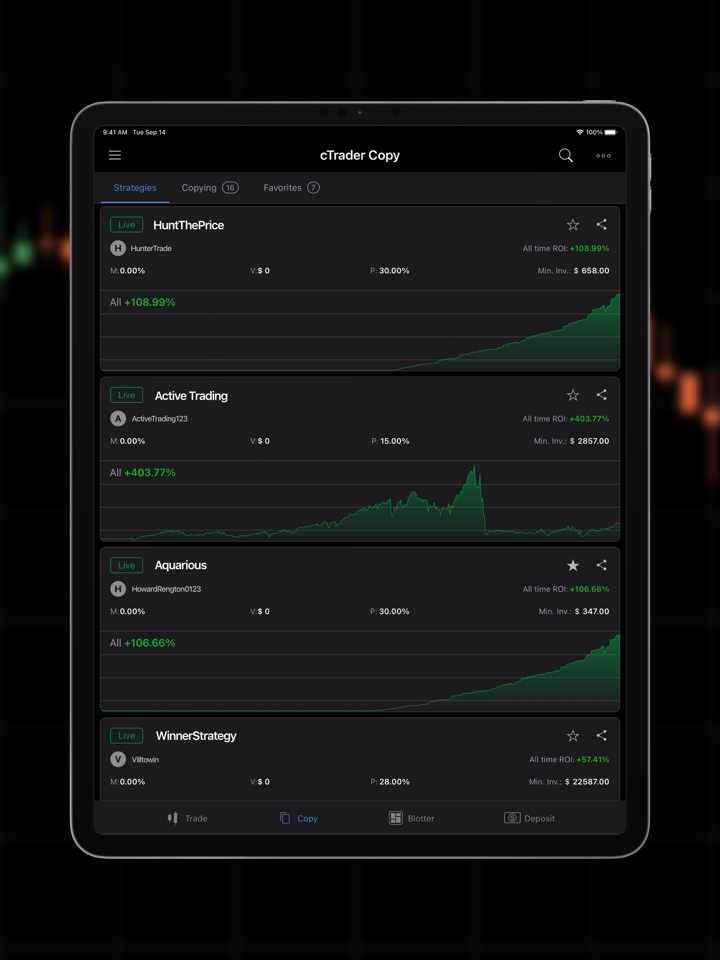

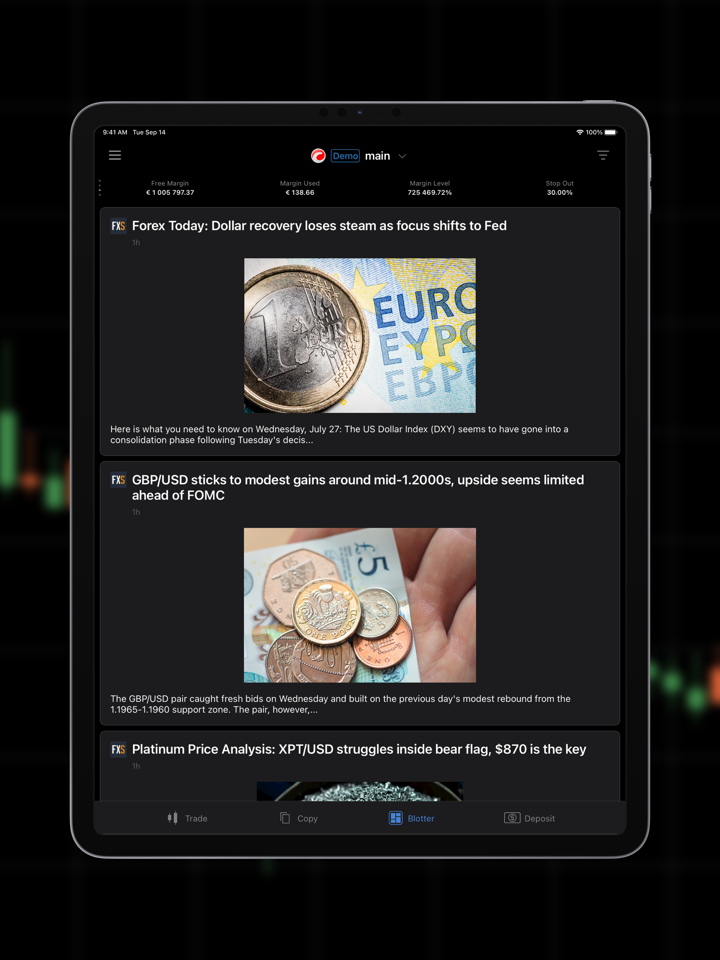

另一方面,cTrader以其直觀的界面、快速執行和二級定價透明度脫穎而出,迎合那些注重速度、精確度和市場深度洞察的交易者。

存款和提款

| 支付方式 | 存款/提款費用 | 最高存款/提款金額 | 存款時間 | 提款時間 |

| MasterCard/Visa | ❌ | EUR 60,000 | 即時 | 1個工作日 |

| 本地支付(CZK和PLN);SEPA支付(EUR) | ❌ | - | 1個工作日 | |

| 其他貨幣的國際支付 | 0.5%(最低5歐元,最高100歐元) | - | 1個工作日 | |

請注意,以與您帳戶貨幣不同的貨幣進行的存款和提款將自動轉換,最終入賬金額可能因匯率和轉換率而有所變動。

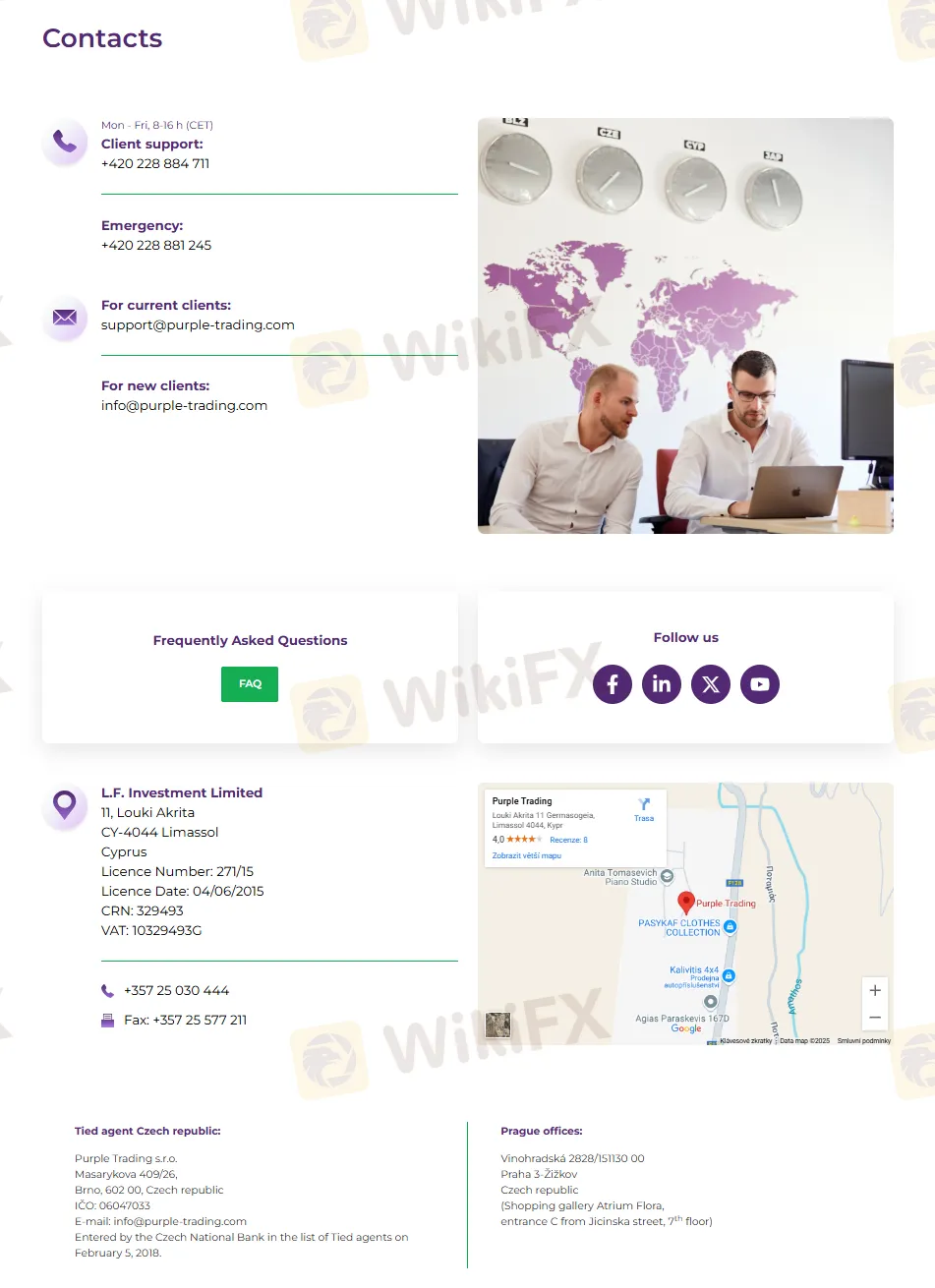

客戶支援

Purple Trading 通過多種渠道提供全面的客戶支援:

- 電話支援:

- 在緊急情況下,客戶可以致電+420 228 881 245聯繫Purple Trading。

- 一般客戶支援可通過週一至週五 8:00至16:00(CET)致電+44 14 46 506 711。

- 電子郵件支援:

- 新客戶可以通過info@purple-trading.com進行查詢。

- 現有客戶可以通過support@purple-trading.com聯繫以獲得協助。

- 在線資源:

- 客戶可以訪問Purple Trading網站上的常見問題(FAQ)部分,快速獲得常見問題的答案。

- 實體地址:

- 客戶可以致電+357 25 030 444或傳真至+357 25 577 211與公司聯繫。

- Purple Trading的總部位於塞浦路斯利馬索爾市11號,郵政編碼CY-4044。